AMCON Distributing Company (“AMCON” or “the Company”) (NYSE

American: DIT), an Omaha, Nebraska based Convenience and

Foodservice Distributor, is pleased to announce fully diluted

earnings per share of $0.89 on net income available to common

shareholders of $0.5 million for its second fiscal quarter ended

March 31, 2024.

“Labor shortages, supply chain issues, inflation, volatility in

energy prices, and the impact of rising interest rates continue to

present challenges for our business. AMCON’s customer-centric

philosophy is a competitive advantage in this economic environment,

as our customers rely on our ability to deliver a timely flow of

goods and services,” said Christopher H. Atayan, AMCON’s Chairman

and Chief Executive Officer. He further noted, “We welcome our new

team members and customers from our recently announced acquisition

of Burklund Distributors, Inc. AMCON is committed to pursuing

strategic acquisition opportunities in the Convenience Distributor

and Foodservice sectors.”

“Foodservice, technology platforms, and associated staffing for

these strategic areas are a central focus for our management team,”

said Andrew C. Plummer, AMCON’s President and Chief Operating

Officer. Mr. Plummer added, “We are actively expanding our

geographic reach to better serve our customers as they grow their

store footprints.”

Charles J. Schmaderer, AMCON’s Chief Financial Officer said, “At

March 31, 2024, our shareholders’ equity was $108.0 million. We

continue to maintain a strong liquidity position and recent

amendments to our bank credit facilities provided additional

flexibility to pursue our strategic objectives that materialized

during the quarter.” Mr. Schmaderer also added, “We continue to

invest in the completion of our 175,000 square foot distribution

facility in Springfield, Missouri. In addition, we are also

deploying capital in enhanced foodservice capabilities in our

recently purchased 250,000 square foot facility in Colorado City,

Colorado.”

AMCON, and its subsidiaries Team Sledd, LLC and Henry’s Foods,

Inc., is a leading Convenience and Foodservice Distributor of

consumer products, including beverages, candy, tobacco, groceries,

foodservice, frozen and refrigerated foods, automotive supplies and

health and beauty care products with twelve (12) distribution

centers in Colorado, Illinois, Minnesota, Missouri, Nebraska, North

Dakota, South Dakota, Tennessee, and West Virginia. Through its

Healthy Edge Retail Group, AMCON operates fourteen (14) health and

natural product retail stores in the Midwest and Florida.

This news release contains forward-looking statements that are

subject to risks and uncertainties and which reflect management's

current beliefs and estimates of future economic circumstances,

industry conditions, Company performance and financial results. A

number of factors could affect the future results of the Company

and could cause those results to differ materially from those

expressed in the Company's forward-looking statements including,

without limitation, availability of sufficient cash resources to

conduct its business and meet its capital expenditures needs and

the other factors described under Item 1.A. of the Company’s Annual

Report on Form 10-K. Moreover, past financial performance should

not be considered a reliable indicator of future performance.

Accordingly, the Company claims the protection of the safe harbor

for forward-looking statements contained in the Private Securities

Litigation Reform Act of 1995 with respect to all such

forward-looking statements.

Visit AMCON Distributing Company's web site

at: www.amcon.com

AMCON Distributing Company and

Subsidiaries

Condensed Consolidated Balance

Sheets

March 31, 2024 and September

30, 2023

March

September

2024

2023

(Unaudited)

ASSETS

Current assets:

Cash

$

951,521

$

790,931

Accounts receivable, less allowance for

credit losses of $2.3 million at March 2024 and $2.4 million at

September 2023

66,881,140

70,878,420

Inventories, net

121,324,279

158,582,816

Income taxes receivable

844,730

1,854,484

Prepaid expenses and other current

assets

15,244,494

13,564,056

Total current assets

205,246,164

245,670,707

Property and equipment, net

94,475,740

80,607,451

Operating lease right-of-use assets,

net

22,830,252

23,173,287

Goodwill

5,778,325

5,778,325

Other intangible assets, net

5,016,084

5,284,935

Other assets

2,810,304

2,914,495

Total assets

$

336,156,869

$

363,429,200

LIABILITIES AND SHAREHOLDERS’

EQUITY

Current liabilities:

Accounts payable

$

51,726,762

$

43,099,326

Accrued expenses

12,661,273

14,922,279

Accrued wages, salaries and bonuses

5,371,550

8,886,529

Current operating lease liabilities

6,031,117

6,063,048

Current maturities of long-term debt

4,485,028

1,955,065

Current mandatorily redeemable

non-controlling interest

1,812,558

1,703,604

Total current liabilities

82,088,288

76,629,851

Credit facilities

99,194,708

140,437,989

Deferred income tax liability, net

5,071,404

4,917,960

Long-term operating lease liabilities

17,106,256

17,408,758

Long-term debt, less current

maturities

16,045,738

11,675,439

Mandatorily redeemable non-controlling

interest, less current portion

8,012,406

7,787,227

Other long-term liabilities

686,435

402,882

Shareholders’ equity:

