false

0000746514

0000746514

2024-11-21

2024-11-21

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event

reported) November 21, 2024

NEW ENGLAND REALTY ASSOCIATES LIMITED PARTNERSHIP

(Exact Name of Registrant as Specified in

Charter)

| Massachusetts |

001-31568 |

04-2619298 |

| |

|

|

| (State or Other Jurisdiction |

(Commission |

(IRS Employer |

| of Incorporation) |

File Number) |

Identification Number) |

| 39 Brighton Avenue, Allston, Massachusetts |

02134 |

| |

|

| (Address of Principal Executive Offices) |

(Zip Code) |

Registrant’s telephone number, including area code (617) 783-0039

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

(see General Instruction A.2. below):

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12

under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant

to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant

to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(g) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange

on which registered |

| CLASS A LIMITED PARTNERSHIP UNITS |

|

NEN |

|

NYSE AMERICAN |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.01 Entry into a Material Definitive Agreement.

New Revolving Line of Credit Agreement

On November 21, 2024, New England Realty Associates Limited

Partnership (“NERA” or “Borrower”) entered into a Loan Agreement with Brookline Bank (“Lender”,

and such Loan Agreement, the “Revolving Line of Credit Agreement”). All capitalized terms not defined herein shall have

the meaning assigned to them in the Revolving Line of Credit Agreement.

Under the Revolving Line of Credit Agreement, Lender shall provide

Borrower Advances up to an aggregate amount of $25,000,000 at any one time. The making of an Advance under the Revolving Line of

Credit Agreement is subject to the satisfaction of certain conditions precedent, including, that no Default or Event of Default has occurred

and is continuing, that no event or circumstance, either individually or in the aggregate, has had or could reasonably be expected to

have a Material Adverse Effect, and that all of the representations and warranties of each Loan Party to the Revolving Line of Credit

Agreement are true and correct as of the date of such Advance. The Borrower’s obligations under the Revolving Line of

Credit Agreement are secured by a first priority Pledge and Security Agreement from the Borrower with respect to the interests of

Borrower in and to that portion of Borrower’s Equity Interests in its subsidiaries.

Borrowings under the Revolving Line of Credit Agreement will mature

on November 21, 2027, with a one-year extension option at Lender’s sole discretion so long as no Events of Default shall have

occurred and be continuing and that Borrower shall pay Lender a nonrefundable commitment fee of 25 basis points of the Maximum Availability

under the Revolving Line of Credit.

Each Advance shall bear interest on the outstanding principal

amount thereof from the applicable borrowing date at a rate per annum equal to the Secured Overnight Financing Rate plus 250 basis points. The

Borrower has also agreed to pay Lender an unused line fee of 75 basis points on any unused availability under the Revolving Line of Credit.

This unused line fee is waived during any period in which Borrower and its Affiliates maintain aggregate deposits of $20,000,000 or greater

with Brookline Bank.

The Revolving Line of Credit Agreement contains certain financial covenants

that Borrower has agreed to comply with for the duration of the Revolving Line of Credit Agreement, including the maintenance of a Debt

Yield of at least 8.50%, a leverage ratio not to exceed 65%, a Debt Service Coverage Ratio of at least 1.50 to 1.00, usage under the Revolving

Line of Credit not to exceed 1.5 times the trailing twelve months of Adjusted EBITDA, and minimum liquidity of $15 million.

If an Event of Default occurs under the Revolving Line of Credit Agreement,

the Lender may terminate the availability of Advances under the Agreement and/or decline to make any Advances, may declare all Obligations

to be immediately due and payable, and exercise on behalf of itself all rights and remedies available under the Loan Documents or

applicable Law or equity.

A copy of the Revolving Line of Credit Agreement is filed as Exhibit 10.1

hereto and is incorporated herein by reference. The above descriptions of Revolving Line of Credit Agreement contained herein are qualified

in their entirety by the full text of such exhibit.

Item 2.03 Creation of a Direct Financial Obligation or

an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The description of the Revolving Line of Credit Agreement set forth

above under Item 1.01 above is incorporated by reference into this Item 2.03.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

10.1 Loan Agreement (Revolving Line of Credit), dated as of November 21, 2024, between New England Realty Associates Limited Partnership, as Borrower, and Brookline Bank, as Lender.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

NEW ENGLAND REALTY ASSOCIATES LIMITED PARTNERSHIP |

| |

|

| |

|

| |

By: |

NewReal, Inc., its General Partner |

| |

|

|

| |

|

By |

/s/ Jameson Brown |

| |

|

|

Jameson Brown, its Treasurer |

| Date November 27, 2024 |

|

Exhibit

10.1

LOAN AGREEMENT

(Revolving Line

of Credit)

Dated as of November 21,

2024

between

NEW ENGLAND REALTY

ASSOCIATES LIMITED PARTNERSHIP

as Borrower

and

BROOKLINE BANK

as Lender

Table of Contents

| 1. |

DEFINITIONS |

1 |

| |

|

|

| 2. |

LINE OF CREDIT |

9 |

| |

2.1 |

Line of Credit |

9 |

| |

2.2 |

Purpose |

9 |

| |

2.3 |

Advances |

9 |

| |

2.4 |

Loan Account |

10 |

| |

|

|

|

| 3. |

SECURITY |

10 |

| |

3.1 |

Collateral |

10 |

| |

3.2 |

Additional Security Documents |

10 |

| |

|

|

|

| 4. |

CONDITIONS PRECEDENT |

10 |

| |

4.1 |

Conditions to Closing |

10 |

| |

4.2 |

Conditions to Each Advance |

12 |

| |

|

|

|

| 5. |

UNUSED FEE |

12 |

| |

5.1 |

Calculation and Payment |

12 |

| |

5.2 |

Minimum Deposits |

12 |

| |

|

|

|

| 6. |

REPRESENTATIONS AND WARRANTIES |

13 |

| |

6.1 |

Existence and Power |

13 |

| |

6.2 |

Authority |

13 |

| |

6.3 |

Validity |

13 |

| |

6.4 |

Financial Statements and Condition |

13 |

| |

6.5 |

Compliance with Law |

14 |

| |

6.6 |

Litigation |

14 |

| |

6.7 |

Events of Default |

14 |

| |

6.8 |

Title to Property |

14 |

| |

6.9 |

Solvency |

14 |

| |

6.10 |

Taxes |

14 |

| |

6.11 |

Jurisdiction of Formation; Principal Office |

14 |

| |

6.12 |

Organizational Structure |

14 |

| |

6.13 |

Regulation U |

15 |

| |

6.14 |

Investment Company Act |

15 |

| |

6.15 |

ERISA |

15 |

| |

6.16 |

Hazardous Materials |

15 |

| |

6.17 |

No Broker |

15 |

| |

6.18 |

Governmental and Other Approvals |

15 |

| |

6.19 |

Insurance |

15 |

| |

6.20 |

Compliance with Anti-Terrorism, Embargo, Sanctions and Anti-Money Laundering Laws |

