Ahold Delhaize Issues EUR600 Million Green Bond

11 Mars 2021 - 7:38PM

Dow Jones News

By Adriano Marchese

Koninklijke Ahold Delhaize NV said Thursday that it has priced

its inaugural sustainability-linked bond amounting to 600 million

euros ($715.7 million).

The Dutch grocer said the green bond has a term of nine years,

maturing in mid-March, 2030, paying an annual coupon of 0.375%.

The company said the proceeds will be used for refinancing debt

maturities and general corporate purposes.

However, the bond is linked to achieving certain sustainability

performance targets by 2025, namely a reduction of scope one and

two CO2e emissions by 29% from a 2018 baseline, and a reduction of

food waste by 32% from a 2016 baseline.

Should it not meet those targets, the coupon will be

adjusted.

"Sustainability-linked bonds represent the next phase of our ESG

financing, where we bring our long-term commitments to tackle our

carbon footprint and food waste directly to our investors," Chief

Financial Officer Natalie Knight said.

Write to Adriano Marchese at adriano.marchese@wsj.com

(END) Dow Jones Newswires

March 11, 2021 13:23 ET (18:23 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

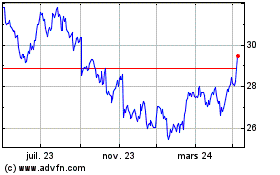

Koninklijke Ahold Delhai... (EU:AD)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Koninklijke Ahold Delhai... (EU:AD)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024