false

0000061398

0000061398

2024-01-02

2024-01-02

0000061398

us-gaap:CommonStockMember

2024-01-02

2024-01-02

0000061398

tell:SeniorNotes8.25PercentDue2028Member

2024-01-02

2024-01-02

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13

or 15(d) of the Securities Exchange Act of 1934

| Date of Report (Date of earliest event reported): |

January 2, 2024 |

|

Tellurian

Inc.

(Exact name of registrant

as specified in its charter)

| Delaware |

|

001-5507 |

|

06-0842255 |

(State

or other jurisdiction of

incorporation) |

|

(Commission

File Number) |

|

(I.R.S.

Employer

Identification No.) |

| 1201

Louisiana Street, Suite

3100, Houston,

TX |

|

77002 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

| Registrant’s telephone number, including

area code: |

(832)

962-4000 |

|

(Former name or former

address, if changed since last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading

symbol |

|

Name of each exchange on which registered |

| Common

stock, par value $0.01 per share |

|

TELL |

|

NYSE

American LLC |

| |

|

|

|

|

| 8.25%

Senior Notes due 2028 |

|

TELZ |

|

NYSE

American LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 1.01 | Entry Into a Material Definitive Agreement. |

On January 2, 2024, Tellurian

Inc. (“Tellurian” or the “Company”) closed the transactions contemplated by the previously announced

letter agreement (the “Letter Agreement”) with an institutional investor (the “Investor”) providing

for the issuance to the Investor of 47,865,061 shares (the “Exchange Shares”) of common stock of the Company. At the

closing of the transactions contemplated by the Letter Agreement, (i) $37,900,000 of the principal amount of the $250,000,000 aggregate

principal amount of 10.00% senior secured notes due 2025 (the “Senior Notes”) previously issued to the Investor was

extinguished, (ii) certain terms of the indentures governing the $83,334,000 aggregate principal amount of 6.00% senior secured convertible

notes due 2025 (the “Convertible Notes,” and together with the Senior Notes, the “Notes”) previously

issued to the Investor and the Senior Notes were amended, and (iii) the Company was deemed to have satisfied its obligations to make

the cash interest payments due in respect of the Notes on January 1, 2024.

The

terms and conditions of the Letter Agreement, the First Amendment to Eighth Supplemental Indenture among Tellurian, Wilmington

Trust, National Association, as trustee (the “Trustee”), and the collateral agent named therein (the “Eighth

Supplemental Indenture Amendment”), and the First Amendment to Ninth Supplemental Indenture among Tellurian, the Trustee, and

the collateral agent named therein (the “Ninth Supplemental Indenture Amendment,” and together with the Eighth Supplemental

Indenture Amendment, the “Supplemental Indenture Amendments”) are summarized in the Company’s Current Report

on Form 8-K filed with the Securities and Exchange Commission (the “SEC”) on December 28, 2023.

Copies of the Eighth Supplemental

Indenture Amendment and the Ninth Supplemental Indenture Amendment are filed as Exhibits 4.1 and 4.2 to this Current Report on Form 8-K

and incorporated herein by reference.

| Item 2.03 | Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant. |

The information set forth

in Item 1.01 is incorporated herein by reference to this Item 2.03.

| Item 3.02 | Unregistered Sales of Equity Securities. |

The information set forth

in Item 1.01 is incorporated herein by reference to this Item 3.02.

The Company and the Investor

closed the transactions contemplated by the Letter Agreement in reliance upon the exemption from securities registration afforded by Section 3(a)(9) of

the Securities Act of 1933, as amended, and the Exchange Shares will be issued under such exemption. The transactions contemplated by

the Letter Agreement were exclusively with the Investor, an existing security holder of the Company, and no commission or other remuneration

will be paid or be given directly or indirectly for soliciting such transactions.

| Item 3.03 | Material Modification to Rights of Security Holders. |

The information set forth

in Item 1.01 is incorporated herein by reference to this Item 3.03.

| Item 5.07 | Submission of Matters to a Vote of Security Holders. |

The information set forth

in Item 1.01 is incorporated herein by reference to this Item 5.07.

