true

FY

0001538495

http://fasb.org/us-gaap/2023#RelatedPartyMember

http://fasb.org/us-gaap/2023#RelatedPartyMember

0001538495

2022-04-01

2023-03-31

0001538495

2023-03-31

0001538495

2022-03-31

0001538495

2021-04-01

2022-03-31

0001538495

us-gaap:CommonStockMember

2021-03-31

0001538495

us-gaap:PreferredStockMember

2021-03-31

0001538495

us-gaap:AdditionalPaidInCapitalMember

2021-03-31

0001538495

us-gaap:RetainedEarningsMember

2021-03-31

0001538495

2021-03-31

0001538495

us-gaap:CommonStockMember

2022-03-31

0001538495

us-gaap:PreferredStockMember

2022-03-31

0001538495

us-gaap:AdditionalPaidInCapitalMember

2022-03-31

0001538495

us-gaap:RetainedEarningsMember

2022-03-31

0001538495

us-gaap:CommonStockMember

2021-04-01

2022-03-31

0001538495

us-gaap:PreferredStockMember

2021-04-01

2022-03-31

0001538495

us-gaap:AdditionalPaidInCapitalMember

2021-04-01

2022-03-31

0001538495

us-gaap:RetainedEarningsMember

2021-04-01

2022-03-31

0001538495

us-gaap:CommonStockMember

2022-04-01

2023-03-31

0001538495

us-gaap:PreferredStockMember

2022-04-01

2023-03-31

0001538495

us-gaap:AdditionalPaidInCapitalMember

2022-04-01

2023-03-31

0001538495

us-gaap:RetainedEarningsMember

2022-04-01

2023-03-31

0001538495

us-gaap:CommonStockMember

2023-03-31

0001538495

us-gaap:PreferredStockMember

2023-03-31

0001538495

us-gaap:AdditionalPaidInCapitalMember

2023-03-31

0001538495

us-gaap:RetainedEarningsMember

2023-03-31

0001538495

us-gaap:DomesticCountryMember

2022-04-01

2023-03-31

0001538495

ETST:SaleOfPharmaceuticalProductsRxCompoundMember

us-gaap:CoreMember

2022-04-01

2023-03-31

0001538495

ETST:SaleOfPharmaceuticalProductsRxCompoundMember

us-gaap:CoreMember

2021-04-01

2022-03-31

0001538495

ETST:CBDSalesHoldingCompanyMember

us-gaap:CoreMember

2022-04-01

2023-03-31

0001538495

ETST:CBDSalesHoldingCompanyMember

us-gaap:CoreMember

2021-04-01

2022-03-31

0001538495

us-gaap:CoreMember

2022-04-01

2023-03-31

0001538495

us-gaap:CoreMember

2021-04-01

2022-03-31

0001538495

ETST:ServicesPeaksMember

us-gaap:NonCoreMember

2022-04-01

2023-03-31

0001538495

ETST:ServicesPeaksMember

us-gaap:NonCoreMember

2021-04-01

2022-03-31

0001538495

us-gaap:NonCoreMember

2022-04-01

2023-03-31

0001538495

us-gaap:NonCoreMember

2021-04-01

2022-03-31

0001538495

ETST:EquipmentCostMember

2023-03-31

0001538495

ETST:EquipmentCostMember

2022-03-31

0001538495

ETST:NewLaneFinanceAndSpenserCapitalGroupMember

2022-04-01

2023-03-31

0001538495

ETST:NewLaneFinanceAndSpenserCapitalGroupMember

2023-03-31

0001538495

2022-06-01

2022-06-30

0001538495

2022-06-30

0001538495

ETST:TelemedicinePlatformMember

2023-03-31

0001538495

ETST:TelemedicinePlatformMember

2022-03-31

0001538495

ETST:WebDomainMember

2023-03-31

0001538495

ETST:WebDomainMember

2022-03-31

0001538495

ETST:RxCompoundStore.comLLCAndPeaksCurativeLLCMember

2020-11-08

0001538495

ETST:RxCompoundStorecomLLCandPeaksCurativeLLCMember

2023-03-31

0001538495

ETST:RxCompoundStorecomLLCandPeaksCurativeLLCMember

2022-04-01

2023-03-31

0001538495

ETST:RxCompoundStorecomLLCHistoricalMember

2023-03-31

0001538495

ETST:RxCompoundStorecomLLCHistoricalMember

2022-04-01

2023-03-31

0001538495

ETST:ChromogenMember

2022-05-31

0001538495

ETST:WilliamLeonardMember

2022-05-31

0001538495

ETST:GarmanTurnerGordonLLPMember

2022-05-31

0001538495

ETST:GHSMember

2022-05-31

0001538495

ETST:RobertStevensMember

2022-05-31

0001538495

ETST:RothchildMember

2022-05-31

0001538495

ETST:RothchildMember

2023-03-31

0001538495

ETST:StrongbowAdvisorsMember

2023-03-31

0001538495

ETST:ChromogenMember

2023-03-31

0001538495

ETST:ChromogenMember

2022-04-01

2023-03-31

0001538495

ETST:GiorgioRSaumatMember

2022-04-01

2023-03-31

0001538495

us-gaap:CommonStockMember

ETST:GiorgioRSaumatMember

2022-04-01

2023-03-31

0001538495

ETST:SBALoanPayableMember

2023-03-31

0001538495

ETST:RevolvingPromissoryNotePayableMember

2023-03-31

0001538495

ETST:ConvertiblePromissoryNotePayableMember

2023-03-31

0001538495

ETST:EquipmentFinanceMember

2023-03-31

0001538495

ETST:SBALoanPayableMember

2022-03-31

0001538495

ETST:RevolvingPromissoryNotePayableMember

2022-03-31

0001538495

ETST:ConvertiblePromissoryNotePayableMember

2022-03-31

0001538495

ETST:PPPLoanPayableMember

2022-03-31

0001538495

ETST:AdvancePayableMember

2022-03-31

0001538495

ETST:PromissoryNotePayableMember

2022-03-31

0001538495

ETST:NotesPayableRelatedPartiesMember

2022-03-31

0001538495

ETST:SBALoanPayableMember

2020-07-27

0001538495

ETST:SBALoanPayableMember

2020-07-27

2020-07-27

0001538495

ETST:SBALoanPayableMember

2021-04-01

0001538495

ETST:SBALoanPayableMember

2021-04-01

2021-04-01

0001538495

ETST:RevolvingPromissoryNotePayableMember

2021-08-31

0001538495

ETST:RevolvingPromissoryNotePayableMember

2022-01-28

2022-01-28

0001538495

ETST:RevolvingPromissoryNotePayableMember

2022-04-01

2022-04-01

0001538495

ETST:RevolvingPromissoryNotePayableMember

2021-08-30

2021-08-31

0001538495

ETST:ConvertiblePromissoryNotePayableMember

ETST:VcamjiIrrevTrustMember

2022-07-10

2022-07-10

0001538495

ETST:ConvertiblePromissoryNotePayableMember

ETST:VcamjiIrrevTrustMember

2022-06-10

2022-06-10

0001538495

ETST:ConvertiblePromissoryNotePayableMember

2022-07-10

0001538495

ETST:ConvertiblePromissoryNotePayableMember

2022-06-10

0001538495

us-gaap:CommonStockMember

ETST:IssaELCheikhMember

2022-04-01

2023-03-31

0001538495

us-gaap:CommonStockMember

ETST:MarioPortellaMember

2022-04-01

2023-03-31

0001538495

ETST:OpeningDebtObligationsMember

2022-04-01

2023-03-31

0001538495

ETST:PPPLoanMember

2023-03-31

0001538495

ETST:RxCompoundStoreLLCandPeaksCurativeLLCMember

2021-11-03

0001538495

us-gaap:CommonStockMember

2021-11-02

2021-11-03

0001538495

ETST:MarioGTabraueMember

2021-11-02

2021-11-03

0001538495

ETST:JoseRodriguezMember

2021-11-02

2021-11-03

0001538495

ETST:MarioPortelaMember

2021-11-02

2021-11-03

0001538495

ETST:AdrianRaventonsMember

2021-11-02

2021-11-03

0001538495

ETST:FrankGarciaMember

2021-11-02

2021-11-03

0001538495

ETST:SamGarciaMember

2021-11-02

2021-11-03

0001538495

2021-11-02

2021-11-03

0001538495

srt:ChiefFinancialOfficerMember

2022-04-01

2023-03-31

0001538495

2022-07-15

2022-07-15

0001538495

us-gaap:CommonStockMember

2021-06-04

2021-06-04

0001538495

us-gaap:CommonStockMember

2021-06-04

0001538495

2019-04-02

2019-04-02

0001538495

us-gaap:SeriesBPreferredStockMember

2022-04-21

0001538495

ETST:NickolasTabraueMember

us-gaap:SeriesBPreferredStockMember

2022-04-21

2022-04-21

0001538495

ETST:MarioTabraueMember

us-gaap:SeriesBPreferredStockMember

2022-04-21

2022-04-21

0001538495

ETST:RobertStevensMember

2022-06-03

0001538495

ETST:RobertStevensMember

2022-06-03

2022-06-03

0001538495

2022-06-03

2022-06-03

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-K/A

Amendment No. 1

☒

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the fiscal year ended March 31, 2023

OR

☐

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission

File No. 000-55000

EARTH

SCIENCE TECH, INC.

