Filed Pursuant to Rule 424(b)(3)

Registration No. 333-278986

PROSPECTUS SUPPLEMENT

(To Prospectus Dated July 15, 2024)

Up to 40 Warrants to Purchase up to 12,014,881 Shares

of Common Stock

147,735 Shares of Series X Preferred Stock

38,620,078 Shares of Common Stock Consisting of:

Up to 12,014,881 Shares of Common Stock Issuable

Upon Exercise of Warrants

Up to 14,773,500 Shares of Common Stock Issuable

Upon Conversion of the Series X Preferred Stock

Up to 11,831,697 Outstanding Shares of Common Stock

BIOMX INC.

This prospectus supplement (the “Prospectus

Supplement”) modifies, supersedes and supplements certain information contained in, and should be read in conjunction with, that

certain prospectus filed with the Securities and Exchange Commission (the “SEC”) by BiomX Inc., a Delaware corporation (the

“Company”), dated July 15, 2024, forming a part of the registration statement on Form S-3, as amended, filed with the SEC

on April 29, 2024 (the “Prospectus”), relating to the resale by the selling securityholders named in the Prospectus or their

permitted transferees of (i) up to 40 Warrants (as defined below) to purchase up to 12,014,881 shares of Common Stock (as defined below),

(ii) up to 147,735 shares of our series X non-voting convertible preferred stock, par value $0.0001 per share (the “Series X Preferred

Stock”) and (iii) up to 38,620,078 shares of common stock, par value $0.0001 per share (“Common Stock”), which consists

of:

| (a) | up to 12,014,881 shares of Common Stock issuable upon the exercise of (w) up to 33 warrants to purchase

up to 10,820,850 shares of Common Stock with an exercise price of $2.311 per share, issued pursuant to the securities purchase agreement

dated March 6, 2024, by and among the Company and the purchasers identified therein (the “PIPE Warrants”), (x) up to four

warrants to purchase up to 216,650 shares of Common Stock with an exercise price of $50.00 per share, issued pursuant to the merger agreement

dated March 6, 2024 (the “Merger Agreement”) by and among the Company, BTX Merger Sub I, Inc., a Delaware corporation, BTX

Merger Sub II, LLC, a Delaware limited liability company and Adaptive Phage Therapeutics, Inc., a Delaware corporation, (y) up to two

warrants to purchase up to 952,381 shares of Common Stock with an exercise price of $2.311 per share, issued to Laidlaw & Co. (UK)

Ltd. and RBC Capital Markets, LLC, and (z) up to one warrant to purchase up to 25,000 shares of Common Stock with an exercise price of

$50.00 per share, issued pursuant to the Sixth Amendment to the Lease Agreement dated March 5, 2024, by and between the APT and Are-708

Quince Orchard, LLC, a Delaware limited liability company; |

| (b) | up to 14,773,500 shares of Common Stock issuable upon the conversion of the Series X Preferred Stock issued

pursuant to the Securities Purchase Agreement and the Merger Agreement; |

| (c) | up to 916,497 shares of Common Stock issued pursuant to the Merger Agreement; and |

| (d) | up to 109,152,000 shares of Common Stock issued upon the automatic conversion of 109,152 shares of Series

X Preferred Stock at 5:00 PM ET on July 15, 2024. |

Our Common Stock is currently quoted on the NYSE American

Stock Market (“NYSE American”) under the symbol “PHGE.” On February 24, 2025, the last reported sale price of

our Common Stock on NYSE American was $1.05 per share.

On August 26, 2024, at 12:01 a.m. Eastern Time, a

1-for-10 reverse stock split (the “Reverse Stock Split”) of the shares of our Common Stock became effective. The Reverse Stock

Split was approved by our stockholders at the annual meeting of our stockholders held on July 9, 2024. Unless otherwise indicated, all

share and per-share amounts in this Prospectus Supplement have been adjusted to give effect to the Reverse Stock Split; however, share

and per share amounts in the Prospectus and all other documents incorporated by reference herein that were filed prior to August 26, 2024,

do not give effect to the Reverse Stock Split.

The information contained in this Prospectus Supplement

modifies and supersedes, in part, the information in the Prospectus. This Prospectus Supplement is not complete without, and may not be

delivered or used except in connection with, the Prospectus. Any information that is modified or superseded in the Prospectus shall not

be deemed to constitute a part of the Prospectus, except as modified or superseded by this Prospectus Supplement.

We may amend or supplement the Prospectus from time

to time by filing amendments or supplements as required. You should read the entire Prospectus, this Prospectus Supplement and any amendments

or supplements carefully before you make an investment decision.

Investing in our securities involves risks. See “Risk

Factors” on page 3 of the Prospectus filed with the SEC on and in the documents incorporated by reference into the Prospectus, including

he risks described under “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2023, filed with

the SEC on April 4, 2024.

Neither the SEC nor any state securities commission

has approved or disapproved of these securities or determined if this Prospectus Supplement or the Prospectus is truthful or complete.

Any representation to the contrary is a criminal offense.

FORWARD-LOOKING STATEMENTS

You should carefully consider the risk factors set

forth in or incorporated by reference into the Prospectus, as well as the other information contained in or incorporated by reference

into this Prospectus Supplement and the Prospectus. This Prospectus Supplement, the Prospectus and documents incorporated therein by reference

contain forward-looking statements regarding events, conditions, and financial trends that may affect our plan of operation, business

strategy, operating results, and financial position. You are cautioned that any forward-looking statements are not guarantees of future

performance and are subject to risks and uncertainties. Actual results may differ materially from those included within the forward-looking

statements as a result of various factors. Cautionary statements in the “Risk Factors” section of the Prospectus and the reports

incorporated by reference therein identify important risks and uncertainties affecting our future, which could cause actual results to

differ materially from the forward-looking statements made or included in this Prospectus Supplement and the Prospectus.

AMENDMENTS TO THE PIPE WARRANTS

This Prospectus Supplement is being filed to disclose

the following:

On February 25, 2025, we entered into (i) that certain

securities purchase agreement with the investors named therein, (ii) that certain registration rights agreement with the investors named

therein, and (iii) certain warrant inducement letter agreements with the investors named therein (collectively, the “February Agreements”

and such offerings contemplated by the February Agreements, the “February Offering”). In connection with the February Agreements,

and in consideration for certain holders’ (the “Holders”) participation in the February Offering, we agreed to, among

other things, amend and restate seven of the PIPE Warrants held by the Holders, to (i) reduce the exercise price from $2.311 per share

to $0.0001 per share (in addition to $0.9305 per share that was pre-funded in connection with the transactions contemplated by the February

Agreements), (ii) extend the Expiration Date (as defined in the PIPE Warrants) from 24 months after the initial exercisability date to

until such time that the PIPE Warrants are exercised in full, and (iii) to remove from Section 4(b) such provisions as related to the

Black-Scholes Value (as defined in the PIPE Warrants) as related to any Fundamental Transactions (as defined in the PIPE Warrants) undertaken

by the Company. No other changes to the other 26 PIPE Warrants were made.

The date of this Prospectus Supplement is February

27, 2025.

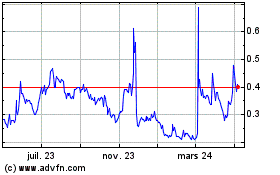

BiomX (AMEX:PHGE)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

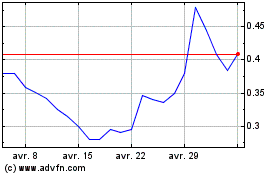

BiomX (AMEX:PHGE)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025