UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 13E-3

(Amendment No. 2)

RULE 13E-3 TRANSACTION STATEMENT UNDER

SECTION 13(E) OF THE SECURITIES EXCHANGE ACT OF 1934

POLYMET MINING CORP.

Name of Subject Company (Issuer)

PolyMet Mining Corp.

Glencore AG

Glencore International AG

Glencore plc

(Names of Persons Filing Statement)

Common Shares, Without Par Value

(Title of Class of Securities)

731916102

(CUSIP Number of Class of Securities)

Patrick Keenan

444 Cedar Street, Suite 2060,

St. Paul, MN 55101

Tel: (651) 389-4100 |

|

John Burton

Glencore AG

Baarermattstrasse 3

CH-6340 Baar

Switzerland

Tel: +41 41 709 2000 |

(Name, address, and telephone numbers of person authorized to receive notices and communications on behalf of filing persons)

With copies to:

Denise C. Nawata

Farris LLP

PO Box 10026, Pacific Centre

South

25th Floor, 700 W Georgia Street

Vancouver, BC

Canada V7Y 1B3

Tel: (604) 684-9151

|

Joseph Walsh

Shona Smith

Troutman Pepper Hamilton

Sanders LLP

875 Third Avenue

New York, NY 10022

Tel: (212) 704-6000 |

Adam Taylor

McCarthy Tétrault LLP

Suite 5300

TD Bank Tower

Box Jericho, NY 11753

Tel: (416) 601-8014 |

Eoghan P. Keenan, Esq.

Weil, Gotshal & Manges LLP

767 Fifth Avenue

New York, NY 10153

Tel: (212) 310-8000

|

This statement is filed in connection with (check the appropriate box):

| a. |

|

☐ |

|

The filing of solicitation materials or an information statement subject to Regulation 14A, Regulation 14C or Rule 13e-3(c) under the Securities Exchange Act of 1934. |

| |

|

|

| b. |

|

☐ |

|

The filing of a registration statement under the Securities Act of 1933. |

| |

|

|

| c. |

|

☐ |

|

A tender offer. |

| |

|

|

| d. |

|

☒ |

|

None of the above. |

Check the following box if the soliciting materials or information statement referred to in checking box (a) are preliminary copies: ☐

Check the following box if the filing is a final amendment reporting the results of the transaction: ☐

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THIS TRANSACTION, PASSED UPON THE MERITS OR FAIRNESS OF THIS TRANSACTION, OR PASSED UPON THE ADEQUACY OR ACCURACY OF THE DISCLOSURE IN THIS SCHEDULE 13E-3. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE

Introduction

This Amendment No. 2 to Schedule 13E-3 (together with the exhibits hereto, this “Amended Schedule 13E-3” or “Amended Transaction Statement”), which amends and supplements the Rule 13E-3 Transaction Statement on Schedule 13E-3 (as amended by Amendment No. 1 to Schedule 13E-3, filed with the U.S. Securities and Exchange Commission (the “SEC”) on September 12, 2023), together with the exhibits hereto is being filed with the SEC pursuant to Section 13(e) of the Securities Exchange Act of 1934, as amended (together with the rules and regulations promulgated thereunder, the “Exchange Act”), jointly by the following persons (each, a “Filing Person” and collectively, the “Filing Persons”): by (i) PolyMet Mining Corp., a corporation existing under the laws of British Columbia, Canada (“PolyMet” or the “Company”), (ii) Glencore AG, a company organized under the laws of Switzerland (“Glencore”), (iii) Glencore International AG, a company organized under the laws of Switzerland and (iv) Glencore plc, a company organized under the laws of Jersey.

This Amended Transaction Statement relates to that certain Arrangement Agreement, dated as of July 16, 2023 (as it may be amended, restated, supplemented or otherwise modified from time to time in accordance with its terms, the "Arrangement Agreement"), by and between the Company and Glencore in respect of a plan of arrangement under the Business Corporations Act (British Columbia) (the "BCBCA"). The Arrangement Agreement provides for the terms and conditions pursuant to which Glencore has agreed to acquire all of the outstanding share capital in the Company that is not owned directly or indirectly by Glencore, and provides that the Company's minority shareholders (i.e., holders of the approximately 17.8% of the outstanding common shares of the Company) would receive US$2.11 in cash per common share in exchange (the "Transaction").

The terms of the Arrangement Agreement further provide that the Transaction will be implemented by way of a statutory plan of arrangement under the BCBCA (the "Plan of Arrangement"). The Plan of Arrangement and the implementation of the arrangement (the "Arrangement") is subject to the review and approval of the Supreme Court of British Columbia. In addition, the Arrangement is subject to certain other conditions, including, among other customary closing conditions, (i) approval of sixty-six and two-thirds percent (66-2/3%) of votes cast by shareholders of the Company (including Glencore) (the "Company Shareholders") at a special meeting of Company Shareholders to be called to consider the Arrangement (the "Special Meeting") and (ii) approval of a majority of the votes of the disinterested Company Shareholders at the Special Meeting.

Concurrently with the filing of this Amended Transaction Statement, the Company is furnishing a management proxy circular (the “Circular”) with the SEC, pursuant to which the Company is soliciting proxies from Company Shareholders in connection with the Arrangement. The Circular is attached hereto as Exhibit (a)(2)(i). A copy of the Plan of Arrangement is attached to the Management Proxy Circular as Appendix B and is incorporated herein by reference. As of the date hereof, the Circular is in final form. Capitalized terms used but not expressly defined in this Amended Transaction Statement have the meanings ascribed to such terms in the Circular.

Pursuant to General Instruction F to Schedule 13E-3, the information in the Circular, including all annexes thereto, is expressly incorporated by reference herein in its entirety, and responses to each item herein are qualified in their entirety by the information contained in the Circular. The cross-references below are being supplied pursuant to General Instruction G to Schedule 13E-3 and show the location in the Circular of the information required to be included in response to the items of Schedule 13E-3.

While each of the Filing Persons acknowledges that the Arrangement is a going private transaction for purposes of Rule 13e-3 under the Exchange Act, the filing of this Amended Transaction Statement shall not be construed as an admission by any Filing Person, or by any affiliate of a Filing Person, that the Company is "controlled" by any of the Filing Persons and/or their respective affiliates.

All information contained in, or incorporated by reference into, this Amended Transaction Statement concerning each Filing Person has been supplied by such Filing Person. No Filing Person, including the Company, is responsible for the accuracy of any information supplied by any other Filing Person.

Item 1. Summary Term Sheet

The information set forth in the Circular under the following captions is incorporated herein by reference:

"Questions and Answers About the Meeting and the Arrangement"

"Summary of Arrangement"

Item 2. Subject Company Information

(a) Name and Address

The name of the subject company is PolyMet Mining Corp. The address and telephone number of the subject company's principal executive offices are as follows:

444 Cedar Street

Suite 2060

St. Paul, MN 55101

(651) 389-4100

The information set forth in the Circular under the caption "Information Concerning PolyMet - General" is incorporated herein by reference.

(b) Securities

The subject class of equity securities is common shares, without par value, of the Company. The information set forth in the Circular under following captions is incorporated herein by reference:

"Information Concerning the Meeting and Voting - Voting Shares"

"The Arrangement"

"The Arrangement - Shareholder Approval of the Arrangement"

"Information Concerning PolyMet - Description of Share Capital"

(c) Trading Market and Price

The information set forth in the Circular under the following captions is incorporated herein by reference:

"Special Factors - Certain Effects of the Arrangement"

"Information Concerning PolyMet - Trading in Shares"

"Summary of Arrangement - Stock Exchange Delisting and Reporting Issuer Status"

"Certain Legal Matters - Securities Law Matters - Stock Exchange Delisting and Reporting Issuer Status"

(d) Dividends

The information set forth in the Circular under the caption "Information Concerning PolyMet - Dividend Policy" is incorporated herein by reference.

(e) Prior Public Offerings

Not Applicable.

(f) Prior Stock Purchases

The information set forth in the Circular under the following captions is incorporated herein by reference:

"Information Concerning PolyMet - Previous Purchases and Sales"

"Information Concerning PolyMet - Ownership of Securities"

"Special Factors - Background to the Arrangement - Recent Glencore Financing Agreements"

"Special Factors - Background to the Arrangement - NewRange and 2023 Rights Offering"

Item 3. Identity and Background of Filing Person

(a) - (c) Name and Address; Business and Background of Entities; Business and Background of Natural Persons.

