Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

03 Mars 2025 - 5:46PM

Edgar (US Regulatory)

Bancroft

Fund

Ltd.

Schedule

of

Investments

—

December

31,

2024

(Unaudited)

Principal

Amount

Market

Value

CONVERTIBLE

CORPORATE

BONDS

—

85.4%

Aerospace

and

Defense

—

1.2%

$

350,000

Rocket

Lab

USA

Inc.,

4.250%,

02/01/29(a)

.............

$

1,769,255

Automotive:

Parts

and

Accessories

—

0.7%

1,000,000

Rivian

Automotive

Inc.,

4.625%,

03/15/29

...............

1,010,375

Business

Services

—

2.3%

1,600,000

Live

Nation

Entertainment

Inc.,

2.875%,

01/15/30(a)

.............

1,614,400

MicroStrategy

Inc.

1,000,000

Zero

Coupon,

12/01/29(a)

.........

805,000

600,000

2.250%,

06/15/32(a)

.............

979,800

3,399,200

Computer

Software

and

Services

—

17.0%

2,875,000

Akamai

Technologies

Inc.,

1.125%,

02/15/29

...............

2,817,640

2,300,000

Alibaba

Group

Holding

Ltd.,

0.500%,

06/01/31(a)(b)

...........

2,450,075

2,000,000

Box

Inc.,

1.500%,

09/15/29(a)

.............

1,952,000

3,000,000

CSG

Systems

International

Inc.,

3.875%,

09/15/28

...............

3,036,000

120,000

Guidewire

Software

Inc.,

1.250%,

11/01/29(a)

.............

117,660

Nutanix

Inc.

1,500,000

0.250%,

10/01/27

...............

1,819,500

400,000

0.500%,

12/15/29(a)

.............

397,400

1,500,000

Pagaya

Technologies

Ltd.,

6.125%,

10/01/29(a)

.............

1,564,500

1,250,000

PagerDuty

Inc.,

1.500%,

10/15/28

...............

1,221,250

1,000,000

Parsons

Corp.,

2.625%,

03/01/29

...............

1,175,500

1,805,000

PROS

Holdings

Inc.,

2.250%,

09/15/27

...............

1,728,287

900,000

Snowflake

Inc.,

Zero

Coupon,

10/01/29(a)

.........

1,071,900

700,000

Varonis

Systems

Inc.,

1.000%,

09/15/29(a)

.............

662,375

4,156,000

Veritone

Inc.,

1.750%,

11/15/26

...............

1,702,005

900,000

Vertex

Inc.,

0.750%,

05/01/29(a)

.............

1,427,419

1,500,000

Workiva

Inc.,

1.250%,

08/15/28

...............

1,593,375

24,736,886

Principal

Amount

Market

Value

Consumer

Services

—

1.6%

$

2,140,000

Uber

Technologies

Inc.,

Ser.

2028,

0.875%,

12/01/28

...............

$

2,364,700

Diversified

Industrial

—

1.7%

1,500,000

Enovix

Corp.,

3.000%,

05/01/28(a)

.............

1,485,312

1,000,000

PureCycle

Technologies

Inc.,

7.250%,

08/15/30

...............

929,005

2,414,317

Energy

and

Utilities

—

20.0%

4,288,000

Array

Technologies

Inc.,

1.000%,

12/01/28

...............

3,135,600

2,000,000

Bloom

Energy

Corp.,

3.000%,

06/01/28

...............

2,765,000

2,000,000

CMS

Energy

Corp.,

3.375%,

05/01/28

...............

2,081,000

350,000

Fluence

Energy

Inc.,

2.250%,

06/15/30(a)

.............

362,600

2,000,000

Fluor

Corp.,

1.125%,

08/15/29

...............

2,523,000

1,700,000

Kosmos

Energy

Ltd.,

3.125%,

03/15/30(a)

.............

1,464,125

3,000,000

Nabors

Industries

Inc.,

1.750%,

06/15/29

...............

2,184,300

3,000,000

Northern

Oil

&

Gas

Inc.,

3.625%,

04/15/29

...............

3,522,750

2,000,000

Ormat

Technologies

Inc.,

2.500%,

07/15/27

...............

1,971,000

3,000,000

PPL

Capital

Funding

Inc.,

2.875%,

03/15/28

...............

3,140,250

1,300,000

Sunnova

Energy

International

Inc.,

2.625%,

02/15/28

...............

