false

0000061398

0000061398

2024-02-27

2024-02-27

0000061398

us-gaap:CommonStockMember

2024-02-27

2024-02-27

0000061398

tell:SeniorNotes8.25PercentDue2028Member

2024-02-27

2024-02-27

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13

or 15(d) of the Securities Exchange Act of 1934

| Date of Report (Date of earliest event reported): |

February 27, 2024 |

|

Tellurian

Inc.

(Exact name of registrant

as specified in its charter)

| Delaware |

|

001-5507 |

|

06-0842255 |

(State

or other jurisdiction of

incorporation) |

|

(Commission

File Number) |

|

(I.R.S.

Employer

Identification No.) |

| 1201

Louisiana Street, Suite

3100, Houston,

TX |

|

77002 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

| Registrant’s telephone number, including

area code: |

(832)

962-4000 |

|

(Former name or former

address, if changed since last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading

symbol |

|

Name of each exchange on which registered |

| Common

stock, par value $0.01 per share |

|

TELL |

|

NYSE

American LLC |

| |

|

|

|

|

| 8.25%

Senior Notes due 2028 |

|

TELZ |

|

NYSE

American LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 2.02 | Results of Operations and Financial Condition. |

The information set forth

in Item 7.01 is incorporated by reference herein.

| Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers. |

On February 27, 2024,

upon the recommendation of the Compensation Committee of the Board of Directors (the “Board”) of Tellurian Inc. (the

“Company”), the Board approved the following base salary and target short-term and long-term compensation under the

Tellurian Inc. Incentive Compensation Program (the “ICP”) for the President of the Company, Daniel Belhumeur:

| Name and principal position | |

Base salary | | |

Target short-term

compensation

(as a percentage of

base salary) | | |

Target long-term

compensation

(as a percentage of

base salary) | |

| Daniel A. Belhumeur, President (1) | |

$ | 850,000 | | |

| 120 | % | |

| 350 | % |

| (1) | On February 27, 2022, upon the recommendation of the Compensation Committee of the Board, the Board

approved increases in Mr. Belhumeur’s base salary (from $525,000), effective as of January 1, 2024, and Mr. Belhumeur’s

target short-term and long-term compensation under the ICP (from 100% and 300%, respectively). |

On March 1, 2024, the

Board elected not to renew or extend the term of the Company’s employment agreement with Octávio Simões, the Chief

Executive Officer of the Company, beyond the term ending on June 5, 2024.

| Item 7.01 | Regulation FD Disclosure. |

On March 4, 2024 Tellurian

Inc. posted a letter to shareholders and an updated corporate presentation to its website, www.tellurianinc.com. Copies of the letter

to shareholders and corporate presentation are attached as Exhibits 99.1 and 99.2, respectively, to this Current Report on Form 8-K

and are incorporated herein by reference.

The information in this Item 7.01,

including the information set forth in Exhibits 99.1 and 99.2, is being furnished and shall not be deemed “filed” for

purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), nor shall it be

deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly

set forth by specific reference in such a filing.

On February 27, 2024,

the Board of the Company appointed Chairman of the Board Martin Houston to the position of Executive Chairman.

| Item 9.01 | Financial Statements and Exhibits. |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

TELLURIAN INC. |

| |

|

|

| Date: March 4, 2024 |

By: |

/s/ Simon G. Oxley |

| |

Name: |

Simon G. Oxley |

| |

Title: |

Executive Vice President and Chief Financial Officer |

Exhibit 99.1

4th March 2024

Dear shareholders of Tellurian,

On February 23rd we issued our

2023 financial results, capping off a year of change for our company. Today we are releasing our new Corporate Presentation which describes

the path forward, including the near-term priorities and strategies for longer term value creation for our company.

