UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

Amendment No.3 to

FORM 10-K/A

☒ ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the fiscal year ended December 31, 2021

or

☐ TRANSITION

REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the transition period from _________ to _________

Commission

file number: 333-239929

KENONGWO

GROUP US, INC.

(Exact

name of registrant as specified in its charter)

| Nevada | | 37-1914208 |

(State or other jurisdiction of

incorporation or organization) | | (IRS Employer

Identification No.) |

Yangjia

Group, Xiaobu Town

Yuanzhou

District, Yichun City

Jiangxi

Province, China 336000

(Address

of Principal Executive Offices) (Zip Code)

Registrant’s

telephone number, including the area code: +86-400-915-2178

Securities

registered pursuant to Section 12(b) of the Act:

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| N/A | | N/A | | N/A |

Securities

registered pursuant to Section 12(g) of the Act: None.

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐ No ☒

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such report(s)), and

(2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files). Yes ☒ No ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting

company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,”

and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | Large accelerated filer ☐ | Accelerated filer ☐ |

| | Non-accelerated filer ☒ | Smaller reporting company ☒ |

| | | Emerging growth company ☒ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report. ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As

of the date of this report, the Company’s common stock is not listed any national securities exchange nor quoted on OTC Markets,

and therefore the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the

price at which the common equity was last sold, or the average bid and ask price of such common equity, as of the last business day of

the registrant’s most recently completed second fiscal quarter is not available or not applicable.

The number of outstanding

shares of the registrant’s common stock on August 1, 2022, was 101,882,482.

Documents

Incorporated by Reference: None.

EXPLANATORY NOTE

This amendment to the Company’s Annual

Report on Form 10-K is being filed in order to address certain comments and concerns that the Securities and Exchange Commission has

expressed regarding our subsidiary’s operations in the People’s Republic of China.

FORM

10-K ANNUAL REPORT

FISCAL

YEAR ENDED DECEMBER 31, 2021

TABLE

OF CONTENTS

FORWARD-LOOKING

STATEMENTS

The

statements contained in this report with respect to our financial condition, results of operations and business that are not historical

facts are “forward-looking statements”. Forward-looking statements can be identified by the use of forward-looking terminology,

such as “anticipate”, “believe”, “expect”, “plan”, “intend”, “seek”,

“estimate”, “project”, “could”, “may” or the negative thereof or other variations thereon,

or by discussions of strategy that involve risks and uncertainties. Management wishes to caution the reader of the forward-looking statements

that any such statements that are contained in this report reflect our current beliefs with respect to future events and involve known

and unknown risks, uncertainties and other factors, including, but not limited to, economic, competitive, regulatory, technological,

key employees, and general business factors affecting our operations, markets, growth, services, products, licenses and other factors,

some of which are described in this report including in “Risk Factors” in Item 1A and some of which are discussed in our

other filings with the SEC. These forward-looking statements are only estimates or predictions. No assurances can be given regarding

the achievement of future results, as actual results may differ materially as a result of risks facing our company, and actual events

may differ from the assumptions underlying the statements that have been made regarding anticipated events.

These

risk factors should be considered in connection with any subsequent written or oral forward-looking statements that we or persons acting

on our behalf may issue. All written and oral forward looking statements made in connection with this report that are attributable to

our company or persons acting on our behalf are expressly qualified in their entirety by these cautionary statements. Given these uncertainties,

we caution investors not to unduly rely on our forward-looking statements. We do not undertake any obligation to review or confirm analysts’

expectations or estimates or to release publicly any revisions to any forward-looking statements to reflect events or circumstances after

the date of this report or to reflect the occurrence of unanticipated events, except as required by applicable law or regulation.

ITEM

1. BUSINESS

Overview

Kenongwo Group US, Inc. is

a Nevada holding company, operating through our wholly-owned subsidiary, Jiangxi Kenongwo Technology Co., Ltd. (“Jiangxi Kenongwo”),

a company incorporated under the laws of the PRC. Through Jiangxi Kenongwo, We primarily engage in studying, developing, manufacturing

and selling bamboo charcoal biomass organic fertilizers, amino acid water-soluble fertilizers, selenium-rich foliage fertilizers and

other types of fertilizers in the PRC.

The

main raw materials that are used in our organic fertilizers include bamboo charcoal, bamboo vinegar, rapeseed dregs and organic selenium.

Bamboo charcoal is carbonized from bamboo and it is an excellent fertilizer carrier that can slowly release the fertilizer substance

and at the same time reduce the pollution in the soil. Bamboo vinegar is a liquid obtained by condensing the water volatile organics

in Moso bamboo, which is released during the high temperature pyrolysis through our patented technology. Fermented rapeseed dregs are

the component of organic materials, which can significantly impact the quality of soil. Selenium is an essential trace mineral that is

important for many bodily processes. By adding organic selenium into our fertilizers and applying them to the crops, selenium can be

well absorbed and converted, making the final agricultural products rich of selenium. Our fertilizers also provide optimum levels of

primary plant nutrients which including multi-minerals, proteins and carbohydrates that promote the healthiest soils capable of growing

the healthy crops and vegetables. It can effectively reduce the use of chemical fertilizers and pesticides as well as reduce the penetration

of large chemical fertilizers and pesticides into the soil and thus avoid water pollution. Therefore, our fertilizer can effectively

improve fertility of soil, and the quality and safety of agricultural products.

We

generate our revenue from the sales of our organic fertilizers, compound fertilizers, specific-function fertilizers and crop-specific

fertilizers. We currently have one integrated factory covering a land area of 143,590 square feet in Yichun City, Jiangxi Province, PRC

to produce our organic fertilizers, which has been in operations since 2017. We plan to expand our production capacity and build an automatic

and standardized production line, equipped with fully automatic production machines for our fertilizers, including fermentation machines,

granulation machines, drying and cooling machines, labeling machines, packaging machines and loading and unloading machines. Specifically,

we plan to establish four automated production lines, including (1) the powder fertilizer production line, (2) the granular fertilizer

production line, (3) the liquid water soluble fertilizer production line and (4) the powder water soluble fertilizer production line.

As of the date of this report, (3) and (4) have been completed. In addition, we also installed the liquid raw material automatic storage

tank system, the palletizing robot system and the raw material weighing and batching system. The estimated cost of building this production

line is approximately RMB12 million (approximately $1.7 million). we plan to finance this amount in equity or debt. There is no assurance

that we could raise that amount on satisfying terms. As a result, the implementation of this expansion depends on whether and when we

could secure the financing.

We

believe that our brand reputation and ability to tailor our products to meet the requirements of various regions of the PRC affords us

a competitive advantage. We purchase the majority of our raw materials from suppliers located in the PRC and use suppliers that are located

in close proximity to our manufacturing facilities, which helps us to control our cost of revenue.

China

is the principal market for our products, which are primarily sold to farmers through distributors in over twenty-two provinces in China,

including Jiangxi, Hunan, Hubei, Fujian, Jiangsu, Shanghai, Zhejiang, Sichuan, Chongqing, Guangdong, Hainan, Xinjiang, Guizhou, Guangxi,

Liaoning, Shandong, Shanxi, Yunnan, Ningxia, Gansu, Henan, and Hebei provinces.

In

2019, the Company and two other individuals, Mr. Haijin Li and Mr. Weizhong Zhang, jointly formed Longyan Fuchi Agricultural Development

Co., Ltd. (“Longyan”) pursuant to a cooperation agreement dated April 27, 2019 (the “Cooperation Agreement”).

