0000061398

false

0000061398

2023-08-01

2023-08-01

0000061398

us-gaap:CommonStockMember

2023-08-01

2023-08-01

0000061398

tell:SeniorNotes8.25PercentDue2028Member

2023-08-01

2023-08-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13

or 15(d) of the Securities Exchange Act of 1934

| Date of Report (Date of earliest event reported): |

August 1, 2023 |

|

| |

|

|

Tellurian

Inc.

(Exact name of registrant

as specified in its charter)

| Delaware |

|

001-5507 |

|

06-0842255 |

(State

or other jurisdiction of

incorporation) |

|

(Commission

File Number) |

|

(I.R.S.

Employer

Identification No.) |

| 1201

Louisiana Street, Suite

3100, Houston,

TX |

|

77002 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

| Registrant’s telephone number, including

area code: |

(832)

962-4000 |

|

(Former name or former

address, if changed since last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading

symbol |

|

Name of each exchange on which registered |

| Common

stock, par value $0.01 per share |

|

TELL |

|

NYSE

American LLC |

| |

|

|

|

|

| 8.25%

Senior Notes due 2028 |

|

TELZ |

|

NYSE

American LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 1.01 | Entry Into a Material Definitive Agreement. |

On August 6, 2023, Tellurian

Inc. (the “Company”) and Wilmington Trust, National Association (the “Trustee”) entered into a seventh

supplemental indenture (the “Seventh Supplemental Indenture”) to the base indenture dated as of June 3, 2022 by

and between the Company and the Trustee, as trustee (the “Base Indenture”), as supplemented by the first supplemental

indenture dated as of June 3, 2022 among the Company, the Trustee, and the collateral agent named therein (the “First Supplemental

Indenture”), the second supplemental indenture dated as of July 18, 2022 between the Company and the Trustee (the “Second

Supplemental Indenture”), the third supplemental indenture dated as of June 16, 2023 between the Company and the Trustee

(the “Third Supplemental Indenture”), the fourth supplemental indenture dated as of June 29, 2023 between the

Company and the Trustee (the “Fourth Supplemental Indenture”), the fifth supplemental indenture dated as of July 14,

2023 between the Company and the Trustee (the “Fifth Supplemental Indenture”), and the sixth supplemental indenture

dated as of July 28, 2023 between the Company and the Trustee (the “Sixth Supplemental Indenture” and, together

with the Base Indenture, the First Supplemental Indenture, the Second Supplemental Indenture, the Third Supplemental Indenture, the Fourth

Supplemental Indenture and the Fifth Supplemental Indenture, the “Prior Indenture”), which collectively govern the

terms of the $333,334,000 outstanding principal amount of the Company’s 6.00% senior secured convertible notes due May 1, 2025

(the “2022 Notes”) issued by the Company to an institutional investor (the “Investor”) on June 3,

2022. The Seventh Supplemental Indenture amends Section 3.14 of the Prior Indenture to reduce the Company’s minimum cash balance

requirement from $100,000,000 to $60,000,000 during the period from August 7, 2023 to August 18, 2023.

The foregoing description

of the terms and conditions of the Seventh Supplemental Indenture and the Prior Indenture does not purport to be complete and is qualified

in its entirety by reference to the full text of the Seventh Supplemental Indenture and the Prior Indenture, forms or copies of which

are filed as Exhibits 4.8, 4.1, 4.2, 4.3, 4.4, 4.5, 4.6 and 4.7, respectively, to this Current Report on Form 8-K and are incorporated

herein by reference.

| Item 1.02 | Termination of a Material Definitive Agreement. |

On August 1, 2023,

the LNG Sale and Purchase Agreement, dated as of May 27, 2021, as amended (the “LNG SPA”), between Driftwood

LNG LLC, a wholly owned subsidiary of the Company, and Gunvor Singapore Pte Ltd was terminated. The parties were unable to reach

agreement on the commercial terms of an amendment to the agreement. The Company’s focus continues being on investment-grade

counterparties. The terms of the LNG SPA are summarized in the Company’s Current Report on Form 8-K filed with the

