0001388126falseN-CSRSNet asset value and market value are published in Barron's on Saturday, The Wall Street Journal on Monday and The New York Times on Monday and Saturday. Net asset value and market value are published daily on the Fund's website at www.amundi.com/us. 0001388126 2023-05-01 2023-10-31 0001388126 2023-10-31 0001388126 2023-04-30 0001388126 2022-05-01 2023-04-30 0001388126 pdhifi:RisksMember 2023-05-01 2023-10-31 0001388126 pdhifi:CommonSharesMember 2023-05-01 2023-10-31 0001388126 pdhifi:CommonSharesMember 2022-05-01 2023-04-30 xbrli:shares xbrli:pure iso4217:USD xbrli:shares

SECURITIES AND EXCHANGE COMMISSION

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number

Pioneer Diversified High Income Fund, Inc.

(Exact name of registrant as specified in charter)

60 State Street, Boston, MA 02109

(Address of principal executive offices) (ZIP code)

Terrence J. Cullen, Amundi Asset Management, Inc.,

60 State Street, Boston, MA 02109

(Name and address of agent for service)

Registrant’s telephone number, including area code: (617)

742-7825

Date of fiscal year end: April 30, 2024

Date of reporting period: May 1, 2023 through October 31, 2023

Form

N-CSR

is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule

30e-1

under the Investment Company Act of 1940 (17 CFR

270.30e-1). The

Commission may use the information provided on Form

N-CSR

in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form

N-CSR,

and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form

N-CSR

unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss. 3507.

ITEM 1. REPORT TO STOCKHOLDERS.

Pioneer Diversified High Income Fund, Inc.

Semiannual Report | October 31, 2023

visit us: www.amundi.com/us

| |

2 |

| |

4 |

| |

13 |

| |

14 |

| |

15 |

| |

17 |

| |

46 |

| |

51 |

| |

73 |

| |

76 |

| |

81 |

Pioneer Diversified High Income Fund, Inc. |

Semiannual Report

|

10/31/23

1

Dear Stockholders,

On February 13, 2023, Amundi US celebrated the 95

th

anniversary of Pioneer Fund, the second-oldest mutual fund in the United States. We recognized the anniversary with ringing of the closing bell at the New York Stock Exchange, which seemed fitting for this special milestone.

Pioneer Fund was launched on February 13, 1928 by Phil Carret, one of the earliest proponents of value investing and a leading innovator in the asset management industry. Mr. Carret began investing in the 1920s and founded Pioneer Investments (now Amundi US) in 1928, and was one of the first investors to realize he could uncover value through rigorous, innovative, fundamental research techniques.

Consistent with Mr. Carret’s investment approach and employing many of the same techniques utilized in the 1920s, Amundi US's portfolio managers have adapted Mr. Carret’s philosophy to a new age of “active” investing.

The last few years have seen investors face some unprecedented challenges, from a global pandemic that shuttered much of the world’s economy for months, to geopolitical strife, to rising inflation that has reached levels not seen in decades. Now, more than ever, Amundi US believes active management – that is, making active investment decisions across all of our portfolios – can help mitigate risk during periods of market volatility.

At Amundi US, active management begins with our own fundamental, bottom-up research process. Our team of dedicated research analysts and portfolio managers analyzes each security under consideration, communicating frequently with the management teams of the companies and other entities issuing the securities, and working together to identify those securities that we believe best meet our investment criteria for our family of funds. Our risk management approach begins with each security under consideration, as we strive to develop a deep understanding of the potential opportunity, while considering any potential risk factors.

Today, as stockholders, we have many options. It is our view that active management can serve stockholders well, not only when markets are thriving, but also during periods of market stress. As you consider your long-term investment goals, we encourage you to work with your financial professional to develop an investment plan that paves the way for you to pursue both your short-term and long-term goals.

2

Pioneer Diversified High Income Fund, Inc. |

Semiannual Report

|

10/31/23

We greatly appreciate the trust you have placed in us and look forward to continuing to serve you in the future.

Lisa M. Jones

Head of the Americas, President and CEO of US

Amundi Asset Management US, Inc.

December 2023

Any information in this stockholder report regarding market or economic trends or the factors influencing the Fund’s historical or future performance are statements of opinion as of the date of this report. Past performance is no guarantee of future results.

Pioneer Diversified High Income Fund, Inc. |

Semiannual Report

|

10/31/23

3

Portfolio Management Discussion | 10/31/23

In the following interview, Andrew Feltus, Jonathan Sharkey, Chin Liu, and Lawrence Zeno discuss the factors that affected the performance of Pioneer Diversified High Income Fund, Inc. during the six-month period ended October 31, 2023. Mr. Feltus, Managing Director, Co-Director of High Yield, and a portfolio manager at Amundi Asset Management US, Inc. (Amundi US), Mr. Sharkey, a senior vice president and a portfolio manager at Amundi US, Mr. Liu, Managing Director, Director of Insurance-Linked Securities (ILS) and Fixed-Income Solutions, and a portfolio manager at Amundi US, and Mr. Zeno, a vice president and a portfolio manager at Amundi US, are responsible for the day-to-day management of the Fund.

Q |

How did the Fund perform during the six-month period ended October 31, 2023? |

A |

Pioneer Diversified High Income Fund, Inc. returned 3.62% at net asset value (NAV) and 4.47% at market price during the six-month period ended October 31, 2023. During the same six-month period, the Fund’s composite benchmark returned 2.18% at NAV. The Fund’s composite benchmark is based on equal weights of the ICE Bank of America (ICE BofA) Global High Yield and Crossover Country Corporate and Government Index and the Morningstar/Loan Syndications & Trading Association (Morningstar/LSTA) Leveraged Loan Index. |

| |

Individually, during the six-month period ended October 31, 2023, the ICE BofA Global High Yield and Crossover Country Corporate and Government Index returned -1.16%, and the Morningstar/LSTA Leveraged Loan Index returned 5.59%. Unlike the Fund, the composite benchmark and its component indices do not use leverage. While the use of leverage increases investment opportunity, it also increases investment risk. |

| |

During the same six-month period, the average return at NAV of the 41 closed end funds in Morningstar’s High Yield Bond Closed End Funds category (which may or may not be leveraged) was 1.09%, while the same closed end fund Morningstar category’s average return at market price was -0.27%. |

| |

The shares of the Fund were selling at a 13.88% discount to NAV on October 31, 2023. Comparatively, the shares of the Fund were selling at a 14.58% discount to NAV on April 30, 2023. |

4

Pioneer Diversified High Income Fund, Inc. |

Semiannual Report

|

10/31/23

| |

As of October 31, 2023, the 30-day SEC yield on the Fund’s shares was 10.79%*. |

Q |

How would you describe the investment environment in the global fixed-income markets during the six-month period ended October 31, 2023? |

A |

After increasing the target range for the federal funds rate by 475 basis points (bps) between March 2022 and April 2023, the US Federal Reserve System (“Fed”) enacted additional 25 bps increases to the federal funds rate target range at its meetings in May and July of 2023. (A basis point is equal to 1/100th of a percentage point.) In addition, the Fed signaled its determination to maintain a tighter monetary policy until inflation reaches its 2% target. Against that messaging backdrop, an uptick in inflation data late in the six-month period, along with a spike in oil prices, led the markets to begin factoring in a “higher for longer” scenario by the Fed with respect to interest rates. By the end of October 2023, investors’ expectations as reflected in the interest-rate futures market were that the process of reducing interest rates would not begin until late 2024. |

| |

Through September and October, driven by the Fed’s higher-for-longer messaging as well as increasing concerns about both higher US Treasury issuance and the US budget deficit, most asset classes sold off as US bond yields rose notably. To illustrate, the yield on the 10-year Treasury finished the period at 4.93% versus 3.44% six months earlier. |

| |

Returns for high-yield corporate bonds were essentially flat for the six-month period, but the asset class still fared better than the more interest rate-sensitive investment-grade corporate bonds. Returns for floating-rate bank loans were well into positive territory for the period, benefiting from the outlook for rising interest rates. Securitized assets in aggregate finished the period notably lower in price, primarily due to the negative performance of residential mortgage-backed securities (RMBS), as the outlook for an extended period of higher interest rates (and corresponding higher mortgage rates) weighed on the segment. |

| * |

The 30-day SEC yield is a standardized formula that is based on the hypothetical annualized earning power (investment income only) of the Fund’s portfolio securities during the period indicated. |

Pioneer Diversified High Income Fund, Inc. |

Semiannual Report

|

10/31/23

5

Q |

What factors affected the Fund’s benchmark-relative performance during the six-month period ended October 31, 2023? |

A |

Within the portfolio’s allocation to high-yield corporate bonds, a tilt toward lower-quality securities aided the Fund's benchmark-relative performance, as non-rated issues and issues in the “CCC” ratings category outperformed higher-rated “BB” issues, to which the Fund was underweight. At the sector allocation level, the Fund’s positioning in the health care, energy, basic industry, leisure, and consumer goods sectors contributed positively to benchmark-relative returns, while positioning within the transportation sector was the only material detractor from relative results within high yield. |

| |

The portfolio’s non-benchmark holdings of securitized assets are primarily comprised of commercial mortgage-backed securities (CMBS), but also include collateralized loan obligations (CLOs) and credit-risk-transfer securities within the RMBS segment. In order of magnitude, the CMBS allocation broadly comprises single asset/single borrower issues, Freddie Mac issued non-guaranteed deals, and traditional conduit deals (diverse, fixed-rate pools). The portfolio’s securitized holdings, overall, made a positive contribution to the Fund’s benchmark-relative returns for the six-month period, with RMBS leading the way. It is important to note that credit-risk-transfer securities, which make up virtually all the Fund’s RMBS exposure, performed much better during the period than the other types of RMBS that account for the vast majority of outstanding RMBS in the market. (Credit-risk-transfer securities transfer a portion of the risk associated with credit losses within pools of conventional residential mortgage loans from the government-sponsored entities – Fannie Mae and Freddie Mac – to the private sector.) |

| |

Elsewhere within the securitized sectors, the Fund’s CLO and ABS (asset-backed securities) exposures generated solid returns for the six-month period. The allocation to CMBS also had a positive return and outperformed the broader CMBS segment, but did act as a modest drag on the Fund’s relative results. We slightly decreased the Fund’s exposure to securitized assets over the course of the six-month period. |

