null

BYLAWS

OF

C2 BLOCKCHAIN, INC.

A Nevada Corporation

As of

July 5, 2023

ARTICLE I

Meetings

of Stockholders

Section 1.1 Time and Place. Any

meeting of the stockholders may be held at such time and such place, either within or without the State of Nevada, as shall be designated

from time to time by resolution of the board of directors or as shall be stated in a duly authorized notice of the meeting.

Section 1.2 Annual Meeting. The

annual meeting of the stockholders shall be held on the date and at the time

fixed, from time to time, by the board

of directors. The annual meeting shall be for the purpose of electing a board of directors

and transacting such other business as may properly

be brought before the meeting.

Section 1.3 Special Meetings. Special

meetings of the stockholders, for any purpose or purposes, unless otherwise prescribed by

statute or by the articles of incorporation, may be called by

the president and shall be called by the president or secretary if requested in

writing by the holders of not less than one-tenth (1/10) of all the shares entitled to vote

at the meeting. Such request shall state the purpose or purposes of

the proposed meeting.

Section 1.4 Notices.

Written notice stating the place, date and hour of the meeting and, in

case of a special meeting, the purpose or purposes for which

the meeting is called, shall be given not less than ten nor more than sixty days before

the date of the meeting, except as otherwise required by

statute or the articles of incorporation, either personally, by

mail or by a form of electronic transmission consented

to by the stockholder, to each stockholder of record entitled to vote at such meeting.

If mailed, such notice shall be deemed to be

given when deposited in the official government mail of the United States or any

other country, postage prepaid, addressed to the stockholder at his address as it appears

on the stock records of the Corporation. If given personally or otherwise than by mail,

such notice shall be deemed to be given when either handed to the stockholder or delivered

to the stockholder’s address as it

appears on the records of the Corporation.

Section 1.5 Record Date. In order

that the Corporation may determine the stockholders entitled to

notice of or to vote at any meeting, or at any

adjournment of a meeting, of stockholders; or entitled

to receive payment of any dividend or other distribution or allotment of any

rights; or entitled to exercise any rights in respect of any change, conversion,

or exchange of stock; or for the purpose of any other lawful action; the board of directors

may fix, in advance, a record date, which record date shall not precede the date which the resolution fixing the record date is adopted

by the board of directors. The record date for determining the stockholders entitled to notice

of or to vote at any meeting of the stockholders

or any adjournment thereof shall not be more than

sixty nor less than ten days before the date of

such meeting. The record date for determining the

stockholders entitled to consent to corporate action in writing without a meeting

shall not be more than ten days after the date

upon which the resolution fixing the record date is adopted by

the board of directors. The record date for any other action shall not be more

than sixty days prior to such action. If no record date is fixed, (i) the record date for

determining stockholders entitled to notice of or to

vote at any meeting shall be at the close of business on the day

next preceding the day on which notice is given or, if notice is waived by

all stockholders, at the close of business on the day next

preceding the day on which the meeting

is held; (ii) the record date for determining stockholders entitled to express consent to

corporate action in writing without a meeting, when no prior action by

the board of directors is required, shall be the first date on which a signed written

consent setting forth the action taken or to be taken is delivered to the Corporation and,

when prior action by the board of directors is

required, shall be at the close of business on the day on which the board of directors adopts the resolution taking such prior action;

and (iii) the record date for determining stockholders for any other purpose shall be at

the close of business on the day on which the board of directors adopts the resolution relating to such

other purpose. A determination of stockholders of record entitled to notice of or to vote at a meeting of stockholders

shall apply to any adjournment of the meeting;

provided, however, that the board of directors may fix a new record date for

the adjourned meeting.

1

Section 1.6 Voting List. If the

Corporation shall have more than five (5) shareholders, the secretary shall prepare and make,

at least ten days before every meeting of stockholders,

a complete list of the stockholders entitled to vote at the meeting, arranged in alphabetical

order and showing the address and the number of shares registered in the name of each stockholder.

Such list shall be open to the examination of any stockholder,

for any purpose germane to the meeting, during ordinary business hours, for a period of at

least ten days prior to the meeting, at the

Corporations principal offices. The list shall be produced and kept at the place of the meeting

during the whole time thereof and may be inspected by any stockholder who is present.

Section 1.7 Quorum. The holders

of a majority of the stock issued and outstanding and entitled to

vote at the meeting, present in person or represented by

proxy, shall constitute a quorum at all meetings of the stockholders for the transaction

of business, except as otherwise provided by statute

or by the articles of incorporation. If, however, such a quorum shall not be present at any

meeting of stockholders, the stockholders entitled

to vote, present in person or represented by

proxy, shall have the power to adjourn the meeting from time

to time, without notice if the time and place are announced at the meeting,

until a quorum shall be present. At such adjourned meeting at which a quorum shall be present,

business may be transacted which might have been transacted at the original meeting.

If the adjournment is for more than thirty days

or if after the adjournment a new record date is fixed for the adjourned meeting, a notice of the adjourned meeting

shall be given to each stockholder of record entitled to vote

at the meeting.

Section 1.8 Voting and Proxies.

At every meeting of the stockholders, each stockholder shall be entitled to one vote, in person

or by proxy, for each share of the capital stock

having voting power held by such stockholder, but no proxy shall be

voted on after six months from its date unless the proxy

provides for a longer period, which may not exceed seven years. When a specified item of

business is required to be voted on by a class or series of stock, the holders of a majority of the shares of such class or series shall

constitute a quorum for the transaction of such item of business by that class or series.

