Form DEFA14A - Additional definitive proxy soliciting materials and Rule 14(a)(12) material

22 Juillet 2024 - 9:04PM

Edgar (US Regulatory)

| UNITED

STATES |

| SECURITIES

AND EXCHANGE COMMISSION |

| Washington,

D.C. 20549 |

| |

| SCHEDULE 14A |

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. ) |

| |

| Filed

by the Registrant x |

| |

|

| Filed

by a Party other than the Registrant ¨ |

| |

|

| Check

the appropriate box: |

| |

|

| ¨ |

Preliminary

Proxy Statement |

| |

|

| ¨ |

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

|

| ¨ |

Definitive

Proxy Statement |

| |

|

| ¨ |

Definitive

Additional Materials |

| |

|

| x |

Soliciting

Material under § 240.14a-12 |

| |

| Tellurian

Inc. |

| (Name

of Registrant as Specified in its Charter) |

| |

| |

| (Name

of Person(s) Filing Proxy Statement, if other than the Registrant) |

| |

| Payment

of Filing Fee (Check all boxes that apply): |

| |

|

| x |

No

fee required. |

| |

|

| ¨ |

Fee

paid previously with preliminary materials. |

| |

|

| ¨ |

Fee

computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

The following social media posts were made

by Tellurian Inc. on July 22, 2024:

X Posts

“Following our strategic repositioning

in December, our new leadership has strengthened Tellurian’s position and advanced Driftwood LNG. Woodside’s offer reflects

this progress, providing a significant premium to our share price,” said Martin Houston, Executive Chairman, Tellurian Board of

Directors. See our press release for important information. $TELL #USLNG #LNG https://ir.tellurianinc.com/press-releases/detail/291/tellurian-to-be-acquired-by-woodside-for-approximately-900

Please see our letter from Executive Chairman

Martin Houston to Tellurian shareholders, which contains important information regarding the announced transaction with Woodside Energy

Group Ltd. $TELL #USLNG #LNG http://bit.ly/4d7Jffh

Additional Information and Where to Find It

Tellurian

Inc. (“Tellurian”), the members of Tellurian’s board of directors and certain of Tellurian’s executive

officers are participants in the solicitation of proxies from stockholders in connection with the transaction described in this communication

(the “Merger”). Tellurian plans to file a proxy statement (the “Transaction Proxy Statement”) with the Securities

and Exchange Commission (the “SEC”) in connection with the solicitation of proxies to approve the Merger. Information regarding

such participants, including their direct or indirect interests, by security holdings or otherwise, will be included in the Transaction

Proxy Statement and other relevant documents to be filed with the SEC in connection with the Merger. Additional information about such

participants is available in Tellurian’s definitive

proxy statement in connection with its 2024 Annual Meeting of Stockholders (the “2024 Proxy Statement”), which was filed

with the SEC on April 25, 2024, under “Proposal

1—Election of Directors to the Company’s Board—Background Information About the Nominees and Other Directors,”

“Proposal 1—Election

of Directors to the Company’s Board—Executive Officers,” “Compensation

Discussion and Analysis” and “Security

Ownership of Certain Beneficial Owners and Management.” To the extent that holdings of Tellurian’s securities have changed

since the amounts printed in the 2024 Proxy Statement, such changes have been or will be reflected on Statements of Change in Ownership

on Form 4 filed with the SEC. Information regarding Tellurian’s transactions with related persons is set forth under the caption

“Certain Relationships

and Related Party Transactions” in the 2024 Proxy Statement.

Promptly after filing the definitive Transaction

Proxy Statement with the SEC, Tellurian will mail the definitive Transaction Proxy Statement to each stockholder entitled to vote at

the special meeting to consider the adoption of the Agreement and Plan of Merger, dated as of July 21, 2024, by and among Woodside

Energy Holdings (NA) LLC, Tellurian, and Woodside Energy (Transitory) Inc. (the “Merger Agreement”). STOCKHOLDERS ARE URGED

TO READ THE TRANSACTION PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT DOCUMENTS THAT TELLURIAN

WILL FILE WITH THE SEC WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Stockholders may obtain, free of charge,

the preliminary and definitive versions of the Transaction Proxy Statement, any amendments or supplements thereto, and any other relevant

documents filed by Tellurian with the SEC in connection with the Merger at the SEC’s website (http://www.sec.gov). Copies of Tellurian’s

definitive Transaction Proxy Statement, any amendments or supplements thereto, and any other relevant documents filed by Tellurian with

the SEC in connection with the Merger will also be available, free of charge, at Tellurian’s investor relations website (https://tellurianinc.com).

CAUTIONARY INFORMATION ABOUT FORWARD-LOOKING STATEMENTS

This communication contains forward-looking statements

within the meaning of U.S. federal securities laws. The words “anticipate,” “assume,” “believe,”

“budget,” “estimate,” “expect,” “forecast,” “initial,” “intend,”

“may,” “plan,” “potential,” “project,” “proposed,” “should,”

“will,” “would,” and similar expressions are intended to identify forward-looking statements. Forward-looking

statements herein relate to, among other things, the pending Merger, the expected timing of the closing of the Merger and other statements

that concern Tellurian’s expectations, intentions or strategies regarding the future. There can be no assurance that the Merger

will in fact be consummated. Known and unknown risks and uncertainties could cause actual results to differ materially from those indicated

in the forward-looking statements, including, but not limited to: (i) the risk that the Merger may not be completed on the anticipated

timeline or at all; (ii) the failure to satisfy any of the conditions to the consummation of the Merger, including the risk that

required approvals from Tellurian’s stockholders for the Merger or required regulatory approvals to consummate the Merger are not

obtained, on a timely basis or at all; (iii) the occurrence of any event, change or other circumstance or condition that could give

rise to the termination of the Merger Agreement, including in circumstances requiring Tellurian to pay a termination fee; (iv) the

effect of the announcement or pendency of the Merger on Tellurian’s business relationships, operating results and business generally;

(v) risks that the Merger disrupts Tellurian’s current plans and operations; (vi) Tellurian’s ability to retain

and hire key personnel and maintain relationships with key business partners, customers and others with whom it does business; (vii) the

diversion of management’s or employees’ attention during the pendency of the Merger from Tellurian’s ongoing business

operations and other opportunities; (viii) the amount of costs, fees, charges or expenses resulting from the Merger; (ix) potential

litigation relating to the Merger; (x) the risk that the price of Tellurian’s common stock may fluctuate during the pendency

of the Merger and may decline significantly if the Merger is not completed; and (xi) other risks described in Tellurian’s

filings with the SEC, including in Item 1A of Part I of the Annual Report on Form 10-K of Tellurian for the fiscal year ended

December 31, 2023, filed by Tellurian with the SEC on February 23, 2024, and other Tellurian filings with the SEC, all of which

are incorporated by reference herein. The forward-looking statements in this communication speak as of the date hereof. Although Tellurian

may from time to time voluntarily update its prior forward-looking statements, it disclaims any commitment to do so except as required

by securities laws.

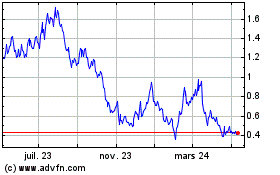

Tellurian (AMEX:TELL)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

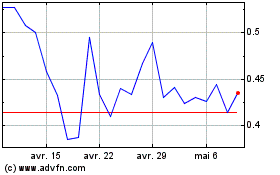

Tellurian (AMEX:TELL)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025