494,204

2,500,000

TXNM

Energy

Inc.,

5.750%,

06/01/54(a)

.............

2,906,723

2,450,000

WEC

Energy

Group

Inc.,

4.375%,

06/01/29(a)

.............

2,649,675

29,200,227

Entertainment

—

1.0%

1,810,000

fuboTV

Inc.,

3.250%,

02/15/26

...............

1,411,800

Financial

Services

—

7.3%

900,000

Cleanspark

Inc.,

Zero

Coupon,

06/15/30(a)

.........

751,394

2,000,000

Galaxy

Digital

Holdings

LP,

2.500%,

12/01/29(a)

.............

1,932,600

3,000,000

Global

Payments

Inc.,

1.500%,

03/01/31(a)

.............

2,952,000

750,000

HCI

Group

Inc.,

4.750%,

06/01/42

...............

1,160,250

Bancroft

Fund

Ltd.

Schedule

of

Investments

(Continued)

—

December

31,

2024

(Unaudited)

Principal

Amount

Market

Value

CONVERTIBLE

CORPORATE

BONDS

(Continued)

Financial

Services

(Continued)

$

1,150,000

MARA

Holdings

Inc.,

2.125%,

09/01/31(a)

.............

$

1,236,250

1,500,000

SoFi

Technologies

Inc.,

1.250%,

03/15/29

...............

2,652,000

10,684,494

Health

Care

—

13.1%

3,000,000

Amphastar

Pharmaceuticals

Inc.,

2.000%,

03/15/29

...............

2,806,800

2,000,000

ANI

Pharmaceuticals

Inc.,

2.250%,

09/01/29(a)

.............

2,030,000

1,000,000

Enovis

Corp.,

3.875%,

10/15/28

...............

1,061,000

1,625,000

Evolent

Health

Inc.,

3.500%,

12/01/29

...............

1,382,225

2,250,000

Exact

Sciences

Corp.,

2.000%,

03/01/30

...............

2,318,625

1,200,000

Halozyme

Therapeutics

Inc.,

1.000%,

08/15/28

...............

1,297,097

940,000

Invacare

Corp.,

Escrow,

Zero

Coupon,

05/08/28(c)

.........

0

2,150,000

Jazz

Investments

I

Ltd.,

3.125%,

09/15/30(a)

.............

2,324,150

1,250,000

Pacira

BioSciences

Inc.,

2.125%,

05/15/29(a)

.............

1,078,125

3,400,000

Sarepta

Therapeutics

Inc.,

1.250%,

09/15/27

...............

3,741,700

1,000,000

TransMedics

Group

Inc.,

1.500%,

06/01/28

...............

1,035,122

19,074,844

Metals

and

Mining

—

2.2%

1,100,000

Centrus

Energy

Corp.,

2.250%,

11/01/30(a)

.............

1,045,660

2,150,000

MP

Materials

Corp.,

3.000%,

03/01/30(a)

.............

2,223,960

3,269,620

Real

Estate

Investment

Trusts

—

3.9%

2,350,000

Digital

Realty

Trust

LP,

1.875%,

11/15/29(a)

.............

2,432,250

3,000,000

Redfin

Corp.,

0.500%,

04/01/27

...............

2,328,900

1,000,000

Redwood

Trust

Inc.,

7.750%,

06/15/27

...............

983,971

5,745,121

Security

Software

—

3.1%

4,350,000

Cardlytics

Inc.,

4.250%,

04/01/29(a)

.............

2,454,639

Principal

Amount

Market

Value

$

2,175,000

Rapid7

Inc.,

1.250%,

03/15/29

...............

$

2,067,664

4,522,303

Semiconductors

—

9.1%

indie

Semiconductor

Inc.

3,000,000

4.500%,

11/15/27

...............

2,746,500

500,000

3.500%,

12/15/29(a)

.............

522,750

2,500,000

MKS

Instruments

Inc.,

1.250%,

06/01/30(a)

.............

2,432,500

3,000,000

ON

Semiconductor

Corp.,

0.500%,

03/01/29

...............

2,835,750

3,150,000

OSI

Systems

Inc.,

2.250%,

08/01/29(a)

.............

3,407,985

3,125,000

Wolfspeed

Inc.,

1.875%,

12/01/29

...............

