| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| |

| SCHEDULE 14A |

|

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. ) |

| |

| Filed by the Registrant x |

| |

|

| Filed by a Party other than the Registrant ¨ |

| |

|

| Check the appropriate box: |

| |

|

| ¨ |

Preliminary Proxy Statement |

| |

|

| ¨ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

|

| ¨ |

Definitive Proxy Statement |

| |

|

| ¨ |

Definitive Additional Materials |

| |

|

| x |

Soliciting Material under § 240.14a-12 |

| |

| Tellurian Inc. |

| (Name of Registrant as Specified in its Charter) |

| |

| |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| |

| Payment of Filing Fee (Check all boxes that apply): |

| |

|

| x |

No fee required. |

| |

|

| ¨ |

Fee paid previously with preliminary materials. |

| |

|

| ¨ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

The following letter was made available by

Tellurian Inc. on July 21, 2024:

21 July 2024

Dear shareholders of Tellurian,

You will by now have seen the announcement that

the Board of Tellurian will be recommending that you approve the purchase of Tellurian by Woodside Energy Group Limited, a company headquartered

in Perth, Australia. In this letter, I want to explain why the Board firmly believes this transaction is in your and the company’s

best interests.

First, and most importantly, this transaction

delivers substantial and certain value for our shareholders with its all-cash offer of $1.00 per share, representing a 75% premium on

Tellurian’s closing price as of July 19, and a 48% premium to Tellurian’s 30-day volume weighted average price. The implied

total enterprise value of the transaction, including net debt, is approximately $1.2 billion.

The Woodside offer fully reflects the company’s

recent progress. When we instituted new leadership last December, Tellurian faced significant challenges. As I have previously outlined,

we have been executing our refreshed strategy focused on strengthening the company’s position, improving our commercial offering,

and bringing Driftwood to FID. This offer would not have materialized without the hard work and advances made over these last several

months. I would like to thank everyone at Tellurian who made this possible.

Second, despite our recent progress, we’ve

been clear that the company’s situation necessitated an exploration of all possible alternatives, including a potential sale. The

Board had to thoughtfully consider the risks and costs associated with continuing to develop Driftwood on our own versus other alternatives.

Ultimately, we decided the attractive offer in hand outweighed the risks and uncertainty associated with going it alone.

There are additional factors that led to our decision,

and which support the Board’s unanimous view that this transaction is the best outcome for our shareholders and for Tellurian:

| · | Timing and speed. This is a transaction

which can be executed now, whereas the financing required to bring Driftwood into FID is contingent on commercial agreements with LNG

buyers who may seek greater certainty from brownfield expansions or from project developers with larger balance sheets. |

| · | Equity and debt financing. While the equity

and debt required to launch Driftwood was available, fewer equity capital providers are seeking development projects in the US. Equity

providers are now less inclined to take risk ahead of projects being fully contracted. This makes the development process more sequential,

and therefore extends the period over which we must self-fund. |

| · | A credible partner. Woodside already has

10 mtpa of equity LNG in Australia and its strategy is to grow that globally. A complementary US position allows Woodside to better service

its customers from a global portfolio and capture further marketing optimization across both Pacific & Atlantic basins. These advantages

cannot easily be replicated by Tellurian on a stand-alone basis and provide a strong rationale for Woodside for the transaction. |

So, this transaction brings benefits to our shareholders

now. Woodside is a high-quality operator, with better access to the substantial financial resources required to launch an LNG project,

and a greater ability to manage offtake risk. Woodside has, after extensive negotiation, agreed to pay a significant premium to our share

price in cash, delivering value and certainty. Of course, we have tested the valuation with our own advisors, including Lazard.

The Board recommends that shareholders accept

Woodside’s offer. Having weighed the balance of the risk and return, we believe it is the best outcome for shareholders.

In due course, we intend to file a proxy statement

with more information on the transaction. We ask that you look out for the proxy materials and vote your shares at the appropriate time.

You may setup e-mail alerts, visit our investor relations website, or follow our SEC filings to receive the most

up-to-date shareholder communications.

Thank you for your support and feedback over these

last several months and beyond. I will continue to update you as the transaction process progresses, and as always, remain open to your

comments and feedback.