Securities and Exchange Commission on May 27, 2021.

| Item 2.02 | Results of Operations and Financial Condition. |

The information set forth

in Item 7.01 is incorporated herein by reference to this Item 2.02.

| Item 3.03 | Material Modification to Rights of Security Holders. |

The information set forth

in Item 1.01 is incorporated herein by reference to this Item 3.03.

| Item 5.07 | Submission of Matters to a Vote of Security Holders. |

The Seventh Supplemental Indenture

was approved by the Investor on August 6, 2023. The Investor is the holder of all of the outstanding 2022 Notes.

| Item 7.01 | Regulation FD Disclosure. |

On

August 7, 2023, Tellurian Inc. (the “Company”) posted an updated corporate presentation to its website, www.tellurianinc.com.

A copy of the presentation is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein

by reference.

The

information in this Current Report on Form 8-K, including the information set forth in Exhibit 99.1, is being furnished and

shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange

Act, except as shall be expressly set forth by specific reference in such a filing.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

| Exhibit No. |

|

Description |

| 4.1 |

|

Indenture, dated as of June 3, 2022, by and between Tellurian Inc., as issuer, and Wilmington Trust, National Association, as trustee (incorporated by reference to Exhibit 4.1 to the Company’s Current Report on Form 8-K filed on June 3, 2022) |

| |

|

|

| 4.2 |

|

First Supplemental Indenture, dated as of June 3, 2022, by and among Tellurian Inc., as issuer, and Wilmington Trust, National Association, as trustee, and the collateral agent named therein, relating to the 6.00% Senior Secured Convertible Notes due 2025 (incorporated by reference to Exhibit 4.2 to the Company’s Current Report on Form 8-K filed on June 3, 2022) |

| |

|

|

| 4.3 |

|

Second Supplemental Indenture, dated as of July 18, 2022, by and between Tellurian Inc., as issuer, and Wilmington Trust, National Association, as trustee, relating to the 6.00% Senior Secured Convertible Notes due 2025 (incorporated by reference to Exhibit 4.3 to the Company’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2022) |

| |

|

|

| 4.4 |

|

Third Supplemental Indenture, dated as of June 16, 2023, by and between Tellurian Inc., as issuer, and Wilmington Trust, National Association, as trustee, relating to the 6.00% Senior Secured Convertible Notes due 2025 (incorporated by reference to Exhibit 4.4 to the Company’s Current Report on Form 8-K filed on June 20, 2023) |

| |

|

|

| 4.5 |

|

Fourth Supplemental Indenture, dated as of June 29, 2023, by and between Tellurian Inc., as issuer, and Wilmington Trust, National Association, as trustee, relating to the 6.00% Senior Secured Convertible Notes due 2025 (incorporated by reference to Exhibit 4.5 to the Company’s Current Report on Form 8-K filed on June 29, 2023) |

| Exhibit No. |

|

Description |

| 4.6 |

|

Fifth Supplemental Indenture, dated as of July 14, 2023, by and between Tellurian Inc., as issuer, and Wilmington Trust, National Association, as trustee, relating to the 6.00% Senior Secured Convertible Notes due 2025 (incorporated by reference to Exhibit 4.6 to the Company’s Current Report on Form 8-K filed on July 14, 2023) |

| |

|

|

| 4.7 |

|

Sixth Supplemental Indenture, dated as of July 28, 2023, by and between Tellurian Inc., as issuer, and Wilmington Trust, National Association, as trustee, relating to the 6.00% Senior Secured Convertible Notes due 2025 (incorporated by reference to Exhibit 4.7 to the Company’s Current Report on Form 8-K filed on July 31, 2023) |

| |

|

|

| 4.8 |

|

Seventh Supplemental Indenture, dated as of August 6, 2023, by and between Tellurian Inc., as issuer, and Wilmington Trust, National Association, as trustee, relating to the 6.00% Senior Secured Convertible Notes due 2025 |

| |

|

|

| 99.1 |

|

Tellurian Inc. Corporate Presentation, dated as of August 2023 |

| |

|

|

| 104 |

|

Cover Page Interactive Data File – the cover page interactive data file does not appear in the Interactive Data File because its XBRL tags are embedded within the Inline XBRL document |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