6

Pioneer Diversified High Income Fund, Inc. |

Semiannual Report

|

10/31/23

| |

The portfolio’s bank-loan allocation continued to benefit from rising interest rates during the period and aided the Fund’s benchmark-relative performance. Economic fundamentals for the loan sector have remained in check, with the percentage of defaults by issuer remaining below the long-term average of slightly under 3% as of period-end. The portfolio’s bank-loan holdings outperformed the broader loan market for the period, primarily due to a rally in lower-quality positions. Individual loans that performed well for the Fund during the period included TeamHealth, as the physician staffing firm resolved a near-term refinancing issue, and Patagonia, which has continued to benefit from increased telecommunications buildout activity in Latin America. Those positives offset performance weakness from loan positions in US Renal, which restructured its loan due to dialysis-related revenue losses incurred during the pandemic, and in kitchen products company Instant Brands, which experienced a liquidity squeeze driven by the culmination of previous supply-chain disruptions. |

| |

The portfolio’s allocation to insurance-linked securities (ILS) aided the Fund’s benchmark-relative performance during the six-month period. One of the main value propositions of ILS, in our view, continues to be that the sources of risk and return for the asset class have remained structurally uncorrelated to the performance of the vast majority of other asset classes. That characteristic was a factor in the positive performance for ILS during the six-month period, especially when considering the volatility experienced in the markets for nearly all of the more traditional asset classes. ILS investments have tended to feature shorter-term maturities and floating interest rates, and, as a result, they have often benefited from rising short-term rates. |

Q |

How did the level of leverage in the Fund change over the six-month period ended October 31, 2023? |

A |

The Fund employs leverage through a credit agreement. (See Note 8 to the Financial Statements.) |

| |

As of October 31, 2023, 31.1% of the Fund’s total managed assets were financed by leverage (or borrowed funds), compared with 30.3% of the Fund’s total managed assets financed by leverage at the start of the six-month period on May 1, 2023. |

Pioneer Diversified High Income Fund, Inc. |

Semiannual Report

|

10/31/23

7

| |

During the six-month period, the Fund increased the absolute amount of funds borrowed by a total of $750,000 to $43.3 million as of October 31, 2023. The percentage of the Fund’s managed assets financed by leverage increased during the six-month period due to the increase in the amount of funds borrowed by the Fund. The interest rate on the Fund's leverage increased by 40 basis points from May 1, 2023 to October 31, 2023. |

Q |

Did the Fund’s distributions** to stockholders change during the six-month period ended October 31, 2023? |

A |

The Fund’s monthly distribution rate remained stable at $0.09000 per share/per month during the six-month period. The Fund has accumulated undistributed net investment income which is part of the Fund's NAV. A portion of this accumulated net investment income was distributed to stockholders during the period, and these reserves may be depleted over time. A decrease in distributions may have a negative effect on the market value of the Fund's shares. |

Q |

Did the Fund have exposure to any derivative securities during the six-month period ended October 31, 2023? If so, did the derivatives have a notable effect on performance? |

A |

We invested the portfolio in forward foreign currency contracts (currency forwards) during the period, as part of our efforts to help manage the risk associated with the Fund’s having exposures to foreign currencies. The currency forwards had a small, positive effect on the Fund’s benchmark-relative results, given the decline in the euro relative to the US dollar over the six-month period. |

Q |

What is your investment outlook? |

A |

While recent economic data may show signs consistent with a domestic “soft landing,” in which growth slows but remains positive while inflation is brought under control, we are wary of extrapolating the current growth signals too far into the future. Consumer spending has been waning after a summer boost, business sentiment has been softening, and the still-tight US labor market has been cooling. In addition, higher interest rates |

** |

Distributions are not guaranteed. |

8

Pioneer Diversified High Income Fund, Inc. |

Semiannual Report

|

10/31/23

| |

and tighter lending conditions are just starting to take their toll on businesses. In a higher-for-longer interest-rate environment, businesses may encounter increasing difficulty with regard to carrying higher interest expenses and eventually rolling over maturing loans. We expect economic growth will slow in the coming quarters, and while it may take into early 2024 to know if the economy has a soft or hard landing, we continue to view the odds of a soft landing as relatively low. |

| |

The recent rise in yields has been rapid and significant. Since the Fed’s last rate increase on July 26, 10-year Treasury yields have moved from 3.86% to 4.93% (as of October 31, 2023). The rise in long-term Treasury rates is likely not due to higher expected inflation, in our view. Rather, it appears the bond market is currently discounting a “higher for forever” scenario, in which the Fed’s “neutral” federal funds target has increased substantially. |

| |

Should there be a recession, we anticipate some high-yield bond issuers will end up in trouble, leading to increased defaults. However, we do not expect a deep recession, such as during the Global Financial Crisis (GFC) of 2007-2008. In the event of a recession, we believe the default rate could remain lower than it was after the GFC. Our view is predicated on the significant weighting of “BB” rated issuers in the high-yield universe (relative to prior periods), strong fundamentals in many sectors such as autos and energy, and the relative strength of many US consumers. In addition, within the below-investment-grade universe, we expect the high-yield bond default rate (as measured by Moody's) might be substantially lower than the default rate for floating-rate leveraged loans. |

| |

Within securitized assets, we expect CMBS and RMBS issuance to pick up, particularly if interest rates begin to ease. ABS issuance has been strong, and we expect the trend to continue until the typical year-end lull. The current interest-rate environment has slowed prepayments in the RMBS market as well as refinancings in the CMBS market. While we remain generally positive with respect to non-agency RMBS, we are very cautious on the CMBS market. However, we believe opportunities within CMBS will ultimately arise, given the current dislocation in that market. |

Pioneer Diversified High Income Fund, Inc. |

Semiannual Report

|

10/31/23

9

While we anticipate that bank-loan defaults may increase to near-historical averages in the coming quarters, a higher-for-longer interest-rate cycle could allow for continued positive performance for the asset class. With respect to ILS, we have been encouraged by the continuation of recent trends, including elevated pricing in an already very attractive market, along with an ongoing supply/demand imbalance. We have maintained our view that having exposure to ILS may help bolster the income and risk-reward profiles of the Fund over the long term.

10

Pioneer Diversified High Income Fund, Inc. |

Semiannual Report

|

10/31/23

Please refer to the Schedule of Investments on pages 17 - 45 for a full listing of Fund securities.

All investments are subject to risk, including the possible loss of principal. In the past several years, financial markets have experienced increased volatility and heightened uncertainty. The market prices of securities may go up or down, sometimes rapidly or unpredictably, due to general market conditions, such as real or perceived adverse economic, political, or regulatory conditions, recessions, inflation, changes in interest or currency rates, lack of liquidity in the bond markets, the spread of infectious illness or other public health issues, armed conflict including Russia's military invasion of Ukraine, sanctions against Russia, other nations or individuals or companies and possible counter measures, market disruptions caused by tariffs, trade disputes or other government actions, or adverse investor sentiment. These conditions may continue, recur, worsen or spread.

Until recently, a commonly used reference rate for floating rate securities was LIBOR (London Interbank Offered Rate). Publication of most LIBOR settings has ceased on a representative basis. The impact of the transition from LIBOR on the Fund's transactions and financial markets generally cannot yet be determined.

Investments in high-yield or lower-rated securities are subject to greater-than-average risk. The Fund may invest in securities of issuers that are in default or that are in bankruptcy.

Investing in foreign and/or emerging markets securities involves risks relating to interest rates, currency exchange rates, economic, and political conditions, which could increase volatility. These risks are magnified in emerging markets.

When interest rates rise, the prices of debt securities held by the Fund will generally fall. Conversely, when interest rates fall the prices of debt securities held by the Fund generally will rise. A general rise in interest rates could adversely affect the price and liquidity of fixed-income securities.

Investments held by the Fund are subject to possible loss due to the financial failure of the issuers of the underlying securities and the issuers’ inability to meet their debt obligations.

The Fund invests a significant amount of its total assets in illiquid securities. Illiquid securities may be difficult to dispose of at a price reflective of their value at the times when the Fund believes it is desirable to do so and the market price of illiquid securities is generally more volatile than that of more liquid securities. Illiquid securities also are more difficult to value, and investment of the Fund’s assets in illiquid securities may restrict the Fund’s ability to take advantage of market opportunities.

Pioneer Diversified High Income Fund, Inc. |

Semiannual Report

|

10/31/23

11

The Fund is authorized to borrow from banks and issue debt securities, which are forms of leverage. The Fund currently employs leverage through a credit agreement. Leverage creates significant risks, including the risk that the Fund’s incremental income or capital appreciation for investments purchased with the proceeds of leverage will not be sufficient to cover the cost of the leverage, which may adversely affect the return for stockholders.

The Fund is required to maintain certain regulatory and other asset coverage requirements in connection with the use of leverage. In order to maintain required asset coverage levels, the Fund may be required to reduce the amount of leverage employed, alter the composition of the Fund’s investment portfolio or take other actions at what might be inopportune times in the market. Such actions could reduce the net earnings or returns to stockholders over time, which is likely to result in a decrease in the market value of the Fund’s shares.

Certain securities in which the Fund invests, including floating rate loans, once sold, may not settle for an extended period (for example, several weeks or even longer). The Fund will not receive its sale proceeds until that time, which may constrain the Fund’s ability to meet its obligations.