PolyMet Mining Corp. is the subject company. The name, business address, business telephone number, present principal occupation or employment, material occupations or employment in the past five years, and citizenship of each director and executive officer of the Company are set forth in Schedule A hereto and are incorporated by reference herein. During the last five years, none of the Company or, to the best of its knowledge, any of the persons listed in Schedule A hereto has been: (i) convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors); or (ii) a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such proceeding was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws.

The name, business address, business telephone number, present principal occupation or employment, material occupations or employment in the past five years, and citizenship of each of the executive officers and directors of Glencore AG are set forth in Schedule B hereto and are incorporated by reference herein. During the last five years, none of Glencore or, to the best of its knowledge, any of the persons listed in Schedule B hereto has been: (i) convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors); or (ii) a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such proceeding was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws.

The information set forth in the Circular under the following captions is incorporated herein by reference:

"Summary of Arrangement - Parties to the Arrangement - PolyMet"

"Summary of Arrangement - Parties to the Arrangement - Glencore"

"Information Concerning Glencore"

"Information Concerning PolyMet - General"

"Information Concerning PolyMet - Ownership of Securities"

"Information Concerning PolyMet - Executive Officers and Directors"

Item 4. Terms of the Transaction

(a) Material Terms

(1) Tender Offers

Not applicable.

(2) Mergers or Similar Transactions

The information set forth in the Circular under the following captions is incorporated herein by reference:

"Questions and Answers About the Meeting and the Arrangement - Questions Relating to the Arrangement"

"Summary of Arrangement - Summary of the Arrangement"

"Summary of Arrangement - Purpose of the Meeting"

"Summary of Arrangement - Recommendation of the Special Committee"

"Summary of Arrangement - Recommendation of the Board"

"Summary of Arrangement - Reasons for the Recommendation"

"Summary of Arrangement - Glencore's Purpose and Reasons for the Arrangement"

"Summary of Arrangement - Required Shareholder Approvals"

"Summary of Arrangement - MI 61-101 Requirements"

"Summary of Arrangement - Procedural Safeguards for Shareholders"

"Summary of Arrangement - Certain Canadian Federal Income Tax Considerations"

"Summary of Arrangement - Certain United States Federal Income Tax Considerations"

"Special Factors - Background to the Arrangement"

"Special Factors - PolyMet's Purposes and Reasons for the Arrangement"

"Special Factors - Position of PolyMet as to the Fairness of the Arrangement - Reasons for the Recommendation - Consideration Payable to Minority Shareholders"

"Special Factors - Position of PolyMet as to the Fairness of the Arrangement - Reasons for the Recommendation - Procedural Safeguards"

"Special Factors - Position of PolyMet as to the Fairness of the Arrangement - Recommendation of the Special Committee"

"Special Factors - Position of PolyMet as to the Fairness of the Arrangement - Recommendation of the Board"

"Special Factors - Formal Valuation and Maxit Fairness Opinion"

"Special Factors - Paradigm Fairness Opinion"

"Special Factors - Glencore's Purposes and Reasons for the Arrangement"

"Special Factors - Position of Glencore as to the Fairness of the Arrangement"

"Special Factors - Certain Effects of the Arrangement"

"Information Concerning the Meeting and Voting - Voting Shares"

"The Arrangement - Overview"

"The Arrangement - Shareholder Approval of the Arrangement"

"The Arrangement - Implementation of the Arrangement"

"The Arrangement - Payment of Consideration"

"The Arrangement - Accounting Treatment of the Arrangement"

"Certain Legal Matters - Stock Exchange Delisting and Reporting Issuer Status"

"Information Concerning PolyMet - Ownership of Securities - Following Completion of the Arrangement"

"Risk Factors - Risks Related to the Arrangement - Former Minority Shareholders will no longer have any interest in the Company after the Arrangement"

"Risk Factors - Risks Related to the Arrangement - The Arrangement will be a taxable transaction for most Shareholders"

"Certain Canadian Federal Income Tax Considerations"

"Certain United States Federal Income Tax Considerations"

(c) Different Terms

The information set forth in the Circular under the following captions is incorporated herein by reference:

"Summary of Arrangement - Glencore's Purpose and Reasons for the Arrangement"

"Summary of Arrangement - Position of Glencore as to the Fairness of the Arrangement"

"Summary of Arrangement - Interests of Certain Persons in the Arrangement; Benefits from the Arrangement"

"Special Factors - Certain Effects of the Arrangement - Benefits of the Arrangement for Directors and Executive Officers of the Company"

"The Arrangement - Interests of Certain Persons in the Arrangement; Benefits from the Arrangement"

"Information Concerning Glencore"

"Risk Factors - Risks Related to the Arrangement - Certain directors and officers may have different interests from those of Shareholders in the Arrangement"

(d) Appraisal Rights

The information set forth in the Circular under the following captions is incorporated herein by reference:

"Questions and Answers About the Meeting and the Arrangement - Questions Relating to the PolyMet Special Meeting of Shareholders"

"Summary of Arrangement - Implementation of the Arrangement"

"Summary of Arrangement - Dissent Rights"

"Special Factors - Position of PolyMet as to the Fairness of the Arrangement - Reasons for the Recommendation - Procedural Safeguards"

"The Arrangement - Implementation of the Arrangement"

"Certain Legal Matters - Implementation of the Arrangement"

"Certain Canadian Federal Income Tax Considerations - Holders Resident in Canada - Dissenting Resident Holders of Shares"

"Certain Canadian Federal Income Tax Considerations - Holders Not Resident in Canada - Dissenting Non-Resident Holders"

"Certain United States Federal Income Tax Considerations - Consequences to Dissenting U.S. Shareholders"

"Dissenting Shareholders' Rights"

"Appendix E: Interim Order"

"Appendix G: Part 8, Division 2 of the Business Corporations Act (British Columbia)"

(e) Provisions for Unaffiliated Security Holders

The information set forth in the Circular under the following captions is incorporated herein by reference:

"The Arrangement - Arrangements between PolyMet and Security Holders"

"Provisions for Unaffiliated Shareholders"

(f) Eligibility for Listing or Trading

Not applicable.

Item 5. Past Contracts, Transactions, Negotiations and Agreements

(a) Transactions

The information set forth in the Circular under the following captions is incorporated herein by reference:

"Special Factors - Background to the Arrangement"

"Information Concerning PolyMet - Previous Purchases and Sales"

"The Arrangement - Interests of Certain Persons in the Arrangement; Benefits from the Arrangement"

(b) - (c) Significant Corporate Events; Negotiations or Contacts.

The information set forth in the Circular under the following captions is incorporated herein by reference:

"Special Factors - Background to the Arrangement"

"Summary of Arrangement - Support Agreements"

"The Arrangement - Support Agreements"

"The Arrangement - Intentions of Directors and Executive Officers"

"The Arrangement - Interests of Certain Persons in the Arrangement; Benefits from the Arrangement - Indemnification and Insurance"

"The Arrangement - Interests of Certain Persons in the Arrangement; Benefits from the Arrangement - Employment Arrangements"

"Appendix G: Part 8, Division 2 of the Business Corporations Act (British Columbia)"

(e) Agreements Involving the Subject Company's Securities

The information set forth in the Circular under the following captions is incorporated herein by reference:

"Special Factors - Background to the Arrangement"

"Summary of Arrangement - Support Agreements"

"The Arrangement - Support Agreements"

"The Arrangement - Intentions of Directors and Executive Officers"

"The Arrangement - Interests of Certain Persons in the Arrangement; Benefits from the Arrangement"

"Appendix G: PART 8, Division 2 of the Business Corporations Act (British Columbia)"

Item 6. Purposes of the Transaction, and Plans or Proposals

(b) Use of Securities Acquired

The information set forth in the Circular under the following captions is incorporated herein by reference:

"Questions and Answers About the Meeting and the Arrangement"

"Summary of Arrangement - Glencore's Purpose and Reasons for the Arrangement"

"Special Factors - Certain Effects of the Arrangement - Benefits of the Arrangement for Glencore"

"Special Factors - Certain Effects of the Arrangement - Detriments of the Arrangement for Glencore"

"The Arrangement - Implementation of the Arrangement"

"Certain Legal Matters - Implementation of the Arrangement and Timing"

(c)(1) - (8) Plans

The information set forth in the Circular under the following captions is incorporated herein by reference:

"Summary of Arrangement - Stock Exchange Delisting and Reporting Issuer Status"

"Special Factors - Certain Effects of the Arrangement"

"The Arrangement - Arrangements between PolyMet and Security Holders"

"The Arrangement - Interests of Certain Persons in the Arrangement; Benefits from the Arrangement"