TELLURIAN INC. |

| |

|

|

| Date: August 7, 2023 |

By: |

/s/ Simon G. Oxley |

| |

Name: |

Simon G. Oxley |

| |

Title: |

Executive Vice President and Chief Financial Officer |

Exhibit 4.8

TELLURIAN INC.

and

WILMINGTON TRUST, NATIONAL ASSOCIATION

as Trustee

SEVENTH SUPPLEMENTAL

INDENTURE

Dated as of August 6, 2023

6.00% Senior Secured Convertible Notes due 2025

This SEVENTH SUPPLEMENTAL

INDENTURE (this “Supplemental Indenture”), dated as of August 6, 2023, is entered into by and among Tellurian Inc.,

a Delaware corporation, as issuer (the “Company”), and Wilmington Trust, National Association, as trustee (the “Trustee”).

RECITALS

WHEREAS, the Company and the

Trustee entered into a Base Indenture, dated as of June 3, 2022 (the “Base Indenture” and the Base Indenture as supplemented

by that First Supplemental Indenture, dated as of June 3, 2022 (the “First Supplemental Indenture”), among the Company,

the Trustee and Tech Opportunities LLC, as the collateral agent, that certain Second Supplemental Indenture, dated as of July 18, 2022,

between the Company and the Trustee (the “Second Supplemental Indenture”), that certain Third Supplemental Indenture,

dated as of June 16, 2023, between the Company and the Trustee (the “Third Supplemental Indenture”), that certain Fourth

Supplemental Indenture, dated as of June 29, 2023, between the Company and the Trustee (the “Fourth Supplemental Indenture”),

that certain Fifth Supplemental Indenture, dated as of July 14, 2023, between the Company and the Trustee (the “Fifth Supplemental

Indenture”), that certain Sixth Supplemental Indenture, dated as of July 28, 2023, between the Company and the Trustee (the

“Sixth Supplemental Indenture” and as further amended or supplemented, the “Indenture”; capitalized

terms used in this Supplemental Indenture without definition have the respective meanings ascribed to them in the Indenture)), pursuant

to which the Company has issued $500,000,000 in aggregate principal amount of 6.00% Senior Secured Convertible Notes due 2025 on the terms

set forth in the First Supplemental Indenture, as amended by the Second Supplemental Indenture, the Third Supplemental Indenture, the

Fourth Supplemental Indenture, the Fifth Supplemental Indenture, and the Sixth Supplemental Indenture;

WHEREAS, Section 8.02(A) of

the First Supplemental Indenture provides, among other things, that with the consent of the Required Holders, the Company and the Trustee

may amend the Indenture to amend the provisions of Section 3.14 of the First Supplemental Indenture; and

WHEREAS, the Required Holders

have consented to the amendment set forth in this Supplemental Indenture;

NOW THEREFORE, to comply with

the provisions of the Indenture and in consideration of the above premises, the Company and the Trustee agree:

Article

1

Amendments

to ARTICLE 3—COVENANTS

Section

1.01. Section 3.14 of the First Supplemental Indenture is hereby amended to add the following sentence at the end thereof:

“Notwithstanding the

foregoing, the first sentence of this Section 3.14 shall not apply during the period from August 7, 2023 to August 18, 2023 (or such later

date as consented to by the Required Holders in their sole discretion), and as long as the Company has liquidity calculated as unrestricted,

unencumbered Cash or Cash Equivalents of the Company and its Subsidiaries, excluding the Driftwood Companies, taken as a whole, in one

or more deposit, securities or money market or similar accounts located in the United States, during such period, in an aggregate minimum

amount equal to sixty million dollars ($60,000,000), the Company shall be in compliance with this Section 3.14.”

Article

2

EFFECTIVENESS

Section

2.01. Except as amended hereby, all of the terms of the Indenture shall remain and continue in full force and effect and are hereby

confirmed in all respects. From and after the date of this Supplemental Indenture, all references to the Indenture (whether in the Indenture

or in any other agreements, documents or instruments) shall be deemed to be references to the Indenture as amended and supplemented by

this Supplemental Indenture and every Holder shall be bound hereby.

