UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or Section 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

June 11, 2024 ( June 10, 2024)

Battalion Oil Corporation

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-35467 |

|

20-0700684 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

Two

Memorial City Plaza

820 Gessner Road,

Suite 1100

Houston, TX |

|

77043 |

| (Address of principal executive offices) |

|

(Zip Code) |

| |

|

|

|

|

Registrant’s telephone number, including

area code: (832) 538-0300

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| x | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol |

|

Name of each exchange on which registered |

| Common Stock par value $0.0001 |

|

BATL |

|

NYSE American |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 1.01 |

Entry into a Material Definitive Agreement |

Fifth Amendment to Merger Agreement

On June 10, 2024, Battalion Oil Corporation,

a Delaware corporation (the “Company” or “we”), Fury Resources, Inc., a Delaware

corporation (“Parent”), and San Jacinto Merger Sub, Inc., a Delaware corporation and a direct, wholly owned

subsidiary of Parent (“Merger Sub”), entered into a Fifth Amendment (the “Fifth Amendment”)

to the Agreement and Plan of Merger, dated as of December 14, 2023 (the “Merger Agreement”), by and among

the Company, Parent and Merger Sub, as amended by that certain First Amendment to Agreement and Plan of Merger, dated as of January 24,

2024 (the “First Amendment”), the Second Amendment to the Agreement and Plan of Merger, dated as of February 6,

2024 (the “Second Amendment”), the Third Amendment to the Agreement and Plan of Merger, dated as of February 16,

2024 (the “Third Amendment”), and the Fourth Amendment to the Agreement and Plan of Merger, dated as of April 16,

2024 (the “Fourth Amendment”).

On June 10, 2024, at a special meeting of

the Company’s board of directors (the “Board”), the Board approved, upon the recommendation of the Special

Committee of the Board (the “Special Committee”), the Fifth Amendment to provide additional time for Parent

to obtain equity financing to consummate the transactions contemplated by the Merger Agreement.

Pursuant to the Merger Agreement (as amended by

the First Amendment), either Parent or the Company has the right to terminate the Merger Agreement if the transactions contemplated by

the Merger Agreement are not consummated on or before 11:59 p.m. Central Time on June 12, 2024 (the “Termination

Date”). The Fifth Amendment amends the Merger Agreement to extend the Termination Date from 11:59 p.m. Central Time

on June 12, 2024 to 11:59 p.m. Central Time on September 12, 2024.

Except as modified by the Fifth Amendment, the

terms of the Merger Agreement, the First Amendment, the Second Amendment, the Third Amendment and the Fourth Amendment, in the forms filed

as Exhibit 2.1 to the Current Reports on Form 8-K filed by the Company on December 18, 2023, January 24, 2024, February 6,

2024, February 16, 2024 and April 16, 2024, respectively, with the Securities and Exchange Commission (the “SEC”),

are unchanged.

The foregoing descriptions of the Merger Agreement,

the First Amendment, the Second Amendment, the Third Amendment and the Fourth Amendment do not purport to be complete and are qualified

in their entirety by reference to the full text of the Merger Agreement, the First Amendment, the Second Amendment, the Third Amendment

and the Fourth Amendment, which were filed as Exhibit 2.1 to the Current Reports on Form 8-K filed by the Company with the SEC

on December 18, 2023, January 24, 2024, February 6, 2024, February 16, 2024 and April 16, 2024, respectively.

The foregoing description of the Fifth Amendment

does not purport to be complete and is qualified in its entirety by reference to the full text of the Fifth Amendment, which is filed

as Exhibit 2.1 to this Current Report on Form 8-K.

As disclosed in the Company’s

Current Report on Form 8-K filed with the SEC on April 29, 2024, Parent failed to deliver binding contracts (each such contract,

individually, an “Equity Financing Subscription Agreement”) entered into by Parent or its affiliates, which

would provide for equity financing for the transaction that would, when taken together with the aggregate proceeds obtained from other

sources of financing available to Parent, be sufficient for Parent to consummate the transactions contemplated by the Merger Agreement

and pay all related fees and expenses (such financing, the “Sufficient Financing”, and the contracts evidencing

Sufficient Financing, collectively, “Qualifying Additional Financing Documents”) by 5:00 p.m. Central Time

on April 26, 2024 (the “Deadline”). Under the terms of the Merger Agreement, the Company has the right

to terminate the Merger Agreement as a result of Parent’s failure to deliver Qualifying Additional Financing Documents by the Deadline

(the “QAFD Termination Right”).

In addition, as disclosed

in the Company’s Current Report on Form 8-K filed with the SEC on May 3, 2024, as of 7:00 a.m. Central Time on May 3,

2024, Parent had provided the Company with Equity Financing Subscription Agreements evidencing agreements by the financing sources party

thereto to provide an aggregate amount of equity financing to Parent equal to $160 million (the “Existing Equity Financing

Subscriptions”).

