false

0001582554

0001582554

2023-11-08

2023-11-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of

The

Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): November 8, 2023

MATINAS

BIOPHARMA HOLDINGS, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-38022 |

|

46-3011414 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

ID

Number) |

1545

Route 206 South, Suite 302

Bedminster,

New Jersey |

|

07921 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (908) 484-8805

Not

Applicable

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of Each Class |

|

Trading

Symbol |

|

Name

of Each Exchange on Which Registered |

| Common

Stock |

|

MTNB

|

|

NYSE

American |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

2.02. Results of Operations and Financial Condition.

On

November 8, 2023, Matinas BioPharma Holdings, Inc. (the “Company”) issued a press release announcing its financial results

for the quarter ended September 30, 2023. The full text of the press release is furnished as Exhibit 99.1 hereto and incorporated herein

by reference.

The

information in Item 2.02 of this Current Report on Form 8-K and Exhibit 99.1 attached hereto shall not be deemed “filed”

for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject

to the liabilities of that Section, nor shall such information be deemed incorporated by reference in any filing under the Securities

Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as shall be expressly set forth by specific reference

in such a filing.

Item

9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

MATINAS

BIOPHARMA HOLDINGS, INC. |

| |

|

|

| Dated:

November 8, 2023 |

By: |

/s/

Jerome D. Jabbour |

| |

Name: |

Jerome

D. Jabbour |

| |

Title: |

Chief

Executive Officer |

Exhibit

99.1

Matinas

BioPharma Reports Third Quarter 2023 Financial Results and Provides a Business Update

FDA

feedback on MAT2203 Phase 3 program supports a patient population in invasive aspergillosis with limited treatment options, acknowledges

potential for LPAD pathway; composite superiority endpoint under evaluation to strengthen commercial opportunity without increasing study

size

Patient

with Candida krusei infection achieved complete clinical resolution with MAT2203; additional patient enrolled in the Compassionate/Expanded

Use Access Program

Oral

LNC formulation of docetaxel showed reduction in tumor size comparable to IV-docetaxel with no systemic toxicity in preclinical melanoma

model

Conference

call begins at 4:30 p.m. Eastern time today

BEDMINSTER,

N.J. (November 8, 2023) – Matinas BioPharma (NYSE American: MTNB), a clinical-stage biopharmaceutical company focused

on delivering groundbreaking therapies using its lipid nanocrystal (LNC) platform delivery technology, reports financial results for

the three and nine months ended September 30, 2023 and provides a business update.

“We

are very excited by the consistent, positive clinical data generated with MAT2203 in our Compassionate/Expanded Use Access Program. The

patients treated under this program suffer from invasive fungal infections with few treatment options. We plan to treat a similar patient

population in our Phase 3 study – those with invasive aspergillosis and limited treatment options,” said Jerome D. Jabbour,

Chief Executive Officer of Matinas. “Our recent meeting with FDA supports our Phase 3 strategy, including the potential for LPAD

registration. We’re highly encouraged by FDA’s openness to a superiority composite primary endpoint, which could be significant

in positioning MAT2203 for commercial success. We look forward to finalizing the Phase 3 study design as soon as possible and advancing

our ongoing partnership discussions for this important product.”

Key

Program Updates

MAT2203

(Oral Amphotericin B) Program

FDA

Meeting Feedback

| |

● |

A

meeting was held with the U.S. Food and Drug Administration (FDA) in mid-October with both the Director and Deputy Director of the