(Exact

name of registrant as specified in its charter)

| florida |

|

80-0961484 |

| (State

or other jurisdiction of |

|

(I.R.S.

Employer |

| incorporation

or organization) |

|

Identification

No.) |

8950

SW 74th CT

Suite

101

Miami,

FL 33156, USA

(Address

of principal executive offices, zip code)

(305)

724-5684

(Registrant’s

telephone number, including area code)

10650

NW 29th Terrace

Doral,

FL 33172, USA

(Former

name, former address and former fiscal year, if changed since last report)

Securities

registered pursuant to Section 12(g) of the Act:

| Title

of Each Class |

|

Trading

Symbol |

|

Name

of each exchange on which registered |

| Common

Stock $0.001 par value |

|

ETST |

|

Over

the Counter Bulletin Board |

Securities

registered pursuant to Section 12(b) of the Act: None

Indicate

by check mark if the registrant is a well-known seasoned issuer as defined in Rule 405 of the Securities Act.

Yes

☐ No ☒

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes

☒ No ☐

Indicate

by check mark whether the issuer (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act

of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has

been subject to such filing requirements for the past 90 days.

Yes

☒ No ☐

Indicate

by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data

File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding

12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes

☒ No ☐

Indicate

by check mark whether the registrant is a large, accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting

company. See the definitions of “large, accelerated filer,” “accelerated filer” and “smaller reporting

company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large,

accelerated filer |

☐ |

|

Accelerated

filer |

☐ |

| |

|

|

|

|

| Non-accelerated

filer |

☐ |

(Do

not check if a smaller reporting company) |

Smaller

reporting company |

☒ |

| |

|

|

|

|

| Emerging

Growth Company |

☐ |

|

|

|

If

securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant

included in the filing reflect the correction of an error to previously issued financial statements. ☒

Indicate

by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based

compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to

§240.10D-1(b). ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Exchange Act Rule 12b-2 of the Exchange Act):

Yes

☐ No ☒

The

aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which

the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the Registrant’s

most recently completed fiscal year (March 31, 2023) was approximately $10,173,999.

APPLICABLE

ONLY TO ISSUERS INVOLVED IN BANKRUPTCY

PROCEEDINGS

DURING THE PRECEDING FIVE YEARS:

Indicate

by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities

Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

Yes

☐ No ☒

The

number of shares of Common Stock, $0.001 par value, outstanding on March 31, 2023, was 282,611,083.

APPLICABLE

ONLY TO CORPORATE ISSUERS

| Audit

Firm ID |

|

Auditor

Name |

|

Auditor

Location |

| 6554 |

|

R.

Bolko, CPA P.A. |

|

Boca

Raton, FL |

EXPLANATORY

NOTE

Earth

Science Tech, Inc. (the “Company”) is restating in this Annual Report on Form 10-K, its consolidated prior year financial

statements arising primarily from errors made in the recording and reporting of Goodwill as described in Note 2 to the Consolidated Financial

Statements.

On

February 14, 2024, the Board of Directors of the Company and in consultation with the Chief Executive Officer and Chief Financial Officer,

concluded that our previously issued financial statements contained errors and that investors should no longer rely upon the Company’s

previously released financial statements. We subsequently determined that prior annual period financial statements should be restated

in this Annual Report on Form 10-K. See Note 2 to the Consolidated Financial Statements for further information. All schedules and footnotes

impacted indicate the restated amounts under the caption “Restated”.

In

addition to the filing of this Form 10-K, we have evaluated the impact of the error on our quarterly reports on Form 10-Q for the quarterly

periods ended June 30, 2023, September 30, 2023, and December 31, 2023. The amount of the error is less than one (1) percent of revenue

resulting in no material impact on the Company’s unaudited consolidated financial statements as previously reported on form 10-Q.

Therefore, no restatement is required.

This

Form 10-K also reflects:

| ● |

Restatement of “Financial Statements and Supplementary Data” in Item 8 for the fiscal year ended March 31, 2023. |

| |

|

| ● |

Conclusions regarding

the effectiveness of disclosure controls and procedures in Item 9a as of March 31, 2023. |

| |

|

| ● |

Reports of Independent Registered Public Accounting

Firm.

|

The

net effect of the adjustments on the Consolidated Statements of Income was to reduce the Net loss by $13,861 for the year ended March

31, 2023.

| (Increase) Decrease in Net income: | |

2023 | | |

2022 | |

| Depreciation and amortization | |

$ | 13,861 | | |

$ | - | |

| Decrease in Net loss | |

$ | 13,861 | | |

$ | - | |

The

net effect of the adjustments on the Consolidated Balance Sheet is to reverse the amortization of Goodwill recorded on the acquired company

RxCompound which was classified as an intangible asset as of March 31, 2023. The Goodwill on the balance sheet of the acquired entity

has been restated to the original balance, classified as Goodwill, and will be tested annually for impairment.

The

increase to accumulated deficit from the adjustments as of March 31, 2023, is as follows:

| Intangible assets, net | |

$ | (102,543 | ) |

| Goodwill | |

| 138,312 | |

| Decrease to retained earnings | |

$ | 35,769 | |

For

discussion of the restatement adjustments, see Note 2 – Restatement of Previously Issued Financial Statements to the consolidated

financial statements in this Form 10-K/A.

TABLE

OF CONTENTS

WHERE

YOU CAN FIND MORE INFORMATION

We

file annual, quarterly, and current reports, proxy statements and other information required by the Securities Exchange Act of 1934,

as amended (the “Exchange Act”), with the Securities and Exchange Commission (the “SEC”). You may read and copy

any document we file with the SEC at the SEC’s public reference room located at 100 F Street, N.E., Washington, D.C. 20549, U.S.A.

Please call the SEC at 1-800-SEC-0330 for further information on the public reference room. Our SEC filings are also available to the

public from the SEC’s internet site at http://www.sec.gov.

On

our Internet website, http://www.earthsciencetech.com, we post the following recent filings as soon as reasonably practicable after they

are electronically filed with or furnished to the SEC: our annual reports on Form 10-K, our quarterly reports on Form 10-Q, our current

reports on Form 8-K, and any amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act.

When

we use the terms “ETST”, “Company”, “we”, “our” and “us” we mean Earth Science

Tech, Inc., a Florida corporation, and its consolidated subsidiaries, taken as a whole, as well as any predecessor entities, unless the

context indicates otherwise.

FORWARD

LOOKING STATEMENTS

This

Annual Report on Form 10-K, the other reports, statements, and information that the Company has previously filed with or furnished to,

or that we may subsequently file with or furnish to, the SEC, and public announcements that we have previously made or may subsequently

make include, may include, or may incorporate by reference certain statements that may be deemed to be “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act of 1995, as amended, and that are intended to enjoy the protection

of the safe harbor for forward-looking statements provided by that Act. To the extent that any statements made in this report contain

information that is not historical, these statements are essentially forward-looking. Forward-looking statements can be identified using

words such as “anticipate”, “estimate”, “plan”, “project”, “continuing”,

“ongoing”, “expect”, “believe”, “intend”, “may”, “will”, “should”,

“could”, and other words of similar meaning. These statements are subject to risks and uncertainties that cannot be predicted

or quantified and, consequently, actual results may differ materially from those expressed or implied by such forward-looking statements.