16 |

| |

6.21 |

Information Complete |

16 |

| |

|

|

|

| 7. |

AFFIRMATIVE COVENANTS |

16 |

| |

7.1 |

Financial Statements; Notice of Default |

16 |

| |

7.2 |

Compliance with Laws |

17 |

| |

7.3 |

Taxes |

17 |

| |

7.4 |

Litigation |

18 |

| |

7.5 |

Maintenance of Existence |

18 |

| |

7.6 |

Insurance |

18 |

| |

7.7 |

Books and Records; Access |

18 |

| |

7.8 |

Senior Management |

18 |

| |

7.9 |

Operating Accounts |

18 |

| |

7.10 |

Organizational Documents |

18 |

| |

7.11 |

Foreign Corrupt Practices Act |

18 |

| |

7.12 |

Patriot Act |

18 |

| |

7.13 |

Financings |

19 |

| |

|

|

|

| 8. |

NEGATIVE COVENANTS |

19 |

| |

8.1 |

Debt Yield |

19 |

| |

8.2 |

Leverage Ratio |

19 |

| |

8.3 |

Debt Service Coverage Ratio |

19 |

| |

8.4 |

Usage |

19 |

| |

8.5 |

Liquidity |

19 |

| |

8.6 |

Encumbrances |

19 |

| |

8.7 |

Other Indebtedness |

20 |

| |

8.8 |

Investments |

20 |

| |

8.9 |

Mergers, etc. |

20 |

| |

8.10 |

Change in Nature of Business |

20 |

| |

8.11 |

OFAC Compliance |

20 |

| |

8.12 |

Environmental Matters |

20 |

| |

8.13 |

Disposition of Collateral and Certain Property |

21 |

| |

8.14 |

Transactions with Affiliates |

21 |

| |

8.15 |

Restricted Payments |

21 |

| |

|

|

|

| 9. |

EVENTS OF DEFAULT; REMEDIES |

21 |

| |

9.1 |

Definition |

21 |

| |

9.2 |

Remedies |

23 |

| |

9.3 |

Singular or Multiple Exercise; Non-Waiver |

23 |

| |

|

|

|

| 10. |

MISCELLANEOUS |

23 |

| |

10.1 |

Waivers |

23 |

| |

10.2 |

Remedies Cumulative |

24 |

| |

10.3 |

Jury Waiver |

24 |

| |

10.4 |

Notices |

24 |

| |

10.5 |

Expenses |

24 |

| |

10.6 |

Indemnification |

25 |

| |

10.7 |

Further Instruments |

25 |

| |

10.8 |

Governing Law; Consent to Jurisdiction |

25 |

| |

10.9 |

Survival of Representations |

25 |

| |

10.10 |

Integration; Amendment |

25 |

| |

10.11 |

Severability |

26 |

| |

10.12 |

Interpretation |

26 |

| |

10.13 |

Binding Effect |

26 |

LOAN AGREEMENT

(Revolving Line

of Credit)

This

LOAN AGREEMENT (the “Agreement”) is made and entered into as of November 21, 2024, by and between NEW ENGLAND REALTY

ASSOCIATES LIMITED PARTNERSHIP, a Massachusetts limited partnership with a principal place of business of 39 Brighton Avenue, Boston,

Massachusetts 02134 (“Borrower’), and BROOKLINE BANK, a Massachusetts chartered trust company with a principal place

of business at 131 Clarendon Street, P.O. Box 179179, Boston, Massachusetts 02117-9179 (the “Lender”).

In

order to induce Lender to advance money or grant other financial accommodations to Borrower, Borrower represents, warrants, covenants

to and agrees with Lender as follows:

As used

in this Agreement, the following terms have the meanings set forth below:

“Adjusted

EBITDA” means, for any Property calculated on trailing twelve (12) month basis, the sum of the following (without duplication):

(a) gross revenues (including interest income) received in the ordinary course from such Property minus (b) all expenses paid

or accrued related to the ownership, operation or maintenance of such Property, including but not limited to taxes, assessments and the

like, insurance, utilities, payroll costs, maintenance, repair and landscaping expenses, marketing expenses, and general and administrative

expenses, minus a capital reserve reasonably acceptable to Lender.

“Advance”

means a disbursement of the Line of Credit.

“Advance Request” is defined in Section 2.3.

“Affiliate”

of any Person means any other Person that, directly or indirectly, Controls or is Controlled by, or is under common Control with, such

Person.

“Beneficial

Ownership Certification” means a certification regarding beneficial ownership as required by the Beneficial Ownership Regulation.

“Beneficial

Ownership Regulation” means 31 C.F.R. §1010.230.

“Business

Day” means any day other than a Saturday or a Sunday or any day on which commercial banks in Boston, Massachusetts are authorized

or required to close.

“Capitalization

Rate” means (a) for residential properties, an amount equal to the annual rate of interest payable on 10-year United States

Treasury obligations plus 200 basis points, and (b) for all other properties, an amount equal to the annual rate of interest payable

on 10-year United States Treasury obligations plus 250 basis points.

“Capital

Lease” means, with respect to any Person, the obligations of such Person to pay rent or other amounts under any lease of (or

other arrangement conveying the right to use) real or personal property, or a combination thereof, which obligations are required to

be classified and accounted for as capital leases on a balance sheet of such Person under GAAP.

“Capital

Lease Obligations” means, with respect to any Person for any period, the capitalized amount of obligations under Capital Leases

for such Person for such period as determined in accordance with GAAP.

“Compliance Certificate”

is defined in Section 7.1(c).

“Change

in Control” means the occurrence of any of the following: (a) Guarantor ceases to be the sole general partner of, and/or

Control, Borrower; (b) any change in the ownership or control of Guarantor that results in JPB Real Estate LLC and/or Maisie Brown

LLC, in the aggregate, owning less than a majority of the stock of the Guarantor, which stock shall be owned and controlled directly

or indirectly by Jameson Brown and/or Harley Brown, or by entities owned and controlled by either of them for their benefit or for the

benefit of their Immediate Family Members; (c) Jameson Brown ceases to be a member of the Board of Directors of Guarantor; (d) Jameson

Brown ceases to control the day to day management of Guarantor; and/or (e) Borrower ceases to own, directly or indirectly, the Equity

Interests of any Pledged Subsidiary unless Lender consents in writing to the transfer of such Equity Interests.

“Closing Date”

means the date hereof.

“Collateral”

means the collateral described in the Pledge Agreement and any all other collateral that secures the Obligations as set forth in the

Loan Documents.

“Control”

means the possession, directly or indirectly, of the power to direct or cause the direction of the management and policies of such Person,

whether through the ownership of voting shares or equity interests, or of the ability to exercise voting power by contract or otherwise.

The terms “Controlling” and “Controlled” have meanings correlative thereto.

“Debt

Service” means, for the applicable twelve (12) month period, the sum of (a) interest expense paid or incurred on Total

Indebtedness (excluding any interest due under the Loan Documents), (b) required amortization payments on Total Indebtedness, and

(c) debt service payments on the Line of Credit based upon the outstanding balance and interest rate annualized, provided that for

the first test of the Debt Service Coverage Ratio, the calculation of actual debt service payments on the Line of Credit shall be annualized.

“Debt

Service Coverage Ratio” is defined in Section 8.3.

“Debt Yield” is defined in Section 8.1.

“Default”

means any event or condition that constitutes an Event of Default or that, with the giving of any notice, the passage of time, or both,

would be an Event of Default.

“Environmental

Claim” means any investigative, enforcement, cleanup, removal, containment, remedial, or other private or governmental or regulatory

action at any time instituted or completed pursuant to any applicable Environmental Requirement against the Borrower, any of its Subsidiaries,

Guarantor or against or with respect to any Property or any condition, use, or activity on any Property (including any such action against

Lender), and any claim at any time made by any Person against Borrower, any of its Subsidiaries, Guarantor or against or with respect

to any Property or any condition, use, or activity on any Property (including any such claim against Lender), relating to damage, contribution,

cost recovery, compensation, loss, or injury resulting from or in any way arising in connection with any Hazardous Materials or any Environmental

Requirement.

“Environmental

Laws” means any and all applicable federal, state, local, and foreign statutes, laws, regulations, ordinances, rules, judgments,

orders, decrees, permits, concessions, grants, franchises, licenses, agreements or governmental restrictions relating to pollution and

the protection of the environment or the release of any materials into the environment, including those related to hazardous substances

or wastes, air emissions and discharges to waste or public systems.

