- This capital increase will be made by way of a public

offering without preferential subscription rights

- The initial amount of the capital increase could be

increased up to €17.25 million should the extension clause be fully

exercised, and up to €19.8 million should the extension clause and

overallotment option be fully exercised

- Extension of CARMAT's cash runway to early May 2024, in the

event of completion of the initial capital increase (excluding the

extension clause and overallotment option).

- After the Offering, the Company’s funding needs for the next

12 months will amount to €37 to 55 million

Videoconference today at 8 pm CET. To

participate, please register by clicking on this link

Regulatory News:

NOT FOR DISTRIBUTION IN THE UNITED STATES OF AMERICA, CANADA,

AUSTRALIA OR JAPAN

CARMAT (FR0010907956, ALCAR), designer and developer of the

world’s most advanced total artificial heart, aiming to provide a

therapeutic alternative for people suffering from advanced

biventricular heart failure (the “Company” or

“CARMAT”), announces the launch of a capital increase by way

of a public offering without preferential subscription rights for

an initial total of €15 million, which could be increased to a

maximum of €19.8 million should the extension clause and

overallotment option be fully exercised. The main characteristics

of this capital increase are as follows:

- Subscription price: €3.99 per share, representing a discount of

30% on the average of the volume-weighted average share prices over

the five trading sessions preceding the setting of this

subscription price;

- Subscription and underwriting commitments totaling €9.17

million, or 61.13% of the initial amount of the transaction

(including €3.25 million by the historical shareholders Lohas,

Santé Holdings and Therabel Invest);

- Subscription period open from January 18 to January 25, 2024,

inclusive;

- Extension of CARMAT’s cash runway to early May 2024, should the

initial capital increase be implemented (excluding the extension

clause and overallotment option).

Stéphane Piat, Chief Executive Officer of CARMAT, said:

“15 years of innovations have enabled us to devise Aeson®, the

world’s only artificial heart combining pulsatility,

hemocompatibility and self-regulation, to replicate as closely as

possible the functioning of a human heart and offer patients a

quality of live with no complications.

In 2023, CARMAT made decisive progress: 50 implants achieved

since inception, 41 hospitals trained to implants of Aeson® in 12

different countries, and opening of a new manufacturing facility

with a capacity of up to 500 hearts a year. Out of the 50 implants

made so far, 11 were performed during the fourth quarter of 2023,

in France, Germany and Italy, demonstrating a strong acceleration

in the adoption of Aeson® by the medical community.

This puts us in a position to move towards a substantial

commercial deployment of Aeson® in Europe, from the beginning of

2024

By launching a public offering which, by definition, is open to

all, we want to allow both our existing shareholders, who we would

like to thank very warmly for their support, and those who are not

yet CARMAT shareholders, to participate in our short-term

financing, and by doing so, support our long-term objective of

providing a solution to the thousands of patients suffering from

advanced biventricular heart failure, who currently have no

therapeutic options due to the lack of a sufficient number of

available human grafts ”.

Reasons for the Offering

The main purpose of this issue is to strengthen CARMAT’s equity

and finance its short-term working

capital requirements. Prior to the Offering (as defined below), the

Company’s confirmed financial resources enable it to finance its

activities until the end of January 2024. The net proceeds of this

transaction will allow CARMAT to continue its operations beyond

that timeline, and notably to continue the development of its

production and sales, as well as its EFICAS clinical study in

France.

The Offering will only partially finance the Company's needs for

the next 12 months, and CARMAT will continue to face the critical

challenge of its short-term financing, with a net shortfall to be

financed of between €37 and €55 million to secure its activities

over the next 12 months, depending on the outcome of its ongoing

discussions with its financial creditors (in particular the

European Investment Banque or “EIB”) (please refer to the

statement on the Company’s working capital for further

details).

The Offering, made at 100% excluding the full exercise of the

extension clause and the over-allotment option, and in the absence

of a definitive agreement with the EIB, would enable the Company to

continue its operations until February 22, 2024.

Statement on the Company’s working capital

As of today, the Company does not have sufficient working

capital to meet its commitments and cash requirements over the next

12 months. Indeed, as at December 31, 2023, CARMAT had a cash

position of €8 million, enabling it to finance its activities until

the end of January 2024. In the event that the Offering is not

completed and the Company does not have access to additional

financing between now and January 31, 2024, its financing shortfall

will materialise from that date.

