UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Schedule

14A

Proxy

Statement Pursuant to Section 14(a) of the

Securities

Exchange Act of 1934

| Filed by the

Registrant |

☒ |

| |

|

| Filed by a Party other

than the Registrant |

☐ |

Check

the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| |

|

| ☐ |

Confidential, for Use of

the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

|

| ☒ |

Definitive Proxy Statement |

| |

|

| ☐ |

Definitive Additional Materials |

| |

|

| ☐ |

Soliciting Material Pursuant

to Section 240.14a-12 |

VIVEON

HEALTH ACQUISITION CORP.

(Name

of Registrant as Specified In Its Charter)

(Name

of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment

of Filing Fee (Check the appropriate box):

| ☒ |

No fee required. |

| |

|

| ☐ |

Fee paid previously with

preliminary materials. |

| |

|

| ☐ |

Fee computed on table in

exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

VIVEON

HEALTH ACQUISITION CORP.

3480

Peachtree Road NE 2nd Floor, Suite #112

Atlanta,

Georgia 30326

NOTICE

OF SPECIAL MEETING OF STOCKHOLDERS

TO

BE HELD March 27, 2024

TO

THE STOCKHOLDERS OF VIVEON HEALTH ACQUISITION CORP.:

You

are cordially invited to attend the Special Meeting (the “Special Meeting”) of stockholders of VIVEON HEALTH

ACQUISITION CORP., (the “Company,” “Viveon,” “we,”

“us” or “our”) to be held at 10:30 a.m. ET on March 27, 2024. Stockholders

will NOT be able to attend the Special Meeting in-person. This proxy statement includes instructions on how to access the Special Meeting

and how to listen and vote from home or any remote location with Internet connectivity. The Company will be holding the Special Meeting

in a virtual meeting format at https://www.cstproxy.com/viveon/2024 and via teleconference using the following dial-in information:

Telephone

access (listen-only):

Within

the U.S. and Canada: 1-800-450-7155 (toll-free)

Outside

of the U.S. and Canada: + 1 857-999-9155

(standard

rates apply)

Conference

ID: 7618674#

The

Special Meeting will be held for the purpose of considering and voting upon the following proposals:

| |

● |

The Fourth Extension Proposal

— a proposal to amend (the “Fourth Extension Amendment”) the Company’s amended and restated

certificate of incorporation, (the “Amended Charter”), to allow the Company to extend the date by which

the Company must consummate a business combination up to six times, each such extension for an additional one month period, until

September 30, 2024 (the “Fourth Extended Date”), upon one calendar day advance notice to Continental Stock

Transfer & Trust Company, prior to the applicable monthly deadline, unless the closing of the proposed Business Combination with

Clearday, Inc., or any potential alternative initial business combination shall have occurred prior to the Fourth Extended Date (we

refer to this proposal as the “Fourth Extension Proposal”); |

| |

|

|

| |

● |

The

Trust Amendment Proposal—a proposal to amend (the “Trust Amendment”) the Company’s Investment

Management Trust Agreement, dated as of December 22, 2020, as amended (the “Trust Agreement”), by and between

the Company and Continental Stock Transfer & Trust Company (the “Trustee”), allowing the Company to

extend the date by which the Company must consummate a business combination up to six times, each such extension for an additional

one month period, until September 30, 2024, by depositing into the Trust Account the amount of $35,000 (the “Extension

Payment”) for each one-month extension until September 30, 2024, (we refer to this proposal as the “Trust

Amendment Proposal”); and |

| |

|

|

| |

● |

The Adjournment Proposal

— a proposal to approve the adjournment of the Special Meeting by the Chairman thereof to a later date, if necessary, under

certain circumstances, to solicit additional proxies (i) to approve the Fourth Extension Proposal, (ii) to approve the Trust Amendment

Proposal, (iii) if a quorum is not present at the Special Meeting, or (iv) to allow reasonable additional time for the filing or

mailing of any supplemental or amended disclosure that the Company has determined in good faith after consultation with outside legal

counsel is required under applicable law and for such supplemental or amended disclosure to be disseminated and reviewed by the Company’s

stockholders prior to the Special Meeting; provided that the Special Meeting is reconvened as promptly as practical thereafter (we

refer to this proposal as the “Adjournment Proposal”). |

Your

attention is directed to the Proxy Statement accompanying this Notice for a more complete statement of matters to be considered at the

Special Meeting.