1,310,625

13,256,110

Telecommunications

—

1.2%

1,700,000

Applied

Digital

Corp.,

2.750%,

06/01/30(a)

.............

1,771,556

TOTAL

CONVERTIBLE

CORPORATE

BONDS

....................

124,630,808

Shares

CONVERTIBLE

PREFERRED

STOCKS

—

0.4%

Business

Services

—

0.0%

809,253

Amerivon

Holdings

LLC,

4.000%(c)

....................

0

272,728

Amerivon

Holdings

LLC,

common

equity

units

(c)

..........................

3

3

Health

Care

—

0.4%

28,911

Invacare

Holdings

Corp.,

Ser.

A,

9.000%

......................

636,042

TOTAL

CONVERTIBLE

PREFERRED

STOCKS

...................

636,045

MANDATORY

CONVERTIBLE

SECURITIES(d)

—

11.5%

Aerospace

and

Defense

—

1.0%

25,050

The

Boeing

Co.,

6.000%,

10/15/27

...............

1,525,294

Computer

Software

and

Services

—

1.2%

27,000

Hewlett

Packard

Enterprise

Co.,

7.625%,

09/01/27

...............

1,693,170

Diversified

Industrial

—

1.6%

33,600

Chart

Industries

Inc.,

Ser.

B,

6.750%,

12/15/25

...............

2,368,128

Bancroft

Fund

Ltd.

Schedule

of

Investments

(Continued)

—

December

31,

2024

(Unaudited)

(a)

Securities

exempt

from

registration

under

Rule

144A

of

the

Securities

Act

of

1933,

as

amended.

These

securities

may

be

resold

in

transactions

exempt

from

registration,

normally

to

qualified

institutional

buyers.

(b)

At

December

31,

2024,

the

Fund

held

an

investment

in

a

restricted

and

illiquid

security

amounting

to

$2,450,075

or

1.68%

of

total

investments,

which

was

valued

under

methods

approved

by

the

Board

of

Trustees

as

follows:

(c)

Security

is

valued

using

significant

unobservable

inputs

and

is

classified

as

Level

3

in

the

fair

value

hierarchy.

(d)

Mandatory

convertible

securities

are

required

to

be

converted

on

the

dates

listed;

they

generally

may

be

converted

prior

to

these

dates

at

the

option

of

the

holder.

†

Non-income

producing

security.

††

Represents

annualized

yields

at

dates

of

purchase.

Shares

Market

Value

MANDATORY

CONVERTIBLE

SECURITIES(d)

(Continued)

Energy

and

Utilities

—

2.9%

44,000

NextEra

Energy

Inc.,

7.234%,

11/01/27

...............

$

2,006,400

44,800

PG&E

Corp.,

Ser.

A,

6.000%,

12/01/27

...............

2,230,592

4,236,992

Financial

Services

—

1.8%

47,000

Ares

Management

Corp.,

Ser.

B,

6.750%,

10/01/27

...............

2,586,880

Health

Care

—

1.3%

30,000

BrightSpring

Health

Services

Inc.,

6.750%,

02/01/27

...............

1,878,000

Specialty

Chemicals

—

1.7%

60,000

Albemarle

Corp.,

7.250%,

03/01/27

...............

2,441,400

TOTAL

MANDATORY

CONVERTIBLE

SECURITIES

................

16,729,864

COMMON

STOCKS

—

0.0%

Health

Care

—

0.0%

12,938

Invacare

Holdings

Corp.†(c)

..........

0

Principal

Amount

U.S.

GOVERNMENT

OBLIGATIONS

—

2.7%

$

3,977,000

U.S.

Treasury

Bills,

4.264%

to

4.273%††,

03/13/25

to

03/20/25

......................

3,943,376

TOTAL

INVESTMENTS

—

100.0%

....

(Cost

$148,248,165)

.............

$

145,940,093

Acquisition

Principal

Amount

Issuer

Acquisition

Dates

Acquisition

Cost

12/31/24

Carrying

Value

Per

Bond

$2,300,000

Alibaba

Group

Holding

Ltd.,

0.500%,

06/01/31

05/23/2024-

11/26/2024

$2,482,786

$106.5250

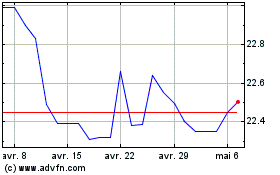

Bancroft (AMEX:BCV-A)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

Bancroft (AMEX:BCV-A)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025