UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

☒

Quarterly report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

for the quarterly period ended September 30,

2024.

OR

☐

Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

for the transition period from _______ to _______.

Commission File Number: 001-36851

Amplify Commodity Trust

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | | 36-4793446 |

(State or Other Jurisdiction of

Incorporation or Organization) | | (I.R.S. Employer

Identification No.) |

| 3333 Warrenville Road Suite 350, Lisle, IL | | 60532 |

| (Address of Principal Executive Offices) | | (Zip Code) |

855-267-3837

(Registrant’s Telephone Number, Including

Area Code)

N/A

(Former Name, Former Address and Former Fiscal

Year, if Changed Since Last Report)

Securities Registered Pursuant to Section 12(b)

of the Act:

| Title of Each Class | | Trading Symbol(s) | | Name Of Each Exchange On Which Registered |

| Shares of Breakwave Dry Bulk Shipping ETF | | BDRY | | NYSE Arca, Inc. |

| Shares of Breakwave Tanker Shipping ETF | | BWET | | NYSE Arca, Inc. |

Indicate by check mark whether the registrant

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months

(or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days. ☒ Yes ☐

No

Indicate by check mark whether the registrant

has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405

of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒

Yes ☐ No

Indicate by check mark whether the

registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company or an emerging

growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller

reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| Emerging growth company | ☐ | | |

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided in Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant

is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐

Yes ☒ No

Securities Registered Pursuant to Section 12(b)

of the Act:

The registrant

had 2,525,040 outstanding shares as of November 1, 2024. (BDRY)

The registrant

had 150,100 outstanding shares as of November 1, 2024. (BWET)

AMPLIFY COMMODITY TRUST

Table of Contents

Part I.

INTERIM FINANCIAL INFORMATION

Item 1. Interim Financial Statements.

Item 1. Interim Financial Statements.

Index

to Interim Financial Statements

| Documents |

|

Page |

| Combined

Statements of Assets and Liabilities at September 30, 2024 (Unaudited) |

|

2 |

| |

|

|

| Combined

Statements of Assets and Liabilities at June 30, 2024 |

|

3 |

| |

|

|

| Combined

Schedules of Investments at September 30, 2024 (Unaudited) |

|

4 |

| |

|

|

| Combined

Schedules of Investments at June 30, 2024 |

|

5 |

| |

|

|

| Combined

Statements of Operations (Unaudited) for the three months ended September 30, 2024 |

|

6 |

| |

|

|

| Combined

Statements of Operations (Unaudited) for the three months ended September 30, 2023 |

|

7 |

| |

|

|

| Combined

Statements of Changes in Net Assets (Unaudited) for the three months ended September 30, 2024 |

|

8 |

| |

|

|

| Combined

Statements of Changes in Net Assets (Unaudited) for the three months ended September 30, 2023 |

|

9 |

| |

|

|

| Combined

Statements of Cash Flows (Unaudited) for the three months ended September 30, 2024 |

|

10 |

| |

|

|

| Combined

Statements of Cash Flows (Unaudited) for the three months ended September 30, 2023 |

|

11 |

| |

|

|

| Notes to

Interim Combined Financial Statements |

|

12 |

AMPLIFY COMMODITY TRUST

Combined Statements of Assets and Liabilities

September 30, 2024 (Unaudited)

| | |

BREAKWAVE | | |

BREAKWAVE | | |

| |

| | |

DRY BULK

SHIPPING | | |

TANKER

SHIPPING | | |

| |

| | |

ETF | | |

ETF | | |

COMBINED | |

| Assets | |

| | |

| | |

| |

| Investment in securities, at fair value (cost $2,699,007 and $1,766,006, respectively) | |

$ | 2,699,007 | | |

$ | 1,766,006 | | |

$ | 4,465,013 | |

Segregated cash held by broker* | |

| 22,095,032 | | |

| 1,450,342 | | |

| 23,545,374 | |

| Due from Sponsor | |

| - | | |

| 19,235 | | |

| 19,235 | |

| Interest receivable | |

| 78,098 | | |

| 10,091 | | |

| 88,189 | |

| Total assets | |

| 24,872,137 | | |

| 3,245,674 | | |

| 28,117,811 | |

| Liabilities | |

| | | |

| | | |

| | |

| Due to Sponsor | |

| 2,029 | | |

| - | | |

| 2,029 | |

| Payable on open futures contracts | |

| 21,605 | | |

| - | | |

| 21,605 | |

| Unrealized depreciation on futures contracts | |

| 84,620 | | |

| 150,358 | | |

| 234,978 | |

| Other accrued expenses | |

| 389,030 | | |

| 124,594 | | |

| 513,624 | |

| Total liabilities | |

| 497,284 | | |

| 274,952 | | |

| 772,236 | |

| | |

| | | |

| | | |

| | |

| Net

Assets | |

$ | 24,374,853 | | |

$ | 2,970,722 | | |

$ | 27,345,575 | |

| Net Assets Consist Of: | |

| | | |

| | | |

| | |

| Paid-in Capital | |

$ | (12,815,801 | ) | |

$ | 2,458,061 | | |

$ | (10,357,740 | ) |

| Total Distributable Earnings (Accumulated Deficit) | |

| 37,190,654 | | |

| 512,661 | | |

| 37,703,315 | |

| Net Assets | |

$ | 24,374,853 | | |

$ | 2,970,722 | | |

$ | 27,345,575 | |

| | |

| | | |

| | | |

| | |

Shares outstanding (unlimited authorized) | |

| 2,275,040 | | |

| 200,100 | | |

| | |

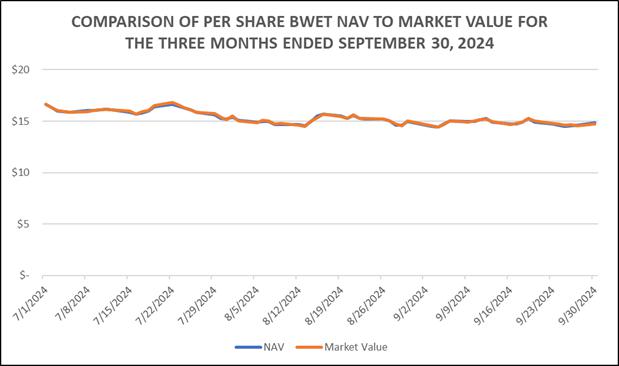

| Net asset value per share | |

$ | 10.71 | | |

$ | 14.85 | | |

| | |

| Market value per share | |

$ | 10.74 | | |

$ | 14.76 | | |

| | |

| * Required margin held as collateral

for open futures contracts | |

$ | 5,800,659 | | |

$ | 530,440 | | |

$ | 6,331,099 | |

See accompanying notes to unaudited interim combined

financial statements.

AMPLIFY COMMODITY TRUST

Combined Statements of Assets and Liabilities

June 30, 2024

| | |

BREAKWAVE

DRY BULK

SHIPPING | | |

BREAKWAVE

TANKER SHIPPING | | |

| |

| | |

ETF | | |

ETF | | |

COMBINED | |

| Assets | |

| | |

| | |

| |

| Investment in securities, at fair value (cost $8,348,195 and $1,029,920, respectively) | |

$ | 8,348,195 | | |

$ | 1,029,920 | | |

$ | 9,378,115 | |

| Segregated cash held by broker | |

| 31,739,612 | | |

| 1,243,877 | | |

| 32,983,489 | |

| Due from Sponsor | |

| - | | |

| 22,674 | | |

| 22,674 | |

| Interest receivable | |

| 119,526 | | |

| 4,504 | | |

| 124,030 | |

| Total assets | |

| 40,207,333 | | |

| 2,300,975 | | |

| 42,508,308 | |

| Liabilities | |

| | |

| | | |

| | |

| Due to Sponsor | |

| 36,204 | | |

| - | | |

| 36,204 | |

| Payable on open futures contracts | |

| 788,675 | | |

| 115,880 | | |

| 904,555 | |

| Other accrued expenses | |

| 269,300 | | |

| 97,278 | | |

| 366,578 | |

| Total liabilities | |

| 1,094,179 | | |

| 213,158 | | |

| 1,307,337 | |

| | |

| | | |

| | | |

| | |

| Net Assets | |

$ | 39,113,154 | | |

$ | 2,087,817 | | |

$ | 41,200,971 | |

| | |

| | | |

| | | |

| | |

| Net Assets Consist Of: | |

| | | |

| | | |

| | |

| Paid-in Capital | |

$ | (2,296,733 | ) | |

$ | 1,239,493 | | |

$ | (1,057,240 | ) |

| Total Distributable Earnings (Accumulated Deficit) | |

| 41,409,887 | | |

| 848,324 | | |

| 42,258,211 | |

| Net Assets | |

$ | 39,113,154 | | |

$ | 2,087,817 | | |

$ | 41,200,971 | |

| | |

| | | |

| | | |

| | |

Shares outstanding (unlimited authorized) | |

| 3,225,040 | | |

| 125,100 | | |

| | |

| Net asset value per share | |

$ | 12.13 | | |

$ | 16.69 | | |

| | |

| Market value per share | |

$ | 12.24 | | |

$ | 16.79 | | |

| | |

See accompanying notes to combined financial statements.