Such risks and uncertainties include, without limitation, marketability of our products; legal and regulatory risks associated with OTC

Markets; our ability to raise additional capital to finance our activities; the future trading of our common stock; our ability to operate

as a public company; our ability to protect our proprietary information; general economic and business conditions; the volatility of

our operating results and financial condition; our ability to attract or retain qualified senior management personnel and research and

development staff; and other risks detailed from time to time in our filings with the SEC, or otherwise.

Information

regarding market and industry statistics contained in this report is included based on information available to us that we believe is

accurate. It is generally based on industry and other publications that are not produced for purposes of securities offerings or economic

analysis. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and the

additional uncertainties accompanying any estimates of future market size, revenue and market acceptance of products and services. We

do not undertake any obligation to publicly update any forward-looking statements. As a result, investors should not place undue reliance

on these forward-looking statements.

PART

I

ITEM

1. BUSINESS

BUSINESS

BACKGROUND AND OVERVIEW

Earth

Science Tech, Inc. (“ETST” or the “Company”) was incorporated under the laws of the State of Nevada on April

23, 2010, and subsequently changed its domicile to the State of Florida on June 27, 2022. As of November 8, 2022, the Company is a holding

entity set to acquire companies with its current focus in the health and wellness industry. The Company is presently in compounding pharmaceuticals

and telemedicine through its wholly owned subsidiaries RxCompoundStore.com, LLC. (“RxCompound”), Peaks Curative, LLC. (“Peaks”),

and Earth Science Foundation, Inc. (“ESF”).

RxCompound

is a complete compounding pharmacy. RxCompound is currently licensed to fulfill prescriptions in the states of Florida, New York, New

Jersey, Delaware, Pennsylvania, Rhode Island, Nevada, Colorado, and Arizona. RxCompound is in the application process to obtain licenses

in the remaining states in which it is not yet licensed to fulfill prescriptions.

Peaks

is a telemedicine referral site focused on men’s health. Peaks’ orders are exclusively fulfilled by RxCompound. Patients

who order Peaks via monthly subscription receive their refills automatically. Currently, Peaks is focused on Men’s health, and,

more specifically, ED. The company intends to expand offerings to include over the counter (“OTC”) (non-prescription) products

such as supplements and topicals. The OTC products will be custom manufactured or fulfilled through partnered companies under the Peaks

brand and offered worldwide.

ESF

is a favored entity of the Company, effectively being a non-profit organization that was incorporated on February 11, 2019, and is structured

to accept grants and donations to help those in need of assistance in paying for prescriptions.

Current

Operations

CORPORATE

STRATEGY

The

Company operates as a holding entity with a presence in the telehealth and compounding pharmaceutical sectors. Its primary objective

is to deliver contemporary and personalized health and wellness medications to patients. These offerings primarily target chronic conditions,

which often require recurring prescriptions and continuous healthcare support.

Most

of the offerings on Peaks’ website are sold to customers on a subscription basis. Subscription plans provide an easy and convenient

way for customers to get the ongoing treatment they need while simultaneously providing the Company with predictability through a recurring

revenue stream.

Acquisitions

In

November 2022, we completed the acquisitions of RxCompound and Peaks. Peaks completed its PCAOB audit on December 30, 2022, and RxCompound

on February 3, 2023.

PRODUCT

REGULATION

As

a consumer-driven healthcare organization, we are required to comply with complex healthcare laws and regulations at both the state and

federal level.

Marketing

Peaks’

marketing strategy relies on a combination of social media and search advertising techniques to reach its target audience effectively.

RxCompound

has garnered a remarkable reputation through positive word-of-mouth, owing to its innovative approaches and unwavering commitment to

quality. The team at RxCompound goes the extra mile by personally visiting new accounts to ensure a strong foundation and continuously

strengthens existing relationships through valuable partnerships.

COMPETITION

The

Company’s competitors are other Specialty Compounding Pharmacies in the markets in which the subsidiaries operate and any telehealth

platforms specializing in men’s health.

EMPLOYEES

As

of March 31, 2023, the Company has eight (8) employees. None of our employees are represented by a union or covered by a collective bargaining

agreement. We have not experienced any work stoppages, and we consider our relationship with our employees to be good.

ITEM

1A. RISK FACTORS

A

description of the risks and uncertainties associated with our business and ownership of our Class A common stock is set forth below.

You should carefully consider the risks described below, as well as the other information in this Annual Report on Form 10-K, including

our consolidated financial statements and the related notes and “Management’s Discussion and Analysis of Financial Condition

and Results of Operations.” The occurrence of any of the events or developments described below could materially and adversely

affect our business, financial condition, results of operations, and growth prospects. In such an event, the market price of our Class

A common stock could decline. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also

impair our business operations. This Annual Report on Form 10-K also contains forward-looking statements that involve risks and uncertainties.

Our actual results could differ materially from those anticipated in the forward-looking statements as a result of a number of factors,

including the risks described below. See “Cautionary Note Regarding Forward-Looking Statements.”

Summary

of Principal Risk Factors

| ● | Our

limited operating history and evolving business make it difficult to evaluate our current

business and future prospects and increase the risk of your investment. |

| ● | Our

results of operations, as well as our key metrics, may fluctuate on a quarterly and annual

basis, which may result in our failing to meet the expectations of industry and securities

analysts or our investors. |

| ● | If

we are unable to expand the scope of our offerings, including the number and type of products

and services that we offer, the number and quality of healthcare providers serving our customers,

and the number and types of conditions capable of being treated through our platform, our

business, financial condition, and results of operations may be materially and adversely

affected. |

| ● | If

we are unable to successfully market to new customers and retain existing customers, or if

evolving privacy, healthcare, or other laws prevent or limit our marketing activities, our

business, financial condition, and results of operations could be harmed. |

| ● | We

operate in highly competitive markets and face competition from large, well-established healthcare

providers and more traditional retailers and pharmaceutical providers with significant resources,

and, as a result, we may not be able to compete effectively. |

| ● | Our

brand is integral to our success. If we fail to effectively maintain, promote, and enhance

our brand in a cost-effective manner, our business and competitive advantage may be harmed. |

| ● | Our

pharmacy business subjects us to additional healthcare laws and regulations beyond those

we face with our core telehealth business and increases the complexity and extent of our

compliance and regulatory obligations. |

| ● | If

we fail to comply with applicable healthcare and other governmental regulations, we could

face substantial penalties, our business, financial condition, and results of operations

could be adversely affected, and we may be required to restructure our operations. |

| ● | Evolving

government regulations and enforcement activities may require increased costs or adversely

affect our results of operations. |

| ● | Security

breaches, loss of data, and other disruptions could compromise sensitive information related

to our business or customers or prevent us from accessing critical information and expose

us to liability, which could adversely affect our business and our reputation. |

| ● | We

may be subject to legal proceedings and litigation, including intellectual property disputes,

which are costly to defend and could materially harm our business and results of operations. |

| ● | We

may require additional capital to support business growth, and this capital might not be

available on acceptable terms, if at all. |

| ● | Our

Series B class Preferred stock structure has the effect of concentrating voting power with

our Chief Executive Officer and Director, Giorgio R. Saumat, which limits an investor’s

ability to influence the outcome of important transactions, including a change in control. |

| ● | The

market price of our common stock may be volatile. |

Risks

Related to Peaks and RxCompound Business

Our

limited operating history and evolving business make it difficult to evaluate our current business and future prospects and increase

the risk of your investment.

If

we are unable to expand the scope of our offerings, including the number and type of products and services that we offer, the number

and quality of healthcare providers serving our customers, and the number and types of conditions capable of being treated through our

platform, our business, financial condition, and results of operations may be materially and adversely affected.

If

we are unable to successfully market to new customers and retain existing customers, or if evolving privacy, healthcare, or other laws

prevent or limit our marketing activities, our business, financial condition, and results of operations could be harmed.

Use

of social media and celebrity influencers may materially and adversely affect our reputation or subject us to fines or other penalties.

Our

brand is integral to our success. If we fail to effectively maintain, promote, and enhance our brand in a cost-effective manner, our

business and competitive advantage may be harmed.

The

failure of our offerings to achieve and maintain market acceptance could result in our achieving revenue below our expectations, which

could cause our business, financial condition, and results of operations to be materially and adversely affected.

The

market for Peaks’ business model and services is new, rapidly evolving, and increasingly competitive, as the healthcare industry

in the United States is undergoing significant structural change and consolidation, which makes it difficult to forecast demand for our

solutions.

