|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549 |

| |

| SCHEDULE 13D/A |

| |

Under the Securities Exchange Act of 1934

(Amendment No. 7)* |

51Talk Online

Education Group

(Name of Issuer)

Class A

ordinary shares, par value $0.0001 per share

(Title of Class of Securities)

16954L

204(1)

(CUSIP Number)

Jack Jiajia Huang

24 Raffles Place #17-04 Clifford Centre,

Singapore 048621

0065 6991 2347

With copies to:

Haiping Li, Esq.

Skadden, Arps, Slate, Meagher & Flom LLP

c/o 42/F, Edinburgh Tower

The Landmark

15 Queen’s Road Central

Hong Kong

+852 3740-4700 |

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

December 13,

2024

(Date of Event Which Requires Filing of this Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D,

and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ¨

* The remainder of this cover page shall

be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any

subsequent amendment containing information which would alter the disclosures provided in a prior cover page.

(1) CUSIP

number 16954L 204 has been assigned to the American depositary shares (“ADSs”)

of the issuer, which are quoted on the NYSE American under the symbol “COE.” Each ADS represents 60 Class A ordinary

shares.

The information required on the remainder of this

cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934

(“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions

of the Act (however, see the Notes).

| CUSIP No. 16954L 204 |

13D/A |

Page 2 of 4 Pages |

| 1 |

Names of Reporting Persons

Jack Jiajia Huang |

| 2 |

Check the Appropriate Box if a Member of a Group |

| |

(a) |

¨ |

| |

(b) |

¨ |

| 3 |

SEC Use Only |

| 4 |

Source of Funds (See Instructions)

PF |

| 5 |

Check

Box if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) ¨ |

| 6 |

Citizenship or Place of Organization

People’s Republic of China |

| Number

of Shares Beneficially Owned by Each Reporting Person With |

7 |

Sole Voting Power

11,763,960 (1) |

| 8 |

Shared Voting Power

86,370,579 (2) |

| 9 |

Sole Dispositive Power

11,763,960 (1) |

| 10 |

Shared Dispositive Power

86,370,579 (2) |

| 11 |

Aggregate Amount Beneficially Owned by Each Reporting Person

98,134,539 (3) |

| 12 |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ¨ |

| 13 |

Percent of Class Represented by Amount in Row (11)

28.4%. The voting power of the shares beneficially owned represented 40.0% of the total outstanding voting power.(4) |

| 14 |

Type of Reporting Person (See Instructions)

IN |

| |

|

|

|

|

Notes:

(1) Represents

(i) 7,111,380 Class A ordinary shares in the form of ADSs purchased by Jack Jiajia Huang in the open market and (ii) 4,652,580

Class A ordinary shares in the form of ADSs purchased by HH Talent Limited in the open market.

(2) Represents

(i) 186,180 Class A ordinary shares in the form of ADSs held by Jack Jiajia Huang, (ii) 39,639,075 Class A ordinary

shares in the form of ADSs held by Dasheng Global Limited, (iii) 275,000 Class A ordinary shares issuable to Dasheng Global

Limited upon the vesting of restricted share units within 60 days after December 6, 2024, (iv) 277,200 Class A

ordinary shares in the form of ADSs held by Ting Shu, (v) 67,380 Class A ordinary shares issuable to Ting Shu upon the vesting

of restricted share units within 60 days after December 6, 2024, (vi) 30,390,321 Class B ordinary shares held by Dasheng

Global Limited, and (vii) 15,535,423 Class B ordinary shares held by Dasheng Online Limited.

(3) Represents

(i) 7,297,560 Class A ordinary shares in the form of ADSs held by Jack Jiajia Huang, (ii) 39,639,075 Class A ordinary

shares in the form of ADSs held by Dasheng Global Limited, (iii) 275,000 Class A ordinary shares issuable to Dasheng Global

Limited upon the vesting of restricted share units within 60 days after December 6, 2024, (iv) 4,652,580 Class A

ordinary shares in the form of ADSs purchased by HH Talent Limited, (v) 277,200 Class A ordinary shares in the form of ADSs

held by Ting Shu, (vi) 67,380 Class A ordinary shares issuable to Ting Shu upon the vesting of restricted share units within

60 days after December 6, 2024, (vii) 30,390,321 Class B ordinary shares held by Dasheng Global Limited, and (viii) 15,535,423

Class B ordinary shares held by Dasheng Online Limited.

