Current Report Filing (8-k)

12 Avril 2023 - 12:02PM

Edgar (US Regulatory)

FALSE000009016800000901682023-04-052023-04-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) – April 5, 2023

SIFCO Industries, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| | | | |

Ohio | | 1-5978 | | 34-0553950 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| |

970 East 64th Street, Cleveland Ohio | | 44103 |

(Address of principal executive offices) | | (ZIP Code) |

Registrant’s telephone number, including area code: (216) 881-8600

N.A.

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Shares | | SIF | | NYSE American |

| | | | | |

Item 2.04 | Triggering Events That Accelerate or Increase a Direct Financial Obligation or an Obligation Under an Off-Balance Sheet Arrangement. |

As reported on the Form 8-K filed on February 10, 2023, SIFCO Industries, Inc. (the “Company”) received a Notice of Event of Default and Reservation of Rights on February 6, 2023 (the “Notice”) from J.P. Morgan Chase Bank, N.A., as Lender, with respect to (i) that certain Credit Agreement dated as of August 8, 2018 (as it may be amended or modified from time to time, together with all Exhibits, Schedules and Riders annexed hereto from time to time, the “Credit Agreement”), by and among the Company, T & W Forge, LLC, an Ohio limited liability company (“T & W”), and Quality Aluminum Forge, LLC, an Ohio limited liability company (“Quality Forge”), the Loan Parties party thereto, and JPMorgan Chase Bank, N.A., a national banking association (the “Lender”); and (ii) that certain Export Credit Agreement dated as of December 17, 2018 (as it may be amended or modified from time to time, together with all Exhibits, Schedules and Riders annexed hereto from time to time, the “Export Credit Agreement”, and collectively with the Credit Agreement, the “Credit Agreements”), by and among the Company, T&W, Quality Forge, the Loan Parties party thereto, and Lender. Capitalized terms used but not otherwise defined herein shall have the meanings ascribed to them in the Credit Agreements.

On April 5, 2023, the Company received written correspondence (the “Subsequent Notice”) with respect to the Credit Agreements in which Lender indicated further that (i) it is still in the process of evaluating the Existing Default described in the Notice; (ii) Lender may reduce the Reserves under the Borrowing Base in the Credit Agreements by up to $1,000,000 and may make any Loan or issue any Letter of Credit under the Credit Agreement or the Export Credit Agreement, but has no obligation to make any Loan or issue any Letter of Credit under either of the Credit Agreements or otherwise; and (iii) it may discontinue making Loans and issuing Letters of Credit under the Credit Agreements at any time and increase the Reserves at any time. The Subsequent Notice noted that Lender reserves all of its rights and remedies under the Credit Agreements and any other Loan Documents with respect thereto.

The Company continues to engage in good faith discussions with Lender to address and to seek to resolve the Existing Defaults.

The Subsequent Notice is attached hereto.

As reported by the Company on Form 12b-25 filed with the Securities and Exchange Commission (the “SEC”) on February 14, 2023, the Company experienced delays in obtaining and compiling the information required in order to complete the preparation of its financial statements to be included in its Quarterly Report on Form 10-Q for the fiscal quarter ended December 31, 2022, attributable primarily to information access limitations experienced due to the cyber incident that occurred on December 30, 2022 (the “Cyber Incident”) and was reported by the Company on Form 8-K filed with the SEC on January 6, 2023 and further described by the Company on Form 8-K filed with the SEC on February 10, 2023. Accordingly, the Company was not able to complete the preparation, review and filing of its Form 10-Q for the quarter ended December 31, 2022 within the prescribed time period without unreasonable effort or expense.

As of the date of this filing, the Company has lifted information access limitations implemented in response to the Cyber Incident and is in the process of working to complete the preparation, review and filing of its Form 10-Q for the quarter ended December 31, 2022. As indicated by the Company on Form 8-K filed with the SEC on February 28, 2023, fiscal second quarter production was negatively impacted due to system constraints during the recovery. The Company as of the date of this filing continues to meet customer needs and continues to evaluate the impact to its operations, controls or financial results caused by the Cyber Incident during the applicable periods.

This Current Report on Form 8-K includes forward-looking statements. All statements other than statements of historical fact are forward-looking statements. These forward-looking statements are generally identified by the words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “could” or similar expressions. Forward-looking statements are based on current expectations and assumptions, which are subject to risks and uncertainties and may cause actual results to differ materially from the forward-looking statements. In particular, our investigation into the Cyber Incident may uncover additional facts presently not known to us, which may cause us to reassess the impacts and scope of the Cyber Incident on the Company’s business and operations. Further, our ability to fully assess and remedy the Cyber Incident, and the legal, reputational and financial risks resulting from this or other cyber incidents, could also cause our results to differ materially from any forward-looking statements made above.

| | | | | |

Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

104 Cover Page Interactive Data File (embedded within the Inline XBRL document).

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | |

| | SIFCO Industries, Inc. |

| | (Registrant) |

| |

Date: April 11, 2023 | | |

| | /s/ Thomas R. Kubera |

| | Thomas R. Kubera |

| | Chief Financial Officer |

| | (Principal Financial Officer) |

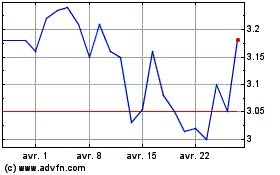

Sifco Industries (AMEX:SIF)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Sifco Industries (AMEX:SIF)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024