On January 2, 2024, the

Investor consented to each of the Supplemental Indenture Amendments. The Investor is the holder of the Notes.

The information set forth

in Item 1.01 is incorporated herein by reference to this Item 8.01.

On January 2, 2024, the

Company filed with the SEC a prospectus supplement to the prospectus included in the registration statement on Form S-3ASR (File

No. 333-269069) to register the resale by the Investor of up to 47,865,061 shares of Tellurian common stock. In connection with such

registration, the Company is filing a legal opinion of Davis Graham & Stubbs LLP as Exhibit 5.1 to this Current Report on

Form 8-K.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

Exhibit

No. |

|

Description |

| 4.1 |

|

First Amendment to Eighth Supplemental Indenture, dated as of January 2, 2024, by and among Tellurian Inc., as issuer, and Wilmington Trust, National Association, as trustee, and the collateral agent named therein, relating to the 10.00% Senior Secured Notes due 2025 |

| |

|

|

| 4.2 |

|

First Amendment to Ninth Supplemental Indenture, dated as of January 2, 2024, by and among Tellurian Inc., as issuer, and Wilmington Trust, National Association, as trustee, and the collateral agent named therein, relating to the 6.00% Senior Secured Convertible Notes due 2025 |

| |

|

|

| 5.1 |

|

Opinion of Davis Graham & Stubbs LLP |

| |

|

|

| 104 |

|

Cover Page Interactive Data File – the cover page interactive data file does not appear in the Interactive Data File because its XBRL tags are embedded within the Inline XBRL document |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

TELLURIAN INC. |

| |

|

|

| Date: January 2, 2024 |

By: |

/s/ Simon G. Oxley |

| |

Name: |

Simon G. Oxley |

| |

Title: |

Executive Vice President and Chief Financial Officer |

Exhibit 4.1

FIRST AMENDMENT TO EIGHTH

SUPPLEMENTAL INDENTURE

FIRST AMENDMENT TO EIGHTH

SUPPLEMENTAL INDENTURE (this “Supplemental Indenture”), dated as of January 2, 2024, by and among TELLURIAN

INC., a Delaware corporation (the “Company”), WILMINGTON TRUST, NATIONAL ASSOCIATION, as trustee (the “Trustee”)

and HB FUND LLC, as collateral agent (the “Collateral Agent”).

W I T N E S S E T H

WHEREAS, the Company

has heretofore executed and delivered to the Trustee an indenture, dated as of June 3, 2022 (the “Base Indenture”),

as amended and supplemented by the eighth supplemental indenture, dated as of August 15, 2023, between the Issuer, the Trustee and

the Collateral Agent (the “Eighth Supplemental Indenture” and the Base Indenture, as amended and supplemented by the

Eighth Supplemental Indenture, the “Indenture”), providing for the issuance of $250,000,000 aggregate principal amount

of the Company’s 10.00% Senior Secured Notes due 2025 (the “Notes”);

WHEREAS, Section 9.2(a) of

the Eighth Supplemental Indenture provides that the Company, the Trustee and the Collateral Agent, as applicable, may, with the consent

of the 100% of Holders (the “Required Holders”), amend or supplement the Indenture, the Notes or the Collateral Documents;

WHEREAS, the Company

and Required Holders have agreed to a repurchase of $37,900,000 of Notes (the “Repurchased Notes”) pursuant to Section 2.18

of the Eighth Supplemental Indenture and a separately negotiated letter agreement, dated December 28, 2023 between the Company and

the Required Holders and the consideration for such repurchase includes all interest due and payable in connection with the January 1,

2024 Interest Payment Date (the “January Payment Date”) on the Notes; and

WHEREAS, the Company

desires, pursuant to Section 9.2(a) of the Eighth Supplemental Indenture, to amend the Indenture with the consent of the Required

Holders.

NOW THEREFORE, for

and in consideration of the provisions set forth herein, it is mutually agreed, for the equal and proportional benefit of the Holders,

from time to time, as follows:

1. Capitalized

Terms. Capitalized terms used herein without definition shall have the meanings assigned to them in the Indenture.

