0001388126 false 0001388126 2021-05-01 2022-04-30 0001388126 2022-05-01 2023-04-30 0001388126 pdhifi:AntiTakeoverProvisionsMember 2022-05-01 2023-04-30 0001388126 pdhifi:CashManagementRiskMember 2022-05-01 2023-04-30 0001388126 pdhifi:CollateralRiskMember 2022-05-01 2023-04-30 0001388126 pdhifi:CreditDefaultSwapRiskMember 2022-05-01 2023-04-30 0001388126 pdhifi:CreditRiskMember 2022-05-01 2023-04-30 0001388126 pdhifi:CurrencyRiskMember 2022-05-01 2023-04-30 0001388126 pdhifi:CybersecurityRiskMember 2022-05-01 2023-04-30 0001388126 pdhifi:DerivativesRiskMember 2022-05-01 2023-04-30 0001388126 pdhifi:ExtensionRiskMember 2022-05-01 2023-04-30 0001388126 pdhifi:ForwardForeignCurrencyTransactionsRiskMember 2022-05-01 2023-04-30 0001388126 pdhifi:HighYieldOrJunkBondRiskMember 2022-05-01 2023-04-30 0001388126 pdhifi:ILSMarketAndReinvestmentRiskMember 2022-05-01 2023-04-30 0001388126 pdhifi:InterestRateRiskMember 2022-05-01 2023-04-30 0001388126 pdhifi:IssuerRiskMember 2022-05-01 2023-04-30 0001388126 pdhifi:LeveragingRiskMember 2022-05-01 2023-04-30 0001388126 pdhifi:LIBORRiskMember 2022-05-01 2023-04-30 0001388126 pdhifi:MarketPriceOfSharesMember 2022-05-01 2023-04-30 0001388126 pdhifi:MarketRiskMember 2022-05-01 2023-04-30 0001388126 pdhifi:MarketSegmentRiskMember 2022-05-01 2023-04-30 0001388126 pdhifi:MortgageRelatedAndAssetBackedSecuritiesRiskMember 2022-05-01 2023-04-30 0001388126 pdhifi:PortfolioSelectionRiskMember 2022-05-01 2023-04-30 0001388126 pdhifi:PreferredStocksRiskMember 2022-05-01 2023-04-30 0001388126 pdhifi:PrepaymentOrCallRiskMember 2022-05-01 2023-04-30 0001388126 pdhifi:ReinvestmentRiskMember 2022-05-01 2023-04-30 0001388126 pdhifi:RepurchaseAgreementRiskMember 2022-05-01 2023-04-30 0001388126 pdhifi:RiskOfDisadvantagedAccessToConfidentialInformationMember 2022-05-01 2023-04-30 0001388126 pdhifi:RiskOfIlliquidInvestmentsMember 2022-05-01 2023-04-30 0001388126 pdhifi:RisksOfConvertibleSecuritiesMember 2022-05-01 2023-04-30 0001388126 pdhifi:RisksOfInstrumentsThatAllowForBalloonPaymentsOrNegativeAmortizationPaymentsMember 2022-05-01 2023-04-30 0001388126 pdhifi:RisksOfInvestingInCollateralizedDebtObligationsMember 2022-05-01 2023-04-30 0001388126 pdhifi:RisksOfInvestingInFloatingRateLoansMember 2022-05-01 2023-04-30 0001388126 pdhifi:RisksOfInvestingInInsuranceLinkedSecuritiesMember 2022-05-01 2023-04-30 0001388126 pdhifi:RisksOfInvestingInStructuredReinsuranceInvestmentsMember 2022-05-01 2023-04-30 0001388126 pdhifi:RisksOfInvestmentInOtherFundsMember 2022-05-01 2023-04-30 0001388126 pdhifi:RisksOfNonUSInvestmentsMember 2022-05-01 2023-04-30 0001388126 pdhifi:RisksOfSubordinatedSecuritiesMember 2022-05-01 2023-04-30 0001388126 pdhifi:RisksOfZeroCouponBondsPaymentInKindDeferredAndContingentPaymentSecuritiesMember 2022-05-01 2023-04-30 0001388126 pdhifi:StructuredSecuritiesRiskMember 2022-05-01 2023-04-30 0001388126 pdhifi:USGovernmentAgencyObligationsRiskMember 2022-05-01 2023-04-30 0001388126 pdhifi:USTreasuryObligationsRiskMember 2022-05-01 2023-04-30 0001388126 pdhifi:ValuationRiskMember 2022-05-01 2023-04-30 iso4217:USDiso4217:USDxbrli:sharesxbrli:purexbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811‑22014

Pioneer Diversified High Income Fund, Inc.

(Exact name of registrant as specified in charter)

60 State Street, Boston, MA 02109

(Address of principal executive offices) (ZIP code)

Christopher J. Kelley, Amundi Asset Management, Inc.,

60 State Street, Boston, MA 02109

(Name and address of agent for service)

Registrant’s telephone number, including area code: (617) 742‑7825

Date of fiscal year end: April 30, 2023

Date of reporting period: May 1, 2022 through April 30, 2023

Form N‑CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e‑1 under the Investment Company Act of 1940 (17 CFR 270.30e‑1). The Commission may use the information provided on Form N‑CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N‑CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N‑CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss. 3507.

ITEM 1. REPORT TO STOCKHOLDERS.

Pioneer Diversified High Income Fund, Inc.

Annual Report | April 30, 2023

visit us: www.amundi.com/us

Pioneer Diversified High Income Fund, Inc. | Annual Report | 4/30/231

Dear Stockholders,

On February 13, 2023, Amundi US celebrated the 95th anniversary of Pioneer Fund, the second-oldest mutual fund in the United States. We recognized the anniversary with ringing of the closing bell at the New York Stock Exchange, which seemed fitting for this special milestone.

Pioneer Fund was launched on February 13, 1928 by Phil Carret, one of the earliest proponents of value investing and a leading innovator in the asset management industry. Mr. Carret began investing in the 1920s and founded Pioneer Investments (now Amundi US) in 1928, and was one of the first investors to realize he could uncover value through rigorous, innovative, fundamental research techniques.

Consistent with Mr. Carret’s investment approach and employing many of the same techniques utilized in the 1920s, Amundi US's portfolio managers have adapted Mr. Carret’s philosophy to a new age of “active” investing.

The last few years have seen investors face some unprecedented challenges, from a global pandemic that shuttered much of the world’s economy for months, to geopolitical strife, to rising inflation that has reached levels not seen in decades. Now, more than ever, Amundi US believes active management – that is, making active investment decisions across all of our portfolios – can help mitigate risk during periods of market volatility.

At Amundi US, active management begins with our own fundamental, bottom-up research process. Our team of dedicated research analysts and portfolio managers analyzes each security under consideration, communicating frequently with the management teams of the companies and other entities issuing the securities, and working together to identify those securities that we believe best meet our investment criteria for our family of funds. Our risk management approach begins with each security under consideration, as we strive to develop a deep understanding of the potential opportunity, while considering any potential risk factors.

Today, as stockholders, we have many options. It is our view that active management can serve stockholders well, not only when markets are thriving, but also during periods of market stress. As you consider your long-term investment goals, we encourage you to work with your financial professional to develop an investment plan that paves the way for you to pursue both your short-term and long-term goals.

2Pioneer Diversified High Income Fund, Inc. | Annual Report | 4/30/23

We greatly appreciate the trust you have placed in us and look forward to continuing to serve you in the future.

Lisa M. Jones

Head of the Americas, President and CEO of US

Amundi Asset Management US, Inc.

June 2023

Any information in this stockholder report regarding market or economic trends or the factors influencing the Fund’s historical or future performance are statements of opinion as of the date of this report. Past performance is no guarantee of future results.

Pioneer Diversified High Income Fund, Inc. | Annual Report | 4/30/233

Portfolio Management Discussion | 4/30/23

In the following interview, Andrew Feltus, Jonathan Sharkey, Chin Liu, and Lawrence Zeno discuss the factors that affected the performance of Pioneer Diversified High Income Fund, Inc. during the 12-month period ended April 30, 2023. Mr. Feltus, Managing Director, Co-Director of High Yield, and a portfolio manager at Amundi Asset Management US, Inc. (Amundi US), Mr. Sharkey, a senior vice president and a portfolio manager at Amundi US, Mr. Liu, Managing Director, Director of Insurance-Linked Securities (ILS), Fixed-Income Solutions and Responsible Investment Research, and a portfolio manager at Amundi, and Mr. Zeno, a vice president and a portfolio manager at Amundi US, are responsible for the day-to-day management of the Fund.

| Q |

How did the Fund perform during the 12-month period ended April 30, 2023? |

| A |

Pioneer Diversified High Income Fund, Inc. returned -3.46% at net asset value (NAV) and -8.96% at market price during the 12-month period ended April 30, 2023. During the same 12-month period, the Fund’s composite benchmark returned 2.20% at NAV. The Fund’s composite benchmark is based on equal weights of the ICE Bank of America (ICE BofA) Global High Yield and Crossover Country Corporate and Government (GHY/CCC & G) Index and the Morningstar/Loan Syndications & Trading Association (Morningstar/LSTA) Leveraged Loan Index. |

| |

Individually, during the 12-month period ended April 30, 2023, the ICE BofA GHY/CCC & G Index returned 0.80%, and the Morningstar/LSTA Leveraged Loan Index returned 3.39%. Unlike the Fund, the composite benchmark and its component indices do not use leverage. While the use of leverage increases investment opportunity, it also increases investment risk. |

| |

During the same 12-month period, the average return at NAV of the 41 closed end funds in Morningstar’s High Yield Bond Closed End Funds category (which may or may not be leveraged) was -1.92%, while the same closed end fund Morningstar category’s average return at market price was -2.27%. |

| |

The shares of the Fund were selling at a -14.58% discount to NAV on April 30, 2023. Comparatively, the shares of the Fund were selling at a -9.43% discount to NAV on April 30, 2022. |

