Filed

Pursuant to General Instruction II.L of Form F-10

File

No. 333-279369

The

information contained in this Preliminary Prospectus Supplement is not complete and may be changed. This Preliminary Prospectus Supplement

and the accompanying Prospectus are not an offer to sell and are not soliciting an offer to buy these securities in any jurisdiction

where the offer or sale is not permitted.

Subject

to completion, dated May 13, 2024

Preliminary

PROSPECTUS SUPPLEMENT

to the Short Form Base Shelf Prospectus dated May 13, 2024

NEW GOLD INC.

US$

Common Shares

This prospectus

supplement (“Prospectus Supplement”), together with the short form base shelf prospectus to which it relates dated

May 13, 2024 (as amended or supplemented, the “Shelf Prospectus”, and as supplemented by this Prospectus Supplement,

the “Prospectus”), qualifies the distribution to the public (the “Offering”) of

common shares (the “Offered Shares”) of New Gold Inc. (“New Gold” or the “Company”)

at a price of US$ (the “Offering Price”) per Offered Share (the “Offering”).

On May 13, 2024, New Gold entered into the Partial Royalty Repurchase and Amending Agreement (as defined herein) with an affiliate

of Ontario Teachers’ Pension Plan Board (“Ontario Teachers’”), whereby the parties will, among other things,

amend the Original Royalty Agreement (as defined herein) to increase the Company’s effective free cash flow interest in the New

Afton mine. New Gold expects to use the net proceeds of the Offering, together with cash on hand and borrowings under the Senior Credit

Facility (as defined herein), to pay the amount payable under the Partial Royalty Repurchase and Amending Agreement. See “Use of

Proceeds”.

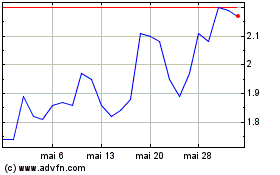

The outstanding

common shares of New Gold (the “Common Shares”) are listed on the Toronto Stock Exchange (the “TSX”)

and on the NYSE American LLC (the “NYSE American”) under the symbol “NGD”. On May 10, 2024, the last

trading day on the TSX and NYSE American prior to the date of this Prospectus Supplement, the closing prices of the Common Shares on

the TSX and NYSE American were C$2.67 and US$1.95, respectively.

| |

Price:

US$ per Common Share |

|

| |

|

Price to the Public |

|

|

Underwriting

Commission(1) |

|

|

Net Proceeds to the

Company(2) |

| Per Offered Share |

|

US$ |

|

|

US$ |

|

|

US$ |

| Total (3) (4) |

|

US$ |

|

|

US$ |

|

|

US$ |

Notes:

| (1) | Pursuant to the Underwriting Agreement

(as defined herein), the Company has agreed to pay the Underwriters (as defined herein),

on the Closing Date (as defined herein), a cash commission (the “Underwriting Commission”)

equal to % of the aggregate gross proceeds

of the Offering (or US$ per Offered Share),

including any proceeds realized from the sale of any Over-Allotment Shares (as defined herein).

See “Plan of Distribution (Conflicts of Interest)”. |

| (2) | After deducting the Underwriting Commission,

but before deducting the expenses of the Offering, estimated to be US$

(exclusive of taxes and disbursements), which will be paid from the gross proceeds of the

Offering. See “Use of Proceeds”. |

| (3) | The Company has granted the Underwriters

an option (the “Over-Allotment Option”) to purchase up to an additional

Common Shares (the “Over-Allotment Shares”) at the Offering Price per

Over-Allotment Share, exercisable from time to time, in whole or in part, upon written notice

to the Company by the Lead Underwriter (as defined herein), on behalf of the Underwriters,

for a period of 30 days following the Closing Date (as defined herein), to cover over-allotments,

if any. If the Over-Allotment Option is exercised in full, the “Price to the Public”,

“Underwriting Commission” and “Net Proceeds to the Company” will

be US$ , US$

and US$ , respectively.

The Prospectus also qualifies the grant of the Over-Allotment Option and the distribution

to the public of the Over-Allotment Shares upon exercise of the Over-Allotment Option. A

purchaser who acquires Over-Allotment Shares forming part of the Underwriters’ over-allotment

position acquires those Common Shares under the Prospectus, regardless of whether the Underwriters’

over-allotment position is ultimately filled through the exercise of the Over-Allotment Option

or secondary market purchases. Unless the context otherwise requires, references herein to

the “Offering” and the “Offered Shares” include the Over-Allotment

Shares. See “Plan of Distribution (Conflicts of Interest)”. |

| (4) | Assuming

no exercise of the Over-Allotment Option. |

The Offering is being made concurrently in Canada

(other than in Quebec) under the terms of the Prospectus and in the United States under the terms of the Company’s registration

statement (the “Registration Statement”) on Form F-10 (File No. 333- ),

filed with the United States Securities and Exchange Commission (the “SEC”) on May 13, 2024, of which the Prospectus

forms a part. The Company is permitted, under a multi-jurisdictional disclosure system adopted by the securities regulatory authorities

in Canada and the United States (“MJDS”), to prepare the Prospectus in accordance with Canadian disclosure requirements,

which are different from United States disclosure requirements.

The Offering is being made pursuant to an underwriting

agreement (the “Underwriting Agreement”) to be dated May , 2024, among the Company, CIBC

World Markets Inc. (the “Lead Underwriter”), and

(collectively with the Lead Underwriter, the “Underwriters”). The terms of the Offering, including the Offering Price,

were determined by negotiation between the Company and the Lead Underwriter, on its own behalf and on behalf of the other Underwriters.

See “Plan of Distribution (Conflicts of Interest)”.

The Company will

apply to list the Offered Shares on the TSX and the NYSE American. The listing of the Offered Shares on the TSX and NYSE American will

be subject to our fulfillment of all listing requirements of the TSX and NYSE American, respectively. Closing of the Offering is conditional

upon the Offered Shares being conditionally approved for listing on the TSX and authorized for listing on the NYSE American.

The following table

specifies the number of additional Over-Allotment Shares issuable under the Over-Allotment Option:

| Underwriters’ Position | |

Maximum size or

number of securities held | |

Exercise period | |

Exercise price |

| Over-Allotment Option | |

Over-Allotment Shares | |

Up to 30 days from the Closing Date | |

US$ per Over-Allotment Share |

The Underwriters,

as principals, conditionally offer the Offered Shares, subject to prior sale, if, as and when issued by the Company and delivered to

and accepted by the Underwriters in accordance with the conditions contained in the Underwriting Agreement referred to under “Plan

of Distribution (Conflicts of Interest)” and subject to approval of certain legal matters relating to the Offering on behalf

of the Company by Davies Ward Phillips & Vineberg LLP, in Canada, and Paul, Weiss, Rifkind, Wharton & Garrison LLP,

in the United States, and on behalf of the Underwriters by Borden Ladner Gervais LLP, in Canada, and Skadden, Arps, Slate, Meagher &

Flom LLP, in the United States.

Subscriptions for

Offered Shares will be received subject to rejection or allotment in whole or in part and the right is reserved to close the subscription

books at any time without notice. It is expected that the closing of the Offering will occur on or about May 17, 2024, or

on such other date as may be agreed upon by the Company and the Lead Underwriter (the “Closing Date”). Except in certain

limited circumstances: (a) the Offered Shares will be registered and represented electronically through the non-certificated inventory

of CDS Clearing and Depository Services Inc. (“CDS”) or its nominee pursuant to the book-based system administered

by CDS; (b) certificates evidencing the Offered Shares will not be issued to purchasers; and (c) purchasers will receive only

a customer confirmation from the Underwriter or other registered dealer who is a CDS participant (a “Participant”)

and from or through whom a beneficial interest in the Offered Shares is purchased. See “Plan of Distribution (Conflicts of Interest)”.