If a quorum is present at a properly held meeting

of the shareholders, the affirmative vote of the holders of a majority of the shares represented in person or by proxy

and entitled to vote on the subject matter under

consideration, shall be the act of the shareholders, unless the vote of a greater

number or voting by classes (i) is required by the articles of incorporation, or (ii) has

been provided for in an agreement among all shareholders entered into pursuant to and enforceable

under Nevada Law.

Section 1.9 Waiver.

Attendance of a stockholder of the Corporation, either in person or by proxy, at any

meeting, whether annual or special, shall constitute a waiver of notice of

such meeting, except where a stockholder attends a meeting

for the express purpose of objecting, at the beginning of the meeting, to the transaction

of any business because the meeting is not lawfully called or convened. A written waiver

of notice of any such meeting signed by a stockholder or stockholders entitled to such notice,

whether before, at or after the time for notice or the time

of the meeting, shall be equivalent to notice. Neither the business to be transacted at, nor

the purpose of, any meeting need be specified

in any written waiver of notice.

Section 1.10 Stockholder Action Without

a Meeting. Except as may otherwise be provided by any applicable provision of the Nevada

Law, any action required or permitted to be taken at a meeting

of the stockholders may be taken without a meeting

if, before or after the action, a written consent thereto is signed by stockholders holding

at least a majority of the voting power; provided that if a different proportion of voting

power is required for such an action at a meeting, then that proportion of written consents

is required. In no instance where action is authorized by

written consent need a meeting of stockholders be called

or noticed.

2

ARTICLE II

Directors

Section

Section 2.1 Number. The number

of directors shall be one or more, as fixed from time

to time by resolution of the board of directors;

provided, however, that the number of directors shall not be reduced so as to shorten the

tenure of any director at the time in office.

Section 2.2 Elections. Except

as provided in Section 2.3 of this Article II, the board of directors shall be elected at

the annual meeting of the stockholders or at a special meeting called for that purpose. Each

director shall hold such office until his successor is elected and qualified or until his earlier resignation or removal.

Section 2.3 Vacancies. Any

vacancy occurring on the board of directors and any

directorship to be filled by reason of an increase in the board of directors may

be filled by the affirmative vote of a majority of the remaining

directors, although less than a quorum, or by a sole remaining director. Such newly

elected director shall hold such office until his successor is

elected and qualified

or until his earlier resignation or removal.

Section 2.4 Meetings. The board

of directors may, by resolution, establish a place

and time for regular meetings which may be held without call or notice.

Section 2.5 Notice of Special Meetings.

Special meetings may be called by

the chairman, the president or any two members

of the board of directors. Notice of special meetings shall be given to each member

of the board of directors: (i) by mail by

the secretary, the chairman or the members of the board calling the meeting by

depositing the same in the official government mail of the United States or

any other country, postage prepaid, at least seven days

before the meeting, addressed to the director at the last address he has furnished to the

Corporation for this purpose, and any notice so mailed

shall be deemed to have been given at the time

when mailed; or (ii) in person, by telephone

or by electronic transmission addressed as stated above at least forty-eight hours before the

meeting, and such notice shall be deemed to have

been given when such personal or telephone conversation occurs or at the time when such electronic

transmission is delivered to such address.

Section 2.6 Quorum. At all meetings

of the board, a majority of the total number of directors shall constitute a quorum for the transaction of business, and the act of a

majority of the directors present at any meeting at which a quorum is present shall be the

act of the board of directors, except as otherwise specifically required by statute, the articles of incorporation

or these bylaws. If less than a quorum is present, the director or directors present may adjourn the meeting

from time to time without further notice. Voting by proxy is not permitted at meetings of the board

of directors.

Section 2.7 Waiver.

Attendance of a director at a meeting of the board of directors shall constitute

a waiver of notice of such meeting, except where a director attends a meeting

for the express purpose of objecting, at the beginning of the meeting, to the transaction

of any business because the meeting is not lawfully called or convened. A written waiver of notice by

a director or directors entitled to such notice, whether before, at or after the time for

notice or the time of the meeting, shall be equivalent

to the giving of such notice.

Section 2.8 Action Without

Meeting. Any action required or permitted to be taken at

a meeting of the board of directors may be taken

without a meeting if a consent in writing setting forth

the action so taken shall be signed by all of

the directors and filed with the minutes

of proceedings of the board of directors. Any such consent may be

in counterparts and shall be effective on the date of the last signature thereon unless otherwise provided therein.

3

Section 2.9 Attendance by

Telephone. Members of the board of directors may participate in a meeting of such board

by means of conference telephone or similar communications

equipment by means

of which all persons participating in the meeting can hear each other, and such participation

in a meeting shall constitute presence in person at such meeting.

ARTICLE III

Officers

Section 3.1 Election. The Corporation

shall have such officers, with such titles and duties, as the board of directors may determine by

resolution, which must include a chairman of the board, a president, a secretary and a treasurer

and may include one or more vice presidents and one or more

assistants to such officers. The officers shall in any event have such titles and duties as shall enable the Corporation to sign instruments

and stock certificates complying with Section 6.1 of these bylaws,

and one of the officers shall have the duty to record the proceedings of the stockholders

and the directors in a book to be kept for that purpose. The officers shall be elected by the board of directors; provided, however, that

the chairman may appoint one or more assistant

secretaries and assistant treasurers and such other subordinate officers as he deems necessary,

who shall hold their offices for such terms and shall exercise such powers and perform such

duties as are prescribed in the bylaws or as may be determined from time

to time by the board of directors or the chairman.