4Pioneer Diversified High Income Fund, Inc. | Annual Report | 4/30/23

| |

As of April 30, 2023, the 30-day SEC yield on the Fund’s shares was 12.70%*. |

| Q |

How would you describe the investment environment in the global fixed-income markets during the 12-month period ended April 30, 2023? |

| A |

Returns for all major segments of the fixed-income market were muted for the 12-month period, as Treasury yields ended the period higher, while credit spreads widened. (Credit spreads are commonly defined as the differences in yield between Treasuries and other types of fixed-income securities with similar maturities.) |

| |

Entering the reporting period in May of 2022, geopolitical developments weighed heavily on investors’ appetites for riskier assets, such as stocks and corporate bonds. These included Russia’s ongoing war against Ukraine and the shuttering of China’s economy as the government there had implemented strict lockdowns in major cities as part of its “Zero-COVID” policy. Both crises served to exacerbate ongoing supply-chain pressures and threaten the global economic growth outlook. |

| |

At the same time, policymakers of many central banks were confronted with historically high inflation numbers. The US consumer price index (CPI) began to post year-over-year increases in excess of 8% beginning with the March 2022 readout, and peaked at over 9% in June 2022. By the late spring of 2022, market speculation had become heightened over whether the US Federal Reserve System (Fed) would be able to achieve a “soft landing,” in which economic growth slows yet remains positive as inflation is brought under control. With market participants concerned about rising inflation, the Fed’s response, and economic growth, returns for riskier assets turned significantly negative. |

| |

The Fed would aggressively increase the target range for the federal funds rate between May and September 2022, bringing the target to a range of 3.00% ‒ 3.25%, versus the 0.00% ‒ 0.25% |

| * |

The 30-day SEC yield is a standardized formula that is based on the hypothetical annualized earning power (investment income only) of the Fund’s portfolio securities during the period indicated. |

Pioneer Diversified High Income Fund, Inc. | Annual Report | 4/30/235

| |

target range at the beginning of 2022. US Treasury yields moved sharply higher in response to the Fed’s determined stance to tighten monetary policy, and the yield curve became inverted as the market began anticipating a recession. (A yield curve is a line that plots the interest rates, at a set point in time, of bonds having equal credit quality but differing maturity dates. An inverted yield curve represents a situation where longer-term rates along the curve are lower than shorter-term rates.) |

| |

Towards the end of 2022, with inflation beginning to show signs of modest easing, investors began to anticipate a pivot by the Fed to a more “dovish” stance on monetary policy, despite another increase to the federal funds rate target range of 75 basis points (bps) in early November. (A basis point is equal to 1/100th of a percentage point.). This led to a rebound for riskier asset classes in the fourth quarter of 2022. However, the market soon turned its attention to the potential recessionary effects of the higher interest-rate regime already put in place by the Fed, leading riskier assets to give back some of their fourth-quarter gains over the month of December. The Fed then implemented a more modest 50 bps increase to the federal funds target range at its December meeting, leaving the target range at 4.25% ‒ 4.50% at the end of 2022. |

| |

Entering 2023, riskier assets continued to rally amid increasing investor optimism that the Fed and other leading central banks were poised to stop raising interest rates. January 2023 saw Treasury yields pull back from their more recent highs on the outlook for a potential easing of monetary policy. In addition, the reopening of China’s economy as the government unwound its “Zero-COVID” policy helped ease concerns about slowing global economic growth. Against this backdrop, areas of the market that had lagged during the 2022 sell-offs, such as growth stocks and corporate credit, outperformed. On February 1, 2023, the Fed once again raised the federal funds target range, this time by a less aggressive 25 bps, bringing the target to 4.50% ‒ 4.75%. |

| |

In March, however, the failure of two regional US banks and the collapse of European banking giant Credit Suisse raised fears of a financial crisis. In response, the Fed implemented a new lending program to support bank liquidity, while market participants began to anticipate interest-rate cuts by the Fed over the second |

6Pioneer Diversified High Income Fund, Inc. | Annual Report | 4/30/23

| |

half of the year. The prospect of a more dovish stance on monetary policy and a “flight to safety” by investors in the wake of the banking-system issues drove Treasury yields sharply lower, which in turn lent support to bond-market returns. At its March 23 meeting, the Fed went forward with another modest 25 bps increase to the federal funds target, bringing the range to 4.75% ‒ 5.00%. The financial markets viewed the latest rate increase as an indication that the Fed believed the financial system, overall, remained on solid footing. As of April 30, 2023, the yield on the 10-year Treasury note had declined from its earlier high of more than 4.00%, and stood at 3.44%, versus 2.89% 12 months earlier. |

| |

High-yield corporate bonds posted a positive, albeit modest, return for the 12-month period, while marginally outperforming their more interest-rate-sensitive investment-grade counterparts. Returns for floating-rate bank loans were somewhat higher, as the asset class benefited from the outlook for rising interest rates. Securitized assets finished the 12-month period with a positive return, led by non-agency residential mortgage-backed securities (RMBS). |

| Q |

What factors affected the Fund’s benchmark-relative performance during the 12-month period ended April 30, 2023? |

| A |

The Fund’s underperformance relative to its composite benchmark was primarily the result of carrying leveraged exposure to credit-oriented sectors as market sentiment weakened over the period. (The use of leverage exacerbates the effects of market moves, in either direction.) Conversely, the portfolio’s below-benchmark (short) duration stance was the largest positive contributor to the Fund’s benchmark-relative returns as Treasury yields moved higher during the 12-month period. (Duration is a measure of the sensitivity of the price, or the value of principal, of a fixed-income investment to a change in interest rates, expressed as a number of years.) |

| |

With respect to ratings categories, the portfolio’s tilt towards owning lower-quality issues within the high-yield corporate segment detracted from the Fund’s relative results for the period, as non-rated issues and issues in the “B” and “CCC” ratings |

Pioneer Diversified High Income Fund, Inc. | Annual Report | 4/30/237

| |

categories underperformed “BB” rated issues, where the Fund was underweight versus the benchmark. |

| |

In sector terms, Fund’s overweight exposures to energy and transportation contributed positively to relative performance, while underweights to the insurance, automotive, and utility sectors detracted. Security selection results were positive for the Fund within the insurance, energy, and real estate sectors, but lagged significantly within the health care, services, and media segments. |

| |

The Fund’s non-benchmark holdings of securitized assets are comprised primarily of commercial MBS (CMBS), but also include collateralized loan obligations (CLOs) and credit-risk transfer securities within RMBS. (Credit-risk transfers are securities that transfer a portion of the risk associated with credit losses within pools of conventional residential mortgage loans from the government-sponsored entities, or GSEs, Fannie Mae and Freddie Mac, to the private sector.) In order of magnitude, the Fund’s CMBS allocation broadly comprises single asset/single borrower issues, Freddie Mac-issued non-guaranteed deals, and the traditional conduit deals (diverse, fixed-rate pools). The Fund’s securitized holdings generated a slight, positive total return for the 12-month period, outperforming high-yield corporates as well as the broader securitized market, with the RMBS allocation leading positive contributions to benchmark-relative returns among the portfolio’s securitized exposures. CMBS exposures also had a positive effect on the Fund’s relative performance, though the portfolio’s holdings of asset-backed securities (ABS) generated a negative return, driven by the bankruptcy of a servicer backing a consumer lending deal. Issuance in both the CMBS and RMBS sectors has plummeted in 2023 as higher interest rates have kicked in, while ABS issuance has declined more modestly. |

| |

We increased the Fund’s bank-loan exposures by a modest amount during the 12-month period, in an attempt to take advantage of higher short-term reference rates for loans resulting from the Fed’s rate increases. Relative performance for the Fund’s bank loans benefited during the period from their floating-rate features and low duration. The loan asset class recovered its earlier losses (driven by investors' concerns over |

8Pioneer Diversified High Income Fund, Inc. | Annual Report | 4/30/23

| |

credit fundamentals) over the second half of the 12-month period, as recession fears were pushed out into late 2023, and loans benefited from sharp increases in London Interbank Offered/ Secured Overnight Financing (LIBOR/SOFR) rates, and generated a positive performance contribution for the full 12-month period. The loans held in the portfolio did lag the larger loan universe, however, as most of the borrowers to which the Fund is exposed also have high-yield bonds in their capital structures, and so the sell-off in the high-yield segment during the period affected investors' sentiment toward those borrowers, in general. The Fund’s overweight to such loan borrowers is based on their history of better recovery values in the event of default, relative to loan-only borrowers. After reaching a period low in February 2023 (just over 2% of invested assets), as noted previously, we had modestly increased the Fund's exposure to bank loans by period-end, as we sought to take advantage of higher LIBOR rates. The Fund’s loan allocation at period-end stood at just over 3% of invested assets, below the average for the last several quarters, as loan yields did not reach parity with high-yield bonds until late in the 12-month period. |

| |

The Fund’s allocation to insurance-linked securities (ILS) performed as we had expected during the period. While the broader markets sold off, the Fund's ILS exposures benefited benchmark-relative returns. One of the favorable characteristics of ILS is the structurally uncorrelated nature of the asset class to the performance of other assets. We continue to view having exposure to ILS as helping to bolster the income and risk-reward profile of the portfolio over the long term. |

| Q |

How did the level of leverage in the Fund change over the 12-month period ended April 30, 2023? |

| A |

The Trust employs leverage through a credit agreement. (See Note 8 to the Financial Statements.) |

| |

As of April 30, 2023, 30.3% of the Fund’s total managed assets were financed by leverage (or borrowed funds), compared with 32.7% of the Fund’s total managed assets financed by leverage at the start of the 12-month period on May 1, 2022. During the 12-month period, the Fund decreased the absolute amount of funds borrowed by a total of $12 million to $43 million as of April 30, |

