Focus on Cost Restructuring and Capital

Optimization Continues

Delta Apparel, Inc. (NYSE American: DLA), a leading provider of

core activewear, lifestyle apparel, and on-demand digital print

strategies, today announced financial results for its fiscal year

2024 first quarter ended December 30, 2023.

Chairman and Chief Executive Officer Robert W. Humphreys

commented, “Many of the unfavorable market dynamics we saw across

our business and the activewear industry last year persisted during

our first quarter. We continued to take decisive action to improve

our balance sheet and streamline our cost structure and operations.

Our debt and inventory levels were down more than 20%

year-over-year and we are very near completion of our plan to

reduce our offshore manufacturing footprint down to two countries

and consolidate production in our more efficient Central American

platform. We completed similar consolidation work in our DTG2Go

digital print business and significantly reduced other areas of our

workforce to better align our cost structure with the lower demand

we continue to see across much of our business.

Our Salt Life business registered sales growth for the quarter

on the strength of its direct-to-consumer channels, and its

recently opened retail location in Virginia has exceeded

expectations to date. At Activewear, we continued to see sluggish

overall activity across its three go-to-market channels and the

excess global manufacturing capacity in the market continued to

drive pricing pressure. On-quality performance and other

operational metrics in our DTG2Go business continued to improve and

shipments in our digital first business were above our internal

plan, but overall demand during the holiday season came in below

original forecasts.”

Mr. Humphreys concluded, “With the challenging start to our

fiscal year and demand across most of our markets generally

expected to be flat relative to last year, we remain tightly

focused on managing liquidity and working capital across all

aspects of our business and will continue to look for areas where

we can generate efficiencies and further streamline operations. We

will also continue to evaluate strategic options with the best

interest of our shareholders in mind and remain committed to

monetizing our real estate portfolio through a sale-leaseback

transaction for the right value proposition.”

For the first quarter ended December 30, 2023:

- Net sales were $79.9 million compared to prior year period net

sales of $107.3 million. Salt Life Group segment net sales were

$10.3 million and up slightly compared to the prior year period.

Net sales in the Delta Group segment were $69.6 million compared to

$97.0 million in the prior year period.

- Gross margins were 10.9% compared to 12.7% in the prior year

period, driven primarily by production curtailments. Adjusted for

the cost impacts of these product curtailments (“Production

Curtailment Costs”), first quarter gross margins were 12.6%. Delta

Group segment gross margins were 5.8% compared to 7.8% in the prior

year period. Adjusted for the Production Curtailment Costs, Delta

Group segment gross margins were 8%. Salt Life Group segment gross

margins were 45.4% versus 57.0% in the prior year period. Salt

Life’s gross margins for the quarter were negatively impacted to

some degree by the timing of inventory receipts, which should

reverse in the second quarter.

- Selling, general, and administrative expenses (“SG&A”)

decreased from $18.9 million in the prior year period to $18.6

million, while SG&A as a percentage of sales increased over the

prior year period to 23.3%.

- Operating loss increased from $2.6 million in the prior year

period to an operating loss of $4.9 million. Adjusting for the

Production Curtailment Costs and costs associated with the

restructuring of our offshore manufacturing footprint down to two

countries and related initiatives (“Restructuring Costs”),

operating loss was $2.8 million. Delta Group segment operating

income improved from $0.1 million to $0.5 million. Adjusted for the

Production Curtailment Costs and Restructuring Costs, Delta Group

segment operating income was $2.7 million, or 3.8% of sales. The

Salt Life Group segment experienced an operating loss of $2.1

million, compared to operating income of $0.3 million in the prior

year period.

- Net interest expense was $3.6 million compared to $2.9 million

in the prior year period, with the increase driven by the elevated

interest rate environment partially offset by lower

borrowings.

- Earnings before interest, taxes, depreciation and amortization

(“EBITDA”) was a loss of $1.3 million. Adjusted for the Production

Curtailment Costs and Restructuring Costs, EBITDA was positive at

$853 thousand. Delta Group segment EBITDA was $3.5 million.

Adjusted for the Production Curtailment Costs and Restructuring

Costs, Delta Group segment EBITDA was $5.7 million. Salt Life Group

segment EBITDA was a loss of $1.6 million.