We remain steadfast in our commitment to developing

Driftwood LNG, which will supply low-cost US-sourced LNG to global markets. In that pursuit, we have taken several necessary steps to

advance our efforts while improving our financial strength.

| · | We received our extension authorization from FERC, which will allow us time to complete all five plants

of Driftwood. |

| · | The recent announcements from the DOE, along with additional focus and simplification, have helped our

commercial efforts. |

| · | We are exploring options to monetize our upstream gas production business as announced on February 6th. |

| · | We’ve widened the commercial aperture, whilst maintaining our business model. |

| · | We have materially reduced corporate overhead and strengthened our balance sheet. |

| · | We restructured certain debt obligations, giving us further liquidity and runway. |

| · | We have agreed to amend delivery dates for long-lead equipment and to extend Driftwood LNG construction

work. |

| · | Last Tuesday, February 27th, the Board appointed me as Executive Chairman. This is part

of a leadership succession and renewal process which will be implemented in the coming months. |

All these actions demonstrate the renewed focus

on delivering value for our shareholders and customers.

Permits – we have all of them and we

are un-constrained.

Externally, the Biden Administration is now taking

an expanded interest in the LNG export approval process. These changes have “paused” additional approvals for other LNG facilities

for some unknown period. Tellurian and a few other companies with existing permits are not impacted.

These changes benefit Tellurian as we are now

one of a few facilities with uncontracted capacity for LNG deliveries in 2028. We have a tremendous opportunity to capitalize on this

market shift as we continue to seek equity partners and sales and purchase agreements with customers for Driftwood.

Upstream – no longer a core strategic

need.

This is a pure capital allocation decision as

we focus on developing Driftwood and assess the best way to fund our operations. Our upstream business is less of a strategic fit in a

world where the US gas market has shown us there is abundant resource availability.

With this in mind, we are comfortable building

a supply model centered on third party producers, as is the case for most US LNG export projects. For potential gas producers, our upstream

assets offer the opportunity to acquire existing production with sizeable undrilled inventory that they may be able to develop faster

than we would, pulling forward value.

Accordingly, with the help of Lazard, we aim to

sell the upstream business, which is a high-quality enterprise. Our Haynesville and Bossier assets are Tier 1, and we know first-hand

that there is keen interest from quality buyers.

Balance sheet – strengthened to provide

commercial runway.

We’re tackling the balance sheet in four

ways. Firstly, we have reduced our costs. Secondly, we reduced our debt with the early debt-for-equity swap. Next, we expect to use proceeds

from our upstream sale to reduce our indebtedness. Finally, we have amended the terms of the indentures governing our senior secured notes

and senior secured convertible notes to reduce our cash obligations in the short term and provide incremental financial flexibility through

a reduced minimum liquidity requirement. The goal is to put the company on more stable financial footing and to limit equity dilution.

Commercial – opening the aperture to

a wider customer base.

We expanded our outreach to customers and are

meeting the market at current terms. Our approach does not radically change our model; however, it recognizes the clearing price for LNG

SPAs and ensures we are positioned to match it. We are positioned well compared to other LNG sellers both in the US and internationally.

We also can offer commercial options to both domestic

sellers of natural gas as well as global LNG buyers alongside options to partner with us directly in Driftwood. Furthermore, we are fully

utilizing our competitively advantaged status since the DOE’s announcement. We are already seeing increased intensity of discussions

with a wider range of potential customers and partners. This work is moving at pace. The range of potential LNG counterparties is as wide

and deep as it’s ever been in my long career in this industry.

On the JV and equity investment side, strategic

gas assets, especially in the US, are seen as compelling investments in a world that is endeavoring to lower carbon intensity while earning

a steady, predictable return. For pure LNG offtake, pricing stability continues to bring in new LNG markets and the expansions of traditional

ones. And lastly, consolidation in the US shale sector allows remaining companies to think and act more globally in scope.

I am confident about both our strategy and our

direction. We are shareholders too, and we are completely aligned with your interests and invested in ensuring Tellurian’s ultimate

success. I can assure you that we are working as fast as possible for your benefit.

Thank you for your continued support, feedback,

and investment. We appreciate you immensely.

Martin Houston

Executive Chairman

Tellurian Inc.