Competitive

platforms or other technological breakthroughs for the monitoring, treatment, or prevention of medical conditions may adversely affect

demand for our offerings.

We

operate in highly competitive markets and face competition from large, well-established healthcare providers and more traditional retailers

and pharmaceutical providers with significant resources, and, as a result, we may not be able to compete effectively.

The

activities and quality of healthcare providers treating Peaks’ customers and providing prescriptions to RxCompound, including any

potentially unethical or illegal practices, could damage our brand, subject us to liability, and harm our business and financial results.

Any

failure to offer high-quality support may adversely affect the Company’s relationships with customers and healthcare providers,

and in turn the Company’s financial condition, and results of operations.

Acquisitions

and investments could result in operating difficulties, dilution, and other harmful consequences that may adversely impact the Company,

financial condition, and results of operations. Additionally, if the Company is not able to identify and successfully acquire suitable

businesses, the Company, results of operations, and prospects could be harmed.

Economic

uncertainty or downturns, particularly as it impacts the healthcare industry, could adversely affect the Company’s business, financial

condition, and results of operations.

If

Peaks is unable to deliver a rewarding experience on mobile devices, Peaks may be unable to attract and retain customers.

Peaks’

business depends on continued and unimpeded access to the internet and mobile networks.

We

depend on a number of other companies to perform functions critical to Peaks’ ability to operate its platform and RxCompound’s

ability to offer services, generate revenue from customers, and to perform many of the related functions.

Disruption

in the Company’s supply chain could negatively impact our business.

The

Pharmacy business subjects the Company to additional healthcare laws and regulations beyond those that Peaks faces with its core telehealth

business, and RxCompound’s services increase the complexity and extent of compliance and regulatory obligations.

The

Company’s payments system depends on third-party service providers and is subject to evolving laws and regulations.

The

Company’s pricing decisions may adversely affect our ability to attract new customers, healthcare providers, and other partners.

The

Company’s success depends on the continuing and collaborative efforts of its management team, and its business may be severely

disrupted if the company loses their services.

We

depend on the Company’s talent to grow and operate its business, and if unable to hire, integrate, develop, motivate, and retain

personnel, the Company may not be able to grow effectively.

The

Company’s inventory is stored in RxCompound’s facility located in Miami, FL, and any damage or disruption at the facility

may harm the business.

Risks

Related to Governmental Regulation

If

the Company fails to comply with applicable healthcare and other governmental regulations, we could face substantial penalties, our business,

financial condition, and results of operations could be adversely affected, and we may be required to restructure our operations.

If

Peaks or RxCompound’s practices are found to violate federal or state anti-kickback, physician self-referral, or false claims laws,

the Company may incur significant penalties and reputational damage that could adversely affect our business.

Evolving

government regulations and enforcement activities may require increased costs or adversely affect the Company’s results of operations.

Changes

in public policy that mandate or enhance healthcare coverage could have a material adverse effect on the business, operations, and/or

results of operations.

The

products Peaks and RxCompound sell are subject to FDA regulations and other international, federal, state, and local requirements, and

if the Company fails to comply with international, federal, state, and local requirements, Peaks and RxCompound’s ability to fulfill

customers’ orders through our platform could be impaired.

Peaks

and RxCompound may be subject to fines, penalties, and injunctions if we are determined to be promoting the use of products for unapproved

uses.

The

information that Peaks and RxCompound provide to healthcare providers, customers, and partners could be inaccurate or incomplete, which

could harm the business, financial condition, and results of operations.

Peaks

and RxCompound use, disclosure, and other processing of personally identifiable information, including health information, is subject

to federal, state, and foreign privacy and security regulations, and failure to comply with those regulations or to adequately secure

the information held could result in significant liability or reputational harm and, in turn, a material adverse effect on customers,

providers, and revenue.

Public

scrutiny of internet privacy and security issues may result in increased regulation and different industry standards, which could deter

or prevent Peaks from providing services to customers, thereby harming the business.

Security

breaches, loss of data, and other disruptions could compromise sensitive information related to the business or to customers or prevent

access to critical information and expose the Company to liability, which could adversely affect the business and its reputation.

Failure

to comply with anti-bribery, anti-corruption, and anti-money laundering laws could subject the Company to penalties and other adverse

consequences.

Risks

Related to Intellectual Property and Legal Proceedings

Failure

to protect or enforce our intellectual property rights could harm the business and results of operations.

The

Company may in the future be subject to claims that we violated the intellectual property rights of others, which are extremely costly

to defend and could require us to pay significant damages and limit our ability to operate.

The

Company may be subject to legal proceedings and litigation, including intellectual property disputes, which are costly to defend and

could materially harm the business and results of operations.

Changes

in accounting rules, assumptions, or judgments could materially and adversely affect the Company, including recent statements from the

SEC regarding SPAC-related companies.

The

Company faces the risk of product liability claims and may not be able to maintain or obtain insurance.

The

business could be disrupted by catastrophic events and man-made problems, such as power disruptions, data security breaches, and terrorism.

Risks

Related to the Company, Results of Operations, and Additional Capital Requirements

The

Company has a history of net losses, anticipates increasing expenses in the future, and may not be able to achieve or maintain profitability.

The

Company’s results of operations, as well as our key metrics, may fluctuate on a quarterly and annual basis, which may result in

failing to meet the expectations of industry and securities analysts or its investors.

Peaks

relies significantly on revenue from customers purchasing subscription-based prescription products and services and may not be successful

in expanding its offerings.

The

requirements of being a public company have strained and may continue to strain the Company’s resources, divert management’s

attention, and may result in litigation.

The

Company may require additional capital to support business growth, and this capital might not be available on acceptable terms, if at

all.

If

the Company’s estimates or judgments relating to its significant accounting policies prove to be incorrect, the results of operations

could be adversely affected.

Adverse

tax laws or regulations could be enacted, or existing laws could be applied to the Company or to customers, which could subject us to

additional tax liability and related interest and penalties, increase the costs of the Company’s offerings, and adversely impact

our business.

Certain

U.S. state tax authorities may assert the Company has a state nexus and seek to impose state and local income taxes which could harm

the results of operations.

Risks

Related to Ownership of the Company Securities

Trading

in our common stock on the Pink Exchange has been subject to wide fluctuations.

Our

common stock is currently quoted only on the OTCPink Marketplace, which may have an unfavorable impact on our stock price and liquidity.

The

regulation of penny stocks by SEC and FINRA may discourage the tradability of our securities.

Florida

law, our Articles of Incorporation, and our by-laws provides for the indemnification of our officers and directors at our expense, and

correspondingly limits their liability, which may result in a major cost to us and hurt the interests of our shareholders because corporate

resources may be expended for the benefit of officers and/or directors.

We

do not intend to pay cash dividends on any investment in the shares of stock of our Company and any gain on an investment in our Company

will need to come through an increase in our stock’s price, which may never happen.

Because

our securities are subject to penny stock rules, you may have difficulty reselling your shares.

Our

common stock market prices may be volatile, which substantially increases the risk that investors may not be able to sell their Securities

at or above the price that was paid for the security.

Because

we may issue additional shares of our common stock, investment in our company could be subject to substantial dilution.

FINRA

sales practice requirements may also limit a stockholder’s ability to buy and sell our stock.

The

issuance of shares to enter acquisitions may have a significant dilutive effect.

ITEM

1B. UNRESOLVED STAFF COMMENTS

None.

ITEM

2. PROPERTY AND EQUIPMENT

The

Company uses a variety of pharmaceutical compounding equipment in its operations. The majority of the equipment used by the Company is

owned outright by the Company, but the Company does lease certain equipment. The leases for such equipment contain terms that are customary

in the industries in which the Company operates. On March 31, 2023, the Company had $143,213 in property and equipment with approximately

$15,436 in accumulated depreciation.

ITEM

3. LEGAL PROCEEDINGS

The

Company received an email on February 9, 2023, from the Autorité des Marchés Financiers (“the AMF”) with a

complaint, in French, dated January 23, 2023. The Complaint alleges that the Company’s former CEO, Dr. Michele Aube, improperly

raised capital for the Company and is claiming Forty Thousand Dollars in damages. Dr. Aube resigned in 2019. On May 23rd, 2023, the Company

signed an agreement not to raise any new capital in Quebec and pay Seven Thousand, Four Hundred and Seven Dollars in administrative penalty

to the AMF.