The Underwriters

may decrease the price at which the Offered Shares are distributed from the Offering Price. See “Plan of Distribution (Conflicts

of Interest)”. The Underwriters propose to offer the Offered Shares initially at the Offering Price specified above. After

a reasonable effort has been made to sell all of the Offered Shares at the Offering Price, the Underwriters may subsequently reduce the

subscription price to investors from time to time in order to sell any of the Offered Shares remaining unsold. Any such reduction will

not affect the proceeds received by the Company, but the aggregate compensation realized by the Underwriters in the Offering will be

decreased by the amount that the aggregate price paid by the purchasers for the Offered Shares is less than the gross proceeds paid by

the Underwriters to the Company.

Subject to applicable

laws, the Underwriters may, in connection with the Offering, over-allot or effect transactions which stabilize or maintain the market

price of the Common Shares at levels other than those which might otherwise prevail on the open market in accordance with market stabilization

rules. Such transactions, if commenced, may be discontinued by the Underwriters at any time. See “Plan of Distribution (Conflicts

of Interest)”.

New Gold is a

Canadian issuer and foreign private issuer under United States securities laws and is permitted under the MJDS to prepare the Prospectus

in accordance with Canadian disclosure requirements. Prospective investors should be aware that such requirements are different from

those of the United States. New Gold has prepared its financial statements, included or incorporated herein by reference, in accordance

with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”)

and, as a result, such financial statements may not be comparable to the financial statements of United States companies.

Prospective investors

should be aware that the acquisition, holding and disposition of the Offered Shares may have tax consequences both in the United States

and in Canada. Such consequences for investors who are resident in, or citizens of, the United States or who are resident in Canada may

not be described fully herein. Prospective investors should read the tax discussion in this Prospectus Supplement and consult their own

tax advisors with respect to their particular circumstances, as well as any provincial, state, foreign and other tax consequences of

acquiring, holding or disposing of the Offered Shares. See “Certain Canadian Federal Income Tax Considerations” and

“Certain United States Federal Income Tax Considerations”.

The ability of

investors to enforce civil liabilities under United States federal securities laws may be affected adversely because New Gold exists

under the laws of the Province of British Columbia, Canada, some of its directors and officers and most of the experts named in the Prospectus

are resident outside the United States, and most of its assets and a significant portion of the assets of those officers, directors and

experts are located outside of the United States. See “Enforceability of Certain Civil Liabilities”.

NONE OF THE CANADIAN

SECURITIES REGULATORY AUTHORITIES, THE SEC NOR ANY UNITED STATES STATE SECURITIES COMMISSION OR OTHER REGULATORY BODY HAS APPROVED OR

DISAPPROVED OF THE SECURITIES OFFERED HEREBY, OR PASSED UPON THE ADEQUACY OR ACCURACY OF THE PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY

IS A CRIMINAL OFFENCE.

An investment in the Offered Shares is speculative

and involves a high degree of risk. Only potential investors who are experienced in high risk investments and who can afford to lose their

entire investment should consider an investment in the Company. A prospective purchaser should therefore review the Prospectus and the

documents incorporated or deemed to be incorporated by reference herein in their entirety. See “Risks Relating to the Offering and

the Common Shares” in this Prospectus Supplement and in the accompanying Shelf Prospectus, “Risk Factors” in the Company’s

Annual Information Form for the year ended December 31, 2023, which is incorporated by reference in the Prospectus, and the risk factors

in all other documents incorporated by reference in the Prospectus.

Prospective purchasers

should rely only on the information contained in the Prospectus and the documents incorporated or deemed to be incorporated herein. Neither

the Company nor the Underwriters have authorized anyone to provide information different from that contained in the Prospectus and the

documents incorporated or deemed to be incorporated herein. See “About this Prospectus Supplement”.

Our head office

is located at Brookfield Place, Suite 3320, 181 Bay Street, Toronto, Ontario, Canada M5J 2T3 and our registered office is located

at Suite 1600, 925 West Georgia Street, Vancouver, British Columbia, Canada V6C 3L2.

Some of New Gold’s

directors, being Nicholas Chirekos, Gillian Davidson, Thomas J. McCulley and Richard O’Brien, reside outside of Canada and each

has appointed New Gold Inc., Brookfield Place, Suite 3320, 181 Bay Street, Toronto, Ontario, Canada M5J 2T3 as agent for service

of process. Investors are advised that it may not be possible to enforce judgments obtained in Canada against any person that resides

outside of Canada, even if such person has appointed an agent for service of process. See “Enforceability of Certain Civil Liabilities”.

Unless otherwise

indicated, all dollar amounts and references to “US$” are to United States dollars and references to “$” and

“C$” are to Canadian dollars.

New

Gold may be considered a “connected issuer” (as defined in National Instrument 33-105 – Underwriting Conflicts

(“NI 33-105”)) of the Lead Underwriter and and

. An affiliate of the Lead Underwriter acts as co-documentation agent and

lender under the Senior Credit Facility and affiliates of and

act as under the Senior Credit Facility. In addition, the Lead Underwriter

or its affiliate is acting as the financial advisor to New Gold in connection with the transaction contemplated by the Partial Royalty

Repurchase and Amending Agreement and will receive a fee in connection therewith. See “Use of Proceeds” and “Plan of

Distribution (Conflicts of Interest)”.

TABLE OF CONTENTS

Prospectus Supplement

Shelf Prospectus

ABOUT

THIS PROSPECTUS SUPPLEMENT

This document is

in two parts. The first part is this Prospectus Supplement, which describes the specific terms of the Offering and adds, updates, or

changes certain information contained in the Shelf Prospectus, and the documents incorporated by reference herein and therein. The second

part is the Shelf Prospectus, which gives more general information, some of which may not apply to the Offering. Before investing in

any Offered Shares, you should read both this Prospectus Supplement together with the Shelf Prospectus, together with additional information

in the documents described herein and therein under “Documents Incorporated by Reference”.

This Prospectus

Supplement is deemed to be incorporated by reference in the Shelf Prospectus solely for the purpose of the Offering. Purchasers should

rely only on information contained in or incorporated by reference in this Prospectus Supplement or the Shelf Prospectus. New Gold has

not authorized anyone to provide investors with different or additional information. New Gold is not making an offer of Common Shares

in any jurisdiction where the offer is not permitted by law. Prospective investors should not assume that the information contained in

or incorporated by reference in this Prospectus Supplement or the Shelf Prospectus is accurate as of any date other than the date on

the front of this Prospectus Supplement, the Shelf Prospectus or the date of the documents incorporated by reference herein and therein,

as applicable. If any information varies between this Prospectus Supplement and the Shelf Prospectus (including the documents incorporated

herein and therein), you should rely on the information in this Prospectus Supplement.

Unless New Gold

has indicated otherwise, or the context otherwise requires, references in the Prospectus to “New Gold”, the “Company”,

“we”, “us” and “our” refer to New Gold Inc. and, as applicable, its subsidiaries. References to our

website in this Prospectus Supplement, the Shelf Prospectus or in any documents that are incorporated by reference herein and therein

do not incorporate by reference the information on such website into this Prospectus Supplement or the Shelf Prospectus, and we disclaim

any such incorporation by reference.

U.S.

REGISTRATION STATEMENT

The Offering is

being made concurrently in Canada (other than in Quebec) pursuant to the Prospectus and in the United States pursuant to the Registration

Statement filed with the SEC under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”),

of which the Prospectus forms a part. The Prospectus does not contain all of the information set forth in the Registration Statement,

certain parts of which have been omitted in accordance with the rules and regulations of the SEC. For further information with respect

to New Gold and the Common Shares offered in the Prospectus, reference is made to the Registration Statement and to the schedules and

exhibits filed therewith. Statements contained in the Prospectus as to the contents of certain documents are not necessarily complete

and, in each instance, reference is made to the copy of the document filed as an exhibit to the Registration Statement. Each such statement

is qualified in its entirety by such reference. The Registration Statement can be found on EDGAR (as defined herein) at the SEC’s

website: www.sec.gov. See “Documents Filed as Part of the Registration Statement”.

