Registration No. 333-

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. ☐

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form S-1 filed with the U.S. Securities and Exchange Commission (the “SEC”), using a “shelf” registration process. By using a shelf registration statement, the Selling Stockholders may sell up to 35,510,720 shares of Common Stock received upon conversion of Series B Preferred Stock from time to time in one or more offerings as described in this prospectus. We will not receive any proceeds from the sale of the Shares by the Selling Stockholders.

We may also file a prospectus supplement or post-effective amendment to the registration statement of which this prospectus forms a part, which may contain material information relating to this offering. The prospectus supplement or post-effective amendment may also add, update or change information contained in this prospectus with respect to the offering. If there is any inconsistency between the information in this prospectus and the applicable prospectus supplement or post-effective amendment, you should rely on the prospectus supplement or post-effective amendment, as applicable. As permitted by the rules and regulations of the SEC, the registration statement filed by us includes additional information that has been incorporated by reference, including reports we file with the SEC, that are not contained in this prospectus. Before purchasing any securities, you should carefully read this prospectus, any post-effective amendment, and any applicable prospectus supplement, together with the documents incorporated by reference and other additional information that we file with the SEC described in the “Where You Can Find More Information” and “Incorporation of Certain Documents by Reference” sections of this prospectus.

This prospectus includes important information about us and the securities being offered. You should rely only on this prospectus, any post-effective amendment, and any applicable prospectus supplement, and the information incorporated or deemed to be incorporated by reference in this prospectus. We have not, and the Selling Stockholders have not, authorized anyone to provide you with information that is in addition to, or different from, the information that is contained, or incorporated by reference, in this prospectus prepared by or on behalf of us or to which we have referred you. If anyone provides you with different or inconsistent information, you should not rely on it. We and the Selling Stockholders take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus does not constitute an offer to sell or the solicitation of an offer to buy securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction.

The documents entered into in connection with the 2021 Private Placement, the Warrant Reprice Transactions (as defined below), and the 2022 Private Placement described herein and/or in our filings with the SEC (collectively, the “Transaction Documents”) contain representations and warranties of the parties to such agreements that may be subject to limitations, qualifications or exceptions agreed upon by the parties, and may be subject to a contractual standard of materiality that differs from the materiality standard that applies to reports and documents filed with the SEC. In particular, in your review of the representations and warranties contained in the Transaction Documents and described in the foregoing summary, it is important to bear in mind that the representations and warranties were negotiated in connection with separate transactions and with the principal purpose of allocating contractual risk between the parties in such transactions. The representations and warranties, other provisions of the Transaction Documents or any description of these provisions should not be read alone, but instead should be read only in conjunction with the information provided elsewhere in this prospectus, any post-effective amendment and any applicable prospectus supplement, as well as in the other reports, statements and filings that the Company publicly files with the SEC.

This prospectus contains market data and industry statistics and forecasts that are based on our internal estimates and] independent industry publications and other sources that we believe to be reliable sources. In some cases, we do not expressly refer to the sources from which this data is derived. Industry publications and third-party research, surveys and studies generally indicate that their information has been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. Our internal estimates are based upon information obtained from trade and business organizations and other contacts in the industry in which we operate, and our management’s understanding of industry conditions. While we believe our internal estimates are reliable, they has not been verified by an independent source. Information that is based on estimates, forecasts, projections, market research or similar methodologies is inherently subject to uncertainties and actual events or circumstances may differ materially from events and circumstances that are assumed in this information. We are responsible for all of the disclosure contained in this prospectus, and we believe these industry publications and third-party research, surveys and studies are reliable. While we are not aware of any misstatements regarding any third-party information presented in this prospectus, their estimates, in particular, as they relate to projections, involve numerous assumptions, are subject to risks and uncertainties, and are subject to change based on various factors, including those discussed under the section entitled “Risk Factors” and elsewhere in this prospectus or otherwise incorporated by reference into this prospectus.

Unless otherwise specifically indicated, references to “prospectus” herein shall include any post-effective amendment, applicable prospectus supplement, and the information incorporation or deemed to be incorporated by reference in this prospectus. This prospectus contains summaries of certain provisions contained in some of the documents described herein or therein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below under the section entitled “Where You Can Find More Information.”

This prospectus includes trademarks, service marks and trade names owned by us, our subsidiary DERMAdoctor, LLC, or other companies. All trademarks, service marks and trade names included or incorporated by reference into this prospectus are the property of their respective owners.

Unless the context indicates otherwise in this prospectus, the terms “NovaBay,” the “Company,” “we,” “our” or “us” in this prospectus refer to NovaBay Pharmaceuticals, Inc.

Except as otherwise indicated, information in this prospectus does not reflect the proposed Reverse Stock Split, which is defined and described below.

PROSPECTUS SUMMARY

This summary highlights, and is qualified in its entirety by, the selected information contained elsewhere in this prospectus or incorporated by reference in this prospectus. This summary does not contain all of the information that may be important to you or that you need to consider in making your investment decision. You should carefully read the entire prospectus, including any applicable prospectus supplement, especially the “Risk Factors” section beginning on page 8 of this prospectus and the risks under similar headings in other documents and filings that are incorporated by referenced into this prospectus, our financial statements, the exhibits to the registration statement of which this prospectus forms a part and other information incorporated by reference in this prospectus before deciding to invest in our Common Stock. Each of the risk factors could adversely affect our business, operating results and financial condition, as well as adversely affect the value of an investment in our securities.

About NovaBay

NovaBay develops and sells scientifically-created and clinically-proven eyecare and skincare products. Our leading product, Avenova® Antimicrobial Lid and Lash Solution (“Avenova Spray”), is proven in laboratory testing to have broad antimicrobial properties as it removes foreign material including microorganisms and debris from the skin around the eye, including the eyelid. Avenova Spray is formulated with our proprietary, stable and pure form of hypochlorous acid and is cleared by the U.S. Food and Drug Administration for sale in the United States. Avenova Spray is available direct to consumers through online distribution channels and is also often prescribed and dispensed by eyecare professionals for blepharitis and dry-eye disease. Other eyecare products offered under the Avenova eyecare brand include Novawipes by Avenova, Avenova Lubricant Eye Drops, Avenova Moist Heating Eye Compress, and the i-Chek.

On November 5, 2021, we significantly expanded our business by acquiring DERMAdoctor, LLC (“DERMAdoctor”) as our wholly-owned subsidiary. DERMAdoctor offers over-the-counter dermatological products targeting common skin concerns. DERMAdoctor branded products are marketed and sold through the DERMAdoctor website, well-known traditional and digital beauty retailers, and a network of international distributors.

