0001555074false00015550742024-01-162024-01-16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 16, 2024

ALTISOURCE ASSET MANAGEMENT CORPORATION

(Exact name of Registrant as specified in its charter)

| | | | | | | | | | | | | | |

| U.S. Virgin Islands | | 001-36063 | | 66-0783125 |

| (State or other jurisdiction of incorporation or organization) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

5100 Tamarind Reef

Christiansted, U.S. Virgin Islands 00820

(Address of principal executive offices including zip code)

(704) 275-9113

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common stock, par value $0.01 per share | AAMC | NYSE American |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter):

Emerging growth company

☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Item 1.01 Entry into a Material Definitive Agreement.

Effective as of January 11, 2024 (the “Effective Date”), Altisource Asset Management Corporation (“AAMC” or the “Company”) entered into a settlement agreement (the “Settlement Agreement”) with Luxor Capital Group LP, Luxor Capital Partners Offshore Masters Fund, LP, Luxor Capital Partners, LP, Luxor Wavefront, LP, Luxor Spectrum, LLC, and Thebes Offshore Master Fund, LP (collectively, “Luxor”) and Nathaniel Redleaf, a former AAMC director (together with AAMC and Luxor, the “Parties”).

Under the terms of the Settlement Agreement:

•Luxor surrendered all 144,212 shares of AAMC Series A Convertible Preferred Stock (the “Preferred Shares”) it held to AAMC. Luxor and AAMC agreed that their related Securities Purchase Agreement dated March 13, 2014 (the “SPA”), along with the Certificate of Designations dated March 17, 2014 attached thereto (the “Certificate”), are void and all rights thereunder are extinguished.

•The Company shall provide the following consideration to Luxor:

•A $1,000,000 cash payment within five (5) days of the Effective Date, plus

•Three Promissory Notes in the following principal amounts and durations:

•A Note in the principal amount of $2,000,000 due and payable on the three (3) year anniversary of the Effective Date;

•A Note in the principal amount of $3,000,000 due and payable on the five (5) year anniversary of the Effective Date; and

•A Note in the principal amount of $6,000,000 due and payable on the eight (8) year anniversary of the Effective Date.

Each Note bears annual interest at either 7.5% on a cash basis or 10% paid-in-kind (“PIK”) basis, at the election of AAMC. The Company shall refrain from making common stock repurchases or issuing dividends at any time the PIK option is in effect and is subject to certain additional covenants enumerated in the Notes.

•The Company shall also pay Luxor 50% of any proceeds received in respect of its damage claims in the action brought by Erbey Holding Corporation pending in USVI Superior Court with case number SX-2018-CV-146, up to a cumulative payout cap to Luxor of $50,000,000.

a.The Parties agreed and stipulated to the dismissal with prejudice of the following actions: (i) Luxor Capital Group LP, et. al v. Altisource Asset Management Corporation filed in the Supreme Court of the State of New York in the County of New York, with index number 650746/2020 (including Luxor’s withdrawal of its pending request for further appellate review by the New York Court of Appeals), and (ii) Altisource Asset Management Corporation v. Nathaniel Redleaf et. al pending in the United States District Court for the District of the Virgin Islands, with case number 1:23-cv-00002. The Parties exchanged mutual releases of their respective claims relating to the aforesaid actions, SPA and Certificate, as applicable, and agreed that the Settlement Agreement shall not be construed as an admission that any of the Parties violated the law, breached any contract or committed any wrong whatsoever.

The foregoing description of the Settlement Agreement is qualified in its entirety by reference to the text of such agreement, which is filed as Exhibit 10.1 to this Current Report on Form 8-K and incorporated herein by reference.

Item 3.01 Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

On November 30, 2023, the Company received a written notice from the New York Stock Exchange (“NYSE” or the “Exchange”) that the NYSE would delist the Company’s shares of common stock from the Exchange. NYSE Regulation staff had determined that the Company was no longer qualified for listing pursuant to Section 1009(a) of the NYSE American Company Guide, citing non-compliance with the Stockholders’ Equity requirements provided in Sections 1003(a)(i), (ii) and (iii) thereof.

As a result of the Settlement Agreement, which has the effect of increasing the Company’s Stockholders’ Equity to an amount exceeding $6,000,000, the NYSE informed the Company that its notice of intent to delist the Company’s common stock would be rescinded.

Item 7.01 Regulation FD

On January 16, 2024, the Company issued a press release announcing the entry into the Settlement Agreement, as described in Item 1.01 of this Current Report on Form 8-K.