Section

2.02. This Supplemental Indenture shall become effective as a binding agreement immediately upon its execution and delivery by

each of the Company and the Trustee.

Article

3

MISCELLANEOUS

Section

3.01. Except as expressly amended hereby, the Indenture is in all respects ratified and confirmed and all the terms, conditions

and provisions thereof shall remain in full force and effect. The terms and conditions of this Supplemental Indenture shall be deemed

to be incorporated in and made a part of the terms and conditions of the Indenture for any and all purposes, and all the terms and conditions

of both shall be read, taken and construed together as though they constitute one and the same instrument, except that in the case of

conflict, the provisions of this Supplemental Indenture will control.

Section

3.02. All agreements in this Supplemental Indenture by the Company or the Trustee shall bind their respective successors and assigns,

whether so expressed or not.

Section

3.03. In case any provision in this Supplemental Indenture shall be invalid, illegal or unenforceable, the validity, legality and

enforceability of the remaining provisions shall not in any way be affected or impaired thereby.

Section

3.04. This Supplemental Indenture may be executed in two or more identical counterparts, all of which shall be considered one and

the same agreement and shall become effective when counterparts have been signed by each party and delivered to the other party. Any signature

to this Agreement may be delivered by facsimile, electronic mail (including pdf) or any electronic signature complying with the U.S. federal

ESIGN Act of 2000 or the New York Electronic Signature and Records Act or other transmission method and any counterpart so delivered shall

be deemed to have been duly and validly delivered and be valid and effective for all purposes to the fullest extent permitted by applicable

law. Each party hereto accepts the foregoing and any document received in accordance with this Section 3.04 shall be deemed to have been

duly and validly delivered and be valid and effective for all purposes to the fullest extent permitted by applicable law. THIS SUPPLEMENTAL

INDENTURE SHALL BE GOVERNED BY, AND CONSTRUED IN ACCORDANCE WITH, THE LAWS OF THE STATE OF NEW YORK.

Section

3.05. In entering into this Supplemental Indenture, the Trustee shall be entitled to the benefit of every provision of the Indenture

relating to the conduct or affecting the liability of or affording protection to the Trustee, whether or not elsewhere herein so provided.

The Trustee makes no representations as to the validity or sufficiency of this Supplemental Indenture other than as to the validity of

its execution and delivery by the Trustee. The Trustee assumes no responsibility for the correctness of the recitals contained herein,

which shall be taken as a statement of the Company.

IN WITNESS WHEREOF, the parties hereto have caused

this Supplemental Indenture to be duly executed as of the date first written above.

| |

COMPANY: |

| |

|

| |

TELLURIAN INC. |

| |

|

| |

By: |

/s/ Simon Oxley |

| |

|

Name: Simon Oxley |

| |

|

Title: Executive Vice President and Chief Financial

Officer |

| |

|

| |

WILMINGTON TRUST, NATIONAL ASSOCIATION,

AS TRUSTEE |

| |

|

| |

By: |

/s/ Karen Ferry |

| |

|

Name: Karen Ferry |

| |

|

Title: Vice President |

[Signature Page to Seventh Supplemental Indenture]