The

Company’s board of directors fixed the close of business on February 29, 2024 as the date for determining the Company’s

stockholders entitled to receive notice of, and to vote at, the Special Meeting and any adjournment thereof. Only holders of record of

the Company’s common stock on that date are entitled to have their votes counted at the Special Meeting or any adjournment thereof.

A complete list of stockholders of record entitled to vote at the Special Meeting will be available for ten days before the Special Meeting

at the Company’s principal executive offices for inspection by stockholders during ordinary business hours for any purpose germane

to the Special Meeting.

After

careful consideration of all relevant factors, the Company’s board of directors recommends that you vote or give instructions to

vote (i) “FOR” the Fourth Extension Proposal; (ii) “FOR” the Trust Amendment Proposal; and (iii) “FOR”

the Adjournment Proposal.

Enclosed

is the proxy statement containing detailed information concerning the Fourth Extension Proposal, the Trust Amendment Proposal, the Adjournment

Proposal and the Special Meeting. Whether or not you plan to virtually attend the Special Meeting, we urge you to read this material

carefully and vote your shares.

March 1, 2024

| |

By Order of

the Board of Directors |

| |

|

| |

/s/

Jagi Gill |

| |

Chairman of the Board |

Your

vote is important. Please sign, date and return your proxy card as soon as possible to make sure that your shares are represented at

the Special Meeting. If you are a stockholder of record, you may also cast your vote in person at the Special Meeting. If your shares

are held in an account at a brokerage firm or bank, you must instruct your broker or bank how to vote your shares, or you may cast your

vote in person at the Special Meeting by obtaining a proxy from your brokerage firm or bank. Your failure to vote or instruct your broker

or bank how to vote will have the same effect as voting against the proposal.

Important

Notice Regarding the Availability of Proxy Materials for the Special Meeting of Stockholders to be held on March 27, 2024. This

notice of meeting, and the accompany proxy statement and proxy card are available at https://www.cstproxy.com/viveon/2024.

For banks and brokers, the notice of meeting and the accompany proxy statement are available at https://www.cstproxy.com/viveon/2024.

VIVEON

HEALTH ACQUISITION CORP.

3480

Peachtree Road NE 2nd Floor, Suite #112

Atlanta,

Georgia 30326

NOTICE

OF SPECIAL MEETING OF STOCKHOLDERS

TO

BE HELD March 27, 2024

PROXY

STATEMENT

VIVEON

HEALTH ACQUISITION CORP., (the “Company,” “Viveon,” “we,”

“us” or “our”), a Delaware corporation, is providing this proxy statement in connection

with the solicitation by the Company’s Board of Directors of proxies to be voted at the Special Meeting to be held at 10:30

a.m. ET on March 27, 2024. Stockholders will NOT be able to attend the Special Meeting in-person. This proxy statement includes

instructions on how to access the Special Meeting and how to listen and vote from home or any remote location with Internet connectivity.

The Company will be holding the Special Meeting in a virtual meeting format at https://www.cstproxy.com/viveon/2024 and via teleconference

using the following dial-in information:

Telephone

access (listen-only):

Within

the U.S. and Canada:1-800-450-7155 (toll-free)

Outside

of the U.S. and Canada: + 1 857-999-9155

(standard

rates apply)

Conference

ID: 7618674#

The

Special Meeting will be held for the sole purpose of considering and voting upon:

| |

● |

The Fourth Extension Proposal

— a proposal to amend (the “Fourth Extension Amendment”) the Company’s amended and restated

certificate of incorporation, (the “Amended Charter”), to allow the Company to extend the date by which

the Company must consummate a business combination up to six times, each such extension for an additional one month period, until

September 30, 2024 (the “Fourth Extended Date”), upon one calendar day advance notice to Continental Stock

Transfer & Trust Company, prior to the applicable monthly deadline, unless the closing of the proposed Business Combination with

Clearday, Inc., or any potential alternative initial business combination shall have occurred prior to the Fourth Extended Date (we

refer to this proposal as the “Fourth Extension Proposal”); |

| |

|

|

| |

● |

The

Trust Amendment Proposal—a proposal to amend (the “Trust Amendment”) the Company’s Investment