The Fund may invest in insurance-linked securities. The return of principal and the payment of interest and/or dividends on insurance-linked securities are contingent on the non-occurrence of a predefined “trigger” event, such as a hurricane or an earthquake of a specific magnitude.

These risks may increase share price volatility.

Any information in this stockholder report regarding market or economic trends or the factors influencing the Fund’s historical or future performance are statements of opinion as of the date of this report. Past performance is no guarantee of future results.

12

Pioneer Diversified High Income Fund, Inc. |

Semiannual Report

|

10/31/23

Portfolio Summary | 10/31/23

Portfolio Diversification

(As a percentage of total investments)*

| (As a percentage of total investments)* |

| 1. |

Liberty Mutual Insurance Co., 7.697%, 10/15/97 (144A) |

3.15% |

| 2. |

Hercules LLC, 6.50%, 6/30/29 |

1.41 |

| 3. |

ABRA Global Finance, 11.50% (5.50% PIK or 6.00% Cash), 3/2/28 (144A) |

1.36 |

| 4. |

Baytex Energy Corp., 8.75%, 4/1/27 (144A) |

1.24 |

| 5. |

Grupo Aeromexico SAB de CV, 8.50%, 3/17/27 (144A) |

1.03 |

| 6. |

Energean Plc, 6.50%, 4/30/27 (144A) |

0.92 |

| 7. |

Gullane Re 2023, 12/31/28 |

0.89 |

| 8. |

Pangaea Re 2023-1, 12/31/28 |

0.87 |

| 9. |

Bantry Re 2023, 12/31/28 |

0.87 |

| 10. |

Aethon United BR LP/Aethon United Finance Corp., 8.25%, 2/15/26 (144A) |

0.84 |

* Excludes short-term investments and all derivative contracts except for options purchased. The Fund is actively managed, and current holdings may be different. The holdings listed should not be considered recommendations to buy or sell any securities.

†

Amount rounds to less than 0.1%.

Pioneer Diversified High Income Fund, Inc. |

Semiannual Report

|

10/31/23

13

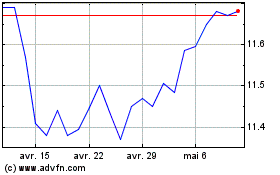

Prices and Distributions | 10/31/23

| |

10/31/23 |

4/30/23 |

| Market Value |

$9.93 |

$10.02 |

| Discount |

(13.88)% |

(14.58)% |

Net Asset Value per Share

^

| |

10/31/23 |

4/30/23 |

| Net Asset Value |

$11.53 |

$11.73 |

| |

Net Investment

Income |

Short-Term

Capital Gains |

Long-Term

Capital Gains |

| 5/1/23 – 10/31/23 |

$0.5400 |

$— |

$— |

| |

10/31/23 |

4/30/23 |

| 30-Day SEC Yield |

10.79% |

12.70% |

The data shown above represents past performance, which is no guarantee of future results.

^ Net asset value and market value are published in

on Saturday,

l on Monday and

on Monday and Saturday. Net asset value and market value are published daily on the Fund's website at www.amundi.com/us.

* The amount of distributions made to stockholders during the year was in excess of the net investment income earned by the Fund during the period. The Fund has accumulated undistributed net investment income which is part of the Fund's NAV. A portion of this accumulated net investment income was distributed to stockholders during the period, and may be depleted over time. A decrease in distributions may have a negative effect on the market value of the Fund's shares.

14

Pioneer Diversified High Income Fund, Inc. |

Semiannual Report

|

10/31/23

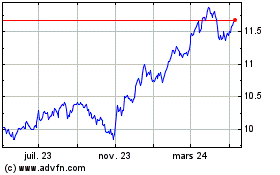

Performance Update | 10/31/23

The mountain chart below shows the change in market value, including reinvestment of dividends and distributions, of a $10,000 investment made in common shares of Pioneer Diversified High Income Fund, Inc. during the periods shown, compared to that of the (50%/50%) ICE BofA Global High Yield & Crossover Country Corporate & Government Index (GHY/CCC & G) Index and Morningstar/LSTA Leveraged Loan Index benchmark, and the two indices that comprise the composite benchmark.

Value of $10,000 Investment

Average Annual Total Return

(As of October 31, 2023) |

Period |

Net

Asset

Value

(NAV) |

Market

Price |

50% ICE BofA

Global High

Yield/CCC & G

Index/50%

Morningstar/

LSTA Leveraged

Loan Index |

Morningstar/LSTA

Leveraged

Loan Index |

ICE BofA

Global

High Yield/

CCC & G Index |

| 10 Years |

3.87% |

1.79% |

3.16% |

4.22% |

2.03% |

| 5 Years |

2.42 |

2.83 |

2.70 |

4.46 |

0.85 |

| 1 Year |

11.99 |

8.08 |

10.76 |

11.92 |

9.50 |

Call 1-800-710-0935 or visit www.amundi.com/us for the most recent month-end performance results. Current performance may be lower or higher than the performance data quoted.

Performance data shown represents past performance. Past performance is no guarantee of future results. Investment return and market price will fluctuate, and your shares may trade below NAV due to such factors as interest rate changes and the perceived credit quality of borrowers.

(Please see the following page for additional performance and expense disclosure.)

Total investment return does not reflect broker sales charges or commissions. All performance is for common shares of the Fund.

Shares of closed-end funds, unlike open-end funds, are not continuously offered. There is a one-time public offering and, once issued, shares of closed-end funds are bought and sold in the open market through a stock exchange and frequently trade at prices lower than their NAV. NAV per common share is total assets less total liabilities, which include preferred shares or borrowings, as applicable, divided by the number of common shares outstanding.

Pioneer Diversified High Income Fund, Inc. |

Semiannual Report

|

10/31/23

15

Performance Update | 10/31/23

When NAV is lower than market price, dividends are assumed to be reinvested at the greater of NAV or 95% of the market price. When NAV is higher, dividends are assumed to be reinvested at prices obtained through open-market purchases under the Fund’s dividend reinvestment plan.

The performance table and graph do not reflect the deduction of fees and taxes that a stockholder would pay on Fund distributions or the sale of Fund shares. Had these fees and taxes been reflected, performance would have been lower.

The ICE BofA GHY/CCC & G Index is an unmanaged index that tracks the performance of the below-and border-line investment-grade global debt markets denominated in the major developed market currencies. The Index includes sovereign issuers rated BBB1 and lower along with corporate issues rated BB1 and lower. There are no restrictions on issuer country of domicile. The Morningstar/LSTA Leveraged Loan Index provides broad and comprehensive total return metrics of the U.S. universe of syndicated term loans.

Index returns are calculated monthly, assume reinvestment of dividends and, unlike Fund returns, do not reflect any fees, expenses or sales charges.

The indices do not use leverage. It is not possible to invest directly in an index.

16

Pioneer Diversified High Income Fund, Inc. |

Semiannual Report

|

10/31/23

Schedule of Investments | 10/31/23

|

|

|

|

|

|

Value |

| |

UNAFFILIATED ISSUERS — 143.3% |

|

| |

Senior Secured Floating Rate Loan Interests — 4.9% of Net Assets*(a) |

|

| |

Auto Parts & Equipment — 0.9% |

|

| 194,510 |

First Brands Group LLC, 2022-II Incremental Term Loan, 10.881% (Term SOFR + 500 bps), 3/30/27 |

$ 191,997 |

| 698,210 |

First Brands Group LLC, First Lien 2021 Term Loan, 10.881% (Term SOFR + 500 bps), 3/30/27 |

690,064 |

| |

Total Auto Parts & Equipment |

|

|

|

| |

Chemicals-Diversified — 0.4% |

|

| 399,687(b) |

LSF11 A5 Holdco LLC, Fourth Amendment Incremental Term Loan, 9.674% (Term SOFR + 425 bps), 10/15/28 |

$ 392,818 |

| |

Total Chemicals-Diversified |

|

|

|

| |

Dialysis Centers — 0.3% |

|

| 481,248 |

U.S. Renal Care, Inc., Closing Date Term Loan, 10.439% (Term SOFR + 500 bps), 6/20/28 |

$ 297,571 |

| |

Total Dialysis Centers |

|

|

|

| |

Distribution & Wholesale — 0.3% |

|

| 312,500 |

Windsor Holdings III LLC, Dollar Term B Loan, 9.815% (Term SOFR + 450 bps), 8/1/30 |

$ 311,928 |

| |

Total Distribution & Wholesale |

|

|

|

| |

Electric-Generation — 0.3% |

|

| 308,872 |

Generation Bridge Northeast LLC, Term Loan B, 9.574% (Term SOFR + 425 bps), 8/22/29 |

$ 309,644 |

| |

Total Electric-Generation |

|

|

|

| |

Electronic Composition — 0.1% |

|

| 121,989 |

Natel Engineering Co., Inc., Initial Term Loan, 11.691% (Term SOFR + 625 bps), 4/30/26 |

$ 106,131 |

| |

Total Electronic Composition |

|

|

|

| |

Medical Labs & Testing Services — 0.0% † |

|

| 206,740(c) |

Envision Healthcare Corp., 2018 Third Out Term Loan, 9.13% (Term SOFR + 375 bps), 3/31/27 |

$ 3,101 |

| |

Total Medical Labs & Testing Services |

|

|

|

| |

Medical-Drugs — 0.4% |

|

| 405,000(b) |

Financiere Mendel, Term Loan B, 11/29/30 |

$ 405,506 |

| |

Total Medical-Drugs |

|

|

|

The accompanying notes are an integral part of these financial statements.