Each

of Dasheng Global Limited, Dasheng Online Limited and HH Talent Limited is a British Virgin Islands company. Mr. Huang is

the sole director of Dasheng Global Limited and HH Talent Limited, and Ms. Shu is the sole director of Dasheng Online Limited. Each

of Dasheng Global Limited and Dasheng Online Limited is wholly beneficially owned by Dasheng International Holdings Limited, which is

in turn wholly owned by TB Family Trust, for which TMF (Cayman) Ltd. acts as the trustee (the “Trustee”). HH Talent Limited

is wholly beneficially owned by HH Talent Holdings Limited, which is in turn wholly owned by HH Talent Trust, for which the Trustee also

acts as the trustee. S.B. Vanwall Ltd., appointed by the Trustee, is the sole director of Dasheng International Holdings Limited and HH

Talent Holdings Limited. The settlors of TB Family Trust are Mr. Huang and Ms. Shu. Mr. Huang, Ms. Shu and their family

members are beneficiaries under TB Family Trust. Pursuant to Section 13(d) of the Exchange Act, and the rules promulgated

thereunder, Dasheng International Holdings Limited, TB Family Trust, the Trustee, Mr. Huang and Ms. Shu may be deemed to be

a group, and each member of such group may be deemed to beneficially own all of the ordinary shares beneficially owned by other members

constituting such group. All shares beneficially owned by TB Family Trust are beneficially owned by the Trustee solely in its capacity

as trustee of TB Family Trust. Accordingly, the Trustee, solely in its capacity as trustee of TB Family Trust, may be deemed to beneficially

own all ordinary shares of the Issuer that are beneficially owned by TB Family Trust. However, the Trustee disclaims beneficial ownership

of all ordinary shares of the Issuer. The settlor of HH Talent Trust is Mr. Huang. Mr. Huang and his family members are beneficiaries

under HH Talent Trust. Pursuant to Section 13(d) of the Exchange Act, and the rules promulgated thereunder, HH Talent Holdings

Limited, HH Talent Trust, the Trustee, Mr. Huang may be deemed to be a group, and each member of such group may be deemed to beneficially

own all of the ordinary shares beneficially owned by other members constituting such group. All shares beneficially owned by HH Talent

Trust are beneficially owned by the Trustee solely in its capacity as trustee of HH Talent Trust. Accordingly, the Trustee, solely in

its capacity as trustee of HH Talent Trust, may be deemed to beneficially own all ordinary shares of the Issuer that are beneficially

owned by HH Talent Trust. However, the Trustee disclaims beneficial ownership of all ordinary shares of the Issuer.

(4) The percentage of voting power is

calculated by dividing the voting power beneficially owned by the reporting person by the voting power of all of the Issuer’s

holders of Class A ordinary shares and Class B ordinary shares as a single class as of February 29, 2024 (taking into

account the number of shares that the reporting person had the right to acquire within 60 days the date hereof). Each holder of

Class A ordinary shares is entitled to one vote per share and each holder of Class B ordinary shares is entitled to ten

votes per share on all matters submitted to them for a vote. Class B ordinary shares are convertible at any time by the holder

thereof into Class A ordinary shares on a one-for-one basis.

| CUSIP No. 16954L 204 |

13D/A |

Page 3 of 4 Pages |

Explanatory Note

Pursuant

to Rule 13d-2 promulgated under the Act, this Amendment No. 7 to Statement on Schedule 13D (this “Amendment”)

amends and supplements the Statement on Schedule 13D originally filed with the U.S. Securities and Exchange Commission on July 25,

2022, as amended by Amendment No. 1 thereto filed on October 5, 2022,

by Amendment No. 2 thereto filed on July 10, 2023, by Amendment No. 3 thereto filed on November 29, 2023, by Amendment

No. 4 thereto filed on February 22, 2024, by Amendment No. 5 thereto filed on July 11, 2024, and by Amendment No. 6

thereto filed on October 10, 2024 (as so amended, the “Statement”). Except as specifically provided herein, this

Amendment does not modify any of the information previously reported in the Statement. All capitalized terms used herein which are not

defined herein have the meanings given to such terms in the Statement.

| |

Item 2. |

Identity and Background |

Items 2(a) through

(f) of the Statement are hereby amended and restated as follows:

(a),

(b), (c) and (f): This Schedule 13D amendment is being filed by Jack Jiajia Huang (the “Reporting Person”).

The Reporting Person is a citizen of the People’s Republic of China. The business address of the Reporting Person is 24 Raffles

Place #17-04 Clifford Centre, Singapore 048621. The Reporting Person is the founder, chairman and chief executive officer of the Issuer.