The Shares and the 2021 Private Placement

In the 2021 Private Placement, we originally issued 15,000 shares of Series B Preferred Stock, which were convertible into an aggregate of 37,500,000 shares of Common Stock, to the 2021 Investors, including the Selling Stockholders, pursuant to the 2021 Securities Purchase Agreement. Of the 15,000 shares of Series B Preferred Stock sold in the 2021 Private Placement that closed on November 2, 2021, 11,260 shares remain outstanding as of the date of this prospectus. This prospectus relates to the resale, from time to time, of up to 35,510,720 Shares of Common Stock by the Selling Stockholders. These Shares reflect an increase in the number of shares of Common Stock issuable by NovaBay upon conversion of the Series B Preferred Stock due to the effect of an anti-dilution adjustment of the conversion price of the Series B Preferred Stock that occurred in connection with the completion of Warrant Reprice Transactions on September 9, 2022. The Warrant Reprice Transactions provided for, among other terms as described in this prospectus, the amendment and reprice of certain of the Company’s previously issued Common Stock purchase warrants and the issuance of new Common Stock purchase warrants, both of which have an exercise price of $0.18, which was an effective price per share that was lower than the Series B Preferred Stock conversion price. As a result of the completion of the Warrant Reprice Transactions, the “full-ratchet” anti-dilution protections as set forth in the Series B Certificate of Designation were triggered resulting in the automatic adjustment of the Series B Preferred Stock conversion price from $0.40 into 2,500 shares of Common Stock prior to the Warrant Reprice Transactions to an adjusted conversion price for the Series B Preferred Stock of $0.18 into 5,556 shares of Common Stock. This conversion price reduction resulted in an additional 35,510,720 shares of Common Stock that are issuable upon conversion of the remaining outstanding Series B Preferred Stock. The other powers, preferences, rights, qualifications, limitations and restrictions applicable to the Series B Preferred Stock, including the full- ratchet and other anti-dilution protections, are set forth in the Series B Certificate of Designation. For additional information, see the sections entitled “Description of Capital Stock”.

In connection with the 2021 Private Placement, we entered into the Registration Rights Agreement, which provides for us to register the shares of Common Stock underlying the Series B Preferred Stock, including those shares that become issuable as a result of an anti-dilution adjustment to the conversion price of the Series B Preferred Stock. Accordingly, we are registering the offer and sale of the Shares by the Selling Stockholders pursuant to the terms and conditions of the Registration Rights Agreement. After the closing of the 2021 Private Placement, we filed the Initial Registration Statement to register the resale of the Initial Shares by the 2021 Investors, including the Selling Stockholders, upon conversion of the Series B Preferred Stock based on the conversion price at that time. For additional information, see the section entitled “Description of Capital Stock”.

We will not receive any proceeds from the sale of the Shares by the Selling Stockholders. We will bear the costs, expenses and fees in connection with the registration of the Shares. The Selling Stockholders will each bear all commissions and discounts, if any, attributable to their respective sales of the Shares. For additional information, see the section entitled “Plan of Distribution”.

Our Common Stock is listed on the NYSE American under the symbol “NBY.” The last reported sale price of our Common Stock on October 24, 2022 was $0.097 per share.

Recent Developments

In our Quarterly Report on Form 10-Q, filed with the SEC on August 11, 2022 (the “June Form 10-Q”), we reported that based primarily on the funds available as of June 30, 2022, our existing cash and cash equivalents and cash flows generated from product sales will be sufficient to fund our existing operations and meet our planned operating expenses into at least the first quarter of 2023. We also reported that we expected that our 2022 expenses will continue to exceed our 2022 revenues, as the Company continues to invest in both its Avenova and DERMA doctor commercialization efforts. Based on the amount of capital and liquidity that our Company had available at the time, we determined that our planned operations raised substantial doubt about our ability to continue as a going concern. In addition, we also noted that changing circumstances may cause us to expend cash significantly faster than currently anticipated or planned, and that we may need to spend more cash than expected because of circumstances beyond our control that impact the broader economy such as periods of inflation, supply chain issues, the continuation of the COVID-19 pandemic and international conflicts (e.g., the conflict between Russia and Ukraine).

To address our need for liquidity and capital to fund our planned operations, we entered into financing transactions on September 9, 2022 to raise up to approximately $5.3 million in the aggregate of additional capital, as discussed below. In the absence of our Company completing these financing transactions or substantial revenue growth from our commercialization efforts, there will be substantial doubt about our ability to continue as a going concern within one year after April 11, 2022, and we will be required to scale back or terminate operations and/or seek protection under applicable bankruptcy laws. For additional information regarding our capital and liquidity situation, please read our Quarterly Report on Form 10-Q for the period ended June 30, 2022, filed with the SEC on August 11, 2022, as well as our other filings we may make with the SEC as provided in the section of this prospectus entitled “Where You Can Find More Information”.

Warrant Reprice Transactions

We previously disclosed that we issued (i) Common Stock purchase warrants to a limited number of accredited investors (the “2020 Investors”) in connection with our prior Warrant Reprice Transaction that closed on July 23, 2020 (the “2020 Original Warrants”), and (ii) Common Stock purchase warrants to the 2021 Investors in the 2021 Private Placement (the “2021 Original Warrants”). Prior to the completion of the Warrant Reprice Transactions, the 2020 Original Warrants had an aggregate of 6,898,566 underlying shares of Common Stock, exercisable at $1.65 per share, and the 2021 Original Warrants had an aggregate of 37,500,000 underlying shares of Common Stock, exercisable at $0.53 per share.

On September 9, 2022, certain of the 2020 Investors holding 2020 Original Warrants (the “2020 Participants”) entered into separate latter agreements with the Company (the “2020 Reprice Letter Agreements”) and all of the 2021 Investors holding 2021 Original Warrants (the “2020 Participants” and together with the 2020 Participants, the “Participants”) entered into separate letter agreements with the Company (the “2021 Reprice Letter Agreements” and, together with the 2020 Reprice Letter Agreements, the “Reprice Letter Agreements”) that provided for their respective warrants to be amended to reduce their exercise price to $0.18 (“Reduced Exercise Price”) and, in the case of the 2021 Original Warrants, extend the term of those warrants. The 2020 Original Warrants and the 2021 Original Warrants as so amended are referred to as the “2020 Amended Warrants” and the “2021 Amended Warrants”, respectively, and together, the “Amended Warrants.” The Amended Warrants also provide for a new restriction on exercise until the later to occur of (i) six months from September 9, 2022 and (ii) or the date that the Company’s stockholders approve (x) an amendment to the Company’s Amended and Restated Certificate of Incorporation, as amended (the “Certificate of Incorporation”), to effect a reverse stock split (the “Reverse Stock Split”, and such approval, the “Reverse Stock Split Approval”) and (y) such stockholder approvals as may be required to comply with the continued listing rules of the NYSE American Company Guide, including pursuant to Section 713, of the NYSE American Company Guide (the “Company Guide Approval”, and, together with the Reverse Stock Split Approval, the “Stockholder Approvals”. The date that the Stockholder Approvals have been obtained and such approvals are effective, including under the laws of the State of Delaware, as applicable, is referred to as the “Stockholder Approval Date”.

Also pursuant to the Reprice Letter Agreements, (i) the 2020 Participants had the opportunity (but were not required) to elect to make a cash exercise of a portion of their Amended 2020 Warrants at the Reduced Exercise Price, which resulted in the exercise of an aggregate of 2,100,000 shares of Common Stock (the “2020 Initial Exercise”) and (ii) the 2021 Participants all agreed to exercise an aggregate of 9,375,000 shares, or 25% of the shares of Common Stock underlying their respective Amended 2021 Warrants, at the Reduced Exercise Price (the “2021 Initial Exercise” and, together with the 2020 Initial Exercise, the “Initial Exercise”). The Company received $2,065,500 in aggregate gross proceeds from the Initial Exercise.