AMPLIFY COMMODITY TRUST

Combined Schedules of Investments

September 30, 2024 (Unaudited)

| | |

BREAKWAVE | | |

BREAKWAVE | | |

| |

| | |

DRY BULK SHIPPING

ETF | | |

TANKER SHIPPING

ETF | | |

COMBINED | |

| MONEY MARKET FUNDS - 11.1% and 59.4%, respectively | |

| | |

| | |

| |

| Invesco Government & Agency Portfolio - Institutional Class, 4.85% (a) (2,699,007 and 1,766,006 shares, respectively) | |

$ | 2,699,007 | | |

$ | 1,766,006 | | |

$ | 4,465,013 | |

| TOTAL MONEY MARKET FUNDS (Cost $2,699,007 and 1,766,006, respectively) | |

| 2,699,007 | | |

| 1,766,006 | | |

| 4,465,013 | |

| | |

| | | |

| | | |

| | |

| Total Investments (Cost $2,699,007 and $1,766,006, respectively) – 11.1% and 59.4%, respectively | |

| 2,699,007 | | |

| 1,766,006 | | |

| 4,465,013 | |

| Other Assets in Excess of Liabilities - 88.9% and 40.6%, respectively (b) | |

| 21,675,846 | | |

| 1,204,716 | | |

| 22,880,562 | |

| TOTAL NET ASSETS - 100.0% and 100.0%, respectively | |

$ | 24,374,853 | | |

$ | 2,970,722 | | |

$ | 27,345,575 | |

| BREAKWAVE DRY BULK SHIPPING ETF | | Unrealized | | | AMPLIFY | |

| Futures Contracts | | Appreciation/ | | | COMMODITY | |

| September 30, 2024 (Unaudited) | | (Depreciation) | | | TRUST | |

| Baltic Exchange Capesize T/C Average Shipping Route Index Expiring October 31, 2024 (Underlying Face Amount at Market Value - $4,456,480) (140 contracts) | | $ | 562,980 | | | $ | 562,980 | |

| Baltic Exchange Capesize T/C Average Shipping Route Index Expiring November 30, 2024 (Underlying Face Amount at Market Value - $4,036,060) (140 contracts) | | | 142,560 | | | | 142,560 | |

| Baltic Exchange Capesize T/C Average Shipping Route Index Expiring December 31, 2024 (Underlying Face Amount at Market Value - $3,892,560) (140 contracts) | | | (940 | ) | | | (940 | ) |

| Baltic Exchange Panamax T/C Average Shipping Route Index Expiring October 31, 2024 (Underlying Face Amount at Market Value - $3,043,250) (235 contracts) | | | (379,250 | ) | | | (379,250 | ) |

| Baltic Exchange Panamax T/C Average Shipping Route Index Expiring November 30, 2024 (Underlying Face Amount at Market Value - $3,257,335) (235 contracts) | | | (165,165 | ) | | | (165,165 | ) |

| Baltic Exchange Panamax T/C Average Shipping Route Index Expiring December 31, 2024 (Underlying Face Amount at Market Value - $3,212,685) (235 contracts) | | | (209,815 | ) | | | (209,815 | ) |

| Baltic Exchange Supramax T/C Average Shipping Route Expiring October 31, 2024 (Underlying Face Amount at Market Value - $803,440) (55 contracts) | | | (7,810 | ) | | | (7,810 | ) |

| Baltic Exchange Supramax T/C Average Shipping Route Expiring November 30, 2024 (Underlying Face Amount at Market Value - $798,435) (55 contracts) | | | (12,815 | ) | | | (12,815 | ) |

| Baltic Exchange Supramax T/C Average Shipping Route Expiring December 31, 2024 (Underlying Face Amount at Market Value - $775,280) (55 contracts) | | | (35,970 | ) | | | (35,970 | ) |

| | | $ | (106,225 | ) | | $ | (106,225 | ) |

| BREAKWAVE TANKER SHIPPING ETF | | Unrealized | | | AMPLIFY | |

| Futures Contracts | | Appreciation/ | | | COMMODITY | |

| September 30, 2024 (Unaudited) | | (Depreciation) | | | TRUST | |

| Baltic Freight Route Middle East Gulf to China Expiring October 31, 2024 (Underlying Face Amount at Market Value - $797,454) (63 contracts) | | $ | (122,529 | ) | | $ | (122,529 | ) |

| Baltic Freight Route Middle East Gulf to China Expiring November 30, 2024 (Underlying Face Amount at Market Value - $897,435) (63 contracts) | | | (22,547 | ) | | | (22,547 | ) |

| Baltic Freight Route Middle East Gulf to China Expiring December 31, 2024 (Underlying Face Amount at Market Value - $939,834) (63 contracts) | | | 19,852 | | | | 19,852 | |

| Baltic Freight Route West Africa to Continent Expiring October 31, 2024 (Underlying Face Amount at Market Value - $75,095) (5 contracts) | | | (14,995 | ) | | | (14,995 | ) |

| Baltic Freight Route West Africa to Continent Expiring November 30, 2024 (Underlying Face Amount at Market Value - $172,740) (10 contracts) | | | (9,585 | ) | | | (9,585 | ) |

| Baltic Freight Route West Africa to Continent Expiring December 31, 2024 (Underlying Face Amount at Market Value - $96,400) (5 contracts) | | | (554 | ) | | | (554 | ) |

| | | $ | (150,358 | ) | | $ | (150,358 | ) |

See accompanying notes to unaudited interim combined

financial statements.

AMPLIFY COMMODITY TRUST

Combined Schedule of Investments

June 30, 2024

| | |

BREAKWAVE

DRY BULK

SHIPPING | | |

BREAKWAVE TANKER SHIPPING | | |

| |

| | |

ETF | | |

ETF | | |

COMBINED | |

| MONEY MARKET FUNDS - 21.3% and 49.3%, respectively | |

| | |

| | |

| |

| Invesco Government & Agency Portfolio - Institutional Class, 5.24% (a) (8,348,195 and 1,029,920 shares, respectively) | |

$ | 8,348,195 | | |

$ | 1,029,920 | | |

$ | 9,378,115 | |

| TOTAL MONEY MARKET FUNDS (Cost $8,348,195 and $1,029,920, respectively) | |

| 8,348,195 | | |

| 1,029,920 | | |

| 9,378,115 | |

| | |

| | | |

| | | |

| | |

| Total Investments (Cost $8,348,195 and $1,029,920, respectively) - 21.3% and 49.3%, respectively | |

| 8,348,195 | | |

| 1,029,920 | | |

| 9,378,115 | |

| Other Assets in Excess of Liabilities - 78.7% and 50.7%, respectively (b) | |

| 30,764,959 | | |

| 1,057,897 | | |

| 31,822,856 | |

| TOTAL NET ASSETS - 100.0% and 100.0%, respectively | |

$ | 39,113,154 | | |

$ | 2,087,817 | | |

$ | 41,200,971 | |

| BREAKWAVE DRY BULK SHIPPING ETF | | Unrealized | | | AMPLIFY | |

| Futures Contracts | | Appreciation/ | | | COMMODITY | |

| June 30, 2024 | | (Depreciation) | | | TRUST | |

| Baltic Exchange Capesize T/C Average Shipping Route Index Expiring July 31, 2024 (Underlying Face Amount at Market Value - $6,807,570) (245 contracts) | | 328,945 | | | 328,945 | |

| Baltic Exchange Capesize T/C Average Shipping Route Index Expiring August 31, 2024 (Underlying Face Amount at Market Value - $6,249,215) (245 contracts) | | | (229,410 | ) | | $ | (229,410 | ) |

| Baltic Exchange Capesize T/C Average Shipping Route Index Expiring September 30, 2024 (Underlying Face Amount at Market Value - $6,383,965) (245 contracts) | | | (94,660 | ) | | | (94,660 | ) |

| Baltic Exchange Panamax T/C Average Shipping Route Index Expiring July 31, 2024 (Underlying Face Amount at Market Value - $4,895,690) (335 contracts) | | | (454,310 | ) | | | (454,310 | ) |

| Baltic Exchange Panamax T/C Average Shipping Route Index Expiring August 31, 2024 (Underlying Face Amount at Market Value - $5,105,065) (335 contracts) | | | (244,935 | ) | | | (244,935 | ) |

| Baltic Exchange Panamax T/C Average Shipping Route Index Expiring September 30, 2024 (Underlying Face Amount at Market Value - $5,334,875) (335 contracts) | | | (15,125 | ) | | | (15,125 | ) |

| Baltic Exchange Supramax T/C Average Shipping Route Expiring July 31, 2024 (Underlying Face Amount at Market Value - $1,273,555) (85 contracts) | | | (33,195 | ) | | | (33,195 | ) |

| Baltic Exchange Supramax T/C Average Shipping Route Expiring August 31, 2024 (Underlying Face Amount at Market Value - $1,281,035) (85 contracts) | | | (25,715 | ) | | | (25,715 | ) |

