As filed with the U.S. Securities and Exchange Commission on September 29, 2023

Registration No. 333-_____

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

IGC PHARMA, INC.

(Exact name of registrant as specified in its charter)

|

Maryland

|

|

|

|

20-2760393

|

|

(State or other jurisdiction of

|

|

|

|

(I.R.S. Employer

|

|

incorporation or organization)

|

|

|

|

Identification No.)

|

10224 Falls Road

Potomac, Maryland 20854

Tel.: +1 (301) 983-0998

(Address, including zip code, and telephone number, including area code,

of registrant’s principal executive offices)

Ram Mukunda

President and Chief Executive Officer

IGC PHARMA, Inc.

10224 Falls Road

Potomac, Maryland 20854

Tel.: +1 (301) 983-0998

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies of notices and communications to:

Spencer G. Feldman, Esq.

Kenneth A. Schlesinger, Esq.

John A. Corrado, Esq.

Olshan Frome Wolosky LLP

1325 Avenue of the Americas, 15th Floor

New York, New York 10019

Tel.: (212) 451-2300

Approximate Date of Commencement of Proposed Sale to the Public: From time to time after this Registration Statement becomes effective.

If the only securities being registered on this form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☑

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer

|

☐

|

Accelerated Filer

|

☐

|

|

Non-accelerated filer

|

☑

|

Smaller reporting company

|

☑

|

| |

|

Emerging growth company

|

☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall hereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities, and we are not soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

|

PRELIMINARY PROSPECTUS

|

Subject to completion, dated September 29, 2023

|

IGC PHARMA, INC.

10,000,000 Shares of Common Stock

This prospectus relates to the resale by the selling stockholders identified in this prospectus (the “Selling Stockholders”) of up to 10,000,000 shares of common stock. All of the shares, when sold, will be sold by these Selling Stockholders. The shares of common stock offered by the Selling Stockholders to which this prospectus relates may be sold from time to time by and for the accounts of the Selling Stockholders named in this prospectus or in supplements to this prospectus. The Selling Stockholders may sell all or a portion of these shares from time to time through public or private transactions at prevailing market prices, at prices related to prevailing market prices, or at privately negotiated prices with purchasers, to or through underwriters, broker-dealers, agents, or through any other means described in the section of this prospectus entitled “Plan of Distribution.” The Selling Stockholders may be deemed underwriters of the shares of common stock that they are offering. We will bear all costs, expenses, and fees in connection with the registration of the Securities.

The Company is not selling any shares of common stock in this offering and, therefore, will not receive any of the proceeds from the sale of the shares of common stock offered by the Selling Stockholders.

No underwriter or person has been engaged to facilitate the sale of shares of common stock in this offering. None of the proceeds from the sale of stock by the selling stockholders will be placed in escrow, trust, or any similar account.

We may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should read the entire prospectus and any amendments or supplements carefully before you make your investment decision.

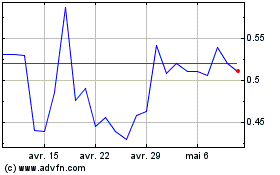

Our common stock is listed for trading on the NYSE American under the symbol “IGC.” The closing price of our common stock on September 27, 2023, as reported by the NYSE American, was $0.36 per share.

We are a smaller reporting company under Rule 405 of the Securities Act and, as such, have elected to comply with certain reduced public company reporting requirements for this prospectus, the documents incorporated by reference herein, and future filings.

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 3.

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is September 29, 2023

TABLE OF CONTENTS

Important Notice about the Information Presented in this Prospectus

You should rely only on the information contained or incorporated by reference in this prospectus or any applicable prospectus supplement. We have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. For further information, see the section of this prospectus entitled “Where You Can Find More Information.” We are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted.

You should not assume that the information appearing in this prospectus or any applicable prospectus supplement is accurate as of any date other than the date on the front cover of this prospectus or the applicable prospectus supplement or that the information contained in any document incorporated by reference is accurate as of any date other than the date of the document incorporated by reference, regardless of the time of delivery of this prospectus or any prospectus supplement or any sale of common stock. Our business, financial condition, results of operations, and prospects may have changed since such dates.

ABOUT THIS PROSPECTUS

This summary highlights important features of this offering and the information included or incorporated by reference in this prospectus. This summary does not contain all of the information that you should consider before investing in our common stock. You should read the entire prospectus carefully, especially the risks of investing in our common stock discussed under “Risk Factors.”

Unless the context requires otherwise, all references in this report to “IGC,” “the Company,” “we,” “our,” and/or “us” refer to IGC Pharma, Inc. (formerly known as India Globalization Capital, Inc.), together with our subsidiaries and beneficially owned subsidiary.

ABOUT IGC PHARMA, INC.

Overview

IGC Pharma, Inc., is a clinical-stage pharmaceutical company with a diversified revenue model that develops prescription drugs and over-the-counter (OTC) products. We were formerly known as India Globalization Capital, Inc. and incorporated in Maryland on April 29, 2005. Our fiscal year is the 52- or 53-week period ending March 31.

Our focus is on developing innovative therapies for neurological disorders such as Alzheimer’s disease, epilepsy, Tourette syndrome, and sleep disorders. We also focus on formulations for eating disorders, chronic pain, premenstrual syndrome (PMS), and dysmenorrhea, in addition to health and wellness OTC formulations. The Company is developing its proprietary lead candidate, IGC-AD1, an investigational oral therapy for the treatment of agitation associated with Alzheimer’s disease. IGC-AD1 is currently in Phase 2 (Phase 2B) clinical trials after completing nearly a decade of research and realizing positive results from pre-clinical and a Phase 1 trial. This previous research into IGC-AD1 has demonstrated efficacy in reducing plaques and tangles, which are two important hallmarks of Alzheimer’s, as well as reducing neuropsychiatric symptoms associated with dementia in Alzheimer’s disease, such as agitation.

The progress we are making in clinical trials gives us confidence in the potential of IGC-AD1 to be a groundbreaking therapy, with the potential to treat Alzheimer’s and also to manage devastating symptoms that separate families, increase admissions to nursing homes, and drive the cost of Alzheimer’s care. We have filed forty-one (41) patent applications in different countries and secured ten patents, including control of four in the Alzheimer’s space. We have built a facility for a potential Phase 3 trial and have strategic relations for the procurement of Active Pharmaceutical Ingredients (APIs). In addition, we have acquired and initiated work on TGR-63, a pre-clinical molecule that exhibits an impressive affinity for reducing neurotoxicity in Alzheimer’s cell lines. The advancement of IGC-AD1 into Phase 2 trials represents a significant milestone for the Company and positions us for multiple pathways to future success. We anticipate that the positive outcomes from these and other trials will drive further growth, valuation, and market potential for IGC-AD1, although there can be no assurance thereof.