CAUTIONARY INFORMATION ABOUT FORWARD-LOOKING

STATEMENTS

This communication contains forward-looking statements

within the meaning of U.S. federal securities laws. The words “anticipate,” “assume,” “believe,” “budget,”

“estimate,” “expect,” “forecast,” “initial,” “intend,” “may,”

“plan,” “potential,” “project,” “proposed,” “should,” “will,”

“would,” and similar expressions are intended to identify forward-looking statements. Forward-looking statements herein relate

to, among other things, strategic, commercial, competitive and regulatory matters and the potential sale of our upstream assets. These

statements involve a number of known and unknown risks, which may cause actual results to differ materially from expectations expressed

or implied in the forward-looking statements. These risks include the matters discussed in Item 1A of Part I of the Annual Report

on Form 10-K of Tellurian for the fiscal year ended December 31, 2023, filed by Tellurian with the Securities and Exchange Commission

(the SEC) on February 23, 2024, and other Tellurian filings with the SEC, all of which are incorporated by reference herein. The

forward-looking statements in this communication speak as of the date of this communication. Although Tellurian may from time to time

voluntarily update its prior forward-looking statements, it disclaims any commitment to do so except as required by securities laws.

Exhibit 99.2

Licensed to export US LNG Delivering the transition Providing energy security March 2024

Cautionary language regarding forward - looking statements The information in this presentation includes “forward - looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical fact are forward - looking statements. The words “anticipate,” “assume,” “believe,” “budget,” “estimate,” “expect,” “forecast,” “initial,” “intend,” “may,” “model,” “plan,” “potential,” “project,” “should,” “will,” “would,” and similar expressions are intended to identify forward - looking statements. The forward - looking statements in this presentation relate to, among other things, commodity prices and demand (including the relationship between domestic and international gas/LNG prices), Driftwood capacity, future demand and supply affecting LNG and general energy markets, liquidity, competitive factors, financial and operating results (including income, production, costs, cash flows and returns), environmental matters, financing efforts and FID, the terms of future contracts, the potential sale of the upstream properties, permitting matters, terms of LNG offtake and other agreements, LNG production, Driftwood construction, growth opportunities, the timing of all of the foregoing, and other aspects of our business and our prospects and those of other industry participants. Our forward - looking statements are based on assumptions and analyses made by us in light of our experience and our perception of historical trends, current conditions, expected future developments, and other factors that we believe are appropriate under the circumstances. These statements are subject to numerous known and unknown risks and uncertainties which may cause actual results to be materially different from any future results or performance expressed or implied by the forward - looking statements. These risks and uncertainties include those described in the “Risk Factors” section of our Annual Report on Form 10 - K for the fiscal year ended December 31, 2023, and our other filings with the Securities and Exchange Commission, which are incorporated by reference in this presentation. Many of the forward - looking statements in this presentation relate to events or developments anticipated to occur numerous years in the future, which increases the likelihood that actual results will differ materially from those indicated in such forward - looking statements. A full notice to proceed with construction of the Driftwood Project is subject to the completion of financing arrangements that may not be completed within the time frame expected or at all. The financial information included is meant for illustrative purposes only and does not purport to show estimates of actual future financial performance. The information on that slide assumes the completion of certain financing and other transactions. Such transactions may not be completed on the assumed terms or at all. Actual commodity prices and contract terms may vary materially from the commodity prices and contract terms assumed for the purposes of the illustrative financial performance information. The forward - looking statements made in or in connection with this presentation speak only as of the date hereof. Although we may from time to time voluntarily update our prior forward - looking statements, we disclaim any commitment to do so except as required by securities laws. 2

Investing now to meet global demand 3 The world requires low - carbon energy to support future economic growth Our purpose is to export reliable, low cost, and low - carbon US LNG to the world Tellurian offers a pure - play, growth - focused investment in US LNG The company is fully permitted 1 to export 27.6 mtpa of US LNG Tellurian’s new leadership is bringing together demand, gas supply and investment We have sharpened our focus on stability, financial discipline, and execution Tellurian is building export infrastructure in a prime location near Lake Charles, LA We have additional land with deep water access to allow us to grow up to ~60 mtpa See Supplemental Information for footnotes.