| Baltic Exchange Supramax T/C Average Shipping Route Expiring September 30, 2024 (Underlying Face Amount at Market Value - $1,286,730) (85 contracts) | | | (20,270 | ) | | | (20,270 | ) |

| | | $ | (788,675 | ) | | $ | (788,675 | ) |

| BREAKWAVE TANKER SHIPPING ETF | | Unrealized | | | AMPLIFY | |

| Futures Contracts | | Appreciation/ | | | COMMODITY | |

| June 30, 2024 | | (Depreciation) | | | TRUST | |

| Baltic Freight Route Middle East Gulf to China Expiring July 31, 2024 (Underlying Face Amount at Market Value - $584,600) (50 contracts) | | $ | (53,469 | ) | | $ | (53,469 | ) |

| Baltic Freight Route Middle East Gulf to China Expiring August 31, 2024 (Underlying Face Amount at Market Value - $592,500) (50 contracts) | | | (45,569 | ) | | | (45,569 | ) |

| Baltic Freight Route Middle East Gulf to China Expiring September 30, 2024 (Underlying Face Amount at Market Value - $622,500) (50 contracts) | | | (15,569 | ) | | | (15,569 | ) |

| Baltic Freight Route West Africa to Continent Expiring July 31, 2024 (Underlying Face Amount at Market Value - $83,710) (5 contracts) | | | (1,232 | ) | | | (1,232 | ) |

| Baltic Freight Route West Africa to Continent Expiring August 31, 2024 (Underlying Face Amount at Market Value - $78,895) (5 contracts) | | | (41 | ) | | | (41 | ) |

| | | $ | (115,880 | ) | | $ | (115,880 | ) |

See accompanying notes to combined financial statements.

AMPLIFY COMMODITY TRUST

Combined Statements of Operations

Three Months Ended September 30, 2024 (Unaudited)

| | |

BREAKWAVE

DRY BULK | | |

BREAKWAVE

TANKER | | |

| |

| | |

SHIPPING

ETF | | |

SHIPPING

ETF | | |

COMBINED | |

| Investment Income | |

| | |

| | |

| |

| Interest | |

$ | 274,416 | | |

$ | 26,431 | | |

$ | 300,847 | |

| | |

| | | |

| | | |

| | |

| Expenses | |

| | | |

| | | |

| | |

| Sponsor fee | |

| 31,507 | | |

| 12,603 | | |

| 44,110 | |

| CTA fee | |

| 108,876 | | |

| 10,193 | | |

| 119,069 | |

| Audit fees | |

| 21,160 | | |

| 13,064 | | |

| 34,224 | |

| Tax preparation fees | |

| 78,297 | | |

| 2,639 | | |

| 80,936 | |

| Admin/accounting/custodian/transfer agent fees | |

| 16,089 | | |

| 15,670 | | |

| 31,759 | |

| Legal fees | |

| 15,732 | | |

| 15,732 | | |

| 31,464 | |

| Chief Compliance Officer fees | |

| 6,256 | | |

| 6,256 | | |

| 12,512 | |

| Principal Financial Officer fees | |

| 6,256 | | |

| 6,256 | | |

| 12,512 | |

| Regulatory reporting fees | |

| 6,256 | | |

| 6,256 | | |

| 12,512 | |

| Brokerage commission fees | |

| 69,277 | | |

| 10,370 | | |

| 79,647 | |

| Distribution fees | |

| 3,937 | | |

| 1,833 | | |

| 5,770 | |

| NJ filing fees | |

| 24,380 | | |

| 920 | | |

| 25,300 | |

| Insurance fees | |

| 1,645 | | |

| 1,645 | | |

| 3,290 | |

| Listing and calculation agent fees | |

| 1,700 | | |

| 1,700 | | |

| 3,400 | |

| Marketing fees | |

| 3,772 | | |

| 3,772 | | |

| 7,544 | |

| Trustee fees | |

| 644 | | |

| 644 | | |

| 1,288 | |

| Printing and postage fees | |

| 12,571 | | |

| 3,794 | | |

| 16,365 | |

| Wholesale support fees | |

| 15,266 | | |

| 4,827 | | |

| 20,093 | |

| Miscellaneous fees | |

| 828 | | |

| 828 | | |

| 1,656 | |

| Total Expenses | |

| 424,449 | | |

| 119,002 | | |

| 543,451 | |

| Less: Waiver of CTA fee | |

| (92,369 | ) | |

| (10,193 | ) | |

| (102,562 | ) |

| Less: Expenses absorbed by Sponsor | |

| - | | |

| (73,835 | ) | |

| (73,835 | ) |

| Net Expenses | |

| 332,080 | | |

| 34,974 | | |

| 367,054 | |

| Net Investment Loss | |

| (57,664 | ) | |

| (8,543 | ) | |

| (66,207 | ) |

| | |

| | | |

| | | |

| | |

| Net Realized and Unrealized Gain (Loss) on Investment Activity | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | |

| Net Realized Loss on | |

| | | |

| | | |

| | |

| Futures contracts | |

| (4,844,019 | ) | |

| (292,642 | ) | |

| (5,136,661 | ) |

| | |

| | | |

| | | |

| | |

| Change in Unrealized Gain (Loss) on | |

| | | |

| | | |

| | |

| Futures contracts | |

| 682,450 | | |

| (34,478 | ) | |

| 647,972 | |

| Net realized and unrealized gain (loss) | |

| (4,161,569 | ) | |

| (327,120 | ) | |

| (4,488,689 | ) |

| Net Loss | |

$ | (4,219,233 | ) | |

$ | (335,663 | ) | |

$ | (4,554,896 | ) |

See accompanying notes to unaudited interim combined

financial statements.

AMPLIFY COMMODITY TRUST

Combined Statements of Operations

Three Months Ended September 30, 2023 (Unaudited)

| | |

BREAKWAVE

DRY BULK | | |

BREAKWAVE

TANKER | | |

| |

| | |

SHIPPING

ETF | | |

SHIPPING

ETF | | |

COMBINED | |

| Investment Income | |

| | |

| | |

| |

| Interest | |

$ | 537,710 | | |

$ | 6,406 | | |

$ | 544,116 | |

| | |

| | | |

| | | |

| | |

| Expenses | |

| | | |

| | | |

| | |

| Sponsor fee | |

| 31,430 | | |

| 12,574 | | |

| 44,004 | |

| CTA fee | |

| 238,286 | | |

| 12,783 | | |

| 251,069 | |

| Audit fees | |

| 19,837 | | |

| 17,375 | | |

| 37,212 | |

| Tax preparation fees | |

| 55,427 | | |

| 7,583 | | |

| 63,010 | |

| Admin/accounting/custodian/transfer agent fees | |

| 16,597 | | |

| 15,036 | | |

| 31,633 | |

| Legal fees | |

| 11,316 | | |

| 11,316 | | |

| 22,632 | |

| Chief Compliance Officer fees | |

| 6,288 | | |

| 6,288 | | |

| 12,576 | |

| Principal Financial Officer fees | |

| 6,288 | | |

| 6,288 | | |

| 12,576 | |

| Regulatory reporting fees | |

| 6,288 | | |

| 6,288 | | |

| 12,576 | |

| Brokerage commissions | |

| 192,298 | | |

| 15,504 | | |

| 207,802 | |

| Distribution fees | |

| 3,949 | | |

| 3,947 | | |

| 7,896 | |

| NJ Filing fees | |

| 63,129 | | |

| 10,159 | | |

| 73,288 | |

| Insurance expense | |

| 3,775 | | |

| 3,771 | | |

| 7,546 | |

| Listing and calculation agent fees | |

| 2,319 | | |

| 1,698 | | |

| 4,017 | |

| Marketing expenses | |

| 8,190 | | |

| 3,771 | | |

| 11,961 | |

| Other expenses | |

| 1,062 | | |

| 1,897 | | |

| 2,959 | |

| Website Support and Marketing Materials | |

| 6,535 | | |

| 1,256 | | |

| 7,791 | |

| Printing and Postage | |

| 2,639 | | |

| 2,513 | | |

| 5,152 | |

| Wholesale support fees | |

| 26,018 | | |

| 5,094 | | |

| 31,112 | |

| Total Expenses | |

| 701,671 | | |

| 145,141 | | |

| 846,812 | |

| Less: Waiver of CTA fee | |

| - | | |

| (12,783 | ) | |

| (12,783 | ) |

| Less: Expenses absorbed by Sponsor | |

| - | | |

| (86,109 | ) | |

| (86,109 | ) |

| Net Expenses | |

| 701,671 | | |

| 46,249 | | |

| 747,920 | |

| Net Investment Loss | |

| (163,961 | ) | |

| (39,843 | ) | |

| (203,804 | ) |

| | |

| | | |

| | | |

| | |

| Net Realized and Unrealized Gain (Loss) on Investment Activity | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | |

| Net Realized Gain (Loss) on | |

| | | |

| | | |

| | |

| Investments and futures contracts | |

| (18,251,265 | ) | |

| 33,625 | | |

| (18,217,640 | ) |

| | |

| | | |

| | | |

| | |

| Change in Unrealized Gain (Loss) on | |

| | | |

| | | |

| | |

| Investments and futures contracts | |

| 19,736,724 | | |

| (896,689 | ) | |

| 18,840,035 | |

| Net realized and unrealized gain (loss) | |

| 1,485,459 | | |

| (863,064 | ) | |

| 622,395 | |

| Net income (loss) | |

$ | 1,321,498 | | |

$ | (902,907 | ) | |

$ | 418,591 | |

See accompanying notes to unaudited interim combined

financial statements.