“Environmental

Liability” means any written claim, demand, obligation, cause of action, accusation or allegation, or any order, violation,

damage (including, without limitation, to any Person, property or natural resources), injury, judgment, penalty or fine, cost of enforcement,

cost of remedial action, clean-up, restoration or any other cost or expense whatsoever, including reasonable attorneys’ fees and

disbursements resulting from the violation or alleged violation of any Environmental Requirement or the imposition of any Lien or otherwise

arising under any Environmental Requirement or resulting from any common law cause of action relating to protection of the environment

or exposure to Hazardous Material asserted by any Person.

“Environmental

Requirement” means any Environmental Law, agreement or restriction, as the same now exists or may be changed or amended or

come into effect in the future, which pertains to any Hazardous Materials or the environment including ground or air or water or noise

pollution or contamination, and underground or aboveground tanks.

“Equity

Interests” means, with respect to any Person, all of the shares of capital stock, partnership and membership interests of (or

other ownership or profit interests in) such Person, all of the warrants, options or other rights for the purchase or acquisition from

such Person of shares of capital stock of (or other ownership or profit interests in) such Person, all of the securities convertible

into or exchangeable for shares of capital stock of (or other ownership or profit interests in) such Person or warrants, rights or options

for the purchase or acquisition from such Person of such shares (or such other interests), and all of the other ownership or profit interests

in such Person (including partnership, member or trust interests therein), whether voting or nonvoting, and whether or not such shares,

warrants, options, rights or other interests are outstanding on any date of determination.

“Event of Default”

is defined in Section 9.1.

“FCPA”

means the Foreign Corrupt Practices Act of 1977, as amended, and the rules and regulations thereunder.

“Fee

Letter” means the Fee Letter dated as of the date hereof between Borrower and Lender.

“GAAP”

means generally accepted accounting principles in the United States set forth in the opinions and pronouncements of the Accounting Principles

Board and the American Institute of Certified Public Accountants and statements and pronouncements of the Financial Accounting Standards

Board or such other principles as may be approved by a significant segment of the accounting profession in the United States, that are

applicable to the circumstances as of the date of determination, consistently applied.

“Governmental

Authority” means the government of the United States or any other nation, or of any political subdivision thereof, whether

state or local, and any agency, authority, instrumentality, regulatory body, court, central bank or other entity exercising executive,

legislative, judicial, taxing, regulatory or administrative powers or functions of or pertaining to government.

“Guarantor”

means NewReal, Inc., a Massachusetts corporation.

“Guaranty”

means the nonrecourse carve-out guaranty executed and delivered by Guarantor.

“Hazardous

Materials” means all explosive or radioactive substances or wastes and all hazardous or toxic substances, wastes or other pollutants

regulated pursuant to any Environmental Law, including petroleum or petroleum distillates, asbestos or asbestos- containing materials,

polychlorinated biphenyls, radon gas, infectious or medical wastes and all other substances or wastes of any nature regulated pursuant

to any Environmental Law.

“Immediate

Family Members” means a child, stepchild, grandchild, spouse, sibling, or parent, and/or trusts or other entities created for

the benefit of any such person.

“Indebtedness”

means, as to any Person at a particular time, without duplication, all of the following, whether or not included as indebtedness or liabilities

in accordance with GAAP:

(a) all

obligations of such Person for borrowed money and all obligations of such Person evidenced by bonds, debentures, notes, loan agreements

or other similar instruments;

(b) all

direct or contingent obligations of such Person arising under letters of credit (including standby and commercial), bankers’ acceptances,

bank guaranties, surety bonds and similar instruments;

(c) all

obligations of such Person to pay the deferred purchase price of property or services (other than trade accounts payable in the ordinary

course of business and, in each case, either (i) not past due for more than one hundred and eighty (180) days or (ii) being

contested in good faith by appropriate proceedings diligently conducted);

(d) Capital Lease Obligations;

(e) all

obligations of such Person to purchase, redeem, retire, defease or otherwise make any payment in respect of any Equity Interest (excluding

perpetual preferred Equity Interests) in such Person or any other Person, valued, in the case of a redeemable preferred interest, at

the greater of its voluntary or involuntary liquidation preference plus (without duplication and only to the extent required to be paid)

accrued and unpaid dividends;

(f) all guarantees of such Person in respect of any of the foregoing;

(g) all

obligations of the kind referred to in clauses (a) through (f) above secured by (or for which the holder of such

obligation has an existing right, contingent or otherwise, to be secured by) any Lien on Property (including accounts and contract rights)

owned by such Person, whether or not such Person has assumed or become liable for the payment of such obligation, but limited to the

lesser of (i) the fair market value of the property subject to such Lien and (ii) the aggregate amount of the obligations so

secured; and

(h) all mark to market obligations of such Person under Swap Contracts.

For

all purposes hereof, the Indebtedness of any Person shall include the Indebtedness of any other entity (including any partnership in

which such Person is a general partner) to the extent such Person is liable therefor as a result of such Person’s ownership interest

in or other relationship with such entity, except to the extent the terms of such Indebtedness expressly provide that such Person is

not liable therefor. The amount of any net obligation under any Swap Contract on any date shall be deemed to be the Swap Termination

Value thereof as of such date. All outstanding Advances shall constitute Indebtedness of Borrower.

“Individual

Asset Value” means, as applicable for any particular Property, the NOI for the trailing twelve (12) months and divided by the

applicable Capitalization Rate based on the property type.

“Investment”

means, as to any Person, any direct or indirect acquisition or investment by such Person, whether by means of (a) the purchase or

other acquisition of Equity Interests of another Person, (b) a loan, advance or capital contribution to, guarantee or assumption

of debt of, or purchase or other acquisition of any other debt or equity participation or interest in, another Person, including any

partnership or joint venture interest in such other Person and any arrangement pursuant to which the investor guarantees Indebtedness

of such other Person, or (c) the purchase or other acquisition (in one transaction or a series of transactions) of assets of another

Person that constitute a business unit. For purposes of covenant compliance, the amount of any Investment shall be the amount actually

invested, without adjustment for subsequent increases or decreases in the value of such Investment.

“Legal

Requirements” means all applicable statutes, laws, ordinances, rules, regulations, orders, writs, injunctions and determinations

of any Governmental Authority.

“Leverage Ratio”

is defined in Section 8.2.

“Lien”

means any mortgage, pledge, hypothecation, assignment, deposit arrangement, encumbrance, lien (statutory or other), charge or other

security interest or any preference, priority or other security agreement or preferential arrangement of any kind or nature

whatsoever (including any conditional sale or other title retention agreement and any capital lease having substantially the same

economic effect as any of the foregoing).

“Line

of Credit” is defined in Section 2.1.

“Liquid Assets” is defined in Section 8.5.

“Loan

Documents” means this Agreement, the Note (as defined in Section 2.1), the Guaranty, the Pledge Agreement and the other

Security Documents, and every other document or instrument executed in connection herewith or therewith.

“Loan

Parties” means, collectively, Borrower and Guarantor, and “Loan Party” means any one of the Loan Parties.

“Material

Adverse Effect” means: (a) a material adverse change in, or a material adverse effect upon, the business, assets, operations,

or financial condition of Borrower; (b) a material adverse change in, or a material adverse effect upon, the business, assets, operations,

or financial condition of Borrower, its Subsidiaries and/or Guarantor, taken as a whole; (c) a material impairment of the ability

of Borrower or Guarantor to fully and timely perform its respective obligations under the Loan Documents; or (d) a material adverse

effect upon the legality, validity, binding effect, or enforceability against Borrower or Guarantor of any Loan Document to which it

is a party.

“Maturity Date”

is defined in Section 2.1.

“Maximum Availability” is defined in Section 2.1.

“Maximum Usage Amount”

is defined in Section 8.4.

