Continues Quarterly Sales Year-over-Year

Growth

Delta Apparel, Inc. (NYSE American: DLA), a leading provider of

core activewear and lifestyle apparel products, today announced

financial results for its fiscal 2022 third quarter ended July 2,

2022.

Robert W. Humphreys, the Company’s Chairman and Chief Executive

Officer, commented, “We are pleased to achieve another quarter of

revenue growth in what remains a dynamic operating environment. We

delivered third-quarter sales growth across both our Delta Group

and Salt Life Group segments. In our Delta Group segment, we

registered year-over-year sales growth of 3% as we continued to

benefit from our broad channels of distribution. Demand increased

for both our Global Brands and on-demand digital print business,

somewhat offset by a decline in our Delta Direct business. At Salt

Life, we saw strong year-over-year sales growth of 30%, further

validating the brand’s broad lifestyle appeal.”

Humphreys further commented, “Our continued growth in the face

of economic headwinds validates our investment in Salt Life’s

retail footprint. This investment combined with our growth in the

wholesale channel and updated ecommerce site is allowing us to

deliver a strong omnichannel shopping experience to our end

consumers. With the opening of four new Salt Life locations during

the quarter, we have achieved our fiscal 2022 year-end target of

opening 20 retail stores. As a result, we are now operating Salt

Life branded stores across seven states. At DTG2Go, we continue to

make progress with our on-demand digital-first strategy and enjoyed

another quarter of unit and revenue growth while broadening the

footprint of our digital equipment to service increasing

demand.

Overall, we made good progress in the third quarter with a solid

performance as our team stayed focused on our long-term strategies

while simultaneously managing through a changing economy and

consumer expectations. Our manufacturing investments have created

scale efficiencies and platform flexibility positioning us well to

continue to grow our business.”

For the third quarter ended July 2, 2022:

Net sales were $126.9 million in the third quarter of fiscal

2022, an increase of 7% compared to the prior year third quarter

net sales of $118.7 million. Net sales in the Delta Group segment

grew 3% to $106.0 million in the third quarter of fiscal 2022

compared to $102.6 million in the prior year third quarter. The

Salt Life segment net sales grew 30% to $20.9 million compared to

$16.1 million in the prior year third quarter.

Within the Delta Group, segment sales increased in the Global

Brands business with both revenue and unit expansion with an

expanded array of value-added service offerings. Sales in the Delta

Direct channel declined following the reduction in market demand

for activewear primarily in the Retail License business. In the

digital print business, DTG2Go increased sales over both the third

quarter of fiscal 2021 and the second quarter of the current year,

benefitting from the demand for the Company’s digital-first

technology and growth in installed capacity.

The strong sales performance in the Salt Life business was

driven by double-digit year-over-year growth in both the wholesale

and retail channels. Continued strong bookings from wholesale

partners and the successful opening of four new Salt Life stores in

the quarter led to year-over-year sales growth. Largely driven by

constraints in inventory available, Salt Life’s sales in its

e-commerce channel were down year-over-year; however, web demand

has accelerated sequentially with sales increasing over 40% from

the second quarter of 2022.

On a consolidated basis, third quarter gross margins were 24.2%,

declining 130 basis points from 25.5% in the prior year, largely as

a result of inflationary cost pressures, which are now flowing

through the cost of sales. During the quarter, the impact of higher

cotton prices, energy, and freight costs were the largest drivers

of margin pressure.

Selling, general, and administrative expenses ("SG&A") were

$22.4 million, or 17.7% of sales, compared to $19.9 million, or

16.8% of sales, in the prior year third quarter. The increase in

SG&A expenses was primarily driven by higher variable selling

costs and travel expenses compared to the same period last year. In

addition, distribution costs were higher primarily due to increased

wages.

Operating income in the third quarter of 2022 decreased to $9.3

million, or 7.3% of sales, compared to the prior year third quarter

profit of $11.9 million, or 10.0% of sales.

Net income was $6.2 million, or $0.88 per diluted share, as

compared to prior year net income of $8.2 million, or $1.14 per

share.

Net inventory as of June 2022 was $227.7 million, an increase of

$30.0 million from March 2022 and $75.4 million from June 2021. The

increase in inventory levels reflect planned increased production

combined with higher input costs.

Total net debt and cash on hand was $162.4 million at June 2022,

an increase of $9.0 million from March 2022 including capital lease

financing. Cash on hand and availability under the Company’s U.S.

revolving credit facility totaled $30.8 million at June 2022, a

$4.4 million decrease from March 2022.