AMPLIFY COMMODITY TRUST

Combined Statements of Changes in Net Assets

Three Months Ended September 30, 2024 (Unaudited)

| | |

BREAKWAVE

DRY BULK | | |

BREAKWAVE

TANKER | | |

| |

| | |

SHIPPING

ETF | | |

SHIPPING

ETF | | |

COMBINED | |

| | |

| | |

| | |

| |

| Net Assets at Beginning of Period | |

$ | 39,113,154 | | |

$ | 2,087,817 | | |

$ | 41,200,971 | |

| | |

| | | |

| | | |

| | |

| Increase (decrease) in Net Assets from share transactions | |

| | | |

| | | |

| | |

| Addition of -0- and 75,000 shares, respectively | |

| | | |

| 1,218,568 | | |

| 1,218,568 | |

| Redemption of 950,000 and -0- shares, respectively | |

| (10,519,068 | ) | |

| - | | |

| (10,519,068 | ) |

| Net increase (decrease) in Net Assets from share transactions | |

| (10,519,068 | ) | |

| 1,218,568 | | |

| (9,300,500 | ) |

| | |

| | | |

| | | |

| | |

| Increase (decrease) in Net Assets from operations | |

| | | |

| | | |

| | |

| Net investment loss | |

| (57,664 | ) | |

| (8,543 | ) | |

| (66,207 | ) |

| Net realized loss | |

| (4,844,019 | ) | |

| (292,642 | ) | |

| (5,136,661 | ) |

| Change in net unrealized gain (loss) | |

| 682,450 | | |

| (34,478 | ) | |

| 647,972 | |

| Net decrease in Net Assets from operations | |

| (4,219,233 | ) | |

| (335,663 | ) | |

| (4,554,896 | ) |

| | |

| | | |

| | | |

| | |

| Net Assets at End of Period | |

$ | 24,374,853 | | |

$ | 2,970,722 | | |

$ | 27,345,575 | |

See accompanying notes to unaudited interim combined

financial statements.

AMPLIFY COMMODITY TRUST

Statements of Changes in Net Assets

Three Months Ended September 30, 2023 (Unaudited)

| | |

BREAKWAVE

DRY BULK | | |

BREAKWAVE

TANKER | | |

| |

| | |

SHIPPING

ETF | | |

SHIPPING

ETF | | |

COMBINED | |

| | |

| | |

| | |

| |

| Net Assets at Beginning of Period | |

$ | 61,193,899 | | |

$ | 4,168,752 | | |

$ | 65,362,651 | |

| | |

| | | |

| | | |

| | |

| Increase (decrease) in Net Assets from share transactions | |

| | | |

| | | |

| | |

| Addition of 2,800,000 and -0- shares, respectively | |

| 13,563,318 | | |

| - | | |

| 13,563,318 | |

| Redemption of 1,800,000 and 100,000 shares, respectively | |

| (9,659,505 | ) | |

| (1,716,210 | ) | |

| (11,375,715 | ) |

| Net Increase (decrease) in Net Assets from share transactions | |

| 3,903,813 | | |

| (1,716,210 | ) | |

| 2,187,603 | |

| | |

| | | |

| | | |

| | |

| Increase (decrease) in Net Assets from operations | |

| | | |

| | | |

| | |

| Net investment loss | |

| (163,961 | ) | |

| (39,843 | ) | |

| (203,804 | ) |

| Net realized gain (loss) | |

| (18,251,265 | ) | |

| 33,625 | | |

| (18,217,640 | ) |

| Change in net unrealized gain (loss) | |

| 19,736,724 | | |

| (896,689 | ) | |

| 18,840,035 | |

| Net Increase (decrease) in Net Assets from operations | |

| 1,321,498 | | |

| (902,907 | ) | |

| 418,591 | |

| | |

| | | |

| | | |

| | |

| Net Assets at End of Period | |

$ | 66,419,210 | | |

| 1,549,635 | | |

$ | 67,968,845 | |

See accompanying notes to unaudited interim combined

financial statements.

AMPLIFY COMMODITY TRUST

Combined Statements of Cash Flows

Three Months Ended September 30, 2024 (Unaudited)

| | |

BREAKWAVE

DRY BULK | | |

BREAKWAVE

TANKER | | |

| |

| | |

SHIPPING

ETF | | |

SHIPPING

ETF | | |

COMBINED | |

| | |

| | |

| | |

| |

| Cash flows provided by (used in) operating activities | |

| | |

| | |

| |

| Net loss | |

$ | (4,219,233 | ) | |

$ | (335,663 | ) | |

$ | (4,554,896 | ) |

| Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities: | |

| | | |

| | | |

| | |

| Sale (Purchase) of investments, net | |

| 5,649,188 | | |

| (736,086 | ) | |

| 4,913,102 | |

| Change in net unrealized loss (gain) on futures | |

| (682,450 | ) | |

| 34,478 | | |

| (647,972 | ) |

| Change in operating assets and liabilities: | |

| | | |

| | | |

| | |

| Decrease (Increase) in interest receivable | |

| 41,428 | | |

| (5,587 | ) | |

| 35,841 | |

| Decrease (Increase) in due from sponsor | |

| - | | |

| 3,439 | | |

| 3,439 | |

| Increase (Decrease) in due to sponsor | |

| (34,175 | ) | |

| - | | |

| (34,175 | ) |

| Increase (Decrease) in accrued expenses | |

| 119,730 | | |

| 27,316 | | |

| 147,046 | |

| Net cash provided by (used in) operating activities | |

| 874,488 | | |

| (1,012,103 | ) | |

| (137,615 | ) |

| | |

| | | |

| | | |

| | |

| Cash flows from financing activities | |

| | | |

| | | |

| | |

| Proceeds from sale of shares | |

| - | | |

| 1,218,568 | | |

| 1,218,568 | |

| Paid on redemption of shares | |

| (10,519,068 | ) | |

| - | | |

| (10,519,068 | ) |

| Net cash provided by (used in) financing activities | |

| (10,519,068 | ) | |

| 1,218,568 | | |

| (9,300,500 | ) |

| | |

| | | |

| | | |

| | |

| Net increase (decrease) in cash and restricted cash | |

| (9,644,580 | ) | |

| 206,465 | | |

| (9,438,115 | ) |

| Cash and restricted cash, beginning of year | |

| 31,739,612 | | |

| 1,243,877 | | |

| 32,983,489 | |

| Cash and restricted cash, end of year | |

$ | 22,095,032 | | |

$ | 1,450,342 | | |

$ | 23,545,374 | |

| | |

| | | |

| | | |

| | |

| The following table provides a reconciliation of cash and restricted cash reported within the Statement of Assets and Liabilities that sum to the total of such amounts shown on the Statement of Cash Flows. | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | |

| Cash | |

$ | - | | |

$ | - | | |

$ | - | |

| Segregated cash held by broker | |

$ | 22,095,032 | | |

$ | 1,450,342 | | |

$ | 23,545,374 | |

| Total cash and restricted cash as shown on the statement of cash flows | |

$ | 22,095,032 | | |

$ | 1,450,342 | | |

$ | 23,545,374 | |

See accompanying notes to unaudited interim combined

financial statements.

AMPLIFY COMMODITY TRUST

Combined Statements of Cash Flows

Three Months Ended September 30, 2023 (Unaudited)

