EXECUTION VERSION SETTLEMENT AGREEMENT This SETTLEMENT AGREEMENT (this “Settlement Agreement”), dated January 11, 2024 (the “Effective Date”), is by and between Luxor Capital Group, LP; Luxor Capital Partners Offshore Master Fund, LP; Luxor Capital Partners, LP; Luxor Wavefront, LP; Luxor Spectrum, LLC; and Thebes Offshore Master Fund, LP (collectively, “Luxor”), Nathaniel Redleaf (“Redleaf”), and Altisource Asset Management Corporation (“AAMC”). Luxor, Redleaf, and AAMC may be referred to hereinafter jointly as the “Parties” or individually as a “Party.” WHEREAS, in March 2014, Luxor acquired one hundred fifty thousand (150,000) shares of AAMC Series A Convertible Preferred Stock at a cost of One Thousand Dollars ($1,000.00) per share (the “Preferred Shares”) pursuant to a Securities Purchase Agreement dated March 13, 2014 (the “SPA”), which attached a Certificate of Designations, dated March 17, 2014 (the “Certificate”); WHEREAS, on or about August 30, 2018, Luxor entered into a series of transactions resulting in the sale of five thousand seven hundred eighty-eight (5,788) Preferred Shares to a third party, leaving Luxor holding a total of one hundred forty-four thousand two hundred twelve (144,212) Preferred Shares; WHEREAS, on or about January 31, 2020, Luxor sent redemption notices to AAMC with respect to all of the remaining Preferred Shares held by Luxor, totaling one hundred forty-four thousand two hundred twelve (144,212) Preferred Shares; WHEREAS, Luxor and AAMC are parties to an action captioned Luxor Capital Group LP, et. al v. Altisource Asset Management Corporation filed in the Supreme Court of the State of New York in the County of New York, with index number 650746/2020, with a request for appellate review pending before the New York Court of Appeals (the “New York Litigation”); WHEREAS, AAMC and Redleaf are parties to an action captioned Altisource Asset Management Corporation v. Nathaniel Redleaf et. al pending in the United States District Court for the District of the Virgin Islands, with case number 1:23-cv-00002 (the “Virgin Islands Litigation”); WHEREAS, AAMC is a plaintiff in an action brought by Erbey Holding Corporation pending in the Superior Court of the Virgin Islands, with case number SX-2018-CV-146 (the “Erbey Holding Corp. Litigation”); and WHEREAS, the Parties now desire to settle amicably all claims arising from or relating to the New York Litigation, the Virgin Islands Litigation, the SPA, the Certificate, and the Preferred Shares on the terms provided herein; NOW, THEREFORE, in consideration of the promises and mutual covenants set forth herein, the receipt and sufficiency of which are hereby acknowledged, the Parties agree as follows:

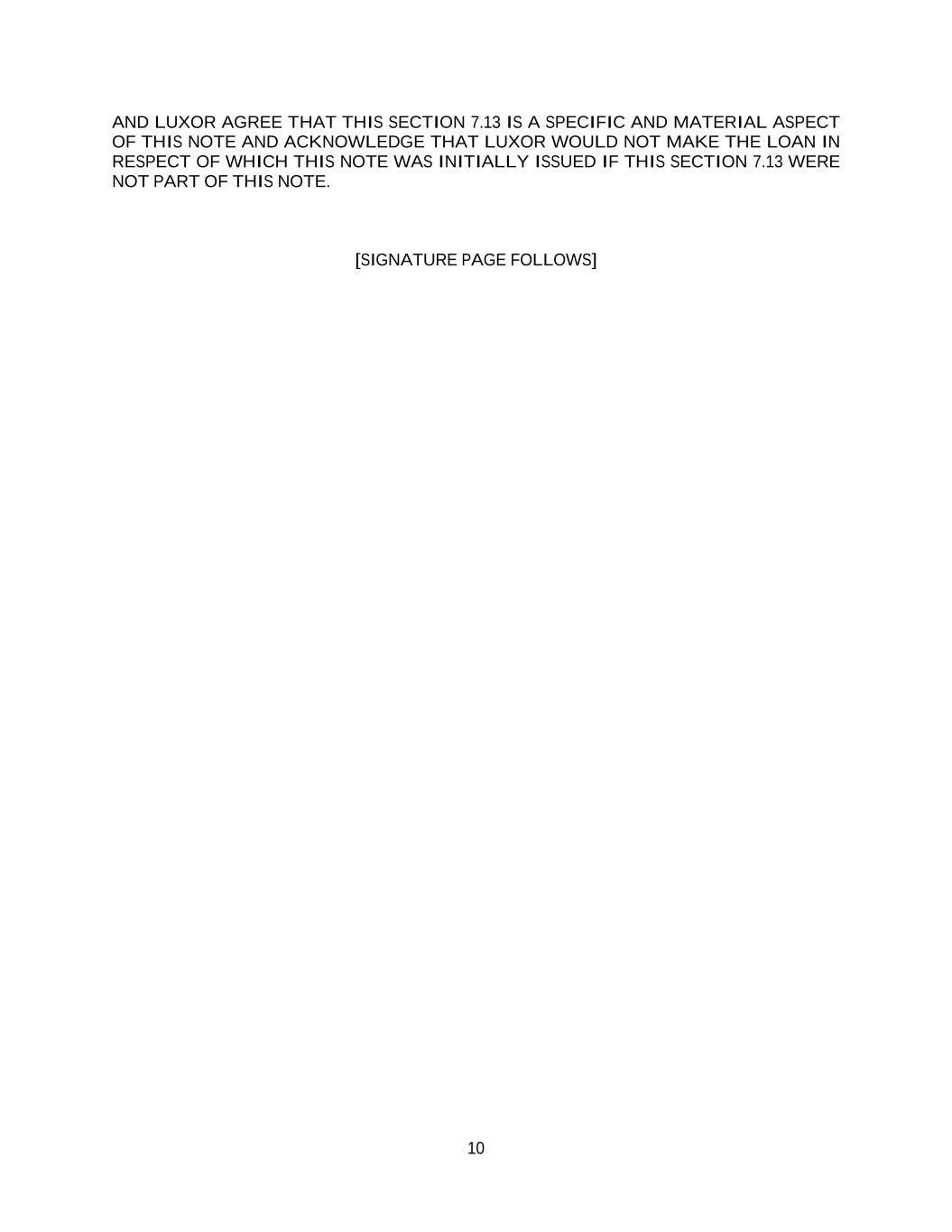

2 1. Settlement Consideration. A. As consideration for settlement of all claims arising from or relating to the New York Litigation, the Virgin Islands Litigation, the SPA, the Certificate, and the Preferred Shares, the Parties agree as follows: (i) AAMC shall pay to Luxor a cash payment in the amount of One Million Dollars ($1,000,000.00) (the “Cash Payment”). The Cash Payment shall be made within five (5) Business Days from the Effective Date by wire transfer to a bank designated by Luxor. (ii) Simultaneously with the Parties’ execution of this Settlement Agreement, AAMC shall issue three promissory notes (each a “Note,” together the “Notes”) payable to Luxor in the following principal amounts and durations: a. A Note in the principal amount of Two Million Dollars ($2,000,000.00) due and payable on the three (3) year anniversary of the Effective Date; b. A Note in the principal amount of Three Million Dollars ($3,000,000.00) due and payable on the five (5) year anniversary of the Effective Date; and c. A Note in the principal amount of Six Million Dollars ($6,000,000.00) due and payable on the eight (8) year anniversary of the Effective Date. (iii) The Notes shall be executed in the forms attached to this Settlement Agreement as Exhibits A, B, and C, as applicable, and are incorporated herein by reference and made a part hereof. Interest on each Note shall be due and payable on each Interest Accrual Date in accordance with Section 2 of each Note. Further, AAMC shall be subject to the terms, conditions, and covenants set forth in each Note, including, without limitation, the restrictions on: (i) the incurrence of debt and liens; (ii) asset sales; (iii) mergers and other fundamental transactions; and (iv) restricted payments, in each case, unless otherwise expressly permitted under such Note. (iv) AAMC shall pay to Luxor 50% of any proceeds it receives at any time, whether by judgment, arbitration award, settlement, or otherwise in respect of the Erbey Holding Corp. Litigation (the “Erbey Holding Corp. Litigation Proceeds”), up to a final cumulative cap of Fifty Million Dollars ($50,000,000.00), to Luxor within five (5) Business Days of receipt of any such Erbey Holding Corp. Litigation Proceeds. AAMC shall have the sole discretion to manage all matters pertaining to its claims in the Erbey Holding Corp. Litigation, including but not limited to engagement of counsel, trial preparation, trial, appeal, and any settlement strategy and negotiations. (v) Simultaneously upon the Parties’ execution of this Settlement Agreement, AAMC shall execute and deliver to Akin Gump Strauss Hauer & Feld LLP (“Luxor’s Counsel”), to be held in escrow, confessions of judgment in the forms attached hereto as Exhibits D, E, and F (the “Confessions of Judgment”), and incorporated by reference herein, whereby AAMC will confess to judgments to be entered in the New York Litigation in the principal amounts of each Note, plus any additional fees or expenses, including without limitation, legal and collection fees, incurred by Luxor in enforcing its rights under the Confessions of Judgment, the