Exhibit 99.1

Tellurian Inc. Corporate presentation August 2023

Cautionary statements The information in this presentation includes “forward - looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical fact are forward - looking statements. The words “anticipate,” “assume,” “believe,” “budget,” “estimate,” “expect,” “forecast,” “initial,” “intend,” “may,” “model,” “plan,” “potential,” “project,” “should,” “will,” “would,” and similar expressions are intended to identify forward - looking statements. The forward - looking statements in this presentation relate to, among other things, the benefits of the proposed integrated structure for Driftwood, Driftwood financing matters, capital structures, future development, transfer pricing, costs, margins, cash flow, production, returns, wells, drilling and other development activities, inventory life, commodity prices and demand (including the relationship between domestic and international gas/LNG prices), funding of current and future phases, liquefaction capacity additions, construction of LNG projects, Driftwood capacity, future demand and supply affecting LNG and general energy markets, future transactions and other aspects of our business and our prospects and those of other industry participants. Our forward - looking statements are based on assumptions and analyses made by us in light of our experience and our perception of historical trends, current conditions, expected future developments, and other factors that we believe are appropriate under the circumstances. These statements are subject to numerous known and unknown risks and uncertainties which may cause actual results to be materially different from any future results or performance expressed or implied by the forward - looking statements. These risks and uncertainties include those described in the “Risk Factors” section of our Annual Report on Form 10 - K for the fiscal year ended December 31, 2022, and our other filings with the Securities and Exchange Commission, which are incorporated by reference in this presentation. Many of the forward - looking statements in this presentation relate to events or developments anticipated to occur numerous years in the future, which increases the likelihood that actual results will differ materially from those indicated in such forward - looking statements. A full notice to proceed with construction of the Driftwood Project is subject to the completion of financing arrangements that may not be completed within the time frame expected or at all. The financial information included on slides 10, 11,12,13,14 and 19 is meant for illustrative purposes only and does not purport to show estimates of actual future financial performance. The information on those slides assumes the completion of certain acquisition, financing and other transactions. Such transactions may not be completed on the assumed terms or at all. Actual commodity prices may vary materially from the commodity prices assumed for the purposes of the illustrative financial performance information. The forward - looking statements made in or in connection with this presentation speak only as of the date hereof. Although we may from time to time voluntarily update our prior forward - looking statements, we disclaim any commitment to do so except as required by securities laws. Forward - looking statements 2

The world is critically short natural gas Demand for energy is projected to grow over 50% in the next 25 years as world population continues to grow and people strive to prosper. Global LNG demand has grown ~7% annually over the last five years. Tellurian’s integrated model aims to connect low - cost U.S. gas with the global market Tellurian will be the first integrated global gas pure - play in the U.S. with access to low - cost domestic resource and infrastructure. Sources: BP Statistical Review, BP World Energy Outlook, Wood Mackenzie, IEA. Note: Tellurian’s integrated model creates a physical hedge from upstream operations for Driftwood’s natural gas purchases. 3 Artist rendition

Tellurian executive summary 4 Driftwood Phase I is well underway with Bechtel having commenced construction in April 2022 ▪ Extended limited notice to proceed with Bechtel in 2023, continuing project work from 2022 ▪ Cleared all Phase I critical areas, drove ~45% of Phase I piles and poured all Plant 1 compressor foundations ▪ The advanced site work de - risks the project execution and timeline, a significant benefit to Driftwood partners Global demand for LNG will exceed supply without additional investment ▪ An estimated 185 mtpa of additional capacity will be needed by 2035, almost 1/3 rd of the expected LNG market size ▪ Following 2022’s record pricing & volatility, buyers remain interested in securing low - cost U.S. LNG supply ▪ Natural gas remains a key fuel for energy transition especially in developing economies Driftwood LNG progress continues with multiple milestones met in 1H23 ▪ Binding commitment for $1bn in Driftwood financing from the Real Estate platform of Blue Owl (NYSE: OWL), a $144bn AUM alternative asset manager ▪ To date, TELL has invested over $1bn and received additional commitments for $1bn of Driftwood project costs ▪ TELL upstream: forecasted 2023 average production of 180 - 190 MMcf /d, with ability to adjust quickly with prices Driftwood’s pioneering approach provides upside to all parties ▪ Best placed among remaining U.S. projects due to site, timeline, capacity and construction progress ▪ Commercial structure aligns partner interests and EPC framework mitigates risks to development process ▪ Available capacity for Phase I allows strategic investors to directly invest in low - cost U.S. LNG at the project level 1 2 3 4 Source: Tellurian analysis.

