BM Technologies, Inc. (NYSE American: BMTX) (the “Company”), one of

the largest digital banking platforms and Banking-as-a-Service

(BaaS) providers, today reported preliminary first quarter results

for the three months ended March 31, 2022.

The company expects to report EBITDA[1] in excess of $8 million

for the quarter, which exceeds the consensus estimate, and strong

revenues of approximately $25 million. The Company recently

executed a term sheet with a significant new BaaS partner and

expects to finalize a contract over the next approximately 90 days

and provide details over the next few quarters.

PRELIMINARY FIRST QUARTER FINANCIAL AND BUSINESS

HIGHLIGHTS:

- Total revenue of approximately $25 million.

- Net income expected to exceed $2.5 million, which includes $2.9

million of non-cash, share-based compensation expense, $0.3 million

of merger costs, and a $1.7 million gain on the private warrant

liability.

- Core 1Q 2022 EBITDA expected to exceed $8 million, beating the

consensus estimate.

- The Company recently executed a term sheet with a significant

new Banking-as-a-Service (BaaS) partner.

- Average serviced deposits totaled $2.1 billion in Q1 2022; a

60% increase compared to Q1 2021. Average new business serviced

deposits increased $0.7 billion, or 102% compared to Q1 2021 to

$1.5 billion.

- Debit card spend was $0.8 billion in Q1 2022, slightly below Q1

2021’s government stimulus driven peak. New business debit card

spend increased 5% compared to Q1 2021.

- Revenue per 90-day active account increased 20% year over year

to approximately $54 in Q1 2022.

- Approximately 115 thousand new accounts were opened in Q1

2022.

- BMTX has signed agreements with six new colleges and

universities year to date in 2022, providing over 40,000 additional

students access to BankMobile Disbursements and the BankMobile Vibe

checking account. In addition, BMTX has signed four colleges and

universities to its new Vendor Pay offering in 2022, and its first

Vendor Pay school recently went live.

- Our pending merger with First Sound Bank (“FSB”) is on track;

the merger application has been filed and integration plans with

First Sound Bank are ongoing. The merger is expected to close

before year-end.

- The Company had a cash balance in excess of $30 million at

March 31, 2022.

[1] Core EBITDA is a non-GAAP metric that adjusts net income to

exclude interest, tax, depreciation and amortization, non-cash

share-based compensation expense, and non-core items.

In the first quarter of 2022 there is approximately $3

million of depreciation and amortization, $3 million of non-cash

share-based compensation expense, a $2 million gain on the private

warrant liability, $1 million of tax and $0.3 million of merger

costs.

Commenting on the preliminary results, Luvleen Sidhu, BMTX’s

Chair and Chief Executive Officer said, “Coming off of record

results in 2021, we are excited by the continuing momentum in 2022

including the signing of a term sheet with a significant

banking-as-a-service partner. We are actively working towards

completion of our merger with FSB which we expect to close in the

second half of this year. We believe the merger will provide

significant benefits to our combined company in 2023 and beyond.

Additionally, the company exceeded consensus estimates for EBITDA

and finished the quarter strong with revenues of approximately $25

million and EBITDA exceeding $8 million in the first quarter. We

also continue to expect to meet or exceed current consensus EBITDA

estimates.”

On May 10, the company filed its 2021 annual report on form 10K.

At the direction of the Audit Committee, the company has launched

an RFP process to identify a new independent accounting firm. The

company is actively engaged in this process and expects formal

written proposals from several firms based on conversations to

date. The company plans to release full first quarter financials

and file its first quarter 2022 10Q after a new independent

accounting firm is engaged and that firm has performed its first

quarter 2022 review. Additionally, the company is proud to announce

the expansion of its Board with the naming of John Dolan as a new

Director. Mr. Dolan will also serve as chairperson of the

Audit Committee. As a former community bank CEO and CFO, Mr. Dolan

brings to the Board extensive financial and regulatory

expertise.

The Company intends to announce the date and time of its first

quarter earnings conference call in a subsequent press release.

About BM Technologies, Inc.

BM Technologies, Inc. (NYSE American: BMTX)—formerly known as

BankMobile—is among the largest digital banking platforms and

Banking-as-a-Service (BaaS) providers in the country, providing

access to checking and savings accounts, personal loans, credit

cards, and financial wellness. It is focused on technology,

innovation, easy-to-use products, and education with the mission to

financially empower millions of Americans by providing a more

affordable, transparent, and consumer-friendly banking experience.

The BM Technologies (BMTX) digital banking platform employs a

multi-partner distribution model, known as "Banking-as-a-Service"

(BaaS), that enables the acquisition of customers at higher volumes

and substantially lower expense than traditional banks, while

providing significant benefits to its customers, partners, and

business. BM Technologies (BMTX) currently has approximately two

million accounts and provides disbursement services at

approximately 750 college and university campuses (covering one out

of every three college students in the U.S.). BM Technologies, Inc.

(BMTX) is a technology company and is not a bank, which means it

provides banking services through its partner bank. More

information can also be found at www.bmtx.com.

BMTX recently announced the signing of a definitive agreement to

merge with First Sound Bank, a Seattle, Washington-based

business bank. The combined company, to be named BMTX Bank, will be

a fintech-based bank focused on serving customers digitally

nationwide. The transaction is subject to regulatory approvals and

other customary closing conditions and is expected to close in the

second half of 2022.

Non-GAAP Financial Measures

This press release, including the accompanying financial

statement tables, contains financial information determined by

methods other than in accordance with generally accepted accounting

principles, or GAAP. This financial information includes certain

operating performance measures, such as EBITDA and core EBITDA.

