The Marygold Companies, Inc. (“TMC,” or the “Company”) (NYSE

American: MGLD), a diversified global holding firm with a focus on

financial services, today reported financial results for the three

and nine months ended March 31, 2024.

Revenue for the three months ended March 31, 2024 was $7.9

million, compared with $8.3 million, last year. The Company

recorded a net loss of $0.5 million, equal to a loss of $0.01 per

share, for the fiscal 2024 third quarter, reflecting continued

investment in the Marygold & Co. fintech app. The total amount

expensed in the three months ended March 31, 2024 for Marygold

& Co. was $1.3 million, bringing the total amount invested in

the fintech app by TMC to $13.5 million since Marygold & Co.’s

inception. TMC reported net income of $0.2 million, or

approximately breakeven per share, for the same quarter a year

ago.

For the nine-month period ended March 31, 2024, revenue was

$24.6 million, versus $26 million for the comparable period last

year. A net loss of $2.2 million, or $0.05 per share, was recorded

for the nine months ended March 31, 2024, versus net income of $0.8

million, equal to $0.02 per fully diluted share, for the same

period a year ago.

TMC’s balance sheet remained strong at March 31, 2024. Cash and

cash equivalents amounted to $4.5 million, and investments totaled

$11.6 million at the end of the quarter, and the Company has

essentially no debt. Total assets at March 31, 2024, were $33.7

million, and total stockholders’ equity at quarter’s end was $28.4

million.

“Operations overall remained on budget, with increased revenues

this quarter over the prior year for our non-financial services

subsidiaries,” said David Neibert, TMC’s Chief Operations Officer.

“Revenues were up slightly for our foreign subsidiaries as well,

despite an unfavorable trend in currency translation rates this

quarter as compared with the same period last year. However, our

largest subsidiary, USCF Investments, closed out the quarter with

an average of $3.0 billion in assets under management, and thus

lower revenues, as compared with the quarter ended March 31, 2023,

when assets under management averaged $3.7 billion.

“We anticipate a continued steady flow of revenues from our core

business units in the coming quarter and using those cash flows to

continue the development and marketing of our newest offering,

Marygold & Co.’s mobile fintech banking app. Use of capital

from segment operations toward the furtherance of Marygold &

Co.’s business plan is expected to produce modest consolidated net

losses for the balance of this fiscal year,” Neibert added.

Nicholas Gerber, TMC’s Chief Executive Officer, said, “Even

though TMC has recorded losses on a consolidated basis due to our

continued investment in the fintech space, we are still basically

debt-free and building long-term value in our Company. I am also

pleased to report we are making good progress toward launching our

proprietary mobile banking app in the U.K.

“Subsequent to the close of the quarter, we finalized the

acquisition of yet another investment advisory firm in the U.K.,

Step-by-Step Financial Planners Limited (“SBS”). This new addition

joins Tiger Financial and Asset Management as a business unit of

our wholly owned subsidiary, Marygold & Co. (UK) Limited, and

brings our total assets under management in the U.K. to

approximately $75 million. With the client base of these two

advisory firms as a starting point, we hope to launch our Marygold

mobile banking app with an in-place potential user base in the UK

within the coming months,” Gerber said.

Business Units

The Company’s USCF Investments subsidiary,

www.uscfinvestments.com, acquired in 2016 and based in Walnut

Creek, Calif., serves as manager, operator or investment adviser to

16 exchange traded products, structured as limited partnerships or

investment trusts that issue shares trading on the NYSE Arca.

Gourmet Foods, https://gourmetfoodsltd.co.nz/, acquired in 2015,

is a commercial-scale bakery that produces and distributes iconic

meat pies and pastries throughout New Zealand under the brand names

Pat’s Pantry and Ponsonby Pies. Acquired by Gourmet Foods in 2020,

Printstock Products Limited https://www.printstocknz.com/, is a

printer of specialized food wrappers and is located in Napier, New

Zealand.