Pioneer Diversified High Income Fund, Inc. | Annual Report | 4/30/239

| |

2023. The percentage of the Fund’s managed assets financed by leverage decreased during the 12-month period due to the decrease in the amount of funds borrowed by the Fund. The interest rate on the Fund's leverage increased by 442 basis points from April 30, 2022 to April 30, 2023. |

| Q |

Did the Fund’s distributions** to stockholders change during the 12-month period ended April 30, 2023? |

| A |

The Fund’s monthly distribution rate declined from $0.11000 cents per share/per month, to $0.09000 cents per share/per month, during the 12-month period. The Fund’s distributions during the reporting period included returns of capital totaling $0.04 per share. The decrease reflected the combination of higher-coupon bonds held in the portfolio being called, and a shift out of higher-yielding, higher-risk emerging markets issues, due to concerns about a potential recession. The Fund has accumulated undistributed net investment income which is part of the Fund's NAV. A portion of this accumulated net investment income was distributed to stockholders during the period, and may be depleted over time. A decrease in distributions may have a negative effect on the market value of the Fund's shares. |

| Q |

Did the Fund have exposure to any derivative securities during the 12-month period ended April 30, 2023? If so, did the derivatives have a notable effect on performance? |

| A |

We invested the Fund in forward foreign currency contracts (currency forwards) during the period to help manage the risk of the portfolio’s exposures to foreign currencies. The use of currency forwards had a small, positive effect on the Fund’s benchmark-relative results, given the decline in the euro relative to the US dollar over the 12-month period. |

| Q |

What is your investment outlook? |

| A |

With elevated inflation proving to be sticky and the Fed committed to bringing inflation down to its 2% long-term target, we believe the federal funds rate target range will remain “higher for longer,” contrary to current market expectations, which have continued to price in rate cuts for the latter part of 2023. We |

| ** |

Distributions are not guaranteed. |

10Pioneer Diversified High Income Fund, Inc. | Annual Report | 4/30/23

| |

believe financial conditions will become more restrictive, and that the likelihood of a recession has risen, particularly as banks tighten lending standards and as the Fed maintains higher interest rates. Consequently, we expect to retain a somewhat defensive posture in the Fund’s portfolio as recession risk increases over the course of the year. |

| |

As has typically been the case during recessions, should one occur, we believe some high-yield bond issuers will end up in trouble, leading to increased defaults. However, we do not expect a deep recession, such as during the global financial crisis (GFC) of 2008. In our view, the economy will likely be on the upswing and the default rate headed lower at some point in 2024. |

| |

In this scenario, we would expect the default rate to remain lower than it was after the GFC. We predicate our view on the significant weighting of “BB” rated issuers in the high-yield universe, strong fundamentals (in our opinion) in many sectors such as autos and energy, and the relative strength of many US consumers. In addition, within the below-investment-grade universe, we expect the high-yield bond default rate to be substantially lower than the default rate for their floating-rate, leveraged-loan counterparts. |

| |

Within securitized assets, we expect that higher interest rates should keep issuance relatively low in both the CMBS and RMBS markets for the near-to-medium terms. The current interest-rate environment has slowed prepayments in the RMBS market as well as refinancings in the CMBS market, which has inhibited us from deploying funds into those categories. While further increases in short-term loan reference rates could potentially lead to an increase in the Fund’s loan exposures going forward, that is dependent upon the depth of any potential recession we may see as 2023 progresses. |

Pioneer Diversified High Income Fund, Inc. | Annual Report | 4/30/2311

Please refer to the Schedule of Investments on pages 16-25 for a full listing of Fund securities.

All investments are subject to risk, including the possible loss of principal. In the past several years, financial markets have experienced increased volatility and heightened uncertainty. The market prices of securities may go up or down, sometimes rapidly or unpredictably, due to general market conditions, such as real or perceived adverse economic, political, or regulatory conditions, recessions, inflation, changes in interest or currency rates, lack of liquidity in the bond markets, the spread of infectious illness or other public health issues, armed conflict including Russia's military invasion of Ukraine, sanctions against Russia, other nations or individuals or companies and possible countermeasures, market disruptions caused by tariffs, trade disputes or other government actions, or adverse investor sentiment. These conditions may continue, recur, worsen or spread.

The Fund’s investments, payment obligations and financing terms may be based on floating rates, such as LIBOR (London Interbank Offered Rate), or SOFR (Secured Overnight Financing Rate). Plans are underway to phase out the use of LIBOR. There remains uncertainty regarding the nature of any replacement rate and the impact of the transition from LIBOR on the Fund, issuers of instruments in which the Fund invests, and financial markets generally.

Investments in high-yield or lower-rated securities are subject to greater-than-average risk. The Fund may invest in securities of issuers that are in default or that are in bankruptcy.

Investing in foreign and/or emerging markets securities involves risks relating to interest rates, currency exchange rates, economic, social, and political conditions, which could increase volatility. These risks are magnified in emerging markets.

When interest rates rise, the prices of debt securities held by the Fund will generally fall. Conversely, when interest rates fall the prices of debt securities held by the Fund generally will rise.

Investments held by the Fund are subject to possible loss due to the financial failure of the issuers of the underlying securities and the issuers’ inability to meet their debt obligations.

The Fund invests a significant amount of its total assets in illiquid securities. Illiquid securities may be difficult to dispose of at a price reflective of their value at the times when the Fund believes it is desirable to do so and the market price of illiquid securities is generally more volatile than that of more liquid securities. Illiquid securities also are more difficult to value, and

12Pioneer Diversified High Income Fund, Inc. | Annual Report | 4/30/23

investment of the Fund’s assets in illiquid securities may restrict the Fund’s ability to take advantage of market opportunities.

The Fund is authorized to borrow from banks and issue debt securities, which are forms of leverage. The Fund currently employs leverage through a credit agreement. Leverage creates significant risks, including the risk that the Fund’s incremental income or capital appreciation for investments purchased with the

proceeds of leverage will not be sufficient to cover the cost of the leverage, which may adversely affect the return for shareholders.

The Fund is required to maintain certain regulatory and other asset coverage requirements in connection with the use of leverage. In order to maintain required asset coverage levels, the Fund may be required to reduce the amount of leverage employed, alter the composition of the Fund’s investment portfolio or take other actions at what might be inopportune times in the market. Such actions could reduce the net earnings or returns to shareowners over time, which is likely to result in a decrease in the market value of the Fund’s shares.

Certain securities in which the Fund invests, including floating rate loans, once sold, may not settle for an extended period (for example, several weeks or even longer). The Fund will not receive its sale proceeds until that time, which may constrain the Fund’s ability to meet its obligations.

The Fund invests in insurance-linked securities. The return of principal and the payment of interest and/or dividends on insurance linked securities are contingent on the non-occurrence of a pre-defined “trigger” event, such as a hurricane or an earthquake of a specific magnitude.

These risks may increase share price volatility.

Any information in this stockholder report regarding market or economic trends or the factors influencing the Fund’s historical or future performance are statements of opinion as of the date of this report. Past performance is no guarantee of future results.

Pioneer Diversified High Income Fund, Inc. | Annual Report | 4/30/2313

Portfolio Summary | 4/30/23

Portfolio Diversification

(As a percentage of total investments)*

+ Amount rounds to less than 0.1%.

10 Largest Holdings

| (As a percentage of total investments)* |

| 1. |

Liberty Mutual Insurance Co., 7.697%, 10/15/97 (144A) |

3.95% |

| 2. |

Hercules LLC, 6.50%, 6/30/29 |

1.45 |

| 3. |

ABRA Global Finance, 11.50% (5.50% PIK or 6.00% Cash), 3/2/28 (144A) |

1.41 |

| 4. |

ProFrac Holdings II LLC, Term Loan, 12.42% (Term SOFR + 725 bps), 3/4/25 |

1.37 |

| 5. |

Baytex Energy Corp., 8.75%, 4/1/27 (144A) |

1.29 |

| 6. |

McGraw-Hill Education, Inc., 8.00%, 8/1/29 (144A) |

1.06 |

| 7. |

Energean Plc, 6.50%, 4/30/27 (144A) |

1.02 |

| 8. |

Grupo Aeromexico SAB de CV, 8.50%, 3/17/27 (144A) |

1.01 |

| 9. |

Williams Cos., Inc., 5.75%, 6/24/44 |

0.87 |

| 10. |

Aethon United BR LP/Aethon United Finance Corp., 8.25%, 2/15/26 (144A) |

0.84 |

| |

|

| * |

Excludes short-term investments and all derivative contracts except for options purchased. The Fund is actively managed, and current holdings may be different. The holdings listed should not be considered recommendations to buy or sell any securities. |

14Pioneer Diversified High Income Fund, Inc. | Annual Report | 4/30/23

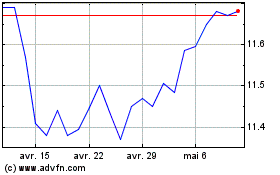

Prices and Distributions | 4/30/23

Market Value per Share^

| |

4/30/23 |

4/30/22 |

| Market Value |

$10.02 |

$12.30 |

| Discount |

(14.58)% |

(9.43)% |

Net Asset Value per Share^

| |

4/30/23 |

4/30/22 |

| Net Asset Value |

$11.73 |

$13.58 |

Distributions per Share*

| |

Net Investment

Income |

Short-Term

Capital Gains |

Long-Term

Capital Gains |

Tax Return

of Capital |

| 5/1/22 – 4/30/23 |

$1.1573 |

$— |

$— |

$0.0427 |

Yields

| |

4/30/23 |

4/30/22 |

| 30-Day SEC Yield |

12.70% |

9.52% |

The data shown above represents past performance, which is no guarantee of future results.

^ Net asset value and market value are published in Barron's on Saturday, The Wall Street Journal on Monday and The New York Times on Monday and Saturday. Net asset value and market value are published daily on the Fund's website at www.amundi.com/us.

* The amount of distributions made to stockholders during the year was in excess of the net investment income earned by the Fund during the period. The Fund has accumulated undistributed net investment income which is part of the Fund's NAV. A portion of this accumulated net investment income was distributed to stockholders during the period, and may be depleted over time. A decrease in distributions may have a negative effect on the market value of the Fund's shares.