(d) and (e): During the

last five years, the Reporting Person has not been: (i) convicted in a criminal proceeding (excluding traffic violations or similar

misdemeanors) or (ii) a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result

of such proceeding was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating

activities subject to, federal or state securities laws or finding any violation with respect to such laws.

| Item 3. | Source and Amount of Funds or Other Consideration |

Item 3 of the Statement

is hereby amended and restated by the following:

Dasheng

Global Limited entered into Rule 10b5-1 trading plans, dated as of March 31, 2022 and June 30, 2022, respectively, with

Tiger Brokers (Singapore) Pte Ltd (the “Trading Plans”). Under the Trading Plans, Dasheng Global Limited proposes to

purchase a total of 1,100,000 ADSs of the Issuer. Pursuant to the Trading Plans, through the date hereof, Dasheng Global Limited has purchased

1,025,415 ADSs in the open market for approximately US$1.6 million, using its capital from previous disposition of its holding of the

Issuer’s ADSs. On December 15, 2022, the Issuer effected a change of the ratio of its ADSs to Class A ordinary

shares from one ADS representing fifteen Class A ordinary shares to one ADS representing sixty Class A ordinary shares.

In

addition, from March 28, 2022 through September 19, 2022, Dasheng Global Limited purchased a total of 562,106 ADSs of the Issuer

in the open market for approximately US$0.9 million, using its capital from previous disposition of its holding of the Issuer’s

ADSs. From September 20, 2022 through June 30, 2023, Dasheng Global Limited purchased a total of 102,984 ADSs of the Issuer

in the open market for approximately US$0.7 million using its own capital. From August 31, 2023 through September 23,

2023, Dasheng Global Limited purchased a total of 26,315 ADSs of the Issuer in the open market for approximately US$0.2 million, using

its own capital.

Dasheng

Global Limited entered into a Rule 10b5-1 trading plan, dated as of June 30, 2023, with Tiger Brokers (Singapore) Pte

Ltd (the “2023 Trading Plan”). Under the 2023 Trading Plan, Dasheng Global Limited proposes to purchase a total of

250,000 ADSs of the Issuer. Pursuant to the 2023 Trading Plan, Dasheng Global Limited has purchased 103,223 ADSs in the open market for

approximately US$0.8 million from October 20, 2023 through February 20, 2024, using its own capital.

From

June 14, 2024 through June 29, 2024, Mr. Jack Jiajia Huang purchased a total of 53,827 ADSs of the Issuer in the open market

for approximately US$0.5 million, using his own capital. From August 27, 2024 through September 30, 2024, Mr. Jack Jiajia

Huang purchased a total of 64,696 ADSs of the Issuer in the open market for approximately US$1.0 million, using his own capital.

| CUSIP No. 16954L 204 |

13D/A |

Page 4 of 4 Pages |

HH

Talent Limited entered into a Rule 10b5-1 trading plan, dated as of June 27, 2024, with Tiger Brokers (Singapore) Pte

Ltd (the “2024 Trading Plan”). Under the 2024 Trading Plan, HH Talent Limited proposes to purchase a total of 250,000

ADSs of the Issuer. Pursuant to the 2024 Trading Plan, HH Talent Limited has purchased 77,543 ADSs in the open market for approximately

US$1.1 million from October 24, 2024 through December 12, 2024, using its own capital.

Apart

from the foregoing open-market purchases, (i) the 275,000 Class A ordinary shares of the Issuer issuable upon the vesting

of restricted share units within 60 days after the date hereof, to be held by Dasheng Global Limited, the 1,874,940 Class A ordinary

shares of the Issuer in the form of ADSs held by Dasheng Global Limited, and the 186,180 Class A ordinary shares of the Issuer in

the form of ADSs held by Mr. Huang are shares issuable or issued to Mr. Huang pursuant to share awards granted under the Issuer’s

share incentive plans, (ii) the 67,380 Class A ordinary shares of the Issuer issuable to Ms. Shu upon the vesting of restricted

share units and the 277,200 Class A ordinary shares of the Issuer in the form of ADSs held by Ms. Shu, are shares issuable or

issued to Ms. Shu pursuant to share awards granted under the Issuer’s share incentive plans, and (iii) the 30,390,321

Class B ordinary shares of the Issuer and the 15,535,423 Class B ordinary shares of the Issuer have been held by Dasheng Global

Limited and Dasheng Online Limited, respectively, since the completion of the initial public offering of the Issuer.

Item 6. Contracts, Arrangements, Understandings

or Relationships with respect to Securities of the Issuer.

Item 6 of the Statement

is hereby amended and supplemented by the following:

The 2023 Trading Plan is attached

as Exhibit C hereto and is incorporated herein by reference.