Any two or more offices may be held by the same

person.

Section 3.2 Removal and Resignation.

Any officer elected or appointed by the board of

directors may be removed at any time by the affirmative

vote of a majority of the board of directors. Any officer appointed by

the chairman may be removed at any time by

the board of directors or the chairman. Any officer may resign at any

time by giving written notice of his resignation to the chairman or

to the secretary, and acceptance of such resignation shall not be necessary to make it effective

unless the notice so provides. Any vacancy occurring in any

office of chairman of the board, president, vice president, secretary or treasurer

shall be filled by the board of directors.

Any vacancy occurring in any

other office may be filled by the chairman.

Section 3.3 Chairman of the Board.

The chairman of the board shall preside at all meetings

of shareholders and of the board of directors, and shall have the powers and perform the duties

usually pertaining to such office, and shall have such other powers and perform such other

duties as may be from time to time prescribed

by the board of directors..

Section 3.4 President. The president

shall be the chief executive officer of the Corporation, and shall have general and active management

of the business and affairs of the Corporation, under the direction of the board of directors. Unless the board of directors has appointed

another presiding officer, the president shall preside at

all meetings of the shareholders.

Section 3.5 Vice President. The

vice president or, if there is more than one,

the vice presidents in the order determined by

the board of directors or, in lieu of such determination, in the order determined by the president,

shall be the officer or officers next in seniority after the president. Each vice president shall also perform

such duties and exercise such powers as are appropriate and such as are prescribed by the board

of directors or, in lieu of or in addition to such prescription, such as are prescribed by

the president from time to time. Upon the death, absence or disability of the president,

the vice president or, if there is more than one, the vice presidents in the order determined

by the board of directors or, in lieu of such determination, in the order determined by

the president, or, in lieu of such determination, in the order determined by

the chairman, shall be the officer or officers next in seniority after the president in the order determined by

the and shall perform the duties and exercise the powers of the president.

Section 3.6 Assistant Vice President.

The assistant vice president, if any, or, if there is more

than one, the assistant vice presidents shall, under the supervision of the president or a

vice president, perform such duties and have such powers as are prescribed by the board of

directors, the president or a vice president from time to time.

4

Section 3.7 Secretary. The secretary

shall give, or cause to be given, notice of all meetings of the stockholders and special

meetings of the board of directors, keep the minutes

of such meetings, have charge of the corporate seal and stock records, be responsible for

the maintenance of all corporate files and records and the preparation and filing of reports

to governmental agencies (other than tax returns), have authority to affix the corporate seal to any instrument requiring it (and, when

so affixed, attest it by his signature), and perform such other duties and have such other powers as are appropriate and such as are prescribed

by the board of directors or the president from time to time.

Section 3.8 Assistant Secretary.

The assistant secretary, if any, or, if there is more than one, the assistant secretaries

in the order determined by the board of directors or, in lieu of determination, by

the president or the secretary shall, in the absence or disability of the secretary or in case such duties are specifically delegated

to him by the board of directors, the chairman, or the secretary, perform the duties and exercise

the powers of the secretary and shall, under the supervision of the secretary, perform such other duties and have such other powers as

are prescribed by the board of directors, the chairman, or the secretary from time to

time.

Section 3.9 Treasurer. The treasurer

shall have control of the funds and the care and custody of all the stocks, bonds and other securities of the Corporation and shall be

responsible for the preparation and filing of tax returns. He shall receive all moneys

paid to the Corporation and shall have authority to give receipts and vouchers, to sign and endorse checks and warrants in its name

and on its behalf, and give full discharge for the same. He shall also have charge of the

disbursement of the funds of the Corporation and shall keep full and accurate records of the receipts and disbursements. He shall

deposit all moneys and other valuable effects in the name and to the credit of the Corporation

in such depositories as shall be designated by the board of directors and shall perform such other duties and have such other powers as

are appropriate and such as are prescribed by the board of directors or the president from

time to time.

Section 3.10 Assistant Treasurer.

The assistant treasurer, if any, or, if there is more

than one, the assistant treasurers in the order determined by the board of directors or, in

lieu of such determination, by the chairman or the treasurer shall, in the absence or disability

of the treasurer or in case such duties are specifically delegated to

him by the board of directors, the chairman or the treasurer, perform the duties and exercise

the powers of the treasurer and shall, under the supervision of the treasurer, perform such

other duties and have such other powers as are prescribed by the board of directors,

the president or the treasurer from time to

time.

Section 3.11 Compensation. Officers

shall receive such compensation, if any, for their services

as may be authorized or ratified by the

board of directors. Election or appointment as an officer shall not of itself create

a right to compensation for services performed as

such officer.

ARTICLE IV

Committees

Section 4.1 Designation of Committees.

The board of directors may establish committees for the performance of delegated or designated

functions to the extent permitted by law, each committee to consist of one or more directors

of the Corporation, and if the board of directors so determines, one or more persons who are not directors of the Corporation. In the

absence or disqualification of a member of a committee,

the member or members thereof present at any

meeting and not disqualified from voting, whether or not he or they a quorum, may unanimously

appoint another member of the board of directors to

act at the meeting in the place of such absent or disqualified member.

5

Section 4.2 Committee Powers and Authority.