Pioneer Diversified High Income Fund, Inc. |

Semiannual Report

|

10/31/23

17

Schedule of Investments | 10/31/23

|

|

|

|

|

|

Value |

| |

Oil-Field Services — 0.5% |

|

| 415,775 |

ProFrac Holdings II LLC, Term Loan, 12.926% (Term SOFR + 725 bps), 3/4/25 |

$ 417,854 |

| |

Total Oil-Field Services |

|

|

|

| |

Physical Practice Management — 0.3% |

|

| 318,493 |

Team Health Holdings, Inc., Extended Term Loan, 10.574% (Term SOFR + 525 bps), 3/2/27 |

$ 230,377 |

| |

Total Physical Practice Management |

|

|

|

| |

Pipelines — 0.2% |

|

| 150,000(b) |

M6 ETX Holdings II MidCo LLC, Initial Term Loan, 9/19/29 |

$ 149,330 |

| |

Total Pipelines |

|

|

|

| |

Recreational Centers — 0.2% |

|

| 191,703 |

Fitness International LLC, Term B Loan, 8.674% (Term SOFR + 325 bps), 4/18/25 |

$ 191,124 |

| |

Total Recreational Centers |

|

|

|

| |

Schools — 0.1% |

|

| 99,749 |

Fugue Finance LLC, Existing Term Loan, 9.386% (Term SOFR + 400 bps), 1/31/28 |

$ 99,749 |

| |

Total Schools |

|

|

|

| |

Telecom Services — 0.9% |

|

| 1,014,750 |

Patagonia Holdco LLC, Amendment No.1 Term Loan, 11.117% (Term SOFR + 575 bps), 8/1/29 |

$ 886,638 |

| |

Total Telecom Services |

|

|

|

| |

Total Senior Secured Floating Rate Loan Interests

(Cost $5,102,189) |

|

|

|

Shares |

|

|

|

|

|

|

| |

Common Stocks — 0.3% of Net Assets |

|

| |

Household Durables — 0.0% † |

|

| 89,094(d) |

Desarrolladora Homex SAB de CV |

$ 64 |

| |

Total Household Durables |

|

|

|

| |

Oil, Gas & Consumable Fuels — 0.0% † |

|

| 6(d) |

Amplify Energy Corp. |

$ 42 |

| 2,189(d) |

Petroquest Energy, Inc. |

111 |

| |

Total Oil, Gas & Consumable Fuels |

|

|

|

The accompanying notes are an integral part of these financial statements.

18

Pioneer Diversified High Income Fund, Inc. |

Semiannual Report

|

10/31/23

Shares |

|

|

|

|

|

Value |

| |

Passenger Airlines — 0.3% |

|

| 24,166(d) + |

Grupo Aeromexico SAB de CV |

$ 301,589 |

| |

Total Passenger Airlines |

|

|

|

| |

Total Common Stocks

(Cost $619,487) |

|

|

|

|

|

|

|

|

|

|

| |

Asset Backed Securities — 3.7% of Net

Assets |

|

| 500,000 |

ACC Auto Trust, Series 2022-A, Class D, 10.07%, 3/15/29 (144A) |

$ 482,016 |

| 500,000(a) |

Goldentree Loan Management US CLO 2, Ltd., Series 2017-2A, Class E, 10.377% (3 Month Term SOFR + 496 bps), 11/28/30 (144A) |

465,349 |

| 1,000,000 |

JPMorgan Chase Bank NA - CACLN, Series 2021-3, Class G, 9.812%, 2/26/29 (144A) |

939,754 |

| 1,000,000(a) |

MCF CLO VII LLC, Series 2017-3A, Class ER, 14.827% (3 Month Term SOFR + 941 bps), 7/20/33 (144A) |

950,032 |

| 500,000(e) |

RMF Buyout Issuance Trust, Series 2022-HB1, Class M5, 4.50%, 4/25/32 (144A) |

55,650 |

| 650,000 |

Santander Bank Auto Credit-Linked Notes, Series 2022-A, Class E, 12.662%, 5/15/32 (144A) |

644,548 |

| |

Total Asset Backed Securities

(Cost $4,036,817) |

|

|

|

| |

Collateralized Mortgage Obligations—2.8% of Net Assets |

|

| 330,000(a) |

Connecticut Avenue Securities Trust, Series 2021-R01, Class 1B2, 11.321% (SOFR30A + 600 bps), 10/25/41 (144A) |

$ 327,938 |

| 11,136(a) |

DSLA Mortgage Loan Trust, Series 2005-AR6, Class 2A1C, 6.288% (1 Month Term SOFR + 95 bps), 10/19/45 |

10,690 |

| 100,000(a) |

Fannie Mae Connecticut Avenue Securities, Series 2021-R02, Class 2B2, 11.521% (SOFR30A + 620 bps), 11/25/41 (144A) |

99,314 |

| 200,000(a) |

Freddie Mac STACR REMIC Trust, Series 2021-DNA7, Class B2, 13.121% (SOFR30A + 780 bps), 11/25/41 (144A) |

202,873 |

| 450,000(a) |

Freddie Mac STACR REMIC Trust, Series 2021-HQA3, Class B2, 11.571% (SOFR30A + 625 bps), 9/25/41 (144A) |

434,642 |

The accompanying notes are an integral part of these financial statements.

Pioneer Diversified High Income Fund, Inc. |

Semiannual Report

|

10/31/23

19

Schedule of Investments | 10/31/23

|

|

|

|

|

|

Value |

| |

Collateralized Mortgage Obligations— (continued) |

|

| 280,000(a) |

Freddie Mac STACR REMIC Trust, Series 2022-DNA2, Class B2, 13.821% (SOFR30A + 850 bps), 2/25/42 (144A) |

$ 286,270 |

| 545,000(a) |

Freddie Mac STACR Trust, Series 2019-DNA3, Class B2, 13.585% (SOFR30A + 826 bps), 7/25/49 (144A) |

603,096 |

| 18,597 |

Global Mortgage Securitization, Ltd., Series 2004-A, Class B1, 5.25%, 11/25/32 (144A) |

8,140 |

| 640,000(a) |

STACR Trust, Series 2018-HRP2, Class B2, 15.935% (SOFR30A + 1,061 bps), 2/25/47 (144A) |

737,151 |

| |

Total Collateralized Mortgage Obligations

(Cost $2,631,488) |

|

|

|

| |

Commercial Mortgage-Backed Securities—10.3% of Net Assets |

|

| 1,000,000(e) |

Benchmark Mortgage Trust, Series 2020-B18, Class AGNG, 4.388%, 7/15/53 (144A) |

$ 822,821 |

| 500,000(a) |

BPR Trust, Series 2021-WILL, Class E, 12.199% (1 Month Term SOFR + 686 bps), 6/15/38 (144A) |

452,144 |

| 642,182(a) |

BX Trust, Series 2022-PSB, Class F, 12.668% (1 Month Term SOFR + 733 bps), 8/15/39 (144A) |

642,565 |

| 85,730(a) |

Capital Funding Mortgage Trust, Series 2020-9, Class A, 8.565% (1 Month Term SOFR + 325 bps), 11/15/23 (144A) |

82,786 |

| 504,632(a) |

Capital Funding Mortgage Trust, Series 2020-9, Class B, 20.215% (1 Month Term SOFR + 1,490 bps), 11/15/23 (144A) |

500,099 |

| 7,224,365(e)(f) |

CD Mortgage Trust, Series 2016-CD1, Class XA, 1.363%, 8/10/49 |

188,690 |

| 641,224(e)(f) |

Citigroup Commercial Mortgage Trust, Series 2014-GC23, Class XA, 0.893%, 7/10/47 |

2,419 |

| 21,019,610(e)(f) |

COMM Mortgage Trust, Series 2015-LC21, Class XA, 0.635%, 7/10/48 |

162,908 |

| 750,000(a) |

Freddie Mac Multifamily Structured Credit Risk, Series 2021-MN1, Class B1, 13.071% (SOFR30A + 775 bps), 1/25/51 (144A) |

744,175 |

| 180,000(a) |

Freddie Mac Multifamily Structured Credit Risk, Series 2021-MN3, Class B1, 12.171% (SOFR30A + 685 bps), 11/25/51 (144A) |

165,438 |

| 568,002(e) |

FREMF Mortgage Trust, Series 2019-KJ24, Class B, 7.60%, 10/25/27 (144A) |

502,625 |

The accompanying notes are an integral part of these financial statements.

20

Pioneer Diversified High Income Fund, Inc. |

Semiannual Report

|

10/31/23

|

|

|

|

|

|

Value |

| |

Commercial Mortgage-Backed Securities— (continued) |

|

| 1,000,000(a) |

FREMF Mortgage Trust, Series 2019-KS12, Class C, 12.331% (SOFR30A + 701 bps), 8/25/29 |

$ 954,904 |

| 141,987(a) |

FREMF Mortgage Trust, Series 2020-KF74, Class C, 11.681% (SOFR30A + 636 bps), 1/25/27 (144A) |

137,044 |

| 229,353(a) |

FREMF Mortgage Trust, Series 2020-KF83, Class C, 14.431% (SOFR30A + 911 bps), 7/25/30 (144A) |

216,486 |

| 1,000,000(g) |

FREMF Mortgage Trust, Series 2021-KG05, Class C, 0.000%, 1/25/31 (144A) |

495,231 |

| 12,333,286(f) |

FREMF Mortgage Trust, Series 2021-KG05, Class X2A, 0.10%, 1/25/31 (144A) |

62,763 |

| 1,000,000(f) |

FREMF Mortgage Trust, Series 2021-KG05, Class X2B, 0.10%, 1/25/31 (144A) |

4,761 |

| 7,597,529(e)(f) |

FRESB Mortgage Trust, Series 2020-SB79, Class X1, 1.085%, 7/25/40 |

278,798 |

| 3,803,056(e)(f) |

GS Mortgage Securities Trust, Series 2014-GC24, Class XA, 0.683%, 9/10/47 |

12,617 |

| 500,000(e) |

JP Morgan Chase Commercial Mortgage Securities Trust, Series 2013-LC11, Class D, 4.167%, 4/15/46 |

224,000 |

| 6,691,699(e)(f) |

JPMBB Commercial Mortgage Securities Trust, Series 2014-C24, Class XA, 0.844%, 11/15/47 |

27,998 |

| 5,846,124(e)(f) |

Morgan Stanley Capital I Trust, Series 2016-UB12, Class XA, 0.649%, 12/15/49 |

93,244 |

| 748,201(a) |

Multifamily Connecticut Avenue Securities Trust, Series 2020-01, Class M10, 9.185% (SOFR30A + 386 bps), 3/25/50 (144A) |

714,582 |

| 900,000(e) |

Natixis Commercial Mortgage Securities Trust, Series 2019-FAME, Class E, 4.398%, 8/15/36 (144A) |

410,449 |

| 290,000 |

Palisades Center Trust, Series 2016-PLSD, Class A, 2.713%, 4/13/33 (144A) |

150,800 |

| 216,125(e) |

Velocity Commercial Capital Loan Trust, Series 2020-1, Class M5, 4.29%, 2/25/50 (144A) |

161,348 |

| 1,100,000 |

Wells Fargo Commercial Mortgage Trust, Series 2015-C28, Class E, 3.00%, 5/15/48 (144A) |

768,834 |

| 1,660,500(e) |

Wells Fargo Commercial Mortgage Trust, Series 2015-C31, Class E, 4.595%, 11/15/48 (144A) |

979,610 |

| |

Total Commercial Mortgage-Backed Securities

(Cost $11,861,465) |

|

|

|

The accompanying notes are an integral part of these financial statements.