We recognize the significance of operational excellence and cost management in clinical trials. We have established an internal capability to manage trials, including proprietary software, rather than working with an external Contract Research Organization (CRO). We believe this empowers us to substantially reduce the costs associated with clinical trials compared to relying on external CROs. Our proprietary software allows us to streamline the trial processes, enabling seamless coordination and data management. Additionally, we are integrating machine learning technologies into our software framework. We believe this overlay of Artificial Intelligence (AI) will help us simulate trial scenarios, generate new insights to facilitate improved decision-making, efficiently design our Phase 3 trial, provide advanced data analysis, and ultimately enhancing the effectiveness and efficiency of our clinical trials, although there can be no assurance thereof.

The Offering

|

Common stock offered

by selling stockholders

|

10,000,000 shares are of common stock.

|

|

Common stock outstanding before the

offering

|

53,706,939 shares(1)

|

|

Common stock outstanding after the

offering

|

63,706,939 shares

|

| |

|

|

Risk Factors:

|

Investing in our securities is highly speculative and involves a high degree of risk. You should carefully consider the information set forth in the “Risk Factors” section on page 3 before deciding to invest in our securities.

|

| |

|

|

Use of proceeds

|

We will not receive any proceeds from the sale of shares in this offering.

|

|

NYSE American Market symbol

|

IGC

|

|

(1)

|

Based on 53,706,939 shares outstanding on September 22, 2023, the number of shares to be outstanding after this offering excludes the following:

|

| |

●

|

restricted share units/stock awards consisting of 3,934,165 shares of common stock, which awards are subject to vesting;

|

| |

●

|

91,472 units; the “unit” component consists of 1 share of “ordinary” share of common stock and subsequent to the 1 for 10 reverse split; the unit” component consists of .10 “ordinary” common; cash-in- lieu @ $1.95 per share.

|

| |

●

|

150,000 shares of common stock reserved for issuance upon the exercise of outstanding stock options;

|

| |

● |

4,730,002 shares of our common stock reserved for future issuance under our certain special grants to our directors and executive officers.

|

RISK FACTORS

An investment in our securities involves a high degree of risk. In addition to the following risk factors, you should carefully consider the risks, uncertainties, and assumptions discussed in Item 1A., “Risk Factors” of our annual report on Form 10-K for the fiscal year ended March 31, 2023, and in other documents that we subsequently file with the SEC that update, supplement or supersede such information, which documents are incorporated by reference into this prospectus. See “Where You Can Find More Information.” Additional risks not presently known to us or which we consider immaterial based on information currently available to us may also materially adversely affect us. If any of the events anticipated by the risks described occur, our results of operations and financial condition could be adversely affected, which could result in a decline in the market price of our common stock, causing you to lose all or part of your investment.

SPECIAL NOTE ABOUT FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated in this prospectus by reference contain “forward-looking statements.” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Additionally, we or our representatives may, from time to time, make written or verbal forward-looking statements. In this prospectus and the documents incorporated by reference, we discuss plans, expectations, and objectives regarding our business, financial condition, and results of operations. Without limiting the foregoing, statements that are in the future tense, and all statements accompanied by terms such as “believe,” “project,” “expect,” “trend,” “estimate,” “forecast,” “assume,” “intend,” “plan,” “target,” “anticipate,” “outlook,” “preliminary,” “will likely result,” “will continue,” and variations of them and similar terms are intended to be “forward-looking statements” as defined by federal securities laws. We caution you not to place undue reliance on forward-looking statements, which are based upon assumptions, expectations, plans, and projections. In addition, our goals and objectives are aspirational and are not guarantees or promises that such goals and objectives will be met. Forward-looking statements are subject to risks and uncertainties, including those identified in the “Risk Factors” included in this prospectus and in the documents incorporated by reference that may cause actual results to differ materially from those expressed or implied in the forward-looking statements. Forward-looking statements speak only as of the date when they are made. Except as required by federal securities law, we do not undertake any obligation to update forward-looking statements to reflect events, circumstances, changes in expectations, or the occurrence of unanticipated events after the date of those statements.

Forward-looking statements are based upon, among other things, our assumptions with respect to:

|

●

|

the sufficiency of our existing cash and cash equivalents and marketable securities to fund our future operating and capital expenses;

|

|

●

|

our ability to successfully register trademarks and patents, create and market new products and services, including trading in Hong Kong and other parts of South Asia, contract for infrastructure projects and rental of equipment in India, and achieve customer acceptance in the industries we serve;

|

|

●

|

current and future economic and political conditions, including in Hong Kong, North America, Colombia, and India;

|

|

●

|

our ability to accurately predict the future demand for our products and services;

|

|

●

|

our ability to successfully market our hemp-based products in countries and states where hemp and hemp products are legal;

|

|

●

|

our ability to maintain a stock listing on a national securities exchange;

|

|

●

|

our ability to obtain and maintain regulatory approval of our existing product candidates and any other product candidates we may develop, and the labeling under any approval we may obtain;

|

|

●

|

our ability to timely complete regulatory filings;

|

|

●

|

our ability to obtain the U.S. Food and Drug Administration (FDA) approval for an Investigational New Drug Application (INDA) and to successfully run medical trials, including a Phase 2 trial for IGC-AD1;

|

|

●

|

our reliance on third parties to conduct clinical trials and for the manufacture of IGC-AD1 for non-clinical studies and clinical trials;

|

|

●

|

the impact of the COVID-19 pandemic on our results of operations, including the delay in our ability to launch certain projects;

|

|

●

|

our financial performance;

|

|

●

|

the outcome of medical trials that are conducted on our Investigational Drug Candidates and products;

|

|

●

|

our ability to fund the costs of clinical trials and other related expenses;

|

|

●

|

our ability to maintain our intellectual property position and our ability to maintain and protect our intellectual property rights;

|

|

●

|

competition and general acceptance of phytocannabinoids for alternative, pharmaceutical, and nutraceutical therapies;

|

|

●

|

our ability to effectively compete and our dependence on market acceptance of our brands and products within and outside the United States;

|

|

●

|

federal and state legislation and administrative policy regulating phytocannabinoids;

|

|

●

|

our ability (based in part on regulatory concerns) to license our products to processors that can produce pharmaceutical grade phytocannabinoids;

|

|

●

|

our ability to obtain and protect patents for the use of phytocannabinoids in our formulations;

|

|

●

|

our ability to obtain and install equipment for processing and manufacturing hemp and hemp products;

|

|

●

|

our ability to successfully navigate disruptions of information technology systems or data security breaches that could adversely affect our business.