- Net loss increased to $8.5 million, or $1.22 per share, from a

loss of $3.6 million, or $0.51 per share. Adjusted for the

Production Curtailment Costs and Restructuring Costs, net loss was

$6.6 million, or $0.94 per share.

- Net inventory as of December 30, 2023, was $196.3 million, a

sequential decrease of almost $16 million, or 8%, from September

2023 and a year-over-year decrease of $62.5 million, or 24%, from

December 2022.

- Debt outstanding under our U.S. revolving credit facility was

$110.8 million at December 30, 2023, a reduction of $31.5 million

from the prior year December and $42.3 million from March 2023.

Total net debt, including capital lease financing and cash on hand,

was $144.4 million as of December 30, 2023, an approximately 26%

reduction from $194.3 million at March 2023 and an approximately

22% reduction from $185.2 million at December 2022.

- Cash on hand and availability under our U.S. revolving credit

facility totaled $7.4 million as of December 30, 2023, a decrease

of $19.8 million from December 2022 and $6.8 million from September

2023. We believe we will need to obtain additional liquidity in the

near term to fund our operations and meet the obligations specified

in our U.S. revolving credit facility, and we are currently

exploring a variety of options toward that end.

- Capital spending was $300 thousand during the first quarter

compared to $2.1 million during the prior year first quarter.

Conference Call

On February 12, 2024, at 4:30 p.m. ET, the Company’s senior

management will hold a conference call to discuss its financial

results. The Company invites you to join the call by dialing

888-886-7786. If calling from outside the United States, the

dial-in number is 416-764-8658. A live webcast of the conference

call will be available at www.deltaapparelinc.com. Please visit the

website at least 15 minutes early to register for the

teleconference webcast and download any necessary software. A

replay of the call will be available through March 12, 2024. To

access the telephone replay, participants should dial toll-free

844-512-2921. International callers can dial 412-317-6671. The

access code for the replay is 35636211.

Non-GAAP Financial Measures

Reconciliations of GAAP gross margins to non-GAAP gross margins,

GAAP operating income to non-GAAP operating income, GAAP net income

to non-GAAP net income, GAAP net income to non-GAAP EBITDA, GAAP

net income to non-GAAP adjusted EBITDA, and GAAP operating income

to non-GAAP EBITDA and adjusted EBITDA are presented in tables

accompanying the selected financial data included in this release

and provide useful information to evaluate the Company’s

operational performance. A description of the amounts excluded on a

non-GAAP basis are provided in conjunction with these tables.

Non-GAAP gross margin, non-GAAP operating income, non-GAAP net

income, non-GAAP EBITDA and non-GAAP adjusted EBITDA should be

evaluated in light of the Company’s financial statements prepared

in accordance with GAAP.

About Delta Apparel, Inc.

Delta Apparel, Inc., along with its operating subsidiaries

DTG2Go, LLC, Salt Life, LLC, and M.J. Soffe, LLC, is a

vertically-integrated, international apparel company that designs,

manufactures, sources, and markets a diverse portfolio of core

activewear and lifestyle apparel products under the primary brands

of Salt Life®, Soffe®, and Delta. The Company is a market leader in

the direct-to-garment digital print and fulfillment industry,

bringing proprietary DTG2Go technology and innovation to customer

supply chains. The Company specializes in selling casual and

athletic products through a variety of distribution channels and

tiers, including outdoor and sporting goods retailers, independent

and specialty stores, better department stores and mid-tier

retailers, mass merchants and e-retailers, the U.S. military, and

through its business-to-business e-commerce sites. The Company’s

products are also made available direct-to-consumer on its websites

at www.saltlife.com, www.soffe.com and www.deltaapparel.com as well

as through its branded retail stores. The Company’s operations are

located throughout the United States, Honduras, El Salvador, and

Mexico, and it employs approximately 6,600 people worldwide.

Additional information about the Company is available at

www.deltaapparelinc.com.