| | |

BREAKWAVE

DRY BULK | | |

BREAKWAVE

TANKER | | |

| |

| | |

SHIPPING

ETF | | |

SHIPPING

ETF | | |

COMBINED | |

| | |

| | |

| | |

| |

| Cash flows provided by (used in) operating activities | |

| | |

| | |

| |

| Net income (loss) | |

$ | 1,321,498 | | |

$ | (902,907 | ) | |

$ | 418,591 | |

| Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities: | |

| | | |

| | | |

| | |

| Net realized loss (gain) on investments | |

| 18,251,265 | | |

| (33,625 | ) | |

| 18,217,640 | |

| Change in net unrealized loss (gain) on investments | |

| (19,736,724 | ) | |

| 896,689 | | |

| (18,840,035 | ) |

| Change in operating assets and liabilities: | |

| | | |

| | | |

| | |

| Sale (Purchase) of investments, net | |

| 4,208,197 | | |

| (611,474 | ) | |

| 3,596,723 | |

| Decrease (increase) in interest receivable | |

| 2,618 | | |

| (380 | ) | |

| 2,238 | |

| Decrease (increase) in receivable on open futures contracts | |

| (6,098,280 | ) | |

| 825,287 | | |

| (5,272,993 | ) |

| Decrease (increase) in payable on open futures contracts | |

| (13,669,745 | ) | |

| 71,402 | | |

| (13,598,343 | ) |

| Increase (decrease) in due to sponsor | |

| 12,892 | | |

| (721 | ) | |

| 12,171 | |

| Increase (decrease) in other accrued expenses | |

| 27,395 | | |

| (221 | ) | |

| 27,174 | |

| Net cash (used in) operating activities | |

| (15,680,884 | ) | |

| 244,050 | | |

| (15,436,834 | ) |

| Cash flows from financing activities | |

| | | |

| | | |

| | |

| Proceeds from sale of shares | |

| 13,563,318 | | |

| - | | |

| 13,563,318 | |

| Paid on redemption of shares | |

| (9,659,505 | ) | |

| (1,716,210 | ) | |

| (11,375,715 | ) |

| Net cash provided by (used in) financing activities | |

| 3,903,813 | | |

| (1,716,210 | ) | |

| 2,187,603 | |

| Net increase (decrease) in cash and restricted cash | |

| (11,777,071 | ) | |

| (1,472,160 | ) | |

| (13,249,231 | ) |

| Cash and restricted cash, beginning of period | |

| 35,323,736 | | |

| 2,879,954 | | |

| 38,203,690 | |

| Cash and restricted cash, end of period | |

$ | 23,546,665 | | |

$ | 1,407,794 | | |

$ | 24,954,459 | |

| | |

| | | |

| | | |

| | |

| The following table provides a reconciliation of cash and restricted cash reported within the Statement of Assets and Liabilities that sum to the total of such amounts shown on the Statement of Cash Flows. | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | |

| Cash | |

$ | - | | |

$ | - | | |

$ | - | |

| Segregated cash held by broker | |

| 23,546,665 | | |

| 1,407,794 | | |

| 24,954,459 | |

| Total cash and restricted cash as shown on the statement of cash flows | |

$ | 23,546,665 | | |

$ | 1,407,794 | | |

$ | 24,954,459 | |

See accompanying notes to unaudited interim combined

financial statements.

Amplify Commodity Trust

Notes to Interim Combined Financial Statements

September 30, 2024 (unaudited)

(1) Organization

Amplify Commodity Trust (the “Trust”)

was organized as a Delaware statutory trust on July 23, 2014. Effective after the close of trading on February 14, 2024, ETF Managers

Capital LLC, as the prior sponsor and commodity pool operator (the “Former Sponsor”) of the Trust, entered into an agreement

(the “Transfer Agreement”) to resign as Sponsor to the Trust and transfer its role as the Trust’s sponsor to Amplify

Investments LLC (“the Sponsor.”) Under the terms of the Transfer Agreement, the Former Sponsor no longer has any involvement

in the operations, management or marketing of the Fund. In connection with this change of Sponsor, Trust changed its name from the ETF

Managers Group Commodity Trust I to the Amplify Commodity Trust. The Trust is a series trust formed pursuant to the Delaware Statutory

Trust Act and currently consists of two separate series. BREAKWAVE DRY BULK SHIPPING ETF (“BDRY”), is the first series of

the Trust and is a commodity pool that continuously issues shares of beneficial interest that may be purchased and sold on the NYSE Arca.

The second series of the Trust, BREAKWAVE TANKER SHIPPING ETF (“BWET”), each a “Fund” and together with BDRY,

the “Funds”), is also a commodity pool that continuously issues shares of beneficial interest that may be purchased and sold

on the NYSE Arca. The Funds are managed and controlled by the Sponsor, a Delaware limited liability company. The Sponsor is registered

with the Commodity Futures Trading Commission (“CFTC”) as a “commodity pool operator” (“CPO”) and

is a member of the National Futures Trading Association (“NFA”). Breakwave Advisors, LLC (“Breakwave”) is registered

as a “commodity trading advisor” (“CTA”) with the CFTC and serves as the Funds commodity trading advisor.

BDRY commenced investment operations on March

22, 2018. BDRY commenced trading on the NYSE Arca on March 22, 2018 and trades under the symbol “BDRY.”

BDRY’s investment objective is to provide

investors with exposure to the daily change in the price of dry bulk freight futures, before expenses and liabilities of BDRY, by tracking

the performance of a portfolio (the “BDRY Benchmark Portfolio”) consisting of a three-month strip of the nearest calendar

quarter of futures contracts on specified indexes (each a “Reference Index”) that measure rates for shipping dry bulk freight

(“Freight Futures”). Each Reference Index is published each United Kingdom business day by the London-based Baltic Exchange

Ltd. (the “Baltic Exchange”) and measures the charter rate for shipping dry bulk freight in a specific size category of cargo

ship – Capesize, Panamax or Supramax. The three Reference Indexes are as follows:

| |

● |

Capesize: the Capesize 5TC Index; |

| |

● |

Panamax: the Panamax 4TC Index; and |

| |

● |

Supramax: the Supramax 10TC Index. |

The value of the Capesize 5TC Index is disseminated

at 11:00 a.m., London Time and the value of the Panamax 4TC Index and the Supramax 10TC Index each is disseminated at 1:00 p.m., London

Time. The Reference Index information disseminated by the Baltic Exchange also includes the components and value of each component in

each Reference Index. Such Reference Index information also is widely disseminated by Reuters and/or other major market data vendors.

BDRY seeks to achieve its investment objective

by investing substantially all of its assets in the Freight Futures currently constituting the BDRY Benchmark Portfolio. The BDRY Benchmark

Portfolio includes all existing positions to maturity and settles them in cash. During any given calendar quarter, the BDRY Benchmark

Portfolio progressively increases its positions to the next calendar quarter three-month strip, thus maintaining constant exposure to

the Freight Futures market as positions mature.

Amplify Commodity Trust

Notes to Interim Combined Financial Statements

September 30, 2024 (unaudited)

(1) Organization - Continued

The BDRY Benchmark Portfolio maintains long-only

positions in Freight Futures. The BDRY Benchmark Portfolio includes a combination of Capesize, Panamax and Supramax Freight Futures. More

specifically, the BDRY Benchmark Portfolio includes 50% exposure in Capesize Freight Futures contracts, 40% exposure in Panamax Freight

Futures contracts and 10% exposure in Supramax Freight Futures contracts. The BDRY Benchmark Portfolio does not include and BDRY does

not invest in swaps, non-cleared dry bulk freight forwards or other over-the-counter derivative instruments that are not cleared through

exchanges or clearing houses. BDRY may hold exchange-traded options on Freight Futures. The BDRY Benchmark Portfolio is maintained by

Breakwave and will be rebalanced annually. The Freight Futures currently constituting the BDRY Benchmark Portfolio, as well as the daily

holdings of BDRY are available on BDRY’s website at www.drybulketf.com.

When establishing positions in Freight Futures,

BDRY will be required to deposit initial margin with a value of approximately 10% to 40% of the notional value of each Freight Futures

position at the time it is established. These margin requirements are established and subject to change from time to time by the relevant

exchanges, clearing houses or BDRY’s Futures Commissions Merchant (“FCM”), Marex Financial Ltd. (formerly ED&F Man

Capital Markets, Inc.) On a daily basis, BDRY is obligated to pay, or entitled to receive, variation margin in an amount equal to the

change in the daily settlement level of its Freight Futures positions. Any assets not required to be posted as margin with the FCM may

be held at BDRY’s custodian or remain with the FCM in cash or cash equivalents, as discussed below.

BDRY was created to provide investors with a cost-effective

and convenient way to gain exposure to daily changes in the price of Freight Futures. BDRY is intended to be used as a diversification

opportunity as part of a complete portfolio, not a complete investment program.

The Fund will incur certain expenses in connection

with its operations. The Fund will hold cash or cash equivalents such as U.S. Treasuries or other high credit quality, short-term fixed-income

or similar securities for direct investment or as collateral for the Freight futures and for other liquidity purposes and to meet redemptions

that may be necessary on an ongoing basis. These expenses and income from the cash and cash equivalent holdings may cause imperfect correlation

between changes in the Fund’s net asset value (“NAV”) and changes in the Benchmark Portfolio, because the Benchmark

Portfolio does not reflect expenses or income. The Fund may also realize interest income from its holdings in U.S. Treasuries or other

market rate instruments.

The Fund seeks to trade its positions prior to

maturity; accordingly, natural market forces may cost the Fund while rebalancing. Each time the Fund seeks to reconstitute its positions,

barring movement in the underlying securities, the futures and option prices may be higher or lower. Such differences in price, barring

a movement in the price of the underlying security, will constitute “roll yield” and may inhibit the Fund’s ability

to achieve its investment objective.

Several factors determine the total return from

investing in a futures contract position. One factor that impacts the total return that will result from investing in near month futures

contracts and “rolling” those contracts forward each month is the price relationship between the current near month contract

and the next month contract.

The CTA will close existing positions when it

determines it would be appropriate to do so and reinvest the proceeds in other positions. Positions may also be closed out to meet orders

for redemption baskets.

