AMCON Distributing Company (“AMCON”) (NYSE AMEX:DIT), an Omaha,

Nebraska based consumer products company is pleased to announce

fully diluted earnings per share of $2.41 on net income available

to common stockholders of $1.8 million for the first fiscal quarter

ended December 31, 2010.

“We were pleased with the performance this quarter. Management

is steadfastly focused on delivering a premium level of service to

our customers. We believe this philosophy enhances our customer’s

bottom line which ultimately benefits our shareholders,” said

Christopher H. Atayan, AMCON’s Chairman and Chief Executive

Officer.

Each of AMCON’s business segments had solid quarters. The

wholesale distribution segment reported revenues of $236.0 million

and operating income before depreciation and amortization of $5.3

million in the first quarter of fiscal 2011. The retail health food

segment reported revenues of $9.1 million and operating income

before depreciation and amortization of $0.9 million for the same

period.

“We are working closely with our customers on a wide variety of

initiatives designed to enhance their profitability and efficiency.

This close level of interaction is mutually beneficial and is the

platform that drove our performance again this quarter,” said

Kathleen Evans, President of AMCON’s wholesale distribution

segment.

“The natural foods segment is particularly sensitive to economic

trends. We have been careful to maintain a high level of customer

service during the downturn because we believe this posture fosters

consumer loyalty and positions us well as the economy recovers,”

said Eric Hinkefent, President of AMCON’s retail health food

segment.

“Our financial focus continues to be centered on balance sheet

liquidity. We ended the quarter with total stockholders’ equity of

$35.5 million and consolidated debt of $23.0 million. We are

carefully evaluating a number of capital projects related to

information technology and foodservice that are designed to enhance

our competitive position in the markets we serve,” said Andrew

Plummer, AMCON’s Chief Financial Officer.

AMCON is a leading wholesale distributor of consumer products,

including beverages, candy, tobacco, groceries, foodservice, frozen

and chilled foods, and health and beauty care products with

locations in Arkansas, Illinois, Missouri, Nebraska, North Dakota

and South Dakota. AMCON also operates fourteen (14) health and

natural product retail stores in the Midwest and Florida. The

retail stores operate under the names Chamberlin's Market &

Cafe www.chamberlins.com and Akin’s Natural Foods Market

www.akins.com.

This news release contains forward-looking statements that are

subject to risks and uncertainties and which reflect management's

current beliefs and estimates of future economic circumstances,

industry conditions, Company performance and financial results. A

number of factors could affect the future results of the Company

and could cause those results to differ materially from those

expressed in the Company's forward-looking statements including,

without limitation, availability of sufficient cash resources to

conduct its business and meet its capital expenditures needs and

the other factors described under Item 1.A. of the Company’s Annual

Report on Form 10-K. Moreover, past financial performance should

not be considered a reliable indicator of future performance.

Accordingly, the Company claims the protection of the safe harbor

for forward-looking statements contained in the Private Securities

Litigation Reform Act of 1995 with respect to all such

forward-looking statements.

Visit AMCON Distributing Company's web site

at: www.amcon.com

AMCON Distributing Company and Subsidiaries

Condensed Consolidated Balance Sheets December 31, 2010

and September 30, 2010 December

September 2010 2010 (Unaudited)

ASSETS Current assets: Cash $ 300,920 $ 356,735 Accounts

receivable, less allowance for doubtful accounts of $1.0 million

and $1.6 million at December 2010 and September 2010, respectively

22,245,824 27,903,689 Inventories, net 36,060,248 35,005,957

Deferred income taxes 1,542,599 1,905,974 Prepaid and other current

assets

4,772,035 3,013,485

Total current assets 64,921,626 68,185,840 Property and

equipment, net 11,712,178 11,855,669 Goodwill 6,149,168 6,149,168

Other intangible assets, net 4,757,019 4,807,644 Other assets

1,075,563 1,069,050

$ 88,615,554 $

92,067,371 LIABILITIES AND SHAREHOLDERS’ EQUITY

Current liabilities: Accounts payable $ 14,698,370 $ 16,656,257

Accrued expenses 6,506,609 6,007,900 Accrued wages, salaries and

bonuses 2,085,776 3,161,817 Income taxes payable 1,100,779

2,366,667 Current maturities of long-term debt

851,153 893,291 Total current

liabilities 25,242,687 29,085,932 Credit facility 17,169,003

18,816,709 Deferred income taxes 1,135,311 1,075,861 Long-term

debt, less current maturities 5,018,717 5,226,586 Other long-term

liabilities 73,072 587,479

Series A cumulative, convertible preferred

stock, $.01 par value 100,000 shares authorized and issued,

liquidation preference $25.00 per share

2,500,000 2,500,000

Series B cumulative, convertible preferred

stock, $.01 par value 80,000 shares authorized and issued,

liquidation preference $25.00 per share

2,000,000 2,000,000

Shareholders’ equity:

