AgEagle Announces Third Quarter 2023 Results

14 Novembre 2023 - 10:30PM

AgEagle Aerial Systems

Inc. (NYSE American: UAVS) (“AgEagle” or the

“Company”), an industry-leading provider of full stack flight

hardware, sensors and software for commercial and government use,

today announces its financial results for the three and nine months

ended September 30, 2023.

Third Quarter 2023 Financial Highlights

- Revenues totaled $3.48 million for

the three months ended September 30, 2023, decreasing 37% from

$5.49 million reported for the same three-month period in the prior

year. Nine-month revenues totaled $10.81 million in 2023, which

were down 26% from $14.62 million for the first nine months of

2022.

- The decrease in revenues was

largely due to lower sales of the Company’s eBee™ series

of drones – a decline that was expected in conjunction with the

commercial launch of AgEagle’s new eBee VISION in

September 2023.

- Total operating expenses increased

minimally to $7.20 million from $7.23 million for the three-month

reporting periods ended September 30, 2023 and 2022. They were

reduced by 28% to $19.24 million from $24.01 million for the

comparable nine-month reporting periods.

- Loss from operations increased 14%

to $5.99 million from $5.15 million for the three months ended

September 30, 2023 and 2022, respectively; and were reduced 17% to

$15.02 million from $18.02 million for the nine months ended

September 30, 2023 and 2022, respectively.

- As of June 30, 2023, AgEagle’s cash

position was $1.6 million, which compared to cash of $4.35 million

as of December 31, 2022.

For more detailed information relating to the

Company’s second quarter financial performance, please refer to the

Interim Report on Form 10-Q filed yesterday afternoon with the U.S.

Securities and Exchange Commission and accessible

at www.sec.gov or on AgEagle’s website

at www.ageagle.com.

Third Quarter 2023 Operational Highlights

- The Company announced

that DeltaQuad, a global leader in the

development, design and production of electrical, long range

Vertical Take-Off and Landing (“VTOL”) drones, is the first to

fully integrate AgEagle’s latest sensor innovation,

the RedEdge-P™ dual,

in its

new DeltaQuad EVO.

- Commercial production of the

Company’s next generation fixed-wing unmanned aerial system,

the eBee™ VISION

commenced and orders for the systems are now being accepted.

-

Kelluu Ltd., a

privately-owned Finnish company engaged in the design, manufacture

and operation of autonomous airships for aerial environmental and

critical infrastructure monitoring and surveillance announced it

has chosen to equip its growing fleet of unmanned airships with

AgEagle’s high performance RedEdge-P™ multispectral

cameras for collection of high-quality images and sensor data.

- AgEagle completed an offering of

16,720,000 shares of common stock and 25,080,000 common stock

purchase warrants (the "common warrant") to purchase 25,080,000

shares of common stock at a combined price of $0.25 per share and

accompanying common warrants for aggregate gross proceeds of

approximately $4.2 million, before deducting placement agent fees

and other offering expenses.

Barrett Mooney, AgEagle’s Chairman and CEO,

stated, “We enter the fourth quarter of 2023 optimistic about the

Company’s long-term growth potential following the commercial

release of our new eBee VISION drone. Given the rise in

geopolitical conflicts and correlating increase in drone usage, we

believe that AgEagle is well-positioned to support the increasing

demand while remaining committed to achieving cost and productivity

efficiencies and executing ongoing product innovation and our

global marketing strategies.”

About AgEagle Aerial Systems Inc.

Through its three centers of excellence, AgEagle

is actively engaged in designing and delivering best-in-class

flight hardware, sensors and software that solve important problems

for its customers. Founded in 2010, AgEagle was originally formed

to pioneer proprietary, professional-grade, fixed-winged drones and

aerial imagery-based data collection and analytics solutions for

the agriculture industry. Today, AgEagle is a leading provider of

full stack drone solutions for customers worldwide in the energy,

construction, agriculture, and government verticals. For additional

information, please visit our website

at www.ageagle.com.