Pioneer Diversified High Income Fund, Inc. | Annual Report | 4/30/2315

Performance Update | 4/30/23

Investment Returns

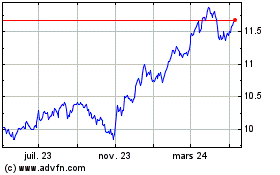

The mountain chart below shows the change in market value, including reinvestment of dividends and distributions, of a $10,000 investment made in common shares of Pioneer Diversified High Income Fund, Inc. during the periods shown, compared to that of the (50%/50%) ICE BofA Global High Yield & Crossover Country Corporate & Government Index (GHY/CCC & G) Index and Morningstar/LSTA Leveraged Loan Index benchmark, and the two indices that comprise the composite benchmark.

Value of $10,000 Investment

Average Annual Total Return

(As of April 30, 2023) |

| Period |

Net

Asset

Value

(NAV) |

Market

Price |

50% ICE BofA

Global High

Yield/CCC & G

Index/50%

Morningstar/

LSTA Leveraged

Loan Index |

Morningstar/LSTA

Leveraged

Loan Index |

ICE BofA

Global

High Yield/

CCC & G Index |

| 10 Years |

3.80% |

1.64% |

3.07% |

3.81% |

2.26% |

| 5 Years |

1.74 |

1.21 |

2.24 |

3.76 |

0.63 |

| 1 Year |

-3.46 |

-8.96 |

2.20 |

3.39 |

0.80 |

Call 1-800-710-0935 or visit www.amundi.com/us for the most recent month-end performance results. Current performance may be lower or higher than the performance data quoted.

Performance data shown represents past performance. Past performance is no guarantee of future results. Investment return and market price will fluctuate, and your shares may trade below NAV due to such factors as interest rate changes and the perceived credit quality of borrowers.

(Please see the following page for additional performance and expense disclosure.)

Total investment return does not reflect broker sales charges or commissions. All performance is for common shares of the Fund.

Shares of closed-end funds, unlike open-end funds, are not continuously offered. There is a one-time public offering and, once issued, shares of closed-end funds are bought and sold in the open market through a stock exchange and frequently trade at prices lower than their NAV. NAV per common share is total assets less total liabilities, which include preferred shares or borrowings, as applicable, divided by the number of common shares outstanding.

16Pioneer Diversified High Income Fund, Inc. | Annual Report | 4/30/23

Performance Update | 4/30/23

When NAV is lower than market price, dividends are assumed to be reinvested at the greater of NAV or 95% of the market price. When NAV is higher, dividends are assumed to be reinvested at prices obtained through open-market purchases under the Fund’s dividend reinvestment plan.

The performance table and graph do not reflect the deduction of fees and taxes that a stockholder would pay on Fund distributions or the sale of Fund shares. Had these fees and taxes been reflected, performance would have been lower.

The ICE BofA GHY/CCC & G Index is an unmanaged index that tracks the performance of the below-and border-line investment-grade global debt markets denominated in the major developed market currencies. The Index includes sovereign issuers rated BBB1 and lower along with corporate issues rated BB1 and lower. There are no restrictions on issuer country of domicile. The Morningstar/LSTA Leveraged Loan Index provides broad and comprehensive total return metrics of the U.S. universe of syndicated term loans.

Index returns are calculated monthly, assume reinvestment of dividends and, unlike Fund returns, do not reflect any fees, expenses or sales charges. The indices do not use leverage. It is not possible to invest directly in an index.

Pioneer Diversified High Income Fund, Inc. | Annual Report | 4/30/2317

Schedule of Investments | 4/30/23

Principal

Amount

USD ($) |

|

|

|

|

|

Value |

| |

UNAFFILIATED ISSUERS — 142.1% |

|

| |

Senior Secured Floating Rate Loan

Interests — 4.6% of Net Assets*(a) |

|

| |

Chemicals-Diversified — 0.1% |

|

| 125,000 |

LSF11 A5 Holdco LLC, Fourth Amendment Incremental Term Loan, 9.332% (Term SOFR + 425 bps), 10/15/28 |

$ 122,500 |

| |

Total Chemicals-Diversified |

$122,500 |

| |

| |

| |

Consumer Products — 0.1% |

|

| 334,469 |

Instant Brands Holdings, Inc., Initial Loan, 9.953% (LIBOR + 500 bps), 4/12/28 |

$ 128,352 |

| |

Total Consumer Products |

$128,352 |

| |

| |

| |

Dialysis Centers — 0.3% |

|

| 482,500 |

US Renal Care, Inc., Initial Term Loan, 9.84% (LIBOR + 500 bps), 6/26/26 |

$ 319,154 |

| |

Total Dialysis Centers |

$319,154 |

| |

| |

| |

Electronic Composition — 0.1% |

|

| 122,689 |

Natel Engineering Co., Inc., Initial Term Loan, 11.275% (LIBOR + 625 bps), 4/30/26 |

$ 107,966 |

| |

Total Electronic Composition |

$107,966 |

| |

| |

| |

Investment Companies — 0.8% |

|

| 726,144 |

Diebold Nixdorf Holding Germany GmbH, Term Loan, 11.629% (Term SOFR + 650 bps), 7/15/25 |

$ 780,605 |

| |

Total Investment Companies |

$780,605 |

| |

| |

| |

Medical Labs & Testing Services — 0.0%† |

|

| 206,740(b) |

Envision Healthcare Corp., 2018 Third Out Term Loan, 8.648% (Term SOFR + 375 bps), 3/31/27 |

$ 13,093 |

| |

Total Medical Labs & Testing Services |

$13,093 |

| |

| |

| |

Oil-Field Services — 1.9% |

|

| 1,846,434 |

ProFrac Holdings II LLC, Term Loan, 12.42% (Term SOFR + 725 bps), 3/4/25 |

$ 1,834,894 |

| |

Total Oil-Field Services |

$1,834,894 |

| |

| |

| |

Physical Practice Management — 0.2% |

|

| 320,304 |

Team Health Holdings, Inc., Extended Term Loan, 10.232% (Term SOFR + 525 bps), 3/2/27 |

$ 210,600 |

| |

Total Physical Practice Management |

$210,600 |

| |

| |

The accompanying notes are an integral part of these financial statements.

18Pioneer Diversified High Income Fund, Inc. | Annual Report | 4/30/23

Principal

Amount

USD ($) |

|

|

|

|

|

Value |

| |

Recreational Centers — 0.2% |

|

| 191,703 |

Fitness International LLC, Term B Loan, 8.445% (Term SOFR + 325 bps), 4/18/25 |

$ 185,233 |

| |

Total Recreational Centers |

$185,233 |

| |

| |

| |

Telecom Services — 0.9% |

|

| 1,019,875 |

Patagonia Holdco LLC, Amendment No.1 Term Loan, 10.473% (Term SOFR + 575 bps), 8/1/29 |

$ 832,473 |

| |

Total Telecom Services |

$832,473 |

| |

| |

| |

Total Senior Secured Floating Rate Loan Interests

(Cost $5,136,725) |

$4,534,870 |

| |

| |

| Shares |

|

|

|

|

|

|

| |

Common Stocks — 0.3% of Net Assets |

|

| |

Household Durables — 0.0%† |

|

| 89,094(c) |

Desarrolladora Homex SAB de CV |

$ 94 |

| |

Total Household Durables |

$94 |

| |

| |

| |

Oil, Gas & Consumable Fuels — 0.0%† |

|

| 6(c) |

Amplify Energy Corp. |

$ 42 |

| 2,189(c) |

Petroquest Energy, Inc. |

109 |

| |

Total Oil, Gas & Consumable Fuels |

$151 |

| |

| |

| |

Passenger Airlines — 0.3% |

|

| 24,166(c)+ |

Grupo Aeromexico SAB de CV |

$ 268,817 |

| |

Total Passenger Airlines |

$268,817 |

| |

| |

| |

Total Common Stocks

(Cost $619,487) |

$269,062 |

| |

| |

Principal

Amount

USD ($) |

|

|

|

|

|

|

| |

Asset Backed Securities — 3.5% of Net

Assets |

|

| 500,000 |

ACC Auto Trust, Series 2022-A, Class D, 10.07%, 3/15/29 (144A) |

$ 482,533 |

| 500,000(a) |

Goldentree Loan Management US CLO 2, Ltd., Series 2017-2A, Class E, 9.95% (3 Month USD LIBOR + 470 bps), 11/28/30 (144A) |

443,909 |

| 1,000,000 |

JPMorgan Chase Bank NA - CACLN, Series 2021-3, Class G, 9.812%, 2/26/29 (144A) |

941,441 |

The accompanying notes are an integral part of these financial statements.

