CI Financial Corp. (“CI” or the “Corporation”)

(TSX:CIX) announced that at the special meeting of shareholders

held earlier today, an overwhelming majority of CI shareholders

voted in favour of the special resolution (the “Arrangement

Resolution”) approving the previously announced plan of

arrangement under the Business Corporations Act (Ontario), pursuant

to which, among other things, an affiliate of funds managed by

Mubadala Capital will acquire, directly or indirectly, all of the

issued and outstanding common shares of the Corporation (the

“Arrangement”). Further details regarding the Arrangement

can be found in the Corporation’s management information circular

dated January 7, 2025 (the “Circular”).

The Arrangement Resolution required approval by not less than:

(i) two-thirds (66⅔%) of the votes cast by CI shareholders present

in person or represented by proxy and entitled to vote at the

meeting; and (ii) a simple majority of the votes attached to shares

held by CI shareholders present in person or represented by proxy

and entitled to vote at the meeting, excluding the votes attached

to the shares held by the persons described in items (a) through

(d) of Section 8.1(2) of Multilateral Instrument 61-101 –

Protection of Minority Security Holders in Special Transactions

(“MI 61-101”). Details on the voting results at the meeting

are below.

The following is a summary of the votes cast at the meeting by

shareholders of the Corporation on the Arrangement Resolution:

Total Number of Votes

For

Percentage of Votes

For

Total Number of Votes

Against

Percentage of Votes

Against

102,066,986

99.94%

63,882

0.06%

The following is a summary of the votes cast at the meeting by

shareholders of the Corporation on the Arrangement Resolution

(excluding shares required to be excluded pursuant to items (a)

through (d) of Section 8.1(2) of MI 61-101(1)):

Total Number of Votes

For

Percentage of Votes

For

Total Number of Votes

Against

Percentage of Votes

Against

88,556,819

99.93%

63,882

0.07%

Note:

(1)

All Shares held by those who qualified as

Eligible Rollover Shareholders (as defined in the Circular) as of

the date of the Circular were excluded. The only Eligible Rollover

Shareholders are the individuals identified as Eligible Rollover

Shareholders on page 47 of the Circular.

A report on voting results for the meeting will be filed under

the Corporation’s profile on SEDAR+ at www.sedarplus.ca.

The final order of the Ontario Superior Court of Justice

(Commercial List) approving the Arrangement will be sought on

February 18, 2025. Completion of the Arrangement remains subject to

receipt of the final order, required regulatory clearances, and

other customary closing conditions. Completion of the Arrangement

is expected to occur in the second quarter of this year, subject to

the satisfaction or waiver of the outstanding conditions.

About CI Financial

CI Financial Corp. is a diversified global asset and wealth

management company operating primarily in Canada, the United States

and Australia. Founded in 1965, CI has developed world-class

portfolio management talent, extensive capabilities in all aspects

of wealth planning, and a comprehensive product suite. CI manages,

advises on and administers approximately $532.7 billion in client

assets as at November 30, 2024. CI operates in three segments:

- Asset Management, which includes CI Global Asset Management,

which operates in Canada, and GSFM, which operates in

Australia.

- Canadian Wealth Management, operating as CI Wealth, which

includes CI Assante Wealth Management, Aligned Capital Partners, CI

Assante Private Client, CI Private Wealth, Northwood Family Office,

CI Coriel Capital, CI Direct Investing, CI Direct Trading and CI

Investment Services.

- U.S. Wealth Management, which includes Corient Private Wealth,

an integrated wealth management firm providing comprehensive

solutions to ultra-high-net-worth and high-net-worth clients across

the United States.

CI is headquartered in Toronto and listed on the Toronto Stock

Exchange (TSX: CIX). To learn more, visit CI’s website or LinkedIn

page.

CI Global Asset Management is a registered business name of CI

Investments Inc., a wholly owned subsidiary of CI Financial

Corp.

Forward-Looking Information

This press release contains “forward-looking information” within

the meaning of applicable Canadian securities laws. Forward-looking

information may relate to our future outlook and anticipated events

or results and may include information regarding our financial

position, business strategy, growth strategy, budgets, operations,

financial results, taxes, dividend policy, plans and objectives.