Based on its business plan, CARMAT expects to need approximately

€65 million in financing to ensure all of its operations over the

next 12 months. This amount includes in particular €15 million of

current liabilities due on February 22, 20241 for the repayment

(principal and interest) of the first tranche of the EIB loan

contracted on December 17, 20182. This amount would be reduced to

€50 million in the event of a deferral of the aforementioned €15

million, should the EIB and the Company formalise in a definitive

agreement the conditional agreement in principle reached with the

EIB in January 2024 on new repayment terms for its loan3. This

conditional agreement in principle, which covers all tranches of

the EIB loan, also provides for the “equitization” (i.e. repaid

through capital increases spread over time) of principal and

interest due under the loan, i.e. a total amount at maturity of €48

million.

Assuming a 100% or 75% completion of the Offering without a

final agreement being reached with the EIB, the Company would only

have financing until February 22, 20242 and would still face a

12-month working capital shortfall of between €52 and €55 million

(depending on whether the net proceeds of the Offering are 100% or

75% of the planned amount).

If the Offering is completed and a definitive agreement is

reached with the EIB to defer the aforementioned €15 million, the

Company would only have financing until early May 2024 (or, if

applicable, mid-April 2024) and would still face a 12-month working

capital shortfall estimated at between €37 and €40 million

(depending on whether the net proceeds of the Offering are 100% or

75% of the planned amount).

The Company works on gradual extension of its 12-month financing

horizon in several steps: the completion of the capital increase in

the very short term purpose of this press release, which should

enable the Company to strengthen its cash position and thus

continue its activities beyond January 2024; then other

complementary initiatives (including: one or more further capital

increases, discussions with the EIB which have led to the agreement

in principle referred to above, and ongoing discussions with the

banks BNP Paribas and Bpifrance with a view to restructuring the

repayment terms of its two state guaranteed loans of €5 million

each contracted in the fourth quarter of 2020, i.e. a total of €9.5

million remaining to be repaid) in order to further extend its

financial horizon.

However, there is no guarantee that the expected financing will

be available or even that the conditional agreement in principle

reached with the EIB will become a definitive agreement. This

represents a significant uncertainty that could jeopardise the

Company’s ability to continue as a going concern and could lead to

the opening of insolvency proceedings in the short or medium

term.

Terms and conditions of the Offering

Pursuant to the delegation granted by the shareholders’

Extraordinary General Meeting of January 5, 2024 in its 2nd and 5th

resolutions, and pursuant to the subdelegation granted by the Board

of Directors on January 12, 2024, on January 16, 2024, the

Company’s Chief Executive Officer notably decided to launch a

capital increase, without preferential subscription rights and

priority period for existing shareholders, by way of a public

offering via the issuance of a maximum of 3,759,399 new ordinary

shares of the Company with a nominal value per share of 0.04 euros

(the “New Shares”), a number that could be increased by

563,909 additional New Shares should the Extension Clause be fully

exercised and 1,212,405 additional New Shares should both the

Extension Clause and Overallotment Option (as defined below) be

fully exercised.

Structure of the Offering

The New Shares, as well as the New Shares to be issued should

the Extension Clause and Overallotment Option be fully or partially

exercised, will be the subject of a global offering (the

“Offering”) comprising:

- a public offering in France primarily intended for individual

investors (the “Public Offer”); and

- a global placement intended for institutional investors (the

“Global Placement”) comprising:

- (a) an offering in France for qualified investors; and

- (b) an international offering for institutional investors in

certain countries outside of the United States, Japan, Australia

and Canada, within the framework of offshore transactions, pursuant

to Regulation S under the US Securities Act of 1933, as

amended.

The allocation of New Shares between the Global Placement on the

one hand and the Public Offer on the other hand will be made in

accordance with the following principles:

- If the demand allows, the Company would like to favor

subscriptions received within the framework of the Public Offer,

targeting a minimum of 10% of allocations;

- Subscriptions within the framework of the Global Placement will

be allocated on the basis of their order of arrival and/or the

quality of the various categories of investor, it being specified

that investors who have committed to subscribe to the transaction

will not benefit from priority allocation under the Global

Placement;

- Underwriting subscription commitments from guarantors will be

allocated if and when the other subscriptions allocated do not

enable the initial size of the Offering to be reached (a

proportional reduction will be applied in the event of a partial

call on the guarantee).