“NOI”

means, with respect to any Property for any period, property rental and other income (as determined by GAAP) attributable to such Property

received during such period minus the amount of all expenses (as determined in accordance with GAAP) incurred in connection with and

directly attributable to the ownership and operation of such Property for such period, including, without limitation, management fees

in an amount equal to the greater of actual management fees paid or three percent (3%) per annum on gross revenues for such Property,

and amounts accrued for the payment of real estate taxes and insurance premiums, but excluding any general and administrative expenses

related to the operation of Borrower and its Subsidiaries, any interest expense or other debt service charges and any non-cash charges

such as depreciation or amortization of financing costs.

“Note”

is defined in Section 2.1.

“Obligations”

means, in the broadest and most comprehensive sense, all loans, advances, indebtedness, liabilities and obligations now or hereafter

owing from Borrower to Lender of whatever kind or nature, whether arising under the Loan Documents or otherwise whether or not such

obligations are now existing or hereafter arising, imposed by agreement or by operation of law, due or not yet due, absolute or

contingent, liquidated or unliquidated, secured or unsecured, actual or contingent, including all accrued interest and all costs and

expenses, including reasonable attorneys’ fees, incurred or paid by Lender in exercising, preserving, defending, collecting,

enforcing or protecting any of its rights under the Obligations or in any litigation arising out of the transactions evidenced by

the Obligations.

“Permitted

Investments” means Investments in (a) equity investments in and contributions to Subsidiaries of Borrower in the ordinary

course of Borrower’s business of owning and operating Properties; and (b) Liquid Assets.

“Permitted

Liens” means (a) Liens not yet due or payable on properties to secure taxes, assessments and other governmental charges

(excluding any Lien imposed pursuant to any of the provisions of ERISA or pursuant to any Environmental Laws) or claims for labor, material

or supplies incurred in the ordinary course of business in respect of obligations not then delinquent or not otherwise required to be

paid or discharged under the terms of this Agreement or any of the other Loan Documents, (b) Liens on assets other than the Collateral,

including mortgages on any Property, (c) deposits or pledges made in connection with, or to secure payment of, workers’ compensation,

unemployment insurance, old age pensions or other social security obligations, and (d) encumbrances on a Property consisting of

easements, rights of way, zoning restrictions, restrictions on the use of real property and defects and irregularities in the title thereto,

leases, landlord’s or lessor’s liens under leases to which Borrower or any of its Subsidiaries is a party, purchase money

security interests and other liens or encumbrances affecting any such Property.

“Person”

means any natural person, corporation, limited liability company, trust, joint venture, association, company, partnership, Governmental

Authority or other entity.

“Pledge Agreement”

is defined in Section 3.1.

“Pledged

Subsidiary” means any Subsidiary as to which Lender is receiving a pledge of Equity Interests therein pursuant to Section 3.1.

“Property”

means any real property, fixtures or improvements thereon and any leasehold or similar interest in real property which is owned, directly

or indirectly, by Borrower or any of its Subsidiaries, as the case may be, or secures any investment of Borrower or any of its Subsidiaries,

as the case may be.

“Responsible

Officer” means, with respect to any Person, (i) in the case of a corporation or trust, its trustee(s), president, senior

vice president, any vice president or treasurer, and, in any case where two Responsible Officers are acting on behalf of such Person,

the second such Responsible Officer may be a secretary or assistant secretary; (ii) in the case of a limited partnership, the Responsible

Officer of the general partner, acting on behalf of such general partner in its capacity as general partner; and (iii) in the case

of a limited liability company, the Responsible Officer of the sole or managing member, acting on behalf of such sole or managing member

in its capacity as sole or managing member. Any document delivered hereunder that is signed by a Responsible Officer of a Person shall

be conclusively presumed to have been authorized by all necessary corporate, partnership and/or other action on the part of such Person

and such Responsible Officer shall be conclusively presumed to have acted on behalf of such party.

“Restricted

Payment” means any dividend or other distribution (whether in cash, Equity Interests or other property) with respect

to any capital stock or other Equity Interest of Borrower, or any payment (whether in cash, Equity Interests or other property), including

any sinking fund or similar deposit, on account of the purchase, redemption, retirement, acquisition, cancellation or termination of

any such capital stock or other Equity Interest, or on account of any return of capital to Borrower’s stockholders, partners or

members (or the equivalent Person thereof), other than any of the foregoing payable solely in shares of stock or of any other Equity

Interest in Borrower.

“SEC”

means the Securities and Exchange Commission, or any Governmental Authority succeeding to any of its principal functions.

“Security Documents”

is defined in Section 3.1.

“Subsidiary”

of a Person means a corporation, partnership, joint venture, limited liability company or other business entity of which a majority of

the Equity Interests having ordinary voting power for the election of directors or other governing body (other than Equity Interests

having such power only by reason of the happening of a contingency) are at the time beneficially owned, or the management of which is

otherwise Controlled, directly or indirectly through one or more intermediaries, or both, by such Person. Unless otherwise specified,

all references herein to a “Subsidiary” or to “Subsidiaries” shall refer to a Subsidiary or Subsidiaries

of Borrower.

“Swap

Contract” means (a) any and all rate swap transactions, basis swaps, credit derivative transactions, forward rate transactions,

commodity swaps, commodity options, forward commodity contracts, equity or equity index swaps or options, bond or bond price or bond

index swaps or options or forward bond or forward bond price or forward bond index transactions, interest rate options, forward foreign

exchange transactions, cap transactions, floor transactions, collar transactions, currency swap transactions, cross-currency rate swap

transactions, currency options, spot contracts, or any other similar transactions or any combination of any of the foregoing (including

any options to enter into any of the foregoing), whether or not any such transaction is governed by or subject to any master agreement,

and (b) any and all transactions of any kind, and the related confirmations, which are subject to the terms and conditions of, or

governed by, any form of master agreement published by the International Swaps and Derivatives Association, Inc., any International

Foreign Exchange Master Agreement, or any other master agreement (any such master agreement, together with any related schedules, a “Master

Agreement”), including any such obligations or liabilities under any Master Agreement.

“Swap

Termination Value” means, in respect of any one or more Swap Contracts, after taking into account the effect of any legally

enforceable netting agreement relating to such Swap Contracts, (a) for any date on or after the date such Swap Contracts have been

closed out and termination value(s) determined in accordance therewith, such termination value(s), and (b) for any date prior

to the date referenced in clause (a), the amount(s) determined as the mark to market value(s) for such Swap Contracts, as determined

based upon one or more mid-market or other readily available quotations provided by any recognized dealer in such Swap Contracts (which

may include Lender).

“Total

Asset Value” means, as of any date of calculation, the sum of Borrower’s and its Subsidiaries’ pro rata share of

(a) to the extent free and clear of any Liens, cash, marketable securities actively traded on a nationally recognized exchange and

Treasury bills, valued at par, and (b) the Individual Asset Value for all Properties; provided, however, accounts payable and any

other liabilities will be deducted from the calculation of Total Asset Value.

“Total

Indebtedness” means the outstanding Indebtedness of Borrower and its Subsidiaries.

“Unused Fee”

is defined in Section 5.1.

2.1 Line

of Credit. Subject to the terms and conditions set forth herein, Lender, from the date hereof until November 21, 2027 (as

it may be extended in writing as set forth below, the “Maturity Date”), shall make advances to Borrower under a

revolving line of credit in the amount set forth below (the “Line of Credit”). Borrower agrees that the aggregate

unpaid principal of all advances outstanding at any one time under the Line of Credit shall not exceed the Maximum Availability. The

term “Maximum Availability” as used herein shall mean the lesser of (a) Twenty-Five Million Dollars

($25,000,000.00) or (b) the Maximum Usage Amount. Borrower may, at its option, at any time prior to the Maturity Date borrow,

repay and reborrow amounts under the Line of Credit, subject to the terms and conditions in this Agreement, up to the Maximum

Availability. All advances shall be secured by the Collateral. The obligation of Borrower to repay the Line of Credit advances,

including interest thereon, shall be evidenced by a promissory note of even date herewith payable to Lender in the amount of

Twenty-Five Million Dollars ($25,000,000.00) (as amended, restated, modified and otherwise in effect from time to time, the

“Note”). As long as no Event of Default has occurred and is continuing, Lender will consider in its sole

discretion a renewal of the Line of Credit for one (1) year, upon receipt of Borrower’s written request for such renewal

(and such other information reasonably requested by Lender) no earlier than ninety (90) days and no later than thirty (30) days

prior to the Maturity Date. As a condition to such renewal, no Events of Default shall have occurred and be continuing and Borrower

shall pay to Lender a nonrefundable commitment fee of twenty-five (25) basis points (0.25%) of the Maximum Availability. If Lender

elects in its sole discretion to make such renewal in writing, then the term “Maturity Date” shall mean

November 21, 2028.