"Certain Legal Matters - Stock Exchange Delisting and Reporting Issuer Status"

"Information Concerning PolyMet - Material Changes in the Affairs of the Company"

"Risk Factors - Risks Related to the Arrangement - Certain directors and officers may have different interests from those of Shareholders in the Arrangement"

"Appendix G: PART 8, Division 2 of the Business Corporations Act (British Columbia)"

Item 7. Purposes, Alternatives, Reasons and Effects

(a) Purposes

The information set forth in the Circular under the following captions is incorporated herein by reference:

"Questions and Answers About the Meeting and the Arrangement"

"Summary of Arrangement - Reasons for the Recommendation"

"Summary of Arrangement - Glencore's Purpose and Reasons for the Arrangement"

"Special Factors - Position of PolyMet as to the Fairness of the Arrangement"

"Special Factors - Background to the Arrangement"

"Special Factors - PolyMet's Purposes and Reasons for the Arrangement"

"Special Factors - Glencore's Purposes and Reasons for the Arrangement"

"Special Factors - Position of Glencore as to the Fairness of the Arrangement"

(b) Alternatives

The information set forth in the Circular under the following captions is incorporated herein by reference:

"Summary of Arrangement - Reasons for the Recommendation"

"Special Factors - Position of PolyMet as to the Fairness of the Arrangement - Reasons for the Recommendation - Challenging Market Conditions and Uncertain Standalone Plan"

"Special Factors - Position of PolyMet as to the Fairness of the Arrangement - Reasons for the Recommendation - Limited Alternatives for Sale to Third Parties"

"Special Factors - Position of PolyMet as to the Fairness of the Arrangement - Reasons for the Recommendation - Procedural Safeguards"

"Special Factors - Position of PolyMet as to the Fairness of the Arrangement - Key Risks and Countervailing Factors Inherent in the Arrangement"

"Special Factors - Position of Glencore as to the Fairness of the Arrangement"

(c) Reasons

The information set forth in the Circular under the following captions is incorporated herein by reference:

"Questions and Answers About the Meeting and the Arrangement"

"Summary of Arrangement - Recommendation of the Special Committee"

"Summary of Arrangement - Recommendation of the Board"

"Summary of Arrangement - Reasons for Recommendation"

"Summary of Arrangement - Glencore's Purpose and Reasons for the Arrangement"

"Summary of Arrangement - Position of Glencore as to the Fairness of the Arrangement"

"Special Factors - Background to the Arrangement"

"Special Factors - PolyMet's Purposes and Reasons for the Arrangement"

"Special Factors - Position of PolyMet as to the Fairness of the Arrangement - Reasons for the Recommendation"

"Special Factors - Position of PolyMet as to the Fairness of the Arrangement - Recommendation of the Special Committee"

"Special Factors - Position of PolyMet as to the Fairness of the Arrangement - Recommendation of the Board"

"Special Factors - Glencore's Purposes and Reasons for the Arrangement"

"Special Factors - Position of Glencore as to the Fairness of the Arrangement"

(d) Effects

The information set forth in the Circular under the following captions is incorporated herein by reference:

"Questions and Answers About the Meeting and the Arrangement"

"Summary of Arrangement - Summary of the Arrangement"

"Summary of Arrangement - Reasons for the Recommendation"

"Summary of Arrangement - Glencore's Purpose and Reasons for the Arrangement"

"Summary of Arrangement - Position of Glencore as to the Fairness of the Arrangement"

"Summary of Arrangement - Implementation of the Arrangement"

"Summary of Arrangement - Certain Canadian Federal Income Tax Considerations"

"Summary of Arrangement - Certain United States Federal Income Tax Considerations"

"Summary of Arrangement - Interests of Certain Persons in the Arrangement; Benefits from the Arrangement"

"Summary of Arrangement - Stock Exchange Delisting and Reporting Issuer Status"

"Special Factors - Certain Effects of the Arrangement"

"Special Factors – Effect of the Arrangement on the Company’s Net Book Value and Net Earnings"

"The Arrangement - Implementation of the Arrangement"

"The Arrangement - Payment of Consideration"

"The Arrangement - Interests of Certain Persons in the Arrangement; Benefits from the Arrangement"

"Information Concerning PolyMet - Ownership of Securities - Situation Following the Completion of the Arrangement"

"Certain Legal Matters - Securities Law Matters - Stock Exchange Delisting and Reporting Issuer Status"

"Risk Factors - Risks Related to the Arrangement - Former Minority Shareholders will no longer have any interest in the Company after the Arrangement"

"Risk Factors - Risks Related to the Arrangement - The Arrangement will be a taxable transaction for most Shareholders"

"Certain Canadian Federal Income Tax Considerations"

"Certain United States Federal Income Tax Consideration"

"Appendix B: Plan of Arrangement"

Item 8. Fairness of the Transaction

(a) - (b) Fairness; Factors Considered in Determining Fairness

The information set forth in the Circular under the following captions is incorporated herein by reference:

"Questions and Answers About the Meeting and the Arrangement - Questions Relating to the Arrangement"

"Summary of Arrangement - Recommendation of the Special Committee"

"Summary of Arrangement - Recommendation of the Board"

"Summary of Arrangement - Reasons for the Recommendation"

"Summary of Arrangement - Position of Glencore as to the Fairness of the Arrangement"

"Special Factors - Background to the Arrangement"

"Special Factors - Position of PolyMet as to the Fairness of the Arrangement - Reasons for the Recommendation"

"Special Factors - Position of PolyMet as to the Fairness of the Arrangement - Recommendation of the Special Committee"

"Special Factors - Position of PolyMet as to the Fairness of the Arrangement - Recommendation of the Board"

"Special Factors - Position of Glencore as to the Fairness of the Arrangement"

"Special Factors - Formal Valuation and Maxit Fairness Opinion"

"Special Factors - Paradigm Fairness Opinion"

"Special Factors - PolyMet's Purposes and Reasons for the Arrangement"

"Appendix C: Formal Valuation and Fairness Opinion of Maxit Capital LP"

"Appendix D: Fairness Opinion of Paradigm Capital Inc."

(c) Approval of Security Holders

The information set forth in the Circular under the following captions is incorporated herein by reference:

"Questions and Answers About the Meeting and the Arrangement - Questions Relating to the Arrangement"

"Summary of Arrangement - Purpose of the Meeting"

"Summary of Arrangement - Reasons for the Recommendation"

"Summary of Arrangement - Position of Glencore as to the Fairness of the Arrangement"

"Summary of Arrangement - Required Shareholder Approvals"

"Summary of Arrangement - MI 61-101 Requirements"

"Summary of Arrangement - Procedural Safeguards for Shareholders"

"Special Factors - Position of PolyMet as to the Fairness of the Arrangement - Reasons for the Recommendation - Procedural Safeguards"

"Special Factors - Position of Glencore as to the Fairness of the Arrangement"

"The Arrangement - Shareholder Approval of the Arrangement"

"Certain Legal Matters - Securities Law Matters - Application of MI 61-101"

"Certain Legal Matters - Securities Law Matters - Minority Approval"

(d) Unaffiliated Representative

The information set forth in the Circular under the following captions is incorporated herein by reference:

"Special Factors - Background to the Arrangement"

"Special Factors - Position of PolyMet as to the Fairness of the Arrangement - Reasons for the Recommendation - Procedural Safeguards"

"The Arrangement - Arrangements between PolyMet and Security Holders"

"Provisions for Unaffiliated Shareholders"

(e) Approval of Directors

The information set forth in the Circular under the following captions is incorporated herein by reference:

"Summary of Arrangement - Recommendation of the Special Committee"

"Summary of Arrangement - Recommendation of the Board"

"Special Factors - PolyMet Purposes and Reasons for the Arrangement"

"Special Factors - Position of PolyMet as to the Fairness of the Arrangement - Reasons for the Recommendation"

"Special Factors - Position of PolyMet as to the Fairness of the Arrangement - Recommendation of the Special Committee"

"Special Factors - Position of PolyMet as to the Fairness of the Arrangement - Recommendation of the Board"

"The Arrangement - Interests of Certain Persons in the Arrangement; Benefits from the Arrangement"

"Risk Factors - Risks Related to the Arrangement - Certain directors and officers may have different interests from those of Shareholders in the Arrangement"

(f) Other Offers

Not applicable.

