Delta Apparel, Inc. (NYSE American: DLA), a provider of core

activewear, lifestyle apparel, and on-demand digital print

strategies, today announced financial results for its fiscal year

2024 second quarter ended March 30, 2024.

For the second quarter ended March 30, 2024:

- Net sales were $78.9 million compared to prior year period net

sales of $110.3 million. Salt Life Group segment net sales were

$15.5 million compared to prior year period net sales of $18.9

million. Net sales in the Delta Group segment were $63.4 million

compared to $91.3 million in the prior year period.

- Gross margins were 4.3% compared to 14.7% in the prior year

period, driven primarily by production curtailments in the Delta

Group segment. Adjusted for the cost impacts of these product

curtailments (“Production Curtailment Costs”), first quarter gross

margins were 14.4%. Delta Group segment gross margins were (6.3%)

compared to 5.5% in the prior year period. Adjusted for the

Production Curtailment Costs, Delta Group segment gross margins

were 6.3%. Salt Life Group segment gross margins were 47.5% versus

59% in the prior year period, driven primarily by price discounting

activity and the timing of inventory receipts.

- Selling, general, and administrative expenses (“SG&A”)

decreased from $19.3 million in the prior year period to $17.9

million, while SG&A as a percentage of sales increased over the

prior year period to 22.8%.

- Operating loss increased from $5.3 million in the prior year

period to $24.4 million. Adjusting for the Production Curtailment

Costs, the costs associated with strategic restructuring actions

(the “Restructuring Costs”), and an $8.8 million non-cash

impairment charge on the goodwill in our DTG2Go business (the

“Impairment Charge”), operating loss was $6.0 million. Delta Group

segment operating loss increased from $7.4 million to $22.4

million. Adjusted for the Production Curtailment Costs,

Restructuring Costs, and Impairment Charge, Delta Group segment

operating loss was $3.9 million. Operating income in the Salt Life

Group segment was $197 thousand compared to $4.6 million in the

prior year period.

- Net interest expense was $3.5 million compared to $3.7 million

in the prior year period, with the decrease driven by lower

borrowings partially offset by the elevated interest rate

environment.

- Earnings before interest, taxes, depreciation and amortization

(“EBITDA”) was a loss of $20.9 million. Adjusted for the Production

Curtailment Costs, Restructuring Costs, and Impairment Charge,

EBITDA was a loss of $2.4 million. Delta Group segment EBITDA was a

loss of $19.4 million. Adjusted for the Production Curtailment

Costs, Restructuring Costs, and Impairment Charge, Delta Group

segment EBITDA was a loss of $1.0 million. Salt Life Group segment

EBITDA was $744 thousand.

- Net loss increased to $36.3 million, or $5.15 per share, from a

net loss of $7.0 million, or $1.00 per share. Adjusted for the

Production Curtailment Costs, Restructuring Costs, and Impairment

Charge, net loss was $17.8 million, or $2.53 per share.

- Net inventory as of March 30, 2024, was $156.9 million, a

year-over-year decrease of 35% from inventory of $243.2 million at

March 2023 and a sequential decrease of almost 40% from inventory

of $258.9 million at December 2022.

- Debt outstanding under our U.S. revolving credit facility was

$95.8 million at March 30, 2024, a year-over-year reduction of

$57.4 million from March 2023. Total net debt, including capital

lease financing and cash on hand, was $126.2 million as of March

30, 2024, an approximately 35% reduction from $194.3 million at

March 2023.

- Cash on hand and availability under our U.S. revolving credit

facility totaled $11.8 million as of March 30, 2024, an increase of

$4.4 million from December 2023 and a decrease of $2.4 million from

September 2023.

- Capital spending was $200 thousand during the second quarter

compared to $2 million during the prior year second quarter.

No Conference Call

The Company will not be holding a conference call to discuss its

financial results for its fiscal year 2024 second quarter.

