Tenneco Upgraded to Neutral - Analyst Blog

13 Mai 2013 - 6:55PM

Zacks

On May 10, we upgraded Tenneco Inc. (TEN) to

Neutral based on its strong commercial vehicle business and robust

performance in the first quarter of 2013. However, we are concerned

about the high customer concentration and weak demand for

high-margin aftermarket parts.

Why the Upgrade?

On Apr 29, Tenneco reported a 9.1% increase in adjusted earnings

per share to 72 cents for the first quarter of 2013 from 66 cents a

year ago, surpassing the Zacks Consensus Estimate by 7 cents. Net

income augmented 7.3% to $44.0 million from $41.0 million a year

ago.

Revenues increased marginally to $1.90 billion, beating the Zacks

Consensus Estimate of $1.84 billion. The year-over-year increase in

revenues was attributable to higher revenues from Clean Air

division, partially offset by decline in revenues from Ride

Performance.

Following the release of the first-quarter results, the Zacks

Consensus Estimate for 2013 increased 1.7% to $3.65 per share. The

Zacks Consensus Estimate for 2014 also went up 1.1% to $4.47 per

share. Currently, the company carries a Zacks Rank #3 (Hold).

The Emission Control segment of the company will have a favorable

impact from tighter emission regulations through 2015, with its

global market share reaching 10%. Tenneco expects to achieve a

5-year average compound annual OE revenue growth rate of 18% to 20%

through 2014 with the implementation of emission regulations.

In addition, the diversified platform mix of Tenneco will lead to

its business expansion. The company also plans to broaden its

product portfolio, gain new business and attain a dominant position

in the emerging markets through various acquisitions and

alliances.

Tenneco remains under pressure as automotive retailers like

AutoZone Inc. (AZO) demand heavy pricing

concessions. In addition, the company faces high customer

concentration as the company’s top 10 aftermarket customers,

including Ford Motor Co. (F), constitute 50% of

its total aftermarket sales.

Other Stocks to Consider

Currently, Denso Corp. (DNZOY) is performing well

in the same industry where Tenneco operates. The stock holds a

Zacks Rank #1 (Strong Buy).

AUTOZONE INC (AZO): Free Stock Analysis Report

DENSO CORP (DNZOY): Get Free Report

FORD MOTOR CO (F): Free Stock Analysis Report

TENNECO INC (TEN): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

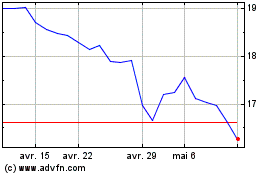

Denso (PK) (USOTC:DNZOY)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

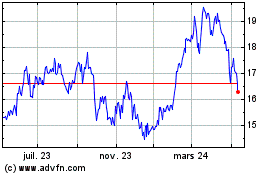

Denso (PK) (USOTC:DNZOY)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024

Real-Time news about Denso Corp Ltd (PK) (OTCMarkets): 0 recent articles

Plus d'articles sur Denso Corp. (PC)