3 Notes, or this Settlement Agreement, plus interest from the date of entry calculated at the default rate of pre-judgment interest authorized under the New York Civil Practice Law and Rules. AAMC consents to Luxor’s registration of the Confessions of Judgment in any court of competent jurisdiction. If there is a default in payment with respect to the Cash Payment, any of the Notes, the interest on any of the Notes, or the Erbey Holding Corp. Litigation Proceeds, Luxor’s Counsel shall be entitled to release the Confessions of Judgment from escrow and enter the Confessions of Judgment, toward which any payments pursuant to this Settlement Agreement paid by AAMC in excess of the Confessions of Judgment amount shall be credited, first against pre-judgment interest and then to principal, and Luxor may immediately resume its judgment enforcement efforts. B. Simultaneously with the Parties’ execution of this Settlement Agreement and in satisfaction of any and all obligations under the SPA and the Certificate, Luxor shall transfer, convey, and assign all of Luxor’s right, title, and interest in and to all of its remaining Preferred Shares, free and clear of any liens or encumbrances, to AAMC. C. Luxor acknowledges and agrees that, upon the Effective Date, the SPA shall be void and of no further force and effect, and that Luxor’s rights under the Certificate shall be extinguished. 2. Mutual Releases. A. Luxor, for itself, its predecessors, successors, Affiliates, parents, subsidiaries, and assigns (“Luxor Releasors”), hereby waives, releases, and forever discharges AAMC and its Affiliates and each of their respective past, present, and future officers, directors, partners, members, shareholders, employees, lawyers, agents, and servants from any and all claims, obligations, demands, actions, causes of action, and liabilities, of whatsoever kind and nature, character and description, whether in law or equity, whether sounding in tort, contract, or under other Applicable Law, whether known or unknown, and whether anticipated or unanticipated, which Luxor Releasors ever had, now have, or may ever have, arising from any event, transaction, matter, circumstance, or fact in any way arising out of, arising as a result of, related to, with respect to, in connection with, or based in whole or in part on the SPA, the Certificate, the Preferred Shares, and any facts or allegations alleged in or that could have been alleged in the New York Litigation or the Virgin Islands Litigation; provided, however that Luxor does not hereby waive, release, or discharge AAMC from any of its obligations under this Settlement Agreement. B. Redleaf, for himself, his predecessors, successors, Affiliates and assigns (“Redleaf Releasors”), hereby waives, releases, and forever discharges AAMC and its Affiliates and each of their respective past, present, and future officers, directors, partners, members, shareholders, employees, lawyers, agents, and servants from any and all claims, obligations, demands, actions, causes of action, and liabilities, of whatsoever kind and nature, character and description, whether in law or equity, whether sounding in tort, contract, or under other Applicable Law, whether known or unknown, and whether anticipated or unanticipated, which Redleaf Releasors ever had, now have, or may ever have, arising from any event, transaction, matter, circumstance, or fact in any way arising out of, arising as a result of, related to, with respect to, in connection with, or based in whole or in part on the SPA, the Certificate, the Preferred Shares, and any facts or allegations alleged in or that could have been alleged in the New York Litigation or

4 the Virgin Islands Litigation; provided, however that Redleaf does not hereby waive, release, or discharge AAMC from any of its obligations under this Settlement Agreement. C. AAMC, for itself, its predecessors, successors, Affiliates, parents, subsidiaries and assigns (“AAMC Releasors”), hereby waives, releases and forever discharges Luxor and its Affiliates and each of their respective past, present and future officers, directors, partners, members, shareholders, employees, lawyers, agents, and servants from any and all claims, obligations, demands, actions, causes of action and liabilities, of whatsoever kind and nature, character and description, whether in law or equity, whether sounding in tort, contract or under other Applicable Law, whether known or unknown, and whether anticipated or unanticipated, which AAMC Releasors ever had, now have or may ever have, arising from any event, transaction, matter, circumstance or fact in any way arising out of, arising as a result of, related to, with respect to or in connection with or based in whole or in part on any business or investment relationship of any kind between the AAMC Releasors and Luxor, its predecessors, successors, Affiliates, parents, subsidiaries and assigns, including but not limited to the transactions and occurrences subject of the SPA, the Certificate, the Preferred Shares, and any facts or allegations alleged in or that could have been alleged in the New York Litigation or the Virgin Islands Litigation; provided, however, that AAMC does not hereby waive, release or discharge Luxor from any of its obligations under this Settlement Agreement. D. AAMC Releasors hereby waive, release, and forever discharge Redleaf and his Affiliates and each of their respective past, present and future officers, directors, partners, members, shareholders, employees, lawyers, agents, and servants from any and all claims, obligations, demands, actions, causes of action, and liabilities, of whatsoever kind and nature, character and description, whether in law or equity, whether sounding in tort, contract, or under other Applicable Law, whether known or unknown, and whether anticipated or unanticipated, which AAMC Releasors ever had, now have, or may ever have, arising from any event, transaction, matter, circumstance, or fact in any way arising out of, arising as a result of, related to, with respect to, in connection with, or based in whole or in part on any business or investment relationship of any kind between the AAMC Releasors and Redleaf, his predecessors, successors, Affiliates and assigns, including but not limited to the transactions and occurrences subject of the SPA, the Certificate, the Preferred Shares, and any facts or allegations alleged in or that could have been alleged in the New York Litigation or the Virgin Islands Litigation; provided, however, that AAMC does not hereby waive, release, or discharge Redleaf from any of his obligations under this Settlement Agreement. E. The consequences of the foregoing waiver provisions have been explained by each of the Parties’ respective counsel. Each of the Parties acknowledge that it may hereafter discover facts different from, or in addition to, those it now knows or believes to be true with respect to the SPA, the Certificate, the Virgin Islands Litigation, and the New York Litigation, and agrees that this Settlement Agreement and the releases contained herein shall be and remain effective in all respects notwithstanding such different or additional facts or the discovery thereof. F. The Parties hereby acknowledge and agree that the release provisions of Section 2 above shall not apply, and shall not be deemed to apply, to any third party, except as provided for in Section 2(A) – (D) herein.

5 3. Discontinuance of Litigations. Within two (2) Business Days of the execution of this Settlement Agreement, the parties will execute stipulations of dismissal of the Virgin Islands Litigation and the New York Litigation and shall, as soon as is practicable thereafter, take all steps necessary to cause the Virgin Island Litigation and the New York Litigation to be dismissed with prejudice in accordance with this paragraph. 4. Non-Disparagement. A. Each Party shall not, directly or indirectly, make any negative or disparaging statements against the other Party maligning, ridiculing, defaming, or otherwise speaking ill of the other Party, and the other Party’s business affairs, practices or policies, standards, or reputation (including, but not limited to, statements or postings harmful to the other Party’s business interests, reputation, or good will) in any form (including, but not limited to, orally, in writing, on social media, internet, to the media, persons and entities engaged in radio, television, or internet broadcasting, or to persons and entities that gather or report information on trade and business practices or reliability) that relate to this Settlement Agreement, the SPA, the Certificate, the Virgin Islands Litigation, the New York Litigation, and/or any matter covered by the releases within this Settlement Agreement. Nothing in the Settlement Agreement shall, however, be deemed to interfere with each Party’s obligations to report transactions, including disclosure of this Settlement Agreement, pursuant to Applicable Law. If AAMC files, submits, or publishes any public statements relating to or concerning this Settlement Agreement or the discontinuations of the Virgin Islands Litigation and/or the New York Litigation, AAMC shall permit Luxor and Redleaf to review, comment upon, and approve the proposed language for the public statement before AAMC makes the statement public, which approval shall not be unreasonably withheld or delayed, provided, however, that once such language is approved by Luxor and Redleaf pursuant to this Section 4, AAMC shall be permitted to make subsequent public statements utilizing substantially the same approved language. B. To the extent AAMC deems it appropriate or necessary to file a current report on Form 8-K announcing this Settlement Agreement and/or the discontinuation(s) of the Virgin Islands Litigation and/or the New York Litigation, Luxor and Redleaf shall have the opportunity to review, comment upon, and approve the Form 8-K and any accompanying press release before filing, which approval shall not be unreasonably withheld or delayed. Failure by AAMC to secure Luxor and Redleaf’s approval of such Form 8-K and accompanying press release shall be deemed a breach of this Settlement Agreement. 5. Definitions. For purposes of this Settlement Agreement, the following terms shall have the following meanings: A. “Affiliate” shall mean a Person directly or indirectly controlled by, controlling, under common control with, or managed by the other Person. For the purposes of this definition, “control” means, when used with respect to any Person, the possession, directly or indirectly, of the power to direct or cause the direction of the management and policies of such Person, whether through the ownership of voting securities, by contract or otherwise.

