AMCON Distributing Company (“AMCON”) (NYSE MKT:DIT), an Omaha,

Nebraska based consumer products company is pleased to announce

fully diluted earnings per share of $0.72 on net income available

to common shareholders of $0.5 million for the fiscal quarter ended

March 31, 2014.

“Both of our business segments operate in a highly competitive

environment. We continue to focus on customer service and

reliability to differentiate AMCON and position us as an industry

leader. We were pleased to make a small acquisition this quarter

that enhances our strength in the North Dakota market,” said

Christopher H. Atayan, AMCON’s Chairman and Chief Executive

Officer. He further noted, “We are actively pursuing acquisitions

to enhance and expand our service territory.”

Our wholesale distribution segment reported revenues of $263.2

million and operating income before depreciation and amortization

of $2.6 million for the second fiscal quarter of 2014. The retail

health food segment reported revenues of $9.2 million and operating

income before depreciation and amortization of $0.6 million for the

same period.

“Our annual spring trade show was very well received and

provides momentum as we enter our seasonally strong period. We

continue to expend resources to enhance our capability in

foodservice as the convenience industry is increasingly focused on

the profits derived from these products and services,” said

Kathleen M. Evans, President of AMCON’s Wholesale Distribution

Segment.

“Our Chamberlin’s and Akin’s retail health food stores have a

strong and long-standing brand dating back to 1935. As the natural

health food industry has grown, so too has the interest in health

food retailing from national and regional competitors. As a result,

the number of retail entrants in our Midwestern markets has

outpaced the natural food industry growth in those markets which

impacts our sales,” said Eric J. Hinkefent, President of AMCON’s

Retail Health Food Segment.

“We continue to maintain a high degree of balance sheet

liquidity. At March 31, 2014 our shareholders’ equity was $53.4

million and consolidated debt was $24.2 million,” said Andrew

Plummer, AMCON’s Chief Financial Officer. “The expansion of our

foodservice facilities at our Rapid City, South Dakota branch

continues to progress according to plan. This expansion will

provide significant additional capacity to meet our customers’

growing needs in the Dakotas resulting from considerable growth as

well as our recent acquisition in that market. In addition, we

continue to invest in information technology for internal and

external purposes,” added Mr. Plummer.

AMCON is a leading wholesale distributor of consumer products,

including beverages, candy, tobacco, groceries, foodservice, frozen

and chilled foods, and health and beauty care products with

locations in Illinois, Missouri, Nebraska, North Dakota, South

Dakota and Tennessee. AMCON also operates sixteen (16) health and

natural product retail stores in the Midwest and Florida. The

retail stores operate under the names Chamberlin's Market &

Cafe www.chamberlins.com and Akin’s Natural Foods Market

www.akins.com.

This news release contains forward-looking statements that are

subject to risks and uncertainties and which reflect management's

current beliefs and estimates of future economic circumstances,

industry conditions, Company performance and financial results. A

number of factors could affect the future results of the Company

and could cause those results to differ materially from those

expressed in the Company's forward-looking statements including,

without limitation, availability of sufficient cash resources to

conduct its business and meet its capital expenditures needs and

the other factors described under Item 1.A. of the Company’s Annual

Report on Form 10-K. Moreover, past financial performance should

not be considered a reliable indicator of future performance.

Accordingly, the Company claims the protection of the safe harbor

for forward-looking statements contained in the Private Securities

Litigation Reform Act of 1995 with respect to all such

forward-looking statements.

Visit AMCON Distributing Company's web site

at: www.amcon.com

AMCON Distributing Company and Subsidiaries

Condensed Consolidated Balance Sheets March 31, 2014 and

September 30, 2013 March September

2014

2013

(Unaudited) ASSETS Current assets: Cash $ 396,560 $

275,036 Accounts receivable, less allowance for doubtful accounts

of $1.2 million and $1.1 million at March 2014 and September 2013,

respectively 26,894,796 28,383,205 Inventories, net 49,075,457

46,125,187 Deferred income taxes 1,502,474 1,831,933 Prepaid and

other current assets

4,996,292

5,001,992 Total current assets 82,865,579

81,617,353 Property and equipment, net 13,525,701 13,088,859

Goodwill 6,349,827 6,349,827 Other intangible assets, net 4,638,478

4,820,978 Other assets

484,828

497,882 $ 107,864,413

$ 106,374,899

LIABILITIES AND SHAREHOLDERS’ EQUITY Current liabilities:

Accounts payable $ 15,904,672 $ 15,859,636 Accrued expenses

5,472,356 6,714,444 Accrued wages, salaries and bonuses 1,992,439

2,754,136 Income taxes payable 303,759 1,922,351 Current maturities

of long-term debt

560,647

998,788 Total current liabilities 24,233,873

28,249,355 Credit facility 19,768,331 14,841,712 Deferred

income taxes 3,459,998 3,327,010 Long-term debt, less current

maturities 3,907,110 4,076,892 Other long-term liabilities 235,373

239,396

Series A cumulative, convertible preferred

stock, $.01 par value 100,000 shares authorized and issued, and a

total liquidation preference of $2.5 million at both March 2014 and

September 2013

2,500,000 2,500,000

Series B cumulative, convertible preferred

stock, $.01 par value 80,000 shares authorized, 16,000 shares

issued and outstanding at both March 2014 and September 2013, and a

total liquidation preference of $0.4 million at both March 2014 and

September 2013

400,000 400,000

Shareholders’ equity:

Preferred stock, $.01 par value, 1,000,000

shares authorized, 116,000 shares outstanding and issued in Series

A and B referred to above

— —

Common stock, $.01 par value, 3,000,000

shares authorized, 611,432 shares outstanding at March 2014 and

623,115 shares outstanding at September 2013

6,677 6,543 Additional paid-in capital 13,580,479 12,502,135

Retained earnings 45,015,446 43,532,812 Treasury stock at cost

(5,242,874 )

(3,300,956 ) Total shareholders’ equity

53,359,728

52,740,534 $

107,864,413 $

106,374,899 AMCON

Distributing Company and Subsidiaries Condensed Consolidated

Unaudited Statements of Operations for the three and six

months ended March 31, 2014 and 2013 For the three

months For the six months ended March ended

March 2014 2013

2014 2013 Sales

(including excise taxes of $85.7 million and $87.2 million, and

$183.1 million and $185.2 million, respectively) $ 272,421,788 $

274,568,151 $ 578,047,345 $ 576,786,472 Cost of sales

254,801,826 256,271,131

540,786,320

539,259,663 Gross profit

17,619,962 18,297,020

37,261,025

37,526,809

Selling, general and administrative

expenses

15,812,174 15,438,195 32,304,437 31,286,667 Depreciation and

amortization

628,834

599,785 1,252,874

1,193,647 16,441,008

16,037,980

33,557,311 32,480,314

Operating income

1,178,954

2,259,040 3,703,714

5,046,495 Other expense (income):

Interest expense 222,624 248,992 524,619 565,044 Other (income),

net

(38,955 )

(114,846 )

(69,186 )

(176,195 )

183,669 134,146

455,433 388,849

Income from operations before income tax expense 995,285

2,124,894 3,248,281 4,657,646 Income tax expense

464,000 911,000

1,429,000 1,981,000

Net income 531,285 1,213,894 1,819,281 2,676,646 Preferred

stock dividend requirements

(48,108 )

(48,108 )

(97,285 )

(107,399 ) Net income available to common shareholders

$ 483,177 $

1,165,786 $ 1,721,996

$ 2,569,247

Basic earnings per share available to common shareholders $ 0.79 $

1.87 $ 2.79 $ 4.13 Diluted earnings per share available to common

shareholders $ 0.72 $ 1.63 $ 2.46 $ 3.55 Basic weighted

average shares outstanding 611,432 623,115 616,888 622,692 Diluted

weighted average shares outstanding 737,461 743,195 739,223 754,881

AMCON Distributing Company and

Subsidiaries Condensed Consolidated Unaudited Statements of

Cash Flows for the six months ended March 31, 2014 and

2013 2014 2013

CASH FLOWS FROM OPERATING ACTIVITIES: Net income $ 1,819,281

$ 2,676,646 Adjustments to reconcile net income from operations to

net cash flows from operating activities: Depreciation 1,070,374

1,011,147 Amortization 182,500 182,500 Gain on sale of property and

equipment (24,746 ) (71,131 ) Equity-based compensation 717,821

652,421 Deferred income taxes 462,447 457,525 Provision for losses

on doubtful accounts 132,000 39,000 Provision for losses

(recoveries) on inventory obsolescence (1,121 ) 49,179 Other (4,023

) (4,023 ) Changes in assets and liabilities: Accounts

receivable 1,356,409 1,686,669 Inventories (2,474,084 ) (780,967 )

Prepaid and other current assets 5,700 152,987 Other assets 13,054

36,724 Accounts payable (34,071 ) (1,802,183 ) Accrued expenses and

accrued wages, salaries and bonuses (1,565,640 ) (1,123,486 )

Income tax payable

(1,618,592 )

(2,060,080 ) Net cash flows from operating activities

37,309 1,102,928 CASH FLOWS FROM INVESTING ACTIVITIES:

Purchases of property and equipment (1,362,832 ) (1,104,229 )

Proceeds from sales of property and equipment 29,969 139,540

Acquisition

(513,938 )

—

Net cash flows from investing activities (1,846,801 ) (964,689 )

CASH FLOWS FROM FINANCING ACTIVITIES: Net borrowings on bank

credit agreements 4,926,619 3,378,417 Principal payments on

long-term debt (607,923 ) (587,355 ) Repurchase of Series B

Convertible Preferred Stock and common stock (1,941,918 )

(2,572,085 ) Dividends paid on convertible preferred stock (97,285

) (107,399 ) Dividends on common stock (239,362 ) (234,917 )

Proceeds from exercise of stock options — 1,180 Withholdings on the

exercise of equity-based awards

(109,115

) (74,610 ) Net cash

flows from financing activities

1,931,016

(196,769 ) Net

change in cash 121,524 (58,530 )

Cash, beginning of period

275,036 491,387

Cash, end of period

$ 396,560

$ 432,857

Supplemental disclosure of cash flow information: Cash paid during

the period for interest $ 523,081 $ 564,422 Cash paid during the

period for income taxes 2,585,145 3,583,555 Supplemental

disclosure of non-cash information: Equipment acquisitions

classified as accounts payable 152,311 57,412

Issuance of common stock in connection

with the vesting and exercise of equity-based awards

1,154,869 1,389,258

Conversion by holder of Series B

Convertible Preferred Stock to common stock

— 100,000 Common stock acquired with other consideration — 760,871

AMCON Distributing CompanyChristopher H. Atayan,

402-331-3727

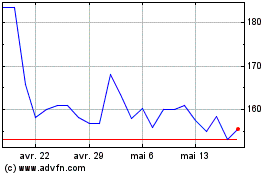

AMCON Distributing (AMEX:DIT)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

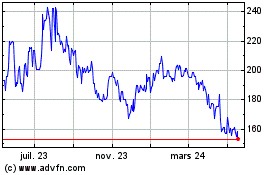

AMCON Distributing (AMEX:DIT)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024