4 “Driftwood is in construction and is fully permitted . We are differentiated from competing projects fighting the US regulatory headwinds. Tellurian’s Board and leadership are laser focused on delivering value to Tellurian shareholders. Alongside balance sheet discipline , we have reduced costs , widened our commercial aperture and increased the pace of activity in the marketplace. In just two months, we have made great progress.” Martin Houston Executive Chairman, Co - Founder 40+ years of energy industry experience

Tellurian’s recent advances 5 Leadership focus Regulatory advancement Balance sheet management • All permits in place • FERC extension approval granted for 27.6 mtpa • Confirmation by DOE that Driftwood non - FTA permit not impacted by current ‘pause’ • Newly appointed Executive Chairman, with decades of LNG experience • Board and leadership teams are laser - focused on delivering shareholder value • Appointment of world - class advisors Leadership focus • Materially reduced corporate overhead • Amended debt agreements to create more sustainable capital structure and improve liquidity without impacting Driftwood timeline • Restructured major payment obligations with partners, lowering near - term liquidity needs Commercial aperture • Widened customer base by way of increased commercial flexibility • Commercially attractive offering conveys current market terms

6 • All permits in place for construction & operation of terminal and pipeline • Competitive regulatory advantage given recent DOE moratorium on non - FTA permits • Only world - scale greenfield facility with capacity for US LNG deliveries in 2028 • Over $1 billion invested: construction ~30% advanced, and sub - surface risk mitigated • 1,200 - acre site with pipeline access to multiple major gas supply hubs Driftwood LNG terminal to export up to 27.6 mtpa Driftwood LNG: de - risked & moving forward

7 Driftwood LNG site progress continuing Being in construction has mitigated regulatory risk Completed ground work has de - risked future EPC timeline and associated costs

Construction milestones Financing process Focused on efficiently reaching Driftwood FID, driving shareholder value 8 Commercial steps Driftwood is... • Offering competitive and financeable contracts that appeal to a wide range of customers • Marketing offtake agreements at Henry Hub index with a liquefaction fee Tellurian is… • Pursuing project financing for Driftwood • Strengthening Tellurian’s cost structure, balance sheet, and financial discipline • Retiring debt secured by upstream assets upon sale Driftwood plans to… • I ssue a full notice to proceed to Bechtel to begin construction for Phase 1 in 2H 2024 1 • Produce first LNG by 2028 • Maximize shareholder returns See Supplemental Information for footnotes.

World - class partners providing best - in - class execution, and design & technology expertise 9 EPC partner • Lump - sum, turn - key EPC contract for all - plant buildout • Premier EPC contractor with history of on - budget and ahead - of - schedule production on US Gulf Coast • Ability to benefit from economies of scale via all - plant buildout schedule Equipment & technology partner • LM6000PF+ turbines reduce fuel gas use, lowering emissions without sacrificing production • Proven aeroderivative turbines and compressors for Driftwood LNG plant • Near - zero emissions via integrated ICL pipeline compressors Liquefaction technology partner • Simplified construction, operation, and maintenance through midscale size and cold box design • Highly efficient, proprietary IPSMR process technology • Increased uptime and redundancy via multi - train design

Driftwood value to Tellurian 10 $800 - 850 EPC cost per tonne 1 $750 $600 - 650 850 1,700 1,250 850 1,800 550 Plants 1 - 3 Plants 4 - 5 Full development Illustrative Driftwood annual cash flows Debt adjusted annual cash flows 2033 - 2034, $MM/ yr Tellurian cash flows Partner cash flows See Supplemental Information for footnotes. Driftwood annual cash flows in excess of $3bn at full development Driftwood • Tellurian expects to own 35% - 40% of Plants 1 and 2 and an increasing share of expansion plants • Plants 1 and 2 are expected to FID in 2024 with Plant 3 expected six to nine months thereafter • Fixed fee contracts to maximize low - cost debt • Increasing merchant exposure over time to reflect Tellurian’s enhanced balance sheet capabilities

16.6 27.6 11.0 Plants 1 - 3 Plants 4 - 5 Driftwood LNG ~ 30.0 Site II LNG Site II enables up to 60 mtpa of LNG capacity 11 Site II could double Tellurian LNG capacity offering long - term shareholder value See Supplemental Information for footnotes. Site II • Further ~800 - acre site in Louisiana with deep draft access, ideal for waterborne export development • Potential expansion options include a second LNG facility, and/or an energy transition hub benefiting from IRA subsidies • Offers incremental long - term value for shareholders 2 LNG capacity development Full phase development, mtpa Creole Trail Site Driftwood LNG Site II FID 2024 1 First LNG 2028 FID 2026/27