ITEM

4. MINE SAFETY DISCLOSURE

Not

applicable.

PART

II

ITEM

5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

Our

common stock is currently quoted on the OTC Pink Market under the symbol “ETST”. Our common stock has been quoted on the

OTC Pink Market since October 6, 2021, under the symbol “ETST”. Because we are quoted on the OTC Pink Market, our securities

may be less liquid, receive less coverage by security analysts and news media, and generate lower prices than might otherwise be obtained

if they were listed on a national securities exchange.

The

following table sets forth the high and low bid quotations for our common stock as reported on the Pink for the periods indicated.

| Fiscal 2022 | |

Low | | |

High | |

| First Quarter – reported June 30, 2022 | |

$ | 0.0231 | | |

$ | 0.0291 | |

| Second Quarter – reported September 30, 2022 | |

$ | 0.0141 | | |

$ | 0.0155 | |

| Third Quarter – reported December 31, 2022 | |

$ | 0.031 | | |

$ | 0.031 | |

| Fourth Quarter – reported March 31, 2023 | |

$ | 0.0235 | | |

$ | 0.05 | |

| Fiscal 2021 | |

Low | | |

High | |

| First Quarter – reported June 30, 2021 | |

$ | 0.0206 | | |

$ | 0.0206 | |

| Second Quarter – reported September 30, 2021 | |

$ | 0.0244 | | |

$ | 0.0305 | |

| Third Quarter – reported December 31, 2021 | |

$ | 0.0196 | | |

$ | 0.0279 | |

| Fourth Quarter – reported March 31, 2022 | |

$ | 0.015 | | |

$ | 0.015 | |

HOLDERS

As

of March 31, 2023, there were 194 record holders of the Company’s common stock.

DIVIDENDS

We

have not paid any dividends on our common stock since our inception and do not intend to pay any dividends in the foreseeable future.

The

declaration of any future cash dividends is at the discretion of our board of directors and depends upon our earnings, if any, our capital

requirements and financial position, our general economic conditions, and other pertinent conditions. It is our present intention not

to pay any cash dividends in the foreseeable future, but rather to reinvest earnings, if any, in our business operations.

UNREGISTERED

SALES OF SECURITIES

The

following shares sold and issued were shares of restricted Common Stock made in reliance upon the exemptions from registration provided

by Section 4(2) of the Securities Act of 1933, and/or Rule 506 of Regulation D promulgated thereunder. The investors were “accredited

investors” and/or “sophisticated investors” pursuant to Section 501(a) of the Securities Act, who provided the Company

with representations, warranties and information concerning their qualifications as a “sophisticated investors” and/or “accredited

investors.” The Company provided and made available, to the investors, full information regarding its business and operations.

There was no general solicitation in connection with the offers or sales of the restricted securities. The investors acquired the restricted

common stock for their own accounts, for investment purposes and not with a view to public resale or distribution thereof within the

meaning of the Securities Act. The restricted shares so purchased cannot be sold unless pursuant to an effective registration statement

by the Company, or by exemptions from registration requirements of Section 5 of the Securities Act—the existence of any such exemptions

is subject to legal review and approval by the Company.

During

the twelve months ended March 31, 2023, the Company issued 227,059,118 shares of its common stock for $1,016,568, in transactions that

were exempt from registration under the Securities Act of 1933, as amended pursuant to Section 4(2) and/or Rule 506 promulgate under

Regulation D. No gain or loss was recognized on the issuances.

On

July 15, 2022, the Company issued 1,000,000 and 2,500,000 shares to two executives at $0.001 per share in an amended executive agreement.

On October 8, 2022, the Company issued 2,000,000 shares and 2,000,000 shares to two private individuals at $0.001 per share in a settlement

and release agreement. On October 10, 2022, the Company issued 16,300,000 shares, 4,000,000 shares, 4,000,000 shares, 200,000 shares

to four private individuals at $0.001 per share in a settlement and release agreement. On October 18, 2022, the Company issued 500,000

shares to a private investor at $0.012 per share for cash. On October 18, 2022, the Company issued 1,000,000 shares, 400,000 shares,

and 400,000 shares to three private investors at $0.005 per share for cash. On October 20, 2022, the Company issued 2,000,000 shares,

500,000 shares, and 2,000,000 shares to three private investors at $0.005 per share for cash. On October 21, 2022, the Company issued

2,000,000 shares, 1,000,000 shares, and 400,000 shares to three private investors at $0.005 per share for cash. On October 24, 2022,

the Company issued 62,562,440 shares to a private individual at $0.01 per share in a settlement and release agreement. On October 25,

2022, the Company issued 2,000,000 shares, 1,000,000 shares, 1,000,000 shares, 400,000 shares, and 13,000,000 shares to five private

investors at $0.005 per share for cash. On October 25, 2022, the Company issued 2,700,000 shares to a private individual at $0.01 per

share in a settlement and release agreement. On October 25, 2022, the Company issued 19,750,000 shares, and 17,000,000 shares to three

private individuals at $0.001 per share in a settlement and release agreement. On October 27, 2022, the Company issued 9,750,000 shares

to a private investor at $0.001 per share in a settlement and release agreement. On November 4, 2022, the Company issued 500,000 shares

to a private investor at $0.005 per share for cash. On November 7, 2022, the Company issued 1,000,000 shares to a private investor at

$0.005 per share for cash. On November 8, 2022, the Company issued 4,000,000 shares, 2,000,000 shares, 2,000,000 shares, 2,000,000 shares,

and 1,000,000 shares to four private investors at $0.005 per share for cash. On November 9, 2022, the Company issued 600,000 shares to

a private investor at $0.005 per share for cash. On November 11, 2022, the Company issued 600,000 shares and 10,000,000 shares to private

investors at $0.005 per share for cash. On November 14, 2022, the Company issued 1,000,000 shares, 200,000 shares, 200,000 shares, 3,000,000

shares, 3,000,000 shares, 1,000,000 shares, 100,000 shares, 200,000 shares, 200,000 shares, 300,000 shares, 200,000 shares, 200,000 shares,

200,000 shares, 200,000 shares, 200,000 shares, and 400,000 shares to sixteen private investors at $0.005 per share for cash. On January

13, 2023, the Company issued 1,666,667 shares, 666,667 shares, 6,000,000 shares, 666,667 shares, and 333,334 shares to five private investors

at $0.015 per share for cash. On January 26, 2023, the Company issued 333,334 shares to a private investor at $0.015 per share for cash.

On January 31, 2023, the Company issued 1,133,333 shares to a private investor at $0.015 per share for cash. On February 3, 2023, the

Company issued 1,200,000 shares to a private investor at $0.005 per share for cash. On February 3, 2023, the Company issued 333,334 shares,

413,334 shares, and 1,333,334 shares to three private investors at $0.015 per share for cash. On February 6, 2023, the Company issued

200,000 shares to a private investor at $0.015 per share for cash. On February 7, 2023, the Company issued 500,000 shares and 333,334

shares to two private investors at $0.015 per share for cash. On February 8, 2023, the Company issued 666,667 shares, 333,334 shares,

333,334 shares, 333,334 shares, and 333,334 shares to five private investors at $0.015 per share for cash. On February 9, 2023, the Company

issued 333,334 shares to a private investor at $0.015 per share for cash. On February 10, 2023, the Company issued 266,667 shares, 333,334

shares, and 166,667 shares to three private investors at $0.015 per share for cash. On February 13, 2023, the Company issued 66,667 shares

to a private investor at $0.015 per share for cash. On February 14, 2023, the Company issued 400,000 shares to a private investor at

$0.015 per share for cash. On February 15, 2023, the Company issued 333,334 shares to a private investor at $0.015 per share for cash.

On February 21, 2023, the Company issued 100,000 shares to a private investor at $0.015 per share for cash. On February 28, 2023, the

Company issued 333,334 shares and 200,000 shares to two private investors at $0.015 per share for cash. On March 20, 2023, the Company

issued 5,000,000 shares to a private investor at $0.005 per share for cash.

EQUITY

COMPENSATION PLAN INFORMATION

The

Company currently does not have an equity compensation plan in place.

COMMON

STOCK

The

holders of our common stock are entitled to one vote per share on all matters submitted to a vote of our stockholders. The holders of

the common stock have the sole right to vote, except as otherwise provided by law, by our articles of incorporation, or in a statement

by our board of directors in a Preferred Stock Designation.