According to the Cooperation Agreement, the Company and Mr. Zhang together shall invest RMB540,000 (approximately $77,510) to Longyan,

which, in exchange, will result in the Company and Mr. Zhang owning 25% and 20% equity interest in Longyan, respectively. As of the date

of this report, the Company has invested RMB 200,000 (approximately $28,955) to and as a result owns 25% equity interest in Longyan.

Longyan is an agricultural company with a primary focus on growing and selling passionfruit, in which the Company perceives excellent

potentials in Fujian province. Pursuant to the Cooperation Agreement, the Company shall jointly manage Longyan with Mr. Li and Mr. Zhang.

Amidst the COVID-19 outbreak

in 2020, our business operations were adversely impacted. In particular, the lockdown policy in China has caused delays in the logistics

industry and consequently, the supply of our raw materials was impacted. In addition, the restrictions of face-to-face interactions have

slowed down the process of our marketing, client meeting and new products launching activities. The spread of COVID-19 has been effectively

controlled in China. People’s daily life and businesses’ operations started going to normalcy. As a result, we believe these

negative impacts are temporary. However, there is significant uncertainty around the breadth and duration of business disruptions related

to COVID-19, as well as its impact on the economy of China and the rest of the world and, as such, the extent of the business disruption

and the related financial impact cannot be reasonably estimated at this time.

China

is the principal market for our products, which are primarily sold to our customers through distributors in over twenty provinces in

China, including Jiangxi, Hunan, Hubei, Fujian, Jiangsu, Shanghai, Zhejiang, Sichuan, Chongqing, Guangdong, Hainan, Xinjiang, Guizhou,

Anhui, Shandong, Shanxi, Shaanxi, Liaoning, Jilin, Heilongjiang, Yunnan and Guangxi provinces.

Kenongwo Group US, Inc. is

a holding company and we operate our business through Jiangxi Kenongwo. Jiangxi Kenongwo is formed and operating the Peoples Republic

of China (“Material PRC Company”) has been duly established and is validly existing as a limited liability company under

the laws of the Peoples Republic of China (“PRC Laws”),and has received all authorizations required by the Peoples Republic

of China (the “Governmental Authorizations”) for its establishment to the extent such Governmental Authorizations are required

under applicable PRC Laws, and its business license is in full force and effect. The Material PRC Company has the capacity and authority

to own assets, to conduct business, and to sue and be sued in its own name under PRC Laws. The articles of association, business license

and other constitutional documents (if any) of the Material PRC Company complies with the requirements of applicable PRC Laws and are

in full force and effect. The Material PRC Company has not taken any corporate action, nor has any legal proceedings commenced against

it, for its liquidation, winding up, dissolution, or bankruptcy, for the appointment of a liquidation committee, team of receivers or

similar officers in respect of its assets or for any adverse suspension, withdrawal, revocation or cancellation of its business license.

All of the equity interests

of the Material PRC Company are owned by Kenongwo Group US, Inc., and (ii) the Material PRC Company has obtained all Governmental Authorizations

for the ownership interest owned by Kenongwo Group US, Inc. Such Governmental Authorizations include the examination and approval of

fertilizer license, which is based on Article 25 of the Agricultural Law of the People’s Republic of China, the Management for

the Administration of Fertilizer Registration (Order No. 32 and No. 38 by the Ministry of Agriculture), and the Requirements for Fertilizer

Registration Materials (Publication No. 161 from the Ministry of Agriculture). Organic fertilizers are required to be registered with

provincial agricultural department. Our fertilizers are registered. The equity interests of the Material PRC Company are owned by Kenongwo

Group US, Inc. free and clear of any pledge or other encumbrance under PRC Laws, and there are no outstanding rights, warrants or options

to acquire, or instruments convertible into or exchangeable for, any equity interest in the Material PRC Company under PRC Laws, except

for such encumbrance that would not be reasonably expected to have a Material Adverse Effect. “Material Adverse Effect,”

as used herein, means a material adverse effect on the assets, liabilities, properties or business of the Company. However, (i) if the

Company does not receive or maintain the necessary permissions or approvals, (ii) inadvertently concludes that such permissions or approvals

are not required, or (iii) applicable laws, regulations, or interpretations change and we are required to obtain such permissions or

approvals in the future, we will be forced to divert our resources to address such errors or omissions or potentially cease operations.

All of our operations

are conducted by our subsidiary, our wholly-foreign-owned entity (“WFOE”) based in China which involves unique risks to investors.

Our WFOE structure is used to provide investors with exposure to foreign investment in China-based companies where Chinese law prohibits

direct foreign investment in the operating companies. Investors may never hold equity interests in the Chinese operating company. The

WFOE structure is not as stable as some have imagined. The senior management and the shareholders of the domestic company play a very

important role in the WFOE structure. Once there are changes to such positions involving interests, potential risks of the WFOE structure

will appear. Chinese regulatory authorities could disallow this structure, which would likely result in a material change in our operations

and/or a material change in the value of the securities we are registering for sale, including that it could cause the value of such

securities to significantly decline or become worthless.

The legal and operational

risks associated with being based in or having the majority of the Company’s operations in China could result in a material change

in the value of our securities or could significantly limit or completely hinder our ability to offer or continue to offer securities

to investors and cause the value of such securities to significantly decline or be worthless and result in a material change in the Company’s

operations.

Beijing revamped its rules

for overseas listings after ride-hailing Didi Global launched its initial public offering despite warnings from regulators. That triggered

a data security investigation led by the Cyberspace Administration of China (“CAC”), which recently culminated with the firm

announcing plans to delist in the US in favor of Hong Kong. This shows how recent statements and regulatory actions by China’s

government have or may impact the company’s ability to conduct its business, accept foreign investments, or list on a U.S. or other

foreign exchange.

Trading securities may be

prohibited under the Holding Foreign Companies Accountable Act if the PCAOB determines that it cannot inspect or fully investigate our

auditor, and that as a result an exchange may determine to delist your securities.

The Company will settle

amounts owed under the WFOE structure by transferring dividends, or distributions between the holding company and its subsidiaries and

consolidated entities, or to investors, which have not yet occurred. The Company intends to rely primarily on dividends paid by the WFOE

for our cash needs for applicable agreements, and the funds necessary to pay dividends and other cash distributions, if any, to our shareholders,

to service any debt we may incur and to pay our operating expenses. The Company has made no such distributions to date nor has it received

any distributions from the WFOE to date, and The Company has no current cash management policies in place. The Company will look to implement

one in the near future. The PRC government also imposes controls on the conversion of RMB into foreign currencies and the remittance

of currencies out of the PRC. Therefore, our WFOE may experience difficulties in completing the administrative procedures necessary to

pay distributions from its profits, if any. Furthermore, if our WFOE incurs debt on its own in the future, the instruments governing

the debt may restrict their ability to pay distributions or make other payments. If SIPN or our subsidiaries are unable to receive all

of the revenues from our operations, we may be unable to pay dividends on our Shares.

Cash dividends, if any,

on the Company’s shares will be paid in U.S. dollars. If the Company is considered a PRC tax resident enterprise for tax purposes,

any dividends paid to our overseas shareholders may be regarded as China-sourced income and as a result may be subject to PRC withholding

tax at a rate of up to 10.0%.