Brigadier Security Systems, www.brigadiersecurity.com, acquired

in 2016 and headquartered in Saskatoon, Canada, provides

comprehensive security solutions to homes and businesses,

government offices, schools and other public buildings throughout

the province under the brands Brigadier Security Systems and Elite

Security.

Original Sprout, acquired in 2017, with warehouse and office

facilities located in San Clemente, California

www.originalsprout.com, produces and distributes a full line of

vegan, safe, non-toxic hair and skin care products, distributed in

the U.S. and many regions throughout the world.

Marygold & Co., formed in the U.S. during 2019 and operating

from offices in Denver, CO, together with its wholly owned

subsidiary, Marygold & Co. Advisory Services, LLC, was

established to explore opportunities in the financial technology

sector. The company continues further development of its mobile

banking app, having completed the soft launch in the U.S. in 2023.

https://marygoldandco.com/

Marygold & Co. (UK) Limited, formed in the U.K. during 2021,

operates through its subsidiary acquired in 2022, Tiger Financial

& Asset Management Limited (“Tiger”), a U.K. based investment

adviser. Tiger’s core business is managing clients’ financial

wealth across a diverse product range, including cash, national

savings, individual savings accounts, unit trusts, insurance

company products such as investment bonds and other investment

vehicles. http://www.tfam.co.uk/

About The Marygold Companies, Inc.

The Marygold Companies, Inc., which changed its name from

Concierge Technologies, Inc. in 2022, was founded in 1996 and

repositioned as a global holding firm in 2015. The Company

currently has operating subsidiaries in financial services, food

manufacturing, printing, security systems and beauty products,

under the trade names USCF Investments, Marygold & Co., Tiger

Financial & Asset Management Limited, Gourmet Foods, Printstock

Products, Brigadier Security Systems and Original Sprout,

respectively. Offices and manufacturing operations are in the U.S.,

New Zealand, U.K., and Canada. For more information, visit

www.themarygoldcompanies.com.

Forward-Looking Statements

This press release includes “forward-looking statements” within

the meaning of U.S. federal securities laws. Words such as

“expect,” “estimate,” “project,” “budget,” “forecast,”

“anticipate,” “intend,” “plan,” “may” “will,” “could,” “should”

“believes,” “predicts,” “potential,” “continue” and similar

expressions are intended to identify such forward-looking

statements. These forward-looking statements, including, but not

limited to, tangible benefits expected to be realized in the 2024

calendar year from current investments, involve significant risks

and uncertainties that could cause actual results to differ

materially from the expected results and, consequently, should not

be relied upon as predictions of future events. These

forward-looking statements, including the factors disclosed in the

Company’s most recent Annual Report on Form 10-K, and in the

Company’s other filings with the Securities and Exchange

Commission, are not exclusive. Readers are cautioned not to place

undue reliance upon any forward-looking statements, which speak

only as of the date made. Except as required by law, the Company

disclaims any obligation to update or publicly announce any

revisions to any of the forward-looking statements contained in

this press release.

THE MARYGOLD COMPANIES,

INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(in thousands, except per

share data)

(unaudited)

March 31, 2024

June 30, 2023

ASSETS

CURRENT ASSETS

Cash and cash equivalents

$

4,490

$

8,161

Accounts receivable, net (of which $1,490

and $1,674, respectively, due from related parties)

2,489

3,026

Inventories

2,113

2,254

Prepaid income tax and tax receivable

1,955

992

Investments, at fair value

11,630

11,481

Other current assets

3,094

904

Total current assets

25,771

26,818

Restricted cash

14

425

Property and equipment, net

1,195

1,255

Operating lease right-of-use assets

1,095

821

Goodwill

2,307

2,307

Intangible assets, net

2,003

2,330

Deferred tax assets, net

771

771

Other assets

553

554

Total assets

$

33,709

$

35,281

LIABILITIES AND STOCKHOLDERS’