As of 7:00 a.m. Central

Time on June 11, 2024, Parent has not yet delivered all of the Qualifying Additional Financing Documents evidencing the Sufficient

Financing and Parent has not delivered to the Company any additional Equity Financing Subscription Agreements other than those representing

the Existing Equity Financing Subscriptions.

The Board and the Special

Committee continue to evaluate the Company’s options in light of the failure to deliver the Qualifying Additional Financing Documents

by the Deadline. While the Company has the ability to exercise the QAFD Termination Right under the terms of the Merger Agreement, the

Board and the Special Committee have determined not to exercise the QAFD Termination Right at this time and to provide Parent additional

time to obtain the Sufficient Financing. The Company continues to reserve all of its rights and remedies under the Merger Agreement and

applicable law.

Important Information for Investors and

Stockholders

This communication is being made in respect of

the proposed transaction involving the Company and Parent. In connection with the proposed transaction, the Company intends to file the

relevant materials with the SEC, including a proxy statement on Schedule 14A and a transaction statement on Schedule 13e-3 (the “Schedule

13e-3”). Promptly after filing its definitive proxy statement with the SEC, the Company will mail the definitive proxy statement

and a proxy card to each stockholder of the Company entitled to vote at the special meeting relating to the proposed transaction. This

communication is not a substitute for the proxy statement, the Schedule 13e-3 or any other document that the Company may file with the

SEC or send to its stockholders in connection with the proposed transaction. The materials to be filed by the Company will be made available

to the Company’s investors and stockholders at no expense to them and copies may be obtained free of charge on the Company’s

website at www.battalionoil.com. In addition, all of those materials will be available at no charge on the SEC’s website at www.sec.gov.

Investors and stockholders of the Company are urged to read the proxy statement, the Schedule 13e-3 and the other relevant materials when

they become available before making any voting or investment decision with respect to the proposed transaction because they contain important

information about the Company and the proposed transaction. The Company and its directors, executive officers, other members of its management

and employees may be deemed to be participants in the solicitation of proxies of the Company stockholders in connection with the proposed

transaction under SEC rules. Investors and stockholders may obtain more detailed information regarding the names, affiliations and interests

of the Company’s executive officers and directors in the solicitation by reading the Company’s Annual Report on Form 10-K

for the fiscal year ended December 31, 2023, and the proxy statement, the Schedule 13e-3 and other relevant materials that will be

filed with the SEC in connection with the proposed transaction when they become available. Information concerning the interests of the

Company’s participants in the solicitation, which may, in some cases, be different than those of the Company’s stockholders

generally, will be set forth in the proxy statement relating to the proposed transaction and the Schedule 13e-3 when they become available.

Forward-Looking Statements

All statements and assumptions in this communication

that do not directly and exclusively relate to historical facts could be deemed “forward-looking statements.” Forward-looking

statements are often identified by the use of words such as “anticipates,” “believes,” “estimates,”

“expects,” “may,” “could,” “should,” “forecast,” “goal,” “intends,”

“objective,” “plans,” “projects,” “strategy,” “target” and “will”

and similar words and terms or variations of such. These statements represent current intentions, expectations, beliefs or projections,

and no assurance can be given that the results described in such statements will be achieved. Forward-looking statements include, among

other things, statements about the potential benefits of the proposed transaction; the prospective performance and outlook of the Company’s

business, performance and opportunities; the ability of the parties to complete the proposed transaction and the expected timing of completion

of the proposed transaction; as well as any assumptions underlying any of the foregoing. Such statements are subject to numerous assumptions,

risks, uncertainties and other factors that could cause actual results to differ materially from those described in such statements, many

of which are outside of the Company’s control. Important factors that could cause actual results to differ materially from those

described in forward-looking statements include, but are not limited to, (i) the risk that the proposed transaction may not be completed

in a timely manner or at all; (ii) the failure to receive, on a timely basis or otherwise, the required approvals of the proposed

transaction by the Company’s stockholders; (iii) the possibility that any or all of the various conditions to the consummation

of the proposed transaction may not be satisfied or waived, including the failure to receive any required regulatory approvals from any

applicable governmental entities (or any conditions, limitations or restrictions placed on such approvals); (iv) the possibility

that competing offers or acquisition proposals for the Company will be made; (v) the occurrence of any event, change or other circumstance

that could give rise to the termination of the definitive transaction agreement relating to the proposed transaction, including in circumstances,

which would require the Company to pay a termination fee; (vi) the effect of the announcement or pendency of the proposed transaction

on the Company’s ability to attract, motivate or retain key executives and employees, its ability to maintain relationships with

its customers, suppliers and other business counterparties, or its operating results and business generally; (vii) risks related

to the proposed transaction diverting management’s attention from the Company’s ongoing business operations; (viii) the

amount of costs, fees and expenses related to the proposed transaction; (ix) the risk that the Company’s stock price may decline

significantly if the Merger is not consummated; (x) the risk of shareholder litigation in connection with the proposed transaction,

including resulting expense or delay; and (xi) other factors as set forth from time to time in the Company’s filings with the