In

addition, such holders are entitled to receive ratably such dividends, if any, as may be declared from time to time by our board of directors

out of legally available funds, subject to the payment of preferential dividends or other restrictions on dividends contained in any

Preferred Stock Designation, including, without limitation, the Preferred Stock Designation establishing a series of preferred stock

described above. In the event of the dissolution, liquidation or winding up of Earth Science Tech, Inc., the holders of our common stock

are entitled to share ratably in all assets remaining after payment of all our liabilities, subject to the preferential distribution

rights granted to the holders of any series of our preferred stock in any Preferred Stock Designation, including, without limitation,

the Preferred Stock Designation establishing a series of our preferred stock described above.

The

holders of the common stock do not have cumulative voting rights or preemptive rights to acquire or subscribe for additional, unissued

or treasury shares in accordance with the laws of the State of Florida. Accordingly, excluding any voting rights granted to any series

of our preferred stock, the holders of more than 50 percent of the issued and outstanding shares of the common stock voting for the election

of directors can elect all of the directors if they choose to do so, and in such event, the holders of the remaining shares of the common

stock voting for the election of the directors will be unable to elect any person or persons to the board of directors. All outstanding

shares of the common stock are fully paid and non-assessable.

The

laws of the State of Florida provide that the affirmative vote of a majority of the holders of the outstanding shares of our common stock

and any series of our preferred stock entitled to vote thereon is required to authorize any amendment to our articles of incorporation,

any merger or consolidation of Earth Science Tech, Inc. with any corporation, or any liquidation or disposition of any substantial assets

of Earth Science Tech, Inc..

PREFERRED

STOCK

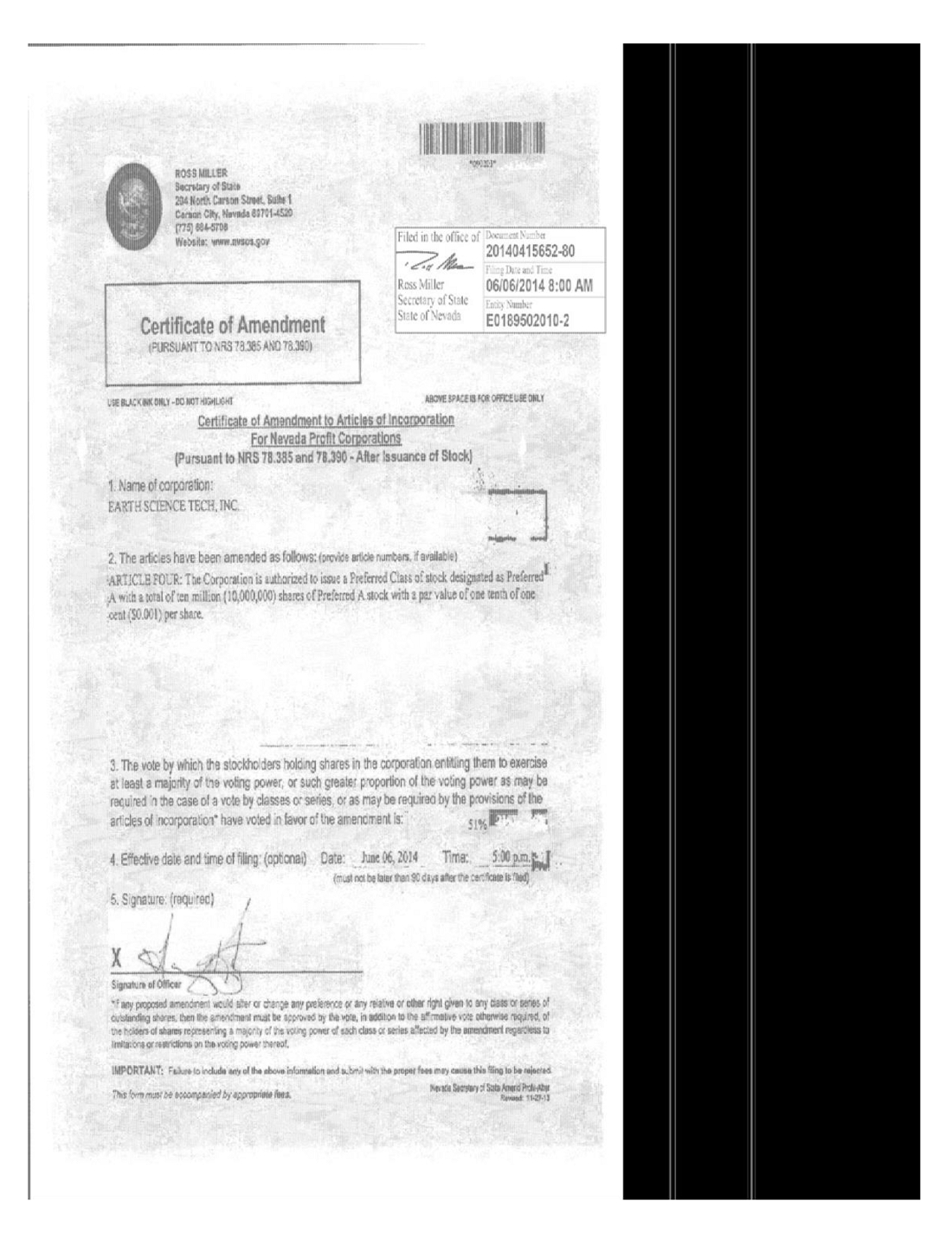

On

April 21, 2022, the Company’s Board of Directors adopted articles of incorporation in the state of Nevada authorizing, without

further vote or action by the stockholders, to create out of the unissued shares of the Company’s preferred stock, $0.001 par value

Series B Preferred Stock. The Board of Directors is authorized to establish, from the authorized and unissued shares of Preferred Stock,

one or more classes or series of shares, to designate each such class and series, and fix the rights and preferences of each such class

of Preferred Stock; which class or series shall have such voting powers, such preferences, relative, participating, optional or other

special rights, and such qualifications, limitations or restrictions as shall be stated and expressed in the resolution or resolutions

providing for the issuance of such class or series of Preferred Stock as may be adopted from time to time by the Board of Directors prior

to the issuance of any shares thereof. The articles of incorporation and designation authorizes the issuance of 1,000,000 shares of Preferred

Stock, of which 1,000,000 shares have been designated as Series B Preferred Stock, of which 1,000,000 of Series B are issued and outstanding

as of March 31, 2023. Each issued and outstanding share of Series B Preferred Stock shall be entitled to the number of votes equal to

the result of: (i) 1.5 multiplied by the addition sum of: (A) the number of shares of Common Stock issued and outstanding at the time

of such vote; and (B) the number of votes in the aggregate of any outstanding shares of any class of preferred stock of the Corporation

(other than the Series B Preferred Stock), if any, at the time of such vote; with such sum divided by (ii) the total number of shares

of Series B Preferred Stock issued and outstanding at the time of such vote, at each meeting of shareholders of the Corporation with

respect to any and all matters presented to the shareholders of the Corporation for their action or consideration, including the election

of directors. Holders of Series B Preferred Stock shall vote together with the holders of Common Shares (and any other outstanding class

of preferred stock of the Corporation (other than the Series B Preferred Stock), if any.

WARRANTS

The

Company does not currently have any warrants issued or outstanding.

ISSUER

REPURCHASES OF EQUITY SECURITIES

We

did not repurchase any shares of our common stock during the fourth quarter of the fiscal year covered by this Annual Report on Form

10-K.

OPTIONS

The

Company has not granted any options since inception.

TRANSFER

AGENT

The

Company’s transfer agent is Continental Stock Transfer & Trust, Co., 1 State Street, 30th Floor, New York, NY 10004.

ITEM

6. SELECTED FINANCIAL DATA

Not

applicable to a “smaller reporting company” as defined in Item 10(f)(1) of SEC Regulation S-K.

ITEM

7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The

following discussion of our financial condition and results of operations for the years ended March 31, 2023, and March 31, 2022, should

be read in conjunction with our consolidated financial statements and the notes to those statements that are included elsewhere in this

Annual Report on Form 10-K. Our discussion includes forward-looking statements based upon current expectations that involve risks and

uncertainties, such as our plans, objectives, expectations, and intentions. Actual results and the timing of events could differ materially

from those anticipated in these forward-looking statements due to a number of factors. We use words such as “anticipate”,

“estimate”, “plan”, “project”, “continuing”, “ongoing”, “expect”,

“believe”, “intend”, “may”, “will”, “should”, “could”, and similar

expressions to identify forward-looking statements.