There

are no legal, arbitral or governmental proceedings, regulatory investigations or other governmental decisions, rulings, orders, or actions

before any Governmental Agencies in progress or pending in the PRC to which the Company or any Material PRC Company is a party or to

which any assets of any Material PRC Company is a subject which, if determined adversely against any of the Company and the Material

PRC Company.

There are no legal, arbitral or governmental proceedings, regulatory investigations or other governmental decisions,

rulings, orders, or actions before any Governmental Agencies in progress or pending in the PRC to which the Company or any Material PRC

Company is a party or to which any assets of any Material PRC Company is a subject which, if determined adversely against any of the

Company and the Material PRC Company, would be reasonably expected to have a material adverse effect.

All dividends declared and

payable upon the equity interests in the WFOE may be converted into foreign currency and freely transferred out of the PRC free of any

deductions in the PRC, provided that (i) the declaration and payment of such dividends complies with applicable PRC Laws and the constitutional

documents of the WFOE, and (ii) the remittance of such dividends out of the PRC complies with the procedures required by the relevant

PRC Laws relating to foreign exchange administration.

We face uncertainties with

respect to indirect transfers of equity interests in PRC resident enterprises by their non-PRC holding companies.

Adverse changes in economic

and political policies of the PRC government could have a material and adverse effect on overall economic growth in China, which could

materially and adversely affect our business. General macroeconomic conditions may materially and adversely affect our business, prospects,

results of operations and financial position. The PRC government’s control over foreign currency conversion may adversely affect

our business and results of operations and our ability to remit dividends.

Because the Company is not

undertaking an offering, issuance or sale of the shares of our common stock, nor does the Company have any plans to undertake such, a

prior approval from the China Securities Regulatory Commission (“CSRC”) is be required. However, there are substantial uncertainties

regarding the interpretation and application of the M&A Rules, other PRC Laws and future PRC laws and regulations, and there can

be no assurance that any Governmental Agency will not take a view that is contrary to or otherwise different from our opinions stated

herein.

Jiangxi Kenongwo Technology

Co., Ltd. obtained the National High-tech Enterprise Certificate on September 14, 2020. The approving authorities are: Jiangxi Provincial

Department of Science and Technology, Jiangxi Provincial Department of Finance, Jiangxi Provincial Taxation Bureau of State Taxation

Bureau.

Trading securities may be

prohibited under the Holding Foreign Companies Accountable Act (“HFCAA”), as amended by the Consolidated Appropriations Act

(“CAA”) of 2023. If the PCAOB determines that it cannot inspect or fully investigate the Company’s auditor for two

consecutive years, and that as a result an exchange may determine to delist your securities. On December 29, 2022, the CAA was signed

into law by President Biden. The CAA contained, among other things, an identical provision to the AHFCAA, which reduces the number of

consecutive non-inspection years required for triggering the prohibitions under the HFCA Act from three years to two. Since our current

registered public accounting firm is not located in the PRC or Hong Kong, the CAA does not apply. However, if it were to expand to Signapore,

you may be deprived of the benefits of regular inspections which could result in limitation or restriction to our access to the U.S.

capital markets and trading of our securities on a national exchange or “over-the-counter” markets may be prohibited under

the HFCAA.

On December 28, 2021,

the Cyberspace Administration of China (the “CAC”) jointly with the relevant authorities formally published Measures for

Cybersecurity Review (2021) which took effect on February 15, 2022 and replace the former Measures for Cybersecurity Review (2020). Measures

for Cybersecurity Review (2021) stipulates that operators of critical information infrastructure purchasing network products and services,

and online platform operator (together with the operators of critical information infrastructure, the “Operators”) carrying

out data processing activities that affect or may affect national security, shall conduct a cybersecurity review, any online platform

operator who controls more than one million users’ personal information must go through a cybersecurity review by the cybersecurity

review office if it seeks to be listed in a foreign country. Given that: (i) we do not possess personal information on more than one

million users in our business operations; and (ii) data processed in our business does not have a bearing on national security and thus

may not be classified as core or important data by the authorities, we are not required to apply for a cybersecurity review under the

Measures for Cybersecurity Review (2021). As a result of the nature of the Company’s operations and size, the Company does not

believe that the above is applicable to the Company.

At present, we do not

believe our operations require the approval and or permission of Chinese authorities. This is because the Company’s business is

fertilizer, which we believe does not require the approval and permission of the Chinese government. The “Special Management Measures

for Foreign Investment Access (Negative List) (2021 Edition)” and “Market Access Negative List (2022 Edition)” issued

by the Chinese government do not include the industry and business the Company is involved in. The Company is of the belief that the

expenses of engaging PRC counsel would be unduly burdensome on the Company, and thus, the Company has not sought to engage PRC counsel

to obtain an additional opinion pertaining to the Company’s understanding of all required approvals and permission to operate our

business.

According

to the Notice by the General Office of the State Council of Comprehensively Implementing the List-based Management of Administrative

Licensing Items (No. 2 [2022] of the General Office of the State Council) and its attachment, the List of Administrative Licensing Items

Set by Laws, Administrative Regulations, and Decisions of the State Council (2022 Edition), as of the date of this annual report, our

PRC subsidiary has received from PRC authorities all requisite licenses, permissions or approvals needed to engage in the businesses

currently conducted in China. As of the date of this annual report, neither we nor our PRC Subsidiary (i) are required to obtain permissions

from any PRC authorities to operate or issue our ordinary shares to foreign investors, (ii) are subject to permission requirements from

the CSRC, the CAC or any other entity that is required to approve our PRC Subsidiary’s operations, or (iii) have received or were

denied such permissions by any PRC authorities.

We believe that we are

not currently required to obtain pre-approval from Chinese authorities, including the China Securities Regulatory Commission, or CSRC,

or CAC, to list or become quoted on U.S. exchanges/quotation servicers or issue securities to foreign investors, however, if we were

required to obtain approval in the future and were denied permission from Chinese authorities to list or become quoted on U.S. exchanges

and/or quotation servicers, we will not be able to continue to be quoted or listed on U.S. exchanges, which would materially affect the

interests of the investors. It is uncertain when and whether the Company will be required to obtain permission from the PRC government

to list or become quoted on U.S. exchanges in the future, and even when such permission is obtained, whether it will be denied or rescinded.

Although the Company is currently not required to obtain permission from any of the PRC central or local government to obtain such permission

and has not received any denial to list or become quoted on the U.S. exchange, our operations could be adversely affected, directly or

indirectly, by existing or future laws and regulations relating to its business or industry; if we inadvertently conclude that such approvals

are not required when they are, or applicable laws, regulations, or interpretations change and we are required to obtain approval in

the future.

We currently intend to retain

all available funds and future earnings, if any, for the operation and expansion of our business and do not anticipate declaring or paying

any dividends in the foreseeable future. Any future determination related to our dividend policy will be made at the discretion of our

board of directors after considering our financial condition, results of operations, capital requirements, contractual requirements,

business prospects and other factors the board of directors deem relevant, and subject to the restrictions contained in any future financing

instruments. To date, our cash is used for the development and operation of the WFOE. Since the Company has just recently started to

recognizing material revenue, it has not yet arranged to issue dividends or distribution and as the Company is trying to use the funds

for the company’s development, the shareholders’ income will not be arranged for the time being. Because our funds are used

for the development of domestic enterprises, there is no foreign exchange restriction for the time being. However, our ability to transfer

cash between our entities is compromised because the People’s Bank of China regularly intervenes in the foreign exchange market

to limit fluctuations in Renminbi exchange rates. It is possible that the PRC authorities may lift restrictions on fluctuations in Renminbi

exchange rates and lessen intervention in the foreign exchange market in the future.