Houston Gillis Haynesville Gas production Driftwood LNG Driftwood Pipeline Tellurian: fully integrated, pure - play LNG 5 Low - cost, integrated business model : upstream gas production in Haynesville (1) , pipeline and LNG terminal in SW Louisiana Pure - play, global gas producer : monetizing U.S. domestic gas production into premium global gas markets; integration provides cost certainty of supply Bechtel EPC execution : best - in - class LNG execution; lump sum turnkey with ~30% of overall engineering complete All critical permits secured : all FERC and DOE permits secured for Driftwood LNG terminal and pipeline Proven management track record : Tellurian team has originated and executed ~79% of U.S. LNG capacity development and ~ 33 % of global LNG capacity development across four continents Critical role in energy transition : significant ESG benefits and end - to - end emissions control from owning upstream Note: (1) Tellurian’s integrated model creates a physical hedge from upstream operations for Driftwood’s natural gas purchases.

Upstream: building inventory for LNG exports Note: (1) Inventory and reserves information as of December 31, 2022 (using December 30, 2022 NYMEX strip pricing) as prepared by N eth erland, Sewell & Associates in accordance with the definitions and guidelines set forth in the 2018 Petroleum Resources Manag eme nt System (PRMS). 6 Upstream segment Production ( MMcf /d) 1Q23 2Q23 Net acreage 1Q23 2Q23 ~30,915 ~191 ~ 214 ~31,117 Acreage ~31,117 net acres primarily in DeSoto, Bossier, Caddo and Webster parishes >60% of undeveloped acreage prospective for Bossier reserves ~75% average operated working interest for operated locations Well inventory >400 undeveloped, ~50% operated Gas/ liquids mix 99+% gas Tellurian Upstream overview (1)

Driftwood LNG 11.0 mpta Phase I LNG liquefaction facility and pipeline ready to deliver gas to global markets by 2027 7 7 Driftwood LNG A Perryville HSC Gillis Henry Hub Eunice C B Acadian Extension PL Acadian PL KM Louisiana Pipeline ( KMLP ) LEAP Gas Gathering Tennessee Gas PL ( TGP ) TETCO Trunkline PL Gas Price Hub Driftwood Pipeline Haynesville + Phase I construction progress Ideal location to source gas Total capacity ~11 mtpa LNG Feedgas requirement ~550 Bcf/year

0% 5% 10% 15% 20% 25% 30% 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 U.S. Share of Global LNG Supply (%) 28% If forward Henry Hub prices exceed global pricing, ~20 - 25% of the global LNG supply could stay within the U.S. market, helping to balance global LNG supply Henry Hub will remain global gas price floor 8 Potential for international pricing / Henry Hub inversion is unsustainable due to U.S. market share on global basis Source: Wood Mackenzie, S&P, Tellurian research. Notes: Includes projects that are under construction. (1) Excludes LNG exports, includes Mexico exports. Price inversion scenario 2030 Expected Figures U.S. LNG Supply: ~21 Bcf/d % of domestic gas consumption (1) (~93 bcf/d) % of global LNG supply (~ 81 bcf/d) ~28% ~ 23 % Future Henry Hub - JKM/TTF pricing dynamics should ensure global gas markets are adequately supplied 20%

2022-2035 Demand Growth 2022-2035 Supply Growth New Supply Required LNG supply vs. demand growth ( mtpa ) LNG demand exceeds supply growth 9 Sources: Wood Mackenzie, Tellurian estimates. Notes: (1) Based on Wood Mackenzie estimates that global LNG demand will grow 5% p.a. from 2021 to 2035. (2) Includes supply from projects that have made FID, net number that includes capacity declines at legacy projects. (3) Assumes a utilization factor of 85%. (1) (2) ~282 mtpa of new LNG demand by 2035 ~185 mtpa of new LNG capacity required by 2035 (3) 126 156 282

$0 $2 $4 $6 $8 $10 $12 $14 $16 Billions How much does a USGC LNG terminal cost? 10 Example Phase I (~11mtpa) Development Cost Stack Construction Scope Owner’s Costs Financing Costs Examples of Major Cost Drivers Civil works Gas Treatment / Utilities LNG Trains LNG Tanks Marine Berths Buildings Land Acquisition Permitting/Regulatory Utility Projects Owner’s Team / G&A Legal / Consultants Cost of Debt During Development Period Approx. Normalized Cost p er tonne of Production Construction Costs : $900 Owner’s Costs : $200 Financing Costs : $200 Total: $1,300 per tonne 10