6 B. “Applicable Law” shall mean any statute, law, rule, or regulation or any judgment, order, consent order, stipulated agreement, ordinance, writ, injunction, or decree of any Governmental Entity. C. “Business Day” shall mean any day that is not a Saturday, a Sunday, or other day on which banks are required or authorized by law to be closed in the State of New York. D. “Governmental Entity” shall mean any domestic or foreign court or tribunal in any domestic or foreign jurisdiction or any federal, state, municipal, or local government or other governmental body, agency, authority, district, department, commission, board, bureau, or other instrumentality, arbitrator, or arbitral body (domestic or foreign), including any joint action agency, public power authority, public utility district, or other similar political subdivision. E. “Interest Accrual Date” shall mean the period commencing on the Execution Date and ending three months thereafter and each subsequent period commencing on the last day of the immediately preceding Interest Accrual Date and ending three months thereafter; provided, however, that: (i) no Interest Accrual Date may end after the Maturity Date; and (ii) whenever the last day of any Interest Accrual Date would otherwise occur on a day other than a Business Day, the last day of such interest period shall be extended to occur on the next succeeding Business Day. F. “Maturity Date” shall have the meaning as ascribed in the Notes. G. “Person” shall mean any individual, corporation, partnership, joint venture, trust, limited liability company, unincorporated organization, investment fund, account, Governmental Entity, or other entity. 6. Representations and Warranties. A. Each Party represents and warrants that it has read fully and understands the provisions set forth in this Settlement Agreement; B. Each Party represents and warrants that it has discussed, or has had the opportunity to discuss to its satisfaction, the provisions of this Settlement Agreement with its attorneys and other professional advisors; C. Each Party represents and warrants that no Party is relying upon any representations, agreements, or understandings, expressed or implied, written or oral, except those representations, agreements, and understandings explicitly set forth in this Settlement Agreement; D. Each Party represents and warrants that the individuals executing this Settlement Agreement on their behalf have full power and authority to execute and deliver this Settlement Agreement on behalf of those Parties, and, once executed and delivered, this Settlement Agreement shall constitute the valid and binding obligation of those Parties and be enforceable against those Parties pursuant to the terms set forth in this Settlement Agreement; and

7 E. Each Party represents and warrants that the execution and delivery of this Settlement Agreement and the performance of, or compliance with, the terms and provisions of this Settlement Agreement will not violate, conflict with, or result in a breach of any of the terms, conditions, or provisions of any law, statute, regulation, or order, or any agreement or any other restrictions of any kind or character, to which the Party may be bound. 7. Miscellaneous. A. Notices. All notices, demands, and other communications hereunder shall be in writing and shall be deemed to have been duly given: (a) when personally delivered; (b) upon actual receipt (as established by confirmation of receipt or otherwise) during normal business hours, otherwise on the first Business Day thereafter, if transmitted by email with confirmation of delivery; and (c) when sent by overnight courier; in each case, to the following addresses, or to such other addresses as a Party may from time to time specify by notice to the other Party given pursuant hereto. If to Luxor or Redleaf, to: Norris Nissim Nathaniel Redleaf Luxor Capital Group, LP 7 Times Square 43rd Floor New York, NY 10036 nnissim@luxorcap.com nredleaf@luxorcap.com with a copy to: Douglas Rappaport Jacqueline Yecies Akin Gump Strauss Hauer & Feld LLP One Bryant Park New York, NY 10036 darappaport@akingump.com jyecies@akingump.com If to AAMC, to: Chief Financial Officer Altisource Asset Management Corporation General Counsel and Secretary 5100 Tamarind Reef Christiansted, VI 0082 Richard.Rodick@altisourceamc.com

8 with a copy to: Howard J. Kaplan Michelle A. Rice Kaplan Rice LLP 142 W. 57th Street, Suite 4A New York, NY 10019 hkaplan@kaplanrice.com mrice@kaplanrice.com B. Covenant Not to Take Action in Breach. The Parties agree not to take any actions that will result, whether directly or indirectly, in the breach of their respective obligations, representations, warranties, agreements, covenants, or obligations contained in this Settlement Agreement. In addition to any owed monetary relief to an injured Party, any non-compliance with and/or breach of this Settlement Agreement shall cause continuing and irreparable harm and injury to the injured Party for which monetary damages are insufficient and entitle the injured Party to injunctive relief, without the posting of any bond or security, from any court of competent jurisdiction, including specific performance. C. Governing Law and Jurisdiction. This Settlement Agreement, the rights and duties of the Parties hereunder, and all claims or causes of action (whether in contract, tort, or otherwise) that may be based upon, arise out of, or relate to this Settlement Agreement, or the negotiation, execution, or performance of this Settlement Agreement (including any claim or cause of action based upon, arising out of, or related to any representation or warranty made in or in connection with this Settlement Agreement or as an inducement to enter into this Settlement Agreement), shall be governed by the laws of the state of New York. The Parties acknowledge and agree that the New York Supreme Court, New York County and the United States District Court for the Southern District of New York in Manhattan shall have the exclusive jurisdiction over this Settlement Agreement and that any claims arising out of or related in any manner to this Settlement Agreement shall be properly brought only before the New York Supreme Court, New York County or the United States District Court for the Southern District of New York in Manhattan. D. Waiver of Jury Trial. Each Party knowingly, voluntarily, and intentionally waives any rights it may have to a trial by jury in respect of any litigation, based hereon, or arising out of, under, or in connection with, this Settlement Agreement. E. Entire Agreement. This Settlement Agreement, as well as the Notes and Confessions of Judgment attached hereto as Exhibits A, B, C, D, E, and F, which are incorporated by reference herein, together contain the entire agreement among the Parties with respect to the subject matter hereof and there are no agreements, understandings, representations, or warranties among the Parties other than those set forth or referred to herein. The Settlement Agreement, Notes, and/or the Confessions of Judgment may be amended, modified, or waived only by a written instrument executed by each of the Parties. F. Severability. In case any provision of this Settlement Agreement shall be determined to be invalid, illegal, or unenforceable for any reason, the remaining provisions of this

9 Settlement Agreement shall be unaffected and unimpaired thereby, and shall remain in full force and effect, to the fullest extent permitted by Applicable Law. G. Survival of Representations. All representations, warranties, agreements, covenants, and obligations herein are material, shall be deemed to have been relied upon by the other Parties, and shall survive the dates of the dismissal of the New York Litigation and the Virgin Islands Litigation. H. Successors and Assigns. This Settlement Agreement shall be binding upon and inure to the benefit of the Parties hereto and their respective successors and assigns. No Party may assign either this Settlement Agreement or any of its rights, interests, or obligations hereunder without the prior written approval of the other Parties. I. No Admission. The Parties understand and agree that this is a compromise settlement of disputed claims and that neither this Settlement Agreement nor the payment or acceptance of consideration hereunder is, nor shall they be construed, described or characterized by any Party hereto or by its agents or representatives, as an admission by the Parties of any liability or wrongdoing. The making of this Settlement Agreement is not intended, and shall not be construed, as an admission that any of the Parties has violated any federal, state, or local law (statutory or decisional), ordinance or regulation, breached any contract, or committed any wrong whatsoever, and particularly, Luxor maintains that it was fully authorized to make all of its trades in AAMC securities. The Parties further agree and understand that this Settlement Agreement is being entered into solely for the purpose of avoiding further expense and litigation and that this Settlement Agreement may not be used as evidence in a subsequent proceeding except in a proceeding to enforce the terms of this Settlement Agreement. J. Interpretation. This Settlement Agreement has been jointly drafted by the Parties at arm’s length and each Party has had ample opportunity to consult with independent legal counsel. No provision or ambiguity in this Settlement Agreement shall be resolved against any Party by virtue of its participation in the drafting of this Settlement Agreement. K. Attorneys’ Fees. Each Party shall be responsible for the payment of its own costs and expenses, including attorneys’ fees, relating to the New York Litigation and the Virgin Islands Litigation, the matters referred to in this Settlement Agreement, and the drafting of this Settlement Agreement. The prevailing party in any litigation necessary to enforce this Settlement Agreement or the Confessions of Judgment shall be entitled to its costs and attorney’s fees. In addition, if it is necessary for Luxor to bring an action for breach of this Settlement Agreement because AAMC fails to make any payment, including interest, Luxor shall be entitled to all of its costs and attorney’s fees. L. Captions. The captions of this Settlement Agreement are for convenience only and are not a part of this Settlement Agreement and do not in any way limit or amplify the terms and provisions of this Settlement Agreement and shall have no effect on its interpretation. M. Counterparts. This Settlement Agreement may be executed in counterparts, by either an original signature or signature transmitted by facsimile transmission, email, or other

10 similar process, and each copy so executed shall be deemed to be an original, and all copies so executed shall constitute one and the same agreement. [Signature Page Follows]

11 IN WITNESS WHEREOF, the Parties have signed this Settlement Agreement in multiple counterparts. LUXOR CAPITAL GROUP, LP LUXOR CAPITAL PARTNERS OFFSHORE MASTER FUND, LP LUXOR CAPITAL PARTNERS, LP LUXOR WAVEFRONT, LP LUXOR SPECTRUM, LLC THEBES OFFSHORE MASTER FUND, LP By: Name: Norris Nissim Title: General Counsel Date: NATHANIEL REDLEAF By: Name: Nathaniel Redleaf Date: ALTISOURCE ASSET MANAGEMENT CORPORATION By: Name: Title: Date: William C. Erbey CEO 0 1 /1 1 /2 4