U.S shareholders may face

difficulties in effecting service of process against the Company and officers and director, as they are both based in China. Even with

proper service of process, the enforcement of judgments obtained in U.S. courts or foreign courts based on the civil liability provisions

of the U.S. federal securities laws would be extremely difficult. Furthermore, there would be added costs and issues with bringing an

original action in foreign courts to enforce liabilities based on the U.S. federal securities laws against the Company.

The PRC government also imposes

controls on the conversion of RMB into foreign currencies and the remittance of currencies out of the PRC. Therefore, we may experience

difficulties in completing the administrative procedures necessary to obtain and remit foreign currency for the payment of dividends

from our profits, if any. Furthermore, if our subsidiaries in the PRC incur debt on their own in the future, the instruments governing

the debt may restrict their ability to pay dividends or make other payments. If we or our subsidiaries are unable to receive all of the

revenues from our operations, we may be unable to pay dividends.

Cash dividends, if any, on

our Shares will be paid in U.S. dollars. If we are considered a PRC tax resident enterprise for tax purposes, any dividends we pay to

our overseas shareholders may be regarded as China-sourced income and as a result may be subject to PRC withholding tax at a rate of

up to 10.0%.

The registered capital of

the Material PRC Company has been duly paid in accordance with applicable PRC Laws and their respective articles of association, to the

extent that such registered capital is required to be paid prior to the date hereof.

All of our business operations

are conducted in China. Accordingly, our business, financial condition, results of operations and prospects are affected significantly

by economic, political and legal developments in China. Although the PRC economy has been transitioning from a planned economy to a more

market-oriented economy since the late 1970s, the PRC government continues to exercise significant control over China’s economic

growth through direct allocation of resources, monetary and tax policies, and a host of other government policies such as those that

encourage or restrict investment in certain industries by foreign investors, control the exchange between the Renminbi and foreign currencies,

and regulate the growth of the general or specific market. While the Chinese economy has experienced significant growth in the past 30 years,

growth has been uneven, both geographically and among various sectors of the economy. As the PRC economy has become increasingly linked

with the global economy, China is affected in various respects by downturns and recessions of major economies around the world. The various

economic and policy measures enacted by the PRC government to forestall economic downturns or bolster China’s economic growth could

materially affect our business. Any adverse change in the economic conditions in China, in policies of the PRC government or in laws

and regulations in China could have a material adverse effect on the overall economic growth of China and market demand for our outsourcing

services. Such developments could adversely affect our businesses, lead to reduction in demand for our services and adversely affect

our competitive position.

The PRC legal system is based

on written statutes. Prior court decisions may be cited for reference but have limited precedential value. Since the late 1970s, the

PRC government has been building a comprehensive system of laws and regulations governing economic matters in general. We conduct our

business primarily through our WFOE, the WFOE is established in China. These companies are generally subject to laws and regulations

applicable to foreign investment in China. However, since these laws and regulations are relatively new and the PRC legal system continues

to rapidly evolve, the interpretations of many laws, regulations and rules are not always uniform and enforcement of these laws, regulations

and rules involves uncertainties, which may limit legal protections available to us. In addition, some regulatory requirements issued

by certain PRC government authorities may not be consistently applied by other government authorities (including local government authorities),

thus making strict compliance with all regulatory requirements impractical, or in some circumstances impossible. For example, we may

have to resort to administrative and court proceedings to enforce the legal protection that we enjoy either by law or contract.

On February 17, 2023, with

the approval of the State Council, the CSRC released the Trial Administrative Measures of Overseas Securities Offering and Listing by

Domestic Companies (the “Trial Measures”) and five supporting guidelines, which will come into effect on March 31, 2023.

According to the Trial Measures, among other requirements, (1) domestic companies that seek to offer or list securities overseas, both

directly and indirectly, should fulfill the filing procedures with the CSRC; if a domestic company fails to complete the filing procedures,

such domestic company may be subject to administrative penalties; and (2) where a domestic company seeks to indirectly offer and list

securities in an overseas market, the issuer shall designate a major domestic operating entity responsible for all filing procedures

with the CSRC, and such filings shall be submitted to the CSRC within three business days after the submission of the overseas offering

and listing application. On the same day, the CSRC also held a press conference for the release of the the Notice on Administration for

the Filing of Overseas Offering and Listing by Domestic Companies, which clarifies that (1) on or prior to the effective date of the

Trial Measures, domestic companies that have already submitted valid applications for overseas offering and listing but have not obtained

approval from overseas regulatory authorities or stock exchanges may reasonably arrange the timing for submitting their filing applications

with the CSRC, and must complete the filing before the completion of their overseas offering and listing; (2) a six-month transition

period will be granted to domestic companies which, prior to the effective date of the Trial Measures, have already obtained the approval

from overseas regulatory authorities or stock exchanges, but have not completed the indirect overseas listing; if domestic companies

fail to complete the overseas listing within such six-month transition period, they shall file with the CSRC according to the requirements;

and (3) the CSRC will solicit opinions from relevant regulatory authorities and complete the filing of the overseas listing of companies

with contractual arrangements which duly meet the compliance requirements, and support the development and growth of these companies.

With

respect to the domestic company, non-compliance with the Trial Measures or an overseas listing completed in breach of it may result in

a warning or a fine ranging from RMB 1 million to RMB10 million. Furthermore, the directly responsible executives and other directly

responsible personnel of the domestic company may be warned or fined between RMB 500,000 and RMB 5 million and the controlling shareholder,

actual controllers, and other legally appointed persons of the domestic company may be warned, or fined between RMB 1 million and RMB

10 million. If, during the filing process, the domestic company conceals important factors or the content is materially false, and securities

are not issued, they are subject to a fine of RMB1 million to RMB10 million. With respect to the directly responsible executives and

other directly responsible personnel of the domestic company, they are subject to a warning and fine between RMB 500,000 and RMB 5 million,

and with respect to the controlling shareholder, actual controllers, and other legally appointed persons of the domestic company, they

are subject to a warning and fine between RMB 1 million and RMB 10 million.

As of the date of this annual

report, the Trial Measures have come into effect. After March 31, 2023, any failure or perceived failure by the domestic company or PRC

subsidiaries to comply with the above confidentiality and archives administration requirements under the Trial Measures and other PRC

laws and regulations may result in that the relevant entities would be held legally liable by competent authorities and referred to the

judicial organization to be investigated for criminal liability if suspected of committing a crime.

