Press Release - SMCP - 2020 Q1 Sales

2020 First quarter Press release

- Paris, April 29th, 2020

Sales performance in line with

expectations

- Q1 2020 sales down -16.7% as reported; -20.4% on an organic1

basis

- Following good start to the year, Q1 sales impacted by Covid-19

in all regions from end of January

- China traffic and sales gradually improving since March,

showing early signs of recovery

- Closure of 6 DOS2 in Q1 20, driven by a slowdown of

international store openings and the French network optimization

plan

- Execution of action plans to mitigate the impact of crisis and

protect cash position

- Good performance in e-commerce driven by China; teams mobilized

to foster digital sales

Commenting on the report, Daniel

Lalonde, SMCP’s CEO, stated: “Following a good start to

the year, all regions have progressively been impacted by the

lockdown measures due to the Covid-19 epidemic. In this context,

SMCP’s key priority has been to ensure the safety and health of its

employees and stakeholders around the world. I would like to

express my gratitude to them, as they have been fully mobilized and

done amazing work in the last few weeks. The Group has also taken a

large number of measures to mitigate the impact of the pandemic on

its activity and balance sheet, reducing capital expenditure to the

essential, reducing operating expenses, adjusting inventories and

collections, securing liquidity position and fostering operations

in e-commerce. Our team are now mobilized to prepare for the post

lockdown period. In line with our values and commitments, it was

also important to think about others and contribute to the

collective effort through solidarity actions from our brands.

Looking forward, although the pandemic will have a strong impact on

our Q2 performance, the early signs of recovery in China are

encouraging. I am confident that SMCP’s strong fundamentals and

brands will enable us to emerge from this period in a stronger

position”.

|

Unaudited figuresSales in €m except

% |

Q1 2019 |

Q1 2020 |

Organic sales change |

Reported sales change |

| Sales by

region |

|

France |

96.0 |

85.7 |

-19.4% |

-10.7% |

|

EMEA3 |

79.4 |

70.9 |

-11.9% |

-10.8% |

|

Americas |

31.7 |

26.9 |

-17.4% |

-15.1% |

|

APAC4 |

67.5 |

45.2 |

-33.4% |

-33.1% |

|

Sales by Brand |

|

Sandro |

132.5 |

105.5 |

-20.9% |

-20.4% |

|

Maje |

106.9 |

85.7 |

-20.5% |

-19.9% |

|

Other brands5 |

35.2 |

37.5 |

-18.4% |

+6.6% |

|

TOTAL |

274.6 |

228.7 |

-20.4% |

-16.7% |

2020 FIRST

QUARTER SALES

In the first quarter of 2020, consolidated sales

reached €228.7 million, down -20.4% on an organic basis. Reported

sales were down -16.7%, including a positive currency impact of

+0.5% and De Fursac’s contribution of +3.7%. This performance

reflected the impact of the Covid-19 epidemic, which resulted in

extensive store closures in Asia from the end of January, and then

in Europe and North America from mid-March, as well as the

suspension of tourism (especially Chinese tourism).

Over the last twelve months, SMCP net openings6

amounted to +77 directly operated stores (DOS). This includes +29

net openings in APAC, +38 in EMEA and +20 in the Americas.

Meanwhile, the Group has pursued the optimization of its network in

France with -10 net closings (DOS). In Q1 2020, SMCP closed 6 DOS7

globally, reflecting 6 store closures in France and a slowdown of

international store openings.

Sales

breakdown by region and by brand

In France and EMEA, sales were

down -19.4% and -11.9% respectively on an organic basis. Following

a good start to the year, performance has been impacted by a sharp

decline in tourism from February (especially Chinese tourism),

followed by a total closure of stores from mid-March. Meanwhile,

the Group generated a solid performance in Digital in EMEA.

Finally, further progress has been made in the French network

optimization, with 6 closures in Q1 2020 vs. Dec 19.

In the Americas, sales were

down -17.4% on an organic basis also impacted by the Covid-19

epidemic. Since February, the Group has seen a slowdown in tourism

(especially Chinese tourism) and has experienced further

deterioration in sales in March following the store closures. The

Group’s distribution centre continues to operate normally to ensure

e-commerce operations. At this stage, digital sales performance

remains soft.