In connection with the Initial Exercise, the Company issued to each 2021 Participant, as well as each 2020 Participant that participated in the 2020 Initial Exercise, a new Common Stock purchase warrant to purchase a number of shares of Common Stock equal to 100% of the shares of Common Stock received by such Participant in its Initial Exercise (the “New Reprice Warrants”). All of the New Reprice Warrants will be initially exercisable on the later to occur of (i) six months from September 9, 2022 and (ii) the Stockholder Approval Date. In addition, the New Reprice Warrants have a term of exercise of six years and an exercise price equal to $0.18, which exercise price and the number of underlying shares of Common Stock will be adjusted to reflect the Reverse Stock Split, as applicable. The New Reprice Warrants are also subject to a provision prohibiting the exercise thereof to the extent that, after giving effect to such exercise, the holder of such Warrant (together with the holder’s affiliates, and any other persons acting as a group together with the holder or any of the holder’s affiliates), would beneficially own in excess of 4.99% or 9.99% of outstanding Common Stock. The New Reprice Warrants do not have any preemptive rights or a preference upon any liquidation, dissolution or winding-up of the Company. For additional information regarding the New Reprice Warrants, see “Description of Capital Stock—Warrants”.

The transactions contemplated by the Reprice Letter Agreements as summarized above are collectively referred to as the “Warrant Reprice Transactions”. For additional information regarding the Warrant Reprice Transactions, see our Current Report on Form 8-K, filed with the SEC on September 13, 2022, and our Definitive Proxy Statement for a special meeting of Company stockholders to obtain the Reverse Stock Split Approval and the Company Guide Approval that was filed with the SEC on September 30, 2022 (the “2022 Special Meeting Proxy Statement”), which are incorporated into this prospectus.

2022 Private Placement

Concurrent with the Warrant Reprice Transactions, we entered into a private placement transaction with accredited investors (the “2022 Private Placement”) to sell, pursuant to the Securities Purchase Agreement, dated September 9, 2022 (the “2022 Securities Purchase Agreement”), units (“Units”) that will consist of (i) a newly designated Series C Non-Voting Convertible Preferred Stock, par value $0.01 per share (“Series C Preferred Stock”), (ii) a new short-term Series A-1 warrant to purchase Common Stock (“Short-Term Warrants”), and (iii) a new long-term Series A-2 warrant to purchase Common Stock (“Long-Term Warrants” and, together with the Short-Term Warrants, the “2022 Warrants”). The closing of the 2022 Private Placement is subject to receiving the Reverse Stock Split Approval and the Company Guide Approval, the effectiveness of the Reverse Stock Split, and satisfaction of other customary closing conditions as provided in the 2022 Securities Purchase Agreement. Upon the satisfaction of the conditions and the closing of the 2022 Private Placement, we expect to receive gross proceeds of $3.25 million from the sale of the Units. For additional information regarding the 2022 Private Placements, see our Current Report on Form 8-K filed with the SEC on September 13, 2022 and the Special Meeting Proxy Statement, which are incorporated into this prospectus.

The Warrant Reprice Transactions and the 2022 Private Placement are collectively referred to herein as the “Financing Transactions”.

Anti-Dilution Adjustment to Series B Preferred Stock

As discussed above under the heading “— The Shares and the 2021 Private Placement”, the consummation of the Warrant Reprice Transactions triggered the anti-dilution protection for the shares of Series B Preferred Stock as set forth in the Series B Certificate of Designation. Accordingly, the conversion price of each share of Series B Preferred Stock, which was $0.40 into 2,500 shares of Common Stock, was automatically adjusted downward and is now $0.18 into 5,556 shares of Common Stock. Therefore, based on the 11,620 shares of Series B Preferred Stock outstanding as of the date of this prospectus, there are an additional 35,510,720 shares of Common Stock that have become issuable upon conversion of the Series B Preferred Stock as a result of the reduction in exercise price. For additional information regarding the anti-dilution protection for the Series B Preferred Stock, see “Description of Capital Stock” in this prospectus.

Additional Information

For additional information related to and a more complete description of our business and operations, financial condition, results of operations and other important information, please refer to the reports and other filings incorporated by reference in this prospectus, including our most recent Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, as described in this prospectus under the caption “Incorporation of Certain Documents by Reference”.

Company Information

NovaBay was incorporated under the laws of the State of California on January 19, 2000, as NovaCal Pharmaceuticals, Inc. It had no operations until July 1, 2002, on which date it acquired all of the operating assets of NovaCal Pharmaceuticals, LLC, a California limited liability company. In February 2007, it changed its name from NovaCal Pharmaceuticals, Inc. to NovaBay Pharmaceuticals, Inc. In June 2010, the Company changed the state in which it was incorporated and is now incorporated under the laws of the State of Delaware.

Our corporate address is 2000 Powell Street, Suite 1150, Emeryville, California 94608, and our telephone number is (510) 899-8800. Our website address is www.novabay.com. Information found on, or accessible through, our website is not a part of, and is not incorporated into, this prospectus, and you should not consider it part of this prospectus. Our website address is included in this document as an inactive textual reference only.

RISK FACTORS

Investing in our Common Stock involves a high degree of risk. You should consider carefully the risk factors described below, and all other information and documents contained in or incorporated by reference in this prospectus (as supplemented and amended), including the risks described under the caption “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2021, Quarterly Reports on Form 10-Q and other filings with the SEC, including those incorporated by reference herein, before deciding whether to buy our Common Stock. The risks described in this prospectus or incorporated by reference into this prospectus are not the only ones we face, but those that we consider to be material. Additional risks not presently known to us or that we currently believe are immaterial may also significantly impair our business operations and could result in a complete loss of your investment. Past financial performance may not be a reliable indicator of future performance, and historical trends should not be used to anticipate results or trends in future periods. If any of the following risks actually occur, our business, financial condition, results of operations or cash flow could be seriously harmed. This could cause the market price of our Common Stock to decline, and you could lose all or part of your investment. Please also read carefully the section below entitled “Special Note Regarding Forward-Looking Statements.”

Risks Related to the Financing Transactions

As a result of the Amended Warrants and the New Reprice Warrants that we issued in connection with the Warrant Reprice Transactions, and the Series C Preferred Stock and the 2022 Warrants that we expect to issue in the 2022 Private Placement, our stockholders will experience significant dilution as a result of the issuance of shares of our Common Stock upon future exercise of the Amended Warrants and the New Reprice Warrants, and if issued, the conversion of the Series C Preferred Stock and the exercise of the 2022 Warrants.

On the later to occur of (i) six months from September 9, 2022 and (ii) the Stockholder Approval Date, the Amended Warrants, will be exercisable for 30,825,000 underlying shares of Common Stock and the New Reprice Warrants will be exercisable for 11,475,000 underlying shares of Common Stock. In addition, after receipt of the Stockholder Approvals, we expect to complete the 2022 Private Placement, after which 3,250 shares of Series C Preferred Stock will become issued and will be immediately convertible into 18,057,000 shares of Common Stock (subject to potential increase or other adjustment in the number of shares due to applicable anti-dilution adjustments), the Long-Term Warrants will be exercisable for 18,055,557 underlying shares of Common Stock and the Short Term Warrants will be exercisable for 18,055,557 underlying shares of Common Stock. Accordingly, as a result of the Warrant Reprice Transactions and, if completed, the 2022 Private Placement, an aggregate of 96,468,114 shares of Common Stock (representing approximately 148% of the total number of shares of Common Stock outstanding as of the date of this prospectus) could become issuable, subject to potential increase in the number of shares due to applicable anti-dilution adjustments. Also, an additional 35,510,720 shares of Common Stock (which are the Shares offered by this prospectus) became issuable upon conversion of the Series B Preferred Stock as a result of the automatic anti-dilution adjustment that occurred pursuant to provisions of the Series B Preferred Certificate of Designation, which represent approximately 5% of the total number of shares of Common Stock outstanding as of the date of this prospectus. Accordingly, upon the conversion or exercise (as applicable) of some or all of the Amended Warrants, the New Reprice Warrants and the Series B Preferred Stock, and, if issued, the Series C Preferred Stock and the 2022 Warrants, the percentage ownership and voting power held by our existing stockholders will be significantly reduced and our stockholders will experience significant dilution.