According to a translated

copy of the current and effective regulations promulgated by the China Securities Regulatory Commission, that is, the “Trial Administrative

Measures of Overseas Securities Offering and Listing by Domestic Companies” Article 2 states, “Direct overseas offering and

listing by domestic companies refers to such overseas offering and listing by joint-stock company incorporated domestically. Indirect

overseas offering and listing by domestic companies refers to such overseas offering and listing by a company in the name of an overseas

incorporated entity, whereas the company’s major business operations are located domestically and such offering and listing is

based on the underlying equity, assets, earnings or other similar rights of a domestic company”. Accordingly, as the Company believes

it is not a joint-stock company incorporated domestically, this offering is not a direct overseas offering and listing by a domestic

company. Article 16 states, “Subsequent securities offerings of an issuer in the same overseas market where it has previously offered

and listed securities shall be filed with the CSRC within 3 working days after the offering is completed. The Company previously

offered securities in the United States pursuant to a registration statement on Form S-1/A, filed on August 6, 2020. The Company is a

Nevada Corporation formed on October 17, 2018 and is a public company with securities quoted on the OTC Pink Sheets. Therefore, any future

offering would be classified as “Subsequent securities offerings of an issuer in the same overseas market where it has previously

offered and listed securities”. The Company does not believe that it is required to seek pre-authorizations from Chinese authorities

prior to the completion of such offering. The Company has taken no actions in regard to the CSRC approval and does not intend to do so,

and the Company does not believe that this offering is contingent upon receipt of pre-approval from the CSRC now.

Article 15 states, “any

overseas offering and listing made by an issuer that meets both the following conditions will be determined as indirect: (1) 50% or more

of the issuer’s operating revenue, total profit, total assets or net assets as documented in its audited consolidated financial

statements for the most recent accounting year is accounted for by domestic companies; and (2) the main parts of the issuer’s business

activities are conducted in the Chinese Mainland, or its main places of business are located in the Chinese Mainland, or the senior managers

in charge of its business operation and management are mostly Chinese citizens or domiciled in the Chinese Mainland. The determination

as to whether or not an overseas offering and listing by domestic companies is indirect, shall be made on a substance over form basis.”

Article 34 states, “For the purpose of this Measures, domestic companies herein refer to companies incorporated within the Chinese

Mainland, including domestic join-stock companies whose securities are directly offered and listed overseas and the domestic operating

entities of companies whose securities are indirectly offered and listed overseas. Accordingly, the Company believes any future offering

would be an indirect overseas offering by a domestic company.

However,

Article 16 states, “Subsequent securities offerings of an issuer in the same overseas market where it has previously offered and

listed securities shall be filed with the CSRC within 3 working days after the offering is completed. The Company is a Nevada Corporation

formed on October 17, 2018 and is a public company with securities quoted on the OTC Pink Sheets. Therefore, any future offering would

be classified as “Subsequent securities offerings of an issuer in the same overseas market where it has previously offered and

listed securities”. The Company does not believe that any offering would be contingent upon receipt of pre-approval from the CSRC.

Corporate

History and Structure

Kenongwo

Group US, Inc. was incorporated in the State of Nevada on October 17, 2018. On January 1, 2019, we acquired all the issued and outstanding

shares of Jiangxi Kenongwo pursuant to certain share transfer agreements with the two former shareholders of Jiangxi Kenongwo. The share

transfer was completed on January 9, 2019. As a result, Jiangxi Kenongwo became our wholly-owned subsidiary.

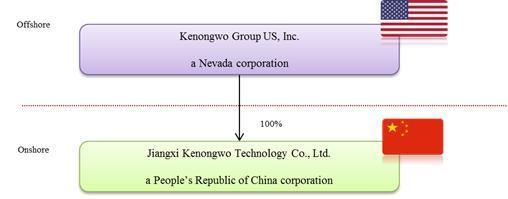

The

following diagram illustrates our current corporate structure:

Any risks that any actions

by the Chinese government to exert more oversight and control over offerings that are conducted overseas and/or foreign investment in

China-based issuers could significantly limit or completely hinder your ability to offer securities to investors and cause the value

of such securities to significantly decline or be worthless.

Subject to the requirements

and public policy considerations as stipulated under applicable PRC Laws relating to the enforceability of foreign court judgments, submission

to foreign jurisdiction for dispute resolution and choice of law, and also subject to the conditions described under the caption “Enforceability

of Civil Liabilities,” (i) the irrevocable submission of the Company to the jurisdiction of any courts in the United States, the

waiver by the Company of any objection to the venue of a proceeding in any such court, the waiver and agreement not to plead an inconvenient

forum, the waiver of sovereign immunity

Under PRC Laws, neither the

Material PRC Company, nor their respective properties, assets or revenues, are entitled to any right of immunity on the grounds of sovereignty

or otherwise from any legal action, suit or proceeding, from set-off or counterclaim, from the jurisdiction of any court, from services

of process, from attachment prior to or in aid of execution of any judgment, or from other legal processes or proceedings for the giving

of any relief or for the enforcement of any judgment.

As a company incorporated

under the laws of Nevada, we are classified as a foreign enterprise under PRC laws and regulations, and our wholly-owned PRC subsidiary,

SRAS, is a foreign-invested enterprise, or a FIE.

All of our revenue is denominated

in Renminbi while our financial reporting is in U.S. dollars. As a result, any significant fluctuation in exchange rates may cause us

to incur currency exchange translation and harm our financial condition and results of operations.

Movements in Renminbi exchange

rates are affected by, among other things, changes in political and economic conditions and China’s foreign exchange regime and

policy. The Renminbi has been unpegged from the U.S. dollar since July 2005 and, although the People’s Bank of China regularly

intervenes in the foreign exchange market to limit fluctuations in Renminbi exchange rates, the Renminbi may appreciate or depreciate

significantly in value against the U.S. dollar in the medium to long term. Moreover, it is possible that the PRC authorities may lift

restrictions on fluctuations in Renminbi exchange rates and lessen intervention in the foreign exchange market in the future.

To date, we have not entered

into any hedging transactions in an effort to reduce our exposure to foreign currency exchange risk. While we may decide to enter into

hedging transactions in the future, the availability and effectiveness of these hedges may be limited and we may not be able to adequately

hedge our exposure or at all.

The M&A Rules and certain

other PRC regulations may make it more difficult for us to pursue growth through acquisitions. Under the Enterprise Income Tax Law, we

may be classified as a “Resident Enterprise” of China. Such classification will likely result in unfavorable tax consequences

to us and our non-PRC shareholders and have a material adverse effect on our results of operations and the value of your investment.

The M&A Rules, among other things, purport to require CSRC approval prior to the listing and trading on an overseas stock exchange

of the securities of an offshore special purpose vehicle established or controlled directly or indirectly by the Material PRC Company

or individuals and formed for the purpose of overseas listing through the acquisition of PRC domestic interests held by such Material

PRC Company or individuals.

We

believe that the Company is not subject to the requirements of Cyberspace Administration of China (“CAC”) and specifically

the cybersecurity law, because we are not an Internet company and do not have the amount of customer data required for pre-approval,

so it is not subject to the Chinese cybersecurity law.

The Company or our subsidiary

is required to obtain from Chinese authorities to operate our business. The Material PRC Company has obtained all material Governmental

Authorizations necessary for its business operations and such Governmental Authorizations are in full force and effect and all required

Governmental Authorizations have been duly obtained.

Enforceability

of Civil Liabilities

All of our assets are located outside the

United States. In addition, all of our directors and officers are nationals and/or residents of jurisdictions other than the United States,

and all or a substantial portion of such persons’ assets are located outside the United States. As a result, it may be nearly impossible

for shareholder to effect service of process within the United States upon us or such persons, or to enforce against them or against

us, including judgments predicated upon the civil liability provisions of the securities laws of the United States or any state thereof.

It may also be difficult for you to enforce judgments obtained in U.S. courts based on the civil liability provisions of the U.S. federal

securities laws against us and our officers and directors. Even in the event there is a judgement, the Company will likely be able to

continue operations without addressing such judgment.