In APAC, sales were down -33.4%

on an organic basis. Following a strong start to the year, sales

were significantly impacted in February by the lockdown in most

Asian countries, especially mainland China. Since then, the Group

has seen some early signs of recovery in mainland China with a

gradual improvement in sales and traffic from March. In parallel,

the e-commerce channel which remained open throughout the crisis,

recorded strong results in mainland China (+39% of sales growth in

Q1 2020). In other regions, traffic remained weak in Hong-Kong and

in Singapore where all stores are closed. In parallel, South Korea,

Taiwan and New Zealand recorded better resilience in sales.

On an organic basis, Sandro

(-20.9%), Maje (-20.5%) and the Other

Brands division (-18.4%) recorded a strong decline in

sales, impacted by the Covid-19 epidemic. Over the quarter, SMCP’s

brands showed a dynamic approach on social media, with a change of

tone to adapt to the current global environment, and to maintain a

close connection with their community and prepare for the post

lockdown period.

UPDATE ON

COVID-19 OUTBREAK AND 2020 OUTLOOK

Since SMCP’s last communication on March 25,

2020, the situation regarding its stores network has slightly

evolved. While most of stores are closed in France, EMEA and

Americas, all stores in Greater China have since reopened.

As of today, 82% of DOS stores are closed:

- In APAC, all stores have re-opened in Greater

China, while they have been closed in Singapore since April 22. In

the meantime, the region’s distribution centre continues to operate

normally. In countries operated by partners, stores are open in

South Korea and partially closed in Australia.

- In France and EMEA, most stores are closed in

Europe, except for Scandinavia. Germany has just started to

gradually reopen from April 23. In countries operated by partners

in the Middle East, all stores are closed. In parallel, the

European distribution centre remains open to ensure exports and

e-Commerce.

- Finally, in Americas, all stores have been

closed since March 18. The Group’s distribution centre continues to

operate normally to ensure the e-commerce operations.

Against this backdrop, the Group has taken

immediate measures to mitigate the impact of the crisis and protect

its cash-flow, including:

- Selecting essential capital expenditure

(c.-40%) with several infrastructure investments postponed, along

with the reduction of 2/3 of its store openings plan (c. 20 DOS net

openings expected this year)

- Reducing operating expenses:

- Renegotiation of commercial leases

- Almost all retail teams in Europe and North America are on

temporary unemployment since the end of March, with support from

local governments

- Strong adjustment in Selling, General & Administrative

Expense (mainly overheads costs optimization and discretionary

spends decrease such as A&P in H1 2020 and travel

expenses)

- Adjusting inventories and collections with a

strong reduction of the FW20 collections buy and some adjustments

in the SS20 collections.

- Fostering operations in e-commerce alongside

brands’ initiatives to engage customers on digital, and all teams

fully mobilized in distribution Centers

SMCP drew the full capacity of its Revolving

Credit Facility (RCF) in March and benefits from a secured

liquidity position of more than €200 million at the end of Q1 2020

to face the crisis period. In addition, the Group has initiated

discussions with its banking partners to further strengthen its

financial flexibility.

In this unprecedented situation, SMCP stands

more than ever alongside its employees, partners and all of its

stakeholders. The global crisis management team, whose priority is

to ensure the safety and health of teams around the world, is

currently working to organize and prepare for the coming transition

period. In order to ensure their protection when stores and

headquarters reopen, the Group has ordered all the necessary

protective equipment including surgical masks, hydro-alcoholic gel

and gloves.

Considering the uncertainties around the

duration and the severity of the epidemic, it is not relevant to

provide forecasts for the full-Year 2020 at this stage, both in

sales and profitability. The Group will monitor the situation

closely and will update the market in due course.

The Group remains confident in its business

model and the attractiveness of its brands. The dedication of its

teams towards ensuring a strict control of its costs will

contribute to mitigating the impact of COVID-19. SMCP’s financial

structure and level of liquidity put the Group in a solid position

to face these exceptional circumstances.