In addition, if the Reverse Stock Split Approval is received and the Reverse Stock Split is effected, there will be a significant number of additional authorized shares of Common Stock that we may issue in the future, which our Board of Directors will have discretion to issue in the future, including, without limitation, in connection with future capital raise transactions and financings, except to the extent prohibited or limited for a period of time by the terms of the 2022 Private Placement. Stockholders will not have a right to approve any such issuances or transactions, unless required by our governing documents or applicable law, and any such issuance of our Common Stock in the future may be dilutive to stockholders.

If we offer Common Stock or other securities in the future and the price that we sell those securities for is less than the current conversion price of our Series B Preferred Stock that was recently adjusted or, when and if issued, the Series C Preferred Stock, then we will be required to issue additional shares of Common Stock to the holders of the Series B Preferred Stock and/or Series C Preferred Stock, as the case may be, upon conversion, which will be dilutive to all of our other stockholders.

The Series B Certificate of Designation contains, and the Certificate of Designation for the Series C Preferred Stock is expected to contain, anti-dilution provisions that require the lowering of the conversion price, as then in effect, to the purchase price of equity or equity-linked securities issued by us in subsequent offerings, if lower than the current conversion price. A reduction in the conversion price of either series of preferred stock will result in a greater number of shares of Common Stock being issuable upon conversion of such preferred stock for no additional consideration, causing greater dilution to our stockholders. For example, as described above, the consummation of the Warrant Reprice Transactions triggered the anti-dilution protection in the Series B Certificate of Designation, and as a result there are now an additional 35,510,720 shares of Common Stock that are issuable upon conversion of the shares of Series B Preferred Stock outstanding as of the date of this prospectus. Furthermore, as there is no floor on the conversion price, we cannot determine the total number of shares issuable upon conversion. In addition, it is possible that even if the Reverse Stock Split Approval is received and the Reverse Stock Split becomes effective, we may not have a sufficient number of authorized and available shares to satisfy the conversion of the Series B Preferred Stock and/or Series C Preferred Stock, as the case may be, if we enter into a future transaction that reduces the applicable conversion price.

If we do not obtain the Stockholder Approvals, we may not be able to satisfy our obligations in connection with the Warrant Reprice Transactions and the closing conditions of the 2022 Private Placement.

In connection with the Warrant Reprice Transactions, we committed to seek the Stockholder Approvals, and effect the Reverse Stock Split after receiving such approvals. In addition, the Stockholder Approvals and the effectiveness of the Reverse Stock Split are conditions to closing the 2022 Private Placement. If we do not obtain stockholder approval of the Reverse Stock Split at the Special Meeting, we have agreed, in connection with the Warrant Reprice Transactions, to continue to hold stockholder meetings every four months to seek such approval until it is obtained. Any need to continue to seek such approval would result in increased expense to the Company and diversion of management’s attention, time, and effort. We will also be subject to restrictions on our ability to raise capital using Common Stock and Common Stock equivalents and incurring indebtedness, until such approvals are obtained, unless the 2022 Securities Purchase Agreement is terminated. In addition, the Amended Warrants and the New Reprice Warrants will not be exercisable unless and until the Stockholder Approvals are obtained and the Reverse Stock Split is effective.

Risks Relating to the Proposed Reverse Stock Split

If we are unable to comply with the continued listing requirements of the NYSE American and satisfy the obligations set forth in the Deficiency Letter, then our Common Stock would be delisted from the NYSE American, which would limit investors’ ability to effect transactions in our Common Stock and subject us to additional trading restrictions.

Our Common Stock is currently listed on the NYSE American. In order to maintain our listing, we must maintain certain share prices, financial and share distribution targets, including maintaining a minimum amount of stockholders’ equity and a minimum number of public stockholders. In addition to these objective standards, NYSE American may delist the securities of any issuer for other reasons involving the judgment of NYSE American. For example, the Company Guide provides that the NYSE American may suspend or remove from listing any common stock selling for a substantial period of time at a low price per share, if the issuer shall fail to effect a reverse split of such shares within a reasonable time after being notified that the Exchange deems such action to be appropriate under all the circumstances.

On October 3, 2022, we received a notification (“Deficiency Letter”) from the NYSE American stating that we are not in compliance with certain NYSE American continued listing standards. Specifically, the Deficiency Letter indicated that the Company is not in compliance with Section 1003(f)(v) of the Company Guide because the NYSE American staff determined that our Common Stock has been selling for a low price per share for a substantial period of time. Pursuant to Section 1003(f)(v) of the Company Guide and as provided in the Deficiency Letter, the Company’s continued listing is predicated on it effecting a reverse stock split of its Common Stock or otherwise demonstrating sustained price improvement within a reasonable period of time, which the NYSE American staff determined to be no later than April 3, 2023. The Deficiency Letter further stated that as a result of the foregoing, the Company has become subject to the procedures and requirements of Section 1009 of the Company Guide, which could, among other things, result in the initiation of delisting proceedings, unless we cure the deficiency in a timely manner.

As disclosed in the 2022 Special Meeting Proxy Statement, our Board of Directors has unanimously approved, and has recommended that our stockholders approve, an amendment to our Certificate of Incorporation, to effect the Reverse Stock Split. However, we cannot assure you that our stockholders will approve the proposal to effect the Reverse Stock Split or that if such proposal is approved and implemented by our Board of Directors that such a Reverse Stock Split will be sufficient to enable the Company to maintain its listing on the NYSE American. Therefore, there is a continued risk that our Common Stock will be delisted if action is not taken to the satisfaction of the NYSE American.

If the NYSE American delists our Common Stock from trading on its exchange and we are not able to list our securities on another national securities exchange, we expect the Common Stock would qualify to be quoted on an over-the-counter market. If this were to occur, we could face significant material adverse consequences, including:

| |

●

|

a limited availability of market quotations for our securities;

|

| |

●

|

reduced liquidity for our securities;

|

| |

●

|

substantially impair our ability to raise additional funds;

|

| |

●

|

result in a loss of institutional investor interest and a decreased ability to issue additional securities or obtain additional financing in the future;

|

| |

●

|

a determination that our Common Stock is a “penny stock,” which will require brokers trading in our Common Stock to adhere to more stringent rules and possibly result in a reduced level of trading activity in the secondary trading market for our securities;

|

| |

●

|

a limited amount of news and analyst coverage; and

|

| |

●

|

potential breaches of representations or covenants of our agreements pursuant to which we made representations or covenants relating to our compliance with applicable listing requirements, which, regardless of merit, could result in costly litigation, significant liabilities and diversion of our management’s time and attention and could have a material adverse effect on our financial condition, business and results of operations.

|

The National Securities Markets Improvement Act of 1996, which is a federal statute, prevents or preempts the states from regulating the sale of certain securities, which are referred to as “covered securities.” Because our Common Stock is listed on the NYSE American, our Common Stock qualifies as a covered securities under such statute. Although the states are preempted from regulating the sale of our securities, the federal statute does allow the states to investigate companies if there is a suspicion of fraud, and, if there is a finding of fraudulent activity, then the states can regulate or bar the sale of covered securities in a particular case. If we were no longer listed on the NYSE American, our Common Stock would not be a covered security and we would be subject to regulation in each state in which we offer our securities.