Subject to the requirements

and public policy considerations as stipulated under applicable PRC Laws relating to the enforceability of foreign court judgments, submission

to foreign jurisdiction for dispute resolution (i) the irrevocable submission of the Company to the jurisdiction of any courts in the

United States, the waiver by the Company of any objection to the venue of a proceeding in any such court, the waiver and agreement not

to plead an inconvenient forum, the waiver of sovereign immunity

Under PRC Laws, neither

the Material PRC Company, nor their respective properties, assets or revenues, are entitled to any right of immunity on the grounds of

sovereignty or otherwise from any legal action, suit or proceeding, from set-off or counterclaim, from the jurisdiction of any court,

from services of process, from attachment prior to or in aid of execution of any judgment, or from other legal processes or proceedings

for the giving of any relief or for the enforcement of any judgment.

There is uncertainty as

to whether the courts of the PRC would recognize or enforce judgments of U.S. courts obtained against us or our directors or officers

that are predicated upon the civil liability provisions of the federal securities laws of the United States or the securities laws of

any state in the United States, and (2) there is uncertainty as to whether the courts of the PRC would entertain original actions brought

in the PRC against us or our directors or officers that are predicated upon the federal securities laws of the United States or the securities

laws of any state in the United States. Min Jiang is located in the PRC.

The recognition and enforcement

of foreign judgments are provided under the PRC Civil Procedure Law. PRC courts may recognize and enforce foreign judgments under certain

circumstances in accordance with the requirements of the PRC Civil Procedure Law. Under PRC law, a foreign judgment that does not otherwise

violate basic legal principles, state sovereignty, safety or social public interest of the PRC may be recognized and enforced by a PRC

court, based either on bilateral treaties or international conventions contracted by China and the country where the judgment is made

or on reciprocity between jurisdictions. As a result, it is uncertain whether and on what basis a PRC court would enforce a judgment

rendered by a court in the United States. Under the PRC Civil Procedures Law, foreign shareholders may originate actions based on PRC

law against us in the PRC, if they can establish sufficient nexus to the PRC for a PRC court to have jurisdiction, and meet other procedural

requirements, including, among others, the plaintiff must have a direct interest in the case, and there must be a concrete claim, a factual

basis and a cause for the suit.

Industry Overview

Overview

of the PRC Fertilizer Industry

According

to Gulf Petrochemicals & Chemicals Association, China is the biggest fertilizer producer and consumer in the world. Total fertilizer

consumption in China represents around a third of global fertilizer use. According to China Fertilizers Market – Growth,

Trends, And Forecasts (2019–2024) (source: www.mordorintelligence.com), the China fertilizers market is projected to grow

at a compound annual growth rate (CAGR) of 0.62% during the forecast period, 2019-2024. The market growth is restrained by the Chinese

government’s zero-growth policy and environmental protection policy system for rural areas and the agricultural sector, in order

to control the pollution and achieve green development. The national policies prohibit the use of pesticides, and require organic fertilizers

to replace chemical fertilizers. In 2020, there was zero-growth in fertilizer and pesticide consumption. The policymakers are adjusting

fertilizer consumption structure and promoting accurate fertilization, improved fertilization, and use of more micronutrients and secondary

fertilizers, as compared to straight fertilizers, particularly nitrogenous fertilizers. This policy is expected to provide a fillip to

the growth of the market for bio-fertilizers in China.

Increasing

Demand for Organic and Bio-fertilizers

According

to the Ministry of Agriculture of the People’s Republic of China (MOA), the use of organic fertilizers as a replacement for chemical

fertilizers is one of the key points of agricultural supply-side structural reform in China, and it has a restraining influence on the

growth of the chemical fertilizers market in China. The key crops used in the country for the trial fertilizer-replacement program are

fruits, vegetables, tea, and others. In May 2016, the “Soil Pollution Prevention Action Plan” was issued to provide strong

support for the promotion of organic fertilizer in the country. The government accords great importance to the production of organic

fertilizers, and implements a tax exemption policy (implemented in 2016) for bio-organic fertilizer products, providing further support

for the development of the organic fertilizer industry in China. The rising number of product innovations and activities in the organic

fertilizer market in China act as a restraint to the chemical fertilizers market. All the products we currently sell qualify as the type

of organic fertilizers discussed in this section.

According

to a press release by Ken Research dated January 23, 2020 (source: https://www.openpr.com/news/1905736/china-complex-fertilizer-market-is-driven-by-rise-in-net),

the long term growth potential of the industry remains optimistic of fertilizer market in China as China’s food grain production

is expected to grow at a CAGR of 1.3% during 2017-2022 from 621.1 million MT* in 2017 to 663.2 million MT by 2022. Additionally, government

support to agriculture industry in China would act as another growth promoting factor to fertilizer industry in China. However, the emerging

segment in the coming years would be the organic fertilizers with the government of China planning additional farm subsidies, elimination

of certain land taxes, land reform initiatives to promote organically grown products. (*The metric ton used here is 1,000 kg, equivalent

to 2,204.6 pounds avoirdupois.)

Our

Products

We

are committed to ensuring the quality of our products and production is in compliance with GB/T19001-2016/ISO 9001: 2015 Standard Quality

System, which is the standard system used by organizations to demonstrate their ability to consistently provide products and services

that meet customer and regulatory requirements and to demonstrate continuous improvement. GB/T19001-2016 is the China national standard

for quality management system requirements, including the examination standards and packaging standards. ISO 9001: 2015 is the international

standard that specifies requirements for a quality management system, covering a broad range of activities, services and products, from

the procurement of raw materials to the release of final products. We aim to provide high-quality and environmental friendly organic

fertilizer to our customers. Our organic fertilizers are the products of natural decomposition and are easy for plants to absorb and

digest. Our core products are bamboo charcoal biomass organic fertilizers, amino acid water-soluble fertilizers and selenium-rich foliar

fertilizers. The main raw materials used in these products are bamboo charcoal, bamboo vinegar, rapeseed dregs and organic selenium,

which are mainly obtained through calcination, distillation, extraction of moso bamboo and transformation of other plants. Our products

can be divided into three categories based on their functions: general-function fertilizers, specific-function fertilizers and crop-specific

fertilizers.

| |

1. |

General-Function

Fertilizers – Bamboo charcoal biomass organic fertilizer |

Our

general-function fertilizers can be applied to all kinds of crops to promote their growth. Bamboo charcoal biomass organic fertilizer

is our flagship product under this category. Bamboo charcoal biomass organic fertilizer is developed on the basis of plant nutrition,

soil biology and physical characteristics of the bamboo charcoal. Bamboo charcoal, one of the main components of bamboo charcoal biomass

organic fertilizers, is carbonized from bamboo through our patented technology. We use bamboo charcoal, rapeseed dregs, bamboo vinegar

liquid, amino acid, beneficial microbial flora and other metal ions (such as copper, iron, zinc and boron) as main raw materials and

adopt international advanced production technology to compound them into the final product.

Growing

in the natural environment, bamboo absorbs a large amount of water-soluble minerals such as potassium, sodium, calcium and magnesium.

These minerals will be dissolved and condensed in the bamboo charcoal after the bamboo is smoldered under high temperature.