Definitive size of the Offering

Following the subscription period, the Company’s Chief Executive

Officer should set, by no later than January 29, 2024, the

definitive terms of the Offering, the maximum number of New Shares

and the nominal amount of the subsequent capital increase.

Depending on the size of the demand expressed within the

framework of the Offering, the Chief Executive Officer could, after

consulting the Lead Manager and Bookrunner, decide to increase the

size of the capital increase of an initial amount of €15 million,

issue premium included, by an additional maximum amount of €2.25

million, issue premium included, representing 15% of the initial

size of the capital increase, within the framework of an extension

clause (the “Extension Clause”). The decision to exercise

the Extension Clause will be indicated in the press release

published by the Company and put online on the Company’s website

and in the notice published by Euronext announcing the results of

the capital increase.

In order notably to enable it to cover any overallotments and to

facilitate stabilizing operations, the Company has granted Invest

Securities (or any entity acting on its behalf) (the

“Stabilizing Agent”), an overallotment option allowing it to

increase, in one or several installments, within the framework of

the provisions of article L. 225-135-1 of the French code of

commerce, the size of the aforementioned capital increase by an

additional number of New Shares representing a maximum of 15% of

the cumulative number of New Shares, after any exercise of the

Extension Clause, i.e. a maximum number of 648,496 additional New

Shares, (the “Overallotment Option”). The Overallotment

Option will be exercised by the Stabilizing Agent, in whole or in

part, during a period of thirty days from the end of the Offering

subscription period i.e., for indicative purposes, up to February

24, 2024. If the Overallotment Option is fully or partially

exercised, a press release will be published by the Company.

It is specified that, should demand not be sufficient, the

capital increase could be limited to 75% of the amount initially

planned, i.e. €11.25 million instead of the initial €15

million.

If, following the subscription period, total subscriptions

received by the Company were to represent less than 75% of the

amount initially planned, the Offering would be cancelled and all

subscription orders placed in this respect would become null and

void.

Public Offer

The Public Offer will be open solely in France from January 18

to January 25, 2024 (inclusive), until 5:30 pm Paris time.

Global Placement

The Global Placement will be carried out from January 18 to

January 25, 2024 (inclusive), until 5:30 pm Paris time. To be taken

into account, orders issued within the framework of the Global

Placement must have been received by the Lead Manager and

Bookrunner by no later than 5:30 pm Paris time on January 25, 2024

(indicative date).

Price of New Shares within the framework of the issue

3.99 euros per New Share (i.e. a par value of 0.04 euros and an

issue premium of 3.95 euros) (the “Offering Price” or

“Subscription Price”), to be fully paid-up in cash at the

time of subscription.

The Offering Price corresponds to the price of the New Shares

offered within the framework of the Public Offer and the Global

Placement. The Offering Price represents:

- a discount of 30% on the average of the volume-weighted average

share prices during the five trading sessions preceding the setting

of the issue price by the Company’s Chief Executive Officer on

January 16, 2024 after the markets close (i.e. January 10, 11, 12,

15 and 16, 2024, inclusive) and

- a discount of 27.6% on the closing price on the day prior to

the setting of the issue price by the Company’s Chief Executive

Officer (i.e. January 16, 2024).

The additional New Shares that could be issued within the

framework of the Overallotment Option would be issued at the

Offering Price.

Gross and net proceeds of the Offering

The amount of the issue proceeds received by the Company would

be, for indicative purposes only, as follows:

(in millions of euros)

Offering at

75%

Offering at

100%(1)

Offering at

115%(2)

Offering at

130%(3)

Gross proceeds

11.25

15.00

17.25

19.84

Estimated costs*

1.47

1.68

1.81

1.96

Net proceeds

9.78

13.32

15.44

17.88

* Including remuneration of financial intermediaries, legal,

administrative and communication costs, as well as the amount of

remuneration relating to underwriting commitments in the event of a

full call by the guarantors (i.e. €400,000 = 7.0% x €5.72 million),

and other costs relating to the issue.

1) Excluding the exercise of the Extension

Clause 2) After the full exercise of the Extension Clause. 3) After

the full exercise of the Extension Clause and the Over-Allotment

Option.

Rights attached to the New Shares

The New Shares and, if applicable, the additional New Shares

will carry dividend rights, will carry rights, from the date of

their issue, to all distributions decided by the Company from that

date and will be admitted to trading on the same listing line as

the Company’s existing shares.

