Sika Chairman Calls on Founding Family to Abandon Stake Sale

17 Avril 2018 - 4:28PM

Dow Jones News

By Nathan Allen

Sika AG's (SIK.EB) chairman Paul Haelg has appealed to the

company's founding family to abandon a controversial sale of its

stake to France's Compagnie de Saint-Gobain SA (SGO.FR).

"We are once again calling on the Burkard heirs and Saint-Gobain

to see reason, to abandon their planned transaction, and to seek

alternative solutions together with us," Mr Haelg said in a speech

at Sika's annual shareholders' meeting on Tuesday.

The Burkard family struck a deal in 2014 to sell its nearly 16%

stake in the company, along with its 52% voting rights, to

Saint-Gobain for 2.75 billion Swiss francs ($2.86 billion).

Sika's management opposed the deal, which they interpreted as a

hostile takeover, as it would have given Saint-Gobain effective

control of the company.

Following a prolonged legal battle a Swiss court ruled in 2016

that the deal would be unlawful and allowed Sika's management to

restrict the family's voting rights.

However, the Burkard family has sought to extend its agreement

with Saint-Gobain and has continued to propose its own candidates

to Sika's board.

"This hostile takeover is not in Sika's interests. It serves

only the ends of the Burkard heirs and Saint-Gobain... That

cannot--and must not--be allowed to happen," Mr. Haelg said.

Write to Nathan Allen at nathan.allen@dowjones.com

(END) Dow Jones Newswires

April 17, 2018 10:13 ET (14:13 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

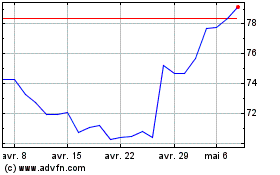

Cie de SaintGobain (EU:SGO)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

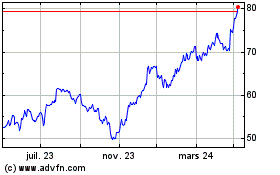

Cie de SaintGobain (EU:SGO)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024