BWET commenced investment operations on May 3,

2023. BWET commenced trading on NYSE Arca on May 3, 2023 and trades under the symbol “BWET.”

BWET’s investment objective is to provide

investors with exposure to the daily change in the price of crude oil tanker freight futures, before expenses and liabilities of the Fund,

by tracking the performance of a portfolio (the “BWET Benchmark Portfolio”) mainly consisting of the nearest calendar quarter

of futures contracts on specified indexes (each a “Reference Index”) that measure prices for shipping crude oil (“Freight

Futures”). Freight Futures reflect market expectations for the future cost of transporting crude oil. Each Reference Index is published

each United Kingdom business day by the London-based Baltic Exchange Ltd. (the “Baltic Exchange”) and measures the charter

rate for crude oil in a specific size category of cargo ship and for a specific route. The two Reference Indexes are as follows:

| |

● |

The TD3C Index: Persian Gulf to China, 270,000mt cargo (Very Large Crude Carrier or VLCC tankers); |

| |

● |

The TD20 Index: West Africa to Europe, 130,000mt cargo (Suezmax Tankers) |

Amplify Commodity Trust

Notes to Interim Combined Financial Statements

September 30, 2024 (unaudited)

(1) Organization - Continued

The value of the TD3C Index and the TD20 Index

is disseminated at 4:00 p.m. London Time by the Baltic Exchange. Such Reference Index information also is widely disseminated by Reuters,

Bloomberg and/or other major market data vendors.

The Fund seeks to achieve its investment objective

by investing substantially all of its assets in the Freight Futures currently constituting the BWET Benchmark Portfolio. The BWET Benchmark

Portfolio includes a combination of TD3C and TD20 Freight Futures. More specifically, the Benchmark Portfolio includes 90% exposure in

TD3C Freight Futures contracts and 10% exposure in TD20 Freight Futures contracts to maturity and settles them in cash. At any given time,

the average maturity of the futures held by the Fund will be approximately 50 to 70 days.

The BWET Benchmark Portfolio does not include

and BWET does not invest in swaps, non-cleared freight forwards or other over-the-counter derivative instruments that are not cleared

through exchanges or clearing houses. BWET may hold exchange-traded options on Freight Futures. The BWET Benchmark Portfolio is maintained

by Breakwave and will be rebalanced annually. The Freight Futures currently constituting the BWET Benchmark Portfolio, as well as the

daily holdings of BWET are available on BWET’s website at www.tankeretf.com.

When establishing positions in Freight Futures,

BWET will be required to deposit initial margin with a value of approximately 10% to 40% of the notional value of each Freight Futures

position at the time it is established. These margin requirements are established and subject to change from time to time by the relevant

exchanges, clearing houses or BWET’s FCM, Marex Financial Ltd. On a daily basis, BWET is obligated to pay, or entitled to receive,

variation margin in an amount equal to the change in the daily settlement level of its Freight Futures positions. Any assets not required

to be posted as margin with the FCM maybe held at BWET’s custodian or remain with the FCM in cash or cash equivalents, as discussed

below.

BWET was created to provide investors with a cost-effective

and convenient way to gain exposure to daily changes in the price of Freight Futures. BWET is intended to be used as a diversification

opportunity as part of a complete portfolio, not a complete investment program.

The Fund will incur certain expenses in connection

with its operations. The Fund will hold cash or cash equivalents such as U.S. Treasuries or other high credit quality, short-term fixed-income

or similar securities for direct investment or as collateral for the Treasury Instruments and for other liquidity purposes and to meet

redemptions that may be necessary on an ongoing basis. The Fund may also realize interest income from its holdings in U.S. Treasuries

or other market rate instruments. These expenses and income from the cash and cash equivalent holdings may cause imperfect correlation

between changes in the Fund’s net asset value (“NAV”) and changes in the Benchmark Portfolio, because the Benchmark

Portfolio does not reflect expenses or income.

The Fund seeks to trade its positions prior to

maturity; accordingly, natural market forces may cost the Fund while rebalancing. Each time the Fund seeks to reconstitute its positions,

barring movement in the underlying securities, the futures and option prices may be higher or lower. Such differences in price, barring

a movement in the price of the underlying security, will constitute “roll yield” and may inhibit the Fund’s ability

to achieve its investment objective.

Several factors determine the total return from

investing in a futures contract position. One factor that impacts the total return that will result from investing in near month futures

contracts and “rolling” those contracts forward each month is the price relationship between the current near month contract

and the next month contract.

The CTA will close existing positions when it

determines it would be appropriate to do so and reinvest the proceeds in other positions. Positions may also be closed out to meet orders

for redemption baskets.

(2) Summary of Significant Accounting Policies

(a) Basis of Accounting

The accompanying combined interim unaudited and

accompanying audited financial statements of the Funds have been prepared in conformity with U.S. generally accepted accounting principles

(“U.S. GAAP”) and with the instructions for the Form 10-Q and the rules and regulations of the United States Securities and

Exchange Commission. Each Fund qualifies as an investment company for financial reporting purposes under Topic 946 of the Accounting Standard

Codification of U.S. GAAP.

Amplify Commodity Trust

Notes to Interim Combined Financial Statements

September 30, 2024 (unaudited)

(2) Summary of Significant Accounting Policies

- Continued

(a) Basis of Accounting - Continued

The accompanying combined interim financial statements

are unaudited, but in the opinion of management, contain all adjustments (which include normal recurring adjustments) considered necessary

to present fairly the interim financial statements. These interim financial statements should be read in conjunction with the Fund’s

annual report on Form 10-K for the year ended June 30, 2024, BDRY’s prospectus dated February 15, 2024 (the “BDRY Prospectus,”),

and BWET’s prospectus dated February 15, 2024 (the “BWET” Prospectus”). Interim period results are not necessarily

indicative of results for a full-year period.

(b) Use of Estimates

The preparation of the combined financial statements

in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities

and disclosure of contingent assets and liabilities at the date of the combined financial statements and accompanying notes. Actual results

could differ from those estimates. There were no significant estimates used in the preparation of the combined financial statements.

(c) Cash

Cash, when shown in the Combined Statements of

Assets and Liabilities, represents non-segregated cash with the custodian and does not include short-term investments.

(d) Cash Held by Broker

Breakwave is registered as a “commodity

trading advisor” and acts as such for the Funds. The Funds’ arrangement with its FCM requires the Funds to meet their variation

margin requirement related to the price movements, both positive and negative, on futures contracts held by the Funds by keeping cash

on deposit with the Commodity Broker (as defined below). These amounts are shown as segregated cash held by broker in the Combined Statements

of Assets and Liabilities. Each Fund deposits cash or United States Treasury Obligations, as applicable, with the FCM subject to the CFTC

regulations and various exchange and broker requirements. The combination of each Fund’s deposits with the FCM of cash and United

States Treasury Obligations, as applicable, and the unrealized gain or loss on open futures contracts (variation margin) represents each

Fund’s overall equity in its brokerage trading account. The Funds use their cash held by the FCM to satisfy individual variation

margin requirements. The Funds earn interest on their cash deposited with the FCM and interest income is recorded on the accrual basis.

(e) Final Net Asset Value for Fiscal Period

The calculation time of the Fund’s final

net asset value for creation and redemption of Fund shares for the three months ended September 30, 2024 and September 30, 2023 was at

4:00 p.m. Eastern Time on September 30, 2024 and September 29, 2023, respectively.

Although the Fund’s shares may continue

to trade on secondary markets subsequent to the calculation of the final NAV, the 4:00 p.m. Eastern Time represented the final opportunity

to transact in creation or redemption baskets for the three months ended September 30, 2024 and September 30, 2023.

Fair value per share is determined at the close

of the NYSE Arca.

For financial reporting purposes, each Fund values

its investment positions based upon the final closing price in their primary markets. Accordingly, the investment valuations in these

interim combined financial statements differ from those used in the calculations of the Fund’s final creation/redemption NAVs at

September 30, 2024 and September 30, 2023.

(f) Investment Valuation

Short-term investments, excluding U.S. Treasury

Bills, are carried at amortized cost, which approximates fair value. U.S. Treasury Bills, when held by the Funds, are valued as determined

by an independent pricing service based on methods which include consideration of: yields or prices of securities of comparable quality,

coupon, maturity and type; indications as to values from dealers; and general market conditions. Money market investments are valued at

their traded net asset value.

Futures and options contracts are valued at the

last settled price on the applicable exchange on which that futures and/or options contract trades.

Amplify Commodity Trust

Notes to Interim Combined Financial Statements

September 30, 2024 (unaudited)

(2) Summary of Significant Accounting Policies

- Continued

(g) Financial Instruments and Fair Value

Each Fund discloses the fair value of its investments

in accordance with the Financial Accounting Standards Board (“FASB”) fair value measurement and disclosure guidance which

requires a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value. The disclosure requirements

establish a fair value hierarchy that distinguishes between: (1) market participant assumptions developed based on market data obtained

from sources independent to the Fund (observable inputs); and (2) the Fund’s own assumptions about market participant assumptions

developed based on the best information available under the circumstances (unobservable inputs). The three levels defined by the disclosure

requirements hierarchy are as follows:

| Level I: |

Quoted prices (unadjusted) in active markets for identical assets and liabilities that the reporting entity has the ability to access at the measurement date. |

| Level II: |

Inputs other than quoted prices included within Level I that are observable for the asset or liability, either directly or indirectly. Level II inputs include the following: quoted prices for similar assets or liabilities in active markets, quoted prices for identical or similar assets or liabilities in markets that are not active, inputs other than quoted prices that are observable for the asset or liability, and inputs that are derived principally from or corroborated by observable market data by correlation or other means (market-corroborated inputs). |

| Level III: |

Unobservable pricing input at the measurement date for the asset or liability. Unobservable inputs shall be used to measure fair value to the extent that observable inputs are not available. |

In some instances, the inputs used to measure

fair value might fall in different levels of the fair value hierarchy. The level in the fair value hierarchy within which the fair value

measurement in its entirety falls shall be determined based on the lowest input level that is significant to the fair value measurement

in its entirety.