Item 7. Material to be Filed as Exhibits.

Item7

of the Statement is hereby amended and supplemented by the following:

SIGNATURE

After reasonable inquiry and

to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

| Dated: December 17, 2024 |

|

| |

|

| Jack Jiajia Huang |

/s/ Jack Jiajia Huang |

Schedule I

60-Day Trading History

| Trade Date | |

Amount of ADSs (Each Representing 60

Class A Ordinary Shares) Purchased | | |

Weighted Average Price Per

ADS (US$) | |

| October 24, 2024 | |

| 7,207 | | |

| 14.70 | |

| October 25, 2024 | |

| 3,500 | | |

| 16.08 | |

| October 28, 2024 | |

| 181 | | |

| 16.16 | |

| October 29, 2024 | |

| 73 | | |

| 16.04 | |

| October 30, 2024 | |

| 10 | | |

| 16.14 | |

| October 31, 2024 | |

| 47 | | |

| 16.07 | |

| November 1, 2024 | |

| 207 | | |

| 16.12 | |

| November 4, 2024 | |

| 205 | | |

| 16.14 | |

| November 13, 2024 | |

| 2,343 | | |

| 14.57 | |

| November 14, 2024 | |

| 1,177 | | |

| 14.89 | |

| November 15, 2024 | |

| 1,286 | | |

| 14.65 | |

| November 18, 2024 | |

| 834 | | |

| 14.72 | |

| November 19, 2024 | |

| 2,930 | | |

| 14.88 | |

| November 20, 2024 | |

| 891 | | |

| 15.28 | |

| November 21, 2024 | |

| 770 | | |

| 15.32 | |

| November 22, 2024 | |

| 2,909 | | |

| 14.89 | |

| November 25, 2024 | |

| 275 | | |

| 15.17 | |

| November 26, 2024 | |

| 2,120 | | |

| 14.60 | |

| November 27, 2024 | |

| 482 | | |

| 14.48 | |

| November 29, 2024 | |

| 9,104 | | |

| 13.64 | |

| December 2, 2024 | |

| 2,963 | | |

| 13.78 | |

| December 3, 2024 | |

| 1,639 | | |

| 13.70 | |

| December 4, 2024 | |

| 2,612 | | |

| 13.51 | |

| December 5, 2024 | |

| 6,328 | | |

| 13.69 | |

| December 6, 2024 | |

| 401 | | |

| 13.88 | |

| December 9, 2024 | |

| 1,575 | | |

| 14.01 | |

| December 10, 2024 | |

| 1,163 | | |

| 13.70 | |

| December 11, 2024 | |

| 11,952 | | |

| 14.80 | |

| December 12, 2024 | |

| 12,359 | | |

| 16.17 | |

The

above transactions were effected by HH Talent Limited in the open market.

Exhibit C

This plan dated June 27, 2024 (together with all possible Exhibits

hereto, this “Plan”) is between HH Talent Limited (the “Customer”) and Tiger Brokers (Singapore) Pte. Ltd.

(“TBSG”), acting as agent.

| 1. | This Plan is reached between the Customer and TBSG for the purpose of establishing a trading plan that

complies with the requirements of Rule 10b5-1 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). |

| 2. | The Customer is establishing this Plan in order to permit the trading of the American depository shares

(the “ADS”) representing Class A ordinary shares (the “Shares”, for purposes hereof including

those in the form of ADS) of 51 Talk Online Education Group (the “Issuer”), which are currently traded on the Nyse

American (the “Principal Market”), and/or the listed derivatives (the “Derivatives”, together with the

Shares referred to as the “Securities”) of the Shares, through the Customer’s account No. ****** at TBSG

(the “Plan Account”). |

| B. | The Customer’s Representations, Warranties and Covenants |

| 1. | As of the date hereof, the Customer is not aware of any material non-public information concerning the

Issuer or the Shares and is not subject to any legal, regulatory, or contractual restriction or undertaking that would prevent TBSG from

acting upon the instructions set forth in this Plan. The Customer is entering into this Plan in good faith and not as part of a plan or

scheme to evade compliance with Rule 10b5-1 under the Exchange Act or other applicable federal or state laws. |

| 2. | The Customer has not entered into or altered, and will not enter into or alter any corresponding or hedging

transaction or position with respect to the Securities during the term of this Plan. |

| | The Customer acknowledges that this Plan shall comply with the requirements of Rule 10b5-1

(c) and that any amendment, modification, waiver or termination of this Plan must be made in accordance with the provisions of