Office of Infectious Diseases in attendance. The FDA agreed with the Phase 3 study design for the treatment of invasive aspergillosis

in patients with limited treatment options and confirmed that MAT2203 may be a candidate for the Limited Population Pathway for Antifungal

and Antibacterial Drugs (LPAD). |

| |

|

|

| |

● |

During

discussions regarding the statistical assumptions for a noninferiority Phase 3 trial design, FDA expressed openness to a proposed

alternative superiority composite endpoint, which we believe would best position MAT2203 for commercial success and differentiation

upon approval. The revised superiority composite endpoint is being finalized and will be submitted to FDA for alignment in the next

few weeks. |

| |

● |

The

Company believes that a superiority study incorporating a composite endpoint would not change the projected study size (<200 patients)

or enrollment timeline (22-24 mos.). The FDA has communicated its commitment to work with the Company on an off-cycle basis to finalize

the Phase 3 protocol as soon as possible. |

General

MAT2203 Updates

| |

● |

A

total of 12 patients have been enrolled in the Company’s Compassionate/Expanded Use Access Program. In October, the Company

announced that a 61-year-old male with a challenging medical history achieved complete clinical resolution of a Candida krusei

infection following only two weeks of treatment with MAT2203. Treatment with IV-amphotericin B was discontinued due to renal toxicity

and the patient was transitioned to MAT2203, which was well-tolerated with no adverse effects. Treatment with MAT2203 led to complete

resolution of his symptoms and improvement of his kidney function to baseline. |

| |

|

|

| |

● |

Earlier

this month, an additional patient was enrolled in this Program at Vanderbilt University Medical Center. This patient is suffering

from a CNS-based fusarium infection and required transition from IV-amphotericin due to significant electrolyte abnormalities. The

patient may also be able to be discharged from the hospital in order to receive treatment at home. |

| |

|

|

| |

● |

University

of Minnesota Medical School researchers published results from the Phase 2 EnACT trial evaluating MAT2203 for the treatment of cryptococcal

meningitis as a Major Article and Editor’s Choice in Clinical Infectious Diseases, an official publication of the Infectious

Diseases Society of America (IDSA). |

| |

|

|

| |

● |

The

published results of the EnACT Phase 2 trial, the ongoing positive clinical outcomes in the Compassionate/Expanded Access Program,

and the recent additional clarity and support from the FDA for the MAT2203 Phase 3 program have all resulted in significant new interest

from potential partners for licensing, acquiring or otherwise collaborating on MAT2203. |

| |

|

|

| |

● |

During

a meeting held in the third quarter, the Biomedical Advanced Research and Development Authority (BARDA) invited the Company to submit

a White Paper for Phase 3 funding consideration. The Company intends to submit the White Paper following finalization of the Phase

3 study design. |

LNC

Platform Updates

Oral

LNC-Docetaxel

| |

● |

The

Company announced positive results from an in vivo animal study of an oral LNC formulation of docetaxel, a well-known chemotherapeutic

agent used in the management of multiple metastatic and unresectable tumors. Anti-tumor effects of daily oral LNC-docetaxel were

comparable to IV-docetaxel with statistically significant reductions in tumor volume compared with untreated controls at Day 14 (high

dose oral LNC -63%; low dose oral LNC -57%; IV docetaxel -68%), and similar reductions in tumor weight at Day 14. No systemic toxicities

were noted. Body weight was stable over treatment duration and hematologic parameters were similar to untreated controls. |

| |

|

|

| |

● |

Potential

next steps include evaluating the efficacy of the current LNC-docetaxel formulation in other tumor models and evaluating longer-term

treatment regimens to confirm lack of toxicity. Additionally, the Company plans to evaluate the potential anti-tumor activity of

LNC formulations of small oligonucleotides. |

Internal

Oral LNC Small Oligonucleotide Program

| |

● |

The

Company is investigating a variety of LNC formulations of two small oligonucleotides designed to target inflammatory cytokines IL-17A

and TNFα, and has conducted a series of in vitro and in vivo studies to evaluate the biological activity associated

with oral delivery as well as the corresponding associated clinical benefit of IL-17A knockdown in an imiquimod (IMQ) induced murine

psoriasis disease model. |

| |

|

|

| |

● |

These

preliminary studies have documented biological activity in the form of cytokine knockdown and have also provided some evidence of

associated tangible clinical benefit with improvements in skin lesion appearance (redness, scaling) in this qualitative psoriasis