Exhibit A

EXECUTION VERSION 1 PROMISSORY NOTE $2,000,000.00 January 11, 2024 FOR VALUE RECEIVED, Altisource Asset Management Corporation, a U.S. Virgin Islands corporation (“AAMC”), hereby unconditionally promises to pay to the order of Luxor Capital Partners Offshore Master Fund, LP, Luxor Capital Partners, LP, Luxor Wavefront, LP, Luxor Spectrum, LLC, and Thebes Offshore Master Fund, LP (each individually a “Luxor Entity” and collectively, together with their successors and assigns, “Luxor”), in lawful money of the United States of America at the time of payment, in immediately available funds, on the Maturity Date (as defined herein), the aggregate principal amount of Two Million Dollars ($2,000,000.00) (with each Luxor Entity’s principal amount as of the date hereof set forth on Schedule 1), together with interest on the outstanding amount thereof, from the date hereof until such principal amount is paid in full, at the rate or rates determined in accordance with, and payable at the times set forth in, Section 2.1 hereof (the “Loan”). This Promissory Note (this “Note”) is the Promissory Note described in Section 1(A)(ii)(a) of that certain Settlement Agreement, dated on the date hereof by and between Luxor, Nathaniel Redleaf, and AAMC (the “Settlement Agreement”). 1. DEFINITIONS As used in this Note, the following terms shall have the following meanings: “Business Day” means any day that is not a Saturday, a Sunday, or other day on which banks are required or authorized by law to be closed in the State of New York. “Debtor Relief Laws” means the Bankruptcy Code of the United States, if applicable, and all other liquidation, conservatorship, bankruptcy, assignment for the benefit of creditors, moratorium, rearrangement, receivership, insolvency, reorganization, or similar debtor relief laws of the United States or other applicable jurisdictions from time to time in effect and affecting the rights of creditors generally. “Disqualified Equity Interest” means any Equity Interest that, by its terms (or the terms of any security or other Equity Interest into which it is convertible or for which it is exchangeable), or upon the happening of any event or condition (a) matures or is mandatorily redeemable, pursuant to a sinking fund obligation or otherwise, (b) is redeemable at the option of the holder thereof, in whole or in part, (c) provides for scheduled payments of dividends in cash, or (d) is or becomes convertible into or exchangeable for Indebtedness or any other Equity Interest that would constitute Disqualified Equity Interests, in each case, prior to the date that is ninety-one days after the Maturity Date. “Equity Interest” means, as to any Person, all of the shares of capital stock of (or other ownership or profit interests in) such Person, all of the warrants, options or other rights for the purchase or acquisition from such Person of shares of capital stock of (or other ownership or profit interests in) such Person, all of the securities convertible into or exchangeable for shares of capital stock of (or other ownership or profit interests in) such Person or warrants, rights or options for the purchase or acquisition from such Person of such shares (or such other interests), and all of the other ownership or profit interests in such Person (including partnership, member or trust interests therein), whether voting or nonvoting, and whether or not such shares, warrants, options, rights or other interests are outstanding on any date of determination. “Governmental Authority” means any United States federal, state or local or any foreign government, governmental, regulatory, or administrative authority, agency, commission, or any court, tribunal, judicial, or arbitral body. “Indebtedness” means, without duplication: (a) all indebtedness for borrowed money and all indebtedness of such Person evidenced by bonds, debentures, notes, loan agreements, or other similar

2 instruments; (b) all or any part of the deferred purchase price of property or services, including earn-out obligations; (c) all direct or contingent obligations arising under or with respect to letters of credit, banker’s acceptances, demand guarantees, and similar independent undertakings, in each case, whether or not representing obligations for borrowed money; (d) all obligations or liabilities created or arising under any capitalized lease of real or personal property, or conditional sale or other title retention agreement, whether or not the rights and remedies of the lessor, seller, or lender thereof are limited to repossession of the property giving rise to such obligations or liabilities; (e) all obligations of such Person under any conditional sale and other title retention agreement(s) relating to property acquired by such Person; (f) all contingent obligations of such Person in respect of Indebtedness of the kind described in clauses (a) – (h) of others; (g) the net obligations of such Person under derivative transactions, commodity transactions, foreign exchange transactions, repurchase agreements, reverse repurchase agreements, or securities lending agreements; and (h) all obligations of such Person in respect of Disqualified Equity Interests. “Interest Accrual Date” means the period commencing on the date hereof and ending three months thereafter and each subsequent period commencing on the last day of the immediately preceding Interest Accrual Date and ending three months thereafter; provided, however, that: (a) no Interest Accrual Date may end after the Maturity Date; and (b) whenever the last day of any Interest Accrual Date would otherwise occur on a day other than a Business Day, the last day of such interest period shall be extended to occur on the next succeeding Business Day. “Interest Rate” means a rate per annum equal to (i) 7.5% for the Cash Option; and (ii) 10% for the PIK Option, as defined herein. “Maturity Date” means January 11, 2027. “Person” means any natural person, corporation, partnership, limited liability company, trust, joint venture, association, unincorporated organization, or Governmental Authority. “subsidiary” of a Person means a corporation, partnership, joint venture, limited liability company or other business entity of which a majority of the shares of voting capital stock is at the time beneficially owned, or the management of which is otherwise controlled, directly, or indirectly through one or more intermediaries, or both, by such Person. 2. PAYMENTS 2.1 Payments of Principal and Interest. (a) The outstanding principal amount of the Loan made to AAMC and evidenced by this Note, together with interest thereon as hereinafter provided, shall be due and payable in cash by AAMC to Luxor on the Maturity Date, subject to acceleration of the maturity as provided below. (b) Interest on the principal amount hereof will accrue at the Interest Rate. The accrued and unpaid interest on the outstanding principal amount of the Loan hereunder is due and payable on each such Interest Accrual Date. AAMC must deliver a written notice to Luxor at least five (5) Business Days prior to the applicable Interest Accrual Date of AAMC’s election to pay interest either entirely (i) in cash (the “Cash Option”) or (ii) in-kind (the “PIK Option”). Once AAMC elects the Cash Option, it may not revoke its election with respect to such Interest Accrual Date. If AAMC fails to deliver a written notice at least five (5) Business Days before each applicable Interest Accrual Date to Luxor of its

3 election of either the Cash Option or the PIK Option, AAMC will be deemed to have elected the PIK Option. If AAMC elects the Cash Option, AAMC shall pay all interest payments payable herein on each Interest Accrual Date in cash. If AAMC elects the PIK Option, AAMC shall pay all interest payments payable herein on each Interest Accrual Date in-kind (“PIK Interest”), which PIK Interest shall be automatically capitalized on the applicable Interest Accrual Date by adding such amount to the outstanding principal amount of the Loan. For the avoidance of doubt, following any increase in the principal amount of the outstanding Loan upon a payment of PIK Interest on any Interest Accrual Date, the Loan shall bear interest on such increased principal amount from and after the date of such Interest Accrual Date, and all references herein to the principal amount of the Loan shall include all interest accrued and capitalized as a result of any payment of PIK Interest except as otherwise specified. Interest will be calculated on the basis of a year of 365/366 days, and charged for the actual number of days elapsed. 2.2 Manner of Payment. All payments received shall be applied first against costs of collection and other expenses, if any, then against accrued and unpaid interest, if any, then against principal. Principal, interest, and all other amounts due under this Note will be payable, in U.S. dollars, in immediately available funds, by wire transfer to Luxor to such account or at such address as designated by Luxor in writing to AAMC. If any payment of principal or interest on this Note is due on a day that is not a Business Day, such payment will be due on the next succeeding Business Day, and such extension of time will be taken into account in calculating the amount of interest payable under this Note. All amounts due under this Note shall be payable without setoff, counterclaim, or any other defense or deduction whatsoever. 2.3 Optional Prepayment. AAMC may prepay the Loan evidenced hereby at any time in whole or in part, together with accrued and unpaid interest thereon in cash, without premium or penalty. Any prepayment, whether in whole or in part, shall be applied first to reimburse Luxor for any expenses, costs, fees, and disbursements incurred and due hereunder, second, to any accrued interest, and third to principal, and interest shall immediately cease to run on any amount of the principal so prepaid. 2.4 Frustration of Repayment. Immediately prior to entering into any agreement, arrangement, or understanding that restricts the ability of AAMC to repay the Loan or interest when, as, and if due in accordance with the terms of this Note, all principal, all accrued interest then remaining unpaid, and other amounts payable in connection with this Note shall become automatically immediately due and payable in cash. 3. CONDITIONS PRECEDENT The effectiveness of this Note is subject to the satisfaction or waiver by Luxor of the following conditions precedent on or prior to the date hereof: (a) Secretary’s Certificates. Luxor shall have received a certificate for AAMC, dated as of the date hereof, duly executed and delivered by an officer of AAMC as to: (i) resolutions of AAMC expressly and specifically authorizing and approving the execution, delivery, and performance of this Note executed by AAMC; and (ii) identifies by name and title and bears the signatures of the officers of AAMC authorized to sign this Note. (b) Executed Documents. Luxor shall have received the following documents executed by an officer of AAMC and each other relevant party: (i) the Settlement Agreement; (ii) this Note; and (iii) the Promissory Notes described in Sections 1(A)(ii)(b) and 1(A)(ii)(c) of the Settlement Agreement. (c) Officer’s Certificate. Luxor shall have received a certificate signed by an officer of AAMC certifying that: (i) the representations and warranties of AAMC herein are true and correct in all