Fair value measurements also require additional

disclosure when the volume and level of activity for the asset or liability have significantly decreased, as well as when circumstances

indicate that a transaction is not orderly.

The following tables summarize BDRY’s valuation

of investments at September 30, 2024 and at June 30, 2024 using the fair value hierarchy:

| | |

September 30, 2024 (unaudited) | |

| | |

Short-Term

Investments(a) | | |

Futures

Contracts(b) | | |

Total | |

| Level I – Quoted Prices | |

$ | 2,699,007 | | |

$ | (106,225 | ) | |

$ | 2,592,782 | |

| | |

June 30, 2024 | |

| | |

Short-Term

Investments(a) | | |

Futures

Contracts(b) | | |

Total | |

| Level I – Quoted Prices | |

$ | 8,348,195 | | |

$ | (788,675 | ) | |

$ | 7,599,520 | |

| a | – | Included in Investments in securities in the Combined Statements of Assets and Liabilities. |

Transfers between levels are recognized at the

end of the reporting period. During the three months ended September 30, 2024 and the year ended June 30, 2024, BDRY recognized no transfers

from Level I, Level II or Level III.

Amplify Commodity Trust

Notes to Interim Combined Financial Statements

September 30, 2024 (unaudited)

(2) Summary of Significant Accounting Policies

- Continued

(g) Financial Instruments and Fair Value -

Continued

The following tables summarize BWET’s valuation

of investments at September 30, 2024 and at June 30, 2024 using the fair value hierarchy:

| | |

September 30, 2024 (unaudited) | |

| | |

Short-Term

Investments(a) | | |

Futures

Contracts(b) | | |

Total | |

| Level I – Quoted Prices | |

$ | 1,766,006 | | |

$ | (150,358 | ) | |

$ | 1,615,648 | |

| a | – | Included in Investments in securities in the Combined Statements of Assets and Liabilities. |

| | |

June 30, 2024 | |

| | |

Short-Term

Investments(a) | | |

Futures

Contracts(b) | | |

Total | |

| Level I – Quoted Prices | |

$ | 1,029,920 | | |

$ | (115,880 | ) | |

$ | 914,040 | |

| a | – | Included in Investments in securities in the Combined Statements of Assets and Liabilities. |

Transfers between levels are recognized at the

end of the reporting period. During the three months ended September 30, 2024 and the year ended June 30, 2024, BWET recognized no transfers

from Level I, Level II or Level III.

The inputs or methodology used for valuing investments

are not necessarily an indication of the risk associated with investing in those securities.

h) Investment Transactions and Related Income

Investment transactions are recorded on the trade

date. All such transactions are recorded on the identified cost basis, and marked to market daily. Unrealized gain/loss on open futures

contracts is reflected in Receivable/Payable on open futures contracts in the Combined Statements of Assets and Liabilities and the change

in the unrealized gain/loss between periods is reflected in the Combined Statements of Operations. The Funds interest earned on short-term

securities and on cash deposited with Marex Financial Ltd. is accrued daily and reflected as Interest Income, when applicable, in the

Combined Statements of Operations.

(i) Federal Income Taxes

Each Fund is registered as a Delaware

statutory trust and is treated as a partnership for U.S. federal income tax purposes. Accordingly, the Funds do not expect to incur

U.S. federal income tax liability; rather, each beneficial owner is required to take into account their allocable share of the

Funds’ income, gain, loss, deductions and other items for the Funds’ taxable year ending with or within the beneficial

owner’s taxable year.

Management of the Funds has reviewed the open

tax years and major jurisdictions and concluded that there is no tax liability resulting from unrecognized tax benefits relating to uncertain

income tax positions taken or expected to be taken in future tax returns at September 30, 2024 and June 30, 2024. The Funds are also not

aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly

change in the next twelve months. On an ongoing basis, management will monitor its tax positions taken to determine if adjustments to

its conclusions are necessary based on factors including, but not limited to, further implementation of guidance expected from the FASB

and on-going analysis of tax law, regulation, and interpretations thereof. The Funds’ federal tax returns are subject to examination

by the Internal Revenue Service for a period of three years after they are filed.

Amplify Commodity Trust

Notes to Interim Combined Financial Statements

September 30, 2024 (unaudited)

(3) Investments

(a) Short -Term Investments

The Funds may purchase U.S. Treasury Bills, agency

securities, and other high-credit quality short-term fixed income or similar securities with original maturities of one year or less.

A portion of these investments may be used as margin for the Funds’ trading in futures contracts.

(b) Accounting for Derivative Instruments

In seeking to achieve each Fund’s investment

objective, the commodity trading advisor uses a mathematical approach to investing. Using this approach, the commodity trading advisor

determines the type, quantity and mix of investment positions that it believes in combination should produce returns consistent with the

Fund’s objective.

All open derivative positions at September 30,

2024 and at June 30, 2024, as applicable, are disclosed in the Combined Schedules of Investments and the notional value of these open

positions relative to the shareholders’ capital of the Funds is generally representative of the notional value of open positions

to shareholders’ capital throughout the reporting periods for the Funds. The volume associated with derivative positions varies

on a daily basis as the Funds transact in derivative contracts in order to achieve the appropriate exposure, as expressed in notional

value, in comparison to shareholders’ capital consistent with the applicable Fund’s investment objective.

Following is a description of the derivative instruments

used by the Funds during the reporting period, including the primary underlying risk exposures.

(c) Futures Contracts

The Funds enter into futures contracts to gain

exposure to changes in the value of the Benchmark Portfolios. A futures contract obligates the seller to deliver (and the purchaser to

accept) the future cash settlement of a specified quantity and type of a freight futures contract at a specified time and place. The contractual

obligations of a buyer or seller of a freight futures contract may generally be satisfied by making an offsetting sale or purchase of

an identical futures contract on the same or linked exchange before the designated date of delivery.

Upon entering into a futures contract, the

Funds are required to deposit and maintain as collateral at least such initial margin as required by the exchange on which the

transaction is affected. The initial margin is segregated as Cash held by broker, as disclosed in the Combined Statements of Assets

and Liabilities, and is restricted as to its use. Pursuant to the futures contract, the Funds agree to receive from or pay to the

broker an amount of cash equal to the daily fluctuation in value of the futures contract. Such receipts or payments are known as

variation margin and are recorded by the Funds as unrealized gains or losses. The Funds will realize a gain or loss upon closing a

futures transaction.

Futures contracts involve, to varying degrees,

elements of market risk (specifically freight futures price risk) and exposure to loss in excess of the amount of variation margin. The

face or contract amounts reflect the extent of the total exposure the Funds have in the particular classes of instruments. Additional

risks associated with the use of futures contracts include imperfect correlation between movements in the price of the futures contracts

and the market value of the underlying securities and the possibility of an illiquid market for a futures contract. With futures contracts,

there is minimal counterparty risk to the Funds since futures contracts are exchange-traded and the exchange’s clearinghouse, as

counterparty to all exchange-traded futures contracts, guarantees the futures contracts against default.

Amplify Commodity Trust

Notes to Interim Combined Financial Statements

September 30, 2024 (unaudited)

(3) Investments - Continued

(c) Futures Contracts - Continued

Average Derivative Volume, for the three months

ended September 30, 2024

| Fund | |

Monthly

Average

Quantity | | |

Monthly

Average

Notional

Value | |

| Breakwave Dry Bulk Shipping ETF | |

| 490 | | |

$ | 9,503,250 | |

| Breakwave Tanker Shipping ETF | |

| 78 | | |

$ | 1,152,096 | |

| Amplify Commodity Trust (combined) | |

| 568 | | |

$ | 10,655,346 | |

Average Derivative Volume, for the period ended

June 30, 2024

| Fund | |

Monthly

Average

Quantity | | |

Monthly

Average

Notional

Value | |

| Breakwave Dry Bulk Shipping ETF | |

| 782 | | |

$ | 15,359,875 | |

| Breakwave Tanker Shipping ETF | |

| 117 | | |

$ | 1,543,866 | |

| Amplify Commodity Trust (combined) | |

| 898 | | |

$ | 16,903,741 | |

BREAKWAVE DRY BULK SHIPPING ETF

Fair Value of Derivative Instruments, as of September

30, 2024

| | | Asset Derivatives | | Liability Derivatives | | | |

| Derivatives | | Combined Statements of

Assets and Liabilities | | Fair Value | | | Combined Statements of

Assets and Liabilities | | Fair Value(a) | | | Total | |

| Dry Bulk Index Rates Market Risk | | Receivable on open futures contracts and unrealized appreciation on futures contracts | | $ | 705,540 | | | Payable on open futures contracts and Unrealized depreciation on futures contracts | | $ | 811,865 | | | $ | 106,225 | |