2. Amendments

to the Indenture and Interest Payment Waiver.

a. The

definition of “Liquidity Threshold” contained in Section 1.01 of the Eighth Supplemental Indenture is amended and restated

in its entirety to read as follows:

““Liquidity

Threshold” means the Company’s Liquidity required to be equal to or greater than (a) one hundred seventy million dollars ($170,000,000) (if the Convertible Notes are not outstanding at such time); and (b) two hundred twelve million one hundred thousand

dollars ($212,100,000) (if any of the Convertible Notes are outstanding at such time); provided that in the case of both (a) and

(b), such Cash and Cash Equivalents shall be held in accounts (x) in which the Company and/or the applicable Subsidiaries have

granted the Collateral Trustee a security interest in form and substance acceptable to the Collateral Trustee and (y) with a

Deposit Account Control Agreement in effect with each of such accounts; provided further, that such Deposit Account Control

Agreement(s) shall (I) be “fully blocked”/“access restricted” or similar Deposit Account Control

Agreement(s) that do not allow the Company and its Subsidiaries access to the accounts nor permit the Company and its

Subsidiaries to access the amounts and assets on deposit or credited to such deposit accounts without the consent of the Collateral

Trustee (“Blocked DACA”) and (II) perfect the Collateral Trustee’s security interest in such

accounts.”

b. Section 4.14

of the Eighth Supplemental Indenture is amended and restated in its entirety to read as follows:

“The Company shall have at all

times liquidity calculated as unrestricted, unencumbered Cash or Cash Equivalents of the Company and its Subsidiaries, excluding the

Driftwood Companies, as taken as a whole, in one or more deposit, securities or money market or similar accounts located in the United

States (“Liquidity”) in an aggregate minimum amount equal to (i) forty million dollars ($40,000,000) for

the period commencing on January 2, 2024 through and including the tenth (10th) Trading Day after the end of

the Top-Up Measuring Period (as defined in that certain letter agreement, dated as of December 28, 2023, entered into between HB

Fund LLC and the Company), and (ii) fifty million dollars ($50,000,000) thereafter.”

c. For

all purposes under the Indenture, (i) interest due and payable on the Notes on the January Payment Date has been paid by the

Company directly to the Required Holders in the form of the consideration paid in connection with the Repurchased Notes and (ii) the

Trustee shall have no obligations with respect to the payment of any interest on the Notes on the January Payment Date or the payment

in respect of the Repurchased Notes and shall be entitled to conclusively presume such amounts were paid directly to the Holders.

3. Governing

Law. This Supplemental Indenture shall be governed by and construed in accordance with the laws of the State of New

York.

4. Counterparts. This

Supplemental Indenture may be executed in two or more identical counterparts, all of which shall be considered one and the same agreement

and shall become effective when counterparts have been signed by each party and delivered to the other party. Any signature to this Supplemental

Indenture may be delivered by facsimile, electronic mail (including pdf) or any electronic signature complying with the U.S. federal

ESIGN Act of 2000 or the New York Electronic Signature and Records Act or other transmission method and any counterpart so delivered

shall be deemed to have been duly and validly delivered and be valid and effective for all purposes to the fullest extent permitted by

applicable law. Each party hereto accepts the foregoing and any document received in accordance with this Section 4 shall be deemed

to have been duly and validly delivered and be valid and effective for all purposes to the fullest extent permitted by applicable law.

5. Effect

of Headings. The Section headings herein are for convenience only and shall not affect the construction hereof.

6. The

Trustee. The Trustee makes no representation or warranty as to the validity or

sufficiency of this Supplemental Indenture or with respect to the recitals contained herein, all of which recitals are made solely by

the other parties hereto.

7. Ratification

of Indenture; Supplemental Indenture part of Indenture. Except as expressly amended hereby, the Indenture is in all

respects ratified and confirmed and all the terms, conditions and provisions thereof shall remain in full force and effect. This Supplemental

Indenture shall form a part of the Indenture for all purposes, and every Holder heretofore or hereafter authenticated and delivered shall

be bound hereby.