4 respects; and (ii) no Event of Default, as defined herein, has occurred and is continuing before and after giving effect to the Loan. 4. REPRESENTATIONS AND WARRANTIES AAMC hereby represents and warrants to Luxor as follows: (a) Good Standing. AAMC is a corporation, duly organized under the laws of the U.S. Virgin Islands, is in good standing and duly authorized to conduct its business as now being conducted in the U.S. Virgin Islands and each jurisdiction in which it conducts business. AAMC is qualified to do business in any other state wherein non-qualification could reasonably be expected to have a material adverse effect on AAMC or its operations. (b) Authority. AAMC has the right, power, and all authority, approval, and capacity to enter into, execute, and deliver this Note and to perform its obligations under this Note. This Note has been duly executed and delivered and has been duly authorized by AAMC, and constitutes the legal, valid, and binding obligation of AAMC, enforceable against AAMC in accordance with its terms. (c) Approvals. No permit, consent, approval, authorization of, declaration to, or filing with any court, governmental agency, or third party is required in connection with the execution, delivery, and performance of this Note by AAMC, except as have already been obtained or accomplished. (d) No Conflicts. The execution and delivery of this Note, the performance of this Note, and the compliance with the provisions of this Note by AAMC, will not violate, conflict with, or result in any breach of any terms, conditions or provisions of, or constitute a default under, or require any consent or notice under, any organizational document, loan agreement, indenture, lease, agreement, Indebtedness, restrictive legend, or other instrument to which AAMC is a party or by which it or any of its properties are bound or any decree, judgment, order, statute, rule, or regulation applicable to it. 5. COVENANTS AAMC covenants that so long as any liabilities (whether direct or contingent, liquidated or unliquidated) under this Note remain outstanding, and until payment and performance in full of all of the obligations under this Note: (a) Punctual Payments. AAMC shall punctually pay all principal, interest, fees or other liabilities due under this Note at the times and place and in the manner specified herein and therein. (b) Conduct of Business. AAMC shall: (i) preserve and maintain its legal existence; (ii) preserve and maintain all of its required material rights, privileges, and licenses (other than: (A) such requirements of the USVI Economic Development Commission of AAMC for the sole purpose of obtaining tax benefits; or (B) as required by the terms of the Non-exclusive Patent and Technology License Agreement between System73 Limited and AAMC dated as of October 6, 2023 (the “PTL Agreement”)); (iii) comply with the requirements of all applicable laws, rules, regulations, and orders of governmental or regulatory authorities; (iv) pay and discharge all taxes, assessments, and governmental charges or levies imposed on it or on its income or profits or on any of its property prior to the date on which penalties attach thereto, except for any such tax, assessment, charge, or levy the payment of which is being contested in good faith and by proper proceedings and against which adequate reserves are being maintained; and (v) keep adequate records and books of account, in which complete entries will be made in accordance with generally accepted accounting principles consistently applied.

5 (c) Notices. AAMC shall notify Luxor within five (5) Business Days of AAMC becoming aware: (i) that any Event of Default (or any event or circumstance that, with the giving of notice and/or the lapse of time, would become an Event of Default) has occurred; (ii) of any litigation pending or threatened against AAMC with a claim in excess of $250,000; or (iii) that any default or breach by AAMC under any agreement or instrument for borrowed money has occurred. To notify Luxor, AAMC shall deliver to Luxor a notice describing the same in reasonable detail and, together with such notice or as soon thereafter as possible, a description of the action that has been taken or is proposed to be taken with respect thereto. (d) Limitations on Indebtedness. Without the prior written consent of Luxor, AAMC shall not, and shall not permit any subsidiary to, create, issue, incur, assume or suffer to exist, any Indebtedness (whether existing as of the date hereof or otherwise), other than: (i) Indebtedness pursuant to this Note; (ii) to the extent constituting Indebtedness, any payment obligations arising out of the PTL Agreement; (iii) capitalized leases entered into in the ordinary course of business and consistent with past practices; (iv) any obligations applicable to repurchase agreements and related hedging arrangements that are necessary to conduct AAMC’s lending business in the ordinary course of business and consistent with past practices; and (v) any Indebtedness that is subordinated to this Note pursuant to a subordination agreement. (e) Organizational Documents. Without the prior written consent of Luxor, which shall not be unreasonably withheld or delayed, AAMC shall not take any action to amend or modify the articles of incorporation or bylaws of AAMC in any manner that would be adverse to Luxor. (f) Limitation on Restricted Payments. Without the prior written consent of Luxor, AAMC shall not, and shall not permit any subsidiary to, directly or indirectly: (i) make any extraordinary payment to any person or entity; (ii) declare or pay any dividends or make any distributions with respect to AAMC’s or its subsidiary’s Equity Interests, or redeem, retire, purchase or otherwise acquire, or permit any subsidiary to redeem, retire, purchase or otherwise acquire, any of AAMC’s or such subsidiary’s stock or other equity securities; provided that AAMC shall be permitted to make such dividends, distributions and redemptions in the event AAMC has elected the Cash Option and Luxor has received cash interest, in each case, with respect to the Interest Accrual Date occurring immediately prior to such dividend, distribution, or redemption, as applicable; or (iii) make any payments, disbursements, distributions or other transfers of cash or assets of AAMC to or on behalf of any equityholder or affiliate of AAMC (including any subsidiary, and in the case of natural persons, any family members thereof), other than (x) compensation payments, distributions, or expense reimbursements, in each case, made in the ordinary course of business and consistent with past practices to a director, or an employee of AAMC or of a subsidiary, and (y) the payment of fees and expenses paid in cash in accordance with Section 2.2 of the PTL Agreement. (g) Merger, Consolidation, Transfer, Sale, or Disposition of Assets. All principal, all accrued interest then remaining unpaid, and other amounts payable in connection with this Note shall become, or may be declared to be, immediately due and payable in cash at the election of Luxor if AAMC or any subsidiary of AAMC, directly or indirectly: (i) merges into or consolidates with any corporation or other entity other than an affiliate; (ii) acquires all or substantially all of the assets of any corporation or other entity other than an affiliate; (iii) sells, leases, transfers or otherwise disposes, whether by asset sale, stock sale, merger, recapitalization, or otherwise, of all or substantially all of the assets of AAMC in a single or series of related transactions (unless the proceeds of such sale are used to prepay the outstanding amount of this Note). (h) Limitation on Pledges of Assets. AAMC shall not, and shall not permit any subsidiary to, mortgage, pledge, grant, or permit to exist any lien upon any of its assets or properties, other than: (i) liens securing Indebtedness incurred pursuant to Section 5(d)(iii) to finance the acquisition of fixed

6 or capital assets; provided that (x) such liens shall be created substantially simultaneously with, or within one hundred eighty (180) days after, the acquisition of such fixed or capital assets, (y) such Liens do not at any time encumber any property other than the property financed by such Indebtedness, and (z) the amount of Indebtedness secured thereby does not exceed the fair market value of such acquired assets; (ii) liens securing Indebtedness incurred pursuant to Section 5(d)(iv) and Section 5(d)(v); and (iii) any Liens not otherwise permitted by this clause (h), so long as the aggregate outstanding principal amount of the obligations secured thereby does not exceed Two Hundred Fifty Thousand Dollars ($250,000.00) at any one time. 6. EVENTS OF DEFAULT 6.1 The following events shall each constitute an “Event of Default” hereunder (whether they result from any voluntary or involuntary action or inaction by AAMC): (a) failure of AAMC to make any payment to Luxor when due, whether upon an Interest Accrual Date, by acceleration, or otherwise; (b) any representation, warranty, or certification made herein (or in any modification or supplement hereto) by AAMC is incorrect as of the date hereof in any material respect; (c) AAMC shall default in the performance of any of its obligations herein, including its obligations under Sections 5 and 6; (d) AAMC institutes or consents to the institution of any proceeding under any Debtor Relief Law, or makes an assignment for the benefit of creditors, or applies for or consents to the appointment of any receiver, trustee, custodian, conservator, liquidator, rehabilitator, or similar officer for AAMC for all or any material part of the property of AAMC; or any receiver, trustee, custodian, conservator, liquidator, rehabilitator or similar officer is appointed without the application or consent of AAMC and the appointment continues undischarged or unstayed for thirty (30) calendar days; or any proceeding under any Debtor Relief Law relating to AAMC or to all or any material part of the property of AAMC is instituted without the consent of AAMC and continues undismissed or unstayed for thirty (30) calendar days, or an order for relief is entered in any such proceeding; (e) AAMC shall admit in writing its inability to pay its debts as such debts become due; (f) one or more judgments for the payment of money in any aggregate amount in excess of $250,000 shall be rendered against AAMC and the same shall remain undischarged for a period of thirty (30) calendar days during which execution shall not be effectively stayed, or any action shall be legally taken by a judgment creditor to levy upon assets or properties of AAMC to enforce any such judgment; (g) AAMC shall default in the performance of any of its obligations under, or shall otherwise breach, any other agreement, including the Settlement Agreement and/or the other notes issued on the date hereof, between it and Luxor and/or their affiliates; or (h) a default by AAMC in any aggregate amount in excess of $250,000 under any other agreement, bond, debenture, note or other evidence of Indebtedness for money borrowed, under any guaranty or under any mortgage, or indenture pursuant to which there shall be issued or by which there shall be secured or evidenced any Indebtedness for money borrowed by AAMC, whether such Indebtedness now exists or shall hereafter be created. Upon the occurrence of any one or more of the Events of Default, all principal, all accrued interest then remaining unpaid and other amounts payable in connection with this Note shall become, or may be declared to be, immediately due and payable in cash at the election of Luxor. 6.2 AAMC shall have five (5) Business Days to cure an Event of Default for AAMC’s default of its obligations under Sections 5(a); 5(b); 5(c); or 6.1(a).