Non-GAAP Financial Measures

Reconciliations of GAAP gross margins to non-GAAP gross margins,

GAAP operating income to non-GAAP operating income, GAAP net income

to non-GAAP net income, GAAP net income to non-GAAP EBITDA, GAAP

net income to non-GAAP adjusted EBITDA, and GAAP operating income

to non-GAAP EBITDA and adjusted EBITDA are presented in tables

accompanying the selected financial data included in this release

and provide useful information to evaluate the Company’s

operational performance. A description of the amounts excluded on a

non-GAAP basis are provided in conjunction with these tables.

Non-GAAP gross margin, non-GAAP operating income, non-GAAP net

income, non-GAAP EBITDA and non-GAAP adjusted EBITDA should be

evaluated in light of the Company’s financial statements prepared

in accordance with GAAP.

About Delta Apparel, Inc.

Delta Apparel, Inc., along with its operating subsidiaries

DTG2Go, LLC, Salt Life, LLC, and M.J. Soffe, LLC, is a

vertically-integrated, international apparel company that designs,

manufactures, sources, and markets a diverse portfolio of core

activewear and lifestyle apparel products under the primary brands

of Salt Life®, Soffe®, and Delta. The Company is a market leader in

the direct-to-garment digital print and fulfillment industry,

bringing proprietary DTG2Go technology and innovation to customer

supply chains. The Company specializes in selling casual and

athletic products through a variety of distribution channels and

tiers, including outdoor and sporting goods retailers, independent

and specialty stores, better department stores and mid-tier

retailers, mass merchants and e-retailers, the U.S. military, and

through its business-to-business e-commerce sites. The Company’s

products are also made available direct-to-consumer on its websites

at www.saltlife.com, www.soffe.com and www.deltaapparel.com as well

as through its branded retail stores. The Company’s operations are

located throughout the United States, Honduras and El Salvador.

Additional information about the Company is available at

www.deltaapparelinc.com.

Cautionary Note Regarding Forward-Looking Statements

This press release may contain “forward-looking” statements that

involve risks and uncertainties. Any number of factors could cause

actual results to differ materially from anticipated or forecasted

results, including, but not limited to, our ability to obtain

necessary liquidity and/or access capital or that such liquidity or

capital will be available on terms acceptable to us or at all; the

general U.S. and international economic conditions; the impact of

the COVID-19 pandemic and government/social actions taken to

contain its spread on our operations, financial condition,

liquidity, and capital investments, including recent labor

shortages, inventory constraints, and supply chain disruptions;

significant interruptions or disruptions within our manufacturing,

distribution or other operations; deterioration in the financial

condition of our customers and suppliers and changes in the

operations and strategies of our customers and suppliers; the

volatility and uncertainty of cotton and other raw material prices

and availability; the competitive conditions in the apparel

industry; our ability to predict or react to changing consumer

preferences or trends; our ability to successfully open and operate

new retail stores in a timely and cost-effective manner; the

ability to grow, achieve synergies and realize the expected

profitability of acquisitions; changes in economic, political or

social stability at our offshore locations or in areas in which we,

or our suppliers or vendors, operate; our ability to attract and

retain key management; the volatility and uncertainty of energy,

fuel and related costs; material disruptions in our information

systems related to our business operations; compromises of our data

security; significant changes in our effective tax rate;

significant litigation in either domestic or international

jurisdictions; recalls, claims and negative publicity associated

with product liability issues; the ability to protect our

trademarks and other intellectual property; changes in

international trade regulations; our ability to comply with trade

regulations; changes in employment laws or regulations or our

relationship with employees; negative publicity resulting from

violations of manufacturing standards or labor laws or unethical

business practices by our suppliers and independent contractors;

the inability or refusal of suppliers or other third-parties,

including those related to transportation, to fulfill the terms of

their contracts with us; continued operating losses and

restrictions on our ability to borrow capital or service our

indebtedness; interest rate fluctuations increasing our obligations

under our variable rate indebtedness; the ability to raise

additional capital; the impairment of acquired intangible assets;