|

You should consider the limitations on and risks associated with forward-looking statements and not unduly rely on the accuracy of predictions contained in such forward-looking statements. As noted above, these forward-looking statements speak only as of the date when they are made. Moreover, in the future, we may make forward-looking statements through our senior management that involve the risk factors and other matters described in this report, as well as other risk factors subsequently identified, including, among others, those identified in our filings with the SEC in our quarterly reports on Form 10-Q and our current reports on Form 8-K.

This document contains statements and claims that are not approved by the FDA, including statements on hemp and hemp extracts, including cannabidiol and other cannabinoids. These statements and claims are intended to be in compliance with state laws, specifically in states where medical cannabis has been legalized, and the diseases which we anticipate our products will target are approved conditions for treatment or usage with cannabis or cannabinoids.

USE OF PROCEEDS

We will not receive any proceeds from the sale of the Securities covered by this prospectus and any accompanying prospectus supplement. All proceeds from the sale of the Securities will be for the respective accounts of the Selling Stockholders named herein.

DESCRIPTION OF TRANSACTION

On June 30, 2023, the Company entered into the 2023 Share Purchase Agreement (the “Purchase Agreement”) with certain investors relating to the sale and issuance by the Company to the investors of an aggregate of 10,000,000 shares of its common stock for a total purchase price of $3,000,000, or $0.30 per share, subject to the terms and conditions set forth in the Purchase Agreement. The investment is subject to customary closing conditions, including NYSE approval. The Purchase Agreement contains certain representations, warranties, and covenants. In addition, both parties have agreed to indemnify each other for losses arising out of breaches of their respective representations, warranties, and covenants and for certain liabilities related to each party’s business, subject to customary limitations.

SELLING STOCKHOLDERS

The following tables set forth information with respect to the beneficial ownership of our common stock by the Selling Stockholders as of September 22, 2023. Beneficial ownership is determined in accordance with SEC rules and generally includes voting or investment power with respect to securities. The Selling Stockholders have not held any position or office or have otherwise had a material relationship with us or any of our subsidiaries within the past three years other than as described in “Description of Transaction” above. To our knowledge, the selling stockholders have sole voting and investment power with respect to their shares of common stock.

The Selling Stockholders, if they desire, may dispose of the shares covered by this prospectus from time to time at such prices as they may choose. Before a stockholder not named below may use this prospectus in connection with an offering of shares, this prospectus must be amended or supplemented to include the name and number of shares beneficially owned by the selling stockholder and the number of shares to be offered. Any amended or supplemented prospectus also will disclose whether any selling stockholder named in that amended or supplemented prospectus has held any position, office, or other material relationship with us or any of our predecessors or affiliates during the three years prior to the date of the amended or supplemented prospectus.

|

Name of Selling Stockholder

|

|

Common

Stock Beneficially Owned

Prior to the

Offering

Shares Percent

|

|

|

Common Stock

Offered

Pursuant to

this Prospectus (1)

|

|

|

Common Stock

Owned Upon

Completion of

this Offering

Shares Percent

|

|

|

Bradbury Strategic Investment Fund A (2)

|

|

|

0 |

|

|

|

0 |

% |

|

|

5,000,000 |

|

|

|

5,000,000 |

|

|

|

7.8 |

% |

|

Bradbury Global Asset S1 Fund SP (2)

|

|

|

0 |

|

|

|

0 |

% |

|

|

300,000 |

|

|

|

300,000 |

|

|

|

0.5 |

% |

|

Bradbury Global Asset S3 Fund SP (2)

|

|

|

0 |

|

|

|

0 |

% |

|

|

1,500,000 |

|

|

|

1,500,000 |

|

|

|

2.4 |

% |

|

Bradbury Global Asset A5 Fund SP (2)

|

|

|

0 |

|

|

|

0 |

% |

|

|

2,000,000 |

|

|

|

2,000,000 |

|

|

|

3.1 |

% |

|

Hoo Mang Leong

|

|

|

0 |

|

|

|

0 |

% |

|

|

170,000 |

|

|

|

170,000 |

|

|

|

0.3 |

% |

|

Wong Wai Kiong

|

|

|

0 |

|

|

|

0 |

% |

|

|

170,000 |

|

|

|

170,000 |

|

|

|

0.3 |

% |

|

Botannia Multi-Asset Strategy Limited (3)

|

|

|

3,181,818 |

|

|

|

5.9 |

% |

|

|

860,000 |

|

|

|

4,041,818 |

|

|

|

6.3 |

% |

|

(1)

|

Assumes the sale of all shares being offered pursuant to this prospectus.

|

|

(2)

|

Bradbury Asset Management (Hong Kong) Limited is the investment manager of each of the Bradbury entities named above. Each fund has investors that may or may not overlap between the funds. The individual who holds voting and investment power in the investment manager is Mr. Loo See Yuen, the Chief Operating Officer of Bradbury Asset Management. The address for each of the entities is Unit 5106-7, 51st Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong.

|

|

(3)

|

Botannia Multi-Asset Strategy Limited address is Unit Level 9F(2), Main Office Tower, Financial Park Labuan, Jalan Merdeka, 87000 Federal Territory of Labuan, Malaysia. The individual who holds the voting and investment power is Mr. Yong Teck Hong, Botannia Multi-Asset Strategy Limited’s Managing Director.

|

DESCRIPTION OF COMMON STOCK

The following is a description of the material terms and provisions of our common stock. It may not contain all the information that is important to you. You can access complete information by referring to our articles of incorporation and by-laws, each as amended to date, which we refer to as our “articles of incorporation” and “by-laws.”

General

We are a Maryland corporation. Under our articles of incorporation, we have authority to issue 150,000,000 shares of common stock, par value $0.0001 per share, and 1,000,000 shares of preferred stock, par value $0.0001 per share.