7 7. MISCELLANEOUS 7.1 Waivers. (a) AAMC hereby waives presentment, demand, protest, and notice of dishonor and protest. (b) No failure on the part of Luxor to exercise and no delay in exercising, and no course of dealing with respect to, any right, power, or privilege under this Note shall operate as a waiver thereof, nor shall any single or partial exercise of any right, power, or privilege under this Note preclude any other or further exercise thereof or the exercise of any other right, power, or privilege. 7.2 Assignment. This Note shall be binding upon and inure to the benefit of AAMC and Luxor and their respective successors and permitted assigns. AAMC may not assign or delegate any of its rights or obligations under this Note without the prior written consent of Luxor, which shall not be unreasonably withheld or delayed, and any purported assignment or delegation by AAMC without such prior written consent will be null and void ab initio. Luxor may at any time and from time to time, without the consent of AAMC, assign all or any portion of its rights under this Note to one or more persons or entities, and, upon Luxor giving notice of such assignment to AAMC specifying the interest hereunder being assigned and the person or entity to which such interest is being assigned, each reference herein to Luxor shall (solely in respect of the interest so assigned) constitute a reference to such assignee (as if such assignee were named herein as Luxor). 7.3 Notices. All notices, requests, demands, claims, and other communications hereunder shall be in writing. Any notice, request, demand, claim, or other communication hereunder shall be deemed duly given if and when: (a) delivered personally; (b) mailed by first class registered or certified mail, return receipt requested, postage prepaid, on the date certified by the U.S. Postal Service to have been received by the addressee; (c) sent by a nationally recognized overnight express courier service, on the date certified by such courier service to have been received by the recipient; or via email, in each case as follows: If to AAMC: Altisource Asset Management Corporation Chief Financial Officer 5100 Tamarind Reef Christiansted, VI 0082 Richard.rodick@altisourceeamc.com with a copy to: Charles Frischer, Director Altisource Asset Management Corporation 5100 Tamarind Reef Christiansted, VI 0082 Charlie.frischer@gmail.com

8 If to Luxor: Norris Nissim Nathaniel Redleaf Luxor Capital Group, LP 7 Times Square 43rd Floor New York, NY 10036 with a copy to: Douglas Rappaport Jacqueline Yecies Akin Gump Strauss Hauer & Feld LLP One Bryant Park New York, NY 10036 darappaport@akingump.com jyecies@akingump.com Any party may change the address to which notices, requests, demands, claims, and other communications hereunder are to be delivered by giving the other parties hereto notice in the manner herein set forth. 7.4 Headings. The article and section headings contained in this Note are inserted for convenience only and will not affect in any way the meaning or interpretation of this Note. 7.5 Governing Law; Submission to Jurisdiction; Venue. THIS NOTE SHALL BE CONSTRUED AND ENFORCED IN ACCORDANCE WITH AND GOVERNED BY THE LAWS OF THE STATE OF NEW YORK, WITHOUT REGARD TO PRINCIPLES OF CONFLICTS OF LAW THAT WOULD RESULT IN THE APPLICATION OF THE LAWS OF ANY OTHER JURISDICTION. AAMC HEREBY IRREVOCABLY SUBMITS ITSELF TO THE EXCLUSIVE JURISDICTION OF THE NEW YORK SUPREME COURT, NEW YORK COUNTY AND THE UNITED STATES DISTRICT COURT FOR THE SOUTHERN DISTRICT OF NEW YORK IN MANHATTAN AND AGREES AND CONSENTS THAT SERVICE OF PROCESS MAY BE MADE UPON IT IN ANY LEGAL PROCEEDING RELATING TO THIS NOTE BY ANY MEANS ALLOWED UNDER NEW YORK OR FEDERAL LAW. TO THE EXTENT PROVIDED BY LAW, SHOULD AAMC, AFTER BEING SERVED, FAIL TO APPEAR OR ANSWER TO ANY SUMMONS, COMPLAINT, PROCESS OR PAPERS SERVED WITHIN THE NUMBER OF DAYS PRESCRIBED BY LAW AFTER THE MAILING THEREOF, AAMC WILL BE DEEMED IN DEFAULT AND AN ORDER AND/OR JUDGMENT MAY BE ENTERED BY THE COURT AGAINST AAMC AS DEMANDED OR PRAYED FOR IN SUCH SUMMONS, COMPLAINT, PROCESS OR PAPERS. 7.6 Amendments and Waivers. No amendment, modification, waiver, replacement, termination, or cancellation of any provision of this Note will be valid, unless the same shall be in writing and signed by AAMC and Luxor. No waiver by Luxor of any default hereunder shall be deemed to extend to any prior or subsequent default hereunder or affect in any way any rights arising out of any prior or subsequent such occurrence. No failure or delay on the part of Luxor in exercising any right, power, or privilege hereunder shall operate as a waiver of any privilege or right hereunder or preclude any other or further exercise of any other right, power or privilege.

9 7.7 Severability. The provisions of this Note shall be deemed severable and the invalidity or unenforceability of any provision will not affect the validity or enforceability of the other provisions hereof. 7.8 Set-off. If any amount owing to Luxor under this Note is not paid when due, Luxor is hereby authorized by AAMC, at any time and from time to time thereafter, without notice, to set-off against, and to appropriate and apply to the payment of, the liabilities of AAMC under this Note any and all liabilities owing by Luxor or any of its affiliates to AAMC (whether matured or unmatured). 7.9 Further Documents. AAMC shall, at the request of Luxor, execute, file, record, or obtain such other agreements, documents or instruments and take such action and obtain such certificates, documents, licenses, and approvals in connection with this Note and Luxor’s rights and remedies hereunder as Luxor may reasonably deem necessary. 7.10 Rights and Remedies. All rights and remedies hereunder are cumulative and not exclusive of any rights or remedies otherwise provided by law or in equity. Any single or partial exercise of any right or remedy shall not preclude the further exercise thereof or the exercise of any other right or remedy. 7.11 Relationship of Parties. Notwithstanding any prior business or personal relationship between AAMC and Luxor, or any of their respective officers, directors or employees, that may exist or have existed, the relationship between AAMC and Luxor is solely that of debtor and creditor, no Luxor Entity has any fiduciary or special relationship with AAMC, AAMC and Luxor are not partners or joint venturers, and no term or condition of this Note shall be construed so as to deem the relationship between AAMC and Luxor to be other than that of debtor and creditor. 7.12 Entire Agreement. This Note, and the other notes issued by AAMC to Luxor on the date hereof, the Settlement Agreement, the Confessions of Judgment, and the exhibits attached to the Settlement Agreement, all of which are incorporated by reference herein, together constitute the entire agreement and understanding among the parties hereto with respect to the subject matter hereof and there are no agreements, understandings, representations, or warranties by or among the parties, written or oral, other than those set forth or referred to herein. 7.13 Waiver of Jury Trial; Other Waivers. EACH OF AAMC AND LUXOR, BY ACCEPTANCE OF THE BENEFITS OF THIS NOTE, KNOWINGLY AND VOLUNTARILY IRREVOCABLY WAIVES, TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW, ANY AND ALL RIGHTS TO TRIAL BY JURY IN ANY LEGAL PROCEEDING ARISING OUT OF OR RELATING TO THIS NOTE; AND AAMC HEREBY WAIVES, TO THE EXTENT PERMITTED BY APPLICABLE LAW, THE RIGHT TO INTERPOSE ANY SETOFF OR COUNTERCLAIM OR CROSSCLAIM IN CONNECTION WITH ANY SUCH LITIGATION, IRRESPECTIVE OF THE NATURE OF SUCH SETOFF, COUNTERCLAIM OR CROSSCLAIM EXCEPT TO THE EXTENT THAT FAILURE SO TO ASSERT ANY SUCH SETOFF, COUNTERCLAIM OR CROSSCLAIM WOULD PERMANENTLY PRECLUDE THE PROSECUTION OF OR RECOVERY UPON THE SAME. NOTWITHSTANDING ANYTHING CONTAINED IN THIS NOTE TO THE CONTRARY, NO CLAIM MAY BE MADE BY AAMC AGAINST LUXOR FOR ANY LOST PROFITS OR ANY SPECIAL, INDIRECT OR CONSEQUENTIAL DAMAGES IN RESPECT OF ANY BREACH OR WRONGFUL CONDUCT IN CONNECTION WITH, ARISING OUT OF OR IN ANY WAY RELATED TO THE ISSUANCE OF THIS NOTE OR ANY ACT, OMISSION, OR EVENT OCCURRING IN CONNECTION THEREWITH; AND AAMC HEREBY WAIVES, RELEASES AND AGREES NOT TO SUE UPON ANY SUCH CLAIM FOR ANY SUCH DAMAGES. AAMC

10 AND LUXOR AGREE THAT THIS SECTION 7.13 IS A SPECIFIC AND MATERIAL ASPECT OF THIS NOTE AND ACKNOWLEDGE THAT LUXOR WOULD NOT MAKE THE LOAN IN RESPECT OF WHICH THIS NOTE WAS INITIALLY ISSUED IF THIS SECTION 7.13 WERE NOT PART OF THIS NOTE. [SIGNATURE PAGE FOLLOWS]

Signature Page to Promissory Note AAMC and Luxor have executed and delivered this Note as of the date first above written. AAMC: Altisource Asset Management Corporation By: Name: Title: LUXOR: Luxor Capital Partners Offshore Master Fund, LP By: Name: Title: Luxor Capital Partners, LP By: Name: Title: Luxor Wavefront, LP By: Name: Title: Luxor Spectrum, LLC By: Name: Title: Thebes Offshore Master Fund, LP By: Name: Title: William C. Erbey CEO Norris Nissim General Counsel Norris Nissim General Counsel Norris Nissim General Counsel Norris Nissim General Counsel Norris Nissim General Counsel