SEC, including its Annual Report on Form 10-K for the fiscal year ended December 31, 2023, as may be updated or supplemented

by any subsequent Quarterly Reports on Form 10-Q or other filings with the SEC. Readers are cautioned not to place undue reliance

on such statements which speak only as of the date they are made. The Company does not undertake any obligation to update or release any

revisions to any forward-looking statement or to report any events or circumstances after the date of this communication or to reflect

the occurrence of unanticipated events except as required by law.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits. The following

exhibits are furnished as part of this Current Report on Form 8-K:

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

BATTALION OIL CORPORATION |

| |

|

| June 11, 2024 |

By: |

/s/

Matthew B. Steele |

| |

Name: |

Matthew B. Steele |

| |

Title: |

Chief Executive Officer |

Exhibit 2.1

EXECUTION VERSION

FIFTH AMENDMENT TO THE AGREEMENT AND PLAN OF

MERGER

THIS

FIFTH AMENDMENT TO THE AGREEMENT AND PLAN OF MERGER is made as of June 10, 2024 (this “Amendment”) by and among

Battalion Oil Corporation, a Delaware corporation (the “Company”), Fury Resources, Inc., a Delaware corporation

(“Parent”), and San Jacinto Merger Sub, Inc., a Delaware corporation (“Merger Sub”).

WHEREAS, the Company, Parent

and Merger Sub are parties to that certain Agreement and Plan of Merger, dated as of December 14, 2023 (the “Agreement”),

which was amended pursuant to that certain First Amendment to the Agreement and Plan of Merger, dated as of January 23, 2024, that

certain Second Amendment to the Agreement and Plan of Merger, dated as of February 6, 2024, that certain Third Amendment to the

Agreement and Plan of Merger, dated as of February 16, 2024, and that certain Fourth Amendment to the Agreement and Plan of Merger,

dated as of April 16, 2024; and

WHEREAS, the Company, Parent

and Merger Sub desire to amend certain terms of the Agreement to the extent provided herein.

NOW,

THEREFORE, in consideration of foregoing and the mutual covenants and agreements contained herein, the parties, intending to be

legally bound, agree as follows:

1. Amendment

to Section 8.1(b). The reference to “June 12, 2024” in Section 8.1(b) of the Agreement is hereby

amended to be “September 12, 2024”.

2. Other

Terms.

a. Interpretation;

Effectiveness. The Agreement shall not be amended or otherwise modified by this Amendment except as set forth in Section 1

of this Amendment. The provisions of the Agreement that have not been amended hereby shall be unchanged and shall remain in full

force and effect. The provisions of the Agreement amended hereby shall remain in full force and effect as amended hereby. The amendments

set forth in herein shall be effective immediately on the date hereof.

b. Reference

to the Agreement. On and after the date hereof, each reference in the Agreement to “this Agreement,” “hereof,”

“herein,” “herewith,” “hereunder” and words of similar import shall, unless otherwise expressly stated,

be construed to refer to the Agreement as amended by this Amendment. No reference to this Amendment need be made in any instrument or

document at any time referring to the Agreement and a reference to the Agreement in any such instrument or document shall, unless otherwise

expressly stated, be deemed to be a reference to the Agreement as amended by this Amendment.

c. Miscellaneous.

The provisions of Sections 9.4 (Counterparts), 9.5 (Interpretation), 9.7 (Governing Law and Venue; Submission to Jurisdiction; Selection

of Forum; Waiver of Trial by Jury), 9.9 (Entire Understanding), 9.12 (Severability) and 9.13 (Construction) of the Agreement are incorporated

herein by reference and form part of this Amendment as if set forth herein, mutatis mutandis.

IN WITNESS WHEREOF, the parties hereto have caused

this Amendment to be executed and delivered as of the date first above written.

| |

BATTALION OIL CORPORATION |

| |

|

| |

By: |

/s/

Matthew Steele |

| |

|

Name: |

Matthew Steele |

| |

|

Title: |

Chief Executive Officer |

[Signature page to

Fifth Amendment to Agreement and Plan of Merger]

| |

FURY RESOURCES, INC. |

| |

|

| |

By: |

/s/

Ariella Fuchs |

| |

|

Name: |

Ariella Fuchs |

| |

|

Title: |

President and General Counsel |

| |

|

| |

SAN JACINTO MERGER SUB, INC. |

| |

|

| |

By: |

/s/

Ariella Fuchs |

| |

|

Name: |

Ariella Fuchs |

| |

|

Title: |

President and General Counsel |

[Signature page to Fifth Amendment to Agreement

and Plan of Merger]

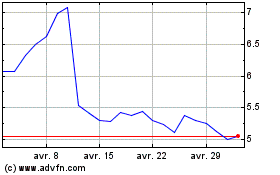

Battalion Oil (AMEX:BATL)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Battalion Oil (AMEX:BATL)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024