As of September 22, 2023, there were issued and outstanding:

|

●

|

53,706,939 shares of common stock;

|

| ● |

no shares of preferred stock; |

| ● |

restricted share units/stock awards consisting of 3,934,165 shares of common stock, which awards are subject to vesting; |

| ● |

91,472 units; the “unit” component consists of 1 share of “ordinary” share of common stock and subsequent to the 1 for 10 reverse split; the unit” component consists of .10 “ordinary” common; cash-in- lieu @ $1.95 per share. |

| ● |

150,000 shares of common stock reserved for issuance upon the exercise of outstanding stock options; |

| ● |

4,730,002 shares of our common stock reserved for future issuance under our certain special grants to our directors and executive officers. |

Voting, Dividends, and Other Rights

Holders of shares of our common stock are entitled to one vote for each share held of record on each matter submitted to a vote of stockholders. There is no cumulative voting for election of directors. Accordingly, the holders of a majority of our outstanding shares of common stock are entitled to vote in any election of directors and can elect all of the directors standing for election if they should so choose. As additional and material consideration for 2023 Share Purchase Agreement, the Investors agreed and warranted that they shall vote in favor of and in accordance with the recommendations of the Company's Board of Directors at each of (i) the seven (7) consecutive annual shareholders’ meetings immediately following execution of this Agreement and (ii) all special shareholders’ meetings that are held prior to the eighth annual shareholders meeting immediately following execution of this Agreement. The Investor agrees that in the event the Investor is unable to vote the shares, it hereby authorizes the Company to cast the vote on its behalf. Holders of shares of our common stock are entitled to receive dividends ratably when, as, and if declared by the board of directors out of funds legally available therefor and, upon our liquidation, dissolution, or winding up, are entitled to share ratably in all assets remaining after payment of liabilities. Holders of shares of our common stock have no preemptive rights and have no rights to convert their common stock into any other securities. There are no redemption or sinking fund provisions applicable to our common stock. The outstanding shares of our common stock are, and the shares of common stock to be sold in this offering will be, when issued, validly authorized and issued, fully paid and nonassessable.

Transfer Agent

The transfer agent and registrar for our common stock is Continental Stock Transfer & Trust Co., and its address is 1 State Street, 30th Floor, New York, NY 10004-1561, telephone number +1 (212) 509-4000.

Listing

Our common stock is listed for trading on the NYSE American under the symbol IGC. It is also quoted on the Frankfurt, Berlin, and Stuttgart (XETRA2) stock exchanges in Germany under the symbol IGSI.

General

We may issue units consisting of common stock, warrants, or any combination thereof. Each unit will be issued so that the holder of the unit is also the holder of each security included in the unit. Thus, the holder of a unit will have the rights and obligations of a holder of each included security. The unit agreement under which a unit is issued may provide that the securities included in the unit may not be held or transferred separately, at any time, or at any time before a specified date.

We will describe in the applicable prospectus supplement the terms of the series of units, including the following:

|

●

|

the designation and terms of the units and of the securities comprising the units, including whether and under what circumstances those securities may be held or transferred separately;

|

|

●

|

any provisions of the governing unit agreement that differ from those described below;

|

|

●

|

any provisions for the issuance, payment, settlement, transfer, or exchange of the units or of the securities comprising the units;

|

|

●

|

the designation and terms of the units and of the securities comprising the units, including whether and under what circumstances those securities may be held or transferred separately;

|

|

●

|

any provisions of the governing unit agreement that differ from those described below; and

|

|

●

|

any provisions for the issuance, payment, settlement, transfer, or exchange of the units or of the securities comprising the units.

|

The provisions described in this section, as well as those described under “Description of Common Stock,” “Description of Warrants,” and “Description of Units,” will apply to each unit and to any common stock or warrant included in each unit, respectively.

ANTI-TAKEOVER LAW, LIMITATIONS OF LIABILITY AND INDEMNIFICATION

Business Combinations

Under the Maryland General Corporation Law, some business combinations, including a merger, consolidation, share exchange, or, in some circumstances, an asset transfer or issuance or reclassification of equity securities, are prohibited for a period of time and require an extraordinary vote. These transactions include those between a Maryland corporation and the following persons (a Specified Person):

An interested stockholder who is defined as any person (other than a subsidiary) who beneficially owns 10% or more of the corporation’s voting stock or who is an affiliate or an associate of the corporation who, at any time within a two-year period prior to the transaction, was the beneficial owner of 10% or more of the voting power of the corporation’s voting stock; or an affiliate of an interested stockholder.

A person is not an interested stockholder if the board of directors approves in advance the transaction by which the person otherwise would have become an interested stockholder. The board of directors of a Maryland corporation also may exempt a person from these business combination restrictions prior to the time the person becomes a Specified Person and may provide that its exemption be subject to compliance with any terms and conditions determined by the board of directors. Transactions between a corporation and a Specified Person are prohibited for five years after the most recent date on which such stockholder becomes a Specified Person. After five years, any business combination must be recommended by the board of directors of the corporation and approved by at least 80% of the votes entitled to be cast by holders of voting stock of the corporation and two-thirds of the votes entitled to be cast by holders of shares other than voting stock held by the Specified Person with whom the business combination is to be effected, unless the corporation’s stockholders receive a minimum price as defined by Maryland law and other conditions under Maryland law are satisfied.

A Maryland corporation may elect not to be governed by these provisions by having its board of directors exempt various Specified Persons, by including a provision in its charter expressly electing not to be governed by the applicable provision of Maryland law, or by amending its existing charter with the approval of at least 80% of the votes entitled to be cast by holders of outstanding shares of voting stock of the corporation and two-thirds of the votes entitled to be cast by holders of shares other than those held by any Specified Person. Our Charter does not include any provision opting out of these business combination provisions.

Control Share Acquisitions

The Maryland General Corporation Law also prevents, subject to exceptions, an acquirer who acquires sufficient shares to exercise specified percentages of the voting power of a corporation from having any voting rights except to the extent approved by two-thirds of the votes entitled to be cast on the matter not including shares of stock owned by the acquiring person, any directors who are employees of the corporation and any officers of the corporation. These provisions are referred to as the control share acquisition statute.