The Company invested approximately $5.5 million on capital

expenditures during the third quarter of fiscal 2022, substantially

in continuing investments in digital print equipment and Salt Life

retail store openings, compared to $3.2 million during the prior

year third quarter.

In the third quarter of fiscal 2022 under the previously

announced share repurchase program, the Company purchased 33,934

shares for $1.0 million, bringing the total amount repurchased to

$56.4 million during the life of the program. At the end of the

third quarter of fiscal 2022, the Company had $3.6 million of

remaining repurchase capacity under the existing authorization.

Conference Call:

The Company will hold a conference call with senior management

to discuss its financial results today at 4:30 p.m. ET. The Company

invites you to join the call by dialing 844-825-9789. If calling

from outside the United States, please dial 412-317-5180. A live

webcast of the conference call will be available at

www.deltaapparelinc.com. Please visit the website at least 15

minutes early to register for the teleconference webcast and

download any necessary software. A replay of the call will be

available through September 4, 2022. To access the telephone

replay, participants should dial toll-free 844-512-2921.

International callers can dial 412-317-6671. The access code for

the replay is 10168456.

About Delta Apparel, Inc.

Delta Apparel, Inc., along with its operating subsidiaries,

DTG2Go, LLC, Salt Life, LLC, and M.J. Soffe, LLC, is a

vertically-integrated, international apparel company that designs,

manufactures, sources, and markets a diverse portfolio of core

activewear and lifestyle apparel products under the primary brands

of Salt Life®, Soffe®, and Delta. The Company is a market leader in

the direct-to-garment digital print and fulfillment industry,

bringing DTG2Go technology and innovation to the supply chain of

its customers. The Company specializes in selling casual and

athletic products through a variety of distribution channels and

tiers, including outdoor and sporting goods retailers, independent

and specialty stores, better department stores and mid-tier

retailers, mass merchants and e-retailers, the U.S. military, and

through its business-to-business e-commerce sites. The Company’s

products are also made available direct-to-consumer on its websites

at www.saltlife.com, www.soffe.com and www.deltaapparel.com as well

as through its branded retail stores. The Company’s operations are

located throughout the United States, Honduras, El Salvador, and

Mexico, and it employs approximately 9,100 people worldwide.

Additional information about the Company is available at

www.deltaapparelinc.com.

Cautionary Note Regarding Forward-Looking Statements

This press release may contain “forward-looking” statements that

involve risks and uncertainties. Any number of factors could cause

actual results to differ materially from anticipated or forecasted

results, including, but not limited to, the general U.S. and

international economic conditions; the impact of the COVID-19

pandemic and government/social actions taken to contain its spread

on our operations, financial condition, liquidity, and capital

investments, including recent labor shortages, inventory

constraints, and supply chain disruptions; significant

interruptions or disruptions within our manufacturing, distribution

or other operations; deterioration in the financial condition of

our customers and suppliers and changes in the operations and

strategies of our customers and suppliers; the volatility and

uncertainty of cotton and other raw material prices and

availability; the competitive conditions in the apparel industry;

our ability to predict or react to changing consumer preferences or

trends; our ability to successfully open and operate new retail

stores in a timely and cost-effective manner; the ability to grow,

achieve synergies and realize the expected profitability of

acquisitions; changes in economic, political or social stability at

our offshore locations in areas in which we, or our suppliers or

vendors, operate; our ability to attract and retain key management;

the volatility and uncertainty of energy, fuel and related costs;

material disruptions in our information systems related to our

business operations; compromises of our data security; significant

changes in our effective tax rate; significant litigation in either

domestic or international jurisdictions; recalls, claims and

negative publicity associated with product liability issues; the

ability to protect our trademarks and other intellectual property;

changes in international trade regulations; our ability to comply

with trade regulations; changes in employment laws or regulations

or our relationship with employees; negative publicity resulting

from violations of manufacturing standards or labor laws or

unethical business practices by our suppliers and independent

contractors; the inability of suppliers or other third-parties,

including those related to transportation, to fulfill the terms of

their contracts with us; restrictions on our ability to borrow

capital or service our indebtedness; interest rate fluctuations

increasing our obligations under our variable rate indebtedness;

the ability to raise additional capital; the impairment of acquired

intangible assets; foreign currency exchange rate fluctuations; the

illiquidity of our shares; price volatility in our shares and the

general volatility of the stock market; and the other factors set

forth in the "Risk Factors" contained in our most recent Annual

Report on Form 10-K filed with the Securities and Exchange

Commission and as updated in our subsequently filed Quarterly

Reports on Form 10-Q. Except as may be required by law, Delta

Apparel, Inc. expressly disclaims any obligation to update these

forward-looking statements to reflect events or circumstances after

the date of this press release or to reflect the occurrence of

unanticipated events.

