0000911216false00009112162023-10-202023-10-20iso4217:USDxbrli:sharesiso4217:USDxbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act Of 1934

Date of Report (Date of earliest event reported): October 20, 2023

Palatin Technologies, Inc. |

(Exact name of registrant as specified in its charter) |

Delaware | | 001-15543 | | 95-4078884 |

(State or other jurisdiction | | (Commission | | (IRS employer |

of incorporation) | | File Number) | | identification number) |

4B Cedar Brook Drive, Cranbury, NJ | | 08512 |

(Address of principal executive offices) | | (Zip Code) |

Registrant's telephone number, including area code: (609) 495-2200

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | | Trading Symbol | | Name of Each Exchange on Which Registered |

Common Stock, par value $0.01 per share | | PTN | | NYSE American |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by checkmark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On October 20, 2023, Palatin Technologies, Inc. (the “Company”) entered into a securities purchase agreement (the “Purchase Agreement”) with the investor named on the signature page thereto, to sell in a registered direct offering (the “RD Offering”), an aggregate of (i) 1,325,000 shares of common stock, $0.01 par value per share (the “Shares”), of the Company and (ii) pre-funded warrants (the “Pre-Funded Warrants”) to purchase up to 1,033,491 shares of the Company’s common stock (the “Pre-Funded Warrant Shares”). The Purchase Agreement also provides that the Company will issue unregistered warrants (the “Private Warrants”) to purchase up to 2,358,491 shares of the Company’s common stock (the “Private Warrant Shares”) in a concurrent private placement (the “Private Offering” and together with the RD Offering, the “Offering”). The Shares and accompanying Private Warrants were offered at a combined offering price of $2.12. The Pre-Funded Warrants and accompanying Private Warrants were offered at a combined offering price of $2.1199. The Offering closed on October 24, 2023.

The Private Warrants will be exercisable on the six-month anniversary of issuance for a period of five and one-half years from the issuance date, at an exercise price equal to $2.12 per Private Warrant Share. The Private Warrants will be exercisable for cash, or, solely during any period when a registration statement for the issuance or resale of the Private Warrant Shares issuable upon exercise of the Private Warrants to or by the holder of such Private Warrants is not in effect, on a cashless basis.

The Pre-Funded Warrants have an exercise price of $0.0001 per Pre-Funded Warrant Share, are exercisable upon issuance, and will expire when exercised in full. There is no established public trading market for the Pre-Funded Warrants and the Company does not intend to list the Pre-Funded Warrants on any national securities exchange or nationally recognized trading system.

H.C. Wainwright & Co., LLC (the “placement agent”) acted as exclusive placement agent in connection with the Offering. The Company (i) paid the placement agent a cash fee equal to 7.0% of the aggregate gross proceeds of the Offering and (ii) reimbursed the placement agent for certain expenses and legal fees in connection with the Offering. In addition, the Company also issued to the placement agent or its designees warrants (the “Placement Agent Warrants”) to purchase up to 117,925 shares of the Company’s common stock (the “Placement Agent Warrant Shares”) as part of the compensation payable to the placement agent. The Placement Agent Warrants have substantially the same terms as the Private Warrants, except that the Placement Agent Warrants have an exercise price of $2.65 per share and will expire five years following the commencement date of the Offering.

The net proceeds from the Offering, after deducting the placement agent fees and offering expenses, were $4.5 million. The Company intends to use the net proceeds received from the Offering for general corporate purposes.

The Shares, the Pre-Funded Warrants, and the Pre-Funded Warrant Shares were offered and sold pursuant to a prospectus, dated September 26, 2022, and a prospectus supplement, dated October 20, 2023, in connection with a takedown from the Company’s shelf registration statement on Form S-3 (File No. 333-262555).

The Purchase Agreement contains representations and warranties that the parties made to, and solely for the benefit of, each other in the context of all of the terms and conditions of that agreement and in the context of the specific relationship between the parties. The Purchase Agreement also contains customary conditions to closing, termination rights of the parties, certain indemnification obligations of the Company and ongoing covenants for the Company, including a prohibition on the Company’s sale and issuance of additional securities for a period of 60 days from the closing date of the Offering and entering into variable rate transactions (as defined in the Purchase Agreement) for a period of 12 months from the closing date of the Offering, subject to certain exceptions. In addition, the Purchase Agreement contains a requirement to file a registration statement on Form S-1 (or other appropriate form if we are not then Form S-1 eligible) providing for the resale of the Private Warrant Shares issuable upon the exercise of the Private Warrants (the “Resale Registration Statement”), on or before December 4, 2023, and to use commercially reasonable efforts to have such Resale Registration Statement declared effective by the Securities and Exchange Commission (the “SEC”) within 120 days following the closing date of the Offering, and to keep the Resale Registration Statement effective at all times until no holder of the Private Warrants owns any Private Warrant Shares.

