AMCON Distributing Company (“AMCON”) (AMEX:DIT), an Omaha,

Nebraska based consumer products company is pleased to announce

fully diluted earnings per common share of $2.40 per share for the

second fiscal quarter ended March 31, 2010.

“We were delighted with the progress our management team has

made in integrating our recent acquisition in Northwest Arkansas.

We continue to seek acquisitions that will expand our geographic

reach and penetration,” said Christopher H. Atayan, AMCON’s

Chairman and Chief Executive Officer.

AMCON’s wholesale distribution business reported revenues of

$221.0 million and operating income before depreciation and

amortization of $3.9 million in the second fiscal quarter of 2010.

AMCON’s retail health food business reported revenues of $9.5

million and operating income before depreciation of $1.2 million

for the same period.

Kathleen M. Evans, President of AMCON’s wholesale distribution

business commented, “We had a highly successful trade show this

year that highlighted our continued efforts to develop profit

making opportunities for our customers. Our continued emphasis on

food service products has been met with a positive reception. We

were especially proud of our ability to maintain continuity of

services to our customers during this very harsh winter

season.”

Eric Hinkefent, President of AMCON’s retail health food business

commented, “We were delighted to open our new store in Tulsa at the

end of the quarter. We are actively exploring opportunities to open

additional stores in our existing markets as well as expanding into

new markets. Conditions are challenging; however, our continued

focus on providing high levels of customer service with a broad

product selection at value oriented price is what consumers are

seeking.”

“Our business strategy is predicated on maintaining high levels

of liquidity. This liquidity enables us to develop proprietary

opportunities for our customers to enhance their profitability,”

said Andrew C. Plummer, AMCON’s Chief Financial Officer. “We expect

the various state and federal governmental authorities who regulate

the tobacco industry will continue to seek tax increases in the

coming quarters. Our careful working capital management is an

important tool for us as we navigate these treacherous waters,”

added Plummer.

AMCON is a leading wholesale distributor of consumer products,

including beverages, candy, tobacco, groceries, food service,

frozen and chilled foods, and health and beauty care products with

locations in Arkansas, Illinois, Missouri, Nebraska, North Dakota

and South Dakota. Chamberlin's Natural Foods, Inc. and Health Food

Associates, Inc., both wholly-owned subsidiaries of The Healthy

Edge, Inc., operate health and natural product retail stores in

central Florida (6), Kansas, Missouri, Nebraska and Oklahoma (5).

The retail stores operate under the names Chamberlin's Market &

Cafe and Akins Natural Foods Market.

This news release contains forward-looking statements that are

subject to risks and uncertainties and which reflect management's

current beliefs and estimates of future economic circumstances,

industry conditions, Company performance and financial results. A

number of factors could affect the future results of the Company

and could cause those results to differ materially from those

expressed in the Company's forward-looking statements including,

without limitation, availability of sufficient cash resources to

conduct its business and meet its capital expenditures needs.

Moreover, past financial performance should not be considered a

reliable indicator of future performance. Accordingly, the Company

claims the protection of the safe harbor for forward-looking

statements contained in the Private Securities Litigation Reform

Act of 1995 with respect to all such forward-looking

statements.

Visit AMCON Distributing Company's

web site at: www.amcon.com

AMCON Distributing Company and Subsidiaries Condensed Consolidated

Balance Sheets March 31, 2010 and September 30, 2009

March 2010 September (Unaudited) 2009 ASSETS Current

assets: Cash $ 529,408 $ 309,914

Accounts receivable, less

allowance for doubtful accounts of $1.1 million and $0.9

million, at March 2010 and September 2009

27,723,560 28,393,198 Inventories, net 35,325,691 34,486,027

Deferred income taxes 1,706,641 1,701,568 Prepaid and other current

assets 2,243,351 1,728,576 Total current assets

67,528,651 66,619,283 Property and equipment, net 11,863,643

11,256,627 Goodwill 6,149,168 5,848,808 Other intangible assets

4,908,894 3,373,269 Other assets 1,073,482 1,026,395

$ 91,523,838 $ 88,124,382 LIABILITIES AND SHAREHOLDERS'