Traditional LNG project economics 11 Illustrative LNG project cost stack (~11 mtpa ) Notes: (1) Assumes 7% interest rate on $8 bn of senior project debt. (2) Assumes 11% internal rate of return on $6 bn equity investment. Needs to be reflected in offtake price to make project feasible (1) (2) Illustrative Capital Structure: • ~$6 bn of equity (~43%) • ~$8 bn of debt (~57%) Not inclusive of: • Debt amortization • Gas sourcing and fuel use • Return to developer’s equity $1.00 $4.00 $1.00 $2.00 O&M + G&A Interest Exp. ROE Full Cost $/ mmBtu

Driftwood LNG Phase I (2 - plant, ~11 mtpa) Notes: (1) Phase I EPC contract is an estimate provided by Bechtel for the price as of July 2022, subject to refresh before full notice to proceed. (2) Includes owner’s costs, terminal labor, opex prior to LNG production, management fee to Tellurian, G&A during construction and contingencies. (3) Includes first phase of Driftwood pipeline system construction plus contingency. (4) Includes interest during construction, based on secured overnight financing rates as of March 2023 as well as financial a dv isory fees and transaction costs. 12 2 - plant development costs ($ bn ) LNG terminal (1) $9.0 EPC cost/tonne ($/tonne) $815 Owner’s cost (2) 2.2 Pipeline (3) 0.9 Capital cost/ tonne ($/ tonne ) $1,100 Financing, interest and other (4) 2.4 Total development costs $14.5 Total capacity ~11 mtpa LNG Feedgas requirement ~550 Bcf /year Note: Artist rendering of full 5 - plant Driftwood LNG development

Henry Hub 115% Henry Hub 115% Henry Hub $2.60 ( $0.50 ) $2.10 Gas Sourcing Transfer Price Bank Coverage and Dividend Realized Price Contingent Equity (2) $2.5 bn Tellurian Equity (1) $1.5 bn Partner Equity $1.8 bn Lease/Mezz $2.0 bn Bank Debt $7.0 bn Driftwood capital structure & economics 13 Equity partners to sign 11 mpta of long - term offtake contracts at the transfer price to support the project financing Illustrative capital structure Transfer pricing Tellurian is seeking partners to invest 55% of equity for 6 mtpa capacity in Phase I of Driftwood Project $/ mmBtu Notes: (1) Tellurian to raise the difference between the $1+ billion development expenditure to date and Tellurian’s equity com mitment. (2) If the six months of commissioning cargoes cover the contingent equity, the contingent equity will not be funded. (3) Assumes 1.5 bcf/day of production. Illustrative Value to Driftwood Cargo (3.8 mt) as of 8/1/2023 11 mtpa Year to Date Gulf Coast Marker ($/ mmBtu ) $6.95 $10.59 115% Henry Hub + $2.10 ($/mmBtu) $5.04 $5.03 Margin ($/ mmBtu ) $1.91 $5.56 Operating cash flow (3) $7.2 mm $1.77 bn

Illustrative cash flow at 2027 LNG pricing Notes: (1) Assumes Brent parity based on 2027 IHS Markit LNG and Gas Price Forecast as of July 2023 (rounded for illustrative purposes) . (2) Assumes transportation estimate of $1.75/ mmBtu . 14 Phase I (Plants 1 - 2) Full Development (Plants 1 - 5) LNG sales price (1,2) (less transportation, $/ mmBtu ) $14.00 $14.00 Gas sourcing (1) ($/ mmBtu ) - $5.00 - $5.00 Liquefaction and transport ($/ mmBtu ) - $1.00 - $1.00 Margin ($/ mmBtu ) = $8.00 = $8.00 Annual capacity x ~550 Bcf x ~1,380 Bcf Potential annual operating cash flow to Driftwood LNG partners before land lease and interest expense = $4.4 billion = $11.0 billion Plants 3 - 5 to be funded by cash flow from Phase I