US LNG continues to be critical to global energy security 12 See Supplemental Information for footnotes. Global LNG demand is forecast to grow by >50% by 2035 Macro • Global demand for LNG to rise by 54% to over 620 mtpa by 2035, a CAGR of 4% • Global LNG supply forecasts impacted by non - FTA ‘pause’ • Market is pivoting to long - term contracts to guarantee security of supply US LNG producers • The US is the world’s largest LNG exporter and respected as a reliable counterparty • Tellurian is helping overcome global challenges of energy affordability, availability, and security while reducing emissions for the power sector 2025 2030 2035 2040 200 750 Existing supply Supply forecast Demand forecast ~170 mtpa shortage Global LNG deficit of >150 mtpa by year 2040 2024 Baseline year, mtpa 1

Our environmental credentials 1 3 Driftwood’s business model enables top quartile Scope 1 ESG ratings 13 Liquefaction Pipelines Power supply Wetlands restoration • 20% lower emissions via leading gas turbine technology 1 • Minimizing of flaring via development of warm start - up sequence • Reduction in Scope 1 emissions by maximizing welded pipe connections • Creation of North America’s first near - zero emission pipeline due to electric compression technology • E mission - free actuators installed on more than 90% of pipeline valves • Execution of MoU with Entergy Louisiana to identify and evaluate new, potential low - or zero - carbon energy generation and delivery solutions • Committed to create ~3,000 acres of restored coastal marsh, which is 4x regulatory requirement • L argest privately funded marsh restoration project in the Gulf Coast area • Partnered with Stream Wetland Services, one of the leading wetland experts in Louisiana See Supplemental Information for footnotes and Tellurian ESG Report 2022.

Purpose Supplying growing global markets with low - cost US LNG Position Driftwood is being constructed on a prime Louisiana location, connecting abundant US natural gas basins with international export routes People Refreshed Board and management team, with the experience and focus to deliver Permitting Fully permitted, putting Driftwood ahead of competitors during DOE pause in approvals. First LNG anticipated in 2028 Our competitive advantages create value for customers and investors 14

Supplemental information 15 Slide 3 1) Tellurian requested extensions with FERC in October 2023 for 36 months extension to finish construction of Driftwood and was gra nted approval on February 15, 2023. Slide 8 1) Phase 1 defined as 2 plant, ~11 mtpa scope. Slide 10 1) Management estimates on EPC costs. 2) Assumes 35% ownership stake in Plants 1 - 2, 50% ownership in Plant 3, 60% ownership in Plant 4, and 65% ownership in Plant 5. Ass umes $2bn in project bonds and $5.5bn in senior debt at 6.25%, $15 LNG price, $10bn EPC price, and $2.35 SPA price in all phases, esc alated accordingly for future phases. Slide 11 1) Management estimates for FID and First LNG dates. FID for Plants 1&2 in 2024. FID for Plant 3 in 2025. 2) Assumes analogous site to Driftwood LNG is permitted and constructed on Site II with design and project execution synergies b etw een two projects. Slide 12 1) Sources: IEA, WoodMackenzie , Shell LNG Outlook 2024, and Tellurian internal research. Slide 13 1) Compared to standard industrial frames . For additional information, a copy of the 2022 Tellurian ESG Report can be found at: https://www.tellurianinc.com/corporate - social - responsibility/esg - performance - summary/.

Contact us 16 Johan Yokay Director, Investor Relations & Assistant Treasurer +1 832 320 9327 johan.yokay@tellurianinc.com Joi Lecznar EVP, Public & Government Affairs +1 832 962 4044 joi.lecznar@tellurianinc.com Matt Phillips VP, Investor Relations & Finance +1 832 320 9331 matthew.phillips@tellurianinc.com

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=tell_SeniorNotes8.25PercentDue2028Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

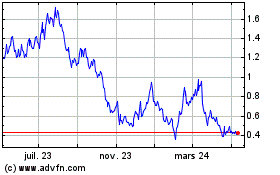

Tellurian (AMEX:TELL)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

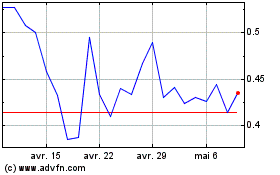

Tellurian (AMEX:TELL)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025