EQUITY Current liabilities: Accounts payable $ 16,453,293 $

15,222,689 Accrued expenses 5,706,747 6,768,924 Accrued wages,

salaries and bonuses 2,441,473 3,257,832 Income taxes payable

876,919 3,984,258 Current maturities of credit facility 76,267

177,867 Current maturities of long-term debt 965,905

1,470,445 Total current liabilities 26,520,604 30,882,015

Credit facility, less current maturities 25,782,537 22,655,861

Deferred income taxes 1,227,590 1,256,713 Long-term debt, less

current maturities 5,637,282 5,066,185 Other long-term liabilities

459,966 - Series A cumulative, convertible preferred stock,

$.01 par value 100,000 shares authorized and issued, liquidation

preference $25.00 per share 2,500,000 2,500,000 Series B

cumulative, convertible preferred stock, $.01 par value 80,000

shares authorized and issued, liquidation preference $25.00 per

share 2,000,000 2,000,000 Shareholders' equity:

Preferred stock, $0.01 par,

1,000,000 shares authorized, 180,000 shares outstanding and

issued in Series A and B referred to above

- -

Common stock, $0.01 par value,

3,000,000 shares authorized, 575,508 shares outstanding at

March 2010 and 573,232 shares outstanding at September

2009

5,755 5,732 Additional paid-in capital 8,084,026 7,617,494 Retained

earnings 19,306,078 16,140,382 Total shareholders'

equity 27,395,859 23,763,608 $ 91,523,838 $

88,124,382 AMCON Distributing Company and Subsidiaries

Condensed Consolidated Unaudited Statements of Operations for the

three and six months ended March 31, 2010 and 2009 For the

three months For the six months ended March ended March 2010

2009 2010 2009 Sales (including excise taxes

of $76.9 million and $43.3 million, and $158.4 million and $93.6

million, respectively) $ 230,499,129 $ 195,442,246 $ 474,440,167 $

412,819,608 Cost of sales 213,558,955

178,195,212 440,271,980 379,727,926 Gross profit

16,940,174 17,247,034 34,168,187

33,091,682 Selling, general and administrative expenses 13,365,802

13,027,140 27,144,541 25,824,722 Depreciation and amortization

415,572 300,988 802,841 611,322

13,781,374 13,328,128 27,947,382 26,436,044

Operating income 3,158,800 3,918,906 6,220,805

6,655,638 Other expense (income): Interest expense 368,425

408,587 773,670 897,786 Other (income), net (23,046 )

(26,476 ) (36,426 ) (40,543 ) 345,379

382,111 737,244 857,243

Income from continuing operations

before income tax

2,813,421 3,536,795 5,483,561 5,798,395 Income tax expense

1,022,000 1,343,000 1,963,000 2,203,000 Income

from continuing operations 1,791,421 2,193,795 3,520,561 3,595,395

Loss from discontinued operations, net of income tax benefit of

$0.1 million in each fiscal period - (97,437 ) -

(199,475 ) Net income 1,791,421 2,096,358 3,520,561 3,395,920

Preferred stock dividend requirements (73,239 )