Forward-Looking Statements

This press release may contain “forward-looking

statements” within the meaning of Section 27A of the Securities Act

of 1933 and Section 21E of the Securities Exchange Act of 1934.

Such statements involve risks and uncertainties that could

negatively affect our business, operating results, financial

condition, and stock price. Factors that could cause actual results

to differ materially from management’s current expectations include

those risks and uncertainties relating to our competitive position,

the industry environment, potential growth opportunities, and the

effects of regulation and events outside of our control, such as

natural disasters, wars, or health epidemics. We expressly disclaim

any obligation or undertaking to release publicly any updates or

revisions to any forward-looking statements contained herein to

reflect any change in our expectations or any changes in events,

conditions, or circumstances on which any such statement is based,

except as required by law.

AgEagle Aerial Systems Contacts:

Investor

Relations:Email: UAVS@ageagle.comMedia: Email: media@ageagle.com

SYSTEMS INC. AND SUBSIDIARIESCONDENSED

CONSOLIDATED BALANCE SHEETS

| |

|

As of |

|

| |

|

September 30, 2023 |

|

|

December 31, 2022 |

|

| |

|

(unaudited) |

|

|

|

|

| ASSETS |

|

|

|

|

|

|

|

|

| CURRENT

ASSETS: |

|

|

|

|

|

|

|

|

|

Cash |

|

$ |

1,600,143 |

|

|

|

$ |

4,349,837 |

|

|

Accounts receivable, net |

|

|

2,015,045 |

|

|

|

|

2,213,040 |

|

|

Inventories, net |

|

|

6,063,935 |

|

|

|

|

6,685,847 |

|

|

Prepaid and other current assets |

|

|

832,188 |

|

|

|

|

1,029,548 |

|

|

Notes receivable |

|

|

185,000 |

|

|

|

|

185,000 |

|

|

Total current assets |

|

|

10,696,311 |

|

|

|

|

14,463,272 |

|

| |

|

|

|

|

|

|

|

|

|

Property and equipment, net |

|

|

597,964 |

|

|

|

|

791,155 |

|

|

Right of use assets |

|

|

3,498,051 |

|

|

|

|

3,952,317 |

|

|

Intangible assets, net |

|

|

9,242,659 |

|

|

|

|

11,507,653 |

|

|

Goodwill |

|

|

21,679,411 |

|

|

|

|

23,179,411 |

|

|

Other assets |

|

|

336,091 |

|

|

|

|

291,066 |

|

|

Total assets |

|

$ |

46,050,487 |

|

|

|

$ |

54,184,874 |

|

| |

|

|

|

|

|

|

|

|

| LIABILITIES AND

STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

2,125,689 |

|

|

|

$ |

1,845,135 |

|

|

Accrued liabilities |

|

|

1,650,609 |

|

|

|

|

1,680,706 |

|

|

Promissory note |

|

|

2,625,000 |

|

|

|

|

287,381 |

|

|

Contract liabilities |

|

|

329,536 |

|

|

|

|

496,390 |

|

|

Current portion of lease liabilities |

|

|

840,535 |

|

|

|

|

628,113 |

|

|

Current portion of COVID loans |

|

|

306,722 |

|

|

|

|

446,456 |

|

|

Total current liabilities |

|

|

7,878,091 |

|

|

|

|

5,384,181 |

|

| |

|

|

|

|

|

|

|

|

|

Long term portion of lease liabilities |

|

|

2,756,056 |

|

|

|

|

3,161,703 |

|

|

Long term portion of COVID loans |

|

|

509,184 |

|

|

|

|

446,813 |

|

|

Defined benefit plan obligation |

|

|

— |

|

|

|

|

106,163 |

|

|

Long term portion of promissory note |

|

|

1,470,000 |

|

|

|

|

1,861,539 |

|

|

Total liabilities |

|

|

12,613,331 |

|

|

|

|

10,960,399 |

|

| |

|

|

|

|

|

|

|

|

| COMMITMENTS AND

CONTINGENCIES (SEE NOTE 10) |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| STOCKHOLDERS’