The proposed Reverse Stock Split, if effected, may not increase our stock price, and could lead to a decrease in our overall market capitalization.

On October 24, 2022, the closing sale price of our Common Stock on the NYSE American was $0.097 per share. We expect that the Reverse Stock Split, if effected, will increase the per share trading price of our Common Stock. However, the market price per share of our Common Stock after the Reverse Stock Split may not rise (or remain constant) in proportion to the reduction in the number of shares of Common Stock outstanding before the Reverse Stock Split. We cannot predict the effect of the Reverse Stock Split on the per share trading price of our Common Stock, and the history of reverse stock splits for other companies is varied, particularly since some investors may view a reverse stock split negatively. In many cases, the market price of a company’s shares declines after a reverse stock split, or the market price of a company’s shares immediately after a reverse stock split does not reflect a proportionate or mathematical adjustment to the market price based on the ratio of the reverse stock split. Accordingly, our total market capitalization after the Reverse Stock Split, if approved and effective, may be lower than our total market capitalization before the Reverse Stock Split, and it is possible that the Reverse Stock Split may not result in a per share trading price that would attract investors who do not trade in lower priced stocks.

Even if the Reverse Stock Split is implemented, the per share trading price of our Common Stock may decrease due to factors unrelated to the Reverse Stock Split. Other factors, such as our financial results, market conditions and the market perception of our business, may adversely affect the per share trading price of our Common Stock. As a result, we cannot assure you that the Reverse Stock Split, if completed, will result in the benefits that we anticipate, that the per share trading price of our Common Stock will increase following the Reverse Stock Split or that the per share trading price of our Common Stock will not decrease in the future.

The proposed Reverse Stock Split, if approved by stockholders and effected, may decrease the liquidity of our Common Stock.

The liquidity of our Common Stock may be harmed by the proposed Reverse Stock Split, given the reduced number of shares that would be outstanding after the Reverse Stock Split, particularly if the per share trading price does not increase proportionately as a result of the Reverse Stock Split. While our Board of Directors believes that a higher stock price may help generate the interest of new investors, the Reverse Stock Split may not result in a per-share price that will attract certain types of investors, such as institutional investors or investment funds, and such share price may not satisfy the investing guidelines of institutional investors or investment funds. As a result, the trading liquidity of our Common Stock may not improve as a result of a Reverse Stock Split and could be adversely affect by a higher per share price. Accordingly, the Reverse Stock Split may not increase marketability of our Common Stock. In addition, investors might consider the increased proportion of unissued authorized shares to issued shares to have an anti-takeover effect under certain circumstances, because the proportion allows for dilutive issuances that could prevent certain stockholders from changing the composition of the Board of Directors or render tender offers for a combination with another entity more difficult.

The proposed Reverse Stock Split, if effected, may result in some stockholders owning “odd lots” that may be more difficult to sell or require greater transaction costs per share to sell.

If the proposed Reverse Stock Split is implemented, it will increase the number of stockholders who own “odd lots” of less than 100 shares of Common Stock. A purchase or sale of less than 100 shares of Common Stock may result in incrementally higher trading costs through certain brokers, particularly “full service” brokers. Therefore, those stockholders who own less than 100 shares of our Common Stock following the Reverse Stock Split may be required to pay higher transaction costs if they sell their shares of Common Stock.

The proposed Reverse Stock Split, if effected, will result in a significant increase in our authorized Common Stock and may result in future dilution to our stockholders.

The Reverse Stock Split will reduce the number of outstanding shares of our Common Stock without a proportionate reduction in the number of shares of authorized but unissued Common Stock in our Certificate of Incorporation, which will give the Company a significantly larger number of authorized shares, as a percentage of total outstanding shares, available for future issuance without further stockholder action, except as may be required by applicable laws or the rules of any stock exchange on which our Common Stock is listed. The issuance of additional shares of Common Stock may have a dilutive effect on the ownership of existing stockholders.

Risks Relating to Owning Our Common Stock

There is uncertainty about our ability to continue as a going concern.

We have sustained operating losses for the majority of our corporate history and expect that our 2022 expenses will exceed our 2022 revenues, as we continue to invest in our Avenova and DERMAdoctor commercialization efforts. Our operating cash flow is not sufficient to support our ongoing operations, and we expect to continue incurring operating losses and negative cash flows until revenues reach a level sufficient to support ongoing growth and operations. We expect that the net proceeds from the Warrant Reprice Transactions may only provide adequate working capital into at least the second quarter of 2023, or through the fourth quarter of 2023, assuming the completion of the 2022 Private Placement after the Special Meeting. As such, additional funding or substantial revenue growth will be needed in both the short- and long-term in order to pursue our business plan. These circumstances raise doubt about our ability to continue as a going concern, which depends on our ability to raise capital to fund our current operations.

The price of our Common Stock may fluctuate substantially, which may result in losses to our stockholders.

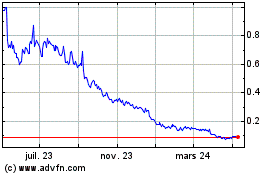

The stock prices of many companies in our market segments have generally experienced wide fluctuations, which are often unrelated to the operating performance of those companies. Our Common Stock traded as low as $0.09 per share and as high as $0.63 per share during the 12-month period ended October 20, 2022.

The market price of our Common Stock has been and is likely to continue to be highly volatile and could fluctuate in response to, among other things:

| |

●

|

the announcement of new products by us or our competitors;

|

| |

●

|

the announcement of partnering arrangements by us or our competitors;

|

| |

●

|

quarterly variations in our or our competitors’ results of operations;

|

| |

●

|

changes in our earnings estimates, investors’ perceptions, recommendations by securities analysts or our failure to achieve analysts’ earnings estimates;

|

| |

●

|

developments in our industry;

|

| |

●

|

dilutive effects of future sales of shares of Common Stock by us or by any of our stockholders (including sales of Common Stock underlying outstanding shares of convertible preferred stock, warrants, and options), especially within a short period of time; and

|

| |

●

|

general, economic and market conditions, including volatility in the financial markets, a decrease in consumer confidence and other factors unrelated to our operating performance or the operating performance of our competitors.

|

Our ability to use our net operating loss carryforwards and certain other tax attributes may be limited.

Under Section 382 of the Internal Revenue Code of 1986, as amended (the “Code”), if a corporation undergoes an “ownership change,” generally defined as a greater than 50% change (by value) in its equity ownership over a three-year period, the corporation’s ability to use its pre-change net operating loss (“NOL”) carryforwards and other pre-change tax attributes (such as research tax credits) to offset its post-change income may be limited. Since our formation, we have raised capital through the issuance of capital stock on many occasions which, combined with the purchasing stockholders’ subsequent disposition of those shares, may have resulted in one or more changes of control, as defined by Section 382 of the Code. We have not currently completed a study to assess whether any change of control has occurred, or whether there have been multiple changes of control since our formation, due to the significant complexity and cost associated with such study. If we have experienced a change of control at any time since our formation, our NOL carryforwards and tax credits may not be available, or their utilization could be subject to an annual limitation under Section 382. In addition, since we may need to raise additional funding to finance our operations, we may undergo further ownership changes in the future. If we earn net taxable income, our ability to use our pre-change NOL carryforwards to offset United States federal taxable income may be subject to limitations, which could potentially result in increased future tax liability to us.