Item 9. Reports, Opinions, Appraisals and Negotiations

(a) - (c) Report, Opinion or Appraisal; Preparer and Summary of the Report, Opinion or Appraisal; Availability of Documents

The information set forth in the Circular under the following captions is incorporated herein by reference:

"Questions and Answers About the Meeting and the Arrangement - Questions Relating to the Arrangement"

"Summary of Arrangement - Recommendation of the Special Committee"

"Summary of Arrangement - Recommendation of the Board"

"Summary of Arrangement - Reasons for the Recommendation"

"Summary of Arrangement - Formal Valuation and Fairness Opinions"

"Special Factors - Background to the Arrangement"

"Special Factors - Formal Valuation and Maxit Fairness Opinion"

"Special Factors - Paradigm Fairness Opinion"

"Certain Legal Matters - Securities Law Matters - Formal Valuation"

"Information Concerning PolyMet - Additional Information"

"Consent of Maxit Capital LP"

"Consent of Paradigm Capital Inc."

"Appendix C: Formal Valuation and Fairness Opinion of Maxit Capital LP"

"Appendix D: Fairness Opinions of Paradigm Capital Inc."

Item 10. Source and Amount of Funds or Other Consideration

(a) - (b) Source of Funds; Conditions

The information set forth in the Circular under the caption "The Arrangement - Sources of Funds for the Arrangement" is incorporated herein by reference.

(c) Expenses

The information set forth in the Circular under the following captions is incorporated herein by reference:

"The Arrangement - Expenses of the Arrangement"

"Arrangement Agreement - Expenses"

(d) Borrowed Funds

Not applicable.

Item 11. Interest in Securities of the Subject Company

(a) Securities Ownership

The information set forth in the Circular under the following captions is incorporated herein by reference:

"Information Concerning the Meeting and Voting - Principal Shareholders"

"The Arrangement - Shareholder Approval of the Arrangement"

"Information Concerning PolyMet - Ownership of Securities"

(b) Securities Transactions

The information set forth in the Circular under the following captions is incorporated herein by reference:

"Information Concerning PolyMet - Previous Purchases and Sales"

"Information Concerning PolyMet - Previous Distributions"

Item 12. The Solicitation or Recommendation

(d) Intent to Tender or Vote in a Going-Private Transaction

The information set forth in the Circular under the following captions is incorporated herein by reference:

"Summary of Arrangement - Support Agreements"

"The Arrangement - Support Agreements"

"The Arrangement - Intentions of Directors and Executive Officers"

(e) Recommendations of Others

The information set forth in the Circular under the following captions is incorporated herein by reference:

"Summary of Arrangement - Recommendation of the Special Committee"

"Summary of Arrangement - Recommendation of the Board"

"Summary of Arrangement - Position of Glencore as to the Fairness of the Arrangement"

"Special Factors - Position of PolyMet as to the Fairness of the Arrangement - Reasons for the Recommendation"

"Special Factors - Position of PolyMet as to the Fairness of the Arrangement - Recommendation of the Special Committee"

"Special Factors - Position of PolyMet as to the Fairness of the Arrangement - Recommendation of the Board"

"Special Factors - Position of Glencore as to the Fairness of the Arrangement"

Item 13. Financial Statements

(a) Financial Information

The information set forth in the Circular under the following captions is incorporated herein by reference:

"Information Concerning PolyMet - Selected Historical Financial Information"

"Information Concerning PolyMet - Net Book Value"

"Information Concerning PolyMet - Additional Information"

(b) Pro Forma Information

Not applicable.

(c) Summary Information

The information set forth in the Circular under the caption "Information Concerning PolyMet - Selected Historical Financial Information" is incorporated herein by reference.

Item 14. Persons/Assets, Retained, Employed, Compensated or Used

(a) Solicitations or Recommendations

The information set forth in the Circular under the following captions is incorporated herein by reference:

"Information Concerning the Meeting and Voting - Solicitation of Proxies"

"The Arrangement - Expenses of the Arrangement"

(b) Employees and Corporate Assets

The information set forth in the Circular under the following captions is incorporated herein by reference:

"Information Concerning the Meeting and Voting - Solicitation of Proxies"

"The Arrangement - Expenses of the Arrangement"

Item 15. Additional Information

(b) Golden Parachute Compensation

Not applicable.

(c) Other Material Information

The entirety of the Circular, including all appendices thereto, is incorporated herein by reference.

Item 16. Exhibits

The following exhibits are filed herewith:

| Exhibit No. |

Description |

| |

|

| (a)(2)(i) |

Management Proxy Circular of PolyMet Mining Corp. dated September 28, 2023 |

| |

|

| (a)(2)(ii) |

Form of Proxy Card |

| |

|

| (a)(2)(iii) |

Voting Instruction Form |

| |

|

| (a)(2)(iv) |

Letter of Transmittal |

| |

|

| (a)(2)(v) * |

Notice of Special Meeting of Shareholders of PolyMet Mining Corp. (incorporated herein by reference to the Circular) |

| |

|

| (a)(2)(vi) * |

Letter to Shareholders of PolyMet Mining Corp. (incorporated herein by reference to the Circular) |

| |

|

| (a)(5)(i) * |

Press Release of PolyMet Mining Corp. dated July 17, 2023 (incorporated herein by reference to Exhibit 99.1 to the report on Form 6-K furnished to the SEC on July 17, 2023) |

| |

|

| (a)(5)(ii) * |

Press Release of PolyMet Mining Corp. dated September 28, 2023 (incorporated herein by reference to Exhibit 99.1 to the report on Form 6-K furnished to the SEC on September 28, 2023) |

| |

|

| (a)(5)(iii) * |

Notice to Canadian Securities Regulatory Authorities of Notice of Meeting and Record Date (incorporated herein by reference to Exhibit 99.1 to the report on Form 6-K furnished to the SEC on September 12, 2023) |

| |

|

| (c)(i) * |

Formal Valuation and Fairness Opinion of Maxit Capital LP (incorporated herein by reference to Appendix C to the Circular) |

| |

|

| (c)(ii) * |

Fairness Opinion of Paradigm Capital Inc. (incorporated herein by reference to Appendix D to the Circular) |

| |

|

| (c)(iii) * |

Special Committee Discussion Materials Provided by Maxit Capital LP to the Special Committee on June 13, 2023 |

| |

|

| (c)(iv) * |

Special Committee Discussion Materials Provided by Maxit Capital LP to the Special Committee on July 15, 2023 |

| |

|

| (c)(v) * |

Discussion Materials Provided by Paradigm Capital Inc. to the Board of Directors and the Special Committee on July 15, 2023 |

| |

|

| (d)(i) * |

Arrangement Agreement dated July 16, 2023, between PolyMet Mining Corp. and Glencore AG (incorporated herein by reference to Exhibit 99.2 to the report on Form 6-K furnished to the SEC on July 17, 2023) |

| |

|

| (d)(ii) * |

Form of Support and Voting Agreement entered into severally by Glencore AG, on the one hand, and each of Jonathan Cherry, Patrick Keenan, Alan R. Hodnik, David Dreisinger, David J. Fermo, Roberto Huby and Stephen Rowland, on the other hand (incorporated herein by reference to Exhibit 99.3 to the report on Form 6-K furnished to the SEC on July 17, 2023) |

| |

|

| (d)(iii) * |

Letter addressed to Glencore AG on behalf of the Board of Directors of PolyMet Mining Corp., dated May 18, 2023 |

| |

|

| (d)(iv) * |

Letter addressed to the Board of Directors of PolyMet Mining Corp. on behalf of Glencore AG, dated May 24, 2023

|

| |

|

| (d)(v) * |

Letter addressed to the Board of Directors of PolyMet Mining Corp. on behalf of Glencore AG, dated June 30, 2023 |

| |

|

| (e)(i) * |

Amended and Restated Corporate Governance Agreement between Glencore AG and PolyMet Mining Corp. dated June 28, 2019 |

| |

|

| (e)(ii) * |

Investor Rights and Governance Agreement between Glencore AG and PolyMet Mining Corp. dated February 14, 2023 |

| |

|

| (f)(i) * |

Interim Order (incorporated herein by reference to Appendix E to the Circular) |

| |

|

| (f)(ii) * |

Part 8, Divisions 2 of the Business Corporations Act (British Columbia) - Rights of Dissenting Shareholders (incorporated herein by reference to Appendix G to the Circular) |

| |

|

| 107 * |

Filing Fee Table |

____________________________

* Previously filed

SIGNATURE

After due inquiry and to the best of each of the undersigned's knowledge and belief, each of the undersigned certifies that the information set forth in this statement is true, complete and correct.