Pioneer Diversified High Income Fund, Inc. | Annual Report | 4/30/2319

Schedule of Investments | 4/30/23 (continued)

Principal

Amount

USD ($) |

|

|

|

|

|

Value |

| |

Asset Backed Securities — (continued) |

|

| 1,000,000(a) |

MCF CLO VII LLC, Series 2017-3A, Class ER, 14.40% (3 Month USD LIBOR + 915 bps), 7/20/33 (144A) |

$ 944,605 |

| 650,000 |

Santander Bank Auto Credit-Linked Notes, Series 2022-A, Class E, 12.662%, 5/15/32 (144A) |

603,139 |

| |

Total Asset Backed Securities

(Cost $3,614,143) |

$3,415,627 |

| |

| |

| |

Collateralized Mortgage

Obligations—2.6% of Net Assets |

|

| 330,000(a) |

Connecticut Avenue Securities Trust, Series 2021-R01, Class 1B2, 10.815% (SOFR30A + 600 bps), 10/25/41 (144A) |

$ 305,680 |

| 10,370(a) |

DSLA Mortgage Loan Trust, Series 2005-AR6, Class 2A1C, 5.791% (1 Month USD LIBOR + 84 bps), 10/19/45 |

10,135 |

| 100,000(a) |

Fannie Mae Connecticut Avenue Securities, Series 2021-R02, Class 2B2, 11.015% (SOFR30A + 620 bps), 11/25/41 (144A) |

92,755 |

| 200,000(a) |

Freddie Mac STACR REMIC Trust, Series 2021-DNA7, Class B2, 12.615% (SOFR30A + 780 bps), 11/25/41 (144A) |

185,330 |

| 450,000(a) |

Freddie Mac STACR REMIC Trust, Series 2021-HQA3, Class B2, 11.065% (SOFR30A + 625 bps), 9/25/41 (144A) |

387,747 |

| 280,000(a) |

Freddie Mac STACR REMIC Trust, Series 2022-DNA2, Class B2, 13.315% (SOFR30A + 850 bps), 2/25/42 (144A) |

260,081 |

| 545,000(a) |

Freddie Mac STACR Trust, Series 2019-DNA3, Class B2, 13.17% (1 Month USD LIBOR + 815 bps), 7/25/49 (144A) |

563,767 |

| 19,339 |

Global Mortgage Securitization, Ltd., Series 2004-A, Class B1, 5.25%, 11/25/32 (144A) |

12,242 |

| 500,000(d) |

RMF Buyout Issuance Trust, Series 2022-HB1, Class M5, 4.50%, 4/25/32 (144A) |

55,625 |

| 640,000(a) |

STACR Trust, Series 2018-HRP2, Class B2, 15.52% (1 Month USD LIBOR + 1,050 bps), 2/25/47 (144A) |

703,134 |

| |

Total Collateralized Mortgage Obligations

(Cost $3,045,167) |

$2,576,496 |

| |

| |

| |

Commercial Mortgage-Backed

Securities—11.8% of Net Assets |

|

| 1,000,000(d) |

Benchmark Mortgage Trust, Series 2020-B18, Class AGNG, 4.535%, 7/15/53 (144A) |

$ 846,837 |

| 500,000(a) |

BPR Trust, Series 2021-WILL, Class E, 11.698% (1 Month USD LIBOR + 675 bps), 6/15/38 (144A) |

454,534 |

The accompanying notes are an integral part of these financial statements.

20Pioneer Diversified High Income Fund, Inc. | Annual Report | 4/30/23

Principal

Amount

USD ($) |

|

|

|

|

|

Value |

| |

Commercial Mortgage-Backed

Securities—(continued) |

|

| 668,314(a) |

BX Trust, Series 2022-PSB, Class F, 12.223% (1 Month Term SOFR + 733 bps), 8/15/39 (144A) |

$ 665,007 |

| 570,966(a) |

Capital Funding Mortgage Trust, Series 2020-9, Class B, 19.748% (1 Month USD LIBOR + 1,490 bps), 11/15/23 (144A) |

563,210 |

| 288,017(a) |

Capital Funding Mortgage Trust, Series 2021-8, Class B, 17.95% (1 Month USD LIBOR + 1,310 bps), 6/22/23 (144A) |

288,017 |

| 1,000,000(a) |

Capital Funding Mortgage Trust, Series 2021-19, Class B, 20.06% (1 Month USD LIBOR + 1,521 bps), 11/6/23 (144A) |

971,384 |

| 21,820,372(d)(e) |

COMM Mortgage Trust, Series 2015-LC21, Class XA, 0.797%, 7/10/48 |

247,474 |

| 702,000(a) |

Freddie Mac Multifamily Structured Credit Risk, Series 2021-MN1, Class B1, 12.31% (SOFR30A + 775 bps), 1/25/51 (144A) |

649,157 |

| 180,000(a) |

Freddie Mac Multifamily Structured Credit Risk, Series 2021-MN3, Class B1, 11.665% (SOFR30A + 685 bps), 11/25/51 (144A) |

149,249 |

| 579,126(d) |

FREMF Mortgage Trust, Series 2019-KJ24, Class B, 7.60%, 10/25/27 (144A) |

533,628 |

| 1,000,000(a) |

FREMF Mortgage Trust, Series 2019-KS12, Class C, 11.758% (1 Month USD LIBOR + 690 bps), 8/25/29 |

945,902 |

| 142,525(a) |

FREMF Mortgage Trust, Series 2020-KF74, Class C, 11.108% (1 Month USD LIBOR + 625 bps), 1/25/27 (144A) |

135,962 |

| 394,124(a) |

FREMF Mortgage Trust, Series 2020-KF83, Class C, 13.858% (1 Month USD LIBOR + 900 bps), 7/25/30 (144A) |

382,456 |

| 1,000,000(f) |

FREMF Mortgage Trust, Series 2021-KG05, Class C, 0.000%, 1/25/31 (144A) |

505,762 |

| 12,333,286(e) |

FREMF Mortgage Trust, Series 2021-KG05, Class X2A, 0.10%, 1/25/31 (144A) |

69,176 |

| 1,000,000(e) |

FREMF Mortgage Trust, Series 2021-KG05, Class X2B, 0.10%, 1/25/31 (144A) |

5,193 |

| 7,651,641(d)(e) |

FRESB Mortgage Trust, Series 2020-SB79, Class X1, 1.193%, 7/25/40 |

313,883 |

| 500,000(d) |

JP Morgan Chase Commercial Mortgage Securities Trust, Series 2013-LC11, Class D, 4.423%, 4/15/46 |

325,004 |

| 750,000(a) |

Multifamily Connecticut Avenue Securities Trust, Series 2020-01, Class M10, 8.77% (1 Month USD LIBOR + 375 bps), 3/25/50 (144A) |

705,047 |

| 900,000(d) |

Natixis Commercial Mortgage Securities Trust, Series 2019-FAME, Class E, 4.544%, 8/15/36 (144A) |

656,204 |

The accompanying notes are an integral part of these financial statements.

Pioneer Diversified High Income Fund, Inc. | Annual Report | 4/30/2321

Schedule of Investments | 4/30/23 (continued)

Principal

Amount

USD ($) |

|

|

|

|

|

Value |

| |

Commercial Mortgage-Backed

Securities—(continued) |

|

| 290,000 |

Palisades Center Trust, Series 2016-PLSD, Class A, 2.713%, 4/13/33 (144A) |

$ 174,000 |

| 235,864(d) |

Velocity Commercial Capital Loan Trust, Series 2020-1, Class M5, 4.29%, 2/25/50 (144A) |

178,872 |

| 1,100,000 |

Wells Fargo Commercial Mortgage Trust, Series 2015-C28, Class E, 3.00%, 5/15/48 (144A) |

740,958 |

| 1,660,500(d) |

Wells Fargo Commercial Mortgage Trust, Series 2015-C31, Class E, 4.749%, 11/15/48 (144A) |

1,004,660 |

| |

Total Commercial Mortgage-Backed Securities

(Cost $13,048,446) |

$11,511,576 |

| |

| |

| |

Convertible Corporate Bonds — 2.3%

of Net Assets |

|

| |

Banks — 0.0%† |

|

| IDR812,959,000 |

PT Bakrie & Brothers Tbk, 7/31/23 |

$ 6,318 |

| |

Total Banks |

$6,318 |

| |

| |

| |

Chemicals — 2.0% |

|

| 1,900,000(g) |

Hercules LLC, 6.50%, 6/30/29 |

$ 1,948,930 |

| |

Total Chemicals |

$1,948,930 |

| |

| |

| |

Entertainment — 0.2% |

|

| 312,000(f) |

DraftKings Holdings, Inc., 3/15/28 |

$ 223,392 |

| |

Total Entertainment |

$223,392 |

| |

| |

| |

Pharmaceuticals — 0.1% |

|

| 300,000(b) |

Tricida, Inc., 3.50%, 5/15/27 |

$ 32,250 |

| |

Total Pharmaceuticals |

$32,250 |

| |

| |

| |

Total Convertible Corporate Bonds

(Cost $2,053,667) |

$2,210,890 |

| |

| |

| |

Corporate Bonds — 87.2% of Net Assets |

|

| |

Advertising — 1.3% |

|

| 645,000 |

Clear Channel Outdoor Holdings, Inc., 7.50%, 6/1/29 (144A) |

$ 477,296 |

| 535,000 |

Clear Channel Outdoor Holdings, Inc., 7.75%, 4/15/28 (144A) |

405,956 |

| 400,000 |

Summer BC Bidco B LLC, 5.50%, 10/31/26 (144A) |

335,733 |

| |

Total Advertising |

$1,218,985 |

| |

| |

The accompanying notes are an integral part of these financial statements.