EQUITY: |

|

|

|

|

|

|

|

|

|

Preferred Stock, $0.001 par value, 25,000,000 shares

authorized: |

|

|

|

|

|

|

|

|

|

Preferred Stock, Series F Convertible, $0.001 par value, 35,000

shares authorized, 6,275 shares issued and outstanding as of

September 30, 2023, and 5,863 shares issued and outstanding as of

December 31, 2022, respectively |

|

|

6 |

|

|

|

|

6 |

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock, $0.001 par value, 250,000,000 shares authorized,

117,878,831 and 88,466,613 shares issued and outstanding as of

September 30, 2023, and December 31, 2022, respectively |

|

|

117,880 |

|

|

|

|

88,467 |

|

| Additional paid-in

capital |

|

|

167,523,676 |

|

|

|

|

154,679,363 |

|

| Accumulated deficit |

|

|

(134,374,548 |

) |

|

|

|

(111,553,444 |

) |

| Accumulated other

comprehensive income |

|

|

170,142 |

|

|

|

|

10,083 |

|

| Total stockholders’

equity |

|

|

33,437,156 |

|

|

|

|

43,224,475 |

|

| Total liabilities and

stockholders’ equity |

|

$ |

46,050,487 |

|

|

|

$ |

54,184,874 |

|

See accompanying notes to these condensed

consolidated financial statements.

AGEAGLE AERIAL SYSTEMS INC. AND

SUBSIDIARIESCONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS AND COMPREHENSIVE

LOSS(UNAUDITED)

|

|

|

For the Three Months EndedSeptember

30, |

|

|

For the Nine Months Ended September 30, |

|

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| Revenues |

|

$ |

3,483,932 |

|

|

$ |

5,490,714 |

|

|

$ |

10,819,213 |

|

|

$ |

14,620,565 |

|

| Cost of sales |

|

|

2,269,858 |

|

|

|

3,407,573 |

|

|

|

6,594,973 |

|

|

|

8,622,436 |

|

|

Gross Profit |

|

|

1,214,074 |

|

|

|

2,083,141 |

|

|

|

4,224,240 |

|

|

|

5,998,129 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| General and administrative |

|

|

3,357,550 |

|

|

|

4,175,090 |

|

|

|

10,435,834 |

|

|

|

14,093,655 |

|

| Research and development |

|

|

1,368,394 |

|

|

|

1,818,540 |

|

|

|

4,320,216 |

|

|

|

6,185,777 |

|

| Sales and marketing |

|

|

978,243 |

|

|

|

1,236,841 |

|

|

|

2,911,963 |

|

|

|

3,736,548 |

|

| Impairment |

|

|

1,500,000 |

|

|

|

— |

|

|

|

1,579,287 |

|

|

|

— |

|

|

Total Operating Expenses |

|

|

7,204,187 |

|

|

|

7,230,471 |

|

|

|

19,247,300 |

|

|

|

24,015,980 |

|

|

Loss from Operations |

|

|

(5,990,113 |

) |

|

|

(5,147,330 |

) |

|

|

(15,023,060 |

) |

|

|

(18,017,851 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other Income (Expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest expense, net |

|

|

(399,651 |

) |

|

|

(6,727 |

) |

|

|

(994,751 |

) |

|

|

(29,776 |

) |

| Gain (loss) on debt extinguishment |

|

|

(1,523,867 |

) |

|

|

6,486,899 |

|

|

|

(1,523,867 |

) |

|

|

6,486,899 |

|

| Other income (expense), net |

|

|

(106,497 |

) |

|

|

332,110 |

|

|

|

(368,532 |

) |

|

|

27,372 |

|

| Total Other Income (Expense), net |

|

|

(2,030,015 |

) |

|

|

6,812,282 |

|

|

|

(2,887,150 |

) |

|

|

6,484,495 |

|

| Net Income (Loss) Before Income Taxes |

|

|

(8,020,128 |

) |

|

|

1,664,952 |

|

|

|

(17,910,210 |

) |

|

|

(11,533,356 |

) |

| Provision for income taxes |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Net Income (Loss) |

|

$ |

(8,020,128 |

) |

|

$ |

1,664,952 |

|

|

$ |

(17,910,210 |

) |

|

$ |

(11,533,356 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Income (Loss) Per Common Share – Basic |

|

$ |

(0.07 |

) |

|

$ |

0.02 |

|

|

$ |

(0.18 |

) |

|

$ |

(0.14 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Income (Loss) Per Common Share – Diluted |

|

$ |

(0.07 |

) |

|

$ |

0.01 |

|

|

$ |

(0.18 |

) |

|

$ |

(0.14 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted Average Number of Shares Outstanding During the