CAUTIONARY STATEMENT

ON FORWARD-LOOKING INFORMATION

The Prospectus,

including the documents incorporated by reference herein, contains “forward-looking information” within the meaning of applicable

Canadian securities laws and “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform

Act of 1995 (collectively referred to herein as “forward-looking information” or “forward-looking statements”).

All statements in the Prospectus, other than statements of historical fact, which address events, results, outcomes or developments that

New Gold expects to occur are “forward-looking statements”. Forward-looking statements are statements that are not historical

facts and are generally, but not always, identified by the use of forward-looking terminology such as “plans”, “expects”,

“is expected”, “budget”, “scheduled”, “targeted”, “estimates”, “forecasts”,

“intends”, “anticipates”, “projects”, “potential”, “believes” or variations

of such words and phrases or statements that certain actions, events or results “may”, “could”, “would”,

“should”, “might” or “will be taken”, “occur” or “be achieved” or the negative

connotation of such terms.

In particular, the Prospectus, including the documents

incorporated by reference herein, contains forward-looking statements including, among others, those discussed in more detail in the Shelf

Prospectus under the heading “Cautionary Statement on Forward-Looking Information” and also include, without limitation, statements

with respect to: the closing of the transaction contemplated by the Partial Royalty Repurchase and Amending Agreement, the details thereof

and the expected financing of the cash payment pursuant thereto; the availability and use of funds available pursuant to the Senior Credit

Facility; the anticipated benefits of the transaction contemplated by the Partial Royalty Repurchase and Amending Agreement to the Company’s

business, financial condition, cash flows and results of operations, and to our shareholders being attained, including with respect to

attributable free cash flow; anticipated costs of the transaction contemplated by the Partial Royalty Repurchase and Amending Agreement;

the Offering and the aggregate gross and net proceeds thereof; the timing and completion of the Offering; the exercise of the Over-Allotment

Option; the use of the net proceeds of the Offering; the listing of the Offered Shares; and obtaining all required regulatory (including

stock exchange) and other approvals in connection with the Offering.

All forward-looking statements in the Prospectus

and the documents incorporated by reference herein are based on the opinions and estimates of management as of the date such statements

are made and are subject to important risk factors and uncertainties, many of which are beyond New Gold’s ability to control or

predict. Certain material assumptions regarding such forward-looking statements are discussed in the Annual Information Form, Annual Management’s

Discussion and Analysis and Interim Management’s Discussion and Analysis (as each such term is defined under the heading “Documents

Incorporated by Reference”) and the Technical Reports (as defined in the Annual Information Form and which are not incorporated

herein) filed on SEDAR+ (www.sedarplus.ca) and EDGAR (www.sec.gov). Such material assumptions include those discussed in more detail in

the Shelf Prospectus under the heading “Cautionary Statement on Forward-Looking Information” and also include, without limitation:

the ability of New Gold to complete the Offering and the transaction contemplated by the Partial Royalty Repurchase and Amending Agreement

on a timely basis and in accordance with the terms of the Underwriting Agreement and the Partial Royalty Repurchase and Amending Agreement,

respectively.

Forward-looking statements are necessarily based

upon a number of estimates and assumptions including material estimates and assumptions related to the risk factors set forth below that,

while considered reasonable by New Gold as at the date of this Prospectus Supplement in light of management’s experience and perception

of current conditions and expected developments, are inherently subject to significant business, economic and competitive uncertainties

and contingencies. Known and unknown risk factors could cause actual results to differ materially from those projected in the forward-looking

statements and undue reliance should not be placed on such statements and information. Such factors include those detailed in the Shelf

Prospectus under the heading “Cautionary Statement on Forward-Looking Information” and also include, without limitation: the

Common Shares are subject to market volatility; future sales by existing shareholders could decrease the value of the Common Shares; the

Company has no history of paying dividends and does not anticipate paying dividends on its Common Shares in the future; there may be an

insufficiently liquid trading market for our Common Shares in the future, which could prevent shareholders from selling their Common Shares

without a significant reduction in the price of their Common Shares, or at all; investors in the Offering may lose their entire investment;

forward-looking statements may prove incorrect; the Offering is not conditional on the closing of the transaction contemplated by the

Partial Royalty Repurchase and Amending Agreement, and our management will have broad discretion over the reallocation of the proceeds

of the Offering if such transaction does not close; the failure to realize anticipated benefits of the transaction contemplated by the

Partial Royalty Repurchase and Amending Agreement may materially adversely affect the Company’s business, operations, assets, financial

performance and cash flows; increased indebtedness may have a negative effect on the Company results of operations and credit ratings

and have important negative consequences for the Company’s shareholders; and the success of the Company is dependent on significant

capital investments.

Many of these uncertainties

and contingencies can affect New Gold’s actual results and could cause actual results to differ materially from those expressed

or implied in any forward-looking statements made by, or on behalf of, New Gold. Readers are cautioned that forward-looking statements

are not guarantees of future performance. For additional information with respect to New Gold’s risk factors, reference should

be made to the sections of this Prospectus Supplement and the Shelf Prospectus entitled “Risk Factors”, to the documents

incorporated by reference herein and therein and to New Gold’s continuous disclosure materials filed from time to time with Canadian

and United States securities regulatory authorities.

All forward-looking

information in this Prospectus Supplement and in the documents incorporated by reference herein is qualified in its entirety by the above

cautionary statements and New Gold disclaims any intention or obligation to update or revise any oral or written forward-looking statements

whether as a result of new information, future events or otherwise, except as required by applicable law.

CAUTIONARY

NOTE TO UNITED STATES INVESTORS

New Gold’s

mineral reserves and mineral resources included in the Prospectus have been estimated as at December 31, 2023 in accordance with

National Instrument 43 101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) as required by Canadian

securities regulatory authorities.

NI 43-101 is a rule developed

by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical

information concerning mineral projects. NI 43-101 differs significantly from the disclosure requirements of the SEC generally applicable

to United States companies. For example, the terms “mineral reserve”, “proven mineral reserve”, “probable

mineral reserve”, “mineral resource”, “measured mineral resource”, “indicated mineral resource”

and “inferred mineral resource” are defined in NI 43-101. These definitions differ from the definitions in the disclosure

requirements promulgated by the SEC.

Accordingly, information

contained in the Prospectus and the documents incorporated by reference will not be comparable to similar information made public by

United States companies reporting pursuant to SEC disclosure requirements.

In addition, United

States investors are cautioned not to assume that any part or all of New Gold’s mineral resources constitute or will be converted

into reserves. These terms have a great amount of uncertainty as to their economic and legal feasibility. Accordingly, United States

investors are cautioned not to assume that any “measured”, “indicated”, or “inferred” mineral resources

that New Gold reports in the Prospectus are or will be economically or legally mineable.

ENFORCEABILITY

OF CERTAIN CIVIL LIABILITIES

New Gold is a company

existing under the laws of the Province of British Columbia, Canada. Most of New Gold’s assets are located outside of the United

States. In addition, some of New Gold’s directors and officers and most of the experts named in the Prospectus are resident outside

the United States, and a significant portion of their respective assets are located outside of the United States. New Gold has appointed

an agent for service of process in the United States, but it may be difficult for holders of Common Shares who reside in the United States

to effect service within the United States upon those directors, officers and experts who are not residents of the United States. It

may also be difficult for holders of the Common Shares who reside in the United States to realize in the United States upon judgments

of courts of the United States predicated upon New Gold’s civil liability and the civil liability of its directors and officers

and experts under United States federal securities laws.

New Gold has filed

with the SEC, concurrently with the Registration Statement on Form F-10, of which the Prospectus forms a part, an appointment of

agent for service of process on Form F-X. Under the Form F-X, New Gold has appointed CT Corporation System, 28 Liberty Street,

New York, NY 10005, as its agent for service of process in the United States in connection with any investigation or administrative proceeding

conducted by the SEC, and any civil suit or action brought against New Gold in a United States court arising out of or related to or

concerning the Offering of the Common Shares under the registration statement.