2.2 Purpose.

The proceeds from the Line of Credit shall be used to refinance existing indebtedness, finance the acquisition and development of commercial

properties, pay for capital improvements to Properties and provide working capital for Borrower’s business purposes; provided that

in no event will any proceeds of the Line of Credit be used to purchase Equity Interests or for any Restricted Payment or in contravention

of any applicable law.

2.3 Advances.

Borrower shall request Advances by delivering to Lender a written request therefor in the form of Exhibit A, or such

other form approved by Lender, signed by a Responsible Officer of Borrower (an “Advance Request”) electronically

or by facsimile by 11:00 a.m. on the date such Advance is requested specifying the amount to be borrowed and the requested

borrowing date of the Advance. Unless other instructions are given by Borrower to Lender, all Advances shall be credited to the

operating account of Borrower with Lender. Each Advance shall be in a minimum amount of $100,000.00 or a whole multiple of

$50,000.00 in excess thereof, unless otherwise approved by Lender in writing.

2.4 Loan

Account. Lender shall maintain an account on its books (the “Loan Account”) to record all Advances and all payments

made by Borrower under the Line of Credit in accordance with Lender’s customary accounting practices as in effect from time to

time provided, however, that any failure to so record or any error in so recording shall not affect the liability of Borrower under the

Loan Documents. The balance in the Loan Account, as set forth on Lender’s most recent statement, shall be presumptive evidence

of the amounts due and owing to Lender by Borrower.

3.1 Collateral.

The Obligations shall be secured, inter alia, by the first priority pledge and security agreement from Borrower with respect the interests

of Borrower in and to that portion of the Equity Interests specified on Schedule 3.1 attached hereto in the Subsidiaries of Borrower

reflected on such Schedule 3.1 and the other collateral related thereto as more particularly described therein (as amended and

in effect from time to time, the “Pledge Agreement”). The Pledge Agreement and all other agreements, instruments and

documents that provide for collateral to secure the repayment of the Obligations are sometimes collectively referred to as the “Security

Documents”.

3.2 Additional

Security Documents. Borrower shall deliver such security agreements, financing statements, assignments, and other security documents

(all of which shall be deemed part of the Security Documents (as defined in Section 3.1)), in form and substance reasonably satisfactory

to Lender, as Lender may reasonably request from time to time for the purpose of granting to, or maintaining or perfecting in favor of

Lender, first and exclusive security interests in any of the Collateral, together with other assurances of the enforceability and priority

of Lender’s liens and assurances of due recording and documentation of the Security Documents or copies thereof, as Lender may

reasonably require to avoid material impairment of the liens and security interests granted or purported to or required to be granted

pursuant to this Agreement and the Pledge Agreement.

4.1 Conditions

to Closing. The effectiveness of this Agreement and the initial Advance under the Line of Credit shall be subject to the conditions

precedent that Lender shall have received on or before the Closing Date the following:

(a) Each

of the Loan Documents satisfactory in form, content and manner of execution and delivery to Lender and its counsel.

(b) Such

certificates of resolutions or other action, incumbency certificates and/or other certificates of Responsible Officers of each Loan Party

as Lender may require evidencing the identity, authority and capacity of each Responsible Officer thereof authorized to act as a Responsible

Officer in connection with this Agreement and the other Loan Documents to which such Loan Party is a party.

(c) Such

documents and certifications as Lender may reasonably require to evidence that each Loan Party is duly organized or formed, and that

each Loan Party is validly existing, in good standing and qualified to engage in business in each jurisdiction where its ownership, lease

or operation of properties or the conduct of its business requires such qualification.

(d) A

favorable opinion of legal counsel to the Loan Parties addressed to Lender, addressing such matters with respect to the Loan Parties

as Lender may reasonably request.

(e) A

duly completed Compliance Certificate as of the date hereof, signed by a Responsible Officer of Borrower, setting forth in reasonable

detail the calculations required to show that Borrower is in compliance with the financial covenants of this Agreement.

(f) A

certificate signed by a Responsible Officer of Borrower certifying that the conditions specified in Sections 4.2(a), (b) and (c) have

been satisfied; provided, that the delivery of an Advance Request to Lender shall be deemed satisfaction of this condition precedent.

(g) The

results of a search of the Uniform Commercial Code filings made with respect to the Loan Parties in the states (or other jurisdictions)

of formation of such Persons, together with copies of any financing statements (or similar documents) disclosed by such search, and accompanied

by evidence satisfactory to Lender that the Liens indicated in any such financing statement (or similar document) have been or will be

contemporaneously released or terminated, and such other litigation, bankruptcy, and other searches with respect to the Loan Parties

as Lender requires.

(h) The

Pledge Agreement creates a valid and perfected first priority Lien on the Collateral described therein, and related UCC filings have

been duly recorded and filed (or submitted for recording or filing) to the satisfaction of Lender and its counsel.

(i) Payment

by Borrower of all fees and expenses that under the terms hereof or of the Fee Letter that are due and payable on or prior to the Closing

Date, and the fees, and disbursements of counsel to Lender.

(j) Any

and all documentation and other information requested by Lender in connection with applicable “know your customer” and anti-money-laundering

rules and regulations, including the USA PATRIOT Act, and a Beneficial Ownership Certification and copies of all applicable identification

from Borrower and any entity constituting a “legal entity customer” under the Beneficial Ownership Regulation.

(k) Such

other documents, financial statements, instruments, agreements, certificates, and information as are customary or appropriate for transactions

similar to the Line of Credit, as determined by Lender, or as has been otherwise reasonably requested by Lender.

4.2 Conditions

to Each Advance. Every Advance under the Line of Credit (including the initial Advance) shall be subject to the following conditions

precedent:

(a) No

Default or Event of Default has occurred and is continuing or would result from the proposed Advance.

(b) There

shall have been no event or circumstance, either individually or in the aggregate, that has had or could reasonably be expected to have

a Material Adverse Effect.

(c) The

representations and warranties of each Loan Party contained in Section 6 or any other Loan Document, or which are contained in any

document furnished at any time under or in connection herewith or therewith, shall be true and correct in all respects on and as of the

date of such Advance; provided, if any such representations and warranties specifically refer to an earlier date, they shall be true

and correct in all material respects as of such earlier date; provided, further, that, for purposes of this Section 4.2, the representations

and warranties contained in Section 6.4 shall be deemed to refer to the most recent statements furnished pursuant to Section 7.1.

(d) Lender

shall have received an Advance Request duly executed by a Responsible Officer of Borrower.

(e) After

giving effect to the proposed Advance, the total principal amount outstanding under the Line of Credit shall not exceed the Maximum Availability.

Each

request for an Advance submitted by Borrower shall be deemed to be a representation and warranty that the conditions specified in Sections

4.2(a), (b), and (c) have been satisfied on and as of the date of the applicable Advance.