[Remainder of page intentionally left

blank]

IN WITNESS WHEREOF, the parties

to this Supplemental Indenture have caused this Supplemental Indenture to be duly executed as of the date first written above.

| |

Tellurian Inc. |

| |

|

| |

By: |

/s/ Simon G. Oxley |

| |

|

Name: Simon G. Oxley |

| |

|

Title: Chief Financial Officer |

| |

|

| |

Wilmington Trust, National

Association, as trustee |

| |

|

| |

By: |

/s/ Karen Ferry |

| |

|

Name: Karen Ferry |

| |

|

Title: Vice President |

| |

|

| |

HB Fund LLC, as the Collateral

Agent |

| |

|

| |

By: Hudson Bay Capital

Management LP |

| |

Not individually, but solely

as Investment Advisor to HB Fund LLC |

| |

|

| |

By: |

/s/ George Antonopoulos |

| |

|

Name: George Antonopoulos* |

| |

|

Title: Authorized Signatory |

| |

* Authorized Signatory |

| |

Hudson Bay Capital Management LP |

| |

Not individually, but solely as Investment Advisor

to HB Fund LLC. |

[Signature Page to First Amendment to

Eighth Supplemental Indenture]

In connection with the execution of this First

Amendment to Eighth Supplemental Indenture, dated as of January 2, 2024, by and among the Company, the Trustee and the Collateral Agent, the undersigned holders of the Notes, representing 100% of the

aggregate principal amount of the outstanding Notes immediately prior to execution of this First Amendment to Eighth Supplemental Indenture,

hereby (i) consent to the amendments to the Eighth Supplemental Indenture set forth in Section 2 of this First Amendment to

Eighth Supplemental Indenture; (ii) direct the Trustee to execute the this First Amendment to Eighth Supplemental Indenture; (iii) represent

and warrant that they are the Holders of the aggregate principal amount of the outstanding Notes set forth under their signature line

on the date hereof and have not transferred its position in such Notes; (iv) certify that it has the full power and authority to

deliver this consent and that such power has not been granted or assigned to any other person:

| HOLDER: |

|

| |

|

| HB Fund

LLC |

|

| |

|

| By: |

/s/

George Antonopoulos |

|

| |

Name: |

George Antonopoulos |

|

| |

Title: |

Authorized Signatory* |

|

Aggregate Principal Amount of Notes Held: $250,000,000

* Authorized Signatory

Hudson Bay Capital Management LP

Not individually, but solely as investment adviser to HB Fund LLC

[Signature Page to First Amendment to

Eighth Supplemental Indenture]

Exhibit 4.2

FIRST AMENDMENT TO NINTH SUPPLEMENTAL INDENTURE

FIRST AMENDMENT TO NINTH

SUPPLEMENTAL INDENTURE (this “Supplemental Indenture”), dated as of January 2, 2024, by and among TELLURIAN

INC., a Delaware corporation (the “Company”), WILMINGTON TRUST, NATIONAL ASSOCIATION, as trustee (the “Trustee”)

and HB FUND LLC, as collateral agent (the “Collateral Agent”).

W I T N E S S E T H

WHEREAS, the Company

has heretofore executed and delivered to the Trustee an indenture, dated as of June 3, 2022 (the “Base Indenture”),

as amended and supplemented by the ninth supplemental indenture, dated as of August 15, 2023, between the Issuer, the Trustee and

the Collateral Agent (the “Ninth Supplemental Indenture” and the Base Indenture, as amended and supplemented by the

Ninth Supplemental Indenture, the “Indenture”), providing for the issuance of $83,334,000 aggregate principal amount

of the Company’s 6.00% Senior Secured Convertible Notes due 2025 (the “Notes”);

WHEREAS, Section 9.2(a) of

the Ninth Supplemental Indenture provides that the Company, the Trustee and the Collateral Agent, as applicable, may, with the consent

of the 100% of Holders (the “Required Holders”), amend or supplement the Indenture, the Notes or the Collateral Documents;

WHEREAS, the Company

and Required Holders have agreed to a separately negotiated letter agreement, dated December 28, 2023 (the “Letter Agreement”),

between the Company and the Required Holders and the consideration for such Letter Agreement, all interest due and payable in connection

with the January 1, 2024 Interest Payment Date (the “January Payment Date”) on the Notes shall be paid in

shares of Common Stock pursuant to the Letter Agreement; and

WHEREAS, the Company

desires, pursuant to Section 9.2(a) of the Ninth Supplemental Indenture, to amend the Indenture with the consent of the Required

Holders.