The control share acquisition statute does not apply to shares acquired in a merger, consolidation, or share exchange if the corporation is a party to the transaction or to acquisitions approved or exempted prior to the acquisition by a provision contained in the corporation’s charter or bylaws. Our Bylaws include a provision exempting us from the restrictions of the control share acquisition statute, but this provision could be amended or rescinded either before or after a person acquired control shares. As a result, the control share acquisition statute could discourage offers to acquire our common stock and could increase the difficulty of completing an offer.

Board of Directors

The Maryland General Corporation Law provides that a Maryland corporation which is subject to the Exchange Act and has at least three outside directors (who are not affiliated with an acquirer of the company) under certain circumstances may elect by resolution of the board of directors or by amendment of its charter or bylaws to be subject to statutory corporate governance provisions that may be inconsistent with the corporation’s charter and bylaws. Under these provisions, a board of directors may divide itself into three separate classes without the vote of stockholders such that only one-third of the directors are elected each year. A board of directors classified in this manner cannot be altered by amendment to the charter of the corporation. Further, the board of directors may, by electing to be covered by the applicable statutory provisions and notwithstanding the corporation’s charter or bylaws:

|

●

|

provide that a special meeting of stockholders will be called only at the request of stockholders entitled to cast at least a majority of the votes entitled to be cast at the meeting,

|

|

●

|

reserve for itself the right to fix the number of directors,

|

|

●

|

provide that a director may be removed only by the vote of at least two-thirds of the votes entitled to be cast generally in the election of directors and

|

|

●

|

retain for itself sole authority to fill vacancies created by an increase in the size of the board or the death, removal, or resignation of a director.

|

In addition, a director elected to fill a vacancy under these provisions serves for the balance of the unexpired term instead of until the next annual meeting of stockholders. A board of directors may implement all or any of these provisions without amending the charter or bylaws and without stockholder approval. Although a corporation may be prohibited by its charter or by resolution of its board of directors from electing any of the provisions of the statute, we have not adopted such a prohibition. We have adopted a staggered board of directors with three separate classes in our charter and given the board the right to fix the number of directors, but we have not prohibited the amendment of these provisions. The adoption of the staggered board may discourage offers to acquire our common stock and may increase the difficulty of completing an offer to acquire our stock. If our Board chooses to implement the statutory provisions, it could further discourage offers to acquire our common stock and could further increase the difficulty of completing an offer to acquire our common stock.

Effect of Certain Provisions of our Articles of Incorporation and Bylaws

In addition to the Charter and Bylaws provisions discussed above, certain other provisions of our Bylaws may have the effect of impeding the acquisition of control of our Company by means of a tender offer, proxy fight, open market purchases, or otherwise in a transaction not approved by our Board of Directors. These provisions of the Bylaws are intended to reduce our vulnerability to an unsolicited proposal for the restructuring or sale of all or substantially all of our assets or an unsolicited takeover attempt, which our Board believes is otherwise unfair to our stockholders. These provisions, however, also could have the effect of delaying, deterring, or preventing a change in control of our Company.

Our Bylaws provide that with respect to annual meetings of stockholders, (i) nominations of individuals for election to our Board of Directors and (ii) the proposal of business to be considered by stockholders may be made only pursuant to our notice of the meeting, by or at the direction of our Board of Directors, or by a stockholder who is entitled to vote at the meeting and has complied with the advance notice procedures set forth in our Bylaws.

Special meetings of stockholders may be called only by the chief executive officer, the board of directors, or the secretary of our Company (upon the written request of the holders of a majority of the shares entitled to vote). At a special meeting of stockholders, the only business that may be conducted is the business specified in our notice of meeting. With respect to nominations of persons for election to our Board of Directors, nominations may be made at a special meeting of stockholders only pursuant to our notice of meeting, by or at the direction of our Board of Directors, or if our Board of Directors has determined that directors will be elected at the special meeting, by a stockholder who is entitled to vote at the meeting and has complied with the advance notice procedures set forth in our Bylaws.

These procedures may limit the ability of stockholders to bring business before a stockholders meeting, including the nomination of directors and the consideration of any transaction that could result in a change in control and that may result in a premium to our stockholders.

Disclosure of the SEC’s Position on Indemnification for Securities Act Liabilities

Insofar as indemnification for liabilities under the Securities Act may be permitted to directors, officers, or persons controlling us pursuant to the above provisions, we have been informed that, in the opinion of the SEC, such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment of expenses incurred or paid by a director, officer, or controlling person in the successful defense of any action, suit, or proceeding) is asserted by such director, officer or controlling person in connection with the shares of common stock being registered, we will, unless in the opinion of our counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by us is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

PLAN OF DISTRIBUTION

The Selling Stockholders may, from time to time, sell any or all of their shares of common stock on any stock exchange, market, or trading facility on which the shares are traded or in private transactions. We will not receive any of the proceeds from the sale of the common stock covered by this prospectus by the Selling Stockholders. The Selling Stockholders will act independently of us in making decisions with respect to the timing, manner, and size of each sale. We will bear all fees and expenses incident to our obligation to register the common stock covered by this prospectus. These sales may be at fixed or negotiated prices. The Selling Stockholders may use any one or more of the following methods when selling shares:

|

●

|

ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

|

|

●

|

block trades in which the broker-dealer will attempt to sell the Securities as an agent but may position and resell a portion of the block as principal to facilitate the transaction;

|

|

●

|

Purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

|

|

●

|

An exchange distribution in accordance with the rules of the applicable exchange;

|

|

●

|

Privately negotiated transactions;

|

|

●

|

Short sales effected after the effective date of the registration statement of which this prospectus is a part;

|

|

●

|

Broker-dealers may agree with the Selling Stockholders to sell a specified number of such shares at a stipulated price per share;

|

|

●

|

A combination of any such methods of sale and

|

|

●

|

Any other method permitted pursuant to applicable law.

|

The Selling Stockholders may also sell shares under Rule 144 under the Securities Act, if available, rather than under this prospectus.

Broker-dealers engaged by the Selling Stockholders may arrange for other broker-dealers to participate in sales. Broker-dealers may receive commissions or discounts from the Selling Stockholders (or, if any broker-dealer acts as agent for the purchaser of shares, from the purchaser) in amounts to be negotiated. The Selling Stockholders do not expect these commissions and discounts to exceed what is customary in the types of transactions involved. Any profits on the resale of shares of common stock by a broker-dealer acting as principal might be deemed to be underwriting discounts or commissions under the Securities Act. Discounts, concessions, commissions, and similar selling expenses, if any, attributable to the sale of shares will be borne by a Selling Stockholder. The Selling Stockholders may agree to indemnify any agent, dealer, or broker-dealer that participates in transactions involving sales of shares if liabilities are imposed on that person under the Securities Act.