We have not paid dividends or repurchased stock in the past and do not expect to pay dividends or repurchase stock in the future, and any return on investment may be limited to the value of our stock.

We have never paid cash dividends on, or repurchased shares of, our Common Stock and do not anticipate paying cash dividends or repurchasing shares of our Common Stock in the foreseeable future. In addition, we do not anticipate paying any dividends or repurchasing any shares of any series of our preferred stock; however, if we pay dividends on our shares of Common Stock, we are required to pay dividends on any series of our preferred stock on an as converted basis. The payment of dividends on, or the repurchase of shares of, our Common Stock or any series of preferred stock will depend on our earnings, financial condition and other business and economic factors affecting us at such time as our Board of Directors may consider relevant. If we do not pay dividends or repurchase stock, holders of our Common Stock will experience a return on their investment in our shares only if our stock price appreciates.

We may issue additional shares of our Common Stock, other series or classes of preferred stock or other equity securities without your approval, which would dilute your ownership interests and may depress the market price of your shares.

We may issue additional shares of our Common Stock, other series or classes of preferred stock, in addition to the Series B Preferred Stock we issued in the 2021 Private Placement and the Series C Preferred Stock that we expect to issue upon closing of the 2022 Private Placement, without stockholder approval. In addition, we will issue additional shares of Common Stock upon the conversion of the Series B Preferred Stock and the Series C Preferred Stock that we expect to issue if the 2022 Private Placement closed, the exercise of the Amended Warrants, the New Reprice Warrants, the 2022 Warrants that we expect to issue if the 2022 Private Placement closes, and other Common Stock purchase warrants that we have issued or other equity securities of equal or senior rank in the future in connection with, among other things, future acquisitions, repayment of outstanding indebtedness or under our 2017 Omnibus Incentive Plan.

Our issuance of additional shares of our Common Stock, preferred stock or other equity securities of equal or senior rank could have the following effects:

| |

●

|

your proportionate ownership interest in NovaBay will decrease;

|

| |

●

|

the relative voting strength of each previously outstanding share of Common Stock may be diminished; or

|

| |

●

|

the market price of your shares of Common Stock may decline.

|

We may require additional capital funding, the receipt of which may impair the value of our Common Stock and any series of our preferred stock.

In order to fully implement our growth strategies, we may need to raise additional capital through public or private equity offerings or debt financings, such as the recently completed Warrant Reprice Transactions and the 2022 Private Placement, if such financing is consummated. Our future capital requirements depend on many factors including our research, development, sales and marketing activities. We do not know whether additional financing will be available when needed or will be available on terms favorable to us. If we cannot raise needed funds on acceptable terms, we may not be able to develop or enhance our products, take advantage of future opportunities or respond to competitive pressures or unanticipated requirements. To the extent we raise additional capital by issuing equity securities, our stockholders may experience substantial dilution and the new equity securities may have greater rights, preferences or privileges than our existing Common Stock. In addition, the new equity securities may be offered in the future at a price that is below the then in effect conversion price of the Series B Preferred Stock or, when and if issued, the Series C Preferred Stock, which would result in the lowering of the conversion price of the preferred stock and a greater number of shares of Common Stock being issuable upon conversion of the Series B Preferred Stock and/or Series C Preferred Stock for no additional consideration, causing even greater dilution to our stockholders.

Offers or availability for sale of a substantial number of shares of our Common Stock, including as a result of the conversion of the Series B Preferred Stock and/or the exercise of the 2020 Original Warrants, the 2021 Original Warrants, the Amended Warrants, the New Reprice Warrants or, when and if issued, the Series C Preferred Stock and/or the 2022 Warrants, may cause the price of our publicly traded securities to decline.

Sales of a significant number of shares of our Common Stock in the public market could depress the market price of our Common Stock and make it more difficult for us to raise funds through future offerings of Common Stock. For example sales of shares of Common Stock that are issuable upon conversion of the Series B Preferred Stock and/or the exercise of the 2020 Original Warrants, the 2021 Original Warrants, the Amended Warrants, the New Reprice Warrants, other Common Stock purchase warrants we have issued or, when and if issued, the Series C Preferred Stock and/or the 2022 Warrants, may cause the price of our publicly traded securities to decline. The shares of Common Stock underlying our shares of Series B Preferred Stock outstanding as of the date of this prospectus, the 2020 Original Warrants, the 2021 Original Warrants, the Amended Warrants, the New Reprice Warrants, other Common Stock purchase warrants we have issued or, when and if issued, the Series C Preferred Stock and/or the 2022 Warrants represent, in the aggregate, approximately 148% of the total number of shares of Common Stock outstanding as of the date of this prospectus. Upon conversion or exercise, as the case may be, of those securities, the shares of Common Stock we issue upon such conversion or exercise could be sold into the public market, and such sales could be significant.

In addition, the Series B Preferred Stock and, when and if issued, the Series C Preferred Stock, may become convertible into a greater number of shares of Common Stock that would be available for sale as a result of the full-ratchet anti-dilution price protection in the Series B Certificate of Designation for the Series B Preferred Stock or, if issued, the Certificate of Designation for the Series C Preferred Stock, as the case may be, which would be triggered if we were to issue Common Stock in the future at an effective Common Stock purchase price that is less than the current conversion price for the Series B Preferred Stock or, when and if issued, the Series C Preferred Stock.

Any of the foregoing could make it more difficult for us to raise additional financing through the sale of equity or equity-related securities in the future at a time and/or at a price that we deem reasonable or appropriate, or at all.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents we have filed with the SEC that are incorporated by reference contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934 (the “Exchange Act”), including, but not limited to, statements that are based upon management’s current expectations, assumptions, estimates, projections and beliefs, including statements about the commercial progress and future financial performance of the Company, as well as matters relating to the Warrant Reprice Transactions, the 2022 Private Placement, and the Stockholder Approvals. These statements relate to future events or to our future operating or financial performance and involve risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements.

The use of words such as, but not limited to, “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “will,” or “would” and similar words or expressions are intended to identify forward-looking statements. These statements include, but are not limited to, statements regarding our ability to regain compliance with the continued listing standards of the NYSE American, the financial and business impact and effect of the completed Warrant Reprice Transactions, the expected timing of, our ability to complete, and impact of the 2022 Private Placement and the Reverse Stock Split, our partnerships, and any future revenue that may result from selling the Company’s products, as well as the Company’s expected future financial results and ability to continue as a going concern. These statements involve risks, uncertainties and other factors that may cause actual results or achievements to be materially different and adverse from those expressed in or implied by these forward-looking statements.

We discuss in greater detail many of these risks under the heading “Risk Factors” contained in this prospectus or otherwise described in our filings with the SEC, including our Annual Report on Form 10-K, in our subsequently filed Quarterly Reports on Form 10-Q, as well as any amendments thereto reflected in subsequent filings with the SEC, which are incorporated by reference into this prospectus in their entirety. Also, these forward-looking statements represent our estimates and assumptions only as of the date of the document containing the applicable statement. Unless required by law, we undertake no obligation to update or revise any forward-looking statements to reflect new information or future events or developments. Thus, you should not assume that our silence over time means that actual events are bearing out as expressed or implied in such forward-looking statements. You should read this prospectus together with the documents we have filed with the SEC that are incorporated by reference completely and with the understanding that our actual future results may be materially different from what we expect. We qualify all of the forward-looking statements in the foregoing documents by these cautionary statements.