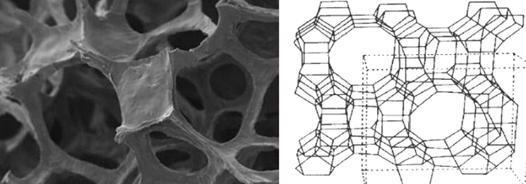

(Structure

of bamboo charcoal)

Our

bamboo charcoal biomass organic fertilizer can promote the reproduction of a large number of probiotic strains around the roots of farm

crops, and meanwhile prevent the growth of harmful microorganisms, thus making the fertilizer to has functions of nitrogen fixation,

phosphorus-dissolving and kalium-dissolving, among others. Our bamboo charcoal biomass organic fertilizer can also greatly improve the

contents and effectiveness of the N, P, K, Ca, Fe and other elements in the soil. Bamboo charcoal itself can adsorb and passivate heavy

metals and pesticide residues in the soil and therefore improve the quality of farm crops. In addition, bamboo charcoal can enhance the

soil permeability, increase crop root activity, promote photosynthesis, maintain nutrient components in the soil, enhance crops’

resistance ability and prevent the occurrence of crop diseases and insect pests. When using our bamboo charcoal biomass organic fertilizer

in acidic soil, the bamboo charcoal substance’s PH value can improve the acidity balance of the soil, making the soil more suitable

for growing crops.

Our

general-function fertilizer products also include bamboo compound fertilizer and water-soluble fertilizer with amino acid.

| 2. | Specific-Function

Fertilizers |

Our

specific-function fertilizers are designed to provide specific benefits to crops. Our selenium-rich foliar fertilizers can promote the

content of selenium in the final agricultural products. Selenium is an essential trace mineral that is important for many bodily processes.

By adding organic selenium into our fertilizers and applying them to the crops, selenium can be well absorbed and converted. In addition,

the major components in our amino acid water-soluble fertilizers are bamboo vinegar. We mixed bamboo vinegar and other microelements,

making our fertilizers rich of nutrition while adding no sterols of any kind. Bamboo vinegar can enhance plants’ abilities to absorb

nutrition from soil and degrade the fertilizer residues. These fertilizers can be applied to the soil or sprayed on crops aboveground

directly or indirectly in order to supply nutrients, increasing crop yields and improving product quality.

| |

3. |

Crop-Specific

Fertilizers |

We

also provide fertilizers that are designed for specific crops based on soil tests. The use of soil tests can help determine the status

of nutrients available to plants in soil, thus it develops fertilizer recommendations to achieve optimum crop production. For example,

we have designed and manufactured special fertilizer products for blueberries, dragon fruits and jackfruits. The best soil for blueberries

to grow is acidic with a PH scale of 4.3 to 5.3 and has an organic-material level of 8% to 12%. Our blueberry fertilizers can effectively

resolve the imbalance between the PH scale and organic-material level.

China’s

fertilizer market is highly commercialized and therefore we adopted a multi-level brand strategy to target different market segments

with tailored products. At present, selenium-rich foliar fertilizer and bamboo charcoal biomass organic fertilizers are marketed as high-end

products, compound fertilizers as intermediate products, and amino acid water-soluble fertilizers as low-end products. We have so far

developed nearly 20 kinds of products. In general, we believe our fertilizers have the following characteristics and advantages:

| |

● |

Increase

the amount of probiotic strains and prevent the growth of harmful microorganisms; |

| |

● |

Help

the soil fix nitrogen, dissolve phosphorus and dissolution and better release the nutrients in the soil; |

| |

● |

Adsorb

and passivate heavy metals and pesticide residues in soil; |

| |

● |

Enrich

the mineral content of the soil, increase the organic matters in the soil and therefor increase the crop yield rate; |

| |

● |

Enhance

soil permeability, increase crop root activity and promote photosynthesis; |

| |

● |

Increase

significantly the protein, vitamin, and mineral contents of most fruits and vegetables; |

| |

● |

Increase

the water retention of soil to help plants to resist drought; and |

| |

● |

Increase

aeration of the soil. |

The

following table summarizes the 15 products we currently sell:

| Product |

|

Function |

| Organic

Bamboo Charcoal Fertilizers |

|

Promote

reproduction of probiotic strains around the roots of farm crops; adsorb and passivate heavy metals and pesticide residues in soil;

enhance soil permeability, increase crop root activity; promote photosynthesis, increase organic components in soil. |

| |

|

|

| Selenium-Rich

Organic Bamboo Charcoal Fertilizers |

|

Promote

reproduction of probiotic strains around the roots of farm crops; adsorb and passivate heavy metals and pesticide residues in soil;

increase organic components and selenium in soil; enhance crop’s ability to absorb nutrition in soil. |

| |

|

|

| Water-Soluble

Fertilizers (2.5L)* |

|

Increase

crops’ ability of resisting disease and harmful bacteria and thus prevent crops disease and improve crops health; promote crops

growing and improve its quality. |

| |

|

|

| Water-Soluble

Fertilizers (1L)* |

|

Increase

crops’ ability of resisting disease and harmful bacteria and thus prevent crops disease and improve crops health; promote crops

growing and improve its quality. |

| |

|

|

| Water-Soluble

Fertilizers (500ML)* |

|

Increase

crops’ ability of resisting disease and harmful bacteria and thus prevent crops disease and improve crops health; promote crops

growing and improve its quality. |

| |

|

|

| Water-Soluble

Fertilizers (250ML)* |

|

Increase

crops’ ability of resisting disease and harmful bacteria and thus prevent crops disease and improve crops health; promote crops

growing and improve its quality. |

| |

|

|

| High-Concentration

Foliage Fertilizers (100ml)* |

|

Increase

crops’ ability of resisting disease and harmful bacteria and thus prevent crops disease and improve crops health; increase

selenium in soil which will lead to rich selenium in crops. |

| |

|

|

| Household

Foliage Fertilizers (1L)* |

|

Promote

the growth of green household plants and reduce pests and plant diseases. |

| |

|

|

| Winter

Fertilizers (40kg)* |

|

Absorb

and passivate heavy metals and pesticide residues in soil; increase organic components in soil; improve the living environment for

probiotic strains in soil. |

| |

|

|

| Winter

Fertilizers (25kg)* |

|

Absorb

and passivate heavy metals and pesticide residues in soil; increase organic components in soil; improve the living environment for

probiotic strains. |

| |

|

|

| Oilseed

Rape-Specific Fertilizers |

|

Enhance

soil permeability; absorb and passivate heavy metals and pesticide residues in soil; protect the environment. |

| |

|

|

| Blueberry-Specific

Fertilizer |

|

Specifically

designed for blueberry with low PH value and few organic materials; promote the growth of blueberry. |

| |

|

|

| Vegetal

Organic Fertilizers |

|

Enhance

soil permeability; absorb and passivate heavy metals and pesticide residues in soil; increase micro-nutrition elements in soil. |

| |

|

|

| Organic

Water-soluble Fertilizer |

|

Promote

the growth of plants and reduce pests and plant diseases. Provide abundant nutrition to the plant and prevent premature fruit drop. |

| |

|

|

| Bamboo

Asphaltene |

|

Promote

the growth of plants and reduce pests and plant diseases. Improve plants’ abilities to resist coldness and drought. Improve

fruit quality. |

| * | The

units following each of these fertilizers respectively represent the level of concentration

of the effective substance in each of these fertilizers. |

Our

Technology and Manufacturing Process

The

main raw materials that are used in our organic fertilizers include bamboo charcoal, bamboo vinegar, rapeseed dregs and organic selenium.