OVERVIEW

The

Company is a holding entity set to acquire companies with its current focus in the health and wellness industry. The Company is presently

in compounding pharmaceuticals and telemedicine through its wholly owned subsidiaries RxCompoundStore.com, LLC. (“RxCompound”),

Peaks Curative, LLC. (“Peaks”), and Earth Science Foundation, Inc. (“ESF”).

RxCompound

is a compounding pharmacy that has historically focused on men’s health, specifically medical products directed at ED such as Tadalafil,

and Sildenafil Citrate (the generic names for Cialis and Viagra, respectively) and longevity. Currently licensed to fulfill prescriptions

in the states of Florida, New York, New Jersey, Delaware, Colorado, Rhode Island, Pennsylvania, Nevada, and Arizona. RxCompound is in

the application process to obtain licenses in the remaining states in which it is not yet licensed to dispense prescriptions. Furthermore,

RxCompound recently obtained its hazardous room to compound hormonal creams within the month of December 2022 and is anticipated to have

its sterile compounding room operational early 2023 to provide sterile products for injection.

Peaks

is the telemedicine referral site facilitating asynchronous consultations for branded compound medications prepared at RxCompound. Peaks

is currently positioned to prescribe to all 50 states utilizing third- party consultation services, but only able to fulfill prescriptions

within RxCompound’s licensed states. Peaks will be able to fulfill more states as RxCompound becomes licensed in additional states.

Patients who order Peaks via monthly subscription are automatically enrolled into Peaks’ Loyalty Program. As a member of the loyalty

program, members will receive credit to cover the costs on their Peaks’ facilitated online doctor consultations. The Peaks membership

enrollment will occur automatically once becoming a monthly subscriber and automatically renewed at the time of the prescription renewal

order. At the time of the renewal order, credits will be applied to cover the Peaks facilitated online doctor consultation.

Peaks

plans to execute a marketing campaign within the states in which RxCompound is licensed to increase brand exposure. This includes over

the counter (“OTC”) (non-prescription) products such as supplements and topicals. The OTC products will be custom manufactured

or fulfilled through partnered companies under Peaks brand and offered worldwide.

ESF

is a favored entity of ETST, effectively being a non-profit organization that was incorporated on February 11, 2019, and is structured

to accept grants and donations to help those in need of assistance in paying for prescriptions.

RESULTS

OF OPERATIONS

The

following tables set forth summarized cost of revenue information for the year ended March 31, 2023, and for the year ended March 31,

2022:

| | |

For the Years Ended March 31, | |

| | |

2023 | | |

2022 | |

| | |

| | |

| |

| Revenue | |

$ | 48,537 | | |

$ | 14,123 | |

| Cost of revenues | |

| 26,477 | | |

| 22,639 | |

| Gross Profit/(Loss) | |

| 22,060 | | |

| (8,516 | ) |

We

had product sales of $48,537 and a gross profit of $22,060, representing a gross margin of 45.45% in the year end March 31, 2023, compared

with product sales of $14,123 and a loss of $8,516, representing a gross margin of (60.30) % in year end March 31, 2022. The revenue

increase in the year ended on March 31, 2023 compared with the year ended on March 31, 2022, is primarily due to acquisition of RxCompound

and Peaks.

The

Company’s acquisition of RxCompound was consummated on November 8, 2022, along with Peaks; however, RxCompound completed its PCAOB

audit on February 3, 2023, after the fiscal quarter that ended December 31, 2022. Hence sales of RxCompound were being recognized from

Feb. 2023 onwards. We are adding results of Peaks for Nov. 2022.

For

the year ended March 31, 2023, the Company had a net loss from continuing operations of approximately $365,405 compared to a gain from

continuing operations of approximately $3,173,260 for the year ended March 31, 2022. This increase in net loss is due largely to losing

the net income that was booked in the year ended March 31, 2022, from the Cromogen Settlement, see Note 6. Legal Proceedings in the period

ended March 31, 2022, 10-K filed July 22, 2022.

OPERATING

EXPENSES

| | |

Years Ended March 31, | |

| | |

2023 | | |

2022 | | |

$ Change | | |

% Change | |

| | |

(Restated) | | |

| | |

| | |

| |

| Compensation – officers | |

$ | 91,020 | | |

$ | 77,308 | | |

$ | 13,712 | | |

| 17.7 | % |

| Officer Compensation Stock | |

$ | 4,500 | | |

$ | - | | |

$ | 4,500 | | |

| 100 | % |

| Marketing | |

$ | 8,074 | | |

$ | 3,655 | | |

$ | 4,419 | | |

| 120.9 | % |

| General and administrative | |

$ | 231,890 | | |

$ | 116,064 | | |

$ | 115,826 | | |

| 99.8 | % |

| Professional fees | |

$ | 67,061 | | |

$ | 8,719 | | |

$ | 58,342 | | |

| 3634 | % |

| Bad Debt Expense | |

$ | - | | |

| 4,944 | | |

$ | (4,944 | ) | |

| (100 | )% |

| Cost of legal proceedings | |

$ | 24,276 | | |

$ | 7,500 | | |

$ | 16,776 | | |

| 224 | % |

| Litigation Expense | |

$ | 512,725 | | |

| - | | |

$ | 512,725 | | |

| 100 | % |

| Licenses and fees | |

$ | 1,706 | | |

| - | | |

$ | 1,706 | | |

| 100 | % |

| Depreciation expense | |

$ | 17,491 | | |

| - | | |

$ | 17,491 | | |

| 100 | % |

| Total operating expenses | |

$ | 958,743 | | |

$ | 218,190 | | |

$ | 740,553 | | |

| 339.4 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Loss from operations | |

| (936,683 | ) | |

| (226,706 | ) | |

$ | (709,977 | ) | |

| 313.2 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Other Income (Expenses): | |

| | | |

| | | |

| | | |

| | |

| Other income | |

$ | 618,711 | | |

| 3,486,672 | | |

| (2,867,961 | ) | |

| (82.3 | )% |

| Interest expense | |

| (47,433 | ) | |

| (86,706 | ) | |

| 39,273 | | |

| 360.3 | % |

| Total other income (expenses) | |

| 571,278 | | |

| 3,399,966 | | |

| (2,828,688 | ) | |

| (83.2 | )% |

| | |

| | | |

| | | |

| | | |

| | |

| Net Profit/(Loss) before income taxes | |

| (365,405 | ) | |

| 3,173,260 | | |

| (3,538,665 | ) | |

| (111.5 | )% |

| | |

| | | |

| | | |

| | | |

| | |

| Income taxes | |

| - | | |

| - | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Net Profit/(Loss) | |

$ | (365,405 | ) | |

$ | 3,173,260 | | |

$ | (3,538,665 | ) | |

| (111.5 | )% |

| | |

| | | |

| | | |

| | | |

| | |

| Net Profit/(Loss) per common share: | |

| | | |

| | | |

| | | |

| | |

| Profit/(Loss) per common share-Basic and Diluted | |

$ | (0.003 | ) | |

$ | 0.06 | | |

$ | (0.06 | ) | |

| (104 | )% |

Marketing

expenses totaled $8,074 for the twelve months ended March 31, 2023, an increase of $4,419 from $3,655 for the twelve months ended March

31, 2022. This increase is primarily related to the Company pushing online sales through social media marketing and good ads.

Officer

compensation totaled $91,020 for the twelve months ended March 31, 2023, an increase of $13,712 from $77,308 for the prior period ended

March 31, 2022. This increase is due to the Company’s having a larger executive team compared to the year prior.

Legal

and professional fees totaled $605,768 for the twelve months ended March 31, 2023, an increase of $589,549 from $16,219 for the

prior period ended March 31, 2022. The increase in legal and professional fees was due to compliance expenses including filing fees,

audit fees, SEC legal fees, and payment of the remaining legal expenses to unwind out of receivership.

Costs

and Expenses - Costs of sales include the costs of manufacturing, packaging, warehousing, and shipping our products. As we develop and

release additional products, we expect our costs of sales to increase.

General

and administrative expenses increased from $116,064 for the year ended March 31, 2022, to $231,892 for the year ended March 31, 2023.

This increase was due to the fees related from the second receiver appointed on August 22, 2021, and unwinding on June 2, 2022, for $137,851.