NOW THEREFORE, for

and in consideration of the provisions set forth herein, it is mutually agreed, for the equal and proportional benefit of the Holders,

from time to time, as follows:

1. Capitalized

Terms. Capitalized terms used herein without definition shall have the meanings assigned to them in the Indenture.

2. Amendments

to the Indenture and Interest Payment Waiver.

a. The

definition of “Liquidity Threshold” contained in Section 1.01 of the Ninth Supplemental Indenture is amended and restated

in its entirety to read as follows:

““Liquidity Threshold”

means the Company’s Liquidity required to be equal to or greater than (a) seventy five million dollars ($75,000,000) (if the

Secured Notes are not outstanding at such time); and (b) two hundred twelve million one hundred thousand dollars ($212,100,000)

(if any of the Secured Notes are outstanding at such time); provided that in the case of both (a) and (b), such Cash and Cash Equivalents

shall be held in accounts (x) in which the Company and/or the applicable Subsidiaries have granted the Collateral Trustee a security

interest in form and substance acceptable to the Collateral Trustee and (y) with a Deposit Account Control Agreement in effect with

each of such accounts; provided further, that such Deposit Account Control Agreement(s) shall (I) be “fully blocked”/“access

restricted” or similar Deposit Account Control Agreement(s) that do not allow the Company and its Subsidiaries access to the

accounts nor permit the Company and its Subsidiaries to access the amounts and assets on deposit or credited to such deposit accounts

without the consent of the Collateral Trustee (“Blocked DACA”) and (II) perfect the Collateral Trustee’s

security interest in such accounts.”

b. Section 4.14

of the Ninth Supplemental Indenture is amended and restated in its entirety to read as follows:

“The Company shall have at all

times liquidity calculated as unrestricted, unencumbered Cash or Cash Equivalents of the Company and its Subsidiaries, excluding the

Driftwood Companies, as taken as a whole, in one or more deposit, securities or money market or similar accounts located in the United

States (“Liquidity”) in an aggregate minimum amount equal to (i) forty million dollars ($40,000,000) for

the period commencing on January 2, 2024 through and including the tenth (10th) Trading Day after the end of

the Top-Up Measuring Period (as defined in that certain letter agreement, dated as of December 28, 2023, entered into between HB

Fund LLC and the Company), and (ii) fifty million dollars ($50,000,000) thereafter.”

c. For

all purposes under the Indenture, (i) interest due and payable on the Notes on the January Payment Date has been paid by the

Company directly to the Required Holders in the form of the consideration paid in connection with the Letter Agreement and (ii) the

Trustee shall have no obligations with respect to the payment of any interest on the Notes on the January Payment Date or the payment

in respect of the Letter Agreement and shall be entitled to conclusively presume such amounts were paid directly to the Holders.

3. Governing

Law. This Supplemental Indenture shall be governed by and construed in accordance with the laws of the State of New

York.

4. Counterparts. This

Supplemental Indenture may be executed in two or more identical counterparts, all of which shall be considered one and the same agreement

and shall become effective when counterparts have been signed by each party and delivered to the other party. Any signature to this Supplemental

Indenture may be delivered by facsimile, electronic mail (including pdf) or any electronic signature complying with the U.S. federal

ESIGN Act of 2000 or the New York Electronic Signature and Records Act or other transmission method and any counterpart so delivered

shall be deemed to have been duly and validly delivered and be valid and effective for all purposes to the fullest extent permitted by

applicable law. Each party hereto accepts the foregoing and any document received in accordance with this Section 4 shall be deemed

to have been duly and validly delivered and be valid and effective for all purposes to the fullest extent permitted by applicable law.

5. Effect

of Headings. The Section headings herein are for convenience only and shall not affect the construction hereof.

6. The

Trustee. The Trustee makes no representation or warranty as to the validity or

sufficiency of this Supplemental Indenture or with respect to the recitals contained herein, all of which recitals are made solely by

the other parties hereto.

