AMCON Announces Termination of Letter of Intent for Sale of Non-Distribution Businesses, and Update on Bank Loan Agreement and T

10 Janvier 2006 - 11:33PM

Business Wire

AMCON Distributing Company (AMEX:DIT) ("AMCON"), an Omaha, NE based

consumer products company, announced that it has terminated a

letter of intent ("LOI") with William F. Wright, its Chairman of

the Board, Chief Executive Officer and largest stockholder, for the

proposed acquisition of 80% of the outstanding common stock of The

Healthy Edge, Inc. ("THE") which is currently a direct wholly-owned

subsidiary of AMCON. The LOI had contemplated that THE would own,

at the time of closing of the proposed acquisition, 100% of the

equity of Health Food Associates, Inc. (d/b/a Akin's Natural Food

Market), Chamberlin's Natural Foods, Inc. (d/b/a Chamberlin's

Market and Cafe), and Hawaiian Natural Water Company, Inc.

("HNWC"), as well as 85% of the equity of Trinity Springs, Inc.

("TSI"), each of which are currently direct or indirect

subsidiaries of AMCON. Even though the LOI is terminated, AMCON

would be required to pay a termination fee of $550,000 to the

buyout group led by Mr. Wright upon the closing of any acquisition

of, business combination with, or investment in, THE that is the

subject of a letter of intent or agreement with a third party

regarding any of those alternatives that is signed prior to

February 28, 2006. The termination of the LOI was due to, among

other things, the complications created by a ruling by the District

Court of the Fifth Judicial District of the State of Idaho

announced by AMCON on December 21, 2005. That ruling granted the

plaintiff's motion for partial summary judgment declaring that the

stockholders of Trinity Springs, Ltd. (which subsequently changed

its name to Crystal Paradise Holdings, Inc.) did not validly

approve the sale of its business and assets because the vote of

certain shares issued as a dividend should not have been counted.

The District Court has not yet ruled on whether money damages or

rescission of the sale transaction and related matters will be

ordered as the relief in this action. In response to a motion filed

by AMCON and TSI, the plaintiffs filed, on January 6, 2006, a plan

of rescission with the District Court which contemplates: (i) the

repayment to TSI of $1,000,000 in cash paid to Crystal Paradise

Holdings at the closing of the purported asset sale, (ii)

cancellation of the three promissory notes in the principal amount

of $500,000 issued at such closing and repayment of interest

thereon of approximately $32,000, (iii) cancellation of a ten-year

promissory note issued at such closing in the principal amount of

$2,828,440 and repayment of principal and interest thereon of

$540,000, (iv) payment for the inventory (including finished goods

and raw materials) and current assets of TSI, (v) payment of

$67,630 for the portion paid by TSI subsequent to such closing of

the $156,275 of the liabilities of Crystal Paradise Holdings'

assumed at such closing, (vi) surrender for cancellation of the 15%

of TSI common stock held by Crystal Paradise Holdings, and (vii)

relieving TSI of any further obligation to pay water royalties but

not reimbursing $275,704 in water royalties paid by TSI. The

plaintiffs' rescission plan would reduce the foregoing repayments

by the depreciation on the assets to be returned to Crystal

Paradise Holdings incurred since the closing of the purported asset

sale. The plaintiffs also assert in their rescission plan that no

repayment would be made by Crystal Paradise Holdings of any loans

or investments in TSI, or other expenses incurred by AMCON for the

benefit of TSI subsequent to the closing of the purported asset

sale. Plaintiffs' rescission plan would not require TSI to repay

any revenues generated from the operation of the TSI business and

provides that Crystal Paradise Holdings would collect the TSI

accounts receivable and pay them to TSI. However, the rescission

plan is inconsistent in that it would require the rescission

payments to be reduced by the fair market value (calculated at the

time of closing of the purported asset sale) of any assets sold,

consumed in the ordinary course of business or otherwise disposed

of by AMCON or TSI. The plaintiffs' rescission plan states that Mr.