model. These data remain under evaluation and the analyses are focused on (a) clarifying the strength and time course of cytokine

inhibition, and (b) evaluating cytokine mRNA levels and specific tissue responses in these models to better understand and interpret

these data. |

| |

|

|

| |

● |

Additional

in vivo studies of LNC-formulated small oligonucleotides in other disease models are ongoing with additional data expected

in the fourth quarter of this year. |

Third

Quarter Financial Results

The

Company reported no revenue for the third quarter of 2023 compared with $1.1 million of revenue for the third quarter of 2022, which

was generated from the Company’s research collaborations with BioNTech SE.

Total

costs and expenses for the third quarter of 2023 were $6.1 million compared with $6.5 million for the third quarter of 2022. The decrease

was primarily attributable to decreases in costs for the manufacturing of clinical trial materials, and lower clinical trial consulting

and headcount costs.

The

net loss for the third quarter of 2023 was $6.1 million, or $0.03 per share, compared with a net loss for the third quarter of 2022 of

$5.5 million, or $0.03 per share.

Nine

Month Financial Results

Revenue

for the first nine months of 2023 was $1.1 million compared with $2.1 million for the first nine months of 2022. Total costs and expenses

for the first nine months of 2023 were $19.0 million compared with $21.2 million for the first nine months of 2022.

The

net loss for the first nine months of 2023 was $17.6 million, or $0.08 per share, compared with a net loss for the first nine months

of 2022 of $17.4 million, or $0.08 per share.

Cash,

cash equivalents and marketable securities as of September 30, 2023, were $18.2 million compared with $28.8 million as of December 31,

2022. Based on current projections, the Company believes its cash position is sufficient to fund planned operations into the third quarter

of 2024.

The

Company is seeking to extend its cash runway by securing non-dilutive funding from potential third-party development partners and government

grant programs through agencies such as BARDA, as well as from potential public or private equity offerings.

Conference

Call and Webcast

Matinas

will host a conference call and webcast today beginning at 4:30 p.m. Eastern time. To participate in the call, please dial 800-267-6316

or 203-518-9783. The live webcast will be accessible on the Investors section of the company’s website and archived for

90 days.

About

Matinas BioPharma

Matinas

BioPharma is a biopharmaceutical company focused on delivering groundbreaking therapies using its lipid nanocrystal (LNC) platform delivery

technology.

Matinas’

lead LNC-based therapy is MAT2203, an oral formulation of the broad-spectrum antifungal drug amphotericin B, which although highly potent,

can be associated with significant toxicity. Matinas’ LNC platform provides oral delivery of amphotericin B without the significant

nephrotoxicity otherwise associated with IV-delivered formulations. MAT2203 also allows for safe, longer-term use outside of a hospital

setting, which could have substantial favorable pharmacoeconomic impact. MAT2203 was successfully evaluated in the completed Phase 2

EnACT study in cryptococcal meningitis, meeting its primary endpoint and achieving robust survival. MAT2203 will be further evaluated

as an oral step-down monotherapy treatment following IV amphotericin B in a single pivotal Phase 3 study in the treatment of aspergillosis

in persons with limited treatment options who are unable to be treated with azoles for reasons related to drug-drug interactions, resistance

or for whom these antifungal agents are unable to be used for other clinical reasons.

In

addition to MAT2203, preclinical and clinical data have demonstrated that this novel technology can potentially provide solutions to

many of the challenges standing in the way of achieving safe and effective intracellular delivery of both small molecules and larger,

more complex molecular cargos such as RNAi, antisense oligonucleotides, and vaccines. The combination of its unique mechanism of action

and flexibility with routes of administration (including oral) positions Matinas’ LNC technology to potentially become a preferred

next-generation orally available intracellular drug delivery platform. For more information, please visit www.matinasbiopharma.com.