foreign currency exchange rate fluctuations; the illiquidity of our

shares; price volatility in our shares and the general volatility

of the stock market; and the other factors set forth in the "Risk

Factors" contained in our most recent Annual Report on Form 10-K

filed with the Securities and Exchange Commission and as updated in

our subsequently filed Quarterly Reports on Form 10-Q. Except as

may be required by law, Delta Apparel, Inc. expressly disclaims any

obligation to update these forward-looking statements to reflect

events or circumstances after the date of this press release or to

reflect the occurrence of unanticipated events.

SELECTED FINANCIAL DATA: (In thousands, except per

share amounts)

Three Months Ended Six

Months Ended March 2024 March 2023

March 2024 March 2023 Net Sales

$

78,936

$

110,335

$

158,869

$

217,630

Cost of Goods Sold

75,580

94,126

146,767

187,798

Gross Profit

3,356

16,209

12,102

29,832

Selling, General and Administrative Expenses

17,961

19,298

36,576

38,168

Impairment of Goodwill

8,780

-

8,780

-

Other Expense (Income), Net

1,051

2,265

(3,870

)

(356

)

Operating Loss

(24,436

)

(5,354

)

(29,384

)

(7,980

)

Interest Expense, Net

3,471

3,723

7,047

6,613

Loss Before Provision For (Benefit From) Income

Taxes

(27,907

)

(9,077

)

(36,431

)

(14,593

)

Provision for (Benefit From) Income Taxes

8,393

(2,079

)

8,403

(3,996

)

Consolidated Net Loss

(36,300

)

(6,998

)

(44,834

)

(10,597

)

Net Loss Attributable to Non-Controlling

Interest

6

6

12

40

Net Loss Attributable to Shareholders

$

(36,294

)

$

(6,992

)

$

(44,822

)

$

(10,557

)

Weighted Average Shares Outstanding

Basic

7,051

7,001

7,027

6,978

Diluted

7,051

7,001

7,027

6,978

Net Loss per Common Share Basic

$

(5.15

)

$

(1.00

)

$

(6.38

)

$

(1.51

)

Diluted

$

(5.15

)

$

(1.00

)

$

(6.38

)

$

(1.51

)

March 2024 September

2023 March 2023 Current Assets

Cash

$

705

$

187

$

625

Receivables, Net

37,133

47,868

64,825

Inventories, Net

156,894

212,365

243,167

Prepaids and Other Assets

3,298

2,542

4,096

Total Current Assets

198,030

262,962

312,713

Noncurrent Assets Property, Plant

& Equipment, Net

59,741

65,611

70,739

Goodwill and Other Intangibles, Net

40,473

50,391

60,731

Deferred Income Taxes

-

7,822

1,342

Operating Lease Assets

54,534

55,464

56,174

Investment in Joint Venture

10,052

10,082

9,036

Other Noncurrent Assets

3,069

2,906

2,239

Total Noncurrent Assets

167,869

192,276

200,261

Total Assets

$

365,899

$

455,238

$

512,974

Current Liabilities

Accounts Payable and Accrued Expenses

$

74,701

$

80,321

$

84,652

Income Taxes Payable

869

710

671

Current Portion of Finance Leases

7,880

8,442

8,843

Current Portion of Operating Leases

9,886

9,124

8,861

Current Portion of Long-Term Debt

103,026

16,567

8,962

Total Current Liabilities

196,362

115,164

111,989

Noncurrent Liabilities Long-Term

Taxes Payable

1,184

2,131

2,131

Deferred Income Taxes

559

-

337

Long-Term Finance Leases

10,250

14,029

17,483

Long-Term Operating Leases

45,837

47,254

48,804

Long-Term Debt

5,757

126,465

159,591

Total Noncurrent Liabilities

63,587

189,879

228,346

Common Stock

96

96

96

Additional Paid-In Capital

60,916

61,315

60,912

Equity Attributable to Non-Controlling Interest

(719

)