Pioneer Diversified High Income Fund, Inc. |

Semiannual Report

|

10/31/23

21

Schedule of Investments | 10/31/23

|

|

|

|

|

|

Value |

| |

Convertible Corporate Bonds — 2.2% of

Net Assets |

|

| |

|

|

| IDR 812,959,000 |

PT Bakrie & Brothers Tbk, 4/28/24 |

$ 5,118 |

| |

Total Banks |

|

|

|

| |

Chemicals — 2.0% |

|

| 1,900,000(h) |

Hercules LLC, 6.50%, 6/30/29 |

$ 1,928,191 |

| |

Total Chemicals |

|

|

|

| |

Entertainment — 0.2% |

|

| 312,000(g) |

DraftKings Holdings, Inc., 3/15/28 |

$ 231,816 |

| |

Total Entertainment |

|

|

|

| |

Total Convertible Corporate Bonds

(Cost $1,857,037) |

|

|

|

| |

Corporate Bonds — 87.8% of Net Assets |

|

| |

Advertising — 1.3% |

|

| 645,000 |

Clear Channel Outdoor Holdings, Inc., 7.50%, 6/1/29 (144A) |

$ 469,486 |

| 535,000 |

Clear Channel Outdoor Holdings, Inc., 7.75%, 4/15/28 (144A) |

408,997 |

| 400,000 |

Summer BC Bidco B LLC, 5.50%, 10/31/26 (144A) |

348,340 |

| |

Total Advertising |

|

|

|

| |

Aerospace & Defense — 0.6% |

|

| 315,000 |

Spirit AeroSystems, Inc., 9.375%, 11/30/29 (144A) |

$ 323,483 |

| 270,000 |

Triumph Group, Inc., 9.00%, 3/15/28 (144A) |

262,235 |

| |

Total Aerospace & Defense |

|

|

|

| |

Agriculture — 1.1% |

|

| 1,310,000 |

Frigorifico Concepcion S.A., 7.70%, 7/21/28 (144A) |

$ 1,061,856 |

| |

Total Agriculture |

|

|

|

| |

Airlines — 7.1% |

|

| 2,417,568(i) |

ABRA Global Finance, 11.50% (5.50% PIK or 6.00% Cash), 3/2/28 (144A) |

$ 1,857,735 |

| 430,000 |

Azul Secured Finance LLP, 11.93%, 8/28/28 (144A) |

417,798 |

| 1,510,000 |

Grupo Aeromexico SAB de CV, 8.50%, 3/17/27 (144A) |

1,400,780 |

| 285,000 |

Latam Airlines Group S.A., 13.375%, 10/15/29 (144A) |

307,160 |

| 1,059,000 |

Pegasus Hava Tasimaciligi AS, 9.25%, 4/30/26 (144A) |

1,061,287 |

The accompanying notes are an integral part of these financial statements.

22

Pioneer Diversified High Income Fund, Inc. |

Semiannual Report

|

10/31/23

|

|

|

|

|

|

Value |

| |

Airlines — (continued) |

|

| EUR 700,000 |

Transportes Aereos Portugueses S.A., 5.625%, 12/2/24 (144A) |

$ 731,233 |

| 465,000 |

VistaJet Malta Finance Plc/Vista Management Holding, Inc., 6.375%, 2/1/30 (144A) |

310,105 |

| 745,000 |

VistaJet Malta Finance Plc/Vista Management Holding, Inc., 7.875%, 5/1/27 (144A) |

572,965 |

| 260,000 |

VistaJet Malta Finance Plc/Vista Management Holding, Inc., 9.50%, 6/1/28 (144A) |

199,205 |

| |

Total Airlines |

|

|

|

| |

Apparel — 0.4% |

|

| 370,000 |

Hanesbrands, Inc., 9.00%, 2/15/31 (144A) |

$ 343,451 |

| |

Total Apparel |

|

|

|

| |

Auto Parts & Equipment — 1.0% |

|

| 1,046,000 |

Dealer Tire LLC/DT Issuer LLC, 8.00%, 2/1/28 (144A) |

$ 981,111 |

| |

Total Auto Parts & Equipment |

|

|

|

| |

Banks — 2.6% |

|

| 300,000(e) |

Banco de Galicia y Buenos Aires SAU, 7.962% (5 Year CMT Index + 716 bps), 7/19/26 (144A) |

$ 275,700 |

| 1,135,000(e) |

Banco GNB Sudameris S.A., 7.50% (5 Year CMT Index + 666 bps), 4/16/31 (144A) |

872,247 |

| 685,000(e)(j) |

Banco Mercantil del Norte S.A., 8.375% (10 Year US Treasury Yield Curve Rate T Note Constant Maturity + 776 bps) (144A) |

622,925 |

| 155,000 |

Freedom Mortgage Corp., 12.25%, 10/1/30 (144A) |

155,051 |

| 350,000(e)(j) |

ING Groep NV, 6.50% (5 Year USD Swap Rate + 445 bps) |

327,477 |

| 225,000(e)(j) |

Intesa Sanpaolo S.p.A., 7.70% (5 Year USD Swap Rate + 546 bps) (144A) |

210,121 |

| 865,000(c)(e)(j)# |

Sovcombank Via SovCom Capital DAC, 7.60% (5 Year CMT Index + 636 bps) (144A) |

31,248 |

| |

Total Banks |

|

|

|

| |

Biotechnology — 0.3% |

|

| EUR 345,000 |

Cidron Aida Finco S.a.r.l., 5.00%, 4/1/28 (144A) |

$ 326,715 |

| |

Total Biotechnology |

|

|

|

The accompanying notes are an integral part of these financial statements.

Pioneer Diversified High Income Fund, Inc. |

Semiannual Report

|

10/31/23

23

Schedule of Investments | 10/31/23

|

|

|

|

|

|

Value |

| |

Building Materials — 1.3% |

|

| 1,000,000 |

AmeriTex HoldCo Intermediate LLC, 10.25%, 10/15/28 (144A) |

$ 945,500 |

| 464,000 |

Cornerstone Building Brands, Inc., 6.125%, 1/15/29 (144A) |

339,231 |

| |

Total Building Materials |

|

|

|

| |

Chemicals — 4.8% |

|

| 425,000 |

LSF11 A5 HoldCo LLC, 6.625%, 10/15/29 (144A) |

$ 344,785 |

| EUR 420,000 |

Lune Holdings S.a.r.l., 5.625%, 11/15/28 (144A) |

362,188 |

| 300,000 |

LYB Finance Co. BV, 8.10%, 3/15/27 (144A) |

315,123 |

| 379,000 |

Mativ Holdings, Inc., 6.875%, 10/1/26 (144A) |

341,100 |

| 280,000 |

Olin Corp., 9.50%, 6/1/25 (144A) |

288,035 |

| EUR 580,000 |

Olympus Water US Holding Corp., 9.625%, 11/15/28 (144A) |

608,475 |

| 985,000 |

Olympus Water US Holding Corp., 9.75%, 11/15/28 (144A) |

962,050 |

| 920,000 |

Rain Carbon, Inc., 12.25%, 9/1/29 (144A) |

936,100 |

| EUR 420,000 |

SCIL IV LLC/SCIL USA Holdings LLC, 9.50%, 7/15/28 (144A) |

449,384 |

| |

Total Chemicals |

|

|

|

| |

Commercial Services — 4.2% |

|

| 585,000 |

Allied Universal Holdco LLC/Allied Universal Finance Corp., 9.75%, 7/15/27 (144A) |

$ 508,146 |

| 1,384,000(c) |

Atento Luxco 1 S.A., 8.00%, 2/10/26 (144A) |

139 |

| 473,000 |

Garda World Security Corp., 6.00%, 6/1/29 (144A) |

360,574 |

| 958,000 |

Garda World Security Corp., 9.50%, 11/1/27 (144A) |

870,532 |

| 625,000 |

Neptune Bidco US, Inc., 9.29%, 4/15/29 (144A) |

551,593 |

| 935,000 |

Prime Security Services Borrower LLC/Prime Finance, Inc., 6.25%, 1/15/28 (144A) |

867,028 |

| 558,000 |

Sotheby's, 7.375%, 10/15/27 (144A) |

498,342 |

| 411,000 |

Verscend Escrow Corp., 9.75%, 8/15/26 (144A) |

407,973 |

| |

Total Commercial Services |

|

|

|

| |

Diversified Financial Services — 7.0% |

|

| 500,000(e)(j) |

Air Lease Corp., 4.125% (5 Year CMT Index + 315 bps) |

$ 359,797 |

| 1,000,000 |

ASG Finance Designated Activity Co., 7.875%, 12/3/24 (144A) |

967,500 |

| 385,381(i) |

Avation Capital S.A., 8.25% (9.00% PIK or 8.25% Cash), 10/31/26 (144A) |

328,537 |

| 1,110,000 |

Bread Financial Holdings, Inc., 7.00%, 1/15/26 (144A) |

1,010,327 |

The accompanying notes are an integral part of these financial statements.