Additionally, it

might be difficult for shareholders to enforce judgments of the United States courts based solely upon civil liability provisions of

the United States federal securities laws or the securities or “blue sky” laws of any state within the United States in a

Canadian court against New Gold or any of its non-U.S. resident directors, officers or the experts named in the Prospectus or to bring

an original action in a Canadian court to enforce liabilities based on the United States federal or state securities laws against such

persons.

Some of New Gold’s

directors, being Nicholas Chirekos, Gillian Davidson, Thomas J. McCulley and Richard O’Brien, reside outside of Canada and each

has appointed New Gold Inc., Brookfield Place, Suite 3320, 181 Bay Street, Toronto, Ontario, Canada M5J 2T3 as agent for service

of process. Investors are advised that it may not be possible to enforce judgments obtained in Canada against any person that resides

outside of Canada, even if such person has appointed an agent for service of process.

CURRENCY

PRESENTATION AND EXCHANGE RATE INFORMATION

This Prospectus

Supplement contains references to United States dollars and Canadian dollars. All dollar amounts referenced, unless otherwise indicated,

are expressed in United States dollars. References to “US$” are to United States dollars and references to “$”

and “C$” are to Canadian dollars. The following table shows, for the periods and dates indicated, certain exchange rate information

for one United States dollar expressed in Canadian dollars. Except as indicated below, the information is based on the average daily

exchange rate as reported by the Bank of Canada. Such average daily exchange rate on May 10, 2024 was C$1.3665 = US$1.00.

| |

Period

End | | |

Average | | |

Low | | |

High | |

| |

(C$ per

US$) | |

| Year ended December 31, |

| | | |

| | | |

| | | |

| | |

| 2023 |

| 1.3226 | | |

| 1.3497 | | |

| 1.3128 | | |

| 1.3875 | |

| 2022 |

| 1.3544 | | |

| 1.3013 | | |

| 1.2451 | | |

| 1.3856 | |

| |

| | | |

| | | |

| | | |

| | |

| Three months ended March 31, |

| | | |

| | | |

| | | |

| | |

| 2024 |

| 1.3555 | | |

| 1.3488 | | |

| 1.3316 | | |

| 1.3593 | |

| 2023 |

| 1.3533 | | |

| 1.3525 | | |

| 1.3312 | | |

| 1.3807 | |

DOCUMENTS

INCORPORATED BY REFERENCE

Information has

been incorporated by reference in this Prospectus Supplement from documents filed with securities commissions or similar regulatory authorities

in each of the provinces and territories in Canada (other than Quebec) and filed with, or furnished to, the SEC. Copies of the documents

incorporated by reference herein may be obtained on request without charge from the Corporate Secretary of New Gold at Brookfield Place,

Suite 3320, 181 Bay Street, Toronto, Ontario, Canada M5J 2T3, (416) 324-6000. These documents are also available through the

Internet on SEDAR+, which can be accessed at www.sedarplus.ca, and EDGAR, which can be accessed at www.sec.gov.

New Gold’s

disclosure documents listed below and filed with the appropriate securities commissions or similar regulatory authorities in each of

the provinces and territories of Canada (other than Quebec) and filed with or furnished to the SEC are specifically incorporated by reference

into and form an integral part of this Prospectus Supplement and the accompanying Shelf Prospectus:

Any document of

the type referred to above, including any material change report (other than any confidential material change report), any business acquisition

report, and any “template version” of “marketing materials” (each as defined in National Instrument 41-101 –

General Prospectus Requirements) subsequently filed by New Gold with such securities commissions or regulatory authorities in

Canada (other than Quebec) after the date of this Prospectus Supplement, and prior to the termination of the Offering, shall be deemed

to be incorporated by reference into this Prospectus Supplement. In addition, any document or information incorporated by reference in

this Prospectus Supplement filed by New Gold with, or furnished by New Gold to, the SEC pursuant to the U.S. Securities Exchange Act

of 1934, as amended (the “Exchange Act”) shall be deemed to be incorporated by reference into the Registration Statement

of which this Prospectus Supplement forms a part. The documents incorporated or deemed to be incorporated by reference herein contain

meaningful and material information relating to New Gold and readers should review all information contained in this Prospectus Supplement,

the Shelf Prospectus and the documents incorporated or deemed to be incorporated by reference herein and therein. New Gold’s current

reports on Form 6-K and annual reports on Form 40-F are available on the SEC’s EDGAR website at www.sec.gov.

Any statement

contained in a document incorporated or deemed to be incorporated by reference in this Prospectus Supplement or the Shelf Prospectus

shall be deemed to be modified or superseded for purposes of this Prospectus Supplement and the Shelf Prospectus to the extent that a

statement contained herein, or in any other subsequently filed document which also is incorporated or is deemed to be incorporated herein

and therein by reference, modifies or supersedes such statement. The modifying or superseding statement need not state that it has modified

or superseded a prior statement or include any other information set forth in the document that it modifies or supersedes. The making

of a modifying or superseding statement will not be deemed an admission for any purpose that the modified or superseded statement, when

made, constituted a misrepresentation, an untrue statement of a material fact or an omission to state a material fact that is required

to be stated or that is necessary to make a statement not misleading in light of the circumstances in which it was made. Any statement

so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Prospectus Supplement

or the Shelf Prospectus.

WHERE

YOU CAN FIND ADDITIONAL INFORMATION

In addition to New

Gold’s continuous disclosure obligations under the securities laws of the provinces and territories of Canada, New Gold is subject

to the informational requirements of the Exchange Act and in accordance therewith files and furnishes reports and other information with

the SEC. Under the MJDS, such reports and other information may be prepared in accordance with the disclosure requirements of Canada,

which requirements are different in certain respects from those of the United States. As a foreign private issuer, New Gold is exempt

from the rules under the Exchange Act prescribing the furnishing and content of proxy statements, and New Gold’s officers

and directors are exempt from the reporting and short swing profit recovery provisions contained in Section 16 of the Exchange Act.

Copies of the documents that New Gold files with or furnishes to the SEC are electronically available from the SEC’s Electronic

Document Gathering and Retrieval system (“EDGAR”) website, and may be accessed at www.sec.gov.

PRESENTATION

OF FINANCIAL INFORMATION

New Gold presents

its consolidated financial statements in United States dollars and its consolidated financial statements are prepared in accordance with

IFRS as issued by the IASB. Unless otherwise indicated, financial information included or incorporated by reference in the Prospectus

has been prepared in accordance with IFRS as issued by IASB. As a result, certain financial information included or incorporated by reference

in the Prospectus may not be comparable to financial information prepared by companies in the United States. Certain calculations included

in tables and other figures in this Prospectus Supplement have been rounded for clarity of presentation.

RISK

FACTORS

Risk factors

relating to the Company’s business are discussed in the Annual Information Form and certain other documents incorporated by

reference or deemed to be incorporated by reference in the Prospectus, which risk factors are incorporated by reference in the Prospectus.

An investment in

the Common Shares offered hereby involves a high degree of risk and should be regarded as speculative due to the nature of the Company’s

business. Prospective purchasers should carefully consider, in light of their own financial circumstances, the risk factors set out below

which relate to the Company and an investment in its securities, as well as the other information contained in the Prospectus and the

documents incorporated or deemed to be incorporated by reference herein and in all subsequently filed documents incorporated by reference

herein, before making an investment decision.

The risks set out

below are not the only risks that New Gold faces. The risk factors discussed or incorporated by reference herein, as well as risks currently

unknown to New Gold or that New Gold currently deems to be immaterial, could materially adversely affect our future business, operations,

financial condition and prospects and could cause any of the foregoing to differ materially from the estimates described in forward-looking

information or statements relating to the Company, or its business, property or financial results, any of which could cause purchasers

of our Common Shares to lose part or all of their investment.