The Selling Stockholders may, from time to time, pledge or grant a security interest in some or all of the shares of common stock owned by them, and if they default in the performance of their secured obligations, the pledgees or secured parties may offer and sell the shares of common stock from time to time under this prospectus after we have filed a supplement to this prospectus under Rule 424(b)(3) or other applicable provision of the Securities Act supplementing or amending the list of Selling Stockholders to include the pledgee, transferee or other successors in interest as selling stockholders under this prospectus.

The Selling Stockholders also may transfer the shares of common stock in other circumstances, in which case the transferees, pledgees, or other successors in interest will be the selling beneficial owners for purposes of this prospectus and may sell the shares of common stock or warrants from time to time under this prospectus after we have filed a supplement to this prospectus under Rule 424(b)(3) or other applicable provision of the Securities Act supplementing or amending the list of Selling Stockholders to include the pledgee, transferee or other successors in interest as selling stockholders under this prospectus.

The Selling Stockholders and any broker-dealers or agents that are involved in selling the shares of common stock may be deemed to be “underwriters” within the meaning of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers or agents and any profit on the resale of the shares of common stock purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act.

We are required to pay all fees and expenses incident to the registration of the shares of common stock. We have agreed to indemnify the Selling Stockholders against certain losses, claims, damages, and liabilities, including liabilities under the Securities Act.

The Selling Stockholders have advised us that they have not entered into any agreements, understandings, or arrangements with any underwriters or broker-dealers regarding the sale of their shares of common stock, nor is there an underwriter or coordinating broker acting in connection with a proposed sale of shares of common stock by any Selling Stockholder. If we are notified by any Selling Stockholder that any material arrangement has been entered into with a broker-dealer for the sale of shares of common stock, if required, we will file a supplement to this prospectus. If the Selling Stockholders use this prospectus for any sale of the shares of common stock, they will be subject to the prospectus delivery requirements of the Securities Act.

To the extent required pursuant to Rule 424(b) under the Securities Act, the Securities to be sold, the names of the selling stockholders, the purchase price and public offering price, the names of any agents, dealer or underwriter, and any applicable commissions or discounts with respect to a particular offer will be set forth in an accompanying prospectus supplement or, if appropriate, a post-effective amendment to the registration statement that includes this prospectus.

In order to comply with the securities laws of some states, if applicable, the Securities may be sold in these jurisdictions only through registered or licensed brokers or dealers. In addition, in some states, the Securities may not be sold unless they have been registered or qualified for sale, or an exemption from registration or qualification requirements is available, and the Selling Stockholder complies with such exemption’s requirements.

The Selling Stockholders and any other person participating in a sale of the Securities registered under this prospectus will be subject to applicable provisions of the Exchange Act and the rules and regulations thereunder, including, without limitation, to the extent applicable, Regulation M of the Exchange Act, which may limit the timing of purchases and sales of any of the Securities by the selling stockholders and any other participating person.

All of the foregoing may affect the marketability of Securities and the ability of any person or entity to engage in market-making activities with respect to the Securities. In addition, we will make copies of this prospectus (as it may be supplemented or amended from time to time) available to the selling stockholders for the purpose of satisfying the prospectus delivery requirements of the Securities Act. The selling stockholders may indemnify any broker-dealer that participates in transactions involving the sale of the Securities against certain liabilities, including liabilities arising under the Securities Act.

There can be no assurance that the selling stockholders will sell any or all of the shares of our common stock registered pursuant to the registration statement, of which this prospectus forms a part.

Once sold under the registration statement, of which this prospectus forms a part, the shares of common stock will be freely tradable in the hands of persons other than our affiliates.

EXPERTS

The consolidated financial statements of IGC Pharma, Inc. included in our annual report on Form 10-K for the fiscal year ended March 31, 2023, and March 31, 2022, have been audited by Manohar Chowdhry & Associates, independent registered public accountants, as set forth in their reports thereon, included therein, and incorporated herein by reference in this prospectus and elsewhere in the registration statement. Such consolidated financial statements are incorporated herein by reference in reliance upon such reports given on the authority of said firm as experts in accounting and auditing.

LEGAL MATTERS

Olshan Frome Wolosky LLP, New York, as our counsel, has opined as to the legality of the shares of common stock being offered by this registration statement.

WHERE YOU CAN FIND MORE INFORMATION

We are a public company and file annual, quarterly, and special reports, proxy statements, and other information with the SEC. Our SEC filings are available, at no charge, to the public at the SEC’s website at http://www.sec.gov.

This prospectus is part of a registration statement on Form S-3 that we filed with the SEC. The registration statement contains more information than this prospectus regarding us and our common stock, including certain exhibits and schedules. You can obtain a copy of the registration statement from the SEC at the address listed above or from the SEC’s Internet site.

You may also access our SEC filings at our website https://igcpharma.com/. The information on our Internet website is not incorporated by reference in this prospectus.

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

We are “incorporating by reference” information into this prospectus. This means that we are disclosing important information to you by referring you to another document that has been filed separately with the SEC. The information incorporated by reference is considered to be part of this prospectus, and information that we file later with the SEC will automatically update and supersede the information contained in documents filed earlier with the SEC or contained in this prospectus. We incorporate by reference in this prospectus supplement the documents listed below and any future filings made by us with the SEC under Sections 13(a), 13(c), 14, and 15(d) of the Exchange Act after the initial filing of this prospectus supplement and prior to the time that we sell all of the securities offered by this prospectus supplement and the accompanying prospectus (except in each case the information contained in such documents to the extent “furnished” and not “filed”):

|

●

|

Annual Report on Form 10-K for the fiscal year ended March 31, 2023, filed with the SEC on July 7, 2023;

|

|

●

|

Our Quarterly Report on Form 10-Q for the quarter ended June 30, 2023, filed with the SEC on August 10, 2023;

|

|

●

|

Our Current Reports on Form 8-K (excluding any reports or portions thereof that are deemed to be furnished and not filed), filed with the SEC on May 8, 2023, July 7, 2023, July 7, 2023, and August 21, 2023; and

|

|

●

|

The description of our common stock contained in our Registration Statement on Form 8-A filed pursuant to Section 12 of the Exchange Act on March 7, 2006, and any amendments or reports filed for the purpose of updating the description.

|

Any statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained herein or in any other subsequently filed document which also is or is deemed to be incorporated by reference herein modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

We will provide to each person, including any beneficial owner to whom this prospectus supplement is delivered, a copy of any or all of the information that has been incorporated by reference in this prospectus supplement but not delivered with this prospectus supplement. Copies of the above documents (other than exhibits to such documents unless those exhibits have been specifically incorporated by reference in this prospectus supplement) may be obtained upon written or oral request, without charge to you, by contacting:

IGC Pharma, Inc.