Rule 10b5-1 (c). |

| 3. | the Customer Agrees to: |

| a. | provide TBSG with a certificate dated as of the date of this Plan and signed by the Issuer substantially

in the form of Exhibit A (issuer representation) to this Plan prior to commencement of the Plan Period. |

| b. | notify TBSG’s dealing team by email as set forth in paragraph G.3 below as soon as practicable if

the Customer becomes aware of (i) the occurrence of any event contemplated by paragraph 4 of the certificate set forth as Exhibit A

to this Plan; (ii) a change in the Issuer’s insider trading policies, so that the trades to be made by TBSG for the Plan Account

pursuant to the Plan would violate these policies; or (iii) a determination by the Issuer’s board of directors or chief executive

officer that the trades pursuant to the Plan would have a material adverse effect on the Issuer’s financial condition. In the case

of a notice relating to clause |

| | (i) above,

such notice shall indicate the anticipated duration of the restriction, but shall not include any other information about the nature

of the restriction or its applicability to the Customer and shall not in any way communicate any material non-public information

about the Issuer or the Shares to TBSG. Such notice shall be in addition to the notice required to be given to TBSG by the Issuer

pursuant to the certificate set forth as Exhibit A to this Plan. |

| 4. | The execution and delivery of this Plan by the Customer and the trades contemplated by this Plan will

not contravene any provision of applicable law or any agreement or other instrument binding on the Customer or any of the Customer's affiliates

or any judgment, order or decree of any governmental body, agency or court having jurisdiction over the Customer or the Customer's affiliates. |

| 5. | The Customer agrees with respect to the Securities, that until this Plan has been terminated, the Customer

shall not (i)enter into a binding contract with respect to the trade of the Securities with another broker, dealer or financial institution

(each, a “Financial Institution”),(ii)instruct another Financial Institution to trade the Securities or (iii)adopt a plan

for trading with respect to the Securities other than this Plan with another Financial Institution. Notwithstanding the foregoing, the

Customer shall notify TBSG in connection with any trade of the Securities prior to such trade. |

| 6. | The Customer agrees that it shall not, directly or indirectly, communicate any material, non-public information

relating to the Issuer or the Shares to any employee of TBSG or its affiliates who is involved, directly or indirectly, in executing

this Plan at any time while this Plan is in effect. |

| a. | to make all filings, if any, required under Sections 13(d),13(g)and 16 of the Exchange Act in a timely

manner, to the extent any such filings are applicable to the Customer. In order to promote compliance with such filing requirements, TBSG

agrees to use reasonable efforts to transmit transaction information for open market transactions under this Plan via email to the Customer

by the close of business on the day of any trade, and shall in any event transmit such information no later than the close of the business

on the first business day after any trade. Emails with transaction information shall be sent to: |

| | | |

| | | Email:

****** |

| b. | that the Customer shall at all times during the Plan Period,

in connection with the performance of this Plan, comply with all applicable laws, including, without limitation, Section 16 of the

Exchange Act and the rules and regulations promulgated thereunder to the extent Section 16 is applicable. |

| 8. | The Customer understands and agrees that if the Customer is an affiliate or control person of the Issuer for purposes of Rule

144(“Rule 144”)of the Securities Act of 1933,as amended (the “Securities Act”),or if the Securities(and

in terms of the Derivatives, their underlying Shares) subject to the Plan are restricted securities subject to limitations under Rule 144

or eligible for resale under Rule 145,then all trades of the Securities under the Plan will be made in accordance with the applicable

provisions of Rule 144,and- |

| a. | the Customer represents and warrants that the Securities (and in terms of the Derivatives, their underlying

Shares)subject to this Plan are currently eligible for sale under Rule 144. |

| b. | the Customer agrees not to take, and agrees to cause any person or entity with which the Customer would

be required to aggregate sales of Shares pursuant to paragraph(a)(2)or(e) of Rule 144 not to take, any action that would cause

the trades under this Plan not to meet all applicable requirements of Rule 144. |

| c. | the Customer agrees to complete, execute and deliver to TBSG Forms 144 for the trades to be effected under

this Plan, where applicable, at such times and in such number of copies as TBSG shall request, and following such delivery, TBSG agrees

to file such Forms 144 on behalf of the Customer as required by applicable law. |

| d. | the Customer hereby grants TBSG a power of attorney to complete and/or file on behalf of the Customer

any required Forms 144.Notwithstanding such power of attorney, the Customer acknowledges that TBSG shall have no obligation to complete

or file Forms 144 on behalf ofthe Customer except as set forth in subparagraph(c). |

| e. | where Rule 144 is applicable, TBSG agrees to conduct all trades under this Plan in accordance with