24

Pioneer Diversified High Income Fund, Inc. |

Semiannual Report

|

10/31/23

|

|

|

|

|

|

Value |

| |

Diversified Financial Services — (continued) |

|

| 275,000(c) |

Credito Real SAB de CV SOFOM ER, 8.00%, 1/21/28 (144A) |

$ 31,625 |

| EUR 235,000 |

Garfunkelux Holdco 3 S.A., 6.75%, 11/1/25 (144A) |

186,413 |

| GBP 400,000 |

Garfunkelux Holdco 3 S.A., 7.75%, 11/1/25 (144A) |

358,237 |

| 1,112,739(i) |

Global Aircraft Leasing Co., Ltd., 6.50% (7.25% PIK or 6.50% Cash), 9/15/24 (144A) |

1,005,599 |

| EUR 840,000 |

Intrum AB, 9.25%, 3/15/28 (144A) |

758,950 |

| 610,000 |

OneMain Finance Corp., 9.00%, 1/15/29 |

593,629 |

| 355,000 |

PHH Mortgage Corp., 7.875%, 3/15/26 (144A) |

306,187 |

| 1,174,000(c) |

Unifin Financiera SAB de CV, 8.375%, 1/27/28 (144A) |

23,544 |

| 865,000 |

United Wholesale Mortgage LLC, 5.75%, 6/15/27 (144A) |

787,089 |

| |

Total Diversified Financial Services |

|

|

|

| |

Electric — 0.9% |

|

| 400,000 |

Cemig Geracao e Transmissao S.A., 9.25%, 12/5/24 (144A) |

$ 397,940 |

| 38,701 |

NSG Holdings LLC/NSG Holdings, Inc., 7.75%, 12/15/25 (144A) |

38,411 |

| 445,000 |

Talen Energy Supply LLC, 8.625%, 6/1/30 (144A) |

452,168 |

| 7,000 |

Vistra Operations Co. LLC, 5.625%, 2/15/27 (144A) |

6,587 |

| |

Total Electric |

|

|

|

| |

Electrical Components & Equipments — 0.6% |

|

| 350,000 |

WESCO Distribution, Inc., 7.125%, 6/15/25 (144A) |

$ 349,797 |

| 245,000 |

WESCO Distribution, Inc., 7.25%, 6/15/28 (144A) |

243,444 |

| |

Total Electrical Components & Equipments |

|

|

|

| |

Energy-Alternate Sources — 0.1% |

|

| 96,604(i) |

SCC Power Plc, 4.00% (4.00% PIK or 4.00% Cash), 5/17/32 (144A) |

$ 11,854 |

| 178,348(i) |

SCC Power Plc, 8.00% (4.00% PIK or 4.00% Cash or 8.00% Cash), 12/31/28 (144A) |

66,470 |

| |

Total Energy-Alternate Sources |

|

|

|

| |

Engineering & Construction — 0.2% |

|

| 230,000 |

IHS Holding, Ltd., 6.25%, 11/29/28 (144A) |

$ 169,183 |

| |

Total Engineering & Construction |

|

|

|

| |

Entertainment — 2.0% |

|

| 295,000 |

Light & Wonder International, Inc., 7.00%, 5/15/28 (144A) |

$ 287,563 |

The accompanying notes are an integral part of these financial statements.

Pioneer Diversified High Income Fund, Inc. |

Semiannual Report

|

10/31/23

25

Schedule of Investments | 10/31/23

|

|

|

|

|

|

Value |

| |

Entertainment — (continued) |

|

| 295,000 |

Light & Wonder International, Inc., 7.25%, 11/15/29 (144A) |

$ 286,082 |

| EUR 325,000 |

Lottomatica S.p.A., 9.75%, 9/30/27 (144A) |

367,486 |

| EUR 310,000 |

Lottomatica S.p.A./Roma, 7.125%, 6/1/28 (144A) |

332,755 |

| 700,000 |

Mohegan Tribal Gaming Authority, 8.00%, 2/1/26 (144A) |

643,125 |

| |

Total Entertainment |

|

|

|

| |

Environmental Control — 0.4% |

|

| 367,000 |

Tervita Corp., 11.00%, 12/1/25 (144A) |

$ 381,669 |

| |

Total Environmental Control |

|

|

|

| |

Food — 0.4% |

|

| 555,000 |

Aragvi Finance International DAC, 8.45%, 4/29/26 (144A) |

$ 376,079 |

| |

Total Food |

|

|

|

| |

Healthcare-Services — 2.9% |

|

| 770,000 |

Auna SAA, 6.50%, 11/20/25 (144A) |

$ 704,559 |

| 550,000 |

Prime Healthcare Services, Inc., 7.25%, 11/1/25 (144A) |

500,500 |

| 357,000 |

RegionalCare Hospital Partners Holdings, Inc./LifePoint Health, Inc., 9.75%, 12/1/26 (144A) |

333,790 |

| 626,000 |

Surgery Center Holdings, Inc., 10.00%, 4/15/27 (144A) |

624,858 |

| 765,000 |

US Acute Care Solutions LLC, 6.375%, 3/1/26 (144A) |

650,834 |

| |

Total Healthcare-Services |

|

|

|

| |

Home Builders — 0.8% |

|

| 885,000 |

Beazer Homes USA, Inc., 7.25%, 10/15/29 |

$ 807,389 |

| |

Total Home Builders |

|

|

|

| |

Home Furnishings — 1.0% |

|

| EUR 930,000 |

International Design Group S.p.A., 6.50%, 11/15/25 (144A) |

$ 934,831 |

| |

Total Home Furnishings |

|

|

|

| |

Insurance — 4.5% |

|

| 4,600,000 |

Liberty Mutual Insurance Co., 7.697%, 10/15/97 (144A) |

$ 4,300,946 |

| |

Total Insurance |

|

|

|

| |

Iron & Steel — 2.0% |

|

| 845,000 |

Carpenter Technology Corp., 7.625%, 3/15/30 |

$ 834,184 |

The accompanying notes are an integral part of these financial statements.

26

Pioneer Diversified High Income Fund, Inc. |

Semiannual Report

|

10/31/23

|

|

|

|

|

|

Value |

| |

Iron & Steel — (continued) |

|

| 613,000 |

Metinvest BV, 7.75%, 10/17/29 (144A) |

$ 363,202 |

| 870,000 |

TMS International Corp., 6.25%, 4/15/29 (144A) |

686,389 |

| |

Total Iron & Steel |

|

|

|

| |

Leisure Time — 1.5% |

|

| 100,000 |

Carnival Corp., 7.625%, 3/1/26 (144A) |

$ 97,239 |

| EUR 130,000 |

Carnival Corp., 7.625%, 3/1/26 (144A) |

134,835 |

| 120,000 |

Carnival Holdings Bermuda, Ltd., 10.375%, 5/1/28 (144A) |

127,946 |

| 170,000 |

NCL Finance, Ltd., 6.125%, 3/15/28 (144A) |

142,160 |

| 64,000 |

Royal Caribbean Cruises, Ltd., 11.50%, 6/1/25 (144A) |

67,638 |

| 595,000 |

Royal Caribbean Cruises, Ltd., 11.625%, 8/15/27 (144A) |

645,316 |

| 245,000 |

Viking Cruises, Ltd., 6.25%, 5/15/25 (144A) |

238,344 |

| |

Total Leisure Time |

|

|

|

| |

Lodging — 0.7% |

|

| 800,000(k) |

Grupo Posadas S.A.B de CV, 5.00%, 12/30/27 (144A) |

$ 674,000 |

| |

Total Lodging |

|

|

|

| |

Media — 1.4% |

|

| 400,000 |

CSC Holdings LLC, 5.375%, 2/1/28 (144A) |

$ 318,534 |

| 1,210,000 |

McGraw-Hill Education, Inc., 8.00%, 8/1/29 (144A) |

996,992 |

| |

Total Media |

|

|

|

| |

Metal Fabricate/Hardware — 0.4% |

|

| 385,000 |

Park-Ohio Industries, Inc., 6.625%, 4/15/27 |

$ 333,988 |

| |

Total Metal Fabricate/Hardware |

|

|

|

| |

Mining — 2.0% |

|

| 633,000 |

Eldorado Gold Corp., 6.25%, 9/1/29 (144A) |

$ 542,791 |

| 400,000 |

First Quantum Minerals, Ltd., 6.875%, 10/15/27 (144A) |

340,690 |

| 1,260,000 |

First Quantum Minerals, Ltd., 8.625%, 6/1/31 (144A) |

1,063,568 |

| |

Total Mining |

|

|

|

| |

Oil & Gas — 17.2% |

|

| 1,160,000 |

Aethon United BR LP/Aethon United Finance Corp., 8.25%, 2/15/26 (144A) |

$ 1,152,274 |

| 910,000 |

Baytex Energy Corp., 8.50%, 4/30/30 (144A) |

901,307 |

| 1,685,000 |

Baytex Energy Corp., 8.75%, 4/1/27 (144A) |

1,698,264 |

The accompanying notes are an integral part of these financial statements.