The board of directors may provide, by resolution

or by amendment to these bylaws, for an Executive Committee to consist of one or more

directors of the Corporation (but no persons who are not directors of the Corporation) that may

exercise all the power and authority of the board of directors in the management of the business and affairs of the Corporation, and may

authorize the seal of the Corporation to be affixed to all papers which may require it; provided, however, that an Executive Committee

may not exercise the power or authority of the board of directors in reference to amending the articles of incorporation (except that

an Executive Committee may, to the extent authorized in the resolution or resolutions providing

for the issuance of shares of stock adopted by the board of directors, pursuant to Article

3(3) of the articles of incorporation, fix the designations

and any of the preferences or rights of shares

of preferred stock relating to dividends, redemption, dissolution, any distribution of property

or assets of the Corporation, or the conversion into, or the exchange of shares for, shares

of any other class or classes or any other series of the same

or any other class or classes of stock of the Corporation or fix the

number of shares of any series of stock or authorize the increase

or decrease of the shares of any series),

adopting an agreement of merger or

consolidation, recommending to the stockholders the sale, lease, or exchange of all or substantially

all of the Corporations property and assets, recommending to the stockholders a dissolution

of the Corporation or a revocation of a dissolution, or amending these bylaws; and, unless the resolution expressly so provides, no an

Executive Committee shall have the power or authority to declare a dividend or to authorize

the issuance of stock.

Section 4.3 Committee Procedures.

To the extent the board of directors or the committee does not establish other procedures for the committee, each committee shall be governed

by the procedures established in Section 2.4 (except as they

relate to an annual meeting of the board of directors) and Sections 2.5, 2.6, 2.7, 2.8 and

2.9 of these bylaws, as if the committee were the board of directors.

ARTICLE V

Indemnification

Section 5.1 Expenses for

Actions Other Than By or In the Right of

the Corporation. The Corporation shall indemnify any person who was or is a party or is

threatened to be made a party to any threatened,

pending or completed action, suit or proceeding, whether civil, criminal, administrative

or investigative (other than an action by or in

the right of the Corporation) by reason of the fact that he is or was a director or officer

of the Corporation, or, while a director or officer of the Corporation, is or was serving

at the request of the Corporation as a director, officer, employee or

agent of another corporation, partnership, venture, trust, association or other enterprise, against expenses (including attorneys

fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by

him in connection with which action, suit or proceeding, if he acted in good faith and in a manner

he reasonably believed to be in or not opposed to the best interests of the Corporation and, with respect to any criminal action

or proceeding, had no reasonable cause to believe his conduct was unlawful. The termination of any action, suit or proceeding by

judgment, order, settlement, conviction or upon plea of nolo contendere or its equivalent, shall not, of itself, create a presumption

that the person did not act in good faith and in a manner which he reasonably believed to be in or not opposed to the best interests

of the Corporation and, with respect to any criminal action or proceeding,

that he had reasonable cause to believe that his conduct was unlawful.

Section 5.2 Expenses for Actions By

or In the Right of the Corporation. The Corporation shall indemnify any

person who was or is a party or is threatened to be made a party to

any threatened, pending or completed action or suit

by or in the right of the Corporation to procure

a judgment in its favor by reason of the fact that he is or was a director or officer of the

Corporation, or, while a director or officer of the Corporation, is or was serving at the

request of the Corporation as a director, officer, employee

or agent of another corporation, partnership,

joint venture, trust, association or other enterprise, against expenses (including attorneys fees) actually and reasonably incurred by

him in connection with the defense or settlement of such action or suit, if he acted in good

faith and in a manner he reasonably believed

to be in or not opposed to the best interests of the Corporation, except that

no indemnification shall be made in respect of any claim, issue or matter

as to which such person shall have been adjudged

to be liable to the Corporation unless and only to the extent that the court in which such

action or suit was brought shall determine upon application that, despite the adjudication

of liability but in view of all the circumstances of the case, such person is fairly and reasonably

entitled to indemnity for such expenses which the court

shall deem proper.

6

Section 5.3 Successful Defense.

To the extent that any person referred to in the

preceding two sections of this Article V has been

successful on the merits or

otherwise in defense of any action, suit

or proceeding referred to in such sections, or in defense of any claim issue, or matter therein,

he shall be indemnified against expenses (including attorneys fees) actually and reasonably incurred by him in connection therewith.

Section 5.4 Determination to Indemnify.

Any indemnification under the first two sections of this Article V (unless ordered by a court)

shall be made by the Corporation only

as authorized in the specific case upon a determination that indemnification of the

director or officer is proper in the circumstances because he

has met the applicable standard of conduct set

forth therein. Such determination shall be made (i) by the stockholders, (ii) by

the board of directors by majority vote of a quorum consisting of directors who were not parties

to action, suit or proceeding, or (iii) if such quorum is not obtainable or, if a quorum of disinterested directors so

directs, by independent legal counsel in a written opinion.

Section 5.5 Expense Advances. Expenses

incurred by an officer or director in defending any civil or criminal action, suit or proceeding

may be paid by the Corporation in advance of the final disposition of such action, suit or

proceeding upon receipt of an undertaking by or on behalf of the director or officer to repay

such amount if it shall ultimately be determined that he is not entitled to be indemnified by the Corporation as authorized in this Article

V.

Section 5.6 Provisions Nonexclusive.