FINANCIAL

CALENDAR

- June 4, 2020 - Annual General Meeting of Shareholders

- July 29, 2020 - 2020 H1 sales

- Sept. 4, 2020 - 2020 H1 results

APPENDICES

Breakdown of DOS

|

Number of DOS |

Q1-19 (excl. DF) |

2019 (incl. DF) |

Q1-20 (incl. DF) |

|

Var. Q1 20 vs. Dec. 19 (incl. DF) |

Var. Q1 20 vs. Q1 19 (excl. DF) |

| |

|

|

|

|

|

|

| By

region |

|

|

|

|

|

|

| France |

476 |

528 |

522 |

|

-6 |

-10 |

| EMEA |

372 |

413 |

413 |

|

- |

+38 |

| Americas |

144 |

162 |

164 |

|

+2 |

+20 |

| APAC |

188 |

219 |

217 |

|

-2 |

+29 |

| |

|

|

|

|

|

|

| By

brand |

|

|

|

|

|

|

| Sandro |

505 |

550 |

554 |

|

+4 |

+49 |

| Maje |

414 |

444 |

443 |

|

-1 |

+29 |

| Claudie

Pierlot |

214 |

224 |

222 |

|

-2 |

+8 |

| Suite 341 |

47 |

44 |

38 |

|

-6 |

-9 |

| De Fursac |

n.a. |

60 |

59 |

|

-1 |

n.a. |

|

Total DOS |

1 180 |

1 322 |

1 316 |

|

-6 |

+77 |

Breakdown of POS

|

Number of POS |

Q1-19 (excl. DF) |

2019 (incl. DF) |

Q1-20 (incl. DF) |

|

Var. Q1 20 vs. Dec. 19 (incl. DF) |

Var. Q1 20 vs. Q1 19 (excl. DF) |

| |

|

|

|

|

|

|

| By

region |

|

|

|

|

|

|

| France |

476 |

530 |

522 |

|

-8 |

-10 |

| EMEA |

491 |

535 |

531 |

|

-4 |

+37 |

| Americas |

176 |

189 |

191 |

|

+2 |

+15 |

| APAC |

342 |

386 |

388 |

|

+2 |

+46 |

| |

|

|

|

|

|

|

| By

brand |

|

|

|

|

|

|

| Sandro |

653 |

707 |

711 |

|

+4 |

+58 |

| Maje |

549 |

577 |

576 |

|

-1 |

+27 |

| Claudie

Pierlot |

236 |

250 |

248 |

|

-2 |

+12 |

| Suite 341 |

47 |

44 |

38 |

|

-6 |

-9 |

| De Fursac |

n.a. |

62 |

59 |

|

-3 |

n.a. |

|

Total POS |

1 485 |

1 640 |

1 632 |

|

-8 |

+88 |

|

o/w Partners POS |

305 |

318 |

316 |

|

-2 |

+11 |

FINANCIAL

INDICATORS NOT DEFINED IN IFRS

The Group uses certain key financial and

non-financial measures to analyse the performance of its business.

The principal performance indicators used include the number of its

points of sale, like-for-like sales growth, Adjusted EBITDA and

Adjusted EBITDA margin.

Number of points of sale

The number of the Group’s points of sale

comprises total retail points of sale open at the relevant date,

which includes (i) directly-operated stores, including

free-standing stores, concessions in department stores,

affiliate-operated stores, factory outlets and online stores, and

(ii) partnered retail points of sale.

Like-for-like sales growth

Like-for-like sales growth corresponds to retail

sales from directly operated points of sale on a like-for-like

basis in a given period compared with the same period in the

previous year, expressed as a percentage change between the two

periods. Like-for-like points of sale for a given period include

all of the Group’s points of sale that were open at the beginning

of the previous period and exclude points of sale closed during the

period, including points of sale closed for renovation for more

than one month, as well as points of sale that changed their

activity (for example, Sandro points of sale changing from Sandro

Femme to Sandro Homme or to a mixed Sandro Femme and Sandro Homme

store). Like-for-like sales growth percentage is presented at

constant exchange rates (sales for year N and year N-1 in foreign

currencies are converted at the average N-1 rate, as presented in

the annexes to the Group's consolidated financial statements as at

December 31 for the year N in question).