Period – Basic |

|

|

111,083,155 |

|

|

|

85,966,687 |

|

|

|

98,976,085 |

|

|

|

81,004,011 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted Average Number of Shares Outstanding During the

Period – Diluted |

|

|

111,083,155 |

|

|

|

113,623,789 |

|

|

|

98,976,085 |

|

|

|

81,004,011 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Comprehensive Income (Loss): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Income (Loss) attributable to common

stockholders |

|

$ |

(8,020,128 |

) |

|

$ |

1,664,952 |

|

|

$ |

(17,910,210 |

) |

|

$ |

(11,533,356 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Amortization of unrecognized periodic pension costs |

|

|

(742 |

) |

|

|

97,846 |

|

|

|

43,302 |

|

|

|

100,487 |

|

| Foreign currency cumulative translation adjustment |

|

|

(7,027 |

) |

|

|

(372,368 |

) |

|

|

116,757 |

|

|

|

(220,060 |

) |

| Total comprehensive income (loss), net of tax |

|

|

(8,027,897 |

) |

|

|

1,390,430 |

|

|

|

(17,750,151 |

) |

|

|

(11,652,929 |

) |

| Accrued dividends on Series F Preferred Stock |

|

|

(49,122 |

) |

|

|

(94,694 |

) |

|

|

(170,277 |

) |

|

|

(94,694 |

) |

| Deemed dividend on Series F Preferred Stock and warrants |

|

|

— |

|

|

|

— |

|

|

|

(4,910,894 |

) |

|

|

— |

|

| Total comprehensive income (loss) available to common

stockholders |

|

$ |

(8,077,019 |

) |

|

$ |

1,295,736 |

|

|

$ |

(22,831,322 |

) |

|

$ |

(11,747,623 |

) |

See accompanying notes to these condensed

consolidated financial statements.

AGEAGLE AERIAL SYSTEMS INC. AND

SUBSIDIARIESCONDENSED CONSOLIDATED STATEMENTS OF

CASH FLOWS(UNAUDITED)