Dated as of October 2, 2023

| |

POLYMET MINING CORP. |

| |

|

|

| |

By: |

/s/ Patrick Keenan |

| |

Name: |

Patrick Keenan |

| |

Title: |

Chief Financial Officer |

| |

|

|

| |

GLENCORE AG |

| |

|

|

| |

By: |

/s/ Carlos Perezagua |

| |

Name: |

Carlos Perezagua |

| |

Title: |

Director |

| |

|

|

| |

By: |

/s/ Stephan Huber |

| |

Name: |

Stephan Huber |

| |

Title: |

Director |

| |

|

|

| |

GLENCORE INTERNATIONAL AG |

| |

|

|

| |

By: |

/s/ Peter Friedli |

| |

Name: |

Peter Friedli |

| |

Title: |

Director |

| |

|

|

| |

By: |

/s/ John Burton |

| |

Name: |

John Burton |

| |

Title: |

Director |

| |

|

|

| |

GLENCORE plc |

| |

|

|

| |

By: |

/s/ John Burton |

| |

Name: |

John Burton |

| |

Title: |

Corporate Secretary |

SCHEDULE A

Directors and Executive Officers of PolyMet

Name/Citizenship/

Business

Address/Business

Telephone

Number |

Company |

Address |

Position Held |

From |

To |

Jonathan Cherry

United States

444 Cedar Street

Suite 2060

St. Paul, MN 55101

651-389-4100 |

PolyMet Mining

Corp. |

444 Cedar Street

Suite 2060

St. Paul, MN 55101 |

Chairman, President & Chief Executive Officer |

July 2012 |

Present |

Patrick Keenan

United States

444 Cedar Street

Suite 2060

St. Paul, MN 55101

651-389-4100 |

PolyMet Mining

Corp. |

444 Cedar Street

Suite 2060

St. Paul, MN 55101 |

Executive Vice President, Chief Financial Officer |

June 2017 |

Present |

Ryan Vogt

United States

444 Cedar Street

Suite 2060

St. Paul, MN 55101

651-389-4100 |

PolyMet Mining

Corp. |

444 Cedar Street

Suite 2060

St. Paul, MN 55101 |

Corporate Controller |

April 2012 |

Present |

John Burton

United States

444 Cedar Street

Suite 2060

St. Paul, MN 55101

651-389-4100 |

PolyMet Mining

Corp. |

444 Cedar Street

Suite 2060

St. Paul, MN 55101 |

Director |

April 2023 |

Present |

| Glencore AG |

Baareramattstrasse 3

Baar

6340 Switzerland |

Company Secretary |

September 2011 |

Present |

Alan R. Hodnik

United States

444 Cedar Street

Suite 2060

St. Paul, MN 55101

651-389-4100 |

PolyMet Mining

Corp. |

444 Cedar Street

Suite 2060

St. Paul, MN 55101 |

Director |

March 2011 |

Present |

| Allete Inc. |

30 W Superior St

Duluth, MN 55802 |

Chairman, President and Chief Executive Officer |

May 2011 |

May 2021 |

Dr. David Dreisinger

Canada

444 Cedar Street

Suite 2060

St. Paul, MN 55101

651-389-4100 |

PolyMet Mining

Corp. |

444 Cedar Street

Suite 2060

St. Paul, MN 55101 |

Director |

October 2003 |

Present |

| University of British Columbia |

309-6350 Stores Road

Vancouver, BC Canada

V6T 1Z4 |

Professor and Chairholder of the Industrial Research Chair in Biohydrometallurgy and the Hydrometallurgy Chair |

May 1988 |

Present |

Name/Citizenship/

Business

Address/Business

Telephone

Number |

Company |

Address |

Position Held |

From |

To |

David J. Fermo

United States

444 Cedar Street

Suite 2060

St. Paul, MN 55101

651-389-4100 |

PolyMet Mining

Corp. |

444 Cedar Street

Suite 2060

St. Paul, MN 55101 |

Director |

June 2020 |

Present |

Stephen Rowland

United States

444 Cedar Street

Suite 2060

St. Paul, MN 55101

651-389-4100 |

PolyMet Ming

Corp. |

444 Cedar Street

Suite 2060

St. Paul, MN 55101 |

Director |

October 2008 |

Present |

| Glencore AG |

Baareramattstrasse 3

Baar

6340 Switzerland |

Executive |

1988 |

Present |

Matthew Rowlinson

Switzerland

Baareramattstrasse 3

Baar

6340 Switzerland

+41 41 709 2000 |

PolyMet Ming

Corp. |

444 Cedar Street

Suite 2060

St. Paul, MN 55101 |

Director |

December 2021 |

Present |

| Glencore AG |

Baareramattstrasse 3

Baar

6340 Switzerland |

Executive |

June 2013 |

Present |

SCHEDULE B

Directors and Executive Officers of Glencore AG

Name/Citizenship/

Business Address |

Company |

Address |

Position Held |

From |

To |

| |

|

|

|

|

|

Martin W. Haering

Switzerland

c/o Glencore International AG

Baarermattstrasse 3

CH-6340 Baar

Switzerland |

Glencore AG |

c/o Glencore International AG

Baarermattstrasse 3

CH-6340 Baar

Switzerland |

Tax Officer |

April 2012 |

Present |

| |

|

|

|

|

|

Carlos Perezagua

Spain

c/o Glencore International AG

Baarermattstrasse 3

CH-6340 Baar

Switzerland |

Glencore AG |

c/o Glencore International AG

Baarermattstrasse 3

CH-6340 Baar

Switzerland |

Chief Risk Officer |

April 2015 |

Present |

| |

|

|

|

|

|

Stephan Huber

Switzerland

c/o Glencore International AG

Baarermattstrasse 3

CH-6340 Baar

Switzerland |

Glencore AG |

c/o Glencore International AG

Baarermattstrasse 3

CH-6340 Baar

Switzerland |

Treasurer |

April 2019 |

Present |

Directors and Executive Officers of Glencore International AG

Name/Citizenship/

Business Address |

Company |

Address |

Position Held |

From |

To |

| |

|

|

|

|

|

Gary Nagle

South Africa

c/o Glencore International AG

Baarermattstrasse 3

CH-6340 Baar

Switzerland |

Glencore International AG |

c/o Glencore International AG

Baarermattstrasse 3

CH-6340 Baar

Switzerland |

Chief Executive Officer |

June 2021 |

Present |

| |

|

|

|

|

|

Steven Kalmin

Australia

c/o Glencore International AG

Baarermattstrasse 3

CH-6340 Baar

Switzerland |

Glencore International AG |

c/o Glencore International AG

Baarermattstrasse 3

CH-6340 Baar

Switzerland |

Chief Financial Officer |

April 2011 |

Present |

| |

|

|

|

|

|

John Burton

United Kingdom

c/o Glencore International AG

Baarermattstrasse 3

CH-6340 Baar

Switzerland |

Glencore International AG |

c/o Glencore International AG

Baarermattstrasse 3

CH-6340 Baar

Switzerland |

Company Secretary of Glencore plc |

May 2019 |

Present |

Directors of Glencore plc

Name/Citizenship/

Business Address |

Company |

Address |

Position Held |

From |

To |

| |

|

|

|

|

|

Gary Nagle

South Africa

c/o Glencore International AG

Baarermattstrasse 3

CH-6340 Baar

Switzerland |

Glencore plc |

c/o Glencore International AG

Baarermattstrasse 3

CH-6340 Baar

Switzerland |

Chief Executive Officer |

July 2021 |

Present |

| |

|

|

|

|

|

Kalidas Madhavpeddi

USA

c/o Glencore International AG

Baarermattstrasse 3

CH-6340 Baar

Switzerland |

Glencore plc |

c/o Glencore International AG

Baarermattstrasse 3

CH-6340 Baar

Switzerland |

Non-Executive Chairman |

February 2020 |

Present |

| |

|

|

|

|

|

Peter Coates

Australia

Level 22, The Gateway Building

1 Macquarie Place

Sydney NSW 2000

Australia |

Glencore plc |

Level 22, The Gateway Building

1 Macquarie Place

Sydney NSW 2000

Australia |

Non-Executive Director |

June 2013 |

Present |

| |

|

|

|

|

|

David Wormsley

United Kingdom

c/o Glencore UK Ltd.

18 Hanover Square

London W1S 1JY

United Kingdom |

Glencore plc |

c/o Glencore UK Ltd.

18 Hanover Square

London W1S 1JY

United Kingdom |

Non-Executive Director |

September 2021 |

Present |

| |

|

|

|

|

|

Martin Gilbert

United Kingdom

c/o Glencore UK Ltd.