The indemnification and advancement of expenses provided by, or granted pursuant to, the

other sections of this Article V shall not be deemed exclusive of any

other rights to which any person seeking indemnification or advancement of expenses may be

entitled under the articles of incorporation or under any other bylaw, agreement,

insurance policy, vote of stockholders or disinterested directors, statute or otherwise,

both as to action in his official capacity and as to action in another capacity while holding such office.

Section 5.7 Insurance. By

action of the board of directors, notwithstanding any interest of the directors in the action,

the Corporation shall have power to purchase and maintain

insurance, in such amounts as the board of directors deems appropriate, on behalf of

any person who is or was a director or officer of the Corporation, or is or was serving at

the request of the Corporation as a director, officer, employee or agent of another corporation,

partnership, joint venture, trust, association or other enterprise, against any liability

asserted against him and incurred by him in any

such capacity, or arising out of his status as such, whether or not he is indemnified against such liability or

expense under the provisions of this Article V and whether or not the Corporation would have the power or would be required to indemnify

him against such liability under the provisions of this Article V or of the Nevada Law or by any

other applicable law.

Section 5.8 Surviving Corporation.

The board of directors may provide by resolution that references to the Corporation in this

Article V shall include, in addition to this Corporation, all constituent corporations absorbed in a merger with this Corporation so that

any person who was a director or officer of such a constituent corporation or is or was serving at the request of such constituent corporation

as a director, employee or agent of another corporation, partnership, joint venture, trust, association or other entity shall stand in

the same position under the provisions of this Article V with respect to this Corporation as he would if he had served this Corporation

in the same capacity or is or was so serving such other entity at the request of this Corporation, as the case may be.

Section 5.9 Inurement. The indemnification

and advancement of expenses provided by, or granted pursuant to, this Article V shall continue

as to a person who has ceased to be a or officer and shall inure to the benefit of the heirs, executors, and administrators of such person.

Section 5.10 Employees and Agents.

To the same extent as it may do for a director or officer, the Corporation may indemnify

and advance expenses to a person who is not and was not a director or officer of the Corporation but who is or was an employee

or agent of the Corporation or who is or was serving at the request of the Corporation as

a director, officer, employee or agent of another corporation, partnership, joint venture,

trust, association or other enterprise.

7

ARTICLE VI

Stock

Section 6.1 Certificates. Every

holder of stock in the Corporation represented by certificates and, upon request, every

holder of uncertificated shares shall be entitled to have a certificate, signed by or in the name of the Corporation by the President

or chairman of the board of directors, or a vice president, and by the secretary or an assistant

secretary, or the treasurer or an assistant treasurer of the Corporation, certifying the number of shares owned by him in the Corporation.

Section 6.2 Facsimile Signatures.

Where a certificate of stock is countersigned (i) by a transfer agent other than the Corporation

or its employee or (ii) by a registrar other than

the Corporation or its employee, any other signature on the certificate may be facsimile.

In case any officer, transfer agent or registrar who has signed, or

whose facsimile signature or signatures have been placed upon, any such certificate shall cease

to be such officer, transfer agent or registrar, whether because of death, resignation or otherwise, before such certificate is issued,

the certificate may nevertheless be issued by the Corporation with the same

effect as if he were such officer, transfer agent or registrar at the date of issue.

Section 6.3 Transfer of Stock.

Transfers of shares of stock of the Corporation shall be made

on the books of the Corporation only upon presentation

of the certificate or certificates representing such shares properly endorsed or accompanied

by a proper instrument of assignment, except as may otherwise be expressly provided

by the laws of the State of Nevada or by order by a court of competent jurisdiction. The

officers or transfer agents of the Corporation may, in their discretion, require a signature

guaranty before making any transfer.

Section 6.5 Lost Certificates. The

board of directors may direct that a new certificate of stock be issued in

place of any certificate issued by

the Corporation that is alleged to have been

lost, stolen or destroyed, upon the making of an affidavit of that fact by

the person claiming the certificate to be lost, stolen, or destroyed. When

authorizing such issue of a certificate, the board of directors may, in its discretion and

as a condition precedent to the issuance of a new certificate, require the owner of such lost,

stolen, or destroyed certificate, or his legal representative, to give the Corporation a bond in

such sum as it may reasonably direct as indemnity against any claim that may

be made against the Corporation on account of the alleged loss, theft or destruction of any such certificate or the issuance of

such new certificate.

ARTICLE VII

Seal

The board of directors may,

but are not required to, adopt and provide a common seal or stamp which, when adopted, shall

constitute the corporate seal of the Corporation. The seal may be used by

causing it or a facsimile thereof to be impressed

or affixed or manually reproduced.

ARTICLE VIII

Fiscal Year

The board of directors, by resolution, have adopted June 30th

as its fiscal year end for the Corporation.

ARTICLE IX

Amendment

The Board of Directors is expressly

authorized to adopt, repeal, alter, amend and rescind any or all of the Bylaws of the Corporation. The affirmative vote of at least a

majority of the Board of Directors then in office shall be required in order for the Board of Directors to adopt, repeal, alter, amend

or rescind the Corporation’s Bylaws. The number of directors of the Corporation shall be determined in the manner set forth in the

Bylaws of the Corporation. The election of directors need not be by written ballot unless the by-laws of the Corporation shall so provide.

The Corporation’s Bylaws may also be adopted, repealed, altered, amended or rescinded by the majority vote of shareholders.

8

These

bylaws have been duly adopted by

the written consent by the Corporation’s

Board of Directors on the

5th day of July 2023 in accordance

with NRS.

C2 Blockchain, Inc.