22Pioneer Diversified High Income Fund, Inc. | Annual Report | 4/30/23

Principal

Amount

USD ($) |

|

|

|

|

|

Value |

| |

Aerospace & Defense — 0.6% |

|

| 315,000 |

Spirit AeroSystems, Inc., 9.375%, 11/30/29 (144A) |

$ 338,597 |

| 270,000 |

Triumph Group, Inc., 9.00%, 3/15/28 (144A) |

273,705 |

| |

Total Aerospace & Defense |

$612,302 |

| |

| |

| |

Agriculture — 1.0% |

|

| 1,310,000 |

Frigorifico Concepcion SA, 7.70%, 7/21/28 (144A) |

$ 937,069 |

| |

Total Agriculture |

$937,069 |

| |

| |

| |

Airlines — 6.5% |

|

| 488,869(h) |

ABRA Global Finance, 5.00% (5.00% PIK), 3/2/28 (144A) |

$ 405,761 |

| 2,374,757(h) |

ABRA Global Finance, 11.50% (5.50% PIK or 6.00% Cash), 3/2/28 (144A) |

1,900,145 |

| 1,510,000 |

Grupo Aeromexico SAB de CV, 8.50%, 3/17/27 (144A) |

1,350,965 |

| 285,000 |

Latam Airlines Group SA, 13.375%, 10/15/29 (144A) |

299,216 |

| 1,059,000 |

Pegasus Hava Tasimaciligi AS, 9.25%, 4/30/26 (144A) |

1,055,145 |

| 585,000 |

Spirit Loyalty Cayman, Ltd./Spirit IP Cayman, Ltd., 8.00%, 9/20/25 (144A) |

590,896 |

| EUR700,000 |

Transportes Aereos Portugueses SA, 5.625%, 12/2/24 (144A) |

750,293 |

| |

Total Airlines |

$6,352,421 |

| |

| |

| |

Apparel — 0.4% |

|

| 370,000 |

Hanesbrands, Inc., 9.00%, 2/15/31 (144A) |

$ 378,750 |

| |

Total Apparel |

$378,750 |

| |

| |

| |

Auto Manufacturers — 0.5% |

|

| 545,000 |

JB Poindexter & Co., Inc., 7.125%, 4/15/26 (144A) |

$ 525,920 |

| |

Total Auto Manufacturers |

$525,920 |

| |

| |

| |

Auto Parts & Equipment — 1.0% |

|

| 1,046,000 |

Dealer Tire LLC/DT Issuer LLC, 8.00%, 2/1/28 (144A) |

$ 970,165 |

| |

Total Auto Parts & Equipment |

$970,165 |

| |

| |

| |

Banks — 3.5% |

|

| 300,000(d) |

Banco de Galicia y Buenos Aires SAU, 7.962% (5 Year CMT Index + 716 bps), 7/19/26 (144A) |

$ 267,210 |

| 1,135,000(d) |

Banco GNB Sudameris SA, 7.50% (5 Year CMT Index + 666 bps), 4/16/31 (144A) |

839,900 |

| 685,000(d)(i) |

Banco Mercantil del Norte SA, 8.375% (10 yr. US Treasury Yield Curve Rate T Note Constant Maturity + 776 bps) (144A) |

648,010 |

The accompanying notes are an integral part of these financial statements.

Pioneer Diversified High Income Fund, Inc. | Annual Report | 4/30/2323

Schedule of Investments | 4/30/23 (continued)

Principal

Amount

USD ($) |

|

|

|

|

|

Value |

| |

Banks — (continued) |

|

| 247,000 |

Freedom Mortgage Corp., 8.125%, 11/15/24 (144A) |

$ 237,863 |

| 911,000 |

Freedom Mortgage Corp., 8.25%, 4/15/25 (144A) |

846,930 |

| 350,000(d)(i) |

ING Groep NV, 6.50% (5 Year USD Swap Rate + 445 bps) |

323,475 |

| 225,000(d)(i) |

Intesa Sanpaolo S.p.A., 7.70% (5 Year USD Swap Rate + 546 bps) (144A) |

204,722 |

| 200,000(b) |

Sberbank of Russia Via SB Capital SA, 5.25%, 5/23/23 (144A) |

10,000 |

| 865,000(b)(d)(i) |

Sovcombank Via SovCom Capital DAC, 7.60% (5 Year CMT Index + 636 bps) (144A) |

31,248 |

| |

Total Banks |

$3,409,358 |

| |

| |

| |

Biotechnology — 0.4% |

|

| EUR345,000 |

Cidron Aida Finco S.a.r.l., 5.00%, 4/1/28 (144A) |

$ 339,380 |

| |

Total Biotechnology |

$339,380 |

| |

| |

| |

Building Materials — 0.4% |

|

| 464,000 |

Cornerstone Building Brands, Inc., 6.125%, 1/15/29 (144A) |

$ 349,160 |

| |

Total Building Materials |

$349,160 |

| |

| |

| |

Chemicals — 2.4% |

|

| 425,000 |

Braskem Idesa SAPI, 6.99%, 2/20/32 (144A) |

$ 304,088 |

| 425,000 |

LSF11 A5 HoldCo LLC, 6.625%, 10/15/29 (144A) |

366,031 |

| EUR420,000 |

Lune Holdings S.a.r.l., 5.625%, 11/15/28 (144A) |

395,486 |

| 300,000 |

LYB Finance Co. BV, 8.10%, 3/15/27 (144A) |

331,225 |

| 379,000 |

Mativ Holdings, Inc., 6.875%, 10/1/26 (144A) |

345,374 |

| 280,000 |

Olin Corp., 9.50%, 6/1/25 (144A) |

295,134 |

| 336,000 |

Rain CII Carbon LLC/CII Carbon Corp., 7.25%, 4/1/25 (144A) |

325,631 |

| |

Total Chemicals |

$2,362,969 |

| |

| |

| |

Commercial Services — 5.4% |

|

| 245,000 |

Allied Universal Holdco LLC/Allied Universal Finance Corp., 6.625%, 7/15/26 (144A) |

$ 236,168 |

| 585,000 |

Allied Universal Holdco LLC/Allied Universal Finance Corp., 9.75%, 7/15/27 (144A) |

544,186 |

| 1,384,000 |

Atento Luxco 1 SA, 8.00%, 2/10/26 (144A) |

354,304 |

| 473,000 |

Garda World Security Corp., 6.00%, 6/1/29 (144A) |

389,043 |

| 958,000 |

Garda World Security Corp., 9.50%, 11/1/27 (144A) |

918,042 |

| 625,000 |

Neptune Bidco US, Inc., 9.29%, 4/15/29 (144A) |

588,281 |

| 350,000 |

PECF USS Intermediate Holding III Corp., 8.00%, 11/15/29 (144A) |

228,434 |

| 935,000 |

Prime Security Services Borrower LLC/Prime Finance, Inc., 6.25%, 1/15/28 (144A) |

875,661 |

The accompanying notes are an integral part of these financial statements.

24Pioneer Diversified High Income Fund, Inc. | Annual Report | 4/30/23

Principal

Amount

USD ($) |

|

|

|

|

|

Value |

| |

Commercial Services — (continued) |

|

| MXN3,375,000 |

Red de Carreteras de Occidente SAB de CV, 9.00%, 6/10/28 (144A) |

$ 175,982 |

| 558,000 |

Sotheby's, 7.375%, 10/15/27 (144A) |

523,143 |

| 411,000 |

Verscend Escrow Corp., 9.75%, 8/15/26 (144A) |

414,793 |

| |

Total Commercial Services |

$5,248,037 |

| |

| |

| |

Computers — 0.0%† |

|

| 1(h) |

Diebold Nixdorf, Inc., 8.50% (8.50% PIK or 12.50% PIK or 8.50% Cash), 10/15/26 (144A) |

$ 0 |

| |

Total Computers |

$0 |

| |

| |

| |

Diversified Financial Services — 7.1% |

|

| 1,000,000 |

ASG Finance Designated Activity Co., 7.875%, 12/3/24 (144A) |

$ 965,000 |

| 380,624(h) |

Avation Capital SA, 8.25% (9.00% PIK or 8.25% Cash), 10/31/26 (144A) |

330,191 |

| 1,110,000 |

Bread Financial Holdings, Inc., 7.00%, 1/15/26 (144A) |

935,427 |

| 275,000(b) |

Credito Real SAB de CV SOFOM ER, 8.00%, 1/21/28 (144A) |

18,290 |

| EUR235,000 |

Garfunkelux Holdco 3 SA, 6.75%, 11/1/25 (144A) |

196,138 |

| GBP400,000 |

Garfunkelux Holdco 3 SA, 7.75%, 11/1/25 (144A) |

377,186 |

| 1,112,739(h) |

Global Aircraft Leasing Co., Ltd., 6.50% (7.25% PIK or 6.50% Cash), 9/15/24 (144A) |

993,364 |

| EUR840,000 |

Intrum AB, 9.25%, 3/15/28 (144A) |

881,630 |

| 355,000 |

PHH Mortgage Corp., 7.875%, 3/15/26 (144A) |

319,053 |

| 1,174,000(b) |

Unifin Financiera SAB de CV, 8.375%, 1/27/28 (144A) |

29,350 |

| 865,000 |

United Wholesale Mortgage LLC, 5.75%, 6/15/27 (144A) |

788,139 |

| 465,000 |

VistaJet Malta Finance Plc/XO Management Holding, Inc., 6.375%, 2/1/30 (144A) |

402,288 |

| 745,000 |

VistaJet Malta Finance Plc/XO Management Holding, Inc., 7.875%, 5/1/27 (144A) |

707,750 |

| |

Total Diversified Financial Services |

$6,943,806 |

| |

| |

| |

Electric — 1.0% |

|

| 400,000 |

Cemig Geracao e Transmissao SA, 9.25%, 12/5/24 (144A) |

$ 410,000 |

| 63,574 |

NSG Holdings LLC/NSG Holdings, Inc., 7.75%, 12/15/25 (144A) |

63,262 |

| 445,000 |

Talen Energy Supply LLC, 8.625%, 6/1/30 (144A) |

445,000 |

| 7,000 |

Vistra Operations Co. LLC, 5.625%, 2/15/27 (144A) |

6,827 |

| |

Total Electric |

$925,089 |

| |

| |

The accompanying notes are an integral part of these financial statements.