18 Hanover Square

London W1S 1JY

United Kingdom |

Glencore plc |

c/o Glencore UK Ltd.

18 Hanover Square

London W1S 1JY

United Kingdom |

Non-Executive Director |

May 2017 |

Present |

| |

|

|

|

|

|

Cynthia Carroll

USA

c/o Glencore International AG

Baarermattstrasse 3

CH-6340 Baar

Switzerland |

Glencore plc |

c/o Glencore International AG

Baarermattstrasse 3

CH-6340 Baar

Switzerland |

Non-Executive Director |

February 2021 |

Present |

| |

|

|

|

|

|

Patrice Merrin

Canada

c/o Glencore Canada Corporation

First Canadian Place

100 King Street West, Suite 6900

Toronto, Ontario M5X 1E3

Canada |

Glencore plc |

c/o Glencore Canada Corporation

First Canadian Place

100 King Street West, Suite 6900

Toronto, Ontario M5X 1E3

Canada |

Non-Executive Director |

June 2014 |

May 2023 |

| |

|

|

|

|

|

Gill Marcus

South Africa

c/o Glencore South Africa (Pty) Ltd.

3rd Floor, Worley Parsons Building

39 Melrose Boulevard

Melrose Arch

Melrose North 2196

South Africa |

Glencore plc |

c/o Glencore South Africa (Pty) Ltd.

3rd Floor, Worley Parsons Building

39 Melrose Boulevard

Melrose Arch

Melrose North 2196

South Africa |

Non-Executive Director |

January 2018 |

Present |

| |

|

|

|

|

|

Liz Hewitt

United Kingdom

c/o Glencore UK Ltd.

18 Hanover Square

London W1S 1JY

United Kingdom |

Glencore plc |

c/o Glencore UK Ltd.

18 Hanover Square

London W1S 1JY

United Kingdom |

Non-Executive Director |

July 2022 |

Present |

Executive Officers of Glencore plc

Name/Citizenship/

Business Address |

Company |

Address |

Position Held |

From |

To |

| |

|

|

|

|

|

Gary Nagle

South Africa

c/o Glencore International AG

Baarermattstrasse 3

CH-6340 Baar

Switzerland |

Glencore plc |

c/o Glencore International AG

Baarermattstrasse 3

CH-6340 Baar

Switzerland |

Chief Executive Officer |

July 2021 |

Present |

| |

|

|

|

|

|

Steven Kalmin

Australia

c/o Glencore International AG

Baarermattstrasse 3

CH-6340 Baar

Switzerland |

Glencore plc |

c/o Glencore International AG

Baarermattstrasse 3

CH-6340 Baar

Switzerland |

Chief Financial Officer |

March 2011 |

Present |

| |

|

|

|

|

|

John Burton

United Kingdom

c/o Glencore International AG

Baarermattstrasse 3

CH-6340 Baar

Switzerland |

Glencore plc |

c/o Glencore International AG

Baarermattstrasse 3

CH-6340 Baar

Switzerland |

Company Secretary |

September 2011 |

Present |

These materials are important and require your immediate attention. They require shareholders of PolyMet Mining Corp. to make important decisions. If you are in doubt about how to make such decisions, please contact your financial, legal, tax or other professional advisors. If you are a shareholder of PolyMet Mining Corp. and have any questions regarding the information contained in this management proxy circular or require assistance in completing your form of proxy, please contact our proxy solicitation agent, Laurel Hill Advisory Group, by telephone at 1-877-452-7184 (North American Toll Free); or 1-416-304-0211 (collect outside North America); or by email at assistance@laurelhill.com. Questions on how to complete the letter of transmittal should be directed to PolyMet Mining Corp.'s depositary, Computershare Investor Services Inc., at 1-800-564-6253 (toll free in North America) or 1-514-982-7555 (outside North America), by facsimile at 1-905-771-4082 or by email at corporateactions@computershare.com.

Shareholders in the United States should read the section "Notice to Shareholders in the United States" on page (iii) of the accompanying management proxy circular.

ARRANGEMENT INVOLVING

POLYMET MINING CORP.

AND

GLENCORE AG

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

to be held on November 1, 2023 at 9:00 a.m. (Pacific time)

in person at Farris LLP, 2500 - 700 West Georgia Street, Vancouver, British Columbia, Canada V7Y 1B3

and online via live webcast at www.virtualshareholdermeeting.com/PLM2023SM

AND

MANAGEMENT PROXY CIRCULAR

|

YOUR VOTE IS IMPORTANT. TAKE ACTION AND VOTE TODAY.

The Unconflicted Board of Directors, acting on the unanimous recommendation of the Special Committee,

unanimously recommends that Minority Shareholders vote

FOR

the Arrangement Resolution

|

NEITHER THE U.S. SECURITIES AND EXCHANGE COMMISSION NOR THE SECURITIES REGULATORY AUTHORITY IN ANY STATE IN THE UNITED STATES HAS APPROVED OR DISAPPROVED OF THE ARRANGEMENT OR PASSED UPON THE FAIRNESS OR MERITS OF THE ARRANGEMENT, NOR HAS THE U.S. SECURITIES AND EXCHANGE COMMISSION OR THE SECURITIES REGULATORY AUTHORITIES OF ANY STATE IN THE UNITED STATES PASSED ON THE ADEQUACY OR ACCURACY OF THIS CIRCULAR. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE. IN ADDITION, NEITHER THE TORONTO STOCK EXCHANGE NOR ANY CANADIAN SECURITIES REGULATORY AUTHORITY HAS IN ANY WAY PASSED UPON THE MERITS OF THE TRANSACTION DESCRIBED IN THIS CIRCULAR, AND ANY REPRESENTATION OTHERWISE IS AN OFFENSE.

September 28, 2023

LETTER TO SHAREHOLDERS

September 28, 2023

Dear fellow Shareholder:

I am pleased and excited to invite you to attend a special meeting of holders of common shares (the "Shareholders") of PolyMet Mining Corp. ("we", "PolyMet" or the "Company") to be held in person and online on November 1, 2023 at 9:00 a.m. (Pacific time) (the "Meeting"). The purpose of the Meeting is to allow Shareholders to consider an offer by Glencore AG ("Glencore") to acquire all of the common shares of PolyMet (each, a "Share") not currently owned by Glencore or its affiliates (each, a "Minority Share") at an all-cash price of US$2.11 per Share (the "Consideration") by way of a Court-approved statutory plan of arrangement (the "Arrangement") involving PolyMet and Glencore pursuant to the provisions of the Business Corporations Act (British Columbia).

A special committee of the Board of Directors of the Company (the "Board") consisting entirely of independent directors (the "Special Committee") conducted, with the assistance of its experienced and qualified independent financial and legal advisors, a review of the Company's operations and financing needs and alternatives available to the Company and obtained an independent formal valuation of the Shares as well as two fairness opinions in respect of the consideration to be received by the holders of the Minority Shares, including the Company’s “unaffiliated security holders” as defined in Rule 13e-3 under the U.S. Exchange Act (the "Minority Shareholders"). Following this process, and after careful consideration, the Special Committee unanimously determined that the Arrangement is in the best interests of the Company and fair to the Minority Shareholders and recommended to the Board that it: (i) determine that the Arrangement is in the best interests of the Company; (ii) determine that the Arrangement is fair to the Minority Shareholders; and (iii) recommend to the Minority Shareholders that they vote their Shares in favor of the Arrangement.

On the unanimous recommendation of the Special Committee, the Board (with John Burton, Stephen Rowland and Matthew Rowlinson (being the three directors on the Board affiliated with Glencore)(the "Conflicted Directors") having recused themselves), and following careful consideration of, among other things, the items below, unanimously determined that the Arrangement is in the best interests of the Company and fair to the Minority Shareholders and unanimously recommends that the Minority Shareholders vote in favor of the Arrangement.

In reaching its conclusion, the Special Committee took into consideration, among other things, the following:

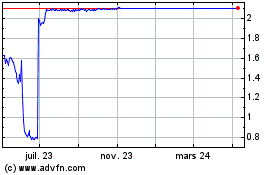

-

Significant Premium. The Consideration represents a 167% premium to the closing price of C$1.04 (US$0.79 based on the daily average exchange rate of C$1.00 = US$0.7553 and US$1.00 = C$1.3240 for June 30, 2023 as reported by the Bank of Canada) of the Shares on the Toronto Stock Exchange ("TSX") and a 167% premium to the closing price of US$0.79 of the Shares on the NYSE American ("NYSE American") on June 30, 2023, being the last trading date prior to the announcement of Glencore's Non-Binding Proposal to acquire the Minority Shares. The Consideration also represents a premium of approximately 34% to the closing price of the Company's shares on the NYSE American on June 6, 2023, being the last trading day before the announcement of the CWA Section 404 permit revocation.