5.1 Calculation

and Payment. Except as provided in Section 5.2 hereof, Borrower agrees to pay to Lender an unused line fee, which shall

accrue and be payable as follows (the “Unused Fee”): seventy-five basis points (0.75%) multiplied by the difference

between (a) the Maximum Availability and (b) the outstanding principal balance of the Line of Credit, on each day during the

period from and including the date hereof to but excluding the date on which availability under the Line of Credit terminates. The Unused

Fee shall be payable annually, in arrears, on the last day of each calendar year and on the date on which availability under the Line

of Credit terminates, commencing on the first such date to occur after the date hereof, and computed on the basis of a year of 360 days

and shall be payable for the actual number of days elapsed (including the first day but excluding the last day). Each determination by

Lender of the Unused Fee shall be conclusive and binding for all purposes, absent manifest error. Notwithstanding the foregoing, the

Unused Fee shall be waived at the times set forth in Section 5.2 hereof.

5.2 Minimum Deposits. During any period in which Borrower and its Affiliates maintains aggregate deposits of Twenty Million Dollars

($20,000,000.00) or greater with Lender, no Unused Fee shall be due or payable.

| 6. | REPRESENTATIONS

AND WARRANTIES. |

In order to induce

Lender to extend the Line of Credit, Borrower hereby represents and warrants to Lender that:

6.1 Existence

and Power. Borrower is duly organized, validly existing and in good standing under the laws of the Commonwealth of Massachusetts,

and is qualified to do business and in good standing in all other jurisdictions in which the property owned, leased or operated by it

or the nature of the business conducted by it makes such qualification necessary. Borrower has full power and authority and all necessary

permits, licenses and approvals to conduct its business as proposed to be conducted, to own its properties, and to execute and deliver

this Agreement and each other Loan Document and to borrow hereunder.

6.2 Authority.

The making and performance by Borrower of this Agreement and the Loan Documents have been authorized by all necessary action of Borrower.

The execution and delivery of this Agreement and the other Loan Documents, the consummation of the transactions herein and therein contemplated,

and the fulfillment of or compliance with the terms and provisions hereof and thereof, (a) will not violate any provision of law

or the organizational documents of Borrower; and (b) will not result in the breach of, or constitute a default under, or result

in the creation of any Lien upon any property or assets of Borrower pursuant to any indenture or bank loan or credit agreement (other

than pursuant to this Agreement and the other Loan Documents) or other agreement or instrument to which Borrower is a party. No approval,

authorization, consent that has not been received, or other order or registration or filing with any Governmental Authority is required

in connection with the making and performance of this Agreement by Borrower.

6.3 Validity.

This Agreement and all other Loan Documents are the legal, valid, binding obligations of Borrower and Guarantor, as applicable, enforceable

against Borrower and Guarantor in accordance with their respective terms, subject to applicable bankruptcy, insolvency, reorganization

or similar laws affecting the rights of creditors and secured parties generally and with respect to the availability of remedies of specific

enforcement, subject to the discretion of the court before which proceedings therefor may be brought.

6.4 Financial

Statements and Condition. The financial statements and tax returns of Borrower and Guarantor delivered to Lender prior to

the date of this Agreement, heretofore furnished to Lender are complete and correct in all material respects and fairly present the financial

condition of Borrower or Guarantor as of the dates of such financial statements and the results of its or their affairs or operations

for the period then ended. Except as set forth on such financial statements, neither Borrower nor Guarantor has any fixed, accrued or

contingent obligation or liability for taxes or otherwise that is not disclosed or reserved against on its balance sheets. Since the

date of the most recent financial statements provided to Lender, there has been no material adverse change in the condition of Borrower's

or Guarantor's financial position or otherwise from that set forth in the financial statements most recently delivered to Lender which

could reasonably be expected to have a Material Adverse Effect.

6.5 Compliance

with Law. To Borrower’s actual knowledge, Borrower is in compliance with all Legal Requirements applicable to it,

its property, including, without limitation, the Properties and the Collateral, or the conduct of its business, including, without

limitation, those pertaining to or concerning the employment of labor, employee benefits, public health, safety and the environment,

except where any noncompliance would not have a Material Adverse Effect.

6.6 Litigation.

There are no suits or proceedings pending, or, to the knowledge of Borrower or Guarantor, threatened against or affecting Borrower

or Guarantor and neither Borrower nor Guarantor is in default in the performance of any agreement to which Borrower or Guarantor is a

party or by which Borrower or Guarantor is bound, or with respect to any order, writ, injunction, or any decree of any Governmental Authority,

which could reasonably be expected to have a Material Adverse Effect.

6.7 Events

of Default. No Default or Event of Default has occurred and is continuing. pursuant to any indenture or bank loan or credit

agreement (other than pursuant to this Agreement and the other Loan Documents) or other agreement or instrument to which Borrower is

a party. There is no default by Borrower or any of its Subsidiaries under any of their respective organizational documents or any material

indenture, agreement, instrument or undertaking to which it is a party or by which it or any of its property is bound that, individually

or in the aggregate, could reasonably be expected to have a Material Adverse Effect.

6.8 Title

to Property. Borrower has good and marketable title to the Collateral. Borrower, through its Subsidiaries, has good and marketable

title to the Properties, subject to Permitted Liens.

6.9 Solvency.

After giving effect to the consummation of the transactions and the extension of the financial accommodations contemplated by this

Agreement, Borrower (i) will be able to pay its debts as they become due, (ii) will have funds and capital sufficient to carry

on its business as now conducted or as proposed to be conducted, (iii) will own property having a value both at fair valuation and

at present fair saleable value greater than the amount required to pay the Obligations; and (iv) will not be rendered insolvent.

6.10 Taxes.

Borrower has filed when due all tax returns and reports required to be filed by it with all federal, state or local authorities and

has paid in full or made adequate provision for the payment of all taxes, interest, penalties, assessments or deficiencies shown to be

due or claimed to be due on or in respect of such tax returns and reports.

6.11 Jurisdiction

of Formation; Principal Office. As of the date hereof, (a) the jurisdiction of formation of Borrower and Guarantor is

Massachusetts; and (b) the principal office, chief executive office and principal place of business of Borrower and Guarantor is

at 39 Brighton Avenue, Boston, Massachusetts 02134.

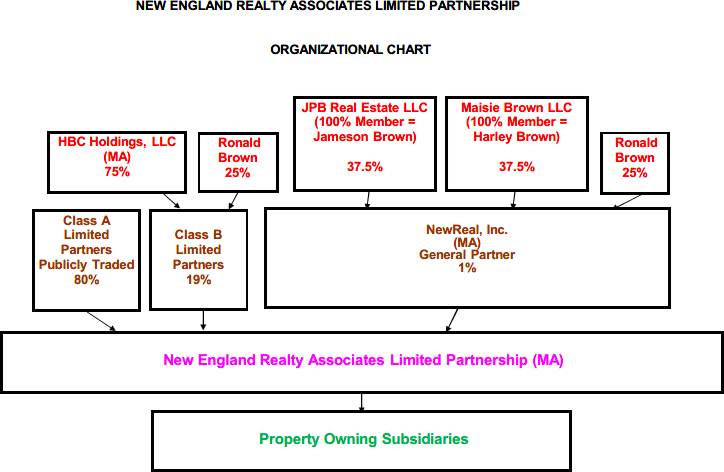

6.12 Organizational

Structure. As of the date hereof, the organizational chart attached hereto as Schedule 6.12 is a true and accurate

representation of the owners of Borrower and Guarantor.

6.13 Regulation

U. None of the proceeds of the Advances will be used, directly or indirectly, by Borrower for the purpose of purchasing

or carrying, or for the purpose of reducing or retiring any indebtedness which was originally incurred to purchase or carry, any

“margin stock” within the meaning of Regulation U (12 CFR Part 221) of the Board of Governors of the Federal

Reserve System (herein called “margin stock”), or for any other purpose which might constitute the transactions

contemplated hereby a “purpose credit” within the meaning of said Regulation U, or cause this Agreement to violate

Regulation U, Regulation T, Regulation X, or any other regulation of the Board of Governors of the Federal Reserve System or the

Securities Exchange Act of 1934 or the FCPA or any other applicable anti-corruption law.