These non-GAAP measures are included because the Company believes

they may provide useful supplemental information for evaluating the

Company’s underlying performance trends. These measures should be

viewed in addition to, and not as an alternative to or substitute

for, measures determined in accordance with GAAP, and are not

necessarily comparable to non-GAAP measures that may be presented

by other companies. To the extent applicable, reconciliations of

these non-GAAP measures to the most directly comparable measures as

reported in accordance with GAAP are included in footnote 1 of this

document.

FORWARD LOOKING STATEMENTS

This press release contains “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. In general, forward-looking statements usually may be

identified through use of words such as “may,” “believe,” “expect,”

“anticipate,” “intend,” “will,” “should,” “plan,” “estimate,”

“predict,” “continue” and “potential” or the negative of these

terms or other comparable terminology, and include statements

related to the expected finalization of a contract with a potential

BaaS partner, completion date of the FSB merger and the expected

benefits to the Company of that merger. Forward-looking statements

are not historical facts and represent management’s beliefs, based

upon information available at the time the statements are made,

with regard to the matters addressed; they are not guarantees of

future performance. Actual results may prove to

be materially different from the results expressed or implied

by the forward-looking statements. Forward-looking statements

are subject to numerous assumptions, risks and uncertainties that

change over time and could cause actual results or financial

condition to differ materially from those expressed in or implied

by such statements.

Factors that could cause or contribute to such differences

include, but are not limited to (1) the risk that we are unable to

finalize a contract with the proposed BaaS partner, (2) the

occurrence of any event, change or other circumstances (including

the failure of closing conditions) that could give rise to a delay

in closing the FSB merger or the termination of the merger

agreement, (3) the failure to obtain the necessary approval by the

shareholders of the Company and FSB, (4) the inability to obtain

required governmental approvals of the FSB merger, (5) the

possibility that the costs, fees, expenses and charges related to

the FSB merger may be greater than anticipated, (6) reputational

risk and the reaction of the companies’ customers, suppliers,

employees or other business partners to the merger of the Company

and FSB, (7) the risks relating to the integration of the Company’s

and FSB’s operations, including the risk that such integration will

be materially delayed or will be more costly or difficult than

expected, (8) the risk of potential litigation or regulatory action

related to the merger of the Company and FSBs, Further

information regarding additional factors which could affect the

forward-looking statements contained in this press release can be

found in the cautionary language included under the headings

“Cautionary Note Regarding Forward-Looking Statements” and “Risk

Factors” in the Company’s Annual Report on Form 10-K for the year

ended December 31, 2021, and other documents subsequently filed by

United with the United States Securities and Exchange Commission

(“SEC”).

Many of these factors are beyond the Company’s (and in the case

of the prospective merger with FSB, FSB’s) ability to control or

predict. If one or more events related to these or other risks or

uncertainties materialize, or if the underlying assumptions prove

to be incorrect, actual results may differ materially from the

forward-looking statements. Accordingly, shareholders and investors

should not place undue reliance on any such forward-looking

statements. Any forward-looking statement speaks only as of the

date of this communication, and the Company undertakes no

obligation to update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise,

except as required by law. New risks and uncertainties may emerge

from time to time, and it is not possible for the Company or FSB to

predict their occurrence or how they will affect the Company or

FSB.

The Company qualifies all forward-looking statements by these

cautionary statements.

Important Information About the Proposed Merger and Where to

Find It

This communication is being made in respect of the proposed

Merger involving the Company. In connection with the Merger

described herein, the Company will file relevant materials with the

SEC, including a definitive proxy statement for the Company’s

shareholders. Promptly after filing the definitive proxy statement

with the SEC, the Company will mail the proxy statement and a proxy

card to each shareholder entitled to vote at the special meeting

relating to the transactions. INVESTORS AND SECURITY HOLDERS ARE

URGED TO READ THESE MATERIALS (INCLUDING ANY AMENDMENTS OR

SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT DOCUMENTS IN CONNECTION

WITH THE TRANSACTIONS THAT BMTX WILL FILE WITH THE SEC WHEN THEY

BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION

ABOUT THE COMPANY, FSB AND THE TRANSACTIONS. The preliminary proxy

statement, the definitive proxy statement and other relevant

materials in connection with the transactions (when they become

available), and any other documents filed by the Company with the

SEC, may be obtained free of charge at the SEC’s website

(www.sec.gov) or by writing to BM Technologies, Inc. at 201 King of

Prussia Road, Suite 350, Wayne, PA 19087.

Participants in Solicitation

The Company and FSB and their respective directors, executive

officers and employees and other persons may be deemed to be

participants in the solicitation of proxies from the holders of the

Company common stock in respect of the proposed transactions.

Information about the Company’s directors and executive officers

and their ownership of the Company’s common stock is set forth in

the Company’s definitive proxy materials filed with the SEC in

connection with its prospective 2022 annual meeting of shareholders

scheduled to take place on June 15, 2022, filed with the SEC on May

2, 2022, as those materials may be amended or supplemented. Other

information regarding the interests of the participants in the

proxy solicitation will be included in the proxy statement

pertaining to the proposed transactions when it becomes available.

These documents can be obtained free of charge from the sources

indicated above.

Investors: Bob Ramsey, CFA

BM Technologies, Inc.

571-236-8851

rramsey@bmtx.com

Media Inquiries: Brigit Hennaman

Rubenstein Public Relations

212-805-3005

bhennaman@rubensteinpr.com

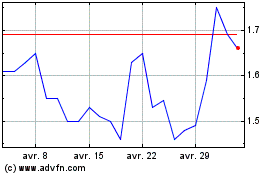

BM Technologies (AMEX:BMTX)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

BM Technologies (AMEX:BMTX)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024