(707

)

(696

)

Retained Earnings

88,566

133,387

156,043

Accumulated Other Comprehensive Gain (Loss)

-

-

180

Treasury Stock

(42,909

)

(43,896

)

(43,896

)

Total Equity

105,950

150,195

172,639

Total Liabilities and Equity

$

365,899

$

455,238

$

512,974

Reconciliation of Gross Margin, Operating Loss, and Net Loss to

Non-GAAP Measures Adjusted Gross Margin, Adjusted Operating Loss,

and Adjusted Net Loss Unaudited (in thousands)

Reconciliation of Gross Margin to Adjusted Gross Margin –

Unaudited Three Months Ending Six Months Ending

March 2024 March 2023 March 2024 March

2023 Gross Margin

$

3,356

$

16,209

$

12,102

$

29,832

Production Curtailment Costs (1)

8,027

879

9,375

4,249

Adjusted Gross Margin

$

11,383

$

17,088

$

21,477

$

34,081

14.4

%

15.5

%

13.5

%

15.7

%

Reconciliation of Operating Loss to Adjusted Operating

Loss – Unaudited Three Months Ending Six Months

Ending March 2024 March 2023 March 2024

March 2023 Operating Loss

$

(24,436

)

$

(5,354

)

$

(29,384

)

$

(7,980

)

Production Curtailment Costs (1)

8,027

879

9,375

4,249

Restructuring Costs (2)

1,664

813

2,477

813

Goodwill Impairment Charges (3)

8,780

-

8,780

-

Adjusted Operating Loss

$

(5,965

)

$

(3,662

)

$

(8,752

)

$

(2,918

)

Reconciliation of Net Loss to Adjusted Net Loss –

Unaudited Three Months Ending Six Months Ending

March 2024 March 2023 March 2024 March

2023 Net Loss

$

(36,294

)

$

(6,992

)

$

(44,822

)

$

(10,557

)

Production Curtailment Costs (1)

8,027

879

9,375

4,249

Restructuring Costs (2)

1,664

813

2,477

813

Goodwill Impairment Charges (3)

8,780

-

8,780

-

Tax Impact

9

(387

)

12

(1,392

)

Adjusted Net Loss

$

(17,814

)

$

(5,687

)

$

(24,178

)

$

(6,887

)

Reconciliation of Delta Group Segment Gross Margin to

Delta Group Segment Adjusted Gross Margin - Unaudited Three

Months Ending Six Months Ending March 2024

March 2023 March 2024 March 2023

Gross Margin

$

(4,017

)

$

5,000

$

40

$

12,759

Production Curtailment Costs (1)

8,027

879

9,375

4,249

Adjusted Gross Margin

$

4,010

$

5,879

$

9,415

$

17,008

6.3

%

6.4

%

7.1

%

9.0

%

Reconciliation of Delta Group Segment Operating Loss to

Delta Group Segment Adjusted Operating Loss - Unaudited

Three Months Ending Six Months Ending March

2024 March 2023 March 2024 March 2023

Operating Income

$

(22,350

)

$

(7,487

)

$

(21,860

)

$

(7,363

)

Production Curtailment Costs (1)

8,027

879

9,375

4,249

Restructuring Costs (2)

1,664

813

2,477

813

Goodwill Impairment Charges (3)

8,780

-

8,780

-

Adjusted Operating Loss

$

(3,879

)

$

(5,795

)

$

(1,228

)

$

(2,301

)

(1) Production Curtailment Costs consist of unabsorbed fixed

costs, temporary unemployment benefit payments, and other expense

items resulting from the Company’s decision to reduce production

levels. (2) Restructuring Costs consist of employee severance

benefits paid in connection with the transition of our more

expensive Mexico manufacturing capacity to our more efficient

Central America manufacturing platform, employee severance benefits

paid in connection with restructuring, and additional cost items

incurred from restructuring activities. (3) Goodwill Impairment

Charges consists of non-cash charge associated with our DTG2Go

business.