-

Formal Valuation. The formal valuation carried out by Maxit Capital LP ("Maxit"), the independent valuator retained by the Special Committee, which determined that as of July 15, 2023 and based upon and subject to the assumptions, limitations and qualifications set out therein, the fair market value of the Shares is in the range of US$1.40 to US$2.50 per Share, placing the US$2.11 cash per Minority Share that the Minority Shareholders are to receive at the 65th percentile of the range. Maxit was engaged to provide the formal valuation and its fairness opinion on a fixed fee basis that was not contingent on the conclusions reached therein or the completion of the Arrangement.

-

Two Independent Fairness Opinions. PolyMet received a fairness opinion from Paradigm Capital Inc. ("Paradigm"), the financial advisor retained by the Company, to the effect that, as of July 15, 2023 and based upon and subject to the assumptions, limitations and qualifications set out therein and such other matters as Paradigm considered relevant, the Consideration to be received by the Minority Shareholders pursuant to the Arrangement is fair, from a financial point of view, to the Minority Shareholders. Additionally, the Special Committee received a fairness opinion from Maxit, the independent valuator retained by the Special Committee, to the effect that, as of the date of such opinion and based upon and subject to the assumptions, limitations and qualifications set out therein, the Consideration to be received by the Minority Shareholders pursuant to the Arrangement is fair, from a financial point of view, to the Minority Shareholders.

-

Certainty of Value and Removal of Risk. The Consideration is all cash, which provides Minority Shareholders with certainty of value and immediate liquidity. The Arrangement crystalizes value for Minority Shareholders and removes uncertainty and risk around the development of the mineral assets of NewRange Copper Nickel LLC, PolyMet's 50:50 joint venture with Teck American Inc., a wholly-owned subsidiary of Teck Resources Limited, and the generally uncertain macroeconomic environment.

-

Thorough Process Conducted by Special Committee. The Arrangement is the result of a process that included robust, arm's length negotiations and procedural safeguards.

-

Limited Alternatives. There are limited alternatives for a sale to third parties, including due to Glencore's 82% controlling interest in the Company and the fact that Glencore informed PolyMet that it was not interested in pursuing any alternative transaction.

-

Limited Conditions and Short Timeline to Closing. There are a limited number of closing conditions and, if approved, completion of the Arrangement is anticipated to take place shortly after the Meeting.

Procedural Safeguards for the Minority Shareholders

The negotiations leading to the execution and announcement of the Arrangement Agreement were undertaken by the Special Committee, which was comprised solely of independent directors and advised by experienced and qualified independent financial and legal advisors. The Arrangement is subject to the following approvals from Shareholders and the Supreme Court of British Columbia (the "Court"), which provides additional protection to the Minority Shareholders:

(a) a special resolution (the "Arrangement Resolution"), the full text of which is outlined in Appendix A of the accompanying management proxy circular (the "Circular"), which must be approved by at least two-thirds (66⅔%) of the votes cast by Shareholders present in person, virtually present or represented by proxy at the Meeting, voting as a single class;

(b) as the Arrangement constitutes a "business combination" for the purposes of Multilateral Instrument 61-101 - Protection of Minority Security Holders in Special Transactions ("MI 61-101"), the Arrangement Resolution must also be approved by a simple majority (more than 50%) of the votes cast by Shareholders present in person, virtually present or represented by proxy at the Meeting, excluding, for this purpose, the votes attached to the Shares held by Glencore and its affiliates and the Shares held by any other Shareholders required to be excluded under MI 61-101; and

(c) the Arrangement must be approved by the Court, after considering the procedural and substantive fairness of the Arrangement at a hearing at which Minority Shareholders and certain others are entitled to be heard.

The 159,806,774 Shares beneficially owned by Glencore and its affiliates, representing approximately 82.18% of the issued and outstanding Shares, will be excluded for the purposes of the "minority approval" required under MI 61-101 and referred to in paragraph (b) above.

In connection with the proposed Arrangement, all directors and executive officers of the Company who hold securities of the Company entered into voting and support agreements pursuant to which they have agreed, subject to the terms thereof, to vote all of their Shares IN FAVOR of the Arrangement Resolution.

The Arrangement is currently scheduled to be completed on or about November 7, 2023 based on the assumption that all required Shareholder and Court approvals are obtained and all other conditions to the Arrangement are satisfied or waived prior to such date.

The Meeting will be a hybrid meeting, held in person at Farris LLP, 2500 - 700 West Georgia Street, Vancouver, British Columbia V7Y 1B3 and online via live webcast. Shareholders will be able to participate and vote at the Meeting online regardless of the geographic location at www.virtualshareholdermeeting.com/PLM2023SM.

Please arrange for your proxy to be received by Broadridge, Attention: Vote Processing, 51 Mercedes Way, Edgewood, NY, 11717, by no later than 12:00 p.m. (Eastern time) on October 30, 2023 (or, if the Meeting is adjourned or postponed, 48 hours, excluding Saturdays, Sundays, and statutory holidays, prior to the commencement of the reconvened Meeting). Late proxies may be accepted or rejected by the Chair of the Meeting at his discretion, subject to the terms of the Arrangement Agreement, and the Chair of the Meeting is under no obligation to accept or reject any particular late proxy.

Shareholders should review the accompanying notice of special meeting of Shareholders and the Circular, which describes, among other things, the background to the Arrangement as well as the reasons for the determinations and recommendations of the Special Committee and the Board (other than the Conflicted Directors) (the "Unconflicted Board of Directors"). The Circular contains a detailed description of the Arrangement and includes additional information to assist you in considering how to vote at the Meeting. You are urged to read this information carefully and, if you require assistance, you are urged to consult your financial, legal, tax or other professional advisors.

Your vote is important regardless of the number of Shares you own. If you are unable to attend the Meeting online or in person, we encourage you to take the time now to complete, sign, date and return the enclosed form of proxy or voting instruction form, as applicable, so that your Shares can be voted at the Meeting in accordance with your instructions. If you are a registered Shareholder, we also encourage you to complete, sign, date and return the enclosed letter of transmittal, which will help the Company arrange for the prompt payment for your Shares if the Arrangement is completed.

If you have any questions about the information contained in the Circular or require assistance in completing your form of proxy please contact our proxy solicitation agent, Laurel Hill Advisory Group, by telephone at 1-877-452-7184 (North American Toll Free); or 1-416-304-0211 (collect outside North America); or by email at assistance@laurelhill.com. Questions on how to complete the Letter of Transmittal should be directed to the Company's depositary, Computershare, at 1-800-564-6253 (toll free in North America) or 1-514-982-7555 (outside North America), by facsimile at 1-905-771-4082 or by email at corporateactions@computershare.com.

On behalf of the Unconflicted Board of Directors, we would like to take this opportunity to thank you for the support you have shown as Shareholders of the Company.

Yours very truly,

(signed) "Alan R. Hodnik"

Alan R. Hodnik

Lead Independent Director

Chair, Special Committee

POLYMET MINING CORP.

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

September 28, 2023

NOTICE IS HEREBY GIVEN that, in accordance with an interim order of the Supreme Court of British Columbia dated September 27, 2023 (the "Interim Order"), a special meeting (the "Meeting") of the holders (the "Shareholders") of common shares (the "Shares") of PolyMet Mining Corp. ("PolyMet" or the "Company") will be held on November 1, 2023 at 9:00 a.m. (Pacific time) in person and in virtual format for the following purposes:

1. to consider and, if deemed advisable, to pass, with or without variation, a special resolution (the "Arrangement Resolution"), the full text of which is outlined in Appendix A of the accompanying management proxy circular (the "Circular"), to approve an arrangement (the "Arrangement") pursuant to Part 9, Division 5 of the Business Corporations Act (British Columbia) (the "BCBCA") involving PolyMet and Glencore AG ("Glencore"), the whole as described in the Circular; and

2. to transact such other business as may properly come before the Meeting or any adjournment(s) or postponement(s) thereof.

The Circular provides additional information relating to the matters to be addressed at the Meeting, including the Arrangement.

Meeting

The Meeting will be a hybrid meeting, held in person at Farris LLP, 2500 - 700 West Georgia Street, Vancouver, British Columbia V7Y 1B3 and online via live webcast. Shareholders will be able to participate and vote at the Meeting online regardless of the geographic location at www.virtualshareholdermeeting.com/PLM2023SM.