/s/ Levi Jacobson

By: Levi Jacobson,

its sole director

EXHIBIT 4.1

C2 BLOCKCHAIN, INC.

SUBSCRIPTION AGREEMENT

123 SE 3rd Ave., #130

Miami, FL 33131

Shares of Common Stock

Subject to the terms and conditions

of the shares of common stock (the "Shares”) described in the C2 Blockchain, Inc. (the “Company”)

Offering Circular dated July___, 2023 (the "Offering"), I hereby subscribe to purchase the number of shares of Common

Stock set forth below for a purchase price of $_____ per share. Enclosed with this Subscription Agreement (the “Agreement”)

is my check (Online “E-Check” or Traditional Paper Check), ACH or money order made payable to "C2 Blockchain,

Inc.” (the “Company”) evidencing $___ for each Share subscribed.

I understand that my subscription is

conditioned upon acceptance by the Company and subject to additional conditions described in the Offering Circular. I further understand

that the Company, in its sole discretion, may reject my subscription in whole or in part and may, without notice, allot to me a

fewer number of Shares that I have subscribed for. In the event the Offering is terminated, all subscription proceeds will be returned

without interest.

I understand that when this Agreement

is executed and delivered, it is irrevocable and binding to me. I further understand and agree that my right to purchase Shares

offered by the Company may be assigned or transferred to any third party without the express written consent of the Company.

I further certify, under penalties of

perjury, that: (1) the taxpayer identification number shown on the signature page of this Offering Circular is my correct identification

number; (2) I am not subject to backup withholding under the Internal Revenue Code because (a) I am exempt from backup withholding;

(b) I have not been notified by the Internal Revenue Service (the “IRS”) that I am subject to backup withholding as

a result of a failure to report all interest or dividends or (c) the IRS has notified me that I am no longer subject to backup

withholding; and (3) I am a U.S. citizen or other U.S. person (as defined in the instructions to Form W-9).

SUBSCRIPTION AGREEMENT (the “Agreement”)

with the undersigned Purchaser for __________ Shares of the Company with a par value per share of $0.001, at a purchase price

of $____ per share (aggregate purchase price: $____________) (hereafter the “Purchase Price,”).

This Agreement is between C2 Blockchain,

Inc., a Delaware corporation (the “Company”), and the Purchaser whose signature appears below on the signature

line of this Agreement (the “Purchaser”).

WI T N E S E T H:

WHEREAS, the Company is offering for sale

up to a maximum of Two Hundred Million (200,000,000) shares of common stock (the “Shares”) (such

offering being referred to in this Agreement as the “Offering”).

NOW, THEREFORE, the Company and the

Purchaser, in consideration of the mutual covenants contained herein and intending to be legally bound, do hereby agree as follows:

| 1. |

Purchase and Sale. Subject to the terms and conditions hereof, the Company shall sell, and the Purchaser shall purchase, the number of Shares indicated above at the price so indicated. |

| |

|

| 2. |

Method

of Subscription. The Purchaser is requested to complete and execute this agreement online or to print, execute

and deliver two copies of this Agreement to the Company, at 123 SE 3rd Ave., #130, Miami, FL 33131 along with payment

in the amount of the Purchase Price of the Shares subscribed (the “Funds”), as outlined below. The Company

reserves the right in its sole discretion, to accept or reject, in whole or in part, any and all subscriptions for

Shares.

|

| |

|

| 3. |

Subscription and Purchase. |

| |

a) |

The Offering will commence

no later than two business days following the earlier of the determination of the offering price or the date the offering circular is

first used after qualification by the Commission in connection with this offering or sale and continue until the Company has sold all of the Shares offered hereby or on such earlier date as the Company may close or terminate the Offering. Any subscription for Shares received will be rejected by the Company within 30 days of receipt thereof or the termination date of this Offering, if earlier. |

| |

|

|

| |

b) |

Contemporaneously with the execution and delivery of this Agreement, Purchaser shall pay the Purchase Price for the Shares by check (Online “E-Check,” ACH debit transfer or Traditional Paper Check) or money order made payable to C2 Blockchain, Inc. |

| |

|

|

| |

c) |

Upon receipt of the Funds to the Company, Purchaser shall receive notice and evidence of the digital entry (or other manner of record) of the number of Shares owned by the Purchaser reflected on the books and records of the Company which books and records shall bear the notation that the Shares were sold in reliance upon Regulation A under the Securities Act of 1933. |

| |

|

|

| |

d) |

If any such subscription is accepted, the Company will promptly deliver or mail to the Purchaser (i) a fully executed counterpart of this Agreement, (ii) a certificate or certificates for the Shares being purchased, registered in the name of the Purchaser or uncertificated shares by registering such shares in the Company’s books and records as book-entry shares and take all action necessary to provide Purchaser with evidence of the uncertificated book-entry shares and (iii) if the subscription has been accepted only in part, a refund of the Funds submitted for Shares not purchased. Simultaneously with the delivery or mailing of the foregoing, the Funds deposited in payment for the Shares purchased will be released to the Company. If any such subscription is rejected by the Company, the Company will promptly return, without interest, the Funds submitted with such subscription to the subscriber. |

| 4. |

Representations, Warranties and Covenants of the Purchaser. The Purchaser represents, warrants and agrees as follows: |

| |

a) |

Prior to making the decision to enter into this Agreement and invest in the Shares subscribed, the Purchaser has received the Offering Circular. The Purchaser acknowledges that the Purchaser has not been given any information or representations concerning the Company or the Offering, other than as set forth in the Offering Statement, and if given or made, such information or representations have not been relied upon by the Purchaser in deciding to invest in the Shares subscribed. |