Preferred stock, $.01 par value, 1,000,000

shares authorized

—

—

Common stock, $.01 par value, 3,000,000

shares authorized, 630,362 shares outstanding at March 2024 and

608,689 shares outstanding at September 2023

9,648

9,431

Additional paid-in capital

33,160,639

30,585,388

Retained earnings

106,053,510

104,846,438

Treasury stock at cost

(31,272,163

)

(31,272,163

)

Total shareholders’ equity

107,951,634

104,169,094

Total liabilities and shareholders’

equity

$

336,156,869

$

363,429,200

AMCON Distributing Company and

Subsidiaries

Condensed Consolidated

Unaudited Statements of Operations

for the three and six months

ended March 31, 2024 and 2023

For the three months ended

March

For the six months ended

March

2024

2023

2024

2023

Sales (including excise taxes of $127.4

and $130.9 million, and $265.5 and $261.3 million,

respectively)

$

601,877,306

$

584,993,848

$

1,246,836,380

$

1,150,983,356

Cost of sales

559,566,439

543,861,287

1,161,224,591

1,074,881,211

Gross profit

42,310,867

41,132,561

85,611,789

76,102,145

Selling, general and administrative

expenses

36,677,814

33,996,988

73,936,491

62,376,176

Depreciation and amortization

2,289,390

1,807,753

4,508,558

2,878,639

38,967,204

35,804,741

78,445,049

65,254,815

Operating income

3,343,663

5,327,820

7,166,740

10,847,330

Other expense (income):

Interest expense

2,247,737

2,169,541

4,559,250

3,863,698

Change in fair value of mandatorily

redeemable non-controlling interest

134,389

221,030

334,133

166,114

Other (income), net

(191,006

)

(173,725

)

(754,147

)

(227,257

)

2,191,120

2,216,846

4,139,236

3,802,555

Income from operations before income

taxes

1,152,543

3,110,974

3,027,504

7,044,775

Income tax expense

613,000

1,045,400

1,417,000

2,350,200

Net income available to common

shareholders

$

539,543

$

2,065,574

$

1,610,504

$

4,694,575

Basic earnings per share available to

common shareholders

$

0.90

$

3.53

$

2.69

$

8.04

Diluted earnings per share available to

common shareholders

$

0.89

$

3.49

$

2.66

$

7.94

Basic weighted average shares

outstanding

600,161

585,885

597,879

583,725

Diluted weighted average shares

outstanding

608,029

592,448

605,917

591,249

Dividends paid per common share

$

0.46

$

5.18

$

0.64

$

5.36

AMCON Distributing Company and

Subsidiaries

Condensed Consolidated

Unaudited Statements of Shareholders’ Equity

for the three and six months

ended March 31, 2024 and 2023

Additional

Common Stock

Treasury Stock

Paid-in

Retained

Shares

Amount

Shares

Amount

Capital

Earnings

Total

THREE MONTHS ENDED MARCH 2023

Balance, January 1, 2023

943,272

$

9,431

(332,220

)

$

(30,867,287

)

$

29,357,154

$

96,212,704

$

94,712,002

Dividends on common stock, $.18 per

share

—

—

—

—

—

(111,220

)

(111,220

)

Compensation expense related to

equity-based awards

—

—

—

—

409,412

—

409,412

Net income available to common

shareholders

—

—

—

—

—

2,065,574

2,065,574

Balance, March 31, 2023

943,272

$

9,431

(332,220

)

$

(30,867,287

)

$

29,766,566

$

98,167,058

$

97,075,768

THREE MONTHS ENDED MARCH 2024

Balance, January 1, 2024

964,945

$

9,648

(334,583

)

$

(31,272,163

)

$

32,521,091

$

105,627,432

$

106,886,008

Dividends on common stock, $0.18 per

share

—

—

—

—

—

(113,465

)

(113,465

)

Compensation expense related to

equity-based awards

—

—

—

—

639,548

—

639,548

Net income available to common

shareholders

—

—

—

—

—

539,543

539,543

Balance, March 31, 2024

964,945

$

9,648

(334,583

)

$

(31,272,163

)

$

33,160,639

$

106,053,510

$

107,951,634

Additional

Common Stock

Treasury Stock

Paid-in

Retained

Shares

Amount

Shares

Amount

Capital

Earnings

Total

SIX MONTHS ENDED MARCH 2023

Balance, October 1, 2022

917,009

$

9,168

(332,220

)

$

(30,867,287

)