Bamboo charcoal is carbonized from bamboo and it is an excellent fertilizer carrier that can slowly release the fertilizer substance

and at the same time reduce the pollution in the soil. Bamboo vinegar is a liquid obtained by condensing the water volatile organics

in Moso bamboo, which is released during the high temperature pyrolysis through our patented technology. Our production procedure is

scientifically designed and its automated production line and quality control system ensures consistent high quality. Our automated production

line for product processing is run by a central control system and only needs the input of control technicians. This central control

system manages the process of producing products, including automatically feeding materials to machines, blending materials and controlling

other manufacturing, packaging and stacking process. The machinery and vats for the line have been supplied by a local medical machinery

manufacturer and the automated control systems were developed by us. Our access rights management system ensures that our proprietary

ingredient mixes are protected at all times. Also, by linking the computer server with the electronic weights on each of the material

input bins, the exact quantity of each element is delivered every time, thus maintaining quality and reducing waste. We also plan to

establish an automatic production line controlled by a computer system to manage raw materials processing, which will control the process

of fermenting and grinding raw materials, subject to our securing necessary financing to support this plan. Specifically, we plan to

establish four automated production lines, including (1) the powder fertilizer production line, (2) the granular fertilizer production

line, (3) the liquid water soluble fertilizer production line, and (4) the powder water soluble fertilizer production line). As of the

date of this report, (3) and (4) have been completed. In addition, we also installed the liquid raw material automatic storage tank system,

the palletizing robot system and the raw material weighing and batching system.

Sales

and Marketing

We

believe that our sales services, combined with the quality and reputation of our products will help us retain and attract new customers.

Our salesmen are trained to work closely with distributors and customers to select suitable products and provide post-sales support.

In addition, our salespersons share their knowledges in the fertilizer industry through organizing and opening agricultural technology

training courses to the public.

China’s

fertilizer market is highly commercialized and therefore we adopted a multi-level brand strategy to target different market segments

with tailored products. At present, selenium-rich foliar fertilizer and bamboo charcoal biomass organic fertilizers are marketed as high-end

products, compound fertilizers as intermediate products, and amino acid water-soluble fertilizers as low-end products.

We

distribute and sell our products to our end-customers through several different channels, including professional markets, sales department

of our company and distributors:

| ● | Professional

Market: we built cooperation relationship with private agricultural companies and agricultural

cooperative associations for sales; |

| |

● |

Sales

Team: we have a team of 8 marketing leaders who are responsible for collecting and correlating marketing data from 27 provinces in

the PRC and they are professionally trained to promote and deliver products to our customers; |

| |

● |

Third-party

agent and distributors: we utilize various third-party agents and distributors to sell and distribute our products on a non-exclusive

basis; and |

| |

● |

E-commerce:

we have established a national hotline (+86-400915217) to answer customers’ questions and a text message platform to interact

with farmers in real time. |

We

currently sell our products through a carefully constructed network covering approximately

300 regional distributors in over 20 provinces across China. The distributors, in turn, sell the products to smaller local retail stores

which then sell them to end users (typically farmers). We do not grant provincial or regional exclusive rights because there is currently

no single distributor strong enough to warrant exclusive rights. We enter into non-exclusive written distribution agreements with selected

distributors who demonstrate their local business experience and extensive regional sales network. The agreements do not specify the

length of the engagement. The typical terms in a distribution agreement are regarding the sales amount of the products, the specification

of the products, the means of transportation and the place of products’ delivery. Although our distributors and agents also work

with other fertilizer manufacturers to sell their products, we have established our reputation in the market and approximately 30% of

the products sold by our distributors and agents were supplied by us. We also plan to work with overseas distributors, such as the distributors

in Malaysia, to sell our products, especially our high-purity bamboo vinegar and organic selenium products.

By

using various channels to sell and distribute our products to customers, we can directly serve our customers and end-customers by providing

customer service and support.

Raw

Materials and Suppliers

Moso

bamboo is the crucial raw material for the production of bamboo charcoal, bamboo vinegar and organic selenium. The Moso bamboo resources

are abundant in Yichun City, Jiangxi Province and they can regenerate fast. We plan to grow Moso bamboos by ourselves in the future We

have been working with 28 suppliers, including Binjiang Yinglan Construction Service Department at Yuanzhou District, Ms. Xueping Li

and others to procure Moso bamboos.

We

have easy access to and we procure the packaging materials, including bags, bottles and cartons, and packaging labels for each type of

fertilizers from local manufacturers and suppliers.

The

following table sets forth information as to each supplier that accounted for 10% or more of the Company’s purchase for the years

ended December 31, 2021 and December 31, 2020.

Our

Customers

Our

customers are mainly located in provinces of Xinjiang, Guizhou, Jiangxi, Hainan, Fujian, Chongqing and Jiangsu.

The

following table sets forth information as to each customer that accounted for 10% or more of the Company’s revenues for the years

ended December 31, 2021 and December 31, 2020.

| | |

December 31, | | |

December 31, | |

| | |

2021 | | |

2020 | |

| Customers | |

Amount $ | | |

% | | |

Amount $ | | |

% | |

| Yijing (Hainan) Agricultural Development Co., Ltd. | |

| 82,413 | | |

| 15.18 | | |

| 123,641 | | |

| 29.74 | |

| Qing Wu | |

| 31,838 | | |

| 5.86 | | |

| 119,843 | | |

| 28.82 | |

Competition

The

Chinese fertilizer industry is highly fragmented. Our major competitors include the below:

1.

Agritech (China) Fertilizer Co., Ltd.

Agritech

(China) Fertilizer Co., Ltd. is engaged in the research and development, manufacture, sales and technical support of hi-tech green agricultural

resources with green organic high-effect liquid compound fertilizer as its core product.

2.

Qiqihaer Fuer Agriculture Co., Ltd, Heilongjiang Province

Established

in 1986, Qiqihaer Fuer Agriculture Co., Ltd. is engaged in research and development, manufacture and sales of high-tech foliar fertilizers,

compound fertilizers, biological pesticide and improved seeds. Its annual production volume is approximately 1,500 metric tons for foliar

fertilizers and 10,000 metric tons for compound fertilizers. We are competing with this company principally in the Heilongjiang province.

3.

Heze Exploitation Region Caozhou Chamurgy Co., Ltd.

The

Heze Exploitation Region Caozhou Chamurgy Co., Ltd. is an agricultural products company. Its principal products include foliar, water

flush, compound, organic fertilizer and pesticides. Its products are sold in 30 provinces in China.

4.

Guangxi Beihai Penshibao Co., Ltd.

Founded

in 1985, Guangxi Beihai Penshibao Co., Ltd. is a wholly foreign owned enterprise engaged in research, production, and promotion of foliar

fertilizer.

Our

Strategies and Competitive Strength

We

intend to build upon our proven ability to produce high-quality organic fertilizer and increase our presence and market share in the

agriculture industry. The summary of our competitive strength is as follows:

Products

with Selenium

Selenium

is an essential trace mineral that is important for many bodily processes. Our factory is located in an area that has high level of selenium

in soil and water which provides us the advantage of manufacturing selenium-rich fertilizer products. By adding organic selenium into

our fertilizers and applying them to the crops, selenium can be well absorbed and converted, making the final agricultural products rich

of selenium.

Nationwide

Distribution Network

We

have established our own distribution channels with approximately 300 distributors in over 20 provinces in China, enabling our products