Robert Burns and Wallace Williams LLC would be the source of the

rescission payments as well as working capital for Crystal Paradise

Holdings, subject to satisfactory completion of due diligence

deemed by them to be necessary in their discretion. No financial

statements or other financial assurances were provided by

plaintiffs to demonstrate the capacity of Mr. Burns or Wallace

Williams LLC to make the restitution payments or provide working

capital to Crystal Paradise Holdings. Likewise, the rescission plan

does not contain any guarantee or assurances that it will be

approved by the Crystal Paradise Holdings Board, its shareholders

or the Court. AMCON and TSI believe that an appropriate plan of

rescission would require the plaintiffs to restore the parties

fully to their position prior to the purported asset sale

transaction, including the return of the consideration paid by TSI

in the purported asset sale transaction as well as monies

subsequently invested in or loaned to TSI by AMCON and other

affiliated parties, the expenses paid by AMCON for the benefit of

TSI, and any other benefits received by TSI during the period of

time since the closing of the purported asset sale transaction. The

District Court has not yet considered the sufficiency of the

plaintiffs' rescission plan, nor has the Court considered the

effect of the notice sent by AMCON and TSI on December 27, 2005

terminating the Asset Purchase Agreement for the purported asset

sale because approval by the requisite vote was not obtained within

the time period permitted under that agreement. On January 6, 2006,

the plaintiffs also filed a motion with the District Court seeking

leave to amend their complaint to: (i) add a claim for civil

conspiracy, intentional interference with economic advantage and

punitive damages against certain defendants which appears to

include AMCON, and (ii) confirm that plaintiffs seek the

alternative remedy of rescissory damages in the event that the

District Court denies the remedy of rescission. At the same time as

the plaintiffs filed their motion to amend their complaint, they

also filed a motion to appoint a receiver and a motion to compel

mediation. AMCON and TSI are still in the process of reviewing

plaintiffs' motions and the merits of the arguments made therein

and will respond as appropriate upon the completion of that review.

AMCON's bank lenders will not allow additional funds to be invested

in or loaned to TSI by AMCON or its other subsidiaries. The

uncertainty created by the District Court's ruling make it unlikely

that TSI will be able to raise additional capital until either (i)

the District Court issues the order referenced above and plaintiffs

clarify their ability to effect full rescission and restitution, or

(ii) a negotiated settlement is reached with among TSI, AMCON,

plaintiffs and Crystal Paradise Holdings, Inc. If these events do

not occur with sufficient lead time before TSI runs out of

operating cash, TSI's board of directors may determine to place TSI

into Chapter 11 bankruptcy. TSI has not made the originally

scheduled installment payments of principal and interest with

respect to the two notes issued by TSI referenced above as part of

the purchase price for the purported asset sale by Crystal Paradise

Holdings, Inc. which was the subject of the failed stockholder vote

described above. Crystal Paradise Holdings, Inc. may seek to

declare a default on those notes and may attempt to accelerate

payment thereof as well as attempt to call upon AMCON's guaranty of

those notes. AMCON and TSI believe that they have meritorious

defenses thereto, including AMCON's and TSI's belief that those

obligations were extinguished upon termination by them of the Asset

Purchase Agreement described above. On January 9, 2006, AMCON's

bank lenders granted a waiver of any event of default as a result

of the failure to agree to the sale or liquidation of TSI or HNWC.

This waiver also encompasses any event of default that would occur

if any proceedings in bankruptcy by or against TSI or HNWC, or for

the liquidation or reorganization of TSI or HNWC, or alleging that

TSI or HNWC is insolvent or unable to pay its debts as they mature,

or for the readjustment or arrangement of TSI's or HNWC's debts.

