Blue Solutions : 2017 results

22 Mars 2018 - 5:45PM

| 2017 financial information |

March 22, 2018 |

2017 results

The Board of Directors of Blue

Solutions approved the 2017 financial statements at its meeting of

March 22, 2018.

-

Revenue: 81 million euros (-26%);

-

EBITDA: -4 million euros (-120%);

-

Operating income: -19 million euros, compared

with -0.4 million euros in 2016;

-

Net income Group share: -19 million euros,

compared with -0.1 million euros in 2016;

-

Net debt: 31 million euros (gearing: 26%).

2017 revenue

Revenue was 26% below the level in

fiscal year 2016. It includes a 12.5 million euros contribution to

Blue Solutions under a collaboration agreement signed between Blue

Solutions and the entities Bluecar, Bluebus and Bluestorage acting

together.

As announced, revenue change is

attributable to longer battery life, which has resulted in a drop

in sales (1,508 batteries sold, down 39% compared with 2016). Sales

of batteries to Bluebus remained strong (391 batteries sold at

end-December 2017, compared with 413 at end-December 2016), thanks

to the 12m bus deliveries (in particular to the RATP).

2017 EBITDA and operating

income

- EBITDA totaled -4 million euros,

compared with 18 million euros in 2016;

- Operating income amounted to -19 million euros,

compared with -0.4 million euros in 2016.

Operating income was down 19.0

million euros. It included Blue Applications' R&D contribution

to Blue Solutions, the decline in the number of batteries produced

and marketed and the consolidation of Capacitor Sciences (negative

impact of 6 million euros).

2017 net income down compared with 2016

Consolidated net income amounted

to -19 million euros, compared with -0.1 million euros in 2016. It

includes net financial expense of -1.8 million euros (compared with

net financial income of +1.7 million euros in 2016, which included

foreign exchange gains resulting from the revaluation of the

Canadian dollar) and a tax gain of 2 million euros mainly due to

lower tax rate in the US.

Shareholders' equity: 118 million euros | Net debt: 31 million

euros

-

As of December 31, 2017, shareholders' equity

amounted to 118 million euros, on net debt of

31 million euros including more than 12 million euros of capital

expenditure. The ratio of net debt to shareholders' equity was 26%,

compared with 16% at end-2016.

| Blue Solutions key consolidated

figures |

| (in millions of euros) |

2017 |

2016 |

Variation |

| Revenue |

81 |

109 |

-26% |

| EBITDA |

(4) |

18 |

N/A |

| Operating income |

(19) |

(0.4) |

N/A |

| Operating margin

(%) |

(24%) |

(0.4%) |

- |

| Financial income |

(2) |

2 |

N/A |

| Taxes |

2 |

(1) |

N/A |

| Net

income |

(19) |

(0.1) |

N/A |

| Net income,

Group share |

(19) |

(0.1) |

N/A |

| |

|

|

|

| Shareholders' equity, Group share |

118 |

138 |

(21) |

| Net

debt |

31 |

22 |

9 |

| Gearing

(%)(1) |

26% |

16% |

- |

(1) Gearing: ratio of net debt to shareholders'

equity

The audit procedures for the 2017

consolidated financial statements have been completed and the

certification report will be issued after review of the management

report.

Blue Solutions : 2017

results

This

announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: Blue Solutions via Globenewswire

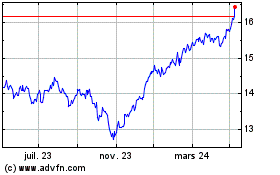

BNP PARIBAS EASY ECPI GL... (EU:BLUE)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

BNP PARIBAS EASY ECPI GL... (EU:BLUE)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024