Notifications of New Shares to subscribers

Within the framework of the Public Offer, investors who have

placed subscription orders will be informed of their allocations by

their financial intermediary. Within the framework of the Global

Placement, investors who have placed subscription orders will be

informed of their allocations by the Lead Manager and

Bookrunner.

Revocation of subscription orders

Subscription orders received within the framework of the Public

Offer are irrevocable.

Indicative timetable of the transaction

January 17, 2024

Approval of the Prospectus by the AMF

Press release announcing the launch of the

Offering (after market close)

January 18, 2024

Publication by Euronext Paris of the

notice of the Opening of the Offering

Availability of the Prospectus

Opening of the Public Offer and Global

Placement

January 25, 2024

Closing of the Public Offer (5:30 pm Paris

time).

Closing of the Global Placement (5:30 pm

Paris time)

January 29, 2024

Setting of the definitive terms of the

Offering (including the exercise or not of the Extension

Clause).

Press release announcing the results of

the Offering (after the markets close)

Publication by Euronext of the notice of

the results of the Public Offer

January 31, 2024

Issuance of the New Shares –

Settlement-Delivery of the New Shares

Admission of the New Shares to trading on

Euronext

February 24, 2024

Deadline for exercising the Overallotment

Option

End of the possible stabilization

period

The public will be informed of any changes to the above

indicative timetable, should this happen, via a press release

published by the Company and put on its website and by a notice

published by Euronext.

Underwriting and other subscription commitments

The issue is not covered by a guarantee or underwriting, as per

the provisions of article L. 225-145 of the French commercial

code.

Nevertheless, the Company has received commitments from certain

investors acting as a guarantee for the Offering totaling €5.72

million, or 38.13% of the initial amount of the capital increase.

These commitments will be triggered should total subscriptions to

New Shares (subscriptions received within the framework of the

Public Offer and Global Placement) represent less than 100% of the

Offering (excluding exercise of the Extension Clause and

Overallotment Option).

All guarantors will be remunerated via a commission equal to 5%

of their commitment, irrespective of the number of shares allocated

to them. The guarantors will also receive a commission of 2% of

their commitment that is effectively called within the framework of

the final allocation of shares issued.

Furthermore, Lohas, Santé Holdings and Therabel Invest,

historical shareholders of the Company have pledged to place

subscription orders in cash for a total amount of €3.25 million,

i.e. 21.67% of the gross amount of the Offering. Finally, one other

investor has pledged to place a subscription order for an amount of

€200,000, i.e. 1.33% of the gross amount of the Offering. None of

these commitments will be remunerated.

All these commitments, of a total amount of €9,17 million

guarantee that the Company will reach at least the threshold for

implementing 61.13% of the Offering.

Summary of commitments

Details of the commitments representing a total of 61.13% of the

size of the Offering are as follows:

Investor’s Name

Amount of the subscription

order

New investor

L1 Capital Global Opportunities Master

Fund

€200,000

Historical

shareholders

Santé Holding Srl

€1,500,000

Therabel Invest SàRL

€250,000

Lohas SàRL

€1,500,000

Sub-total historical

shareholders

€3,250,200

Guarantors

Johannes Groeff

€350,000

Global Tech Opportunities 21 (ABO)

€500,000

Maitice Gestion

€500,000

Crazy Duck BV

€250,000

Gestys SA

€400,000

Giga SS

€70,000

Jérôme Marsac

€150,000

iXcore SAS

€1,500,000

Friedland Gestion SAS

€500,000

Hamilton Stuart Capital Ltd

€500,000

Market Wizards BV

€600,000

Sully Patrimoine Gestion SA

€200,000

TVB Invest SARL

€50,000

Nyenburgh

€150,000

Sub-total guarantors

€5,720,000

Total

€9,170,000

Lock-up commitment by the Company

The Company has signed, until March 15, 2024, a lock-up

commitment with the Lead Manager and Bookrunner, subject to certain

customary exceptions and the issue by the Company of securities in

connection with the planned “equitization” of the EIB loan4.

It is specified that no lock-up commitment has been asked for in

the context of the Offering neither from the Company’s existing

shareholders nor from investors who have committed to subscribe to

the Offering.

Impact of the Offering on a shareholder’s situation

The breakdown of the Company’s share capital and voting rights

(on a non-diluted basis) is, as on the date hereof and to the best

of the Company’s knowledge, as indicated in section 2 of the

summary (Key Information on the Issuer) and section 5.10.3 of the

“Note d'Opération” (as defined below).