Pioneer Diversified High Income Fund, Inc. | Annual Report | 4/30/2325

Schedule of Investments | 4/30/23 (continued)

Principal

Amount

USD ($) |

|

|

|

|

|

Value |

| |

Electrical Components & Equipments — 0.6% |

|

| 350,000 |

WESCO Distribution, Inc., 7.125%, 6/15/25 (144A) |

$ 355,916 |

| 245,000 |

WESCO Distribution, Inc., 7.25%, 6/15/28 (144A) |

251,485 |

| |

Total Electrical Components & Equipments |

$607,401 |

| |

| |

| |

Energy-Alternate Sources — 0.1% |

|

| 94,702(h) |

SCC Power Plc, 4.00% (4.00% PIK or 4.00% Cash), 5/17/32 (144A) |

$ 8,530 |

| 174,835(h) |

SCC Power Plc, 8.00% (4.00% PIK or 4.00% Cash or 8.00% Cash), 12/31/28 (144A) |

59,007 |

| |

Total Energy-Alternate Sources |

$67,537 |

| |

| |

| |

Engineering & Construction — 2.0% |

|

| 200,000 |

Aeropuertos Dominicanos Siglo XXI SA, 6.75%, 3/30/29 (144A) |

$ 196,500 |

| 998,816 |

Artera Services LLC, 9.033%, 12/4/25 (144A) |

857,848 |

| 230,000 |

IHS Holding, Ltd., 6.25%, 11/29/28 (144A) |

182,275 |

| EUR360,000 |

Promontoria Holding 264 BV, 6.375%, 3/1/27 (144A) |

398,271 |

| 280,000 |

Promontoria Holding 264 BV, 7.875%, 3/1/27 (144A) |

283,150 |

| |

Total Engineering & Construction |

$1,918,044 |

| |

| |

| |

Entertainment — 1.6% |

|

| EUR325,000 |

Lottomatica S.p.A./Roma, 9.75%, 9/30/27 (144A) |

$ 383,519 |

| 700,000 |

Mohegan Tribal Gaming Authority, 8.00%, 2/1/26 (144A) |

626,500 |

| 295,000 |

Scientific Games International, Inc., 7.00%, 5/15/28 (144A) |

294,280 |

| 295,000 |

Scientific Games International, Inc., 7.25%, 11/15/29 (144A) |

295,000 |

| |

Total Entertainment |

$1,599,299 |

| |

| |

| |

Environmental Control — 0.4% |

|

| 367,000 |

Tervita Corp., 11.00%, 12/1/25 (144A) |

$ 391,154 |

| |

Total Environmental Control |

$391,154 |

| |

| |

| |

Food — 0.4% |

|

| 555,000 |

Aragvi Finance International DAC, 8.45%, 4/29/26 (144A) |

$ 377,400 |

| |

Total Food |

$377,400 |

| |

| |

| |

Healthcare-Products — 0.2% |

|

| 239,000 |

Varex Imaging Corp., 7.875%, 10/15/27 (144A) |

$ 236,610 |

| |

Total Healthcare-Products |

$236,610 |

| |

| |

| |

Healthcare-Services — 2.7% |

|

| 445,000 |

Auna SAA, 6.50%, 11/20/25 (144A) |

$ 350,438 |

The accompanying notes are an integral part of these financial statements.

26Pioneer Diversified High Income Fund, Inc. | Annual Report | 4/30/23

Principal

Amount

USD ($) |

|

|

|

|

|

Value |

| |

Healthcare-Services — (continued) |

|

| 550,000 |

Prime Healthcare Services, Inc., 7.25%, 11/1/25 (144A) |

$ 496,515 |

| 357,000 |

RegionalCare Hospital Partners Holdings, Inc./LifePoint Health, Inc., 9.75%, 12/1/26 (144A) |

296,886 |

| 626,000 |

Surgery Center Holdings, Inc., 10.00%, 4/15/27 (144A) |

641,646 |

| 765,000 |

US Acute Care Solutions LLC, 6.375%, 3/1/26 (144A) |

682,762 |

| 1,165,000 |

US Renal Care, Inc., 10.625%, 7/15/27 (144A) |

206,788 |

| |

Total Healthcare-Services |

$2,675,035 |

| |

| |

| |

Home Builders — 0.9% |

|

| 885,000 |

Beazer Homes USA, Inc., 7.25%, 10/15/29 |

$ 843,846 |

| |

Total Home Builders |

$843,846 |

| |

| |

| |

Home Furnishings — 1.0% |

|

| EUR930,000 |

International Design Group S.p.A., 6.50%, 11/15/25 (144A) |

$ 979,933 |

| |

Total Home Furnishings |

$979,933 |

| |

| |

| |

Insurance — 5.4% |

|

| 4,600,000 |

Liberty Mutual Insurance Co., 7.697%, 10/15/97 (144A) |

$ 5,313,314 |

| |

Total Insurance |

$5,313,314 |

| |

| |

| |

Iron & Steel — 1.9% |

|

| 845,000 |

Carpenter Technology Corp., 7.625%, 3/15/30 |

$ 864,271 |

| 613,000 |

Metinvest BV, 7.75%, 10/17/29 (144A) |

349,410 |

| 870,000 |

TMS International Corp., 6.25%, 4/15/29 (144A) |

672,317 |

| |

Total Iron & Steel |

$1,885,998 |

| |

| |

| |

Leisure Time — 2.1% |

|

| 100,000 |

Carnival Corp., 7.625%, 3/1/26 (144A) |

$ 91,438 |

| EUR130,000 |

Carnival Corp., 7.625%, 3/1/26 (144A) |

127,657 |

| 135,000 |

Carnival Corp., 10.50%, 2/1/26 (144A) |

140,930 |

| 120,000 |

Carnival Holdings Bermuda, Ltd., 10.375%, 5/1/28 (144A) |

129,010 |

| 400,000 |

NCL Corp., Ltd., 5.875%, 3/15/26 (144A) |

344,547 |

| 170,000 |

NCL Finance, Ltd., 6.125%, 3/15/28 (144A) |

137,275 |

| 178,000 |

Royal Caribbean Cruises, Ltd., 11.50%, 6/1/25 (144A) |

188,903 |

| 595,000 |

Royal Caribbean Cruises, Ltd., 11.625%, 8/15/27 (144A) |

632,952 |

| 245,000 |

Viking Cruises, Ltd., 6.25%, 5/15/25 (144A) |

232,618 |

| |

Total Leisure Time |

$2,025,330 |

| |

| |

The accompanying notes are an integral part of these financial statements.

Pioneer Diversified High Income Fund, Inc. | Annual Report | 4/30/2327

Schedule of Investments | 4/30/23 (continued)

Principal

Amount

USD ($) |

|

|

|

|

|

Value |

| |

Media — 1.8% |

|

| 400,000 |

CSC Holdings LLC, 5.375%, 2/1/28 (144A) |

$ 328,079 |

| 1,660,000 |

McGraw-Hill Education, Inc., 8.00%, 8/1/29 (144A) |

1,427,600 |

| |

Total Media |

$1,755,679 |

| |

| |

| |

Metal Fabricate/Hardware — 0.3% |

|

| 385,000 |

Park-Ohio Industries, Inc., 6.625%, 4/15/27 |

$ 306,075 |

| |

Total Metal Fabricate/Hardware |

$306,075 |

| |

| |

| |

Mining — 1.0% |

|

| 633,000 |

Eldorado Gold Corp., 6.25%, 9/1/29 (144A) |

$ 588,690 |

| 400,000 |

First Quantum Minerals, Ltd., 6.875%, 10/15/27 (144A) |

388,340 |

| |

Total Mining |

$977,030 |

| |

| |

| |

Oil & Gas — 16.1% |

|

| 1,160,000 |

Aethon United BR LP/Aethon United Finance Corp., 8.25%, 2/15/26 (144A) |

$ 1,126,437 |

| 910,000 |

Baytex Energy Corp., 8.50%, 4/30/30 (144A) |

914,842 |

| 1,685,000 |

Baytex Energy Corp., 8.75%, 4/1/27 (144A) |

1,733,403 |

| 294,000 |

Cenovus Energy, Inc., 6.75%, 11/15/39 |

319,235 |

| 1,510,000 |

Energean Plc, 6.50%, 4/30/27 (144A) |

1,367,154 |

| 383,000 |

International Petroleum Corp., 7.25%, 2/1/27 (144A) |

360,925 |

| 405,000 |

Kosmos Energy, Ltd., 7.75%, 5/1/27 (144A) |

349,993 |

| 590,000 |

Matador Resources Co., 6.875%, 4/15/28 (144A) |

593,699 |

| 1,309,271 |

MC Brazil Downstream Trading S.a.r.l, 7.25%, 6/30/31 (144A) |

1,006,134 |

| 605,000 |

Murphy Oil Corp., 6.375%, 7/15/28 |

602,742 |

| 515,000 |

Nabors Industries, Ltd., 7.50%, 1/15/28 (144A) |

468,640 |

| 603,000 |

Neptune Energy Bondco Plc, 6.625%, 5/15/25 (144A) |

594,416 |

| 175,000 |

Noble Finance II LLC, 8.00%, 4/15/30 (144A) |

179,204 |

| 955,000 |

Occidental Petroleum Corp., 4.40%, 4/15/46 |

769,152 |

| 674,000 |

Petroleos Mexicanos, 6.70%, 2/16/32 |

518,827 |

| 271,000 |

Precision Drilling Corp., 6.875%, 1/15/29 (144A) |

248,643 |

| 395,000 |

Shelf Drilling Holdings, Ltd., 8.25%, 2/15/25 (144A) |

359,450 |

| 480,000 |

Shelf Drilling Holdings, Ltd., 8.875%, 11/15/24 (144A) |

480,000 |

| 900,000 |

SierraCol Energy Andina LLC, 6.00%, 6/15/28 (144A) |

666,450 |

| 860,000 |

Strathcona Resources, Ltd., 6.875%, 8/1/26 (144A) |

727,273 |

| 120,000 |

Transocean Titan Financing, Ltd., 8.375%, 2/1/28 (144A) |

122,308 |

| 785,000 |

Tullow Oil Plc, 10.25%, 5/15/26 (144A) |

613,085 |

The accompanying notes are an integral part of these financial statements.