The press release is furnished pursuant to Item 7.01 of Form 8-K and shall not be deemed to be “filed” for any other purpose, including for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section. The information in Item 7.01 of this Current Report, including Exhibit 99.1, shall not be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof, regardless of any general incorporation language in such filings, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| | | | | | | | |

Exhibit No. | | Description |

| 10.1 | | Settlement Agreement, dated January __, 2024, by and between Luxor Capital Group, LP; Luxor Capital Partners Offshore Master Fund, LP; Luxor Capital Partners, LP; Luxor Wavefront, LP; Luxor Spectrum, LLC; and Thebes Offshore Master Fund, LP, Nathaniel Redleaf, and Altisource Asset Management Corporation |

| | Press Release dated January 16, 2024. |

| 101 | | Pursuant to Rule 406 of Regulation S-T, the cover page is formatted in Inline XBRL (Inline eXtensible Business Reporting Language) |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | |

| | Altisource Asset Management Corporation |

| January 16, 2024 | By: | /s/ Richard G. Rodick |

| | Richard G. Rodick Chief Financial Officer |

ALTISOURCE ASSET MANAGEMENT CORPORATION REPURCHASES PREFERRED SHARES IN GLOBAL SETTLEMENT WITH LUXOR CAPITAL

CHRISTIANSTED, U.S. Virgin Islands—(BUSINESS WIRE)--January 16, 2024-- Altisource Asset Management Corporation (“AAMC” or the “Company”) (NYSE American: AAMC) announces that it has settled litigation with Luxor Capital Group, LP and related entities (collectively “Luxor”) in respect of the Company’s Series A Convertible Preferred Stock (the “Preferred Shares”), as well as separate litigation with former AAMC director Nathanel Redleaf.

Settlement Highlights

•Luxor surrenders all 144,212 of its Preferred Shares, thereby extinguishing all rights under the related Securities Purchase Agreement and Certificate of Designations.

•The Company provides the following consideration to Luxor:

◦A $1,000,000 cash payment now, plus

◦Three Promissory Notes in the following amounts and durations:

▪$2,000,000 due in three years;

▪$3,000,000 due in five years; and

▪$6,000,000 due in eight years

Each Note bears annual interest at either 7.5% on a cash basis or 10% paid-in-kind (“PIK”) basis, at the election of AAMC. The Company shall refrain from making common stock repurchases or issuing dividends at any time the PIK option is in effect and is subject to certain other covenants.

◦AAMC shall also pay Luxor 50% of any proceeds received in respect of the Company’s damage claims in litigation brought by Erbey Holding Corporation pending in USVI Superior Court with case number SX-2018-CV-146, up to a cumulative payout cap of $50,000,000.

•The Parties agree to dismissals of their litigation with prejudice and exchange mutual releases of all claims with no admission by any Party of liability, violation of law or wrongdoing.

As a result of the settlement, which has the effect of increasing the Company’s Stockholders’ Equity to an amount exceeding $6,000,000, the New York Stock Exchange informed the Company that its November 30, 2023 notice of intent to delist the Company’s common stock would be rescinded.

“We are pleased to announce AAMC’s global resolution of these matters relating to Luxor” said William Erbey, Chairman and CEO of AAMC. “This represents a positive start to 2024 as we continue to focus and work hard on initiatives to enhance shareholder value going forward.”

About AAMC

AAMC is a private credit provider that originates alternative assets to provide liquidity and capital to under-served markets. Additional information is available at www.altisourceamc.com.

Forward-looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, regarding management’s beliefs, estimates, projections, anticipations, and assumptions with respect to, among other things, the potential results of the damage claims in the litigation brought by Erbey Holding Corporation pending in USVI Superior Court with case number SX-2018-CV- These statements may be identified by words such as “anticipate,” “intend,” “expect,” “may,” “could,” “should,” “would,” “plan,” “estimate,” “target,” “seek,” “believe,” and other expressions or words of similar meaning. We caution that forward-looking statements are qualified by the existence of certain risks and uncertainties that could cause actual results and events to differ materially from what is contemplated by the forward-looking statements. Factors that could cause our actual results to differ materially from these forward-looking statements may include, without limitation, our ability to develop our businesses, and to make them successful or sustain the performance of any such businesses; and other risks and uncertainties detailed in the “Risk Factors” and other sections described from time to time in the Company’s current and future filings with the Securities and Exchange Commission. The foregoing list of factors should not be construed as exhaustive.

The statements made in this press release are current as of the date of this press release only. The Company undertakes no obligation to publicly update or revise any forward-looking statements or any other information contained herein, whether as a result of new information, future events or otherwise.

Contacts

Charles Frischer

T: +1-813-474-9047

E: charles.frischer@altisourceamc.com

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

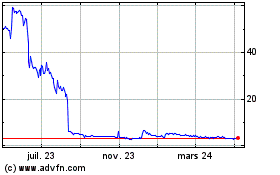

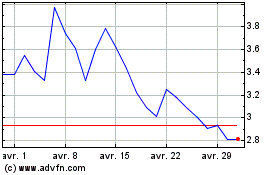

Altisource Asset Managem... (AMEX:AAMC)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Altisource Asset Managem... (AMEX:AAMC)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024