| |

|

|

| |

b) |

The Purchaser has such knowledge and experience in financial and business matters that the Purchaser is capable of evaluating the merits and risks of the investment in the Shares subscribed and the Purchaser believes that the Purchaser’s prior investment experience and knowledge of investments in low-priced securities (“penny stocks”) enables the Purchaser to make an informal decision with respect to an investment in the Shares subscribed. |

| |

|

|

| |

c) |

The Shares subscribed are being acquired for the Purchaser’s own account and for the purposes of investment and not with a view to, or for the sale in connection with, the distribution thereof, nor with any present intention of distributing or selling any such Shares. |

| |

|

|

| |

d) |

The Purchaser’s overall commitment to investments is not disproportionate to his/her net worth, and his/her investment in the Shares subscribed will not cause such overall commitment to become excessive. |

| |

|

|

| |

e) |

The Purchaser reiterates that he meets the standards set forth in the Offering Circular and, more specifically, the Purchaser has adequate means of providing for his/her current needs and personal contingencies, and has no need for current income or liquidity in his/her investment in the Shares subscribed. |

| |

|

|

| |

f) |

With respect to the tax aspects of the investment, the Purchaser will rely upon the advice of the Purchaser’s own tax advisors. |

| |

|

|

| |

g) |

The Purchaser can withstand the loss of the Purchaser’s entire investment without suffering serious financial difficulties. |

| |

|

|

| |

h) |

The Purchaser is aware that this investment involves a high degree of risk and that it is possible that his/her entire investment will be lost. |

| |

|

|

| |

i) |

The Purchaser is a resident of the State set forth below the signature of the Purchaser on the last age of this Agreement. |

| |

|

|

| |

j) |

The Purchaser confirms that he understands that, unless a subscription is rejected, the funds will automatically be retained by the Company per the terms of the Offering Circular. |

| 5. |

Notices. All notices, request, consents and other communications required or permitted hereunder shall be in writing and shall be delivered, or mailed first class, postage prepaid, registered or certified mail, return receipt requested: |

| |

a) |

If to any holder of any of the Shares, addressed to such holder at the holder’s last address appearing on the books of the Company, or |

| |

b) |

If to

the Company, addressed to the Company at 123 SE 3rd Ave., #130, Miami, FL 33131 or such other address as the Company may specify by

written notice to the Purchaser, and such notices or other communications shall for all purposes of this Agreement be treated as

being effective on delivery, if delivered personally or, if sent by mail, on the earlier of actual receipt or the third postal

business day after the same has been deposited in a regularly maintained receptacle for the deposit of United States’ mail,

addressed and postage prepaid as aforesaid. |

| 6. |

Severability. If any provision of this Subscription Agreement is determined to be invalid or unenforceable under any applicable law, then such provision shall be deemed inoperative to the extent that it may conflict with such applicable law and shall be deemed modified to conform with such law. Any provision of this Agreement that may be invalid or unenforceable under any applicable law shall not affect the validity or enforceability of any other provision of this Agreement, and to this extent the provisions of this Agreement shall be severable. |

| |

|

| 7. |

Parties in Interest. This Agreement shall be binding upon and inure to the benefits of and be enforceable against the parties hereto and their respective successors or assigns, provided, however, that the Purchaser may not assign this Agreement or any rights or benefits hereunder. |

| |

|

| 8. |

Choice

of Law. This Agreement is made under the laws of Nevada and for all purposes shall be governed by and construed in

accordance with the laws of that State, including, without limitation, the validity of this Agreement, the construction of its

terms, and the interpretation of the rights and obligations of the parties hereto. |

| |

|

| 9. |

Headings. Sections and paragraph heading used in this Agreement have been inserted for convenience of reference only, do not constitute a part of this Agreement and shall not affect the construction of this Agreement. |

| |

|

| 10. |

Execution in Counterparts. This Agreement may be executed an any number of counterparts and by different parties hereto in separate counterparts, each of which when so executed and delivered shall be deemed to be an original and all of which when taken together shall constitute but one and the same instrument. |

| |

|

| 11. |

Survival of Representations and Warranties. The representations and warranties of the Purchaser in and with respect to this Agreement shall survive the execution and delivery of this Agreement, any investigation at any time made by or on behalf of any Purchaser, and the sale and purchase of the Shares and payment therefore. |

| |

|

|

|

| 12. |

No Incidental, Consequential, Punitive or Special Damages. In no event shall any party be liable for any incidental, consequential, punitive or special damages by reason of its breach of this Agreement. The liability, if any, of the Company and its Managers, Directors, Officers, Employees, Agents, Representatives and Employees to the undersigned under this Agreement for claims, costs, damages and expenses of any nature for which they are or may be legally liable, whether arising in negligence or other tort, contract, or otherwise shall not exceed, in the aggregate the undersigned’s investment amount. |

| 13. |

Additional Information. The Purchaser realizes that the Shares are offered hereby pursuant to exemptions from registration provided by Regulation A and the Securities Act of 1933. The shares may be offered to residents of as many as all 50 states through registered broker-dealer(s)/Selling Agent(s) and any affiliated broker groups to assist in the placement of its securities on a best efforts basis. Depending on the agreement(s) with the respective Selling Agent and affiliated group, the brokerage commissions payable will range from __% to ___% of the Purchase Price for a given investor |

IN WITNESSES WHEREOF, the parties hereto

have executed this Subscription Agreement on ________, ____, 2023.