The loan agreement with the bank lenders was also amended on

January 9, 2006 to replace all prior financial covenants, which had

previously been suspended, with a covenant requiring that

consolidated EBITDA (excluding TSI, HNWC and The Beverage Group,

Inc.) not be less than: (i) $100,000 as of the last day of each

month for the one-month period then ending, except for the month

ending February 28, 2006 which is permitted to be zero, (ii)

$1,100,000 as of March 31, 2006 for the three-month period then

ending, (iii) $3,200,000 as of June 30, 2006 for the six-month

period then ending, and (iv) $5,500,000 as of September 30, 2006

for the ninth-month period then ending, and (v) $6,500,000 as of

December 31, 2006 for the twelve-month period then ending. The

amendment also requires AMCON and its subsidiaries to hire a

turn-around consultant acceptable to the agent for the bank lenders

by January 31, 2006 and to pay to the agent its customary fees and

expenses in exercising its rights under the loan agreement. In

addition, the amendment creates a new event of default if AMCON or

its subsidiaries makes any payment (in cash or other property) or a

judgment is entered against AMCON or its subsidiaries requiring a

payment (in cash or other property) to be made under or in

connection with the guaranty by AMCON of the TSI acquisition notes

or the water royalty under the Asset Purchase Agreement for the

purported sale of TSI assets. The Company is presently assessing

the accounting and other implications of the court's ruling in the

TSI matter and the possible alternatives available to it in order

to develop a course of action to resolve the issues impacting its

beverage businesses. The Company's priority continues to be

preserving its primary businesses, wholesale distribution and

retail health food, which continue to be profitable and generate

positive cash flows. However, because of the uncertainties created

by the TSI matter, there can be no assurances that the Company will

be able to resolve these matters in a timely manner without

incurring further costs and the beverage businesses incurring

further losses. AMCON is a leading wholesale distributor of

consumer products, including beverages, candy, tobacco, groceries,

food service, frozen and chilled foods, and health and beauty care

products with distribution centers in Illinois, Missouri, Nebraska,

North Dakota and South Dakota. Chamberlin's Natural Foods, Inc. and

Health Food Associates, Inc., both wholly-owned subsidiaries of The

Healthy Edge, Inc., operate health and natural product retail

stores in central Florida (6), Kansas, Missouri, Nebraska and

Oklahoma (4). The retail stores operate under the names

Chamberlin's Market & Cafe and Akin's Natural Foods Market.

Hawaiian Natural Water Company, Inc. produces and sells natural

spring water under the Hawaiian Springs label in Hawaii and other

foreign markets and purified bottled water on the Island of Oahu in

Hawaii. The natural spring water is bottled at the source on the

Big Island of Hawaii. Trinity Springs, Inc. produces and sells

geothermal bottled water and a natural mineral supplement under the

Trinity label and recently introduced a vitamin enhanced beverage

product under the Trinity Enhanced label. The water and mineral

supplement are both bottled at the base of the Trinity Mountains in

Paradise, Idaho, one of the world's deepest known sources. Trinity

Springs also distributes Hawaiian Springs on the U.S. mainland.

This news release contains forward-looking statements that are

subject to risks and uncertainties and which reflect management's

current beliefs and estimates of future economic circumstances,

industry conditions, Company performance and financial results. A

number of factors could affect the future results of the Company

and could cause those results to differ materially from those

expressed in the Company's forward-looking statements including,

without limitation, availability of sufficient cash resources to

conduct its business and meet its capital expenditures needs.

Moreover, past financial performance should not be considered a

reliable indicator of future performance. Accordingly, the Company

claims the protection of the safe harbor for forward-looking

statements contained in the Private Securities Litigation Reform

Act of 1995 with respect to all such forward-looking statements.

Visit AMCON Distributing Company's web site at: www.amcon.com

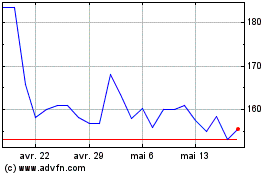

AMCON Distributing (AMEX:DIT)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

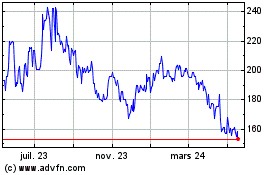

AMCON Distributing (AMEX:DIT)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024