Japan Shares Fall, Led by Car Makers

24 Septembre 2015 - 4:30AM

Dow Jones News

Shares in Japan fell Thursday, tracking regional losses earlier

this week, with auto makers leading the decline as the potential

fallout of a scandal at Volkswagen AG spreads concern to other

firms.

The Nikkei Stock Average was down 1.5% as trading resumed after

a three-day holiday. Reports that Volkswagen cheated on U.S.

exhaust-emissions tests could signal more stringent environmental

testing for other auto makers, a factor that has pressured shares

early Thursday. Shares of Mazda Motor Corp. were down 7.3%,

Mitsubishi Motors Corp. lost 4.3% and auto-parts maker Denso Corp.

fell 4.3%.

The losses follow the resignation of Volkswagen's chief

executive Martin Winterkorn Wednesday, and a calamitous few days

for Europe's largest auto maker after the U.S. Environmental

Protection Agency on Friday disclosed that the company used

software on some VW and Audi diesel-powered cars to manipulate the

results of routine emissions tests.

While one of Volkswagen's direct rivals in Japan, Toyota Motor

Corp., has outperformed the broader market, it was still down

1.2%.

"Toyota is competing with the No. 1 [car marker in the global

market]. Some investors must have sold Volkswagen shares, putting

some of the money in Toyota," said Hideyuki Ishiguro, a senior

strategist at Okasan Securities.

Losses in Japan also follow dismal Chinese manufacturing data

from Wednesday, which fell to a 6½ -year low, stoking further

worries about the ripple effects of its slowing economy.

Elsewhere, shares mostly rebounded. Australia's S&P ASX 200

was up 1.1%, after hitting a two-year low on Wednesday. The Hang

Seng Index was flat while the Shanghai Composite Index gained 0.3%.

South Korea's Kospi was up 0.5%.

Shares in the U.S. ended slightly lower overnight as economic

news from Europe helped offset the weak Chinese data.

Investors are also looking to a coming speech by Federal Reserve

Chairwoman Janet Yellen on Thursday at the University of

Massachusetts-Amherst for clues about the probability of a rise in

interest rates later this year. The speech comes a mere week after

the bank decided to keep interest rates unchanged.

Morgan Stanley notes that in each of her three speeches earlier

this year—the most recent being July 10—Ms. Yellen stated that if

the economy improved as she expected, an increase to the policy

rate would be appropriate "at some point this year." If that key

phrase is missing Thursday, it could lower expectations for 2015

liftoff.

Uncertainty about the timing of the Fed's rate increase has

added to worries about China's slowdown, causing volatility in

stocks and currencies in the region. Earlier this week, a

strengthening U.S. dollar pressured Asian currencies, which

continued to fall Wednesday after the poor Chinese economic

reading. The Indonesian rupiah, for example, reached a fresh

17-year low.

On Thursday, the Australian dollar was up 0.1% against the U.S.

dollar to just above $0.70, a level that it had breached earlier

this month for the first time in years.

Prices for brent crude oil were up 0.4% in Asia trade after U.S.

oil prices declined more than 4% overnight.

Gold was up 0.1% at $1,130.80 a troy ounce.

Paul Vigna and Kosaku Narioka contributed to this article.

Write to Chao Deng at Chao.Deng@wsj.com

Access Investor Kit for "Volkswagen AG"

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=DE0007664039

Access Investor Kit for "Toyota Motor Corp."

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=JP3633400001

Access Investor Kit for "Toyota Motor Corp."

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=US8923313071

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

September 23, 2015 22:15 ET (02:15 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

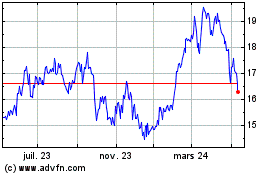

Denso (PK) (USOTC:DNZOY)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

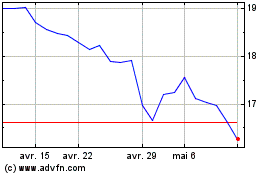

Denso (PK) (USOTC:DNZOY)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024