NOT FOR

DISTRIBUTION IN OR INTO THE UNITED STATES, CANADA, AUSTRALIA OR

JAPAN

Inventiva launches

a capital increase to raise approximately €30 Million

Daix (France)

April 12, 2018 - Inventiva S.A. ("Inventiva" or the "Company"), a

biopharmaceutical company developing innovative therapies in

nonalcoholic steatohepatitis (NASH), systemic sclerosis (SSc) and

mucopolysaccharidosis (MPS), intends to issue new ordinary shares

without preferential subscription rights (the "New

Shares") for a total capital increase of approximately €30

Million by means of a private placement reserved to a specified

category of investors as described below (the "Reserved Offering").

The Reserved Offering will

commence immediately and is expected to be finalized before market

open on Euronext Paris tomorrow, subject to acceleration or

extension at any time. The Company will announce the results of the

Reserved Offering as soon as practicable thereafter in a subsequent

press release.

The Company intends to use the net

proceeds from this capital increase as follows:

-

Ensure the clinical development of

Lanifibranor and more specifically to launch preliminary works

prior to (i) the potential NASH Phase III and (ii) future clinical

developments in SSc;

-

Ensure the clinical development of

odiparcil and more specifically (i) for the launch of the clinical

Phase Ib in children with MPS VI; (ii) to ensure the development of

the clinical package in MPS I, II, IVa, and VII and (iii) to launch

preliminary workstreams prior to the potential Phase III in MPS I,

II, IVa, VI and VII;

-

Ensure the development of on going

discovery programmes; and

-

Use the remainder to finance other

corporate purposes.

The net proceeds are expected to

provide the Company with a cash runway based on the on-going

programmes to mid-2020.

Key upcoming milestones

include:

-

Lanifibranor 2 years carcinogenicity

study results are expected by the end of the second quarter

2018;

-

Lanifibranor Phase IIb SSc study

results are expected early 2019 and Phase IIb NASH study results

are expected in the second half of 2019; and

-

Odiparcil : Phase IIa MPS VI study

results are expected in the first half of 2019 and Phase Ib in MPS

VI children study results are expected in 2019.

The capital increase will be

carried out without shareholders' preferential subscription rights.

Pursuant to Article L. 225-138 of the French Commercial Code

(Code de commerce), it will be reserved to a

specified category of investors as defined in the 15th resolution

of the General Shareholders' Meeting of the Company dated 29

May 2017, i.e. (i) a natural or legal person (including companies),

trust or investment fund, or other investment vehicle, in any form,

established under French or foreign law, which regularly invests in

the pharmaceutical, biotechnology and the medical technology

sectors; and/or (ii) a company, institution or entity, in any form,

French or foreign, exercising a significant part of its activity in

the pharmaceutical, cosmetic or chemical sectors or researching in

such sectors; and/or (iii) a French or foreign service provider, or

any foreign establishment with an equivalent status, likely to

guarantee the completion of an issuance intended to be placed with

the persons referred to in (i) and/or (ii) above and, in this

context, likely to subscribe to the securities issued.

Detailed information on the

Company relating to its business, results of operations, financial

condition and prospects, as well as risk factors related thereto,

are included in the 2016 Registration Document (Document de référence) of the Company registered with

the French Autorité des Marchés Financiers

(the "AMF") on 26 April 2017 under number R.17-025. The 2016

Registration Document can be found, together with other regulated

information (including its 2017 audited financial statements),

Inventiva's press releases and investors presentation, on

Inventiva's website (www.inventivapharma.com). The attention of the

public is drawn to the risk factors section presented at section 4

of the 2016 Registration Document. If one or more of such risks

were to materialize, this could have a material adverse effect on

the business, financial condition or results of the Company or on

its ability to meet its targets.

The Reserved Offering will be

made, within the category of investors defined above, to

institutional investors in France and elsewhere in a private

placement via an accelerated bookbuilding process.

The fund Sofinnova Crossover I SLP

("Sofinnova") has expressed its intention to

place an order and to subscribe for New Shares up to the value of

€10,000,000 in the Reserved Offering. Subject to the effective

subscription by Sofinnova for this amount or any other amount that

the Managers may decide to allocate to Sofinnova provided that such

other amount represents a minimum of €9,000,000 in the Reserved

Offering, Pierre Broqua and Fédéric Cren have undertaken to propose

to the board of directors of the Company the appointment to the

board of a candidate proposed by Sofinnova and to vote in favor of

such an appointment. The intention of Sofinnova to subscribe for

New Shares does not constitute a firm purchase commitment and the

Managers may thus decide to allocate, or Sofinnova may decide to

subscribe for fewer or no New Shares in the Reserved

Offering.