For information purposes, assuming a 100% Offering and the full

allocation of the above-mentioned subscription and underwriting

commitments, and on the basis of the number of shares outstanding

at the date hereof and the breakdown of the Company's shareholder

as at December 31, 2023, the breakdown of the Company’s shareholder

base would be as follows:

Shareholders

Excluding exercise of the

Extension Clause

After full exercise of the

Extension Clause

After full exercise of the

Extension Clause and Overallotment Option

Number of shares

% of capital

% of voting rights (1)

Number of shares

Number of shares

% of capital

% of voting rights (1)

% of capital

Number of shares

Lohas SARL

3,322,893

11.6%

10.2%

3,322,893

11.4%

10.0%

3,322,893

11.2%

9.8%

Matra Defense SAS

2,670,640

9.4%

11.2%

2,670,640

9.2%

11.0%

2,670,640

9.0%

10.8%

Santé Holdings SRL

2,894,283

10.1%

12.3%

2,894,283

9.9%

12.1%

2,894,283

9.7%

11.9%

Corely Belgium SPRL

880,000

3.1%

5.1%

880,000

3.0%

5.0%

880,000

3.0%

4.9%

Bratya SPRL

99,490

0.3%

0.6%

99,490

0.3%

0.6%

99,490

0.3%

0.6%

Pr. Alain Carpentier & Famille

491,583

1.7%

3.0%

491,583

1.7%

3.0%

491,583

1.7%

2.9%

ARSF A. Carpentier

115,000

0.4%

0.7%

115,000

0.4%

0.7%

115,000

0.4%

0.7%

Therabel Invest

741,706

2.6%

2.3%

741,706

2.5%

2.2%

741,706

2.5%

2.2%

Cornovum

458,715

1.6%

1.4%

458,715

1.6%

1.4%

458,715

1.5%

1.4%

Stéphane Piat

174,165

0.6%

1.4%

174,165

0.6%

1.4%

174,165

0.6%

1.4%

Treasury shares

6,474

0.0%

0.0%

6,474

0.0%

0.0%

6,474

0.0%

0.0%

Free float

16,692,486

58.5%

51.9%

17,256,395

59.3%

52.7%

17,904,891

60.2%

53.6%

TOTAL

28,547,435

100.0%

100%

29,111,344

100.0%

100.0%

29,759,840

100.0%

100%

Amount and percentage of the dilution immediately resulting

from the Offering

For guidance purposes, the impact of the Offering on the stake

of a shareholder holding 1% of the Company’s share capital prior to

the Offering and not subscribing to it and on the portion of the

Company’s shareholders’ equity per share would be as follows (based

on 24,788,036 shares outstanding and shareholders’ equity of

-€17.54 million as of November 30, 2023):

Portion of capital

Portion of shareholders’

equity per share

Non-diluted basis

Diluted basis

Non-diluted basis

Diluted basis*

Before the Offering

1.00%

0.91%

-0.0007

-0.0003

After the issuance of 2,819,550 New Shares

(should the Offering be reduced to 75%)

0.90%

0.82%

0.4069

0.3996

After the issuance of 3,759,399 New Shares

resulting from this capital increase (excluding the Extension

Clause)

0.87%

0.80%

0.5248

0.5083

After the issuance of all New Shares

(including full exercise of the Extension Clause but excluding the

Overallotment Option)

0.85%

0.78%

0.5926

0.5704

After the issuance of all New Shares

(including full exercise of both the Extension Clause and the

Overallotment Option)

0.83%

0.77%

0.6660

0.6391

* At the date of this prospectus, 2,439,907 free shares and

66,000 warrants are outstanding. This diluted basis does not take

into account the number of shares likely to be issued in connection

with the equitization of the EIB loan, which cannot be precisely

determined as it will depend in particular on future trends in

CARMAT's share price.

CARMAT is continuing its development and intends to reserve

itself the right to implement other initiatives aimed at securing

additional financing and easing its cash constraints.

Eligibility of the Offering to the PEA and PEA-PME equity

savings plans and economic reinvestment within the framework of a

share contribution and subsequent share transfer (article 150-O B

ter of the French Tax Code)

CARMAT shares can be fully integrated into equity savings plans

(plan d’épargne en actions or “PEA”) and PEA-PME accounts, which

offer the same tax advantages as the classic PEA.

The Company is also eligible to the economic reinvestment

mechanism provided for by article 150-O B ter of the French Tax

Code, which allows the persons who have sold contributed securities

within three years following their contribution to maintain their

tax deferral in the case of cash subscriptions.