Reconciliations of GAAP Net Loss and

GAAP Operating Loss to Non-GAAP Measure Earnings Before Interest

Taxes Depreciation and Amortization ("EBITDA") and Adjusted Net

Loss and Adjusted Operating (Loss) Income to Adjusted

EBITDA

Unaudited (in thousands) Reconciliation of

Net Loss to EBITDA and Adjusted Net Loss to Adjusted EBITDA –

Unaudited Three Months Ending Six Months Ending

March 2024 March 2024 Net Loss

$

(36,294

)

$

(44,822

)

Interest Expense, Net

3,471

7,047

Provision For Income Taxes

8,393

8,403

Delta Group Segment Depreciation and Amortization

2,916

5,957

Salt Life Group Segment Depreciation and Amortization

547

1,081

Unallocated Depreciation and Amortization

57

115

EBITDA

(20,910

)

(22,219

)

Production Curtailment Costs (1)

8,027

9,375

Restructuring Costs (2)

1,664

2,477

Goodwill Impairment Charges (3)

8,780

8,780

Tax Impact

9

12

Adjusted Net Loss

(17,814

)

(24,178

)

Interest Expense, Net

3,471

7,047

Benefit From Income Taxes

8,384

8,391

Delta Group Segment Depreciation and Amortization

2,916

5,957

Salt Life Group Segment Depreciation and Amortization

547

1,081

Unallocated Depreciation and Amortization

57

115

Adjusted EBITDA

$

(2,439

)

$

(1,587

)

Reconciliation of Delta Group Segment Operating Loss to

Delta Group Segment EBITDA and Adjusted Delta Group Segment

Operating Loss to Adjusted Delta Group Segment EBITDA –

Unaudited Three Months Ending Six Months Ending

March 2024 March 2024 Delta Group Segment

Operating Income

$

(22,350

)

$

(21,860

)

Delta Group Segment Depreciation and Amortization

2,916

5,957

Delta Group Segment EBITDA

(19,434

)

(15,903

)

Production Curtailment Costs (1)

8,027

9,375

Restructuring Costs (2)

1,664

2,477

Goodwill Impairment Charges (3)

8,780

8,780

Adjusted Delta Group Segment Operating Income

(3,879

)

(1,228

)

Delta Group Segment Depreciation and Amortization

2,916

5,957

Adjusted Delta Group Segment EBITDA

$

(963

)

$

4,729

Reconciliation of Salt Life Group Segment

Operating Income (Loss) to Salt Life Group Segment EBITDA –

Unaudited Three Months Ending Six Months Ending

March 2024 March 2024 Salt Life Group

Segment Operating Income (Loss)

$

197

$

(1,933

)

Salt Life Group Segment Depreciation and Amortization

547

1,081

Salt Life Group Segment EBITDA

$

744

$

(852

)

(1) Production Curtailment Costs consist of unabsorbed fixed

costs, temporary unemployment benefit payments, and other expense

items resulting from the Company’s decision to reduce production

levels. (2) Restructuring Costs consist of employee severance

benefits paid in connection with the transition of our more

expensive Mexico manufacturing capacity to our more efficient

Central America manufacturing platform, employee severance benefits

paid in connection with restructuring, and additional cost items

incurred from restructuring activities. (3) Goodwill Impairment

Charges consists of non-cash charge associated with our DTG2Go

business.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240508438976/en/

Company Contact: Justin Grow, 864-232-5200 x6604

investor.relations@deltaapparel.com

Investor Relations Contact: ICR, Inc.

Investors: Tom Filandro, 646-277-1235

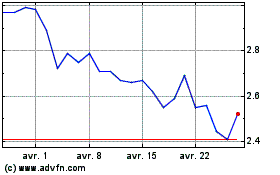

Delta Apparel (AMEX:DLA)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

Delta Apparel (AMEX:DLA)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025