Management Trust Agreement, dated as of December 22, 2020 (the “Trust Agreement”), by and between the Company

and Continental Stock Transfer & Trust Company (the “Trustee”), allowing the Company to extend the

date by which the Company must consummate a business combination up to six times, each such extension for an additional one month

period, until September 30, 2024, by depositing into the Trust Account the amount of $35,000 (the “Extension Payment”)

for each one-month extension until September 30, 2024, (we refer to this proposal as the “Trust Amendment Proposal”);

and |

| |

|

|

| |

● |

The Adjournment Proposal

— a proposal to approve the adjournment of the Special Meeting by the Chairman thereof to a later date, if necessary, under

certain circumstances, to solicit additional proxies (i) to approve the Fourth Extension Proposal, (ii) to approve the Trust Amendment

Proposal, (iii) if a quorum is not present at the Special Meeting, or (iv) to allow reasonable additional time for the filing or

mailing of any supplemental or amended disclosure that the Company has determined in good faith after consultation with outside legal

counsel is required under applicable law and for such supplemental or amended disclosure to be disseminated and reviewed by the Company’s

stockholders prior to the Special Meeting, provided that the Special Meeting is reconvened as promptly as practical thereafter (we

refer to this proposal as the “Adjournment Proposal”). |

RATIONALE

AND PROCESS FOR THE FOURTH EXTENSION

On

April 6, 2023, the Company announced that it entered into a definitive agreement to acquire Clearday (the “Business Combination”).

If the Business Combination is approved at a special meeting for such purpose, the Company would consummate the Business Combination

shortly thereafter.

The

purpose of the Fourth Extension Proposal and the Trust Amendment Proposal is to allow the Company additional time to complete the proposed

Business Combination. The Company’s Amended Charter provides that the Company has until the March 31, 2024 (the “March

Termination Date”) to complete an initial business combination. The Company will not have sufficient time by the March

Termination Date to consummate the proposed Business Combination. As a result, the Company’s board of directors believes that it

is in the best interests of its stockholders to again extend the date that the Company has to consummate an initial business combination.

If the Fourth Extension Proposal and the Trust Amendment Proposal are approved, the Company would have until September 30, 2024 to consummate

the proposed Business Combination or any potential alternative initial business combination.

The

Company has agreed that if the Fourth Extension Proposal and the Trust Amendment Proposal are approved, then, prior to filing the Fourth

Extension Amendment, it will make an initial deposit (each deposit being referred to herein as a “Deposit”)

into the Trust Account of $35,000 to initially extend the date by which the Company can complete an initial business combination

by one month to April 30, 2024. Thereafter, the Company shall deposit $35,000 for each monthly period, or portion thereof, that

is needed by the Company to complete an initial business combination on or prior to September 30, 2024.

If

the Company does not have the funds necessary to make the Deposit referred to above, Viveon Health LLC (the “Sponsor”)

has agreed that it and/or any of its affiliates or designees will contribute to the Company as a loan (the Sponsor, affiliate or designee

making the loan being referred to herein as a “Contributor” and each loan being referred to herein as a “Contribution”)

the amounts described above for the Company to Deposit. Each Deposit or Contribution will be placed in the Trust Account no less than

one calendar day prior to the beginning of such monthly period. If such Deposits or Contributions are not timely made, the Company must

either (i) consummate an initial business combination prior to the next monthly period, or (ii) wind up the Company’s affairs and

redeem 100% of the outstanding public shares in accordance with the same procedures set forth below that would be applicable if the Fourth

Extension Proposal and the Trust Amendment Proposal are not approved.

No

Deposit or Contribution will be made unless the Fourth Extension Proposal and the Trust Amendment Proposal are approved and the Company

determines to file the Fourth Extension Amendment. The Contribution(s) will be repayable by the Company to the Contributor(s) upon consummation

of the proposed Business Combination or a potential alternative initial business combination. The loans will be forgiven if the Company

is unable to consummate the proposed Business Combination or a potential alternative initial business combination, except to the extent

of any funds held outside of the Trust Account. The Company will have the sole discretion whether to extend for additional monthly periods

after the March Termination Date. If prior to March 31, 2024, the Company determines not to extend for additional monthly periods

through September 30, 2024, the obligation to make additional Deposits or Contributions will terminate. If this occurs, or if

the Company’s board of directors otherwise determines that the Company will not be able to consummate the proposed Business Combination,

or a potential alternative initial business combination by the Fourth Extended Date, the Company would wind up the Company’s affairs

and redeem 100% of the outstanding public shares in accordance with the same procedures set forth below that would be applicable if the

Fourth Extension Proposal and the Trust Amendment Proposal are not approved.