the manner of sale requirement of Rule 144 and in no event shall TBSG effect any trade if such trade would exceed the then-applicable

amount limitation under Rule 144,assuming TBSG's trades under this Plan are the only trades subject to that limitation. |

| f. | the Customer agrees to complete, execute and deliver to TBSG a customer representation letter dated as

of the date of this Plan substantially in the form of Exhibit B to this Plan prior to the commencement of the Plan Period. |

| 9. | The Customer acknowledges and agrees that the Customer does not have, and shall not attempt to exercise,

any influence over how, when or whether to effect trades of Derivative under this Plan |

| C. | Implementation of the Plan |

| 1. | The Customer hereby appoints TBSG as its broker and instructs

TBSG or instructs TBSG to instruct its affiliates to execute trades with respect to the Securities pursuant to the terms and conditions

set forth below.Subject to such terms and conditions, TBSG hereby accepts such appointment and instruction |

| 2. | This Plan shall be effective from the Customer's signature date.

TBSG is authorized to begin trading the Securities under this Plan commencing.(For directors and officers, their plan will not begin

until the later of(a)90 days after the adoption of the Rule 10b5-1 plan or(b)two business days following the disclosure of the issuer's

financial results in a Form 10-Q or Form 10-K for the fiscal quarter in which the plan was adopted or modified or, for FPI,

in a Form 20-F or Form 6-K.But in any event, the required cooling off period is subject to a maximum of 120 days after the

adoption of the plan)at the open of the Principal Market and shall cease trading the Securities on the earliest to occur of:(i)the date

on which TBSG is required to terminate trades under this Plan pursuant to paragraph D.1 below;(ii)the date on which TBSG receives notice

of the death of the Customer;(ii)the date that the Issuer or any other person publicly announces a tender or exchange offer with respect

to the Shares;(iv)the date of public announcement of a merger acquisition, reorganization, recapitalization or comparable transaction

affecting the securities of the Issuer as a result of which the Shares will be exchanged or converted into shares of another company;(v)the

date on which TBSG receives notice of the commencement of any proceedings in respect of or triggered by the Customer's bankruptcy or

insolvency;(vi)the date on which TBSG, Issuer or the Customer reasonably determines that the Plan does not comply with Rule

10b5-1 or applicable securities laws; and(vii)Sept,25,2025 at the close of the Principal Market. |

| | (the period during which TBSG is authorized to trade Securities under this paragraph C.2 is referred

to in this Plan as the “Plan Period”). |

| 3. | During the Plan Period, TBSG shall use reasonable efforts to

trade the Securities pursuant to the instructions set forth in Exhibit C to this plan.(the total amount of Securities that TBSG

is authorized to trade under this paragraph C.3 is referred to in this Plan as the “Instructed Amount”) . |

| | Subject to the restrictions set forth in this paragraph C.3 above, TBSG shall trade the Instructed

Amount under ordinary principles of best execution at the then-prevailing market price. If, consistent with ordinary principles of

best execution or for any other reason, TBSG cannot trade the amount instructed to be sold for each trading day under paragraph

C.3,then (select one): |

| | x the amount of such shortfall may be traded as soon as practicable from the next trading day

at the beginning of the Principal Market under ordinary principles of best execution. |

| | ¨ TBSG's obligation to trade Securities for that day under

this Plan shall be deemed to have been satisfied. |

| | Nevertheless, if any such shortfall exists after the close of trading on the last trading day of the

Plan Period, TBSG's authority to trade such Securities for the Plan Account under this Plan shall terminate. |

| | The above trade limits and prices referred to in this Plan shall be adjusted automatically on a

proportionate basis to take into account any stock split, reverse stock split or stock dividend with respect to the Shares or any

change in capitalization with respect to the Issuer that occurs during the Plan Period and that affects the Shares. The Customer or

the Issuer will give written notice to TBSG of any such event in a timely fashion such that TBSG can instruct TBSG to make an

adjustment, if necessary, to the trades due under this Plan. |

| | TBSG shall have complete discretion as to the time per trading day to make those trades set forth

above. The Customer may not discuss with TBSG the timing of the trading in the Securities on the Customer's behalf (other than to

confirm these instructions and describe/explain them if necessary). |

| | The Customer understands and agrees that during the Issuer's trading window period (determined

pursuant to the Issuer's insider trading policies),these instructions cannot be revoked/amended except in connection with a

termination/amendment of the Plan under paragraph D below and that the Customer will not have the ability to exercise any discretion

with regards to how, when or whether to effect trades of the Securities. |

| | Notwithstanding the forgoing instructions, during the Plan Period, where Rule 144 is applicable

in no event shall TBSG trade more than the maximum allowable volume pursuant to Rule 144 in any three-month period, assuming