USE OF PROCEEDS

The Shares covered by this prospectus are issuable upon conversion of our currently outstanding Series B Preferred Stock (as of the date of this prospectus) into 35,510,720 shares of Common Stock as described in “Prospectus Summary — The Shares and the 2021 Private Placement”. We will not receive any proceeds from the sale of the Shares by the Selling Stockholders. We will bear the costs, expenses and fees in connection with the registration of the Shares. The Selling Stockholders will each bear all commissions and discounts, if any, attributable to their respective sales of the Shares.

MARKET FOR OUR COMMON STOCK

Market Information

Our Common Stock is listed on the NYSE American, under the symbol “NBY.”

Holders

As of October 20, 2022, we had 64,988,364 shares of Common Stock outstanding and there were approximately 119 holders of record of our Common Stock. We have 11,260 shares of Series B Preferred Stock that have been issued in the 2021 Private Placement, and no other preferred stock outstanding as of the date of this prospectus. After the Stockholder Approval Date and subject to the satisfaction of the other closing conditions for the transaction, we expect to close the 2022 Private Placement and issue 3,250 shares of Series C Preferred Stock. This figure does not reflect persons or entities that hold their stock in nominee or “street” name through various brokerage firms.

DIVIDEND POLICY

We have not paid cash dividends on our Common Stock since our inception. We currently expect to retain earnings primarily for use in the operation and expansion of our business; therefore, we do not anticipate paying any cash dividends in the foreseeable future. Any future determination to pay cash dividends will be at the discretion of our Board of Directors and will be dependent upon our financial condition, results of operations, capital requirements, restrictions under any existing indebtedness and other factors the Board of Directors deems relevant.

PRINCIPAL STOCKHOLDERS

The following table indicates information as of October 20, 2022 regarding the beneficial ownership of our Common Stock by:

| |

●

|

each person who is known by us to beneficially own more than five percent (5%) of our securities;

|

| |

●

|

our current executive officers;

|

| |

●

|

each of our directors; and

|

| |

●

|

all of our directors and executive officers as a group.

|

The percentage of shares beneficially owned is based on 64,988,364 shares of Common Stock outstanding as of October 20, 2022. Except as indicated in the footnotes to this table, and as affected by applicable community property laws, all persons listed have sole voting and investment power for all shares shown as beneficially owned by them and no shares are pledged.

|

Name and Address of Beneficial Owner (1)

|

|

Number of

Shares

Beneficially

Owned

|

|

|

Percent

of Class

|

|

|

Beneficial Owners Holding More Than 5%

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Pioneer Pharma (Hong Kong) Company Ltd. (“Pioneer Hong Kong”) (2)

|

|

|

5,188,421 |

|

|

|

8.0 |

%

|

|

682 Castle Peak Road

|

|

|

|

|

|

|

|

|

|

Lai Chi Kok, Kowloon, Hong Kong

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Hudson Bay Master Fund Ltd. (3)

|

|

|

6,667,200 |

|

|

|

9.3 |

%

|

|

c/o Hudson Bay Capital Management LP

|

|

|

|

|

|

|

|

|

|

28 Havemeyer Place, 2nd Floor

|

|

|

|

|

|

|

|

|

|

Greenwich, CT 06830

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

FGP Protective Opportunity Master Fund SP (4)

|

|

|

7,063,781 |

|

|

|

9.9 |

%

|

|

94 Solaris Ave, 2nd Floor

|

|

|

|

|

|

|

|

|

|

Camana Bay

|

|

|

|

|

|

|

|

|

|

P.O. Box 30 745 Grand Cayman

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Jian Ping Fu (“Mr. Fu”) (5)

|

|

|

4,000,000 |

|

|

|

6.2 |

%

|

|

11 Williams Road

|

|

|

|

|

|

|

|

|

|

Mt. Eliza, Melbourne VIC 3930, Australia

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Executive Officers and Directors

|

|

|

|

|

|

|

|

|

|

Justin M. Hall, Esq. (6)

|

|

|

559,157 |

|

|

|

* |

|

|

Andrew Jones (7)

|

|

|

329,024 |

|

|

|

* |

|

|

Audrey Kunin, M.D. (8)

|

|

|

283,632 |

|

|

|

* |

|

|

Jeff Kunin, M.D. (9)

|

|

|

208,632 |

|

|

|

* |

|

|

Paul E. Freiman, Ph.D. (10)

|

|

|

154,409 |

|

|

|

* |

|

|

Julie Garlikov

|

|

|

- |

|

|

|

* |

|

|

Swan Sit (11)

|

|

|

50,000 |

|

|

|

* |

|

|

Mijia (Bob) Wu, M.B.A. (12)

|

|

|

85,244 |

|

|

|

* |

|

|

Yenyou (Jeff) Zheng, Ph.D. (13)

|

|

|

50,000 |

|

|

|

* |

|

|

Yongxiang (Sean) Zheng

|

|

|

- |

|

|

|

* |

|

|

All directors and executive officers as a group (10 persons)

|

|

|

1,488,028 |

|

|

|

2.7 |

%

|

|

*

|

Less than one percent (1%).

|

|

(1)

|

The address for each director and officer of NovaBay listed is c/o NovaBay Pharmaceuticals, Inc., 2000 Powell Street, Suite 1150, Emeryville, CA 94608. Number of shares beneficially owned and percent of class is calculated in accordance with SEC rules. A beneficial owner is deemed to beneficially own shares the beneficial owner has the right to acquire within 60 days of October 20, 2022. For purposes of calculating the percent of class held by a single beneficial owner, the shares that such beneficial owner has the right to acquire within 60 days of October 20, 2022 are also deemed to be outstanding; however, such shares are not deemed to be outstanding for purposes of calculating the percentage ownership of any other beneficial owner.

|

|

(2)

|

Based upon information contained in the Schedule 13D/A filed by Pioneer Hong Kong and China Pioneer Pharma Holdings Limited, the parent company of Pioneer Hong Kong, with the SEC on January 13, 2017, Pioneer Hong Kong beneficially owned 5,188,421 shares of Common Stock as of December 9, 2016, with shared voting and dispositive power of all shares and sole voting and dispositive power of no shares.

|

| |

|

|

(3)

|

Based upon the Company’s records, as of October 20, 2022, Hudson Bay Master Fund Ltd. owned 6,667,200 shares of Common Stock issuable upon the conversion of shares of the Series B Preferred Stock.

|

| |

|

|

(4)

|

Based upon the Company’s records, as of October 20, 2022, FGP Protective Opportunity Master Fund SP owned 700,000 shares of Common Stock and at least 6,363,781 shares of Common Stock issuable upon the conversion of shares of the Series B Preferred Stock (with such number of shares of Common Stock representing the maximum amount convertible up to a beneficial ownership threshold of 9.9%).

|

| |

|

|

(5)

|

Based upon information contained in the Schedule 13D/A filed by Mr. Fu with the SEC on August 24, 2020, Mr. Fu beneficially owned 4,000,000 shares of Common Stock as of August 1, 2020, with sole voting power over 4,000,000 shares, shared voting power over no shares, sole dispositive power over 4,000,000 shares and shared dispositive power over no shares.