Application will be made to list

the New Shares on the regulated market of Euronext Paris pursuant

to a listing prospectus, which will be submitted for the approval

of the AMF.

Simultaneously with the

determination of the final terms and conditions in connection with

the Reserved Offering, the Company will enter into a lock-up

agreement ending 90 calendar days after the settlement and delivery

of the Reserved Offering, subject to certain customary exceptions

including transactions under the existing liquidity agreement

entered into with Kepler Cheuvreux on 19 January 2018. Key

executives and directors of the Company have also signed lock-up

agreements with regard to the Company's shares that they hold, for

the same period, subject to certain exceptions including the call

option agreements entered into with BVF Partners L.P. and

Perceptive Advisors, by which Frédéric Cren and Pierre Broqua

agreed to grant a call option on existing shares in the context of

the initial public offering of the Company.

The Reserved Offering is being

conducted by Jefferies International Limited, acting as Global

Coordinator and Joint Bookrunner, and Société Générale Corporate

& Investment Banking and Gilbert Dupont acting as Joint

Bookrunners (together with the Global Coordinator and Joint

Bookrunner, the "Managers"). Namsen Capital is

acting as Inventiva's Capital Markets Advisor.

Update of the

Company's corporate presentation

An update of the Company's

corporate presentation dated 9 April 2018, with a presentation of

the Company's activities, including the progress status of

preclinical and clinical programs, is now available on the

Company's website.

This press release does not

constitute an invitation to subscribe for shares of the Company and

the offering of any New Shares does not constitute a public

offering in any country or jurisdiction.

About

Inventiva: www.inventivapharma.com

Inventiva is a biopharmaceutical

company specialized in the development of drugs interacting with

nuclear receptors, transcription factors and epigenetic modulators.

Inventiva's research engine opens up novel breakthrough therapies

against fibrotic diseases, cancers and orphan diseases with

substantial unmet medical needs.

Lanifibranor, its lead product, is

an anti-fibrotic treatment acting on the three alpha, gamma and

delta PPARs (peroxisome proliferator-activated receptors), which

play key roles in controlling the fibrotic process. Its

anti-fibrotic action targets two initial indications with

substantial unmet medical need: NASH, a severe and increasingly

prevalent liver disease already affecting over 30 million people in

the United States, and systemic sclerosis, a disease with a very

high mortality rate and for which there is no approved treatment to

date.

Inventiva is also developing in

parallel, a second clinical product, Odiparcil (formerly IVA336), a

treatment for several forms of mucopolysaccharidosis where dermatan

and/or chondroïtin sulfates GAGs accumulate: MPS I or Hurler/Scheie

syndromes, MPS II or Hunter syndrome, MPS IVa or Morquio syndrome,

MPS VI or Maroteaux-Lamy syndrome and MPS VII or Sly syndrome.

Inventiva is also developing a preclinical stage oncology

portfolio.

Inventiva benefits from

partnerships with world-leading research entities such as the

Institut Curie. Two strategic R&D partnerships have also been

established with AbbVie and Boehringer Ingelheim, making Inventiva

eligible for preclinical, clinical, regulatory and commercial

milestone payments, in addition to royalties on the products

resulting from the partnerships.

Inventiva employs over 100 highly

qualified employees and owns state-of-the-art R&D facilities

near Dijon, acquired from the international pharmaceutical group

Abbott. The Company owns a proprietary chemical library of over

240,000 molecules as well as integrated biology, chemistry, ADME

and pharmacology platforms.

Contacts

Inventiva

Frédéric Cren

Chief Executive Officer

info@inventivapharma.com

+ 33 3 80 44 75 00 |

|

|

|

|

|

DISCLAIMER

This press release does not and

shall not, in any circumstances, constitute a public offering nor

an invitation to solicit the interest of public in France, the

United States, or in any other jurisdiction, in connection with any

offer.

The distribution of this document

may be restricted by law in certain jurisdictions. Persons into

whose possession this document comes are required to inform

themselves about and to observe any such restrictions.

This announcement is an

advertisement and not a prospectus within the meaning of Directive

2003/71/EC of the European Parliament and of the Council of

November 4, 2003, as amended (the "Prospectus

Directive").

With respect to the member States

of the European Economic Area (including France), no action has

been undertaken or will be undertaken to make an offer to the

public of the securities referred to herein requiring a publication

of a prospectus in any relevant member State. As a result, the

securities may not and will not be offered in any relevant member

State except in accordance with the exemptions set forth in Article

3(2) of the Prospectus Directive, or under any other circumstances

which do not require the publication by the Company of a prospectus

pursuant to Article 3 of the Prospectus Directive and/or to

applicable regulations of that relevant member State.