Preferred stock, $0.01 par, 1,000,000 shares authorized, 180,000

shares

outstanding and issued in Series A and B

referred to above

— — Common stock, $.01 par value, 3,000,000 shares authorized,

590,232 shares

outstanding at December 2010 and 577,432

shares outstanding at September 2010

5,902 5,774 Additional paid-in capital 9,425,208 8,376,640 Retained

earnings

26,045,654

24,392,390 Total shareholders’ equity

35,476,764 32,774,804

$ 88,615,554 $

92,067,371 AMCON Distributing Company

and Subsidiaries Condensed Consolidated Unaudited Statements

of Operations for the three months ended December 31, 2010

and 2009 2010

2009 Sales (including excise taxes of $81.3

million and $81.6 million, respectively) $ 244,957,161 $

243,941,038 Cost of sales

227,349,439

226,713,025 Gross profit

17,607,722 17,228,013

Selling, general and administrative expenses 13,687,371 13,778,739

Depreciation and amortization

497,583

387,269 14,184,954

14,166,008 Operating income

3,422,768 3,062,005 Other expense

(income): Interest expense 384,583 405,245 Other (income), net

(22,881 )

(13,380 )

361,702 391,865 Income from

operations before income taxes 3,061,066 2,670,140 Income tax

expense

1,229,000 941,000

Net income 1,832,066 1,729,140 Preferred stock dividend

requirements

(74,867 )

(74,867 ) Net income available to common shareholders

$ 1,757,199 $

1,654,273 Basic earnings per share

available to common shareholders $ 3.04 $ 2.95 Diluted earnings per

share available to common shareholders $ 2.41 $ 2.32 Basic

weighted average shares outstanding 578,636 560,119 Diluted

weighted average shares outstanding 758,692 745,223

AMCON Distributing Company and Subsidiaries Condensed

Consolidated Unaudited Statements of Cash Flows for the

three months ended December 31, 2010 and 2009

2010 2009

CASH FLOWS FROM OPERATING ACTIVITIES:

Net income $ 1,832,066 $ 1,729,140

Adjustments to reconcile net income from

operations to net cash flows from operating activities:

Depreciation 418,565 338,099 Amortization 79,018 49,170 Gain on

sale of property and equipment (2,315 ) (16,935 ) Stock based

compensation 1,166,833 163,364 Net excess tax benefit on

equity-based awards (79,863 ) (107,048 ) Deferred income taxes

422,825 10,104 Provision for (recoveries) losses on doubtful

accounts (625,000 ) 16,426 Provision for losses on inventory

obsolescence 81,416 76,703 Other (2,011 ) — Changes in

assets and liabilities: Accounts receivable 6,282,865 4,695,589

Inventories (1,135,707 ) 3,442,508 Prepaid and other current assets

(1,758,550 ) (2,679,354 ) Other assets (6,513 ) 519 Accounts

payable (1,949,184 ) (1,329,456 ) Accrued expenses and accrued

wages, salaries and bonuses (1,316,121 ) (2,127,887 ) Income tax

payable

(1,186,025 )

(2,973,111 ) Net cash flows from

operating activities 2,222,299 1,287,831 CASH FLOWS FROM

INVESTING ACTIVITIES: Purchases of property and equipment (293,037

) (596,612 ) Proceeds from sales of property and equipment 11,575

34,306 Acquisition

—

(3,099,836 ) Net cash flows from

investing activities (281,462 ) (3,662,142 )

CASH FLOWS FROM FINANCING ACTIVITIES:

Net (payments) borrowings on bank credit agreements (1,647,706 )

2,769,851 Principal payments on long-term debt (250,007 ) (182,901

) Proceeds from exercise of stock options — 66,411 Net excess tax

benefit on equity-based awards 79,863 107,048 Dividends paid on

convertible preferred stock (74,867 ) (74,867 ) Dividends on common

stock

(103,935 )

(103,181 )

Net cash flows from financing activities

(1,996,652 )

2,582,361 Net change in cash (55,815 ) 208,050

Cash, beginning of period

356,735 309,914 Cash, end

of period

$ 300,920 $

517,964 Supplemental disclosure of cash flow

information: Cash paid during the period for interest $ 372,376 $

381,746 Cash paid during the period for income taxes 1,992,200

3,903,998 Supplemental disclosure of non-cash information:

Equipment acquisitions classified as accounts payable 29,503 21,512

Business acquisition: Inventory — 1,981,498 Property and

equipment — 122,978 Customer relationships intangible asset —

1,620,000 Goodwill — 300,360 Note payable — 500,000 Contingent

consideration — 425,000

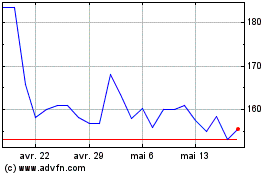

AMCON Distributing (AMEX:DIT)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

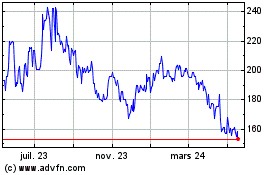

AMCON Distributing (AMEX:DIT)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024