Those concerned are invited to seek information from their usual

tax advisor regarding the tax regime that apply in their specific

case, notably regarding the subscription, acquisition, ownership

and divestment of CARMAT shares.

Partners in the transaction

Invest Securities EuroLand Corporate Lead Manager and

Bookrunner Advisor

Availability of the prospectus

The Public Offer has been the subject of a prospectus approved

by the French Financial Markets Authority (Autorité des marchés

financiers - the “AMF”) on January 17, 2024 under number

24-005 (the “Prospectus”). This prospectus comprises: (i)

the Company’s 2022 universal registration document filed with the

AMF on April 21, 2023 under number D.23-0323 (the “2022

URD”); (ii) an amendment to the 2022 URD filed with the AMF on

January 17, 2024 under number D.23-0323-A1 (the

“Amendment”); (iii) a securities note (Note d’opération)

(the “Note d’Opération”); and (iv) a summary of the

Prospectus (included in the Note d’Opération and replicated in the

appendix to this press release). Copies of the Prospectus approved

by the AMF are available free of charge from CARMAT’s head offices,

36, avenue de l’Europe, Immeuble l’Etendard Energy III, 78140

Vélizy-Villacoublay, France. This document is also available online

on the AMF (www.amf-france.org) and CARMAT (www.carmatsa.com)

websites. The approval of the Prospectus should not be taken to be

an endorsement by the AMF of the securities offered.

Risk Factors

Investors are invited to carefully consider the risk factors

described in chapter 2 “Risk Factors” of the 2022 URD, and in

particular the “Funding risk”, “Risk of operational and financial

unviability”, “Risk associated with production quality” and “Risk

associated with the supply of materials and components” sections,

as updated in chapter 4 of the Amendment and chapter 3 “Risk

Factors associated with the Offering” of the Note d’Opération.

***

About CARMAT

CARMAT is a French MedTech that designs, manufactures and

markets the Aeson® artificial heart. The Company’s ambition is to

make Aeson® the first alternative to a heart transplant, and thus

provide a therapeutic solution to people suffering from end-stage

biventricular heart failure, who are facing a well-known shortfall

in available human grafts. The world’s first physiological

artificial heart that is highly hemocompatible, pulsatile and

self-regulated, Aeson® could save, every year, the lives of

thousands of patients waiting for a heart transplant. The device

offers patients quality of life and mobility thanks to its

ergonomic and portable external power supply system that is

continuously connected to the implanted prosthesis. Aeson® is

commercially available as a bridge to transplant in the European

Union and other countries that recognize CE marking. Aeson® is also

currently being assessed within the framework of an Early

Feasibility Study (EFS) in the United States. Founded in 2008,

CARMAT is based in the Paris region, with its head offices located

in Vélizy-Villacoublay and its production site in Bois-d’Arcy. The

Company can rely on the talent and expertise of a multidisciplinary

team of circa 200 highly specialized people. CARMAT is listed on

the Euronext Growth market in Paris (Ticker: ALCAR / ISIN code:

FR0010907956).

For more information, please go to www.carmatsa.com and follow

us on LinkedIn.

Name: CARMAT ISIN code:

FR0010907956 Ticker: ALCAR

Disclaimer

This press release does not constitute an offer to sell nor a

solicitation of an offer to buy ordinary shares of Carmat, and does

not constitute an offer, solicitation or sale in any jurisdiction

in which such offer, solicitation or sale would be unlawful prior

to registration or qualification under the securities laws of any

such state or jurisdiction.

With respect to Member States of the European Economic Area

other than France, no action has been taken or will be taken to

permit a public offering of the securities referred to in this

press release requiring the publication of a prospectus in any such

Member State. Therefore, such securities will only be offered in

any such Member State (i) to qualified investors as defined in

Regulation (EU) 2017/1129 of the European Parliament and European

Council of 14 June 2017, as amended (the “Prospectus

Regulation”) or (ii) in accordance with the other exemptions of

Article 1(4) of Prospectus Regulation.

This press release is an advertisement and not a prospectus

within the meaning of the Prospectus Regulation.