Martin Houston

Executive Chairman

Additional Information and Where to Find It

Tellurian Inc. (“Tellurian”), the

members of Tellurian’s board of directors and certain of Tellurian’s executive officers are participants in the solicitation

of proxies from stockholders in connection with the transaction described in this communication (the “Merger”). Tellurian

plans to file a proxy statement (the “Transaction Proxy Statement”) with the Securities and Exchange Commission (the “SEC”)

in connection with the solicitation of proxies to approve the Merger. Information regarding such participants, including their direct

or indirect interests, by security holdings or otherwise, will be included in the Transaction Proxy Statement and other relevant documents

to be filed with the SEC in connection with the Merger. Additional information about such participants is available in Tellurian’s

definitive proxy statement

in connection with its 2024 Annual Meeting of Stockholders (the “2024 Proxy Statement”), which was filed with the SEC on April

25, 2024, under “Proposal

1—Election of Directors to the Company’s Board—Background Information About the Nominees and Other Directors,”

“Proposal 1—Election

of Directors to the Company’s Board—Executive Officers,” “Compensation

Discussion and Analysis” and “Security

Ownership of Certain Beneficial Owners and Management.” To the extent that holdings of Tellurian’s securities have changed

since the amounts printed in the 2024 Proxy Statement, such changes have been or will be reflected on Statements of Change in Ownership

on Form 4 filed with the SEC. Information regarding Tellurian’s transactions with related persons is set forth under the caption

“Certain Relationships

and Related Party Transactions” in the 2024 Proxy Statement.

Promptly after filing the definitive Transaction

Proxy Statement with the SEC, Tellurian will mail the definitive Transaction Proxy Statement to each stockholder entitled to vote at the

special meeting to consider the adoption of the Agreement and Plan of Merger, dated as of July 21, 2024, by and among Woodside Energy

Holdings (NA) LLC, Tellurian, and Woodside Energy (Transitory) Inc. (the “Merger Agreement”). STOCKHOLDERS ARE URGED TO READ

THE TRANSACTION PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT DOCUMENTS THAT TELLURIAN WILL

FILE WITH THE SEC WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Stockholders may obtain, free of charge,

the preliminary and definitive versions of the Transaction Proxy Statement, any amendments or supplements thereto, and any other relevant

documents filed by Tellurian with the SEC in connection with the Merger at the SEC’s website (http://www.sec.gov). Copies of Tellurian’s

definitive Transaction Proxy Statement, any amendments or supplements thereto, and any other relevant documents filed by Tellurian with

the SEC in connection with the Merger will also be available, free of charge, at Tellurian’s investor relations website (https://tellurianinc.com).

CAUTIONARY INFORMATION ABOUT FORWARD-LOOKING

STATEMENTS

This communication contains forward-looking statements

within the meaning of U.S. federal securities laws. The words “anticipate,” “assume,” “believe,” “budget,”

“estimate,” “expect,” “forecast,” “initial,” “intend,” “may,”

“plan,” “potential,” “project,” “proposed,” “should,” “will,”

“would,” and similar expressions are intended to identify forward-looking statements. Forward-looking statements herein relate

to, among other things, the pending Merger, the expected timing of the closing of the Merger and other statements that concern Tellurian’s

expectations, intentions or strategies regarding the future. There can be no assurance that the Merger will in fact be consummated. Known

and unknown risks and uncertainties could cause actual results to differ materially from those indicated in the forward-looking statements,

including, but not limited to: (i) the risk that the Merger may not be completed on the anticipated timeline or at all; (ii) the failure

to satisfy any of the conditions to the consummation of the Merger, including the risk that required approvals from Tellurian’s

stockholders for the Merger or required regulatory approvals to consummate the Merger are not obtained, on a timely basis or at all; (iii)

the occurrence of any event, change or other circumstance or condition that could give rise to the termination of the Merger Agreement,

including in circumstances requiring Tellurian to pay a termination fee; (iv) the effect of the announcement or pendency of the Merger

on Tellurian’s business relationships, operating results and business generally; (v) risks that the Merger disrupts Tellurian’s

current plans and operations; (vi) Tellurian’s ability to retain and hire key personnel and maintain relationships with key business

partners, customers and others with whom it does business; (vii) the diversion of management’s or employees’ attention during

the pendency of the Merger from Tellurian’s ongoing business operations and other opportunities; (viii) the amount of costs, fees,

charges or expenses resulting from the Merger; (ix) potential litigation relating to the Merger; (x) the risk that the price of Tellurian’s

common stock may fluctuate during the pendency of the Merger and may decline significantly if the Merger is not completed; and (xi) other

risks described in Tellurian’s filings with the SEC, including in Item 1A of Part I of the Annual Report on Form 10-K of Tellurian

for the fiscal year ended December 31, 2023, filed by Tellurian with the SEC on February 23, 2024, and other Tellurian filings with the

SEC, all of which are incorporated by reference herein. The forward-looking statements in this communication speak as of the date hereof.

Although Tellurian may from time to time voluntarily update its prior forward-looking statements, it disclaims any commitment to do so

except as required by securities laws.

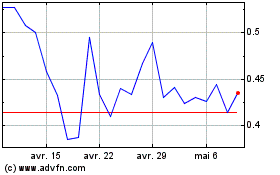

Tellurian (AMEX:TELL)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

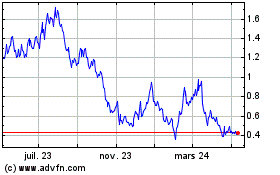

Tellurian (AMEX:TELL)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024