7. Ratification

of Indenture; Supplemental Indenture part of Indenture. Except as expressly amended hereby, the Indenture is in all

respects ratified and confirmed and all the terms, conditions and provisions thereof shall remain in full force and effect. This Supplemental

Indenture shall form a part of the Indenture for all purposes, and every Holder heretofore or hereafter authenticated and delivered shall

be bound hereby.

[Remainder of page intentionally left

blank]

IN WITNESS WHEREOF, the parties

to this Supplemental Indenture have caused this Supplemental Indenture to be duly executed as of the date first written above.

| |

Tellurian Inc. |

| |

|

| |

By: |

/s/

Simon G. Oxley |

| |

|

Name: Simon G. Oxley |

| |

|

Title: Chief Financial Officer |

| |

|

| |

Wilmington Trust, National

Association, as trustee |

| |

|

| |

By: |

/s/ Karen Ferry |

| |

|

Name: Karen Ferry |

| |

|

Title: Vice President |

| |

|

| |

HB Fund LLC, as the Collateral

Agent |

| |

|

| |

By: Hudson Bay Capital

Management LP |

| |

Not individually, but solely

as Investment Advisor to HB Fund LLC |

| |

|

| |

By: |

/s/ George Antonopoulos |

| |

|

Name: George Antonopoulos* |

| |

|

Title: Authorized Signatory |

| |

* Authorized Signatory |

| |

Hudson Bay Capital Management LP |

| |

Not individually, but solely as Investment Advisor

to HB Fund LLC. |

[Signature Page to First Amendment to

Ninth Supplemental Indenture]

In connection with the execution

of this First Amendment to Ninth Supplemental Indenture, dated as of January 2, 2024, by and among the Company, the Trustee and the Collateral Agent, the undersigned holders of the Notes, representing 100% of the

aggregate principal amount of the outstanding Notes immediately prior to execution of this First Amendment to Ninth Supplemental Indenture,

hereby (i) consent to the amendments to the Ninth Supplemental Indenture set forth in Section 2 of this First Amendment to

Ninth Supplemental Indenture; (ii) direct the Trustee to execute the this First Amendment to Ninth Supplemental Indenture; (iii) represent

and warrant that they are the Holders of the aggregate principal amount of the outstanding Notes set forth under their signature line

on the date hereof and have not transferred its position in such Notes; (iv) certify that it has the full power and authority to

deliver this consent and that such power has not been granted or assigned to any other person:

| HOLDER: |

|

| |

|

| HB Fund

LLC |

|

| |

|

| By: |

/s/

George Antonopoulos |

|

| |

Name: |

George Antonopoulos |

|

| |

Title: |

Authorized Signatory* |

|

Aggregate Principal Amount of Notes Held: $83,334,000

* Authorized Signatory

Hudson Bay Capital Management LP

Not individually, but solely as investment adviser to HB Fund LLC

[Signature Page to First Amendment to

Ninth Supplemental Indenture]

Exhibit 5.1

January 2, 2024

Board of Directors

Tellurian Inc.

1201 Louisiana Street, Suite 3100

Houston, Texas 77002

Ladies and Gentlemen:

We have acted as counsel to

Tellurian Inc., a Delaware corporation (the “Company”), in connection with the filing by the Company of a prospectus

supplement dated January 2, 2024 (the “Prospectus Supplement”), which supplements the registration statement on

Form S-3ASR (Registration No. 333-269069) (the “Registration Statement”)

filed by the Company on December 30, 2022 with the Securities and Exchange Commission (the “SEC”) under the Securities

Act of 1933, as amended (the “Securities Act”), including the base prospectus dated December 30, 2022 included

therein (together with the Prospectus Supplement, the “Prospectus”), relating to the resale by the selling stockholder

named in the Prospectus Supplement (the “Selling Stockholder”) of up to 47,865,061 shares (the “Shares”)

of common stock, par value $0.01 per share, of the Company issued pursuant to that certain letter agreement dated December 28, 2023