If

the Fourth Extension Proposal is approved and the Fourth Extension Amendment is filed and the Company takes the full time through the

Fourth Extended Date to complete an initial business combination, the redemption amount per share at the meeting for such business combination

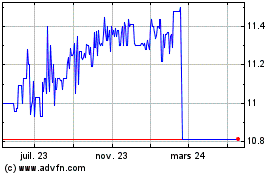

or the Company’s subsequent liquidation will be greater than the current redemption amount of $11.57 per share. The exact

per share amount will be determined after the Special Meeting, and depend upon the amount of redemptions in connection with the Fourth

Extension Amendment.

THE

NYSE AMERICAN LISTING

Under

NYSE American Rules Section 119(b), within 36 months of the effectiveness of the initial public offering registration statement for a

SPAC, or such shorter period that the company specifies in its charter, the company must complete one or more business combinations having

an aggregate fair market value of at least 80% of the value of the deposit account (excluding any deferred underwriter’s fees and

taxes payable on the income earned on the deposit account) at the time of the agreement to enter into the initial business combination.

The

Company’s initial public offering registration statement was declared effective on December 21, 2020. On December 22, 2023, the

Company received a letter from the NYSE American stating that the staff of NYSE Regulation (the “Staff”) determined

to commence proceedings to delist the Company’s Common Stock, Units and Rights (collectively, the “Securities”)

pursuant to Sections 119(b) and 119(f) of the NYSE American Company Guide (the “Company Guide”) because the

Company failed to consummate a business combination within 36 months of the effectiveness of its initial public offering registration

statement, or such shorter period that the Company specified in its registration statement. As indicated in the letter, the Company had

a right to a review of the delisting determination by a Listing Qualifications Panel (the “Panel”) of the NYSE

American’s Committee for Review (the “Committee”), provided a written request for such review was

requested no later than December 29, 2023. The Company requested an in-person hearing to deliver an oral presentation to the

Panel, which was held on February 13, 2024. The Panel’s hearing considered written and oral presentations made by the Company

and the Staff.

On

February 21, 2024, the Company received a letter from the NYSE American that the based upon the material and information presented

to the Panel, discussion that occurred at the hearing and analysis of the NYSE American rules and the Company Guide, the Panel

unanimously determined to affirm the Staff’s decision to initiate delisting proceedings because the Company did not consummate

a merger within the maximum 36 months of the effectiveness of its initial public offering registration statement. The Company may

request, as provided by Section 1205 of the Company Guide, that the full Committee reconsider the decision of the Panel. The request

for the review and the required fee must be made in writing and received within 15 calendar days from the date of the letter. The

Company intends to request that the full Committee reconsiders the Panel’s decision to delist. At this time the Securities

remain listed on the NYSE American, although trading has been suspended. The Securities will trade on the over-the-counter market

until a final determination has been made to delist by the Committee. If

the Committee does not overturn the decision by the Panel to delist, the Securities will be de-listed from the

NYSE American and trade in the over-the-counter market. At that time, the Company, together with Clearday, will make a determination

as to whether the Company should cease operations and liquidate, or if they will proceed with the Business Combination and submit an

initial listing application for the combined company to a national securities exchange in connection with the closing of the

Business Combination. There is no guarantee that the initial listing application for the combined company’s securities will be

approved by a national securities exchange.

Record

Date and Meeting Date

The

Company’s board of directors has fixed the close of business on February 29, 2024 as the record date for determining the Company’s

stockholders entitled to receive notice of and to vote at the Special Meeting and any adjournment thereof (the “Record Date”).

On the Record Date, there were 6,648,665 outstanding shares of Company common stock, including 1,617,415 outstanding public shares.

The Company’s warrants and rights do not have voting rights. Only holders of record of the Company’s common stock on the

Record Date are entitled to have their votes counted at the Special Meeting or any adjournment thereof. A complete list of stockholders

of record entitled to vote at the Special Meeting will be available for ten days before the Special Meeting at the Company’s principal

executive offices for inspection by stockholders during ordinary business hours for any purpose germane to the Special Meeting.

This

proxy statement contains important information about the Special Meeting, the Fourth Extension Proposal, the Trust Amendment Proposal

and the Adjournment Proposal. Please read it carefully and vote your shares.

This

proxy statement, together with the proxy card is first being mailed to stockholders on or about March 2, 2024.