6.14 Investment

Company Act. None of Borrower, any Subsidiary of Borrower or Guarantor is or is required to be registered as an “investment

company” under the Investment Company Act of 1940.

6.15 ERISA.

To Borrower’s knowledge, it is in compliance with ERISA with respect to any Plan; no Reportable Event has occurred and is continuing

with respect to any Plan; and it has no unfunded vested liability under any Plan. The word “Plan” as used in this

Agreement means any employee plan subject to Title IV of the Employee Retirement Income Security Act of 1974, as amended, (“ERISA”)

maintained for employees of the Borrower, any Subsidiary of the Borrower or any other trade or business under common control with the

Borrower within the meaning of Section 414(c) of the Internal Revenue Code of 1986, as amended, or any regulations thereunder.

6.16 Hazardous

Materials. Each of Borrower, Guarantor and their Subsidiaries (a) has not received any notice or other communication

or otherwise learned of any Environmental Claim or Environmental Liability which would individually or in the aggregate reasonably be

expected to have a Material Adverse Effect, and (b) to its knowledge, is not aware of any threatened or actual liability in connection

with the release or threatened release of any Hazardous Material into the environment which would individually or in the aggregate reasonably

be expected to have a Material Adverse Effect.

6.17 No

Broker. Neither Borrower, nor Guarantor nor anyone on behalf thereof has dealt with any broker, finder or other person or

entity who or which may be entitled to a broker’s or finder’s fee, or other compensation, payable by Lender in connection

with the Line of Credit. If Borrower has engaged a mortgage broker in connection with the Line of Credit (the “Broker”),

Borrower shall pay at closing all amounts due to the Broker in connection with the Line of Credit.

6.18 Governmental

and Other Approvals. To Borrower’s actual knowledge except for the filing of UCC financing statements, no order, consent,

approval, license, authorization or validation of, or filing, recording or registration with (except as have been obtained or made on

or prior to closing), or exemption by, any Governmental Authority, is required to be made or obtained by Borrower to authorize, or is

required in connection with (i) the execution, delivery and performance by Borrower of any Loan Documents or (ii) the legality,

validity, binding effect or enforceability against Borrower of any such Loan Document.

6.19 Insurance. The

properties of Borrower and its Subsidiaries are insured with financially sound and reputable insurance companies not Affiliates of

Borrower or Guarantor, in such amounts, with such deductibles and covering such risks as are customarily carried by companies

engaged in similar businesses and owning similar properties in localities where Borrower and its Subsidiaries operate. Borrower has

in force, and has paid the premiums in respect of, all of the insurance required by the Loan Documents.

6.20 Compliance

with Anti-Terrorism, Embargo, Sanctions and Anti-Money Laundering Laws. Borrower, and to the best of Borrower's knowledge,

after having made diligent inquiry, (a) each Person owning an interest of 20% or more in Borrower and (b) Guarantor: (i) is

not currently identified on the U.S. Office of Foreign Asset Control list, and (ii) is not a person with whom a citizen of the United

States is prohibited to engage in transactions by any trade embargo, economic sanction, or other prohibition of United States law, regulation,

or Executive Order of the President of the United States. Borrower has implemented procedures, and will consistently apply those procedures

throughout the term of the Line of Credit, to ensure the foregoing representations and warranties remain true and correct during the

term of the Line of Credit.

6.21 Information

Complete. No information furnished or to be furnished by Borrower pursuant to the terms hereof contains any untrue statement

of material fact or omits any material fact necessary in order to make the information furnished, in the light of the circumstances under

which such information is furnished, not misleading.

Borrower

(and Guarantor where indicated below) covenants and agrees that from the date hereof until payment in full and performance of all Obligations,

unless Lender otherwise consents in writing, to comply with the following affirmative covenants:

7.1 Financial

Statements; Notice of Default. Borrower and Guarantor shall deliver to Lender:

(a) by

April 30 of each calendar year, the consolidated and consolidating balance sheet of the Borrower and its Subsidiaries as at the

end of such year and the related consolidated and consolidating statements of income or operations, schedule of real estate owned, equity

and cash flows for such year setting forth comparative figures for the preceding year certified by a Responsible Officer of Borrower;

(b) by

August 15 of each calendar year, the consolidated and consolidating balance sheet of the Borrower and its Subsidiaries as at June 30

of such year and the related consolidated and consolidating statements of income or operations, schedule of real estate owned, equity

and cash flows for the trailing twelve (12) months ending on June 30 of such year setting forth comparative figures for the preceding

fiscal year certified by a Responsible Officer of Borrower;

(c) together

with the financial statements required in Section 7.1(a) and (b), a duly completed certificate, signed by a Responsible

Officer of Borrower, in the form of Exhibit B attached hereto (a “Compliance Certificate”), stating

(i) that such financial statements are true and accurate in all material respects, (ii) that such officer is familiar with

the terms and provisions of the Loan Documents and whether any Event of Default or, to its knowledge any Default, has occurred and

is continuing on the date of such certificate and, if any Event of Default has occurred and is continuing, setting forth the details

thereof and the action which Borrower is taking or proposes to take with respect thereto and (iii) all relevant facts in

reasonable detail to evidence, and the computations as to, whether or not Borrower is in compliance with the financial covenants

described herein;

(d) promptly,

and in any event within five (5) Business Days, after (i) the same are available, copies of each annual report, proxy or financial

statement or other report or communication sent to the stockholders of Borrower, and copies of all annual, regular, periodic and special

reports and registration statements which Borrower may file or be required to file with the SEC under Section 13 or 15(d) of

the Securities Exchange Act of 1934, and not otherwise required to be delivered to Lender pursuant to this Agreement; and (ii) receipt

thereof by Borrower, copies of each notice or other correspondence received from the SEC concerning any material investigation or other

material inquiry by such agency regarding financial or other operational results of Borrower or any of its Subsidiaries unless restricted

from doing so by such agency;

(e) upon

Lender’s request, a copy of Borrower’s federal income tax return for the most recent year such other information about the

financial condition, business and operations of Borrower, its Subsidiaries and Guarantor as Lender may from time to time, reasonably

request;

(f) promptly

upon becoming aware of any Default or Event of Default, notice thereof, in writing.

(g) promptly

upon becoming aware of any of the following events if they could reasonably be expected to result in a Material Adverse Effect, notice

thereof, in writing: (a) any change in the financial condition or business of any Loan Party or its Subsidiaries; (b) any default

under any material agreement, contract, or other instrument to which any Loan Party or a Subsidiary thereof is a party or by which any

of its properties are bound, or any acceleration of the maturity of any material indebtedness owing by any Loan Party or Subsidiary thereof;

(c) any uninsured claim against or affecting any Loan Party, any of its Subsidiaries, or any of its properties; (d) the commencement

of, and any material determination in, any litigation with any third party or any proceeding before any Governmental Authority affecting

any Loan Party or its Subsidiaries; (e) any Environmental Claim, or the release or threatened release of any Hazardous Material

into the environment in violation of any Environmental Requirement; (f) the existence of any Lien resulting from an Environmental

Claim or Environmental Liability on any Properties or of any Loan Party or its Subsidiaries; (g) any material remedial action taken

by any Loan Party or its Subsidiaries in response to any Environmental Claim or any Environmental Liability; or (h) any material

change in such Borrower’s method of accounting.

7.2 Compliance

with Laws. Borrower shall comply with all Legal Requirements, except where any noncompliance would not have a Material Adverse Effect.

7.3 Taxes.

Borrower shall pay when due all taxes, assessments, governmental charges or levies, if such failure would have a Material Adverse

Effect, except those being contested in good faith and against which, if requested by Lender, Borrower shall maintain reserves in amount

and in form (book, cash, bond or otherwise) reasonably satisfactory to Lender.

