Buyout Firms Team Up on More Than $15 Billion KPN Bid

07 Avril 2021 - 10:57PM

Dow Jones News

By Cara Lombardo, Ben Dummett and Miriam Gottfried

A pair of private-equity firms have teamed up to make a bid for

Royal KPN NV that could value the Dutch communications-services

provider at more than $15 billion, according to people familiar

with the matter.

New York-based Stonepeak Infrastructure Partners and Sweden's

EQT AB are working on a bid that could be valued at more than EUR3,

equivalent to $3.56, a share some of the people said. KPN shares

closed Wednesday at EUR2.88 in European trading. The funds are

preparing to conduct due diligence with the goal of submitting a

formal bid this spring. It's possible they could take on another

partner and that they will face competition, these people said.

There are no guarantees the parties will follow through, and if

they do, that they will reach an agreement. Adding a layer of

complication, the Dutch government would need to sign off on any

deal.

KPN is the largest telecommunications operator in the

Netherlands, offering mobile telephony, data and television

services to customers across the country. KPN's business also

includes a wholesale operation that leases fixed and mobile

networks to other carriers that don't operate their own

networks.

Bloomberg in November reported that EQT had made an approach to

KPN.

(END) Dow Jones Newswires

April 07, 2021 16:42 ET (20:42 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

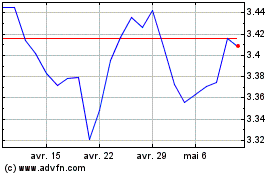

Koninklijke KPN NV (EU:KPN)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

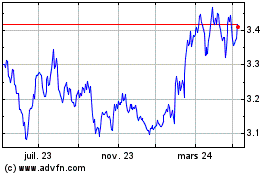

Koninklijke KPN NV (EU:KPN)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024