QUESTIONS

AND ANSWERS ABOUT THE SPECIAL MEETING

These

Questions and Answers are only summaries of the matters they discuss. They do not contain all of the information that may be important

to you. You should carefully read the entire document, including the annexes to this proxy statement.

| Q. |

What is being voted on? |

|

A.

You are being asked to vote on (i) a proposal to amend (the “Fourth Extension Amendment”) the Company’s

amended and restated certificate of incorporation, (the “Amended Charter”) to allow the Company to extend

the date by which the Company must consummate an initial business combination up to six times, each such extension for an additional

one month period, until September 30, 2024, (the “Fourth Extended Date”), upon one calendar day advance notice

to the Trustee, prior to the applicable monthly deadline, unless the closing of the proposed Business Combination with Clearday,

Inc., or any potential alternative initial business combination shall have occurred prior to the Fourth Extended Date (we refer to

this proposal as the “Fourth Extension Proposal”); (ii) a proposal to amend (the “Trust Amendment”)

the Company’s Investment Management Trust Agreement, dated as of December 22, 2020 (the “Trust Agreement”),

by and between the Company and the Trustee, allowing the Company to extend the date by which the Company must consummate an initial

business combination up to six times, each such extension for an additional one month period, until September 30, 2024, by depositing

into the Trust Account the amount of $35,000 (the “Extension Payment”) for each one-month extension

until September 30, 2024, (we refer to this proposal as the “Trust Amendment Proposal”); and (iii) a proposal

to adjourn the Special Meeting, if necessary, under certain circumstances. |

| |

|

|

|

| Q. |

Why is the Company proposing the Fourth Extension Proposal

and the Trust Amendment Proposal? |

|

A. The Company is a blank

check company (also referred to as a “SPAC”) formed in August 2020 for the purpose of entering into a merger,

share exchange, asset acquisition, stock purchase, recapitalization, reorganization or other similar business combination with one

or more businesses or entities. In December 2020, the Company consummated its IPO from which it derived gross proceeds of $201,250,000

(including $26,250,000 from the exercise of the underwriters’ over-allotment option). Like most blank check companies, at the

time of the IPO, the charter provided for the return of the IPO proceeds held in the Trust Account to the holders of public shares

if there was no qualifying business combination(s) consummated on or before a certain date. |

| |

|

|

|

| |

|

|

As

previously disclosed in the Form 8-K filed on June 27, 2023 with the SEC, we filed a third

amendment to our Amended Charter, effective as of June 27, 2023, to extend the date to consummate an initial business combination

on a monthly basis for up to six times by an additional one month each time for a total of up to six months until December 31,

2023, by depositing into the trust account (the “Trust Account”)

established in connection with the Company’s initial public offering, the amount of $85,000 for each one-month extension

until December 31, 2023, and (ii) further extend the date by which the Company must consummate an initial business combination

(without seeking additional approval from the stockholders) for up to an additional three months, from January 1, 2024 to March

31, 2024, each such extension for an additional one month period, with no additional deposits to be made into the Trust Account

during such period from January 1, 2024 through March 31, 2024.

On

April 6, 2023, we announced that we entered into a definitive agreement to engage in the Business Combination with Clearday. |

| |

|

|

Given our expenditure

of time, effort, and money negotiating with and reaching a definitive agreement with Clearday, we believe that the circumstances

warrant providing public stockholders an opportunity to consider the proposed Business Combination at a special meeting to be held

to allow stockholders to approve the Business Combination. There will not be sufficient time by the March Termination Date for the

Company to consummate the proposed Business Combination. Accordingly, the Company’s board believes that it is in the best interests

of its stockholders to continue the Company’s existence in order to allow the Company more time to complete the proposed Business

Combination or any potential alternative initial business combination. Therefore, we are seeking approval of the Fourth Extension

Proposal to file the Fourth Extension Amendment. |

| |

|

|

|

| |

|

|

YOU ARE NOT BEING ASKED

TO VOTE ON THE BUSINESS COMBINATION AT THIS TIME. IF THE FOURTH EXTENSION PROPOSAL IS APPROVED AND THE FOURTH EXTENSION AMENDMENT

IS FILED, IF YOU DO NOT SEEK TO REDEEM YOUR PUBLIC SHARES IN CONNECTION WITH THIS VOTE, YOU WILL RETAIN THE RIGHT TO VOTE ON THE