Particularly, information regarding our expectations of future

results, performance, achievements, prospects or opportunities,

including the timing for receipt of the final court order or

completion of the Arrangement, is forward-looking information. In

some cases, forward-looking information can be identified by the

use of forward-looking terminology such as “plans”, “targets”,

“expects” or “does not expect”, “is expected”, “an opportunity

exists”, “budget”, “scheduled”, “estimates”, “outlook”,

“forecasts”, “projection”, “prospects”, “strategy”, “intends”,

“anticipates”, “does not anticipate”, “believes”, or variations of

such words and phrases or statements that certain actions, events

or results “may”, “could”, “would”, “might”, “will”, “will be

taken”, “occur” or “be achieved”. In addition, any statements that

refer to expectations, intentions, projections or other

characterizations of future events or circumstances contain

forward-looking information. Statements containing forward-looking

information are not historical facts but instead represent

management’s expectations, estimates and projections regarding

future events or circumstances.

Undue reliance should not be placed on forward-looking

information. The forward-looking information in this press release

is based on our opinions, estimates and assumptions in light of our

experience and perception of historical trends, current conditions

and expected future developments, as well as other factors that we

currently believe are appropriate and reasonable in the

circumstances. Despite a careful process to prepare and review the

forward-looking information, there can be no assurance that the

underlying opinions, estimates and assumptions will prove to be

correct. Further, forward-looking information is subject to known

and unknown risks, uncertainties and other factors that may cause

actual results, level of activity, performance or achievements to

be materially different from those expressed or implied by such

forward-looking information, including but not limited to, those

described in this press release. The belief that the investment

fund industry and wealth management industry will remain stable and

that interest rates will remain relatively stable are material

factors made in preparing the forward-looking information and

management’s expectations contained in this press release and that

may cause actual results to differ materially from the

forward-looking information disclosed in this press release. In

addition, factors that could cause actual results to differ

materially from expectations include, among other things, the

possibility that the final order of the court may not be obtained,

the timing of the final order of the court, the possibility that

the Arrangement may not be completed, the timing of closing of the

Arrangement, the negative impact that the failure to complete the

Arrangement for any reason could have on the price of the shares or

on the business of the Corporation, general economic and market

conditions, including interest and foreign exchange rates, global

financial markets, the impact of pandemics or epidemics, changes in

government regulations or in tax laws, industry competition,

technological developments and other factors described or discussed

in CI’s disclosure materials filed with applicable securities

regulatory authorities from time to time. Additional information

about the risks and uncertainties of the Corporation’s business and

material risk factors or assumptions on which information contained

in forward‐looking information is based is provided in the

Corporation’s disclosure materials, including the Corporation’s

most recently filed annual information form and any subsequently

filed interim management’s discussion and analysis, which are

available under our profile on SEDAR+ at www.sedarplus.ca.

There can be no assurance that such information will prove to be

accurate, as actual results and future events could differ

materially from those anticipated in such information. Accordingly,

readers should not place undue reliance on forward looking

information, which speaks only as of the date made. The

forward-looking information contained in this press release

represents our expectations as of the date of this news release and

is subject to change after such date. CI disclaims any intention or

obligation or undertaking to update or revise any forward-looking

information, whether as a result of new information, future events

or otherwise, except as required by applicable law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250212894921/en/

CI Financial Corp. Investor Relations Jason

Weyeneth, CFA Vice-President, Investor Relations & Strategy

416-681-8779 jweyeneth@ci.com Media Relations Canada

Murray Oxby Vice-President, Corporate Communications 416-681-3254

moxby@ci.com United States Jimmy Moock Managing Partner,

StreetCred 610-304-4570 jimmy@streetcredpr.com ci@streetcredpr.com

Shareholders Laurel Hill Advisory Group North America

(toll-free): 1-877-452-7184 Outside North America: 1-416-304-0211

Email: assistance@laurelhill.com

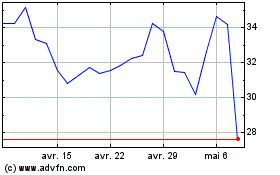

CompX (AMEX:CIX)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

CompX (AMEX:CIX)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025