Risks Relating to the Offering and the Common Shares

The Common Shares are subject

to market volatility.

The market price

of the Common Shares fluctuates significantly. The market price of the Common Shares may fluctuate based on a number of factors, including

but not limited to:

| · | the

Company’s operating performance and the performance of competitors and other similar

companies; |

| · | the

market’s reaction to the issuance of securities or to other financing plans of the

Company; |

| · | changes

in general economic conditions; |

| · | the

number of the Common Shares outstanding; |

| · | the

price of gold, silver, copper and other commodities; |

| · | the

arrival or departure of key personnel; and |

| · | acquisitions,

strategic alliances or joint ventures involving the Company or its competitors. |

In addition, the

market price of the Common Shares is affected by many variables not directly related to the Company’s success and not within the

Company’s control, including developments that affect the industry as a whole, the breadth of the public market for the Common

Shares, and the attractiveness of alternative investments. In addition, securities markets have recently experienced significant levels

of price and volume volatility, and the market price of securities of many companies has experienced wide fluctuations which have not

necessarily been related to the operating performance, underlying asset values or prospects of such companies. As a result of these and

other factors, the Company’s share price may be volatile in the future.

Future sales by existing shareholders

could decrease the value of the Common Shares.

Future sales of

Common Shares by shareholders of the Company could decrease the value of the Common Shares. We cannot predict the volume of future sales

by shareholders of the Company, or the effect, if any, that such sales will have on the market price of the Common Shares. Sales of a

substantial number of Common Shares, or the perception that such sales could occur, may adversely affect the prevailing market price

of the Common Shares.

The Company has no history of

paying dividends and does not anticipate paying dividends on its Common Shares in the future.

To date, New Gold

has not paid dividends on its Common Shares. New Gold currently intends to retain future earnings, if any, for use in its business and

does not, at this time, anticipate paying dividends on its Common Shares. Any determination to pay any future dividends will remain at

the discretion of New Gold’s board of directors and will be made taking into account its financial condition and other factors

deemed relevant by the board. Further, pursuant to debt instruments of New Gold in place from time to time, New Gold may, in certain

circumstances, be required to obtain consent from lenders prior to declaring dividends. See “Dividends”.

There may be an insufficiently

liquid trading market for our Common Shares in the future, which could prevent shareholders from selling their Common Shares without

a significant reduction in the price of their Common Shares, or at all.

Shareholders of

the Company may be unable to sell significant quantities of Common Shares into the public trading markets without a significant reduction

in the price of their Common Shares, or at all. There can be no assurance that there will be sufficient liquidity of the Company’s

Common Shares in the public trading markets, and that the Company will continue to meet the listing requirements of the TSX or the NYSE

American or achieve or maintain a listing on any other securities exchange or marketplace.

Investors in the Offering may

lose their entire investment.

An investment in

the Common Shares is speculative and may result in the loss of an investor’s entire investment. Only potential investors who are

experienced in high-risk investments and who can afford to lose their entire investment should consider an investment in the Company.

Forward-looking statements may

prove incorrect.

The forward-looking

statements relating to, among other things, the Company’s future results, performance, achievements, prospects or opportunities

included or incorporated by reference in this Prospectus Supplement, are based on opinions, assumptions and estimates made by management

in light of their experience and perception of historical trends, current conditions and expected future developments, as well as other

factors that management believes are appropriate and reasonable in the circumstances. There can be no assurance that such estimates and

assumptions will prove to be correct. The Company’s actual future results may vary significantly from historical and estimated

results, and those variations may be material. There is no representation by the Company that actual results achieved by it in the future

will be the same, in whole or in part, as those included or incorporated by reference in this Prospectus Supplement. See “Cautionary

Statement on Forward-Looking Information”.

Risks Relating to the Partial Royalty Repurchase and Amending Agreement

The Offering is not conditional

on the closing of the transaction contemplated by the Partial Royalty Repurchase and Amending Agreement, and our management will have

broad discretion over the reallocation of the proceeds of the Offering if such transaction does not close.

The Company currently

intends to use the net proceeds of the Offering as specified under the heading “Use of Proceeds”. Specifically, the net proceeds

of the Offering, in the approximate amount of US$ , together with

cash on hand and borrowings under its Senior Credit Facility, in the approximate amount of US$ ,

will be used to pay the amount payable under the Partial Royalty Repurchase and Amending Agreement, being US$255,000,000. Any excess

net proceeds, including from the exercise of the Over-Allotment Option, are anticipated to be used for general corporate purposes, which

may include repayment of indebtedness.

The Offering is

not conditional upon the closing of the transaction contemplated by the Partial Royalty Repurchase and Amending Agreement. If the transaction

contemplated by the Partial Royalty Repurchase and Amending Agreement does not close, the Company may reallocate the net proceeds of

the Offering for general corporate purposes, which may include repayment of indebtedness. In addition, circumstances and developments

could arise where the Company’s capital resources may need to be allocated differently at the discretion of New Gold’s board

of directors or management. In such circumstances, New Gold’s management will have broad discretion concerning the use of net proceeds

of the Offering, as well as the timing of such expenditures. As a result, investors will be relying on the judgment of New Gold’s

management as to the application of net proceeds of the Offering. The failure by the board of directors or management of the Company

to apply the Company’s capital resources effectively could have a material adverse effect on the development of the Company’s

projects and the Company’s business, financial condition, results of operations and cash flows.

The failure to realize anticipated

benefits of the transaction contemplated by the Partial Royalty Repurchase and Amending Agreement may materially adversely affect the

Company’s business, operations, assets, financial performance and cash flows.

The Company believes

that the transaction contemplated by the Partial Royalty Repurchase and Amending Agreement will provide certain benefits to the Company

and its shareholders. See “Recent Developments” and “Use of Proceeds”. However, these expected benefits may not

be achieved, or may take longer than expected to realize, and other assumptions upon which the Company had determined the benefits of

the transactions may prove to be incorrect or may not materialize. To the extent that the anticipated benefits of the transactions are

not achieved, or take longer than expected to be achieved, the results of operations and the financial condition of the Company may suffer,

which may materially adversely affect the Company’s business, operations, assets, financial performance and cash flows.

Increased indebtedness may have

a negative effect on the Company results of operations and credit ratings and have important negative consequences for the Company’s

shareholders.

The Company intends

to incur additional indebtedness under its Senior Credit Facility to finance a portion of the transaction contemplated by the Partial

Royalty Repurchase and Amending Agreement. Any such borrowing will increase the Company’s consolidated indebtedness. Any such additional

indebtedness will increase the Company’s interest expense and debt service obligations and may have a negative effect on the Company’s

results of operations and credit ratings. Such increased indebtedness will also make the Company’s results more sensitive to increases

in interest rates. The Company’s degree of leverage could have other important negative consequences for purchasers, including:

(i) potentially having a negative effect on the Company’s issuer debt rating; (ii) potentially limiting the Company’s

ability to obtain additional financing for working capital, capital expenditures, debt service requirements, acquisitions and general

corporate or other purposes; (iii) potentially limiting the Company’s ability to declare dividends on the Common Shares; (iv) the

possibility that the Company may be more vulnerable in a downturn in general economic conditions; and (v) the possibility that the

Company may be unable to make capital expenditures that are important to its growth and strategies.

Risks Relating to the Company

The success of the Company is

dependent on significant capital investments.

The Company has

made, and expects to make in the future, substantial capital investments in its business and operations. Historically, the Company has

financed capital investments primarily with the issuance of equity and debt securities and borrowings under various lending arrangements.

The Company intends to finance its future capital investments primarily through future cash flows from operations, through borrowings

under various lending arrangements, and access to global capital markets; however these sources may not be sufficient to fund the Company’s

business objectives.

The Company may

not have sufficient capital resources to undertake future capital investments in its business and operations. As such, the Company may

require additional financing that cannot be satisfied from future cash flows from operations. There is a risk that if the economy and

banking industry experience unexpected or prolonged deterioration, the Company’s access to additional financing may be affected.