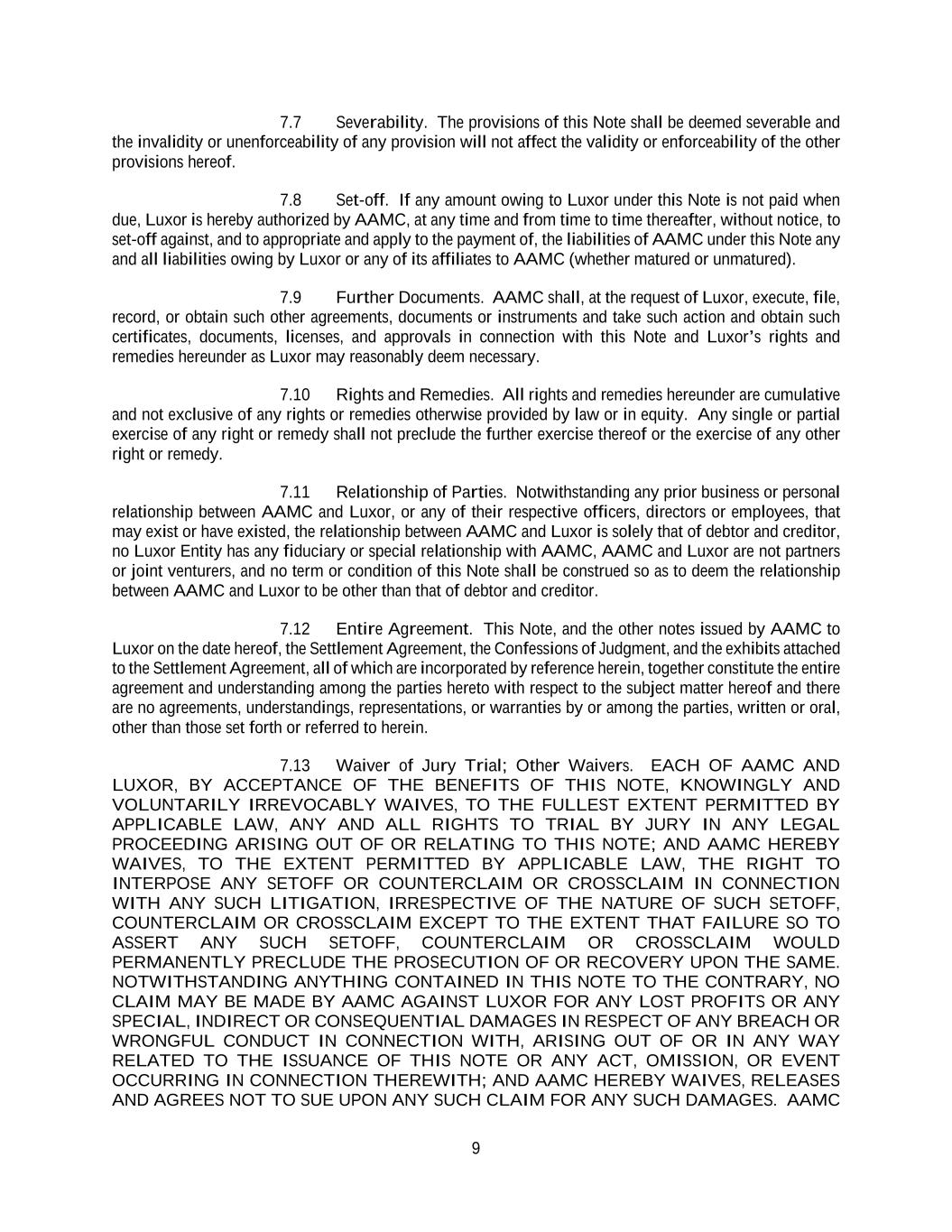

Schedule 1 Original Principal Amount Luxor Entity Principal Amount Luxor Capital Partners Offshore Master Fund, LP; $1,019,415.86 Luxor Capital Partners, LP $722,270.00 Luxor Wavefront, LP; $211,743.82 Luxor Spectrum, LLC $4,521.12 Thebes Offshore Master Fund, LP $42,049.20 Total: $2,000,000.00

Exhibit B

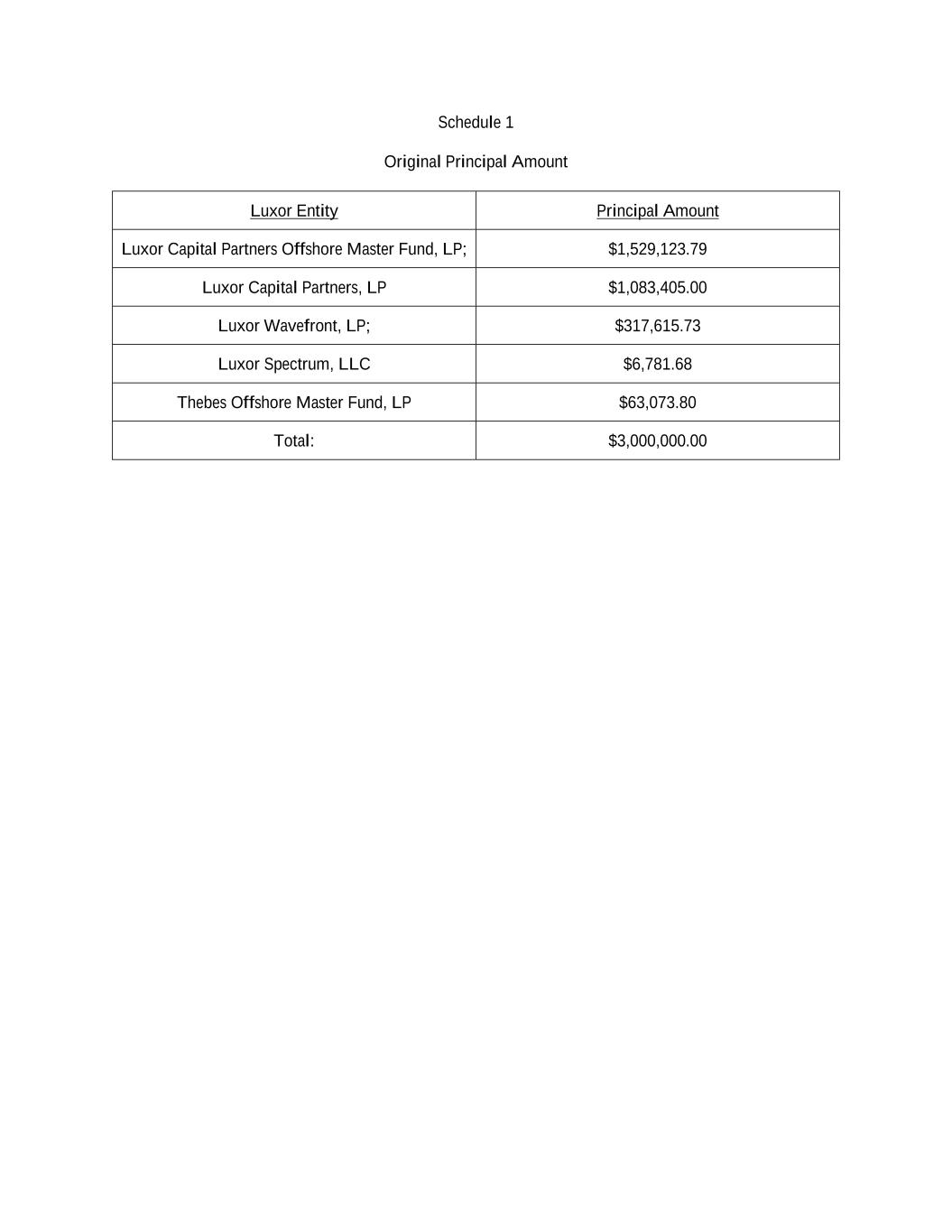

EXECUTION VERSION 1 PROMISSORY NOTE $3,000,000.00 January 11, 2024 FOR VALUE RECEIVED, Altisource Asset Management Corporation, a U.S. Virgin Islands corporation (“AAMC”), hereby unconditionally promises to pay to the order of Luxor Capital Partners Offshore Master Fund, LP, Luxor Capital Partners, LP, Luxor Wavefront, LP, Luxor Spectrum, LLC, and Thebes Offshore Master Fund, LP (each individually a “Luxor Entity” and collectively, together with their successors and assigns, “Luxor”), in lawful money of the United States of America at the time of payment, in immediately available funds, on the Maturity Date (as defined herein), the aggregate principal amount of Three Million Dollars ($3,000,000.00) (with each Luxor Entity’s principal amount as of the date hereof set forth on Schedule 1), together with interest on the outstanding amount thereof, from the date hereof until such principal amount is paid in full, at the rate or rates determined in accordance with, and payable at the times set forth in, Section 2.1 hereof (the “Loan”). This Promissory Note (this “Note”) is the Promissory Note described in Section 1(A)(ii)(b) of that certain Settlement Agreement, dated on the date hereof by and between Luxor, Nathaniel Redleaf, and AAMC (the “Settlement Agreement”). 1. DEFINITIONS As used in this Note, the following terms shall have the following meanings: “Business Day” means any day that is not a Saturday, a Sunday, or other day on which banks are required or authorized by law to be closed in the State of New York. “Debtor Relief Laws” means the Bankruptcy Code of the United States, if applicable, and all other liquidation, conservatorship, bankruptcy, assignment for the benefit of creditors, moratorium, rearrangement, receivership, insolvency, reorganization, or similar debtor relief laws of the United States or other applicable jurisdictions from time to time in effect and affecting the rights of creditors generally. “Disqualified Equity Interest” means any Equity Interest that, by its terms (or the terms of any security or other Equity Interest into which it is convertible or for which it is exchangeable), or upon the happening of any event or condition (a) matures or is mandatorily redeemable, pursuant to a sinking fund obligation or otherwise, (b) is redeemable at the option of the holder thereof, in whole or in part, (c) provides for scheduled payments of dividends in cash, or (d) is or becomes convertible into or exchangeable for Indebtedness or any other Equity Interest that would constitute Disqualified Equity Interests, in each case, prior to the date that is ninety-one days after the Maturity Date. “Equity Interest” means, as to any Person, all of the shares of capital stock of (or other ownership or profit interests in) such Person, all of the warrants, options or other rights for the purchase or acquisition from such Person of shares of capital stock of (or other ownership or profit interests in) such Person, all of the securities convertible into or exchangeable for shares of capital stock of (or other ownership or profit interests in) such Person or warrants, rights or options for the purchase or acquisition from such Person of such shares (or such other interests), and all of the other ownership or profit interests in such Person (including partnership, member or trust interests therein), whether voting or nonvoting, and whether or not such shares, warrants, options, rights or other interests are outstanding on any date of determination. “Governmental Authority” means any United States federal, state or local or any foreign government, governmental, regulatory, or administrative authority, agency, commission, or any court, tribunal, judicial, or arbitral body. “Indebtedness” means, without duplication: (a) all indebtedness for borrowed money and all indebtedness of such Person evidenced by bonds, debentures, notes, loan agreements, or other similar