TBSG's trades under this Plan are the only trades subject to that limitation. |

| 4. | TBSG shall not trade Securities under this Plan at any time

when: |

| a. | TBSG, in its sole discretion, has determined that a market disruption, banking moratorium outbreak or escalation of hostilities or

other crisis or calamity has occurred, or |

| b. | TBSG, in its sole discretion, has determined that it is prohibited from doing so by a legal, contractual or regulatory restriction

applicable to it or its affiliates or to the Customer or the Customer's affiliates (other than any such restriction relating to the Customer's

possession or alleged possession of material non-public information about the Issuer or the Shares),or |

| c. | TBSG has received notice from the Issuer or the Customer of the occurrence of any event contemplated by paragraph 4 of the certificate

set forth as Exhibit A to this Plan, or |

| d. | a trade effected under the Plan fails to comply (or in the reasonable opinion of TBSG is not likely to comply)with Rule 144(where

Rule 144 is applicable),or |

| e. | TBSG has received notice from the Customer to terminate this Plan in accordance with paragraph D.1 below. |

| a. | the Customer agrees to deliver the total number of Securities (and in terms of the Derivatives, their underlying Shares)to be traded

(only those the trading of which is deemed a sale of the Shares for purposes of Rule 144)under this Plan(with the amount to be estimated

by the Customer in good faith, if the daily trade amount is designated as an aggregate dollar amount), into the Plan Account and the Shares

will be in street name, electronically transferable form, without legend or stop transfer within the Plan Account prior to the close of

the Principal Market on the business day preceding the commencement of trades under this Plan, or this Plan may be terminated or suspended

as deemed necessary by TBSG without prior notice. |

| b. | TBSG agrees to notify the Customer promptly if at any time during the Plan Period the number of Shares in the Plan Account is less

than the necessary number for the Securities to be traded under this Plan. Upon such notification, the Customer agrees to deliver promptly

to the Plan Account the number of Shares necessary to eliminate this shortfall, upon the failure of which this Plan may be terminated

or suspended as deemed necessary by TBSG without prior notice. |

| 6. | The Customer may instruct TBSG to trade the Securities other than pursuant to this Plan. The parties hereto agree that any such transaction(i)will

not be deemed to modify this Plan unless the Customer so requests in writing in accordance with paragraph D.2&3 below and (ii)will

be given by the Customer to TBSG only if such transaction does not contravene any of the representations, warranties or covenants set

forth in Section B of this Plan. |

| D. | Amendment and Termination |

| 1. | This Plan may not be terminated prior to the end of the Plan Period,except that: |

| a. | it may be terminated by the Customer at any time during the Issuer's trading window period upon one

day's prior written notice sent to TBSG's project manager via telephone and email as set forth in paragraph G.3 below; and |

| b. | it may be terminated pursuant to Paragraph C.5 of this Plan; |

| c. | it may be, at TBSG's option, terminated if TBSG has received notice from the Issuer of the

occurrence of any event contemplated by paragraph 4 of the certificate set forth as Exhibit A to this Plan. |

| 2. | Notwithstanding the provisions of paragraph D.1.herein,this Plan may only be amended or terminated pursuant to the Issuer's insider

trading policies, and only after pre-clearance by the Issuer |

| 3. | Unless the requirements herein are waived by TBSG, this Plan may be amended (including being terminated outside the Issuer's trading

window period)by the Customer only upon the written consent of TBSG and receipt by TBSG of the following documents, each dated as of the

date of such amendment: |

| a. | a representation signed by the Issuer substantially in the form of Exhibit A to this Plan, |

| b. | a certificate signed by the Customer certifying that the representations

and warranties of the Customer contained in this Plan are true at and as of the date of such certificate as if made at and as of such

date, and |

| c. | the customer representation letter completed and executed

by the Customer substantially in the form of Exhibit B to this Plan. |

| E. | Indemnification; Limitation of Liability |

| a. | the Customer agrees to indemnify and hold harmless TBSG and

its directors, officers employees and affiliates and any directors, officers, employee of its affiliates from and against all claims,

losses, damages and liabilities (including, without limitation, any legal or other expenses reasonably incurred in connection with defending

or investigating any such action or claim)arising out of or attributable to TBSG's actions taken or not taken in compliance with this