Attn: Corporate Secretary

10224 Falls Road

Potomac, Maryland 20854

Telephone: +1 (301) 983-0998.

You should rely only on the information contained in this prospectus, including information incorporated by reference as described above or any prospectus supplement that we have specifically referred you to. We have not authorized anyone else to provide you with different information. You should not assume that the information in this prospectus or any prospectus supplement is accurate as of any date other than the date on the front of those documents or that any document incorporated by reference is accurate as of any date other than its filing date. You should not consider this prospectus to be an offer or solicitation relating to the securities in any jurisdiction in which such an offer or solicitation relating to the securities is not authorized. Furthermore, you should not consider this prospectus to be an offer or solicitation relating to the securities if the person making the offer or solicitation is not qualified to do so or if it is unlawful for you to receive such an offer or solicitation.

PART II

INFORMATION NOT REQUIRED IN THE PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution

The following table sets forth the various expenses to be incurred in connection with the sale and distribution of the securities being registered hereby, all of which will be borne by the Company (except any underwriting discounts and commissions and expenses incurred by the selling stockholders for brokerage, accounting, tax or legal services or any other expenses incurred by the selling stockholders in connection with the sale of the shares). All amounts shown are estimates except the SEC registration fee.

|

SEC registration fee

|

|

$ |

442.8 |

|

|

Legal fees and expenses

|

|

|

* |

|

|

Accounting fees and expenses

|

|

|

* |

|

|

Transfer agent fees and expenses

|

|

|

* |

|

|

Printing fees and expenses

|

|

|

* |

|

|

Miscellaneous expenses

|

|

|

* |

|

|

Total expenses

|

|

$ |

442.8 |

|

|

*

|

|

These fees and expenses are calculated based on the securities offered and the number of issuances and, accordingly, cannot be estimated at this time. An estimate of the aggregate amount of these expenses will be reflected in the applicable prospectus supplement.

|

|

Item 15. Indemnification of Directors and Officers

Paragraph B of Article Ten of our amended and restated articles of incorporation provides as follows:

“The Corporation, to the full extent permitted by Section 2-418 of the MGCL, as amended from time to time, shall indemnify all persons whom it may indemnify pursuant thereto. Expenses (including attorneys’ fees) incurred by an officer or director in defending any civil, criminal, administrative, or investigative action, suit, or proceeding or which such officer or director may be entitled to indemnification hereunder shall be paid by the Corporation in advance of the final disposition of such action, suit or proceeding upon receipt of an undertaking by or on behalf of such director or officer to repay such amount if it shall ultimately be determined that he or she is not entitled to be indemnified by the Corporation as authorized hereby.”

Article IX of our bylaws also provides for indemnification of our directors, officers, employees, or agents for certain matters in accordance with Section 2-418 of the Maryland General Corporation Law.

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to our directors, officers, and controlling persons pursuant to the foregoing provisions, or otherwise, we have been advised that in the opinion of the SEC, such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment of expenses incurred or paid by a director, officer, or controlling person in a successful defense of any action, suit, or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, we will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to the court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

Item 16. Exhibits and Financial Statement Schedules

The exhibits listed in the following Exhibit Index are filed as part of this Registration Statement on Form S-3.

|

Exhibit No.

|

Description

|

|

3.1

|

Amended and Restated Articles of Incorporation (incorporated by reference to Exhibit 3.1 to the registrant’s current report on Form 8-K filed on August 6, 2012).

|

|

3.2

|

Amendment to the Amended and Restated Articles of Incorporation of the Registrant as amended on August 2, 2014. (incorporated by reference to Exhibit 3.3 to the Company’s Post-Effective Amendment No.1 to Form S-3 filed on January 22, 2021).

|

|

3.3

|

Articles of Amendment to the Company’s Amended and Restated Articles of Incorporation filed with the State Department of Assessments and Taxation of Maryland on March 7, 2023 (incorporated by reference to Exhibit 3.1 to the Company’s Current Report on Form 8-K filed on March 21, 2023).

|

|

3.4

|

By-laws of the Registrant (incorporated by reference to Exhibit 3.3 to the Company’s Post-Effective Amendment No.1 to Form S-3 filed on January 22, 2021).

|

|

3.5

|

Amendment to the Bylaws of the Company dated March 2, 2023 (incorporated by reference to Exhibit 3.2 to the Company’s Current Report on Form 8-K filed on March 21, 2023).

|

|

5.1*

|

Opinion of Olshan Frome Wolosky LLP, counsel to the registrant, as to the legality of the securities.

|

|

23.1*

|

Consent of Manohar Chowdhry & Associates, independent registered public accounting firm.

|

|

23.3*

|

Consent of Olshan Frome Wolosky LLP (included in the opinion filed as Exhibit 5.1).

|

|

24.1

|

Power of Attorney (set forth on the signature page of the registration statement).

|

| 107 |

Filing Fee Table |

Unless otherwise indicated, exhibits were previously filed.

Item 17. Undertakings

| |

(a)

|

The undersigned registrant hereby undertakes:

|

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i) To include any prospectus required by Section 10(a)(3) of the Securities Act.

(ii) To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than 20% change in the maximum aggregate offering price set forth in the “Calculation of Filing Fee Tables” or “Calculation of Registration Fee” table, as applicable, in the effective registration statement; and

(iii) To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

provided, however, that paragraphs (a)(1)(i), (ii) and (iii) above do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the registrant pursuant to Section 13 or 15(d) of the Exchange Act that are incorporated by reference in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

That, for the purpose of determining liability under the Securities Act of 1933 to any purchaser:

(i) If the registrant is relying on Rule 430B:

(A) Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement and

(B) Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information required by Section 10(a) of the Securities Act shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date; or

(ii) If the Registrant is subject to Rule 430C, each prospectus filed pursuant to Rule 424(b) as part of a registration statement relating to an offering, other than registration statements relying on Rule 430B or other than prospectuses filed in reliance on Rule 430A, shall be deemed to be part of and included in the registration statement as of the date it is first used after effectiveness. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such first use, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such date of first use.

