3M Moves To Acquire Medical Company -- WSJ

03 Mai 2019 - 9:02AM

Dow Jones News

By Colin Kellaher

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (May 3, 2019).

3M Co. on Thursday said it agreed to buy wound-care company

Acelity Inc. from an investor group for about $4.3 billion as the

manufacturing and technology conglomerate continues to build its

health-care business.

The St. Paul, Minn., company is buying Acelity from

private-equity firm Apax Partners and Canadian pension giants

Canada Pension Plan Investment Board and Public Sector Pension

Investment Board for a total enterprise value of about $6.7

billion, including the assumption of roughly $2.4 billion in

debt.

Acelity last month filed for an initial public offering as KCI

Holdings Inc., more than seven years after the buyout group

acquired the company, then known as Kinetic Concepts Inc., in a

deal valued at about $6.3 billion.

Since then, KCI has transformed into a company focused on

advanced wound care and specialty surgical applications through a

series of acquisitions and divestitures.

3M said Acelity, which complements its health-care business,

posted revenue of $1.5 billion and adjusted earnings before

interest, taxes, depreciation and amortization of $441 million in

2018. The company in March said it expected its health-care segment

to generate annual revenue of $7 billion.

"This acquisition bolsters our Medical Solutions business and

supports our growth strategy to offer comprehensive advanced and

surgical wound-care solutions to improve outcomes and enhance the

patient and provider experience," said Mike Roman, 3M's chief

executive.

3M earlier this year acquired the technology business of

health-care-technology provider M*Modal for a total enterprise

value of $1 billion, expanding the capabilities of its

health-information-systems business.

3M said the Acelity purchase price represents a multiple of

15-times 2018 adjusted Ebitda, or 11-times the expected first-year

Ebitda after factoring in anticipated cost savings.

The company said it expects the deal will add 25 cents a share

to adjusted earnings in the first 12 months, but noted it will

reduce reported per-share earnings by 35 cents over the same

period.

As a result of the transaction, 3M lowered its planned share

repurchases for this year to $1 billion to $1.5 billion from a

prior target of $2 billion to $4 billion.

3M said it expects to complete the transaction, which it will

finance with cash on hand and the issuance of new debt, in the

second half.

S&P Global Ratings on Thursday affirmed its "AA-" credit

rating on 3M but changed its outlook to negative from stable,

citing the increased leverage from the Acelity deal and 3M's

weaker-than-expected first-quarter earnings.

Write to Colin Kellaher at colin.kellaher@wsj.com

(END) Dow Jones Newswires

May 03, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

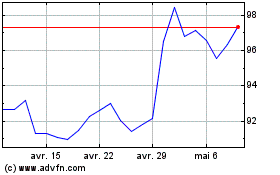

3M (NYSE:MMM)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

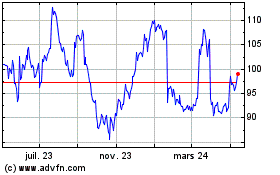

3M (NYSE:MMM)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024