Plan or arising out of or attributable to any breach by the Customer of this Plan (including the Customer's representations and waranties

in this Plan)or any violation by the Customer of applicable laws or regulations; provided, however, that the indemnification provisions

of this paragraph E.1.a.shall not apply in the case of any claims, losses, damages or liabilities finally judicially determined to have

resulted from TBSG's gross negligence or willful misconduct. This indemnification shall survive termination of this Plan |

| b. | Notwithstanding any other provision of this Plan, neither party shall be liable to the other party for: |

| | (i) special, indirect, punitive, exemplary or consequential damages, or incidental losses or damages

of any kind, even if advised of the possibility of such losses or damages or if such losses or damages could have been reasonably

foreseen, or |

| | (ii) any failure to perform or to cease performance or any delay in performance that results from

a cause or circumstance that is beyond its reasonable control, including but not limited to failure of electronic or mechanical

equipment, strikes, failure of common carrier or utility systems, severe weather, market disruptions or other causes commonly known

as “acts of God.” |

| 2. | The Customer has consulted

with the Customer's own advisors as to the legal, tax, business, financial and related aspects of,and has not relied upon TBSG or any

person affiliated with TBSG in connection with the Customer's adoption and implementation of this Plan |

| 3. | The Customer acknowledges

and agrees that in performing the Customer's obligations under this Plan, neither TBSG nor any of its affiliates nor any of their respective

officers, employees or other representatives is exercising any discretionary authority or discretionary control respecting management

of the Customer's assets, or exercising any authority or control respecting management or disposition of the Customer's assets, or otherwise

acting as a fiduciary (within the meaning of Section 3(21)of the Employee Retirement Income Security Act of1974, as amended, or

Section 2510.3-21 of the Regulations promulgated by the United States Department of Labor)with respect to the Customer or the Customer's

assets. Without limiting the foregoing, the Customer further acknowledges and agrees that neither TBSG nor any of its affiliates nor

any of their respective officers, employees or other representatives has provided any “investment advice” within the meaning

of such provisions, and that no views expressed by any such person will serve as a primary basis for investment decisions with respect

to the Customer's assets. |

This Agreement is governed by the laws

of the Republic of Singapore and the terns hereof in confliction with the law provisions will be void. The Republic of Singapore has the

exclusive right of jurisdiction over disputes related to this Agreement.

| 1. | The Customer shall pay TBSG $0.031 per ADS traded,$2.95 per contract of the Derivatives traded |

| 2. | This Plan constitutes the entire agreement between the parties with respect to this Plan and supersedes any prior agreements or understandings

with regards to the trades of the Securities between the parties |

| 3. | All notices to TBSG under this Plan shall be given to TBSG's dealing team in the manner specified by this Plan by email at dealing@tigerbrokers.com.sg

Notices to the Customer shall be given to: |

Address:6 Floor Deshi Building,NO.9 East Shangdi Road,

Haidian District, Beijing, China

Attn: Huang Jiajia

Tel:******

Email: ******

| 4. | Each party's rights and obligations under this Plan may not be assigned or delegated without the written permission of the other party,

which may be withheld in such party's sole discretion. However, TBSG could assign or delegate the rights and obligations under this Plan

to its affiliates. |

| 5. | This Plan may be signed and delivered in electronic format in any number of counterparts, each of which shall be an original, with

the same effect as if the signatures on all counterparts were upon the same instrument |

| 6. | If any provision of this Plan is or becomes inconsistent with any applicable present or future law, rule or regulation, that

provision will be deemed modified or, if necessary, rescinded in order to comply with the relevant law, rule or regulation. All other

provisions of this Plan will continue and remain in full force and effect. |

| 7. | This Plan shall be applicable to agreements made and to be fully performed therein and may be modified or amended only by a writing

signed by the parties to this Plan. |

IN WITNESS WHEREOF, the undersigned have signed this Plan as of the

date first written above.

| The Customer’s full name: |

|

Tiger Brokers (Singapore) Pte. Ltd. |

| |

|

|

| HH Talent Limited |

|

|

| Date: June 27, 2024 |

|

Date: June 27, 2024 |

| Signature: |

/s/ Huang Jiajia |

|

Signature: |

/s/ IAN LEONG |

| Print Name: Huang Jiajia |

|

Print Name: IAN LEONG |

| Title: Director |

|

Title: Director |

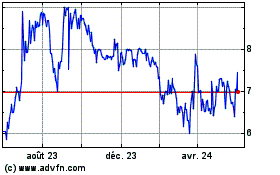

51Talk Online Education (AMEX:COE)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

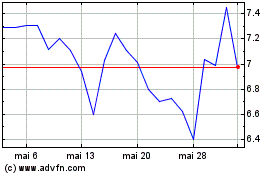

51Talk Online Education (AMEX:COE)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025