This press release and the information it contains are being

distributed to and are only intended for persons who are (x)

outside the United Kingdom or (y) in the United Kingdom who are

qualified investors (as defined in the Prospectus Regulation as it

forms part of domestic law by virtue of the European Union

(Withdrawal) Act 2018) and are (i) investment professionals falling

within Article 19(5) of the Financial Services and Markets Act 2000

(Financial Promotion) Order 2005, as amended (the “Order”),

(ii) high net worth entities and other such persons falling within

Article 49(2)(a) to (d) of the Order (“high net worth companies”,

“unincorporated associations”, etc.) or (iii) other persons to whom

an invitation or inducement to participate in investment activity

(within the meaning of Section 21 of the Financial Services and

Market Act 2000) may otherwise lawfully be communicated or caused

to be communicated (all such persons in (y)(i), (y)(ii) and

(y)(iii) together being referred to as “Relevant Persons”).

Any invitation, offer or agreement to subscribe, purchase or

otherwise acquire securities to which this press release relates

will only be engaged with Relevant Persons. Any person who is not a

Relevant Person should not act or rely on this press release or any

of its contents.

This press release may not be distributed, directly or

indirectly, in or into the United States. This press release and

the information contained therein does not, and will not,

constitute an offer of securities for sale, nor the solicitation of

an offer to purchase, securities in the United States or any other

jurisdiction where restrictions may apply. Securities may not be

offered or sold in the United States absent registration or an

exemption from registration under the U.S. Securities Act of 1933,

as amended (the “Securities Act”). The securities of Carmat

have not been and will not be registered under the Securities Act,

and Carmat does not intend to conduct a public offering in the

United States.

MIFID II Product Governance/Target Market: solely for the

purposes of the requirements of Article 9.8 of the Delegated

Directive (EU) 2017/593 relating to the product approval process,

the target market assessment in respect of the shares of Carmat has

led to the conclusion in relation to the type of clients criteria

only that: (i) the type of clients to whom the shares are targeted

is eligible counterparties and professional clients and retail

clients, each as defined in Directive 2014/65/EU, as amended

(“MiFID II”); and (ii) all channels for distribution of the

shares of Carmat to eligible counterparties and professional

clients and retail clients are appropriate. Any person subsequently

offering, selling or recommending the shares of Carmat (a

“distributor”) should take into consideration the type of

clients assessment; however, a distributor subject to MiFID II is

responsible for undertaking its own target market assessment in

respect of the shares of Carmat and determining appropriate

distribution channels.

The distribution of this press release may be subject to legal

or regulatory restrictions in certain jurisdictions. Any person who

comes into possession of this press release must inform him or

herself of and comply with any such restrictions.

Any decision to subscribe for or purchase the shares or other

securities of Carmat must be made solely based on information

publicly available about Carmat. Such information is not the

responsibility of Invest Securities and has not been independently

verified by Invest Securities.”

1 Initially due on January 31, 2024, the Company has obtained

from the EIB, BNP Paribas and Bpifrance a standstill on the

principal of the above-mentioned loans until February 22, 2024. 2

Loan for a total principal amount of €30m, paid in three tranches

of €10m each repayable in principal and interest 5 years after

payment (the first on 31 January 2024 for a total amount of €15m).

3 For more details on this conditional agreement in principle,

please refer to the Company’s press release dated January 12, 2024.

4 For further details of this potential equitization, please refer

to the Company’s press release dated January 12, 2024. The

attention of investors is drawn to the fact that the implementation

of the “equitization” mechanism (extinguishment of liabilities

through spread issues of shares to be sold within a short period of

time) on all or part of the tranches of the loan (representing a

maximum of €48 million including interest) is likely to result in

significant dilution and downward pressure on the share price.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240117232742/en/

CARMAT Stéphane Piat Chief Executive Officer

Pascale d’Arbonneau Chief Financial Officer Tel.: +33 1 39

45 64 50 contact@carmatsas.com Alize RP Press Relations

Caroline Carmagnol Tel.: +33 6 64 18 99 59

carmat@alizerp.com NewCap Financial Communication &

Investor Relations Dusan Oresansky Tel.: +33 1 44 71 94 92

carmat@newcap.eu

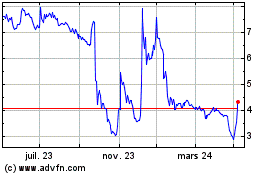

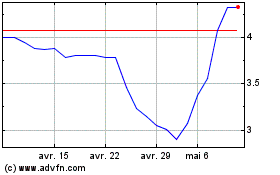

Carmat (EU:ALCAR)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Carmat (EU:ALCAR)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024