BUSINESS COMBINATION WHEN IT IS SUBMITTED TO STOCKHOLDERS AND THE RIGHT TO REDEEM YOUR PUBLIC SHARES FOR A PRO RATA PORTION OF THE

TRUST ACCOUNT IN THE EVENT THE BUSINESS COMBINATION IS APPROVED AND COMPLETED OR THE COMPANY HAS NOT CONSUMMATED A BUSINESS COMBINATION

BY THE FOURTH EXTENDED DATE. |

| |

|

|

|

| Q. |

Why should I vote for the Fourth Extension Proposal

and the Trust Amendment Proposal? |

|

A. The Company’s

board of directors believes stockholders will benefit from the Company consummating the proposed Business Combination and is proposing

the Fourth Extension Proposal and the Trust Amendment Proposal to extend the date by which the Company has to complete the proposed

Business Combination. Approval of the Fourth Extension Proposal and the Trust Amendment Proposal would give the Company additional

time to complete the proposed Business Combination, or a potential alternative initial business combination, and would allow you

as a stockholder the benefit of voting for the proposed Business Combination, or a potential alternative initial business combination,

and remaining a stockholder in the post-business combination company, if you desire. |

| |

|

|

|

| |

|

|

Accordingly,

we believe that the Fourth Extension Proposal and the Trust Amendment Proposal are consistent with the spirit in which the Company

offered its securities to the public in the IPO.

The

Company has agreed that if the Fourth Extension Proposal and the Trust Amendment Proposal are approved, prior to filing the Fourth

Extension Amendment, it will make an initial Deposit into the Trust Account in the amount of $35,000 to extend the date by

which the Company can complete an initial business combination by one month to April 30, 2024. Thereafter, the Company shall Deposit

$35,000 per monthly period, or portion thereof, that is needed by the Company to complete the proposed Business Combination

or a potential alternative initial business combination until the September 30, 2024.

If

the Company does not have the funds necessary to make the Deposits referred to above, the Sponsor and/or any of its affiliates or

designees will make a Contribution to the Company (as a loan) in the amounts described above. If such Deposits or Contributions are

not timely made, the Company must either (i) consummate the proposed Business Combination or a potential alternative initial business

combination prior to the next monthly period, or (ii) wind up the Company’s affairs and redeem 100% of the outstanding public

shares in accordance with the same procedures set forth below that would be applicable if the Fourth Extension Proposal and the Trust

Amendment Proposal are not approved. |

| |

|

|

You will have

redemption rights in connection with the Fourth Extension Proposal and the Trust Amendment Proposal, however, you will not have any

redemption rights in connection with the Company electing to extend on a monthly basis after the March Termination Date until the

Fourth Extended Date. |

| |

|

|

|

| |

|

|

No Deposit or Contribution

will be made unless the Fourth Extension Proposal and the Trust Amendment Proposal are approved and the Company determines to file

the Fourth Extension Amendment. The Contribution(s) will be repayable by the Company to the Contributor(s) upon consummation of the

proposed Business Combination or a potential alternative initial business combination. The loans will be forgiven if the Company

is unable to consummate the proposed Business Combination or a potential alternative initial business combination, except to the

extent of any funds held outside of the Trust Account. The Company will have the sole discretion whether to extend for additional

monthly periods after the March Termination Date until the Fourth Extended Date. If prior to March 31, 2024, the Company determines

not to continue to extend for additional monthly periods through September 30, 2024, the obligation to make additional Deposits or

Contributions will terminate. If this occurs, or if the Company’s board of directors otherwise determines that the Company

will not be able to consummate the proposed Business Combination or a potential alternative initial business combination by the Fourth

Extended Date, the Company would wind up the Company’s affairs and redeem 100% of the outstanding public shares in accordance

with the same procedures set forth below that would be applicable if the Fourth Extension Proposal and the Trust Amendment Proposal

are not approved. |

| |

|

|

|

| Q. |

May I redeem my public shares in connection with the

vote at the Special Meeting? |

|

Yes. Under our Amended

Charter, the submission of a matter to amend our charter entitles holders of public shares to redeem their shares for their pro rata

portion of the funds held in the Trust Account established at the time of the IPO. Holders of public shares do not need to vote against

the Fourth Extension Proposal or the Trust Amendment Proposal or be a holder of record on the Record Date to exercise their redemption

rights. |

| |

|

|

|

| |

|

|

If the Fourth Extension

Proposal and the Trust Amendment Proposal are approved and the Fourth Extension Amendment is filed with the Delaware Secretary of