| |

|

For the Nine Months EndedSeptember

30, |

|

| |

|

2023 |

|

|

2022 |

|

| CASH FLOWS FROM

OPERATING ACTIVITIES: |

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(17,910,210 |

) |

|

$ |

(11,533,356 |

) |

|

Adjustments to reconcile net loss to net cash used in operating

activities: |

|

|

|

|

|

|

|

|

|

Stock-based compensation |

|

|

1,125,209 |

|

|

|

3,058,741 |

|

|

Depreciation and amortization |

|

|

3,027,644 |

|

|

|

2,887,244 |

|

|

Defined benefit plan obligation and other |

|

|

(188,653 |

) |

|

|

(148,851 |

) |

|

Amortization of debt discount and warrant modification |

|

|

612,712 |

|

|

|

— |

|

|

(Loss) gain on debt extinguishment |

|

|

1,523,867 |

|

|

|

(6,486,899 |

) |

|

Goodwill impairment |

|

|

1,500,000 |

|

|

|

— |

|

|

Lease impairment charge |

|

|

79,287 |

|

|

|

|

|

| Changes in assets and

liabilities: |

|

|

|

|

|

|

|

|

|

Accounts receivable, net |

|

|

223,208 |

|

|

|

(396,617 |

) |

|

Inventories, net |

|

|

660,208 |

|

|

|

(2,221,569 |

) |

|

Prepaid expenses and other assets |

|

|

237,815 |

|

|

|

22,579 |

|

|

Accounts payable |

|

|

264,123 |

|

|

|

(281,937 |

) |

|

Accrued expenses and other liabilities |

|

|

(28,133 |

) |

|

|

(193,818 |

) |

|

Contract liabilities |

|

|

(169,352 |

) |

|

|

(307,610 |

) |

|

Other |

|

|

212,606 |

|

|

|

433,357 |

|

| Net cash used in operating

activities |

|

|

(8,829,669 |

) |

|

|

(15,168,736 |

) |

| |

|

|

|

|

|

|

|

|

| CASH FLOWS FROM

INVESTING ACTIVITIES: |

|

|

|

|

|

|

|

|

| Purchases of property and

equipment |

|

|

(95,004 |

) |

|

|

(250,379 |

) |

| Payment of acquisition-related

liabilities |

|

|

— |

|

|

|

(6,610,900 |

) |

| Capitalization of platform

development costs |

|

|

(297,596 |

) |

|

|

(635,568 |

) |

| Capitalization of internal use

software costs |

|

|

(171,516 |

) |

|

|

(565,894 |

) |

| Net cash used in investing

activities |

|

|

(564,116 |

) |

|

|

(8,062,741 |

) |

| |

|

|

|

|

|

|

|

|

| CASH FLOWS FROM

FINANCING ACTIVITIES: |

|

|

|

|

|

|

|

|

| Sales of Common Stock, net of

issuance costs |

|

|

3,817,400 |

|

|

|

4,583,341 |

|

| Sale of Preferred Stock,

Series F Convertible, net of issuance costs |

|

|

3,000,000 |

|

|

|

9,920,000 |

|

| Exercise of stock options |

|

|

— |

|

|

|

74,350 |

|

| Repayments on COVID loans |

|

|

(87,052 |

) |

|

|

(173,313 |

) |

| Net cash provided by financing

activities |

|

|

6,730,348 |

|

|

|

14,404,378 |

|

| |

|

|

|

|

|

|

|

|

| Effects of foreign exchange

rates on cash flows |

|

|

(86,257 |

) |

|

|

(460,980 |

) |

| |

|

|

|

|

|

|

|

|

| Net decrease in cash |

|

|

(2,749,694 |

) |

|

|

(9,288,079 |

) |

| Cash at beginning of

period |

|

|

4,349,837 |

|

|

|

14,590,566 |

|

| Cash at end of period |

|

$ |

1,600,143 |

|

|

$ |

5,302,487 |

|

| |

|

|

|

|

|

|

|

|

| SUPPLEMENTAL

DISCLOSURE OF CASH FLOW INFORMATION: |

|

|

|

|

|

|

|

|

| Interest cash paid |

|

$ |

— |

|

|

$ |

— |

|

| Income taxes paid |

|

$ |

— |

|

|

$ |

— |

|

| NON-CASH INVESTING AND

FINANCING ACTIVITIES: |

|

|

|

|

|

|

|

|

| Conversion of Preferred Stock,

Series F Convertible to Common Stock |

|

$ |

7,305 |

|

|

$ |

5,950 |

|

| Issuance of Restricted Common

Stock |

|

$ |

388 |

|

|

$ |

316 |

|

| Dividends on Series F

Preferred Stock |

|

$ |

170,277 |

|

|

$ |

94,694 |

|

| Deemed dividend on Series F

Preferred stock and warrant |

|

$ |

4,910,894 |

|

|

$ |

— |

|

| Stock consideration for

senseFly Acquisition |

|

$ |

— |

|

|

$ |

3,000,000 |

|

| Settlement of Common Stock

from contingent liability related to Measure |

|

$ |

— |

|

|

$ |

2,812,500 |

|

See accompanying notes to condensed consolidated

financial statements.

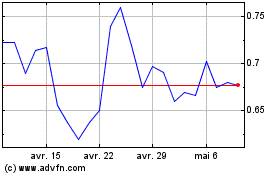

AgEagle Aerial Systems (AMEX:UAVS)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

AgEagle Aerial Systems (AMEX:UAVS)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024