Because of global economic volatility, the Company may from time to time have restricted access to capital and increased borrowing costs.

Failure to obtain such additional financing on a timely basis could cause the Company to miss certain acquisition opportunities and reduce

or terminate all or certain of its operations.

If the Company’s

revenues decrease as a result of lower sales, operating difficulties or otherwise, it will affect the Company’s ability to obtain

the necessary capital to fund the Company’s business objectives. To the extent that external sources of capital become limited,

unavailable, or available only on onerous terms, the Company’s ability to make capital investments and maintain existing assets

may be impaired, and its assets, liabilities, business, financial condition and results of operations may be materially and adversely

affected. Additionally, there can be no assurance that additional debt or equity financing will be available to meet these requirements

on favourable terms or at all. Future equity financings may result in a change of control of the Company.

ABOUT

NEW GOLD

New Gold is a Canadian-focused

intermediate gold mining company engaged in the exploration, development and operation of mineral properties. New Gold currently has

the following interests in mines: (i) a 100% interest in the Rainy River gold mine in Ontario, Canada, and (ii) a 100% interest

in the New Afton copper-gold mine in British Columbia, Canada. New Gold also holds a 100% interest in the Cerro San Pedro gold-silver

mine in San Luis Potosí, Mexico, which transitioned to the post-closure phase at the beginning of 2024. New Gold has been engaged

in the acquisition, exploration and development of natural resource properties since 1980. New Gold’s current structure arose through

two accretive business combinations in mid-2008 and mid-2009. New Gold is continually working to maximize shareholder value through diversified

production, maintaining an attractive risk profile and enhancing growth potential in a safe and an environmentally and socially responsible

manner. The Company also holds Canadian-focused investments.

New Gold’s

corporate office is located at Brookfield Place, Suite 3320, 181 Bay Street, Toronto, Ontario, Canada M5J 2T3. New Gold’s

registered office is located at 1600 – 925 West Georgia Street, Vancouver, British Columbia, Canada V6C 3L2.

RECENT

DEVELOPMENTS

Original Royalty Agreement

On February 24,

2020, the Company entered into a strategic partnership agreement (the “2020 Purchase Agreement”) with a limited partnership

controlled by Ontario Teachers, pursuant to which, among other things, the Company and the Ontario Teachers’ affiliate entered

into a free cash flow royalty agreement dated March 31, 2020 (the “Original Royalty Agreement” and, together

with the 2020 Purchase Agreement, the “2020 Agreements”). Under the terms of the 2020 Agreements, the Ontario Teachers’

affiliate acquired a 46.0% free cash flow royalty interest in the New Afton mine with an option (the “Partnership Option”)

to convert the interest into a 46.0% limited partnership interest in the period from and after March 31, 2024 and terminating on

May 30, 2024 (such period, the “Partnership Option Exercise Period”). Pursuant to the terms of the Original Royalty

Agreement, if the Partnership Option is not exercised during the Partnership Option Exercise Period, the free cash flow royalty rate

will be reduced to 42.5%. Additionally, the 2020 Agreements set out certain governance rights and protections for the Ontario Teachers’

affiliate in relation to the operation of the New Afton mine, including establishment of an advisory committee to keep the Ontario Teachers’

affiliate advised of material operational matters and to provide the opportunity to make suggestions with respect to the operations of

the New Afton mine. Under the arrangement, the Company retains operating control over the New Afton mine.

Partial Royalty Repurchase and Amending

Agreement

On May 13, 2024, New Gold and the

Ontario Teachers’ affiliate entered into a partial royalty repurchase and amending agreement (the “Partial

Royalty Repurchase and Amending Agreement”), pursuant to which New Gold and the Ontario Teachers’ affiliate agreed

to: (i) reduce the royalty rate payable by New Gold pursuant to the Original Royalty Agreement from 46.0% to 19.9% from and

after May 31, 2024; (ii) terminate the option whereby the Ontario Teachers’ affiliate or, after May 30, 2024, a third

party purchaser of the Ontario Teachers’ affiliate’s interest, could elect to form a partnership with respect to the New

Afton mine; (iii) terminate New Gold’s option to repurchase and cancel the Original Royalty Agreement (which right would

otherwise terminate on May 30, 2024); and (iv) make certain other related or consequential amendments to the Original Royalty

Agreement and terminate the 2020 Purchase Agreement, all in consideration for a one-time cash payment by New Gold to the Ontario

Teachers’ affiliate of US$255,000,000 (the “Partial Royalty Repurchase”).

The Partial Royalty

Repurchase and Amending Agreement provides that, subject to satisfaction of the terms and conditions therein, the parties will enter

into the amended and restated free cash flow royalty agreement (the “Amended and Restated Free Cash Flow Royalty Agreement”).

The Partial Royalty Repurchase and Amending Agreement contains customary representations, warranties and closing conditions for a transaction

of this nature, including a condition that the Offering is completed.

The Amended and

Restated Free Cash Flow Royalty Agreement is on terms substantially similar to the terms of the Original Royalty Agreement, except as

otherwise described below. In particular, the royalty rate payable will be reduced to 19.9% after May 31, 2024 and the option to

convert the royalty to a formal partnership will be removed. The right of first offer in favour of New Gold on any proposed sale by the

Ontario Teachers’ affiliate of its royalty interest will be replaced with a right of first refusal, whereby if the Ontario Teachers’

affiliate receives a bona fide, binding offer to acquire all, but not less than all, of its royalty interest, New Gold

will have a right, exercisable within 60 days, to repurchase the royalty for cancellation at a price equal to 103.0% of the amount provided

in the third party offer. Upon exercise of such right of first refusal, New Gold shall satisfy the purchase price in cash, provided that

if the third party offer includes non-cash consideration, New Gold may elect to satisfy the purchase price in cash or non-cash consideration,

including newly issued Common Shares of New Gold or non-cash consideration that is reasonably equivalent to that contained in the third

party offer, at New Gold’s discretion.

New Gold will

not be subject to any restrictions on transfer of the New Afton mine; provided that, if a change of control (as defined in the

indenture for New Gold’s outstanding 7.5% senior notes dated as of June 24, 2020, the “Change of

Control”) is announced on or prior to December 31, 2030 that is subsequently completed, the Ontario Teachers’

affiliate may elect, within 10 business days after announcement of the Change of Control, to sell its royalty interest to New

Gold or its successor-in-interest for fair market value (as determined in accordance with the terms of the Amended and Restated Free

Cash Flow Royalty Agreement) within 30 days following the closing of the Change of Control transaction (subject to extension if

necessary to complete the fair market value determination). The purchase price may be payable in cash or listed securities of New

Gold’s successor-in-interest, at its election, or a combination thereof, subject to a cap on the number of securities to be

issued of 9.99% of the class of listed securities issued. If the Ontario Teachers’ affiliate declines to sell its royalty

interest in connection with such Change of Control, the right will not apply to any subsequent Change of Control.

In addition, if a Change of Control is completed

within 20 months following the completion of the Partial Royalty Repurchase, the Ontario Teachers’ affiliate will receive a one-time

cash payment from New Gold or its successor-in-interest in the amount of US$20,000,000, payable within 30 days following the completion

of the Change of Control.

In recognition of the fact that the royalty interest

is reduced to 19.9%, certain governance rights provided under the 2020 Agreements will be reduced, including the elimination of a standing

advisory committee.

Pursuant to the

Amended and Restated Free Cash Flow Royalty Agreement, the 2020 Purchase Agreement will be terminated effective as of the closing of

the Partial Royalty Repurchase, save for the indemnification provisions thereunder, which shall remain outstanding in accordance with

their terms.