28Pioneer Diversified High Income Fund, Inc. | Annual Report | 4/30/23

Principal

Amount

USD ($) |

|

|

|

|

|

Value |

| |

Oil & Gas — (continued) |

|

| 725,000 |

Valaris, Ltd., 8.375%, 4/30/30 (144A) |

$ 725,312 |

| 1,195,000 |

YPF SA, 6.95%, 7/21/27 (144A) |

860,451 |

| |

Total Oil & Gas |

$15,707,775 |

| |

| |

| |

Oil & Gas Services — 1.2% |

|

| 521,000 |

Archrock Partners LP/Archrock Partners Finance Corp., 6.875%, 4/1/27 (144A) |

$ 511,914 |

| 630,000 |

Enerflex, Ltd., 9.00%, 10/15/27 (144A) |

627,732 |

| |

Total Oil & Gas Services |

$1,139,646 |

| |

| |

| |

Packaging & Containers — 0.5% |

|

| EUR425,000 |

Fiber Bidco S.p.A., 11.00%, 10/25/27 (144A) |

$ 504,367 |

| |

Total Packaging & Containers |

$504,367 |

| |

| |

| |

Pharmaceuticals — 1.0% |

|

| 234,000(b) |

Endo Dac/Endo Finance LLC/Endo Finco, Inc., 9.50%, 7/31/27 (144A) |

$ 13,163 |

| 790,000 |

P&L Development LLC/PLD Finance Corp., 7.75%, 11/15/25 (144A) |

632,000 |

| 381,000 |

Par Pharmaceutical, Inc., 7.50%, 4/1/27 (144A) |

269,959 |

| 93,000 |

Teva Pharmaceutical Finance Netherlands III BV, 2.80%, 7/21/23 |

92,258 |

| |

Total Pharmaceuticals |

$1,007,380 |

| |

| |

| |

Pipelines — 6.0% |

|

| 810,012 |

Acu Petroleo Luxembourg S.a.r.l., 7.50%, 1/13/32 (144A) |

$ 706,446 |

| 555,000 |

Delek Logistics Partners LP/Delek Logistics Finance Corp., 6.75%, 5/15/25 |

543,900 |

| 510,000 |

Delek Logistics Partners LP/Delek Logistics Finance Corp., 7.125%, 6/1/28 (144A) |

464,526 |

| 450,000(a) |

Energy Transfer LP, 8.317% (3 Month USD LIBOR + 302 bps), 11/1/66 |

335,250 |

| 915,000(d)(i) |

Energy Transfer LP, 7.125% (5 Year CMT Index + 531 bps) |

770,888 |

| 118,000 |

EnLink Midstream Partners LP, 5.05%, 4/1/45 |

93,642 |

| 145,000 |

EnLink Midstream Partners LP, 5.45%, 6/1/47 |

121,075 |

| 344,000 |

EnLink Midstream Partners LP, 5.60%, 4/1/44 |

285,889 |

| 365,000 |

Genesis Energy LP/Genesis Energy Finance Corp., 8.00%, 1/15/27 |

364,240 |

| 197,000 |

Global Partners LP/GLP Finance Corp., 7.00%, 8/1/27 |

190,408 |

The accompanying notes are an integral part of these financial statements.

Pioneer Diversified High Income Fund, Inc. | Annual Report | 4/30/2329

Schedule of Investments | 4/30/23 (continued)

Principal

Amount

USD ($) |

|

|

|

|

|

Value |

| |

Pipelines — (continued) |

|

| 845,000 |

Harvest Midstream I LP, 7.50%, 9/1/28 (144A) |

$ 826,791 |

| 1,175,000 |

Williams Cos., Inc., 5.75%, 6/24/44 |

1,164,300 |

| |

Total Pipelines |

$5,867,355 |

| |

| |

| |

REITs — 0.9% |

|

| 890,000 |

Uniti Group LP/Uniti Fiber Holdings, Inc./CSL Capital LLC, 6.00%, 1/15/30 (144A) |

$ 525,020 |

| 10,000 |

Uniti Group LP/Uniti Group Finance, Inc./CSL Capital LLC, 6.50%, 2/15/29 (144A) |

6,037 |

| 410,000 |

Uniti Group LP/Uniti Group Finance, Inc./CSL Capital LLC, 10.50%, 2/15/28 (144A) |

392,327 |

| |

Total REITs |

$923,384 |

| |

| |

| |

Retail — 0.3% |

|

| 389,000 |

Staples, Inc., 7.50%, 4/15/26 (144A) |

$ 328,058 |

| |

Total Retail |

$328,058 |

| |

| |

| |

Software — 0.4% |

|

| 505,000 |

AthenaHealth Group, Inc., 6.50%, 2/15/30 (144A) |

$ 414,776 |

| |

Total Software |

$414,776 |

| |

| |

| |

Telecommunications — 4.0% |

|

| 695,000 |

Altice France Holding SA, 6.00%, 2/15/28 (144A) |

$ 427,961 |

| 607,000 |

Altice France Holding SA, 10.50%, 5/15/27 (144A) |

448,257 |

| 200,000 |

Altice France SA, 8.125%, 2/1/27 (144A) |

178,583 |

| 750,000(b) |

Digicel, Ltd., 6.75%, 3/1/24 |

150,000 |

| 836,000 |

Kenbourne Invest SA, 6.875%, 11/26/24 (144A) |

551,760 |

| 850,000 |

Sprint LLC, 7.625%, 3/1/26 |

900,076 |

| 850,000 |

Total Play Telecomunicaciones SA de CV, 6.375%, 9/20/28 (144A) |

560,015 |

| 875,000 |

Windstream Escrow LLC/Windstream Escrow Finance Corp., 7.75%, 8/15/28 (144A) |

720,675 |

| |

Total Telecommunications |

$3,937,327 |

| |

| |

| |

Transportation — 2.6% |

|

| 1,245,000 |

Carriage Purchaser, Inc., 7.875%, 10/15/29 (144A) |

$ 914,189 |

| 655,000 |

Danaos Corp., 8.50%, 3/1/28 (144A) |

648,281 |

| 400,000 |

Simpar Europe SA, 5.20%, 1/26/31 (144A) |

295,984 |

| 575,000 |

Watco Cos. LLC/Watco Finance Corp., 6.50%, 6/15/27 (144A) |

557,569 |

| 965,000 |

Western Global Airlines LLC, 10.375%, 8/15/25 (144A) |

125,450 |

| |

Total Transportation |

$2,541,473 |

| |

| |

The accompanying notes are an integral part of these financial statements.

30Pioneer Diversified High Income Fund, Inc. | Annual Report | 4/30/23

Principal

Amount

USD ($) |

|

|

|

|

|

Value |

| |

Trucking & Leasing — 0.3% |

|

| 325,000 |

Fortress Transportation and Infrastructure Investors LLC, 9.75%, 8/1/27 (144A) |

$ 338,466 |

| |

Total Trucking & Leasing |

$338,466 |

| |

| |

| |

Total Corporate Bonds

(Cost $96,356,573) |

$85,243,103 |

| |

| |

| Shares |

|

|

|

|

|

|

| |

Preferred Stock — 0.6% of Net Assets |

|

| |

Capital Markets — 0.0%† |

|

| 1,322 |

B Riley Financial, Inc., 6.75%, 5/31/24 |

$ 32,654 |

| |

Total Capital Markets |

$32,654 |

| |

| |

| |

Financial Services — 0.5% |

|

| 500(d)(i) |

Compeer Financial ACA, 6.75% (3 Month USD LIBOR + 458 bps) (144A) |

$ 501,258 |

| |

Total Financial Services |

$501,258 |

| |

| |

| |

Internet — 0.1% |

|

| 50,188 |

MYT Holding LLC, 10.00%, 6/6/29 |

$ 41,405 |

| |

Total Internet |

$41,405 |

| |

| |

| |

Total Preferred Stock

(Cost $624,106) |

$575,317 |

| |

| |

| |

Right/Warrant — 0.0%† of Net Assets |

|

| |

Aerospace & Defense — 0.0%† |

|

| GBP6,475(c) |

Avation Plc, 1/1/59 |

$ 4,923 |

| |

Total Aerospace & Defense |

$4,923 |

| |

| |

| |

Total Right/Warrant

(Cost $—) |

$4,923 |

| |

| |

Principal

Amount

USD ($) |

|

|

|

|

|

|

| |

Insurance-Linked Securities — 22.7% of

Net Assets# |

|

| |

Event Linked Bonds — 10.2% |

|

| |

Earthquakes – U.S. — 0.3% |

|

| 250,000(a) |

Ursa Re, 10.53%, (3 Month U.S. Treasury Bill + 550 bps), 12/6/25 (144A) |

$ 249,875 |

| |

Flood – U.S. — 0.7% |

|

| 250,000(a) |

FloodSmart Re, 16.28%, (3 Month U.S. Treasury Bill + 1,125 bps), 2/25/25 (144A) |

$ 234,100 |

The accompanying notes are an integral part of these financial statements.

Pioneer Diversified High Income Fund, Inc. | Annual Report | 4/30/2331

Schedule of Investments | 4/30/23 (continued)

Principal

Amount

USD ($) |

|

|

|

|

|

Value |

| |

Flood – U.S. — (continued) |

|

| 250,000(a) |

FloodSmart Re, 18.61%, (3 Month U.S. Treasury Bill + 1,358 bps), 3/1/24 (144A) |

$ 234,850 |

| 250,000(a) |

FloodSmart Re, 21.28%, (1 Month U.S. Treasury Bill + 1,625 bps), 3/11/26 (144A) |

249,800 |

| |

|

|

|

|

|

$718,750 |

| |

| |

| |

Multiperil – U.S. — 2.3% |

|

| 400,000(a) |

Caelus Re V, 5.125%, (1 Month USD LIBOR + 10 bps), 6/5/24 (144A) |

$ 32,000 |

| 250,000(a) |

Caelus Re V, 5.13%, (3 Month U.S. Treasury Bill + 10 bps), 6/9/25 (144A) |

25 |

| 250,000(a) |

Four Lakes Re, 12.33%, (3 Month U.S. Treasury Bill + 730 bps), 1/5/24 (144A) |

233,900 |

| 250,000(a) |

Four Lakes Re, 15.19%, (3 Month U.S. Treasury Bill + 1,016 bps), 1/5/24 (144A) |

231,350 |

| 500,000(a) |

Matterhorn Re, 12.59%, (SOFR + 775 bps), 3/24/25 (144A) |

457,250 |

| 375,000(a) |

Residential Re, 12.03%, (3 Month U.S. Treasury Bill + 700 bps), 12/6/26 (144A) |

374,212 |

| 250,000(a) |