Cautionary Note Regarding Forward-Looking Statements

This press release may contain “forward-looking” statements that

involve risks and uncertainties. Any number of factors could cause

actual results to differ materially from anticipated or forecasted

results, including, but not limited to, our ability to access

capital or that it will be available on terms acceptable to us or

at all; the general U.S. and international economic conditions; the

impact of the COVID-19 pandemic and government/social actions taken

to contain its spread on our operations, financial condition,

liquidity, and capital investments, including recent labor

shortages, inventory constraints, and supply chain disruptions;

significant interruptions or disruptions within our manufacturing,

distribution or other operations; deterioration in the financial

condition of our customers and suppliers and changes in the

operations and strategies of our customers and suppliers; the

volatility and uncertainty of cotton and other raw material prices

and availability; the competitive conditions in the apparel

industry; our ability to predict or react to changing consumer

preferences or trends; our ability to successfully open and operate

new retail stores in a timely and cost-effective manner; the

ability to grow, achieve synergies and realize the expected

profitability of acquisitions; changes in economic, political or

social stability at our offshore locations or in areas in which we,

or our suppliers or vendors, operate; our ability to attract and

retain key management; the volatility and uncertainty of energy,

fuel and related costs; material disruptions in our information

systems related to our business operations; compromises of our data

security; significant changes in our effective tax rate;

significant litigation in either domestic or international

jurisdictions; recalls, claims and negative publicity associated

with product liability issues; the ability to protect our

trademarks and other intellectual property; changes in

international trade regulations; our ability to comply with trade

regulations; changes in employment laws or regulations or our

relationship with employees; negative publicity resulting from

violations of manufacturing standards or labor laws or unethical

business practices by our suppliers and independent contractors;

the inability or refusal of suppliers or other third-parties,

including those related to transportation, to fulfill the terms of

their contracts with us; continued operating losses and

restrictions on our ability to borrow capital or service our

indebtedness; interest rate fluctuations increasing our obligations

under our variable rate indebtedness; the ability to raise

additional capital; the impairment of acquired intangible assets;

foreign currency exchange rate fluctuations; the illiquidity of our

shares; price volatility in our shares and the general volatility

of the stock market; and the other factors set forth in the "Risk

Factors" contained in our most recent Annual Report on Form 10-K

filed with the Securities and Exchange Commission and as updated in

our subsequently filed Quarterly Reports on Form 10-Q. Except as

may be required by law, Delta Apparel, Inc. expressly disclaims any

obligation to update these forward-looking statements to reflect

events or circumstances after the date of this press release or to

reflect the occurrence of unanticipated events.

SELECTED FINANCIAL DATA:

(In thousands, except per share

amounts)

Three Months Ended

December 2023

December 2022

Net Sales

$

79,934

$

107,295

Cost of Goods Sold

71,187

93,672

Gross Profit

8,747

13,623

Selling, General and Administrative

Expenses

18,614

18,870

Other Income, Net

(4,921

)

(2,621

)

Operating Loss

(4,946

)

(2,626

)

Interest Expense, Net

3,577

2,890

Loss Before Provision For (Benefit

From) Income Taxes

(8,523

)

(5,516

)

Provision For (Benefit From) Income

Taxes

10

(1,917

)

Consolidated Net Loss

(8,533

)

(3,599

)

Net Loss Attributable to

Non-Controlling Interest

6

34

Net Loss Attributable to

Shareholders

$

(8,527

)

$

(3,565

)

Weighted Average Shares

Outstanding

Basic

7,003

6,954

Diluted

7,003

6,954

Net Loss per Common Share

Basic

$

(1.22

)

$

(0.51

)

Diluted

$

(1.22

)

$

(0.51

)