If completed, the

transaction contemplated by the Partial Royalty Repurchase and Amending Agreement is expected to provide benefits to the Company, including:

| · | Realizing

on a time-limited opportunity to reduce significant royalty obligations and consolidate the

Company’s existing asset. |

| · | Delivering a meaningful increase in attributable life-of-mine cash flow while maintaining New Gold’s balance sheet strength

and financial liquidity. |

| · | Creating a renewed focus on exploration activities at the New Afton mine, with the potential to add value by improving the production

profile and extending mine life. |

| · | Doing so while minimizing the requirement for additional technical, operational, and social knowledge and expertise and without any

additional corporate general and administrative expense. |

CONSOLIDATED

CAPITALIZATION

Other than in connection with the Offering and

the completion of the proposed transaction contemplated by the Partial Royalty Repurchase and Amending Agreement, there have been no material

changes in the share and loan capital of New Gold, on a consolidated basis, since March 31, 2024, the date of New Gold’s most recently

filed financial statements.

The following table sets forth the cash and cash

equivalents and consolidated capitalization of the Company as at March 31, 2024, as adjusted (i) to give effect to the Offering, and as

further adjusted (ii) to give effect to the Offering and the completion of the transaction contemplated by the Partial Royalty Repurchase

and Amending Agreement. The financial information set out below should be read in conjunction with the Annual Financial Statements and

the Interim Financial Statements. Other than as set forth below, there have been no material changes in the Company’s share and

loan capital since March 31, 2024.

| Description(1) | |

As at March 31, 2024

(US$mm, except share count) | | |

As at March 31, 2024 after

giving effect to the Offering

(US$mm, except share count) | | |

As at March 31, 2024 after

giving effect to the Offering

and the Partial Royalty

Repurchase

(US$mm, except share count) | |

| Cash and cash equivalents(2) | |

| 156.7 | | |

| | | |

| | |

| Long-term debt(2) | |

| 396.2 | | |

| 396.2 | | |

| | |

| Common Shares(3) | |

| 3,168.1 (689.8 million) | | |

| ( million) | | |

| ( million) | |

| Contributed surplus | |

| 106.5 | | |

| 106.5 | | |

| 106.5 | |

| Other reserves | |

| (149.4 | ) | |

| (149.4 | ) | |

| (149.4 | ) |

| Deficit | |

| (2,388.8 | ) | |

| (2,388.8 | ) | |

| (2,388.8 | ) |

| Total equity | |

| 736.4 | | |

| | | |

| | |

| Total loan and share capital | |

| 1,132.6 | | |

| | | |

| | |

Notes:

| (1) | Based on prevailing metal prices and timely completion of the transaction contemplated by the Partial

Royalty Repurchase and Amending Agreement. Assumes no exercise of the Over-Allotment Option. |

| (2) | Assumes that the amount payable under the Partial Royalty Repurchase and Amending Agreement will be

satisfied with US$ of cash on hand and a draw under the Senior Credit Facility

of US$ . |

| (3) | Does not include 251,274 Common Shares issued between April

1, 2024 and the date of this Prospectus Supplement upon the exercise of stock options. |

USE

OF PROCEEDS

The net proceeds

to the Company from the Offering (assuming no exercise of the Over-Allotment Option) are estimated to be approximately US$

after deducting the Underwriting Commission of US$ and

the estimated expenses of the Offering of US$ (excluding

taxes). If the Over-Allotment Option is exercised in full, the net proceeds to the Company are estimated to be approximately US$

after deducting the Underwriting Commission of US$ and

the estimated expenses of the Offering of US$ (excluding

taxes).

The net proceeds

of the Offering, together with cash on hand and borrowings under the Senior Credit Facility, are anticipated to be used to pay the amount

payable under the Partial Royalty Repurchase and Amending Agreement, being US$255,000,000, and to the extent there are excess net proceeds,

such proceeds are anticipated to be used for general corporate purposes, which may include repayment of indebtedness. See “Recent

Developments”. Anticipated net borrowing under the Senior Credit Facility may decrease to the extent that the Over-Allotment Option

is exercised. All expenses relating to the Offering and any compensation paid to Underwriters will be paid out of the proceeds of the

Offering.

The Offering is

not conditional upon completion of the transaction contemplated by the Partial Royalty Repurchase and Amending Agreement. If the transaction

does not close, the Company intends to reallocate the net proceeds of the Offering for other purposes in the discretion of management,

including for general corporate purposes, which may include repayment of indebtedness. See “Risk Factors”.

The transaction remains subject to customary closing

conditions in respect thereof. The Company anticipates the closing of the transaction will take place by the end of May, following completion

of the Offering. If closing does not occur, the Company will not realize the anticipated benefits of the transaction contemplated by the

Partial Royalty Repurchase and Amending Agreement. See “Recent Developments” and “Risk Factors – Risks Relating

to the Partial Royalty Repurchase and Amending Agreement”.

DIVIDENDS

To date, New Gold

has not paid dividends on its Common Shares. New Gold currently intends to retain future earnings, if any, for use in its business and

does not, at this time, anticipate paying dividends on its Common Shares. Any determination to pay any future dividends will remain at

the discretion of New Gold’s board of directors and will be made taking into account its financial condition and other factors

deemed relevant by the board. Further, pursuant to debt instruments of New Gold in place from time to time, New Gold may, in certain

circumstances, be required to obtain consent from lenders prior to declaring dividends.

DESCRIPTION

OF SECURITIES OFFERED

New Gold’s

authorized share capital consists of an unlimited number of Common Shares. For a description of the terms and provisions of the Common

Shares, see “Description of Securities Offered – Common Shares” in the Shelf Prospectus. As of May 10, 2024, New

Gold had 690,079,951 Common Shares issued and outstanding.

PRIOR

SALES

The following are

the only issuances of Common Shares, or securities that are convertible or exchangeable into Common Shares, by the Company within the

12 months prior to the date of this Prospectus Supplement:

| Date of Issuance | |

Type of Security | |

Issue Price (C$) | | |

Number Issued | |

| July 5, 2023 (1) | |

Common Shares | |

$ | 1.38 | | |

| 181,159 | |

| July 13, 2023 (2) | |

Common Shares | |

$ | 1.20 | | |

| 22,661 | |

| August 8, 2023(3) | |

Performance Share Units | |

$ | 1.47 | | |

| 51,020 | |

| September 8, 2023(2) | |

Common Shares | |

$ | 1.20 | | |

| 28,521 | |

| November 7, 2023 (2) | |

Common Shares | |

$ | 1.17 | | |

| 88,965 | |

| November 8, 2023 (2) | |

Common Shares | |

$ | 1.18 | | |

| 112,575 | |

| November 21, 2023 (2) | |

Common Shares | |

$ | 1.19 | | |

| 68,140 | |

| November 23, 2023 (2) | |

Common Shares | |

$ | 1.17 | | |

| 114,600 | |

| November 29, 2023 (2) | |

Common Shares | |

$ | 1.17 | | |

| 50,257 | |

| December 1, 2023 (2) | |

Common Shares | |

$ | 1.17 | | |

| 19,394 | |

| December 5, 2023 (2) | |

Common Shares | |

$ | 1.20 | | |

| 360,313 | |

| December 14, 2023 (4) | |

Common Shares | |

$ | 1.86 | | |

| 1,642,037 | |

| December 21, 2023 (2) | |

Common Shares | |

$ | 1.17 | | |

| 3,700 | |

| December 27, 2023 (2) | |

Common Shares | |

$ | 1.17 | | |

| 4,000 | |

| December 28, 2023 (2) | |

Common Shares | |

$ | 1.17 | | |

| 34,493 | |

| January 12, 2024 (5) | |

Common Shares | |

$ | 1.88 | | |

| 193,827 | |

| February 26, 2024 | |

Performance Share Units | |

$ | 1.54 | | |

| 3,223,093 | |

| March 6, 2024 (2) | |

Common Shares | |

$ | 1.20 | | |

| 114,387 | |

| March 14, 2024 (2) | |

Common Shares | |

$ | 2.06 | | |

| 76,487 | |

| March 18, 2024 (1) | |

Common Shares | |

$ | 1.92 | | |

| 2,399,999 | |

| March 25, 2024 (2) | |

Common Shares | |

$ | 2.18 | | |

| 37,999 | |

| April 9, 2024 (2) | |

Common Shares | |

$ | 1.20 | | |

| 34,417 | |

| April 10, 2024 (2) | |

Common Shares | |

$ | 2.09 | | |

| 216,857 | |

Notes:

| (1) | Common Shares issued pursuant to a First Nation agreement. |

| (2) | Common Shares issued pursuant to exercise of stock options. The issue price reflects the exercise

price of the stock option and not the Company’s share price on the market on that date. As of the date of this Prospectus