EQUITY

CURRENT LIABILITIES

Accounts payable and accrued expenses

$

3,566

$

2,771

Operating lease liabilities, current

portion

635

457

Purchase consideration payable

-

605

Loans - property and equipment, current

portion

340

359

Total current liabilities

4,541

4,192

Loans - property and equipment, net of

current portion

74

88

Operating lease liabilities, net of

current portion

471

381

Deferred tax liabilities, net

242

242

Total long-term liabilities

787

711

Total liabilities

5,328

4,903

STOCKHOLDERS’ EQUITY

Preferred stock, par value $0.001; 50,000

shares authorized

Series B: 49,360 issued and outstanding at

March 31, 2024 and June 30, 2023

-

-

Common stock, $0.001 par value; 900,000

shares authorized; 39,383 shares issued and outstanding at March

31, 2024 and at June 30, 2023

39

39

Additional paid-in capital

12,714

12,397

Accumulated other comprehensive loss

(246

)

(145

)

Retained earnings

15,874

18,087

Total stockholders’ equity

28,381

30,378

Total liabilities and stockholders’

equity

$

33,709

$

35,281

THE MARYGOLD COMPANIES,

INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(in thousands, except per

share data)

(unaudited)

2024

2023

2024

2023

Three Months Ended March

31,

Nine Months Ended March

31,

2024

2023

2024

2023

Revenue

Fund management - related party

$

4,406

$

5,022

$

14,453

$

15,708

Food products

1,836

1,825

5,485

5,702

Beauty products

858

746

2,475

2,334

Security systems

650

576

1,773

1,871

Financial services

130

130

385

388

Revenue

7,880

8,299

24,571

26,003

Cost of revenue

2,323

2,195

6,449

6,450

Gross profit

5,557

6,104

18,122

19,553

Operating expense

Salaries and compensation

2,690

2,355

8,279

7,530

General and administrative expense

2,166

1,750

6,730

5,269

Fund operations

1,295

1,081

3,752

3,334

Marketing and advertising

745

612

2,426

1,936

Depreciation and amortization

132

140

439

437

Total operating expenses

7,028

5,938

21,626

18,506

(Loss) income from operations

(1,471

)

166

(3,504

)

1,047

Other income (expense)

Interest and dividend income

259

59

580

174

Interest expense

(5

)

(5

)

(12

)

(16

)

Other income (expense), net

333

(97

)

(116

)

(68

)

Total other income (expense), net

587

(43

)

452

90

(Loss) income before income taxes

(884

)

123

(3,052

)

1,137

Benefit (provision) of income taxes

355

30

840

(305

)

Net (loss) income

$

(529

)

$

153

$

(2,212

)

$

832

Weighted average shares of common

stock

Basic

40,401

40,371

40,401

40,371

Diluted

40,401

40,438

40,401

40,402

Net (loss) income per common share

Basic

$

(0.01

)

$

0.00

$

(0.05

)

$

0.02

Diluted

$

(0.01

)

$

0.00

$

(0.05

)

$

0.02

The accompanying notes on Form 10-Q are an

integral part of these condensed consolidated financial

statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240513059996/en/

Media and investors, for more Information, contact: Roger

S. Pondel PondelWilkinson Inc. 310-279-5965 rpondel@pondel.com

Contact the Company: David Neibert, Chief Operations

Officer 949-429-5370 dneibert@themarygoldcompanies.com

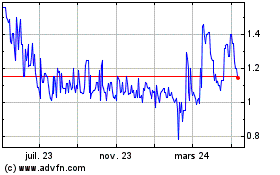

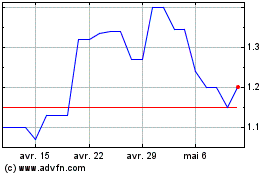

Marygold Companies (AMEX:MGLD)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Marygold Companies (AMEX:MGLD)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025