C2 Blockchain, Inc.

By: _____________________________________________

Levi Jacobson, Chief Executive Officer

PURCHASER:

_____________________________________________

Signature of Purchaser

_____________________________________________

Name of Purchaser

______________________________________________

Phone Number of Purchaser

______________________________________________

Email of Purchaser

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING

FIRM

We hereby consent to the incorporation in this Offering

Statement on Form 1-A of our report dated August 15, 2022, relating to the financial statements of C2 Blockchain, Inc. as of June 30,

2022 and the period from June 30, 2021 (Inception) through June 30, 2021 and to all references to our firm included in this Offering Statement.

/s/

BF Borgers CPA PC

Certified Public Accountants

Lakewood, CO

July 5, 2023

LAW OFFICE OF CARL P.

RANNO

|

CARL P. RANNO

Attorney and Counselor at Law

|

2733 EAST VISTA DRIVE

PHOENIX, ARIZONA 85032

|

Telephone: 602-493-0369

Email: carlranno@cox.net

|

Exhibit 1A-12

July 5, 2023

C2 Blockchain, Inc.

123 SE 3rd Avenue, #130

Miami, Florida

ATTN: Levi Jacobson

Via email: levateva123@gmail.com

RE: Opinion to be included with a Form 1-A Tier 2 Offering Statement to

be filed by C2 Blockchain, Inc., a Nevada Corporation.

Dear Sir,

This opinion is submitted pursuant to Item 17.12 of Form 1-A with respect

to the proposed offering of C2 Blockchain, Inc., a Nevada Corporation (the Company) relating to the application for exemption from registration

under Section 3(b) of the Securities Act of 1933, as amended (the “Act”), and Regulation A+ promulgated thereunder.

The Company is offering up to a maximum of 200,000,000 shares of its common

stock which will not exceed $75,000,000. The Company will provide a final fixed price in an offering circular supplement after qualification

of our offering statement by the Commission. The offering will commence no later than two business days following the earlier of the determination

of the offering price or the date the offering circular is first used after qualification by the Commission in connection with this offering

or sale. The Company will receive all of the proceeds from the sale of shares. The offering is being made on a self-underwritten,

“best efforts” basis notwithstanding shares may be sold to or through underwriters or dealers, directly to purchasers or through

agents designated from time to time. There is no minimum number of shares required to be purchased by each investor. The shares

offered by the Company will be sold on its behalf by the sole director and Chief Executive Officer, Levi Jacobson. Mr. Jacobson is

deemed to be an underwriter of this offering. He will not receive any commissions or proceeds for selling the registered shares on our

behalf. There is uncertainty that the Company will be able to sell any of the shares being offered herein by the Company.

Currently, there are 253,936,005 common shares issued and outstanding. Mr.

Jacobson indirectly owns 200,000,000 common shares of the Company by and through Mendel Holdings, LLC, a Delaware Limited Liability company

whereas he is the sole member resulting in control and representing a voting percentage of 78.760 %.

The Company qualifies as an “emerging growth company” as defined

in the Jumpstart Our Business Startups Act, which became law in April 2012 and will be subject to reduced public company reporting requirements.

For purposes of rendering this opinion, I have

examined the Offering Statement, the Company’s Articles of Incorporation filed on June 30, 2021, the Company’s Bylaws, the

Exhibits attached to the Offering Statement, and such other documents and matters of law as I have deemed necessary for the expression

of the opinion herein contained. For the purposes of such examination, I have assumed the genuineness of all signatures on original documents

and the conformity to original documents of all copies submitted. I have relied, without independent investigation, on certificates of

public officials and, as to matters of fact, material to the opinion set forth below, on certificates of officers of the Company.

On the basis of and in reliance upon the foregoing examination and assumptions,

I am of the opinion that assuming the Offering Statement shall have become qualified, the Shares, when issued by the Company against payment

therefore (not less than par value) and in accordance with the Offering Statement and the provisions of the Subscription Agreements, a

form of which I have reviewed, and when duly registered on the books of the Company’s transfer agent and registrar therefor in the

name or on behalf of the purchasers, will be validly issued, fully paid and non-assessable. I express no opinion as to the laws

of any state or jurisdiction other than the applicable sections of the Nevada Business Corporation Act, as currently in effect and the

federal laws of the United States.

I hereby consent to the filing of this opinion as an exhibit to the Offering

Statement and to the reference to me under the caption “Legal Matters” in the Offering Circular constituting a part of the

Offering Statement. This opinion is for your benefit in connection with the Offering Statement and may be relied upon by you and by people

entitled to rely upon it pursuant to the applicable provisions of the Act. In giving this consent, I do not admit that my firm is in the

category of persons whose consent is required under Section 7 of the Act or the rules and regulations of the Commission.

Sincerely,

/s/Carl P. Ranno

Carl P. Ranno

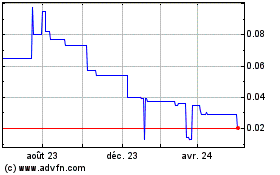

C2 Blockchain (PK) (USOTC:CBLO)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

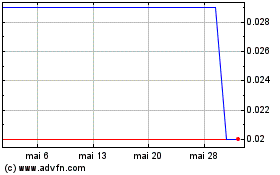

C2 Blockchain (PK) (USOTC:CBLO)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025