Supplement, the Company has 921,837 stock options outstanding. |

| (3) | As of the date of this Prospectus Supplement, the Company has 6,264,690 performance share units outstanding. |

| (4) | Common Shares issued pursuant to a flow-through share issuance. |

| (5) | Common Shares issued upon vesting of performance share units. |

TRADING

PRICES AND VOLUMES

The Common Shares

are listed on the TSX and the NYSE American under the symbol “NGD”. The following tables set forth information relating to

the trading and quotation of the Common Shares on the TSX and the NYSE American, for the months indicated.

| | |

Toronto Stock Exchange | | |

NYSE American | |

| | |

High

(C$) | | |

Low

(C$) | | |

Volume | | |

High

(US$) | | |

Low

(US$) | | |

Volume | |

| May 1 to 12, 2024 | |

| 2.75 | | |

| 2.45 | | |

| 10,794,640 | | |

| 2.01 | | |

| 1.79 | | |

| 2,770,492 | |

| April 2024 | |

| 2.67 | | |

| 2.26 | | |

| 34,407,265 | | |

| 1.94 | | |

| 1.67 | | |

| 12,110,099 | |

| March 2024 | |

| 2.37 | | |

| 1.68 | | |

| 30,260,104 | | |

| 1.76 | | |

| 1.24 | | |

| 18,024,649 | |

| February 2024 | |

| 1.77 | | |

| 1.47 | | |

| 24,231,386 | | |

| 1.31 | | |

| 1.09 | | |

| 5,621,505 | |

| January 2024 | |

| 1.95 | | |

| 1.50 | | |

| 24,372,640 | | |

| 1.46 | | |

| 1.17 | | |

| 3,406,359 | |

| December 2023 | |

| 2.12 | | |

| 1.81 | | |

| 42,346,375 | | |

| 1.60 | | |

| 1.33 | | |

| 7,656,928 | |

| November 2023 | |

| 2.00 | | |

| 1.55 | | |

| 22,209,747 | | |

| 1.47 | | |

| 1.12 | | |

| 3,465,227 | |

| October 2023 | |

| 1.75 | | |

| 1.18 | | |

| 26,407,187 | | |

| 1.25 | | |

| 0.86 | | |

| 4,677,539 | |

| September 2023 | |

| 1.47 | | |

| 1.21 | | |

| 11,705,674 | | |

| 1.08 | | |

| 0.89 | | |

| 3,999,926 | |

| August 2023 | |

| 1.51 | | |

| 1.24 | | |

| 16,635,899 | | |

| 1.13 | | |

| 0.93 | | |

| 4,034,528 | |

| July 2023 | |

| 1.75 | | |

| 1.35 | | |

| 17,196,007 | | |

| 1.32 | | |

| 1.01 | | |

| 3,618,793 | |

| June 2023 | |

| 1.74 | | |

| 1.33 | | |

| 16,671,351 | | |

| 1.29 | | |

| 1.02 | | |

| 6,987,790 | |

| May 2023 | |

| 1.99 | | |

| 1.54 | | |

| 28,681,082 | | |

| 1.48 | | |

| 1.14 | | |

| 5,504,823 | |

PLAN

OF DISTRIBUTION (Conflicts of Interest)

Pursuant to the

Underwriting Agreement, the Company has agreed to issue and sell the Offered Shares to the Underwriters and the Underwriters have severally

(and not jointly and severally) agreed to purchase the Offered Shares at the Offering Price on the Closing Date, payable in cash to the

Company against delivery of such Offered Shares, subject to compliance with all necessary legal requirements and the terms and conditions

of the Underwriting Agreement. The Underwriting Agreement provides that the Company will pay the Underwriters the Underwriting Commission

of % of the gross proceeds of the Offering (or US$

per Offered Share) for an aggregate Underwriting Commission payable by the Company of US$

(assuming no exercise of the Over-Allotment Option) in consideration for the services of the Underwriters in connection with the Offering.

The terms of the Offering, including the Offering Price, were determined by negotiation between the Company and the Lead Underwriter,

on its own behalf and on behalf of the other Underwriters.

The Company has

granted to the Underwriters the Over-Allotment Option, exercisable from time to time, in whole or in part, upon written notice to the

Company by the Lead Underwriter, on behalf of the Underwriters for a period of 30 days following the Closing Date, enabling the Underwriters

to purchase up to an additional Over-Allotment

Shares at the Offering Price to cover over-allotments, if any. The Company will pay to the Underwriters a fee equal to %

of the proceeds realized on the exercise of the Over-Allotment Option, or US$ per Over-Allotment

Share. If the Over-Allotment Option is exercised in full, the total gross proceeds of the Offering, the Underwriting Commission and the

net proceeds to the Company (before deducting expenses of the Offering) will be approximately US$ ,

US$ and US$ ,

respectively. The Prospectus qualifies the distribution of the Offered Shares and the grant of the Over-Allotment Option. A purchaser

who acquires Common Shares forming part of the Underwriters’ over-allotment position acquires those Common Shares under the Prospectus

regardless of whether the over-allotment position is ultimately filled through the exercise of the Over-Allotment Option or secondary

market purchases.

The obligations

of the Underwriters under the Underwriting Agreement may be terminated at their discretion upon the basis of “material change out”,

“disaster out”, “regulatory out”, and “breach out” termination provisions in the Underwriting Agreement

and may also be terminated upon the occurrence of certain other stated events.

The Underwriters

are, however, obligated to take-up and pay for all of the Offered Shares (not including the Over-Allotment Shares issuable upon exercise

of the Over-Allotment Option) if any Offered Shares are purchased under the Underwriting Agreement, subject to certain exceptions.

The Underwriters

propose to offer the Offered Shares initially at the Offering Price specified on the cover page hereof. After a reasonable effort

has been made to sell all of the Offered Shares at the Offering Price, the Underwriters may subsequently reduce the selling price to

investors from time to time in order to sell any of the Offered Shares remaining unsold. Any such reduction will not affect the proceeds

received by the Company or the fees payable by the Company to the Underwriters in connection with the Offering. The compensation realized

by the Underwriters in the event of such reduction will be decreased by the amount that the aggregate price paid by purchasers for the

Offered Shares is less than the gross proceeds paid by the Underwriters to the Company.

The Offered Shares

will be offered concurrently in the United States and the provinces and territories of Canada (other than in Quebec), through the Underwriters

either directly or through their respective U.S. or Canadian broker-dealer affiliates who are registered to offer the Offered Shares

for sale in the United States and such provinces and territories of Canada, as applicable, and such other registered dealers as may be

designated by the Underwriters, in accordance with the Underwriting Agreement. No Offered Shares will be offered or sold in any jurisdiction

except by or through brokers or dealers duly registered under the applicable securities laws of that jurisdiction, or in circumstances

where an exemption from such registered dealer requirements is available.

The Common Shares

are currently listed on the TSX and the NYSE American under the symbol “NGD”. The Company will apply to list the Offered

Shares (including the Over-Allotment Shares) on the TSX and the NYSE American. Listing will be subject to the Company fulfilling all

of the listing requirements of the TSX and NYSE American, respectively. Closing of the Offering is conditional on the Offered Shares

being conditionally approved for listing on the TSX and authorized for listing on the NYSE American.

Pursuant to the terms of the Underwriting Agreement,