December 2023

September 2023

December 2022

Current Assets

Cash

$

377

$

187

$

327

Receivables, Net

34,488

47,868

61,514

Inventories, Net

196,348

212,365

258,891

Prepaids and Other Assets

3,526

2,542

4,114

Total Current Assets

234,739

262,962

324,846

Noncurrent Assets

Property, Plant & Equipment,

Net

62,598

65,611

72,771

Goodwill and Other Intangibles,

Net

49,822

50,391

61,324

Deferred Income Taxes

7,822

7,822

1,342

Operating Lease Assets

56,909

55,464

49,313

Investment in Joint Venture

9,751

10,082

9,045

Other Noncurrent Assets

3,263

2,906

2,800

Total Noncurrent Assets

190,165

192,276

196,595

Total Assets

$

424,904

$

455,238

$

521,441

Current Liabilities

Accounts Payable and Accrued

Expenses

$

77,308

$

80,321

$

100,652

Income Taxes Payable

700

710

321

Current Portion of Finance

Leases

8,246

8,442

8,603

Current Portion of Operating

Leases

9,741

9,124

8,585

Current Portion of Long-Term

Debt

117,275

16,567

9,514

Total Current Liabilities

213,270

115,164

127,675

Noncurrent Liabilities

Long-Term Taxes Payable

2,131

2,131

2,841

Deferred Income Taxes

-

-

2,232

Long-Term Finance Leases

12,007

14,029

18,465

Long-Term Operating Leases

48,259

47,254

42,015

Long-Term Debt

7,260

126,465

148,899

Total Noncurrent Liabilities

69,657

189,879

214,452

Common Stock

96

96

96

Additional Paid-In Capital

60,643

61,315

60,559

Equity Attributable to Non-Controlling

Interest

(713

)

(707

)

(690

)

Retained Earnings

124,860

133,387

163,035

Accumulated Other Comprehensive Gain

(Loss)

-

-

210

Treasury Stock

(42,909

)

(43,896

)

(43,896

)

Total Equity

141,977

150,195

179,314

Total Liabilities and Equity

$

424,904

$

455,238

$

521,441

Reconciliations of GAAP Net Loss to Non-GAAP Measures Earnings

Before Interest Taxes Depreciation and Amortization ("EBITDA"),

Adjusted Net Loss, and Adjusted EBITDA Unaudited (in

thousands) Reconciliation of GAAP Measure Net Loss to

Non-GAAP Measures EBITDA, Adjusted Net Loss, and Adjusted EBITDA –

Unaudited Three Months Ending December 2023

Net Loss

$

(8,527

)

Interest Expense, Net

3,577

Provision For Income Taxes

10

Delta Group Segment Depreciation and Amortization

3,041

Salt Life Group Segment Depreciation and Amortization

534

Unallocated Depreciation and Amortization

57

EBITDA

(1,308

)

Production Curtailment Costs (1)

1,348

Restructuring Costs (2)

813

Tax Impact

(216

)

Adjusted Net Loss

(6,582

)

Interest Expense, Net

3,577

Provision For Income Taxes

226

Delta Group Segment Depreciation and Amortization

3,041

Salt Life Group Segment Depreciation and Amortization

534

Unallocated Depreciation and Amortization

57

Adjusted EBITDA

$

853

Reconciliation of GAAP Measure Delta Group Segment

Operating Income to Non-GAAP Measures Delta Group Segment EBITDA,

Adjusted Delta Group Segment Operating Income, and Adjusted Delta

Group Segment EBITDA – Unaudited Three Months Ending

December 2023 Delta Group Segment Operating

Income

$

492

Delta Group Segment Depreciation and Amortization

3,041

Delta Group Segment EBITDA

3,533

Production Curtailment Costs (1)

1,348

Restructuring Costs (2)

813

Adjusted Delta Group Segment Operating Income

2,653

Delta Group Segment Depreciation and Amortization

3,041

Adjusted Delta Group Segment EBITDA

$

5,694

Reconciliation of GAAP Measure Salt Life Group

Segment Operating Loss to Non-GAAP Measure Salt Life Group Segment

EBITDA – Unaudited Three Months Ending December

2023 Salt Life Group Segment Operating Loss

$

(2,130

)

Salt Life Group Segment Depreciation and Amortization

534

Salt Life Group Segment EBITDA

$

(1,596

)

(1) Production Curtailment Costs consist of unabsorbed fixed

costs, temporary unemployment benefit payments, and other expense

items resulting from the Company’s decision to reduce production

levels to better align with the significantly reduced demand across

the activewear industry due to high inventory levels stemming from

the heavy replenishment activity following pandemic-related supply

chain challenges. (2) Restructuring Costs consist of

employee severance benefits paid in connection with the transition

of our more expensive Mexico manufacturing capacity to our more

efficient Central America manufacturing platform, employee

severance benefits paid in connection with leadership

restructuring, and additional cost items incurred from

restructuring activities.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240212240772/en/

Company Contact: Justin Grow, 864-232-5200 x6604

investor.relations@deltaapparel.com Investor Relations Contact:

ICR, Inc. Investors: Tom Filandro, 646-277-1235

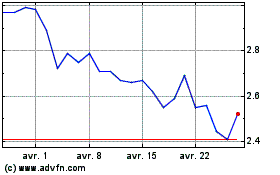

Delta Apparel (AMEX:DLA)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Delta Apparel (AMEX:DLA)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024