7.4 Litigation.

Borrower shall promptly advise Lender of the commencement of or threat of any litigation, including arbitration proceedings and any

proceedings before any Governmental Authority, which could reasonably be expected to have a Material Adverse Effect.

7.5 Maintenance

of Existence. Borrower shall conduct its business as presently proposed to be conducted, maintain its legal existence and maintain

its properties in good repair, working order and operating condition.

7.6 Insurance.

Borrower shall, and shall cause its Subsidiaries to, maintain with financially sound and reputable insurance companies not Affiliates

of Borrower or Guarantor, insurance with respect to its properties and business against loss or damage of the kinds customarily insured

against by Persons engaged in the same or similar business, of such types and in such amounts as are customarily carried under similar

circumstances by such other Persons.

7.7 Books

and Records; Access. Borrower will, and will cause its Subsidiaries to, give any representative of Lender, upon reasonable

prior notice, access during all business hours to, and permit such representative to examine, copy, or make excerpts from, any and all

books, records, and documents in the possession of such Person and relating to its affairs, and to inspect any of the Properties.

7.8 Senior

Management. At all times during the term of the Line of Credit, Guarantor shall be actively involved in the management of,

and Control, Borrower.

7.9 Operating

Accounts. Borrower shall establish and maintain all of its operating accounts for all Properties owned by Borrower with Lender,

into which Borrower shall cause all of its revenues to be deposited. Borrower may use funds in such accounts to make principal payments

on the Line of Credit at any time.

7.10 Organizational

Documents. Borrower shall comply with its organizational documents and shall not amend or modify any of its organizational

documents, or any of the organizational documents of any Pledged Subsidiary, in any material respect without the prior consent of Lender,

which consent shall not be unreasonably withheld, conditioned or delayed. Promptly after Lender’s written request from time to

time, but not more frequently than once in any calendar year, Borrower shall deliver to Lender evidence reasonably satisfactory to Lender

that Borrower is in compliance with the provisions of this Section.

7.11 Foreign

Corrupt Practices Act. Borrower will maintain in effect policies and procedures designed to promote compliance by Borrower,

and its respective directors, officers, employees, and agents with the FCPA and any other applicable anti-corruption laws.

7.12 Patriot

Act. To the extent required, each of Borrower and Guarantor is in compliance, in all material respects, with the

(i) the Trading with the Enemy Act, as amended, and each of the foreign assets control regulations of the United States

Treasury Department (31 C.F.R., Subtitle B, Chapter V, as amended) and any other applicable enabling legislation or executive order

relating thereto, and (ii) the Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and

Obstruct Terrorism (USA Patriot Act of 2001). To the best of Borrower’s and Guarantor’s knowledge, no part of the

proceeds of the Line of Credit will be used, directly or indirectly, for any payments to any governmental official or employee,

political party, official of a political party, candidate for political office, or anyone else acting in an official capacity, in

order to obtain, retain or direct business or obtain any improper advantage, in violation of the FCPA.

7.13 Financings.

Borrower shall use reasonable efforts to finance the purchase of any acquisitions of property or new construction projects funded

by the Line of Credit with Lender.

Borrower

covenants and agrees that from the date hereof until payment in full and performance of all Obligations, unless Lender otherwise consents

in writing, Borrower shall comply with the following negative covenants:

8.1 Debt

Yield. Borrower shall not permit the Debt Yield to be less than 8.5%. This covenant shall be tested on a semi-annual basis.

“Debt Yield” means, as of any date of calculation, the ratio (expressed as a percentage) of (a) the sum of the

NOI from the Properties for the trailing twelve (12) months and income received for the trailing twelve (12) months from any Treasury

bills held by Borrower to (b) Total Indebtedness.

8.2 Leverage

Ratio. Borrower shall not permit the Leverage Ratio to exceed sixty- five percent (65%). This covenant shall be tested at

closing and on an annual basis. “Leverage Ratio” means, as of any date of calculation, the ratio (expressed as a percentage)

of (a) Total Indebtedness less the amount outstanding under the Line of Credit to (b) Total Asset Value.

8.3 Debt

Service Coverage Ratio. Borrower shall not permit the Debt Service Coverage Ratio to be less than 1.50 to 1.00. This covenant

shall be tested on a semi-annual basis. “Debt Service Coverage Ratio” means, as of any date of calculation, the ratio

for the trailing twelve (12) months of (a) the NOI from the Properties for the trailing twelve (12) months to (b) Debt Service.

8.4 Usage.

Borrower shall not permit the total outstanding Advances to exceed an amount equal to 1.5 multiplied by the trailing twelve (12)

months of Adjusted EBITDA (the “Maximum Usage Amount”).

8.5 Liquidity.

Borrower shall not permit its Liquid Assets at any time to be less than $15,000,000.00. This covenant shall be tested on a semi-annual

basis. “Liquid Assets” means the following assets which (i) are free and clear of any Liens, (ii) are owned

solely by Borrower (with no other Persons having rights therein), (iii) may be converted to cash within five (5) days, and

(iv) are unrestricted and unencumbered cash, funds on deposit in any bank located in the United States, investment grade commercial

paper, money market funds, marketable securities actively traded on a nationally recognized exchange.

8.6 Encumbrances.

Borrower shall not create or permit to exist any Lien against the Collateral except for Liens in favor of Lender. Borrower shall

not create or permit to exist any Lien on any Property owned by a Subsidiary of Borrower other than Permitted Liens, subject to the limits

on Indebtedness in Section 8.7 hereof.

8.7 Other

Indebtedness. Neither Borrower nor any of its Subsidiaries shall incur, any Indebtedness other than (i) the Obligations under

this Agreement and the other Loan Documents, (ii) Indebtedness incurred by any Pledged Subsidiary secured by a Property as long

as the aggregate amount of such Indebtedness does not exceed sixty-five percent (65%) of the value of such Property and Borrower remains

in compliance with the financial covenants contained in Sections 8.1 through 8.5, (iii) other unsecured trade indebtedness incurred

by a Subsidiary of Borrower in the ordinary course of business, (iv) Indebtedness arising under Swap Contracts not otherwise prohibited

hereunder, and (v) Indebtedness in respect of Capital Leases and purchase money obligations. Borrower will not enter or participate

in any agreement, arrangement, or transaction with any other person or entity if the effect of such agreement, arrangement or transaction

has or could reasonably be expected in the future to have a Material Adverse Effect.

8.8 Investments.

Borrower shall not have, nor shall it permit its Subsidiaries to have, any Investments other than Permitted Investments.

8.9 Mergers, etc.

Borrower shall not, nor shall it permit its Subsidiaries to, liquidate or merge or consolidate with any other Person unless Borrower

is the surviving entity and no Change in Control results therefrom.

8.10 Change

in Nature of Business. Borrower shall not, nor shall it permit its Subsidiaries to, directly or indirectly, engage in any

business substantially different from the business conducted by them on the date hereof or any business substantially related or incidental

thereto.

8.11 OFAC

Compliance. Borrower shall not (a) be or become subject at any time to any law, regulation, or list of any Governmental

Authority (including, without limitation, the U.S. Office of Foreign Asset Control list) that prohibits or limits Lender from making

any advance or extension of credit to Borrower or from otherwise conducting business with Borrower, or (b) fail to provide documentary

and other evidence of Borrower’s identity as may be requested by Lender at any time to enable Lender to verify Borrower’s

identity or to comply with any applicable law or regulation. Borrower has implemented procedures, and will consistently apply those procedures

throughout the term of the Line of Credit, to ensure compliance with the foregoing subsection (a) during the term of the Line of

Credit.

8.12 Environmental

Matters. Except for such conditions as are in or will promptly be brought into compliance with relevant Environmental Requirements

or otherwise could not reasonably be expected to result in a Material Adverse Effect, Borrower: (a) shall not cause or permit any