Contact us ▪ Matt Phillips VP, Investor Relations & Finance +1 832 320 9331 matthew.phillips@tellurianinc.com ▪ Joi Lecznar EVP, Public & Government Affairs +1 832 962 4044 joi.lecznar@tellurianinc.com 15 ▪ Johan Yokay Director , Investor Relations & Assistant Treasurer +1 832 320 9327 johan.yokay@tellurianinc.com

Appendix

Driftwood LNG’s ideal site for exports 17 Access to power and water Berth over 45’ depth with access to high seas Support from local communities Access to pipeline infrastructure Site size over 1,200 acres Insulation from surge, wind and local populations Artist rendition x Fully permitted x 30% engineering complete x EPC contract signed x Under construction

Unmatched LNG development experience Tellurian’s management team has >80 years of combined LNG development experience globally 18 Charif Souki Executive Chairman of the Board Co - founder of Tellurian Founded Cheniere in 1996, Chairman and CEO until 2015 Martin Houston Vice Chairman Co - founder of Tellurian 32 years at BG Group, retired as COO in 2014 Octávio Simões President & CEO Joined Tellurian in 2019 after 20 years at Sempra Former President & CEO of Sempra LNG & Midstream 166 mtpa Tellurian management responsible for ~33% of global LNG in production today and 79% of U.S. LNG in production today 35 years Tellurian management has delivered cost - leading LNG projects for >35 years Samik Mukherjee EVP and President, Driftwood Assets Joined Tellurian in 2022 Former EVP, COO of McDermott International, Ltd.

$0 $5 $10 $15 $20 JKM & TTF Forward Curve TTF JKM Low - cost U.S. supply provides global gas arbitrage 19 Access to premium global gas market generates up to $11/ mmBtu margin (1) at current forward prices JKM (Asia benchmark) 1 - yr forward price: $17/ mmBtu TTF (European benchmark) 1 - yr forward price: $ 17 / mmBtu Sources: Wood Mackenzie, IHS Markit, Bloomberg , ICE data via Marketview , CME Group. Notes: (1) Assumes maximum netback from Asia or Europe based on 7/24/2023 12 - month strip pricing for Henry Hub, TTF, and JKM, $1 .00/ mmBtu for plant opex and G&A and $1 - $1.70/ mmBtu shipping, depending on the destination to Europe or Asia. (2) Driftwood LNG variable cost assumes $5.00/ mmBtu for gas sourcing based on 2027 IHS Markit LNG and Gas Price Forecast as of July 2023 and $1.00/ mmBtu for plant opex and G&A. Driftwood LNG Variable cost: ~ $6/ mmBtu Driftwood LNG variable cost (2) = ~$6/ mmBtu

17 4 0 6 12 27 30 29 38 26 14 13 10 11 20 45 32 27 14 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 Supply fails to keep pace with demand Global liquefaction capacity additions ( mtpa ) Sources: Wood Mackenzie, Platts via Marketview . Note: Capacity additions for projects that have reached FID only. 20 JKM annual average: ~1 50 mtpa capacity additions 6.9 % per annum ~ 116 mtpa capacity additions 3.8 % per annum ~68 mtpa capacity additions 2.7% per annum ~ 38 mtpa capacity additions 2.7 % per annum $14.04 $15.12 $16.54 $13.85 $7.45 $5.73 $7.13 $9.74 $5.49 $4.38 $18.59 $33.98 $ 14.25 YTD

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=tell_SeniorNotes8.25PercentDue2028Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

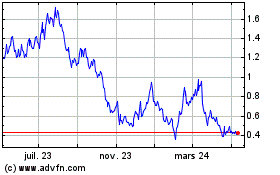

Tellurian (AMEX:TELL)

Graphique Historique de l'Action

De Mar 2025 à Avr 2025

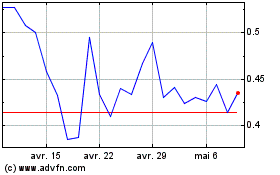

Tellurian (AMEX:TELL)

Graphique Historique de l'Action

De Avr 2024 à Avr 2025