That, for the purpose of determining the liability of the Registrant under the Securities Act of 1933 to any purchaser in the initial distribution of the securities, the undersigned Registrant undertakes that in a primary offering of securities of the undersigned Registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned Registrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

(i) Any preliminary prospectus or prospectus of the undersigned Registrant relating to the offering required to be filed pursuant to Rule 424;

(ii) Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned Registrant or used or referred to by the undersigned Registrant;

(iii) The portion of any other free writing prospectus relating to the offering containing material information about the undersigned Registrant or its securities provided by or on behalf of the undersigned Registrant; and

(iv) Any other communication that is an offer in the offering made by the undersigned Registrant to the purchaser.

The undersigned hereby undertakes that, for purposes of determining any liability under the Securities Act of 1933, each filing of the Registrant’s annual report pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers, and controlling persons of the registrant pursuant to the provisions described in Item 15 above, or otherwise, the registrant has been advised that in the opinion of the Securities and Exchange Commission, such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer, or controlling person of the registrant in the successful defense of any action, suit, or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, as amended, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-3 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Potomac, State of Maryland, on this 29 day of September 2023.

| |

IGC PHARMA, INC.

|

| |

|

| |

By:

|

/s/ Ram Mukunda

|

|

| |

|

Ram Mukunda

|

|

| |

|

President and Chief Executive Officer

|

POWER OF ATTORNEY

Each person whose signature appears below hereby constitutes and appoints Ram Mukunda and Claudia Grimaldi and each of them severally, as his or her true and lawful attorney-in-fact and agent with full power of substitution and resubstitution, for him or her in his or her name, place and stead, in any and all capacities, to sign any and all amendments to this registration statement and any additional registration statement pursuant to Rule 462(b) under the Securities Act of 1933 and to file the same, with all exhibits thereto, and other documents in connection therewith, with the Securities and Exchange Commission, and hereby grants to such attorney-in-fact and agent, full power and authority to do and perform each and every act and thing requisite and necessary to be done, as fully to all intents and purposes as he or she might or could do in person, hereby ratifying and confirming all that said attorney-in-fact and agent or his or her substitute or substitutes may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, as amended, this registration statement has been signed by the following persons in the capacities and on the dates indicated.

|

Signature

|

|

Title

|

|

Date

|

| |

|

|

|

|

|

/s/ Ram Mukunda

|

|

President and Chief Executive Officer (Principal

|

|

September 29, 2023

|

|

Ram Mukunda

|

|

Executive Officer)

|

|

|

|

/s/ Richard Prins

|

|

Chairman of the Board of Directors

|

|

September 29, 2023

|

|

Richard Prins

|

|

|

|

|

|

/s/ Claudia Grimaldi

|

|

Vice President and Director (Principal Financial Officer)

|

|

September 29, 2023

|

|

Claudia Grimaldi

|

|

|

|

|

|

/s/ James Moran

|

|

Director

|

|

September 29, 2023

|

|

James Moran

|

|

|

|

|

Exhibit 5.1

OLSHAN FROME WOLOSKY LLP

1325 Avenue of the Americas, 15th Floor

New York, New York 10019

September 28, 2023

IGC Pharma, Inc.

10224 Falls Road

Potomac, Maryland 20854

Re: Registration Statement on Form S-3

Ladies and Gentlemen:

This opinion is furnished to you in connection with a Registration Statement on Form S-3 (the “Registration Statement”) to be filed with the Securities and Exchange Commission (the “Commission”) under the Securities Act of 1933, as amended (the “Securities Act”), for the registration of 10,000,000 shares of Common Stock, par value $0.0001 per share (the “Shares”), of IGC Pharma, Inc., a Maryland corporation (the “Company”), issuable pursuant to the Share Purchase Agreement, date June 30, 2023, between the Company and the investors party thereto (the “Purchase Agreement”). The Shares are being registered on behalf of the selling stockholders of the Company.

We are acting as counsel for the Company in connection with the registration for resale of the Shares. We have examined signed copies of the Registration Statement to be filed with the Commission. We have also examined and relied upon minutes of meetings of the stockholders and the Board of Directors of the Company as provided to us by the Company, stock record books of the Company as provided to us by the Company, the Articles of Incorporation and By-laws of the Company, each as amended to date, and such other documents as we have deemed necessary for purposes of rendering the opinions hereinafter set forth. This opinion is subject to the assumption that the required shareholder approval to amend the Company’s Articles of Incorporation to increase the authorized number of Shares will be obtained prior to the effective date of this Registration Statement.

In our examination of the foregoing documents, we have assumed the genuineness of all signatures, the authenticity of all documents submitted to us as originals, the conformity to original documents of all documents submitted to us as copies, the authenticity of the originals of such latter documents and the legal competence of all signatories to such documents.

We assume that the appropriate action will be taken, prior to the offer and sale of the Shares, to register and qualify the Shares for sale under all applicable state securities or “blue sky” laws.

Based upon and subject to the foregoing, we are of the opinion that the Shares issued in accordance with the terms of the Share Purchase Agreement are validly issued, fully paid, and nonassessable.

It is understood that this opinion is to be used only in connection with the offer and sale of the Shares while the Registration Statement is in effect.

Please note that we are opining only as to the matters expressly set forth herein, and no opinion should be inferred as to any other matters. This opinion is based upon currently existing statutes, rules, regulations, and judicial decisions, and we disclaim any obligation to advise you of any change in any of these sources of law or subsequent legal or factual developments which might affect any matters or opinion set forth herein.

We hereby consent to the filing of this opinion with the Commission as an exhibit to the Registration Statement in accordance with the requirements of Item 601(b)(5) of Regulation S-K under the Securities Act and to the use of our name therein and in the related prospectus under the caption “Legal Matters.” In giving such consent, we do not hereby admit that we are in the category of persons whose consent is required under Section 7 of the Securities Act or the rules and regulations of the Commission.

| |

|

| |

Very truly yours,

|

| |

|

| |

|

| |

/s/ OLSHAN FROME WOLOSKY LLP

|

| |

OLSHAN FROME WOLOSKY LLP

|

Exhibit 23.1

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors

IGC Pharma, Inc.