SELECTED FINANCIAL DATA: (In

thousands, except per share amounts)

Three Months Ended Nine Months Ended

June 2022 June 2021 June

2022 June 2021

Net Sales

$

126,875

$

118,666

$

369,319

$

322,015

Cost of Goods Sold

96,182

88,427

282,100

246,677

Gross Profit

30,693

30,239

87,219

75,338

Selling, General and

Administrative Expenses

22,416

19,914

59,613

53,005

Other (Income), Net

(1,018

)

(1,578

)

(1,947

)

(218

)

Operating Income

9,295

11,903

29,553

22,551

Interest Expense, Net

1,971

1,735

5,370

5,225

Earnings Before Provision For

Income Taxes

7,324

10,168

24,183

17,326

Provision For Income

Taxes

1,087

2,019

4,149

4,032

Consolidated Net Earnings

6,237

8,149

20,034

13,294

Net Loss (Income)

Attributable to Non-Controlling Interest

3

12

(11

)

149

Net Earnings Attributable to

Shareholders

$

6,240

$

8,161

$

20,023

$

13,443

Weighted Average Shares

Outstanding Basic

6,946

6,975

6,966

6,956

Diluted

7,065

7,128

7,061

7,077

Net Earnings per Common

Share Basic

$

0.90

$

1.17

$

2.87

$

1.93

Diluted

$

0.88

$

1.14

$

2.84

$

1.90

June 2022 September 2021

June 2021

Current Assets Cash

$

542

$

9,376

$

11,389

Receivables, Net

69,868

68,090

66,969

Inventories, Net

227,671

161,703

152,312

Prepaids and Other Assets

3,798

3,794

4,704

Total Current Assets

301,879

242,963

235,374

Noncurrent Assets

Property, Plant & Equipment,

Net

75,144

67,564

66,397

Goodwill and Other Intangibles, Net

62,524

64,188

64,647

Deferred Income Taxes

1,164

1,854

3,139

Operating Lease Assets

47,570

45,279

48,241

Investment in Joint Venture

10,277

10,433

10,333

Other Noncurrent Assets

2,893

2,007

2,063

Total Noncurrent Assets

199,572

191,325

194,820

Total Assets

$

501,451

$

434,288

$

430,194

Current Liabilities

Accounts Payable and Accrued Expenses

$

102,180

$

82,885

$

68,816

Income Tax Payable

666

379

1,714

Current Portion of Finance Leases

8,265

6,621

7,102

Current Portion of Operating Leases

8,044

8,509

8,974

Current Portion of Long-Term Debt

7,615

7,067

7,520

Current Portion of Contingent Consideration

563

-

1,200

Total Current Liabilities

127,333

105,461

95,326

Noncurrent

Liabilities Long-Term Taxes

Payable

2,841

3,220

3,220

Long-Term Finance Leases

18,802

15,669

17,319

Long-Term Operating Leases

40,940

38,546

41,093

Long-Term Debt

128,230

101,680

111,782

Long-Term Contingent Consideration

-

1,897

1,900

Other Noncurrent Liabilities

1,591

3,621

2,883

Total Noncurrent Liabilities

192,404

164,633

178,197

Common Stock

96

96

96

Additional Paid-In Capital

60,822

60,831

60,284

Equity Attributable to Non-Controlling Interest

(647

)

(658

)

(673

)

Retained Earnings

166,882

146,860

140,006

Accumulated Other Comprehensive Loss

(7

)

(786

)

(893

)

Treasury Stock

(45,432

)

(42,149

)

(42,149

)

Total Equity

181,714

164,194

156,671

Total Liabilities and

Equity

$

501,451

$

434,288

$

430,194

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220804005844/en/

ICR,Inc.

Investors:

Tom Filandro, 646-277-1235

investor.relations@deltaapparel.com

Media:

Jessica Liddell, 203-682-8208 DLAPR@icrinc.com

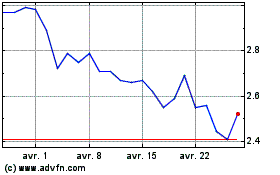

Delta Apparel (AMEX:DLA)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Delta Apparel (AMEX:DLA)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024