For the purposes of the provision

above, the expression "offer to the public" in relation to any

shares of the Company in any member States of the European Economic

Area means the communication in any form and by any means of

sufficient information on the terms of the offer and any securities

to be offered so as to enable an investor to decide to purchase any

securities, as the same may be varied in that member State.This

press release does not constitute an offer to the public in France

and the securities referred to in this press release can only be

offered or sold in France pursuant to Article L. 411-2-II of the

French Code monétaire et financier to (i)

providers of third party portfolio management investment services,

(ii) qualified investors (investisseurs

qualifiés) acting for their own account and/or (iii) a limited

group of investors (cercle restreint

d'investisseurs) acting for their own account, all as defined

in and in accordance with Articles L. 411-1, L. 411-2 and D. 411-1

to D. 411-4 and D. 754-1 and D. 764-1 of the French Code monétaire et financier. In addition, in accordance

with the autorisation granted by the general meeting of the

Company's shareholders dated 29 May 2017, only the persons

pertaining to the categories specified in the 15th

resolution of such general meeting may subscribe to the Reserved

Offering.

The distribution of this press

release is only being distributed to, and is only directed at

persons outside the United Kingdom, subject to applicable laws, (i)

persons having professional experience in matters relating to

investments who fall within the definition of "investment

professionals" in Article 19(5) of the Financial Services and

Markets Act 2000 (Financial Promotion) Order 2005 as amended (the

"Order"); (ii) high net worth bodies

corporate, unincorporated associations and partnerships and

trustees of high value trusts as described in Article 49(2) (a) to

(d) of the Order or (iii) are persons to whom an invitation or

inducement to engage in investment activity (within the meaning of

Article 21 of the Financial Services and Markets Act 2000) in

connection with the issue or sale of any securities may otherwise

lawfully be communicated or caused to be communicated (all such

persons together being referred to as "Relevant

Persons"). The Reserved Offering mentioned herein is only

available to, and any invitation, offer or agreement to subscribe,

purchase or otherwise acquire shares will be engaged in only with,

Relevant Persons. Any person who is not a Relevant Person should

not act or rely on, this press release or any information contained

herein.

This press release has been

prepared on the understanding that the offer of securities referred

to herein in any Member State of the European Union or the members

of the European Economic Area Agreement who have transposed the

Prospectus Directive, as defined below, (each, a "Concerned Member State") will not require the

publication of a prospectus in any Concerned Member State, and no

action has been nor will be undertaken to allow the public offering

of securities requiring the publication of a prospectus in any

Concerned Member State. As a result, any person offering or

intending to offer, in any Concerned Member State, the securities

that are the subject of the Reserved Offering described herein may

not do so except in a manner that will not create any obligation on

the part of Inventiva or the Managers mentioned herein to publish a

prospectus with respect to such offer under Article 3 of the

Prospectus Directive, as modified by Prospectus Directive Amendment

2010/73/UE. Neither Inventiva nor any of the Managers has

authorized, nor will authorize, any offer of the securities

mentioned referred to herein in circumstances that would result in

the obligation on the part of Inventiva or any of the Managers to

publish a prospectus in connection with such offer.

This press release does not

constitute a prospectus within the meaning of the Prospectus

Directive.

This press release may not be

distributed, directly or indirectly, in or into the United States.

This press release does not constitute an offer of securities for

sale or the solicitation of an offer to purchase securities in the

United States or any other jurisdiction where such offer may be

restricted. Securities may not be offered or sold in the United

States absent registration under the U.S. Securities Act of 1933,

as amended (the "Securities Act"), except

pursuant to an exemption from, or in a transaction not subject to,

the registration requirements thereof. The securities of Inventiva

have not been and will not be registered under the Securities Act

and Inventiva does not intend to make a public offering of its

securities in the United States, Canada, Australia or Japan.

Copies of this document are not being, and should not be,

distributed in or sent into the United States.

Investors may not accept an offer

of securities referred to herein, nor acquire such securities,

unless on the basis of information contained in the Prospectus.

This announcement cannot be used as basis for any investment

agreement or decision.This press release may not be distributed,

directly or indirectly, in or into the United States, Canada,

Australia or Japan.

The Managers are acting as

financial advisers to the Company and no-one else and will not be

responsible to anyone other than the Company for providing the

protections afforded to customers of the Managers or for providing

advice in relation to this communication or any other matter

contemplated herein.

Inventiva - PR - Launch - 12 04

18

This

announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: INVENTIVA via Globenewswire

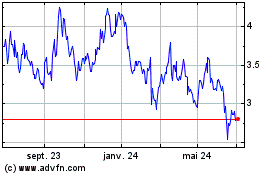

Inventiva (EU:IVA)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Inventiva (EU:IVA)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024