Attending the Virtual Meeting

To participate in the Meeting virtually, registered and non-registered (beneficial) shareholders or their proxyholders, will need to visit www.virtualshareholdermeeting.com/PLM2023SM and log-in. The webcast will allow you to attend the Meeting live, submit questions and vote if you have not already done so in advance of the Meeting. The Meeting will begin promptly at 9:00 a.m. (Pacific Time) on November 1, 2023. Online check-in will begin starting 15 minutes prior, at 8:45 a.m. (Pacific Time). You should allow ample time for online check-in procedures.

Registered Shareholders log-in to the Meeting using the 16-digit control number included on their form of proxy and may submit questions and vote if they have not already done so in advance of the Meeting.

Guests will be able to attend the live webcast by joining as a guest at www.virtualshareholdermeeting.com/PLM2023SM but will not be able to submit questions or vote.

The Meeting platform is fully supported across browsers and devices running the most updated version of applicable software plug-ins. You should ensure you have a strong, preferably high-speed, internet connection wherever you intend to participate in the Meeting. Shareholders who are participating must be connected to the internet throughout the entire Meeting in order to be able to vote.

Appointment of Proxyholders

Shareholders who wish to appoint a person other than the management nominees identified in the form of proxy or voting instruction form must carefully follow the instructions in the accompanying Circular and on their form of proxy or voting instruction form.

The Board of Directors of the Company (the "Board of Directors" or the "Board") has set the close of business on September 22, 2023 as the record date (the "Record Date") for determining the Shareholders who are entitled to receive notice of and to vote their Shares at the Meeting. Only persons who are shown on the register of Shareholders at the close of business on the Record Date, or their duly appointed proxyholders, will be entitled to attend the Meeting and vote on the Arrangement Resolution.

As of the Record Date, there were 194,460,251 Shares issued and outstanding. Each Share entitles its holder to one (1) vote with respect to the matters to be voted on at the Meeting.

In order to become effective, the Arrangement must be approved by: (i) at least two-thirds (66⅔%) of the votes cast by Shareholders present in person, virtually present or represented by proxy at the Meeting, voting as a single class, and (ii) as the Arrangement constitutes a "business combination" for the purposes of Multilateral Instrument 61-101 - Protection of Minority Security Holders in Special Transactions ("MI 61-101"), a simple majority (more than 50%) of the votes cast by Shareholders present in person, virtually present or represented by proxy at the Meeting, excluding, for the purposes of (ii), the votes attached to the Shares held by Glencore and its affiliates and the Shares held by any other Shareholders required to be excluded under MI 61-101. The 159,806,774 Shares beneficially owned by Glencore and its affiliates (collectively, the "Excluded Shares"), representing approximately 82.18% of the issued and outstanding Shares, will be excluded for purposes of such "minority approval" required under MI 61-101.

Accompanying this notice of meeting is the Circular, a form of proxy and a letter of transmittal (for registered Shareholders) (the "Letter of Transmittal"). The accompanying Circular provides information relating to the matters to be addressed at the Meeting and is incorporated into this notice of meeting. Any adjourned or postponed meeting resulting from an adjournment or postponement of the Meeting will be held at a time and place to be specified either by the Company before the Meeting or at the Chair's discretion at the Meeting.

For a registered Shareholder (other than any dissenting Shareholders and the holders of the Excluded Shares) to receive the consideration of US$2.11 in cash per Share (the "Consideration") to which such Shareholder is entitled upon the completion of the Arrangement, such Shareholder must complete, sign and return the Letter of Transmittal together with such Shareholder's share certificate(s) and/or Direct Registration System advice(s), as applicable, and any other required documents and instruments to the depositary named in the Letter of Transmittal, in accordance with the procedures set out therein.

Whether or not you are able to attend the Meeting, the Board and management of the Company urge you to participate in the Meeting and vote your Shares. If you cannot attend the Meeting in person or online to vote your Shares, please vote in one of the following ways:

(i) by following the instructions for internet voting in the accompanying form of proxy at least 48 hours, excluding Saturdays, Sundays, and holidays, prior to the Meeting or related adjournment(s) or postponement(s); OR

(ii) by completing and signing the accompanying form of proxy and returning it in the enclosed envelope, postage prepaid at least 48 hours, excluding Saturdays, Sundays, and statutory holidays, prior to the Meeting or related adjournment(s) or postponement(s); OR

(iii) by duly appointing someone as a proxy to participate in the Meeting and vote your Shares for you.

The Chair of the Meeting reserves the right to accept late proxies and to extend or waive the proxy cut off at their discretion, with or without notice, subject to the terms of the Arrangement Agreement.

If you are a beneficial (non-registered) Shareholder, meaning you hold your Shares through a broker, investment dealer, bank, trust company, custodian, nominee, or another intermediary (an "Intermediary"), please refer to the section in the Circular entitled "Information Concerning the Meeting and Voting - Non-Registered Shareholders" for information on how to vote your Shares. Beneficial (non-registered) Shareholders should carefully follow the instructions of their Intermediary to ensure that their Shares are voted at the Meeting in accordance with such Shareholders' instructions from their Intermediary and, as applicable, to arrange for their Intermediary to complete the necessary transmittal documents and to ensure that they receive payment of the Consideration for their Shares if the Arrangement is completed.

Dissent Rights

Pursuant to the Interim Order, registered Shareholders have the right to dissent with respect to the Arrangement Resolution and, if the Arrangement becomes effective, to be paid the fair value of their Shares by Glencore in accordance with the provisions of Part 8, Division 2 of the BCBCA (the "Dissent Rights"), as modified by the Interim Order and/or the plan of arrangement pertaining to the Arrangement (the "Plan of Arrangement"). It is recommended that you seek independent legal advice if you wish to exercise Dissent Rights. The Dissent Rights are more particularly described in the accompanying Circular, and copies of the Plan of Arrangement, the Interim Order and the text of Part 8, Division 2 of the BCBCA are outlined in Appendix B, Appendix E and Appendix G, respectively, of the Circular. Failure to strictly comply with the requirements set forth in Part 8, Division 2 of the BCBCA, as modified by the Interim Order and/or the Plan of Arrangement, will result in the loss of any right of dissent.

| |

By order of the Board of Directors, |

| |

|

| |

(signed) "Jonathan Cherry" |

| |

|

| |

Jonathan Cherry

Chairman, President, and Chief Executive Officer |

MANAGEMENT PROXY CIRCULAR

SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD NOVEMBER 1, 2023

This management proxy circular (this "Circular") is provided in relation to the solicitation of proxies by the management of PolyMet Mining Corp. ("we", "us", "PolyMet" and the "Company") for use at the special meeting of Shareholders (the "Meeting") of the Company to be held on November 1, 2023 at 9:00 a.m. (Pacific time) in person at Farris LLP, 2500 - 700 West Georgia Street, Vancouver, British Columbia, Canada, V7Y 1B3 and online via live webcast at www.virtualshareholdermeeting.com/PLM2023SM and at any adjournment or postponement thereof. Unless otherwise indicated, the information provided in this Circular is provided as of the Record Date of September 22, 2023.

All capitalized terms used in this Circular but not otherwise defined herein have the meanings set forth in the "Glossary of Terms". In this Circular, unless there is something in the subject matter or context inconsistent therewith, words importing the singular number only (including defined terms) include the plural.

CURRENCY AND EXCHANGE RATES

Unless otherwise indicated, references to "C$" refer to the lawful currency of Canada and references to "$" or "US$" refer to the lawful currency of the United States of America. On September 27, 2023, the daily average exchange rate as reported by the Bank of Canada was: C$1.00 = US$0.74 and US$1.00 = C$1.35.

The cash payments to Shareholders following completion of the Arrangement will be denominated in U.S. dollars.

Registered Shareholders can receive payment of the cash to which they are entitled under the Arrangement in Canadian dollars by checking "Canadian dollars" on the Letter of Transmittal in which case each such Registered Shareholder will have acknowledged and agreed that the exchange rate for the U.S. dollar expressed in Canadian dollars will be based on the exchange rate available to the Depositary at its typical banking institution on the date the funds are converted. A Registered Shareholder electing to receive payment of the cash to which it is entitled under the Arrangement made in Canadian dollars will have further acknowledged and agreed that any change to the currency exchange rates of the United States or Canada will be at the sole risk of such Shareholder. Any Registered Shareholder who does not make a Canadian dollar election prior to the Effective Date will receive U.S. dollars.

INFORMATION REGARDING GLENCORE