Forward-looking

Statements

This

release contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995,

including those relating to our business activities, our strategy and plans, our collaboration with National Resilience, Inc., the potential

of our LNC platform technology, and the future development of its product candidates, including MAT2203, the Company’s ability

to identify and pursue development, licensing and partnership opportunities for its products, including MAT2203, or platform delivery

technologies on favorable terms, if at all, and the ability to obtain required regulatory approval and other statements that are predictive

in nature, that depend upon or refer to future events or conditions. All statements other than statements of historical fact are statements

that could be forward-looking statements. Forward-looking statements include words such as “expects,” “anticipates,”

“intends,” “plans,” “could,” “believes,” “estimates” and similar expressions.

These statements involve known and unknown risks, uncertainties and other factors which may cause actual results to be materially different

from any future results expressed or implied by the forward-looking statements. Forward-looking statements are subject to a number of

risks and uncertainties, including, but not limited to, our ability to continue as a going concern, our ability to obtain additional

capital to meet our liquidity needs on acceptable terms, or at all, including the additional capital which will be necessary to complete

the clinical trials of our product candidates; our ability to successfully complete research and further development and commercialization

of our product candidates; the uncertainties inherent in clinical testing; the timing, cost and uncertainty of obtaining regulatory approvals;

our ability to protect the Company’s intellectual property; the loss of any executive officers or key personnel or consultants;

competition; changes in the regulatory landscape or the imposition of regulations that affect the Company’s products; and the other

factors listed under “Risk Factors” in our filings with the SEC, including Forms 10-K, 10-Q and 8-K. Investors are cautioned

not to place undue reliance on such forward-looking statements, which speak only as of the date of this release. Except as may be required

by law, the Company does not undertake any obligation to release publicly any revisions to such forward-looking statements to reflect

events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. Matinas BioPharma’s product

candidates are all in a development stage and are not available for sale or use.

Investor

Contact:

LHA

Investor Relations

Jody

Cain

Jcain@lhai.com

310-691-7100

[Financial

Tables to Follow]

Matinas

BioPharma Holdings, Inc.

Condensed

Consolidated Balance Sheets

(in

thousands, except for share data)

| | |

September 30, 2023 | | |

December 31, 2022 | |

| | |

(Unaudited) | | |

(Audited) | |

| ASSETS: | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 6,407 | | |

$ | 6,830 | |

| Marketable debt securities | |

| 11,809 | | |

| 21,933 | |

| Restricted cash – security deposit | |

| 50 | | |

| 50 | |

| Prepaid expenses and other current assets | |

| 1,723 | | |

| 5,719 | |

| Total current assets | |

| 19,989 | | |

| 34,532 | |

| | |

| | | |

| | |

| Non-current assets: | |

| | | |

| | |

| Leasehold improvements and equipment – net | |

| 2,021 | | |

| 2,091 | |

| Operating lease right-of-use assets – net | |

| 3,206 | | |

| 3,613 | |

| Finance lease right-of-use assets – net | |

| 22 | | |

| 30 | |

| In-process research and development | |

| 3,017 | | |

| 3,017 | |

| Goodwill | |

| 1,336 | | |

| 1,336 | |

| Restricted cash – security deposit | |

| 200 | | |

| 200 | |

| Total non-current assets | |

| 9,802 | | |

| 10,287 | |

| Total assets | |

$ | 29,791 | | |

$ | 44,819 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY: | |

| | | |

| | |

| | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 835 | | |

$ | 618 | |

| Accrued expenses | |

| 1,757 | | |

| 3,099 | |

| Operating lease liabilities – current | |

| 632 | | |

| 562 | |

| Financing lease liabilities – current | |

| 5 | | |

| 7 | |

| Total current liabilities | |

| 3,229 | | |

| 4,286 | |

| | |

| | | |

| | |

| Non-current liabilities: | |

| | | |

| | |

| Deferred tax liability | |

| 341 | | |

| 341 | |

| Operating lease liabilities – net of current portion | |

| 3,052 | | |

| 3,533 | |

| Financing lease liabilities – net of current portion | |

| 19 | | |

| 22 | |

| Total non-current liabilities | |

| 3,412 | | |

| 3,896 | |

| Total liabilities | |

| 6,641 | | |

| 8,182 | |

| | |

| | | |

| | |

| Stockholders’ equity: | |

| | | |

| | |

| Common stock par value $0.0001 per share, 500,000,000 shares authorized at September 30, 2023 and December 31, 2022; 217,264,526 issued and outstanding as of September 30, 2023 and December 31, 2022 | |