BREAKWAVE DRY BULK SHIPPING ETF

Fair Value of Derivative Instruments, as of June

30, 2024

| | | Asset Derivatives | | Liability Derivatives | |

| Derivatives | | Combined Statements of

Assets and Liabilities | | Fair Value | | | Combined Statements of

Assets and Liabilities | | Fair Value(a) | |

| Dry Bulk Index Rates Market Risk | | | | $ | - | | | Payable on open futures contracts | | $ | 788,675 | |

| (a) | Represents cumulative depreciation

of futures contracts as reported in the Combined Statements of Assets and Liabilities. |

Amplify Commodity Trust

Notes to Interim Combined Financial Statements

September 30, 2024 (unaudited)

(3) Investments - Continued

(c) Futures Contracts - Continued

BREAKWAVE DRY BULK SHIPPING ETF

The Effect of Derivative Instruments on the Combined

Statements of Operations

For the Three Months Ended September 30, 2024

| Derivatives | | Location of Gain (Loss) on Derivatives | | Realized

Loss on

Derivatives

Recognized in

Income | | | Change in

Unrealized

Gain

(Loss) on

Derivatives

Recognized in

Income | |

| Dry Bulk Index Rates Market Risk | | Net realized loss on futures contracts and/or change in unrealized gain (loss) on futures contracts | | $ | (4,844,019 | ) | | $ | 682,450 | |

The futures contracts open at September 30, 2024 are indicative of

the activity for the three months ended September 30, 2024.

BREAKWAVE DRY BULK SHIPPING ETF

The Effect of Derivative Instruments on the Combined

Statements of Operations

For the Three Months Ended September 30, 2023

| Derivatives | | Location of Gain (Loss) on Derivatives | | Realized

Loss on

Derivatives

Recognized in

Income | | | Change in

Unrealized Gain

(Loss) on

Derivatives

Recognized in

Income | |

| Dry Bulk Index Rates Market Risk | | Net realized loss futures contracts and/or change in unrealized gain (loss) on futures contracts | | $ | (18,251,265 | ) | | $ | 19,736,724 | |

The futures contracts open at September 30, 2023

are indicative of the activity for the three months ended September 30, 2023.

BREAKWAVE TANKER SHIPPING ETF

Fair Value of Derivative Instruments, as of September

30, 2024

| | | Asset Derivatives | | Liability Derivatives | | | |

| Derivatives | | Combined Statements of

Assets and Liabilities | | Fair Value | | | Combined Statements of

Assets and Liabilities | | Fair Value(a) | | | Total | |

| Crude Oil Tanker Index Rates Market Risk | | Unrealized appreciation on futures contracts | | $ | 19,852 | | | Unrealized depreciation on futures contracts | | $ | 170,210 | | | $ | 150,358 | |

| (a) |

Represents cumulative depreciation of futures contracts as reported in the Combined Statements of Assets and Liabilities. |

Amplify Commodity Trust

Notes to Interim Combined Financial Statements

September 30, 2024 (unaudited)

(3) Investments - Continued

(c) Futures Contracts - Continued

BREAKWAVE TANKER SHIPPING ETF

Fair Value of Derivative Instruments, as of June

30, 2024

| | | Asset Derivatives | | Liability Derivatives |

| Derivatives | | Combined Statements of

Assets and Liabilities | | Fair

Value(a) | | | Combined Statements of

Assets and Liabilities | | Fair

Value(a) | |

| Crude Oil Tanker Index Rates Market Risk | | | | $ | -- | | | Payable on open futures contracts | | $ | 115,880 | |

| (a) |

Represents cumulative depreciation of futures contracts as reported in the Combined Statements of Assets and Liabilities. |

BREAKWAVE TANKER SHIPPING ETF

The Effect of Derivative Instruments on the Combined

Statements of Operations

For the Three Months Ended September 30, 2024

| Derivatives | | Location of Gain (Loss) on Derivatives | | Realized

Loss on

Derivatives

Recognized in

Income | | | Change in

Unrealized

Gain (Loss) on Derivatives Recognized in

Income | |

| Crude Oil Tanker Index Rates Market Risk | | Net realized loss on futures contracts and/or change in unrealized gain (loss) on futures contracts | | $ | (292,642 | ) | | $ | (34,478 | ) |

The futures contracts open at September 30, 2024 are indicative of

the activity for the three months ended September 30, 2024.

BREAKWAVE TANKER SHIPPING ETF

The Effect of Derivative Instruments on the Combined

Statements of Operations

For the Three Months Ended September 30, 2023

| Derivatives | | Location of Gain (Loss) on Derivatives | | Realized

Gain on

Derivatives

Recognized in

Income | | | Change in

Unrealized

Gain (Loss) on Derivatives Recognized in

Income | |

| Crude Oil Tanker Index Rates Market Risk | | Net realized gain on futures contracts and/or change in unrealized gain (loss) on futures contracts | | $ | 33,625 | | | $ | (896,689 | ) |

The futures contracts open at September 30, 2023 are indicative of

the activity for the three months ended September 30, 2023.

Amplify Commodity Trust

Notes to Interim Combined Financial Statements

September 30, 2024 (unaudited)

(4) Agreements

(a) Management Fee

Each Fund pays the Sponsor a sponsor fee (the

“Sponsor Fee”) in consideration of the Sponsor’s advisory services to the Funds. Additionally, each Fund pays the commodity

trading advisor a license and service fee (the “CTA fee”).

BDRY pays the Sponsor an annual Sponsor Fee, monthly

in arrears, in an amount calculated as the greater of 0.15% of its average daily net assets, or $125,000. BDRY also pays an annual fee

to Breakwave, monthly in arrears, in an amount equal to 1.45% of BDRY’s average daily net assets. Breakwave has agreed to waive

its CTA fee to the extent necessary, and the Sponsor has voluntarily agreed to correspondingly assume the remaining expenses of BDRY such

that Fund expenses do not exceed an annual rate of 3.50%, excluding brokerage commissions, interest expense, and extraordinary expenses,

if any, of the value of BDRY’s average daily net assets through December 31, 2024 (the “BDRY Expense Cap,”). The assumption

of expenses by the Sponsor and waiver of BDRY’s CTA fee are contractual on the part of the Sponsor and Breakwave, respectively.

The waiver of BDRY’s CTA fees, pursuant

to the undertaking, amounted to $92,369 and $-0-, for the three months ended September 30, 2024 and 2023, respectively, as disclosed in

the Combined Statements of Operations. Effective September 1, 2022 Breakwave may, during the term of the waiver agreement, recoup any

fees waived pursuant to the contract; however, the Fund will only make repayments to Breakwave if such repayment does not cause the Fund’s

expense ratio after the repayment is taken into account, to exceed either (i) the expense cap in place at the time such amounts were waived,

or (ii) the Fund’s current expense cap. Such recoupment is limited to three years from the date the amount is initially waived.

At September 30, 2024, BDRY is subject to potential future repayments of $116,248 to Breakwave. The potential future repayments expire

during the year ending June 30, 2027 and 2028, in the amount of $23,879 and 92,369, respectively.

BWET pays the Sponsor an annual Sponsor Fee, monthly

in arrears, in an amount calculated as the greater of 0.30% of its average daily net assets, or $50,000. BWET also pays an annual CTA

license and service fee to Breakwave, monthly in arrears, in an amount equal to 1.45% of BDRY’s average daily net assets. Breakwave

has agreed to waive its CTA fee to the extent necessary, and the Sponsor has voluntarily agreed to correspondingly assume the remaining

expenses of BWET such that Fund expenses do not exceed an annual rate of 3.50%, excluding brokerage commissions, interest expense, and

extraordinary expenses, if any, of the value of BWET’s average daily net assets through December 31, 2024 (the “BWET Expense

Cap”). The assumption of expenses by the Sponsor and waiver of BWET’s CTA fee are contractual on the part of the Sponsor and

Breakwave, respectively.

The waiver of BWET’s CTA fees, pursuant

to the undertaking, amounted to $10,193 and $12,783 for the three months ended September 30, 2024 and 2023, respectively, as disclosed

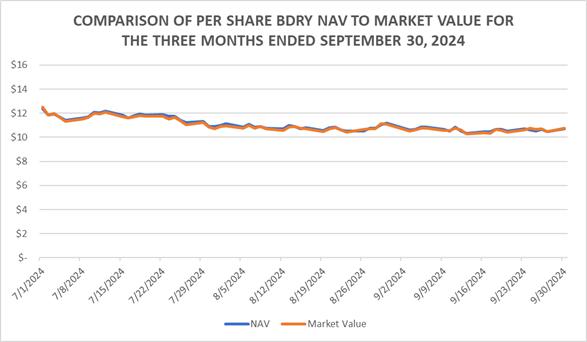

in the Combined Statements of Operations. Breakwave may, during the term of the waiver agreement, recoup any fees waived pursuant to the