A holder (together with its affiliates) may not exercise any portion of the Pre-Funded Warrants or Private Warrants to the extent that the holder would own more than 9.99% (or, at the holder’s option upon closing of the Offering, 4.99%) of the number of shares of the Company’s outstanding common stock immediately after exercise. However, any holder may increase or decrease such percentage to any other percentage not in excess of 9.99% upon notice to us, provided that any increase in this limitation will not be effective until 61 days after such notice from the holder to us and such increase or decrease will apply only to the holder providing such notice.

The descriptions of terms and conditions of the Purchase Agreement, the Pre-Funded Warrants, the Private Warrants, and the Placement Agent Warrants set forth herein do not purport to be complete and are qualified in their entirety by the full text of the form of Purchase Agreement, the form of Pre-Funded Warrant, the form of Private Warrant, and the form of Placement Agent Warrant, which are attached hereto as Exhibits 10.1, 4.1, 4.2, and 4.3, respectively, and incorporated herein by reference. Accordingly, the Purchase Agreement is incorporated herein by reference only to provide investors with information regarding the terms of the Purchase Agreement and not to provide investors with any other factual information regarding the Company or its business and investors and the public should look to other disclosures contained in the Company’s filings with the SEC for any other such factual information.

A copy of the opinion of Thompson Hine LLP relating to the legality of the securities offered by us in the Offering is attached as Exhibit 5.1 hereto.

The Offering closed on October 24, 2023.

This Current Report on Form 8-K does not constitute an offer to sell the securities or a solicitation of an offer to buy the securities, nor shall there be any sale of the securities in any state or jurisdiction in which such an offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

The Company cautions you that statements included in this report that are not a description of historical facts are forward-looking statements. Words such as “believes,” “anticipates,” “plans,” “expects,” “indicates,” “will,” “intends,” “potential,” “suggests,” “assuming,” “designed” and similar expressions are intended to identify forward-looking statements. These statements are based on the Company’s current beliefs and expectations. These forward-looking statements include statements regarding the expected net proceeds therefrom. The inclusion of forward-looking statements should not be regarded as a representation by the Company that any of its plans will be achieved. Actual results may differ from those set forth in this release due to the risks and uncertainties associated with market conditions and risks and uncertainties inherent in the Company’s business; and other risks described in the Company’s filings with the SEC. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof, and the Company undertakes no obligation to revise or update this report to reflect events or circumstances after the date hereof. This caution is made under the safe harbor provisions of Section 21E of the Private Securities Litigation Reform Act of 1995.

Item 3.02. Unregistered Sales of Equity Securities.

The disclosures in Item 1.01 of this Current Report on Form 8-K related to the Private Offering and the issuance of the Placement Agent Warrants are incorporated by reference into this Item 3.02. The Private Warrants, the Placement Agent Warrants, the Private Warrant Shares and the Placement Agent Warrant Shares described in this Current Report on Form 8-K have not been registered under the Securities Act of 1933, as amended (the “Securities Act”), and were offered and sold in reliance upon exemption from the registration requirements under Section 4(a)(2) under the Securities Act and/or Regulation D promulgated thereunder.

Item 8.01 Other Events.

On October 23, 2023, the Company issued a press release announcing the Offering. A copy of this press release is attached as Exhibit 99.1 and incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| PALATIN TECHNOLOGIES, INC. | |

| | | |

Date: October 24, 2023 | By: | /s/ Stephen T. Wills | |

| | Stephen T. Wills, CPA, MST | |

| | Executive Vice President, Chief Financial Officer and Chief Operating Officer | |

nullnullnullnullnullnull

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

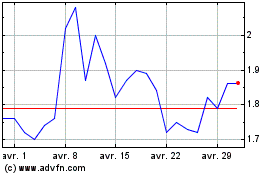

Palatin Technologies (AMEX:PTN)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Palatin Technologies (AMEX:PTN)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024