| 22 | | |

| 22 | |

| Additional paid-in capital | |

| 193,746 | | |

| 190,070 | |

| Accumulated deficit | |

| (170,259 | ) | |

| (152,631 | ) |

| Accumulated other comprehensive loss | |

| (359 | ) | |

| (824 | ) |

| Total stockholders’ equity | |

| 23,150 | | |

| 36,637 | |

| Total liabilities and stockholders’ equity | |

$ | 29,791 | | |

$ | 44,819 | |

Matinas

BioPharma Holdings, Inc.

Condensed

Consolidated Statements of Operations and Comprehensive Loss

(in

thousands, except share and per share data)

Unaudited

| | |

Three Months Ended September 30, | | |

Nine Months Ended September 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Revenue: | |

| | |

| | |

| | |

| |

| Contract Revenue | |

$ | — | | |

$ | 1,063 | | |

$ | 1,096 | | |

$ | 2,125 | |

| Costs and expenses: | |

| | | |

| | | |

| | | |

| | |

| Research and development | |

| 3,295 | | |

| 3,707 | | |

| 10,824 | | |

| 12,811 | |

| General and administrative | |

| 2,839 | | |

| 2,818 | | |

| 8,151 | | |

| 8,424 | |

| | |

| | | |

| | | |

| | | |

| | |

| Total costs and expenses | |

| 6,134 | | |

| 6,525 | | |

| 18,975 | | |

| 21,235 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss from operations | |

| (6,134 | ) | |

| (5,462 | ) | |

| (17,879 | ) | |

| (19,110 | ) |

| Sale of New Jersey net operating losses & tax credits | |

| — | | |

| — | | |

| — | | |

| 1,734 | |

| Other income, net | |

| 79 | | |

| — | | |

| 251 | | |

| 13 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

$ | (6,055 | ) | |

$ | (5,462 | ) | |

$ | (17,628 | ) | |

$ | (17,363 | ) |

| Net loss per share – basic and diluted | |

$ | (0.03 | ) | |

$ | (0.03 | ) | |

$ | (0.08 | ) | |

$ | (0.08 | ) |

| Weighted average common shares outstanding: | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted | |

| 217,264,526 | | |

| 216,864,526 | | |

| 217,264,526 | | |

| 216,792,083 | |

| Other comprehensive gain/(loss), net of tax | |

| | | |

| | | |

| | | |

| | |

| Unrealized gain/(loss) on securities available-for-sale | |

| 155 | | |

| (181 | ) | |

| 465 | | |

| (790 | ) |

| Other comprehensive gain/(loss), net of tax | |

| 155 | | |

| (181 | ) | |

| 465 | | |

| (790 | ) |

| Comprehensive loss | |

$ | (5,900 | ) | |

$ | (5,643 | ) | |

$ | (17,163 | ) | |

$ | (18,153 | ) |

#

# #

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

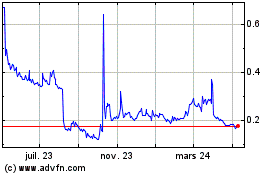

Matinas Biopharma (AMEX:MTNB)

Graphique Historique de l'Action

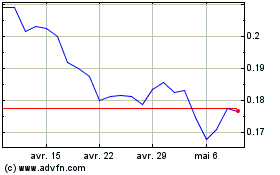

De Avr 2024 à Mai 2024

Matinas Biopharma (AMEX:MTNB)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024