|

| |

|

|

(6)

|

Consists of (i) 83,172 shares of Common Stock held directly by Mr. Hall and (ii) 475,985 shares issuable upon the exercise of outstanding options which are exercisable as of October 20, 2022 or within 60 days after such date. Does not include 500,000 performance restricted stock units granted to Mr. Hall on May 4, 2021 that will vest based on the achievement of three performance goals at the end of a three-year performance period ending December 31, 2023.

|

| |

|

|

(7)

|

Consists of (i) 127,461 shares of Common Stock held directly by Mr. Jones and (ii) 201,563 shares issuable upon exercise of outstanding options which are exercisable as of October 20, 2022 or within 60 days after such date. Does not include 250,000 performance restricted stock units granted to Mr. Jones on May 4, 2021 that will vest based on the achievement of three performance goals at the end of a three-year performance period ending December 31, 2023.

|

| |

|

|

(8)

|

Consists of (i) 208,632 shares held by The Audrey G. Kunin Trust of which Dr. Audrey Kunin serves as the trustee (with sole voting and investment power) and (ii) 75,000 shares issuable upon exercise of outstanding options which are exercisable as of October 20, 2022 or within 60 days after such date. Does not include 300,000 performance restricted stock units granted to Dr. Audrey Kunin on November 8, 2021 that will vest based on the achievement of three performance goals at the end of a three year performance period ending December 31, 2023.

|

| |

|

|

(9)

|

Consists of 208,632 shares held by The Audrey G. Kunin Trust of which Dr. Jeff Kunin’s spouse (Dr. Audrey Kunin) serves as the trustee (with sole voting and investment power).

|

| |

|

|

(10)

|

Consists of (i) 32,311 shares held by the Paul Freiman and Anna Mazzuchi Freiman Trust, of which Dr. Freiman and his spouse are trustees (with sole voting power over 625 shares, shared voting power over 1,061 shares, sole investment power over no shares and shared investment power over 1,686 shares) and (ii) 122,097 shares issuable upon exercise of outstanding options which are exercisable as of October 20, 2022 or within 60 days after such date.

|

| |

|

|

(11)

|

Consists of (i) 30,000 shares of Common Stock held directly by Ms. Sit and (ii) 20,000 shares issuable upon exercise of outstanding options which are exercisable as of October 20, 2022 or within 60 days after such date.

|

| |

|

|

(12)

|

Consists of (i) 30,000 shares of Common Stock held directly by Mr. Wu and (ii) 55,244 shares issuable upon exercise of outstanding options which are exercisable as of October 20, 2022 or within 60 days after such date. As Non-Executive Director of China Pioneer, the parent company of Pioneer Hong Kong, Mr. Wu disclaims beneficial ownership of the shares of the Common Stock held by China Pioneer Pharma and Pioneer Hong Kong.

|

| |

|

|

(13)

|

Consists of (i) 30,000 shares of Common Stock held directly by Dr. Jeff Zheng and (ii) 20,000 shares issuable upon exercise of outstanding options which are exercisable as of October 20, 2022 or within 60 days after such date.

|

DESCRIPTION OF CAPITAL STOCK

Our authorized capital stock currently consists of 150,000,000 shares of Common Stock with a $0.01 par value per share, and 5,000,000 shares of preferred stock with a $0.01 par value per share. A description of material terms and provisions of the Certificate of Incorporation and the Bylaws affecting the rights of holders of the Company’s capital stock is set forth below. The description is intended as a summary, and is qualified in its entirety by reference to the Company’s Certificate of Incorporation and the Bylaws, which are available in our filings with the SEC. As of October 20, 2022, there were 64,988,364 shares of Common Stock outstanding, and, of 15,000 shares of the Series B Preferred Stock initially issued in the 2021 Private Placement, there are 11,620 shares of Series B Preferred Stock that have not been converted and are outstanding.

Common Stock

Dividend rights. Subject to preferences that may apply to shares of preferred stock outstanding at the time, the holders of outstanding shares of our Common Stock are entitled to receive dividends out of funds legally available if the Board, in its discretion, determines to issue dividends and then only at the times and in the amounts that the Board may determine.

Voting rights. Each holder of Common Stock is entitled to one vote for each share of Common Stock held on all matters submitted to a vote of stockholders. Our Certificate of Incorporation does not provide for the right of stockholders to cumulate votes for the election of directors. Our Certificate of Incorporation establishes a classified Board, divided into three classes with staggered three-year terms. Only one class of directors is elected at each annual meeting of our stockholders, with the other classes continuing for the remainder of their respective three-year terms.

No preemptive or similar rights. Our Common Stock is not entitled to preemptive rights and is not subject to conversion, redemption or sinking fund provisions. The rights, preferences and privileges of the holders of our Common Stock are subject to, and may be adversely affected by, the rights of the holders of any series of our preferred stock that NovaBay may designate and issue in the future.

Right to receive liquidation distributions. Upon our dissolution, liquidation or winding-up, the assets legally available for distribution to holders of our Common Stock are distributable ratably among the holders of our Common Stock, subject to prior satisfaction of all outstanding debt and liabilities and the preferential or pari passu rights and payment of liquidation preferences, if any, on any outstanding shares of our preferred stock, including the Series B Preferred Stock.

The rights of the holders of Common Stock are subject to, and may be adversely affected by, the rights of holders of shares of the Series B Preferred Stock, as described below, and any other preferred stock that we may designate and issue in the future.

Preferred Stock

Under the terms of the Certificate of Incorporation, the Board is authorized to issue up to 5,000,000 shares of preferred stock in one or more series without stockholder approval. Other than the Series B Preferred Stock, we do not currently have any shares of preferred stock issued and outstanding.

Our Certificate of Incorporation authorized the Board, subject to limitations prescribed by Delaware law, to issue preferred stock in one or more series, to establish from time to time the number of shares to be included in each series and to fix the designation, powers, preferences and rights of the shares of each series and any of its qualifications, limitations or restrictions. The Board can also increase or decrease the number of shares of any series, but not below the number of shares of that series then outstanding, without any further vote or action by our stockholders. The Board may authorize the issuance of preferred stock with voting or conversion rights that could adversely affect the voting power or other rights of the holders of the Common Stock. The issuance of preferred stock, while providing flexibility in connection with financings, possible acquisitions and other corporate purposes, could, among other things, have the effect of delaying, deferring, discouraging or preventing a change in control of the Company, may adversely affect the market price of our Common Stock and the voting and other rights of the holders of Common Stock, and may reduce the likelihood that stockholders will receive dividend payments and payments upon liquidation.

Series B Non-Voting Convertible Preferred Stock

On November 2, 2021, we issued 15,000 shares of the Series B Preferred Stock, all of which were convertible into shares of Common Stock at the election of the holders of the Series B Preferred Stock, subject to the beneficial ownership limitation described below. Of the 15,000 shares of Series B Preferred Stock originally issued and sold in the 2021 Private Placement, 11,260 shares of Series B Preferred Stock have not been converted and remain outstanding. The conversion price of each share of Series B Preferred Stock is currently $0.18 into 5,556 shares of Common Stock. The following is a summary of the terms of the Series B Preferred Stock, which is qualified in its entirety by the Series B Certificate of Designation, which was filed as Exhibit 3.1 to our Current Report on Form 8-K filed with the SEC on November 1, 2021 and which is incorporated into this prospectus by reference.

Rank

The Series B Preferred Stock ranks as to dividends or distributions of assets upon our liquidation, dissolution or winding up, whether voluntarily or involuntarily, as follows:

| |

●

|