FDML Earnings Fall but Beat - Analyst Blog

29 Avril 2013 - 11:30AM

Zacks

Federal-Mogul Corp. (FDML) posted a 45.7% fall

in earnings per share to 19 cents in the first quarter of 2013 from

35 cents in the corresponding quarter last year. However, earnings

per share comfortably outpaced the Zacks Consensus Estimate of a

loss of 29 cents. Net income declined 43.2% to $21.0 million from

$37.0 million in the year-ago quarter.

Revenues also decreased 2.4% to $1.69 billion in the reported

quarter, missing the Zacks Consensus Estimate of $1.75 billion. The

year-over-decline was due to lower European light vehicle shipment

and reduced global commercial vehicle production.

Segment Results

Revenues from the Powertrain Segment went down 2%

to $1.1 billion. Higher revenues from North America were offset by

lower light vehicle and commercial vehicle production in the

region. The company also recorded lower revenues from European

operation together with lower vehicle production.

Operational EBITDA of the Powertrain Segment declined 15.9% to

$90.0 million. However, it was higher than the fourth quarter

results based on favorable impacts of cost reduction and portfolio

restructuring actions.

Revenues from the Vehicle Components Segment

declined 2.3% to $737.0 million from $754.0 million a year ago,

driven by a 7% decline in revenues from North America, partially

offset by higher revenues from European operation. Operational

EBITDA of Vehicle Components Segment declined 12.1% to $51.0

million from $58.0 million in the first quarter of 2012, due to

lower sales volume.

Financial Details

Federal-Mogul had cash and cash equivalents of $269.0 million as of

Mar 31, 2013, compared with $467.0 million as of Dec 31, 2012.

Total debt remained flat at $2.8 billion as of Mar 31, 2013.

In the first quarter of 2013, cash outflow from operating

activities amounted to $50.0 million, compared with cash inflow of

$5.0 million in the same period of 2012. Capital expenditure

amounted to $93.0 million compared with $130.0 million a year

ago.

Our Take

Federal-Mogul is a leading global supplier of powertrain, chassis

and safety technologies. The company’s leading technology and

innovation, lean manufacturing expertise, as well as marketing and

distribution deliver world-class products, brands and services with

quality excellence at a competitive cost. Currently, it retains a

Zacks Rank #3 (Hold).

Some other stocks that are performing well in the industry where

Federal-Mogul operates include Gentherm

Incorporated (THRM), Visteon Corp. (VC)

and Denso Corp. (DNZOY). All these companies carry

a Zacks Rank #1 (Strong Buy).

DENSO CORP (DNZOY): Get Free Report

FEDERAL MOGUL-A (FDML): Free Stock Analysis Report

GENTHERM INC (THRM): Free Stock Analysis Report

VISTEON CORP (VC): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

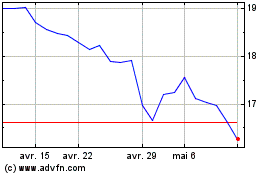

Denso (PK) (USOTC:DNZOY)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

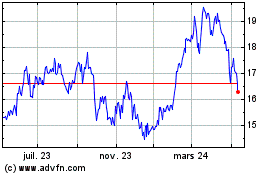

Denso (PK) (USOTC:DNZOY)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024

Real-Time news about Denso Corp Ltd (PK) (OTCMarkets): 0 recent articles

Plus d'articles sur Denso Corp. (PC)