(314,201 ) (148,106 ) (419,734 ) Net

income available to common shareholders $ 1,718,182 $ 1,782,157 $

3,372,455 $ 2,976,186 Basic earnings (loss) per share available to

common shareholders: Continuing operations $ 3.05 $ 3.43 $ 6.00 $

5.80 Discontinued operations - (0.18 ) - (0.36 ) Net

basic earnings per share available to common shareholders $ 3.05 $

3.25 $ 6.00 $ 5.44 Diluted earnings (loss) per share available to

common shareholders: Continuing operations $ 2.40 $ 2.72 $ 4.72 $

4.33 Discontinued operations - (0.12 ) - (0.24 ) Net

diluted earnings per share available to common shareholders $ 2.40

$ 2.60 $ 4.72 $ 4.09 Weighted average shares outstanding: Basic

564,216 548,619 562,145 547,089 Diluted 746,873 805,236 745,773

830,923 AMCON Distributing Company and Subsidiaries

Condensed Consolidated Unaudited Statements of Cash Flows for the

six months ended March 31, 2010 and 2009 2010

2009 CASH FLOWS FROM OPERATING ACTIVITIES: Net income $

3,520,561 $ 3,395,920 Deduct: Loss from discontinued operations,

net of tax - (199,475 ) Income from continuing operations

3,520,561 3,595,395 Adjustments to reconcile net income from

continuing operations to net cash flows from operating activities:

Depreciation 678,860 611,322 Amortization 123,981 - Gain on sale of

property and equipment (16,935 ) (47,700 ) Stock based compensation

267,464 265,800 Net excess tax (benefit) deficiency on equity-based

awards (130,126 ) 16,592 Deferred income taxes (34,196 ) (222,412 )

Provision for losses on doubtful accounts 178,367 346,000 Provision

for losses on inventory obsolescence 16,393 327,673 Changes in

assets and liabilities: Accounts receivable 491,271 5,859,370

Inventories 1,125,441 6,480,136 Prepaid and other current assets

(519,415 ) (735,490 ) Other assets (47,087 ) 107,646 Accounts

payable 1,144,665 (2,852,021 ) Accrued expenses and accrued wages,

salaries and bonuses (1,878,536 ) 2,641,991 Income tax payable

(2,977,213 ) 2,045,058 Net cash flows from operating

activities - continuing operations 1,943,495 18,439,360 Net cash

flows from operating activities - discontinued operations -

42,692 Net cash flows from operating activities 1,943,495

18,482,052 CASH FLOWS FROM INVESTING ACTIVITIES: Purchases

of property and equipment (1,102,929 ) (497,401 ) Proceeds from

sales of property and equipment 42,905 76,405 Acquisition

(3,099,836 ) - Net cash flows from investing activities (4,159,860

) (420,996 ) CASH FLOWS FROM FINANCING ACTIVITIES: Net

borrowings (payments) on bank credit agreements 3,025,076

(15,380,790 ) Principal payments on long-term debt (433,443 )

(397,410 ) Proceeds from exercise of stock options 68,965 - Net

excess tax benefit (deficiency) on equity-based awards 130,126

(16,592 ) Redemption of Series C convertible preferred stock -

(2,000,000 ) Dividends paid on preferred stock (148,106 ) (198,106

) Dividends on common stock (206,759 ) (114,079 ) Net

cash flows from financing activities 2,435,859

(18,106,977 ) Net change in cash 219,494 (45,921 ) Cash,

beginning of period 309,914 457,681 Cash, end of

period $ 529,408 $ 411,760 Supplemental

disclosure of cash flow information: Cash paid during the period

for interest $ 760,727 $ 968,296 Cash paid during the period for

income taxes 4,974,408 264,355 Supplemental disclosure of

non-cash information: Equipment acquisitions classified as accounts

payable 85,939 - Constructive dividends on Series A, B, and C

Convertible Preferred Stock - 221,628 Business acquisition:

Inventory 1,981,498 - Property and equipment 122,978 - Customer

relationships intangible asset 1,620,000 - Goodwill 300,360 - Note

payable 500,000 - Contingent consideration 425,000 -

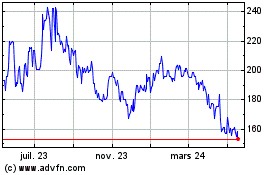

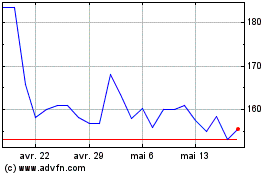

AMCON Distributing (AMEX:DIT)

Graphique Historique de l'Action

De Juil 2024 à Août 2024

AMCON Distributing (AMEX:DIT)

Graphique Historique de l'Action

De Août 2023 à Août 2024