The remaining expenses include office expenses of $14,433, employee compensation of $38,595 (this includes RxCompound, Peaks, and the

Company), and the remaining balance in other various expenses.

We

are a smaller reporting company, as defined by 17 CFR § 229.10(f)(1). We do not consider the impact of inflation and changing prices

as having a material effect on our net sales and revenues and on income from our operations for the previous two years or from continuing

operations going forward.

INTEREST

EXPENSE

Interest

expense decreased to $47,433 in March 31, 2023 year-end compared with $86,706 in March 31, 2022, year-end. This decrease in interest expense

was due to settlement of prior year’s debt obligation – refer to Note 7.

NON-GAAP

FINANCIAL MEASURES

We

use Adjusted EBITDA internally to evaluate our performance and make financial and operational decisions that are presented in a manner

that adjusts from their equivalent GAAP measures or that supplements the information provided by our GAAP measures. Adjusted EBITDA is

defined by us as EBITDA (net income (loss) plus depreciation expense, amortization expense, interest and income tax expense, minus income

tax benefit), further adjusted to exclude certain non-cash expenses and other adjustments as set forth below. We use Adjusted EBITDA

because we believe it more clearly highlights trends in our business that may not otherwise be apparent when relying solely on GAAP financial

measures, since Adjusted EBITDA eliminates from our results specific financial items that have less bearing on our core operating performance.

We

use Adjusted EBITDA in communicating certain aspects of our results and performance, including in this Annual Report, and believe that

Adjusted EBITDA, when viewed in conjunction with our GAAP results and the accompanying reconciliation, can provide investors with greater

transparency and a greater understanding of factors affecting our financial condition and results of operations than GAAP measures alone.

In addition, we believe the presentation of Adjusted EBITDA is useful to investors in making period-to-period comparison of results because

the adjustments to GAAP are not reflective of our core business performance.

Adjusted

EBITDA is not presented in accordance with, or as an alternative to, GAAP financial measures and may be different from non-GAAP measures

used by other companies. We encourage investors to review the GAAP financial measures included in this Annual Report, including our consolidated

financial statements, to aid in their analysis and understanding of our performance and in making comparisons.

CASH

FLOW & ASSETS

A

summary of our changes in cash flows & assets for the years ended March 31, 2023, and 2022, is provided below:

| | |

As of March 31, | |

| | |

2023 | | |

2022 | |

| | |

(Restated) | | |

| |

| ASSETS: | |

| | | |

| | |

| Current Assets: | |

| | | |

| | |

| Cash | |

$ | 35,756 | | |

$ | 26,942 | |

| Inventory | |

| 10,260 | | |

| - | |

| Total current assets | |

| 46,016 | | |

| 26,942 | |

| Property and equipment, net | |

| 143,213 | | |

| - | |

| Right of use asset, net | |

| 200,674 | | |

| - | |

| Intangible assets, net | |

| 35,276 | | |

| - | |

| Goodwill | |

| 2,302,792 | | |

| - | |

| Other assets | |

| - | | |

| 50,000 | |

| Total Assets | |

$ | 2,727,971 | | |

$ | 76,942 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY: | |

| | | |

| | |

| Current Liabilities: | |

| | | |

| | |

| Accounts payable and accrued liabilities | |

$ | 517,137 | | |

$ | 1,099,766 | |

| Current portion of loans and obligations | |

| 604,767 | | |

| 780,694 | |

| Due to RX | |

| - | | |

| 1,895 | |

| Other payables | |

| 117,193 | | |

| - | |

| Current portion of operating lease obligations | |

| 68,188 | | |

| - | |

| Total current liabilities | |

| 1,307,285 | | |

| 1,882,355 | |

| Operating lease obligations; less current maturities | |

| 96,743 | | |

| - | |

| Loans and obligations; less current maturities | |

| 204,408 | | |

| | |

| Total liabilities | |

| 1,608,436 | | |

| 1,882,355 | |

| Commitments and contingencies | |

| | | |

| | |

| | |

| | | |

| | |

| Stockholders’ (Deficit) Equity: | |

| | | |

| | |

| Preferred stock, par value $0.001 per share, 1,000,000 shares authorized; 1,000,000 and 0 shares issued and outstanding as of March 31, 2023, and March 31, 2022, respectively | |

| 1,000 | | |

| - | |

| Common stock, par value $0.001 per share, 750,000,000 shares authorized; 282,611,083 and 53,851,966 shares issued and outstanding as of March 31, 2023, and March 31, 2022, respectively | |

| 282,612 | | |

| 53,853 | |

| Additional paid-in capital | |

| 31,303,138 | | |

| 28,264,452 | |

| Accumulated deficit | |

| (30,467,215 | ) | |

| (30,123,718 | |

| Total stockholders’ (Deficit) Equity | |

| 1,119,535 | | |

| (1,805,413 | ) |

| Total Liabilities and Stockholders’ Equity | |

$ | 2,727,971 | | |

$ | 76,942 | |

The

Company had $35,756 in Cash for the period ended March 31, 2023, compared with $26,942 for the same period ended March 31, 2022.

Assets’

position has been improved significantly on account of recognition of goodwill, acquisition of equipment by RxCompound and addition of

right of use assets for lease agreement of premises. Peaks also added its telemedicine platform in intangibles.

The

Company had $90,790 in Accounts Payable for the period ended March 31, 2023, compared with $202,270 for the same period ended March 31,

2022. This decrease is primarily due to many of the payables being settled for shares, see Company’s October 28, 2022, filed 8-K.

Accrued

expenses totaled $115,400 for the twelve months ended March 31, 2023, a decrease of $196,210 from $311,610 for the period ended March

31, 2022. The majority of the accrued expenses were $67,863 of accrued payroll for Wendell Hecker and Nickolas Tabraue, $33,391 of accrued

interest payable, and the remaining amounts for receiver’s fees.

Long

term and short-term debt obligations have been reduced on settlement of outstanding claims against issue of shares.

The

Company had a Stockholder’s Equity of $1,119,535 for the period ended March 31, 2023, compared with $1,805,413 of Stockholder’s

Deficit for the same period ended March 31, 2022. This improvement is primarily due to the issuance of shares for cash and debt settlements

(also caused reduction in accrued settlement payable).

CASH

FLOWS FROM OPERATING ACTIVITIES

Operating

Activities for the years ended March 31, 2023, and March 31, 2022: the Company used cash for operating activities of $1,013,128 expenses

and $168,106, respectively.

CASH

FLOWS FROM INVESTING ACTIVITIES

During

the years ended March 31, 2023, and March 31, 2022, the Company had $0 in investing activities and $1,712, respectively.

CASH

FLOWS FROM FINANCING ACTIVITIES

During

the year ended March 31, 2023, the Company received $ 564,200 through the issue of common stock.

Proceeds

of $350,000 and $199,980 were received through convertible promissory notes of VCAMJI IRREV. TRUST, C/O Giorgio R. Saumat, Trustee and

revolving promissory note of Great Lakes Holding Group, LLC.

Net

settlement of $85,000 was made to the GHS Investments, LLC as per the Court Order, dated May 31, 2023.

FUTURE

FINANCING

Private

investors through standard notes, discounted registered stock, and facilitated debt.

STOCK

BASED COMPENSATION

The

Company issued shares of common stock (3,500,000 shares) and Preferred B stock (1,000,000 shares) to Nickolas S. Tabraue and Mario G.

Tabraue against services provided during the year ended March 31, 2023. No outstanding stock-based compensation as of March 31, 2023.

RECENT

ACCOUNTING PRONOUNCEMENTS

The

company has assessed the impact of the recent pronouncements in the preparation of Consolidated Financial Statements and their impact

has been disclosed in NOTE 2.

OFF-

BALANCE SHEET ARRANGEMENTS

None.

ITEM

7A. QUANTITATIVE AND QUALITATIVE DISCLOSURE ABOUT MARKET RISK

Not

applicable to a “smaller reporting company” as defined in Item 10(f)(1) of Regulation S-K.

ITEM

8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA (Restated)

The

financial statements required by this item are set forth at the pages indicated in Part IV, Item 15(a)(1) of this Annual Report.

EARTH

SCIENCE TECH, INC. AND SUBSIDIARIES

Table

of Contents

Report

of Independent Registered Public Accounting Firm

To

the shareholders and Board of Directors of Earth Science Tech, Inc.

Opinion

on the Consolidated Financial Statements

We