2 instruments; (b) all or any part of the deferred purchase price of property or services, including earn-out obligations; (c) all direct or contingent obligations arising under or with respect to letters of credit, banker’s acceptances, demand guarantees, and similar independent undertakings, in each case, whether or not representing obligations for borrowed money; (d) all obligations or liabilities created or arising under any capitalized lease of real or personal property, or conditional sale or other title retention agreement, whether or not the rights and remedies of the lessor, seller, or lender thereof are limited to repossession of the property giving rise to such obligations or liabilities; (e) all obligations of such Person under any conditional sale and other title retention agreement(s) relating to property acquired by such Person; (f) all contingent obligations of such Person in respect of Indebtedness of the kind described in clauses (a) – (h) of others; (g) the net obligations of such Person under derivative transactions, commodity transactions, foreign exchange transactions, repurchase agreements, reverse repurchase agreements, or securities lending agreements; and (h) all obligations of such Person in respect of Disqualified Equity Interests. “Interest Accrual Date” means the period commencing on the date hereof and ending three months thereafter and each subsequent period commencing on the last day of the immediately preceding Interest Accrual Date and ending three months thereafter; provided, however, that: (a) no Interest Accrual Date may end after the Maturity Date; and (b) whenever the last day of any Interest Accrual Date would otherwise occur on a day other than a Business Day, the last day of such interest period shall be extended to occur on the next succeeding Business Day. “Interest Rate” means a rate per annum equal to (i) 7.5% for the Cash Option; and (ii) 10% for the PIK Option, as defined herein. “Maturity Date” means January 11, 2029. “Person” means any natural person, corporation, partnership, limited liability company, trust, joint venture, association, unincorporated organization, or Governmental Authority. “subsidiary” of a Person means a corporation, partnership, joint venture, limited liability company or other business entity of which a majority of the shares of voting capital stock is at the time beneficially owned, or the management of which is otherwise controlled, directly, or indirectly through one or more intermediaries, or both, by such Person. 2. PAYMENTS 2.1 Payments of Principal and Interest. (a) The outstanding principal amount of the Loan made to AAMC and evidenced by this Note, together with interest thereon as hereinafter provided, shall be due and payable in cash by AAMC to Luxor on the Maturity Date, subject to acceleration of the maturity as provided below. (b) Interest on the principal amount hereof will accrue at the Interest Rate. The accrued and unpaid interest on the outstanding principal amount of the Loan hereunder is due and payable on each such Interest Accrual Date. AAMC must deliver a written notice to Luxor at least five (5) Business Days prior to the applicable Interest Accrual Date of AAMC’s election to pay interest either entirely (i) in cash (the “Cash Option”) or (ii) in-kind (the “PIK Option”). Once AAMC elects the Cash Option, it may not revoke its election with respect to such Interest Accrual Date. If AAMC fails to deliver a written notice at least five (5) Business Days before each applicable Interest Accrual Date to Luxor of its

3 election of either the Cash Option or the PIK Option, AAMC will be deemed to have elected the PIK Option. If AAMC elects the Cash Option, AAMC shall pay all interest payments payable herein on each Interest Accrual Date in cash. If AAMC elects the PIK Option, AAMC shall pay all interest payments payable herein on each Interest Accrual Date in-kind (“PIK Interest”), which PIK Interest shall be automatically capitalized on the applicable Interest Accrual Date by adding such amount to the outstanding principal amount of the Loan. For the avoidance of doubt, following any increase in the principal amount of the outstanding Loan upon a payment of PIK Interest on any Interest Accrual Date, the Loan shall bear interest on such increased principal amount from and after the date of such Interest Accrual Date, and all references herein to the principal amount of the Loan shall include all interest accrued and capitalized as a result of any payment of PIK Interest except as otherwise specified. Interest will be calculated on the basis of a year of 365/366 days, and charged for the actual number of days elapsed. 2.2 Manner of Payment. All payments received shall be applied first against costs of collection and other expenses, if any, then against accrued and unpaid interest, if any, then against principal. Principal, interest, and all other amounts due under this Note will be payable, in U.S. dollars, in immediately available funds, by wire transfer to Luxor to such account or at such address as designated by Luxor in writing to AAMC. If any payment of principal or interest on this Note is due on a day that is not a Business Day, such payment will be due on the next succeeding Business Day, and such extension of time will be taken into account in calculating the amount of interest payable under this Note. All amounts due under this Note shall be payable without setoff, counterclaim, or any other defense or deduction whatsoever. 2.3 Optional Prepayment. AAMC may prepay the Loan evidenced hereby at any time in whole or in part, together with accrued and unpaid interest thereon in cash, without premium or penalty. Any prepayment, whether in whole or in part, shall be applied first to reimburse Luxor for any expenses, costs, fees, and disbursements incurred and due hereunder, second, to any accrued interest, and third to principal, and interest shall immediately cease to run on any amount of the principal so prepaid. 2.4 Frustration of Repayment. Immediately prior to entering into any agreement, arrangement, or understanding that restricts the ability of AAMC to repay the Loan or interest when, as, and if due in accordance with the terms of this Note, all principal, all accrued interest then remaining unpaid, and other amounts payable in connection with this Note shall become automatically immediately due and payable in cash. 3. CONDITIONS PRECEDENT The effectiveness of this Note is subject to the satisfaction or waiver by Luxor of the following conditions precedent on or prior to the date hereof: (a) Secretary’s Certificates. Luxor shall have received a certificate for AAMC, dated as of the date hereof, duly executed and delivered by an officer of AAMC as to: (i) resolutions of AAMC expressly and specifically authorizing and approving the execution, delivery, and performance of this Note executed by AAMC; and (ii) identifies by name and title and bears the signatures of the officers of AAMC authorized to sign this Note. (b) Executed Documents. Luxor shall have received the following documents executed by an officer of AAMC and each other relevant party: (i) the Settlement Agreement; (ii) this Note; and (iii) the Promissory Notes described in Sections 1(A)(ii)(a) and 1(A)(ii)(c) of the Settlement Agreement. (c) Officer’s Certificate. Luxor shall have received a certificate signed by an officer of AAMC certifying that: (i) the representations and warranties of AAMC herein are true and correct in all

4 respects; and (ii) no Event of Default, as defined herein, has occurred and is continuing before and after giving effect to the Loan. 4. REPRESENTATIONS AND WARRANTIES AAMC hereby represents and warrants to Luxor as follows: (a) Good Standing. AAMC is a corporation, duly organized under the laws of the U.S. Virgin Islands, is in good standing and duly authorized to conduct its business as now being conducted in the U.S. Virgin Islands and each jurisdiction in which it conducts business. AAMC is qualified to do business in any other state wherein non-qualification could reasonably be expected to have a material adverse effect on AAMC or its operations. (b) Authority. AAMC has the right, power, and all authority, approval, and capacity to enter into, execute, and deliver this Note and to perform its obligations under this Note. This Note has been duly executed and delivered and has been duly authorized by AAMC, and constitutes the legal, valid, and binding obligation of AAMC, enforceable against AAMC in accordance with its terms. (c) Approvals. No permit, consent, approval, authorization of, declaration to, or filing with any court, governmental agency, or third party is required in connection with the execution, delivery, and performance of this Note by AAMC, except as have already been obtained or accomplished. (d) No Conflicts. The execution and delivery of this Note, the performance of this Note, and the compliance with the provisions of this Note by AAMC, will not violate, conflict with, or result in any breach of any terms, conditions or provisions of, or constitute a default under, or require any consent or notice under, any organizational document, loan agreement, indenture, lease, agreement, Indebtedness, restrictive legend, or other instrument to which AAMC is a party or by which it or any of its properties are bound or any decree, judgment, order, statute, rule, or regulation applicable to it. 5. COVENANTS AAMC covenants that so long as any liabilities (whether direct or contingent, liquidated or unliquidated) under this Note remain outstanding, and until payment and performance in full of all of the obligations under this Note: (a) Punctual Payments. AAMC shall punctually pay all principal, interest, fees or other liabilities due under this Note at the times and place and in the manner specified herein and therein. (b) Conduct of Business. AAMC shall: (i) preserve and maintain its legal existence; (ii) preserve and maintain all of its required material rights, privileges, and licenses (other than: (A) such requirements of the USVI Economic Development Commission of AAMC for the sole purpose of obtaining tax benefits; or (B) as required by the terms of the Non-exclusive Patent and Technology License Agreement between System73 Limited and AAMC dated as of October 6, 2023 (the “PTL Agreement”)); (iii) comply with the requirements of all applicable laws, rules, regulations, and orders of governmental or regulatory authorities; (iv) pay and discharge all taxes, assessments, and governmental charges or levies imposed on it or on its income or profits or on any of its property prior to the date on which penalties attach thereto, except for any such tax, assessment, charge, or levy the payment of which is being contested in good faith and by proper proceedings and against which adequate reserves are being maintained; and (v) keep adequate records and books of account, in which complete entries will be made in accordance with generally accepted accounting principles consistently applied.