Pioneer Diversified High Income Fund, Inc. |

Semiannual Report

|

10/31/23

27

Schedule of Investments | 10/31/23

|

|

|

|

|

|

Value |

| |

Oil & Gas — (continued) |

|

| 335,000(l) |

Borr IHC, Ltd./Borr Finance LLC, 10.00%, 11/15/28 (144A) |

$ 333,403 |

| 240,000(l) |

Borr IHC, Ltd./Borr Finance LLC, 10.375%, 11/15/30 (144A) |

237,960 |

| 85,000 |

Cenovus Energy, Inc., 6.75%, 11/15/39 |

82,155 |

| 520,000 |

Civitas Resources, Inc., 8.375%, 7/1/28 (144A) |

523,204 |

| 370,000 |

Civitas Resources, Inc., 8.625%, 11/1/30 (144A) |

376,595 |

| 520,000 |

Civitas Resources, Inc., 8.75%, 7/1/31 (144A) |

524,819 |

| 1,510,000 |

Energean Plc, 6.50%, 4/30/27 (144A) |

1,256,169 |

| 383,000 |

International Petroleum Corp., 7.25%, 2/1/27 (144A) |

354,466 |

| 405,000 |

Kosmos Energy, Ltd., 7.75%, 5/1/27 (144A) |

363,898 |

| 1,309,271 |

MC Brazil Downstream Trading S.a.r.l, 7.25%, 6/30/31 (144A) |

931,546 |

| 515,000 |

Nabors Industries, Ltd., 7.50%, 1/15/28 (144A) |

454,848 |

| 603,000 |

Neptune Energy Bondco Plc, 6.625%, 5/15/25 (144A) |

596,924 |

| 955,000 |

Occidental Petroleum Corp., 4.40%, 4/15/46 |

681,268 |

| 800,000 |

Petroleos Mexicanos, 5.95%, 1/28/31 |

572,400 |

| 271,000 |

Precision Drilling Corp., 6.875%, 1/15/29 (144A) |

250,920 |

| 455,000 |

Seadrill Finance, Ltd., 8.375%, 8/1/30 (144A) |

455,146 |

| 970,000 |

Shelf Drilling Holdings, Ltd., 9.625%, 4/15/29 (144A) |

922,250 |

| 900,000 |

SierraCol Energy Andina LLC, 6.00%, 6/15/28 (144A) |

696,700 |

| 860,000 |

Strathcona Resources, Ltd., 6.875%, 8/1/26 (144A) |

793,350 |

| 120,000 |

Transocean Titan Financing, Ltd., 8.375%, 2/1/28 (144A) |

120,486 |

| 785,000 |

Tullow Oil Plc, 10.25%, 5/15/26 (144A) |

674,315 |

| 725,000 |

Valaris, Ltd., 8.375%, 4/30/30 (144A) |

711,406 |

| 1,195,000 |

YPF S.A., 6.95%, 7/21/27 (144A) |

903,152 |

| |

Total Oil & Gas |

$16,569,225 |

|

|

| |

Oil & Gas Services — 1.1% |

|

| 521,000 |

Archrock Partners LP/Archrock Partners Finance Corp., 6.875%, 4/1/27 (144A) |

$ 500,867 |

| 630,000 |

Enerflex, Ltd., 9.00%, 10/15/27 (144A) |

573,300 |

| |

Total Oil & Gas Services |

|

|

|

The accompanying notes are an integral part of these financial statements.

28

Pioneer Diversified High Income Fund, Inc. |

Semiannual Report

|

10/31/23

|

|

|

|

|

|

Value |

| |

Packaging & Containers — 1.1% |

|

| EUR 425,000 |

Fiber Bidco S.p.A., 11.00%, 10/25/27 (144A) |

$ 476,674 |

| 580,000 |

Owens-Brockway Glass Container, Inc., 7.25%, 5/15/31 (144A) |

530,700 |

| |

Total Packaging & Containers |

|

|

|

| |

Pharmaceuticals — 0.8% |

|

| 790,000 |

P&L Development LLC/PLD Finance Corp., 7.75%, 11/15/25 (144A) |

$ 530,643 |

| 381,000 |

Par Pharmaceutical, Inc., 7.50%, 4/1/27 (144A) |

258,360 |

| 300,000 + |

Tricida, Inc., 3.50%, 5/15/27 |

— |

| 300,000 + |

Tricida, Inc., 3.50%, 5/15/27 |

— |

| |

Total Pharmaceuticals |

|

|

|

| |

Pipelines — 5.9% |

|

| 800,020 |

Acu Petroleo Luxembourg S.a.r.l., 7.50%, 1/13/32 (144A) |

$ 721,982 |

| 555,000 |

Delek Logistics Partners LP/Delek Logistics Finance Corp., 6.75%, 5/15/25 |

545,767 |

| 510,000 |

Delek Logistics Partners LP/Delek Logistics Finance Corp., 7.125%, 6/1/28 (144A) |

464,100 |

| 450,000(a) |

Energy Transfer LP, 8.656% (3 Month Term SOFR + 328 bps), 11/1/66 |

367,209 |

| 915,000(e)(j) |

Energy Transfer LP, 7.125% (5 Year CMT Index + 531 bps) |

759,841 |

| 145,000 |

EnLink Midstream Partners LP, 5.45%, 6/1/47 |

108,998 |

| 344,000 |

EnLink Midstream Partners LP, 5.60%, 4/1/44 |

270,470 |

| 365,000 |

Genesis Energy LP/Genesis Energy Finance Corp., 8.00%, 1/15/27 |

350,492 |

| 197,000 |

Global Partners LP/GLP Finance Corp., 7.00%, 8/1/27 |

185,684 |

| 310,000 |

Venture Global LNG, Inc., 8.125%, 6/1/28 (144A) |

300,955 |

| 575,000 |

Venture Global LNG, Inc., 8.375%, 6/1/31 (144A) |

548,697 |

| 1,175,000 |

Williams Cos., Inc., 5.75%, 6/24/44 |

1,024,357 |

| |

Total Pipelines |

|

|

|

| |

REITs — 1.0% |

|

| 890,000 |

Uniti Group LP/Uniti Fiber Holdings, Inc./CSL Capital LLC, 6.00%, 1/15/30 (144A) |

$ 539,592 |

| 10,000 |

Uniti Group LP/Uniti Group Finance, Inc./CSL Capital LLC, 6.50%, 2/15/29 (144A) |

6,494 |

| 410,000 |

Uniti Group LP/Uniti Group Finance, Inc./CSL Capital LLC, 10.50%, 2/15/28 (144A) |

394,811 |

| |

Total REITs |

|

|

|

The accompanying notes are an integral part of these financial statements.

Pioneer Diversified High Income Fund, Inc. |

Semiannual Report

|

10/31/23

29

Schedule of Investments | 10/31/23

|

|

|

|

|

|

Value |

| |

Retail — 0.3% |

|

| 389,000 |

Staples, Inc., 7.50%, 4/15/26 (144A) |

$ 317,305 |

| |

Total Retail |

|

|

|

| |

Software — 0.4% |

|

| 505,000 |

AthenaHealth Group, Inc., 6.50%, 2/15/30 (144A) |

$ 412,709 |

| |

Total Software |

|

|

|

| |

Telecommunications — 3.6% |

|

| 695,000 |

Altice France Holding S.A., 6.00%, 2/15/28 (144A) |

$ 304,796 |

| 607,000 |

Altice France Holding S.A., 10.50%, 5/15/27 (144A) |

330,269 |

| 200,000 |

Altice France S.A., 8.125%, 2/1/27 (144A) |

168,593 |

| 750,000(c) |

Digicel, Ltd., 6.75%, 3/1/24 |

18,750 |

| 836,000 |

Kenbourne Invest S.A., 6.875%, 11/26/24 (144A) |

631,573 |

| 850,000 |

Sprint LLC, 7.625%, 3/1/26 |

873,063 |

| 850,000 |

Total Play Telecomunicaciones SA de CV, 6.375%, 9/20/28 (144A) |

407,013 |

| 875,000 |

Windstream Escrow LLC/Windstream Escrow Finance Corp., 7.75%, 8/15/28 (144A) |

693,863 |

| |

Total Telecommunications |

|

|

|

| |

Transportation — 2.5% |

|

| 1,245,000 |

Carriage Purchaser, Inc., 7.875%, 10/15/29 (144A) |

$ 915,914 |

| 655,000 |

Danaos Corp., 8.50%, 3/1/28 (144A) |

650,998 |

| 400,000 |

Simpar Europe S.A., 5.20%, 1/26/31 (144A) |

312,000 |

| 575,000 |

Watco Cos. LLC/Watco Finance Corp., 6.50%, 6/15/27 (144A) |

535,741 |

| 965,000(c) |

Western Global Airlines LLC, 10.375%, 8/15/25 (144A) |

7,238 |

| |

Total Transportation |

|

|

|

| |

Trucking & Leasing — 0.4% |

|

| 325,000 |

Fortress Transportation and Infrastructure Investors LLC, 9.75%, 8/1/27 (144A) |

$ 334,344 |

| |

Total Trucking & Leasing |

|

|

|

| |

Total Corporate Bonds

(Cost $97,127,715) |

$84,371,966 |

|

|

The accompanying notes are an integral part of these financial statements.