Organic sales growth

Organic sales growth corresponds to total sales

in a given period compared with the same period in the previous

year, expressed as a percentage change between the two periods, and

presented at constant exchange rates (sales for period N and period

N-1 in foreign currencies are converted at the average year N-1

rate) excluding scope effects, i.e. excluding the acquisition of De

Fursac

Adjusted EBITDA and adjusted EBITDA

margin

Adjusted EBITDA is defined by the Group as

operating income before depreciation, amortization, provisions and

charges related to share-based long-term incentive plans (LTIP).

Consequently, Adjusted EBITDA corresponds to EBITDA before charges

related to LTIP.Adjusted EBITDA is not a standardized accounting

measure that meets a single generally accepted definition. It must

not be considered as a substitute for operating income, net income,

cash flow from operating activities, or as a measure of liquidity.

Adjusted EBITDA margin corresponds to adjusted EBITDA divided by

net sales.

***

METHODOLOGY NOTE

Unless otherwise indicated, amounts are

expressed in millions of euros and rounded to the nearest million.

In general, figures presented in this press release are rounded to

the nearest full unit. As a result, the sum of rounded amounts may

show non-material differences with the total as reported. Note that

ratios and differences are calculated based on underlying amounts

and not on the basis of rounded amounts.

***

DISCLAIMER: FORWARD-LOOKING

STATEMENTS

Certain information contained in this document

include projections and forecasts. These projections and forecasts

are based on SMCP management's current views and assumptions. Such

forward-looking statements are not guarantees of future performance

of the Group. Actual results or performances may differ materially

from those in such projections and forecasts as a result of

numerous factors, risks and uncertainties. These risks and

uncertainties include those discussed or identified under Chapter 4

“Risk factors” of the Company’s registration document (document de

référence) filed with the French Financial Markets Authority

(Autorité des Marchés Financiers - AMF) on 26 April 2019 and

available on SMCP's website (www.smcp.com).This document has not

been independently verified. SMCP makes no representation or

undertaking as to the accuracy or completeness of such information.

None of the SMCP or any of its affiliate’s representatives shall

bear any liability (in negligence or otherwise) for any loss

arising from any use of this document or its contents or otherwise

arising in connection with this document.

***

A conference call to

investors and analysts will be held today by Daniel Lalonde, CEO

and Philippe Gautier, CFO and Operations Director from 9.00 a.m.

(Paris time).

Related slides will

also be available on the website (www.smcp.com), in the Finance

section.

ABOUT SMCP

SMCP is a global leader in the accessible luxury

market with four unique Parisian brands: Sandro, Maje, Claudie

Pierlot and De Fursac. Present in 41 countries, SMCP is a

fast-growing company which reached the milestone of €1bn in sales

in 2018. The Group comprises a network of over 1,500 stores

globally plus a strong digital presence in all its key markets.

Evelyne Chetrite and Judith Milgrom founded Sandro and Maje in

Paris, in 1984 and 1998 respectively, and continue to provide

creative direction for the brands. Claudie Pierlot and De Fursac

were respectively acquired by SMCP in 2009 and 2019. SMCP is listed

on the Euronext Paris regulated market (compartment A, ISIN Code

FR0013214145, ticker: SMCP).

CONTACTS

INVESTORS/PRESS

PRESS

SMCP

BRUNSWICK

Célia d’Everlange

Hugues

Boëton

Tristan Roquet Montegon

+33 (0) 1 55 80 51 00

+33 (0) 1 53 96 83

83

celia.deverlange@smcp.com

smcp@brunswickgroup.com

1 All references in this document to the organic sales

performance refer to the performance of the Group at constant

currency and scope”, i.e. excluding the acquisition of De

Fursac

2 Including De Fursac

3 EMEA covers the Group's activities in European countries

excluding France (mainly the United Kingdom, Spain, Germany,

Switzerland, Italy and Russia) as well as the Middle East

(including the United Arab Emirates).

4 APAC includes the Group's Asia-Pacific operations (mainly

Mainland China, Hong Kong, South Korea, Singapore, Thailand and

Australia).

5 Claudie Pierlot and De Fursac brands

6 Excluding De Fursac

7 Including De Fursac

- Press Release - SMCP - 2020 Q1 Sales

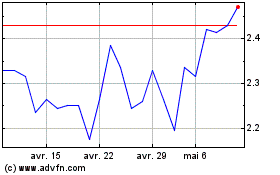

SMCP (EU:SMCP)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

SMCP (EU:SMCP)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024