(the “Letter Agreement”) by and between the Company and the Selling Stockholder. At the closing of the transactions

contemplated by the Letter Agreement, (i) $37,900,000 of the principal amount of the $250,000,000 aggregate principal amount of 10.00%

senior secured notes due 2025 (the “Senior Notes”) previously issued to the Selling Stockholder was extinguished, (ii) certain

terms of the indentures governing the $83,334,000 aggregate principal amount of 6.00% senior secured convertible notes due 2025 (the “Convertible

Notes,” and together with the Senior Notes, the “Notes”) previously issued to the Selling Stockholder and

the Senior Notes were amended, and (iii) the Company was deemed to have satisfied its obligations to make the cash interest payments

due in respect of the Notes on January 1, 2024.

We have examined originals

or certified copies of the Letter Agreement, the amendments to the supplemental indentures governing the Notes, the Notes, the Registration

Statement and the Prospectus, and such corporate records of the Company, including certain resolutions of the board of directors of the

Company, and other certificates and documents of officials of the Company, public officials and others as we have deemed appropriate for

purposes of this letter. We have assumed the genuineness of all signatures, the legal capacity of each natural person signing any document

reviewed by us, the authority of each person signing in a representative capacity (other than the Company) any document reviewed by us,

the authenticity of all documents submitted to us as originals and the conformity to authentic original documents of all copies submitted

to us or filed with the SEC as conformed and certified or reproduced copies. In conducting our examination of documents, we have assumed

the power, corporate or other, of all parties thereto (other than the Company) to enter into and perform all obligations thereunder and

have also assumed the due authorization by all requisite action, corporate or other, and the due execution and delivery by such parties

of such documents and that to the extent such documents purport to constitute agreements, such documents constitute valid and binding

obligations of such parties. As to any facts material to our opinion, we have made no independent investigation of such facts and have

relied, to the extent that we deem such reliance proper, upon certificates of public officials and officers or other representatives of

the Company.

| Davis Graham & Stubbs LLP ▪ 1550 17th Street, Suite 500 ▪ Denver, CO 80202 ▪ 303.892.9400 ▪ fax 303.893.1379 ▪ dgslaw.com |

Tellurian Inc.

January 2, 2024

Page 2

Based upon the foregoing and

subject to the assumptions, exceptions, qualifications and limitations set forth herein, we are of the opinion that the Shares have been

duly authorized and, when issued and delivered to the Selling Stockholder in accordance with the terms of the Letter Agreement, will be

validly issued, fully paid and non-assessable.

The opinions and other matters

in this letter are qualified in their entirety and subject to the following:

A. The

foregoing opinion is limited to the Delaware General Corporation Law (including the applicable provisions of the Delaware Constitution

and the reported judicial decisions interpreting the Delaware General Corporation Law) and the federal laws of the United States of America.

We are expressing no opinion as to the effect of the laws of any other jurisdiction, domestic or foreign.

B. This

letter is limited to the matters stated herein, and no opinion is implied or may be inferred beyond the matters expressly stated. We assume

herein no obligation, and hereby disclaim any obligation, to make any inquiry after the date hereof or to advise you of any future changes

in the foregoing or of any fact or circumstance that may hereafter come to our attention.

We hereby consent to the filing

of this opinion as an exhibit to the Current Report on Form 8-K filed by the Company on the date hereof and to the use of our name

in the Registration Statement and the Prospectus under the caption “Legal Matters.” In giving this consent, we do not thereby

admit that we are within the category of persons whose consent is required under Section 7 of the Securities Act and the rules and

regulations thereunder.

| | Very truly yours,

/s/ Davis Graham & Stubbs LLP

Davis Graham &

Stubbs LLP

|

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=tell_SeniorNotes8.25PercentDue2028Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

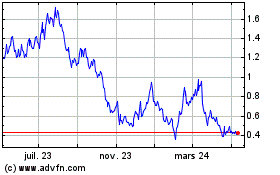

Tellurian (AMEX:TELL)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

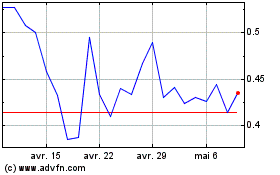

Tellurian (AMEX:TELL)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025