30

Pioneer Diversified High Income Fund, Inc. |

Semiannual Report

|

10/31/23

Shares |

|

|

|

|

|

Value |

| |

Preferred Stock — 0.6% of Net Assets |

|

| |

Capital Markets — 0.1% |

|

| 1,322 |

B Riley Financial, Inc., 6.75%, 5/31/24 |

$ 32,521 |

| |

Total Capital Markets |

|

|

|

| |

Financial Services — 0.5% |

|

| 500(e)(j) |

Compeer Financial ACA, 10.206% (3 Month USD LIBOR + 484 bps) (144A) |

$ 502,049 |

| |

Total Financial Services |

|

|

|

| |

|

|

| 50,188 |

MYT Holding LLC, 10.00%, 6/6/29 |

$ 23,840 |

| |

Total Internet |

|

|

|

| |

Total Preferred Stock

(Cost $624,106) |

|

|

|

| |

Right/Warrant — 0.0% † of Net Assets |

|

| |

Trading Companies & Distributors — 0.0% † |

|

| GBP 6,475 (d) |

Avation Plc, 1/1/59 |

$ 2,361 |

| |

Total Trading Companies & Distributors |

|

|

|

| |

Total Right/Warrant

(Cost $—) |

|

|

|

|

|

|

|

|

|

|

| |

Insurance-Linked Securities — 28.4% of

Net Assets# |

|

| |

Event Linked Bonds — 13.0% |

|

| |

Earthquakes – California — 0.6% |

|

| 250,000(a) |

Sutter Re, 15.195%, (3 Month U.S. Treasury Bill + 975 bps), 6/19/26 (144A) |

$ 251,875 |

| 300,000(a) |

Torrey Pines Re, 10.445%, (3 Month U.S. Treasury Bill + 500 bps), 6/5/26 (144A) |

302,490 |

| |

|

|

|

|

|

$554,365 |

|

|

| |

Earthquakes – U.S. — 0.3% |

|

| 250,000(a) |

Ursa Re, 10.945%, (3 Month U.S. Treasury Bill + 550 bps), 12/6/25 (144A) |

$ 252,100 |

| |

Flood – U.S. — 0.8% |

|

| 250,000(a) |

FloodSmart Re, 17.275%, (3 Month U.S. Treasury Bill + 1,183 bps), 2/25/25 (144A) |

$ 246,975 |

The accompanying notes are an integral part of these financial statements.

Pioneer Diversified High Income Fund, Inc. |

Semiannual Report

|

10/31/23

31

Schedule of Investments | 10/31/23

|

|

|

|

|

|

Value |

| |

Flood – U.S. — (continued) |

|

| 250,000(a) |

FloodSmart Re, 19.025%, (3 Month U.S. Treasury Bill + 1,358 bps), 3/1/24 (144A) |

$ 249,750 |

| 250,000(a) |

FloodSmart Re, 21.695%, (1 Month U.S. Treasury Bill + 1,625 bps), 3/11/26 (144A) |

255,350 |

| |

|

|

|

|

|

$752,075 |

|

|

| |

Multiperil – Florida — 0.5% |

|

| 500,000(a) |

Sanders Re, 13.447%, (3 Month U.S. Treasury Bill + 800 bps), 6/5/26 (144A) |

$ 514,300 |

| |

Multiperil – U.S. — 3.8% |

|

| 250,000(a) |

Aquila Re, 12.945%, (3 Month U.S. Treasury Bill + 750 bps), 6/8/26 (144A) |

$ 255,725 |

| 250,000(a) |

Aquila Re, 14.695%, (3 Month U.S. Treasury Bill + 925 bps), 6/8/26 (144A) |

260,625 |

| 400,000(a) |

Caelus Re V, 5.539%, (1 Month USD LIBOR + 10 bps), 6/5/24 (144A) |

32,000 |

| 250,000(a) |

Four Lakes Re, 12.745%, (3 Month U.S. Treasury Bill + 730 bps), 1/5/24 (144A) |

246,750 |

| 250,000(a) |

Four Lakes Re, 15.605%, (3 Month U.S. Treasury Bill + 1,016 bps), 1/5/24 (144A) |

250,375 |

| 500,000(a) |

Matterhorn Re, 13.095%, (SOFR + 775 bps), 3/24/25 (144A) |

497,000 |

| 375,000(a) |

Residential Re, 12.447%, (3 Month U.S. Treasury Bill + 700 bps), 12/6/26 (144A) |

378,375 |

| 250,000(a) |

Residential Re, 17.675%, (3 Month U.S. Treasury Bill + 1,223 bps), 12/6/23 (144A) |

249,500 |

| 500,000(a) |

Residential Re , 17.355%, (3 Month U.S. Treasury Bill + 1,191 bps), 12/6/25 (144A) |

480,750 |

| 250,000(a) |

Sanders Re III, 11.195%, (3 Month U.S. Treasury Bill + 575 bps), 4/7/27 (144A) |

246,325 |

| 250,000(a) |

Solomon Re, 10.695%, (3 Month U.S. Treasury Bill + 525 bps), 6/8/26 (144A) |

254,450 |

| 250,000(a) |

Stabilitas Re, 13.945%, (3 Month U.S. Treasury Bill + 850 bps), 6/5/26 (144A) |

255,375 |

| 250,000(a) |

Topanga Re, 10.435%, (3 Month U.S. Treasury Bill + 499 bps), 1/8/26 (144A) |

227,500 |

| |

|

|

|

|

|

$3,634,750 |

|

|

| |

Multiperil – U.S. & Canada — 1.8% |

|

| 250,000(a) |

Kilimanjaro III Re, 17.805%, (3 Month U.S. Treasury Bill + 1,236 bps), 4/20/26 (144A) |

$ 239,625 |

| 250,000(a) |

Kilimanjaro III Re, 17.807%, (3 Month U.S. Treasury Bill + 1,236 bps), 4/21/25 (144A) |

244,125 |

The accompanying notes are an integral part of these financial statements.

32

Pioneer Diversified High Income Fund, Inc. |

Semiannual Report

|

10/31/23

|

|

|

|

|

|

Value |

| |

Multiperil – U.S. & Canada — (continued) |

|

| 250,000(a) |

Matterhorn Re, 11.094%, (SOFR + 575 bps), 12/8/25 (144A) |

$ 230,600 |

| 250,000(a) |

Mona Lisa Re, 17.945%, (3 Month U.S. Treasury Bill + 1,250 bps), 1/8/26 (144A) |

267,500 |

| 250,000(a) |

Mystic Re IV, 11.575%, (3 Month U.S. Treasury Bill + 613 bps), 1/8/25 (144A) |

242,125 |

| 500,000(a) |

Mystic Re IV, 11.69%, (3 Month U.S. Treasury Bill + 1,160 bps), 1/8/25 (144A) |

490,200 |

| |

|

|

|

|

|

$1,714,175 |

|

|

| |

Multiperil – Worldwide — 0.3% |

|

| 250,000(a) |

Atlas Capital, 12.56%, (SOFR + 725 bps), 6/5/26 (144A) |

$ 252,700 |

| |

Pandemic – U.S — 0.2% |

|

| 250,000(a) |

Vitality Re XI, 7.245%, (3 Month U.S. Treasury Bill + 180 bps), 1/9/24 (144A) |

$ 249,500 |

| |

Windstorm – Florida — 0.2% |

|

| 250,000(a) |

Integrity Re, 12.515%, (3 Month U.S. Treasury Bill + 707 bps), 6/6/25 (144A) |

$ 225,000 |

| |

Windstorm – Jamaica — 0.3% |

|

| 250,000(a) |

International Bank for Reconstruction & Development, 9.72%, (SOFR + 440 bps), 12/29/23 (144A) |

$ 250,375 |

| |

Windstorm – North Carolina — 0.8% |

|

| 250,000(a) |

Cape Lookout Re, 9.145%, (1 Month U.S. Treasury Bill + 370 bps), 3/22/24 (144A) |

$ 248,750 |

| 250,000(a) |

Cape Lookout Re, 10.795%, (3 Month U.S. Treasury Bill + 535 bps), 3/28/25 (144A) |

243,750 |

| 250,000(a) |

Cape Lookout Re, 11.945%, (1 Month U.S. Treasury Bill + 650 bps), 4/28/26 (144A) |

255,075 |

| |

|

|

|

|

|

$747,575 |

|

|

| |

Windstorm – Texas — 0.3% |

|

| 250,000(a) |

Alamo Re, 13.945%, (1 Month U.S. Treasury Bill + 850 bps), 6/7/26 (144A) |

$ 250,675 |

| |

Windstorm – U.S. — 2.6% |

|

| 250,000(a) |

Bonanza Re, 11.195%, (3 Month U.S. Treasury Bill + 575 bps), 3/16/25 (144A) |

$ 238,000 |

| 250,000(a) |

Bonanza Re, 13.697%, (3 Month U.S. Treasury Bill + 825 bps), 1/8/26 (144A) |

252,250 |

| 250,000(a) |

Citrus Re, 12.195%, (3 Month U.S. Treasury Bill + 675 bps), 6/7/26 (144A) |

255,850 |

The accompanying notes are an integral part of these financial statements.

Pioneer Diversified High Income Fund, Inc. |

Semiannual Report

|

10/31/23

33

Schedule of Investments | 10/31/23

|

|

|

|

|

|

Value |

|

| |

Windstorm – U.S. — (continued) |

|

|

| 250,000(a) |

Citrus Re, 14.445%, (3 Month U.S. Treasury Bill + 900 bps), 6/7/26 (144A) |

$ 252,150 |

|

| 250,000(a) |

Gateway Re, 18.445%, (1 Month U.S. Treasury Bill + 1,300 bps), 2/24/26 (144A) |

263,925 |

|

| 250,000(a) |

Gateway Re II, 14.945%, (3 Month U.S. Treasury Bill + 950 bps), 4/27/26 (144A) |

254,725 |

|

| 250,000(a) |

Merna Re II, 15.695%, (3 Month U.S. Treasury Bill + 1,025 bps), 7/7/26 (144A) |

260,375 |

|

| 250,000(a) |

Purple Re, 17.695%, (1 Month U.S. Treasury Bill + 1,225 bps), 4/24/26 (144A) |

252,250 |

|

| 500,000(a) |

Queen Street Re, 12.945%, (3 Month U.S. Treasury Bill + 750 bps), 12/8/25 (144A) |

512,050 |

|

| |

|

|

|

|

|

$2,541,575 |

|

|

|

|

|

| |

Winterstorm – Florida — 0.5% |

|

|

| 250,000(a) |

Integrity Re, 17.445%, (1 Month U.S. Treasury Bill + 1,200 bps), 6/6/25 (144A) |

$ 263,475 |

|

| 250,000(a) |

Lightning Re, 16.447%, (3 Month U.S. Treasury Bill + 1,100 bps), 3/31/26 (144A) |

262,200 |

|

| |