$

26,903,201

$

96,784,353

$

92,829,435

Dividends on common stock, $5.36 per

share

—

—

—

—

—

(3,311,870

)

(3,311,870

)

Compensation expense and issuance of stock

in connection with equity-based awards

26,263

263

—

—

2,863,365

—

2,863,628

Net income available to common

shareholders

—

—

—

—

—

4,694,575

4,694,575

Balance, March 31, 2023

943,272

$

9,431

(332,220

)

$

(30,867,287

)

$

29,766,566

$

98,167,058

$

97,075,768

SIX MONTHS ENDED MARCH 2024

Balance, October 1, 2023

943,272

$

9,431

(334,583

)

$

(31,272,163

)

$

30,585,388

$

104,846,438

$

104,169,094

Dividends on common stock, $0.64 per

share

—

—

—

—

—

(403,432

)

(403,432

)

Compensation expense and issuance of stock

in connection with equity-based awards

21,673

217

—

—

2,575,251

—

2,575,468

Net income available to common

shareholders

—

—

—

—

—

1,610,504

1,610,504

Balance, March 31, 2024

964,945

$

9,648

(334,583

)

$

(31,272,163

)

$

33,160,639

$

106,053,510

$

107,951,634

AMCON Distributing Company and

Subsidiaries

Condensed Consolidated

Unaudited Statements of Cash Flows

for the six months ended March

31, 2024 and 2023

March

March

2024

2023

CASH FLOWS FROM OPERATING ACTIVITIES:

Net income available to common

shareholders

$

1,610,504

$

4,694,575

Adjustments to reconcile net income

available to common shareholders to net cash flows from (used in)

operating activities:

Depreciation

4,239,707

2,732,312

Amortization

268,851

146,327

(Gain) loss on sales of property and

equipment

(105,505

)

(133,159

)

Equity-based compensation

1,210,685

1,061,383

Deferred income taxes

153,444

989,702

Provision for credit losses

(133,707

)

(378,302

)

Inventory allowance

22,413

(6,947

)

Change in fair value of mandatorily

redeemable non-controlling interest

334,133

166,114

Changes in assets and liabilities:

Accounts receivable

4,130,987

5,097,281

Inventories

37,236,124

19,843,973

Prepaid and other current assets

(1,680,438

)

(411,185

)

Other assets

104,191

(275,796

)

Accounts payable

9,475,057

10,457,273

Accrued expenses and accrued wages,

salaries and bonuses

(4,402,600

)

(1,094,009

)

Other long-term liabilities

283,553

116,896

Income taxes payable and receivable

1,009,754

(59,527

)

Net cash flows from (used in) operating

activities

53,757,153

42,946,911

CASH FLOWS FROM INVESTING ACTIVITIES:

Purchase of property and equipment

(11,084,390

)

(2,760,586

)

Proceeds from sales of property and

equipment

234,278

137,500

Acquisition of Henry's

—

(54,958,637

)

Net cash flows from (used in) investing

activities

(10,850,112

)

(57,581,723

)

CASH FLOWS FROM FINANCING ACTIVITIES:

Borrowings under revolving credit

facilities

1,128,853,805

1,184,888,842

Repayments under revolving credit

facilities

(1,170,097,086

)

(1,173,087,034

)

Proceeds from borrowings on long-term

debt

—

7,000,000

Principal payments on long-term debt

(1,099,738

)

(504,941

)

Dividends on common stock

(403,432

)

(3,311,870

)

Net cash flows from (used in) financing

activities

(42,746,451

)

14,984,997

Net change in cash

160,590

350,185

Cash, beginning of period

790,931

431,576

Cash, end of period

$

951,521

$

781,761

Supplemental disclosure of cash flow

information:

Cash paid during the period for interest,

net of amounts capitalized

$

4,568,790

$

3,527,737

Cash paid during the period for income

taxes, net of refunds

194,902

1,419,354

Supplemental disclosure of non-cash

information:

Equipment acquisitions classified in

accounts payable

$

167,913

$

132,876

Purchase of property financed with

debt

8,000,000

—

Issuance of common stock in connection

with the vesting of equity-based awards

1,296,372

2,044,805

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240418789423/en/

Charles J. Schmaderer AMCON Distributing Company Ph

402-331-3727

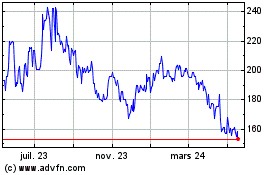

AMCON Distributing (AMEX:DIT)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

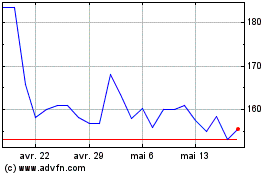

AMCON Distributing (AMEX:DIT)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024