State, with respect to a holder’s right to redeem, the Company will (i) remove from the Trust Account an amount (the “Withdrawal

Amount”) equal to the pro rata portion of funds available in the Trust Account relating to any public shares redeemed

by holders in connection with the Fourth Extension Proposal and the Trust Amendment Proposal, if any, and (ii) deliver to the holders

of such redeemed public shares their pro rata portion of the Withdrawal Amount. The remainder of such funds shall remain in the Trust

Account and be available for use by the Company to complete the proposed Business Combination or a potential alternative initial

business combination on or before the Fourth Extended Date. Holders of public shares who do not redeem their public shares in connection

with the Special Meeting will retain their redemption rights and their ability to vote on the proposed Business Combination or a

potential alternative initial business combination. |

| |

|

|

|

| Q. |

Why is the Company proposing the Adjournment Proposal? |

|

The Company is proposing

the Adjournment Proposal to allow the Company more time to solicit additional proxies in favor of the Fourth Extension Proposal,

in the event the Company does not have a quorum or does not receive the requisite stockholder vote to approve the Fourth Extension

Proposal and the Trust Amendment Proposal. |

| Q. |

How do the Company’s executive

officers, directors and affiliates intend to vote their shares? |

|

A. All of the

Company’s directors, executive officers and their respective affiliates, as well as the Sponsor, are expected to vote any common

stock over which they have voting control (including any public shares owned by them) in favor of the Fourth Extension Proposal,

the Trust Amendment Proposal, and the Adjournment Proposal. |

| |

|

|

|

| |

|

|

The

holders of the insider shares are not entitled to redeem such shares in connection with the Fourth Extension Proposal and the Trust

Amendment Proposal. On the Record Date, the 5,031,250 insider shares represented approximately 75.7% of the Company’s

issued and outstanding common stock. |

| |

|

|

|

| |

|

|

Neither

the Company’s Sponsor, directors or executive officers, nor any of their respective affiliates beneficially owned any public

shares as of the Record Date. However, the Sponsor and the Company’s directors, executive officers and their respective

affiliates may choose to buy public shares in the open market or through negotiated private purchases, outside of the redemption

process, for purposes of helping to ensure that the Company maintains (i) sufficient funds in the Trust Account in connection

with the proposed initial business combination, and (ii) its continued listing with NYSE American.

In

the event that such purchases do occur, the purchasers may seek to purchase shares from stockholders who would otherwise have voted

against the Fourth Extension Proposal and the Trust Amendment Proposal and/or elected to redeem their shares. Any public shares so

purchased will not be able to be voted in favor of the Fourth Extension Proposal and the Trust Amendment Proposal. |

| |

|

|

|

| Q. |

What vote is required to adopt the proposals? |

|

Fourth

Extension Proposal. Approval of the Fourth Extension Proposal requires the affirmative vote of holders of at least a

majority of the issued and outstanding shares of the Company’s common stock.

Trust

Amendment Proposal. Approval of the Trust Amendment Proposal requires the affirmative vote of holders of at least 50% of

the public shares of common stock issued and outstanding.

Adjournment

Proposal. Approval of the Adjournment Proposal requires the affirmative vote of holders of at least a majority of the issued

and outstanding shares of common stock present in person by virtual attendance or represented by proxy and entitled to vote at the

Special Meeting or any adjournment thereof. |

| Q. |

What if I do not want to approve the Fourth Extension

Proposal, the Trust Amendment Proposal or the Adjournment Proposal? |

|

A. If you do not want to

approve the Fourth Extension Proposal, the Trust Amendment Proposal or the Adjournment Proposal, you must abstain, not vote, or vote

against each proposal. |

| |

|

|

|

| Q. |

The Company received a delisting notice from the NYSE

American for not completing the business combination within the time periods required under the NYSE American Rules. What happens

to the business combination now? |

|

A.

Under NYSE American Rules Section 119(b), within 36 months of the effectiveness of the initial public offering registration statement

for a SPAC, or such shorter period that the company specifies in its registration statement, the company must complete one or

more business combinations having an aggregate fair market value of at least 80% of the value of the deposit account (excluding

any deferred underwriter’s fees and taxes payable on the income earned on the deposit account) at the time of the agreement

to enter into the initial business combination. |

| |

|

|

|

|

|

|

The

Company’s initial public offering registration statement was declared effective on December 21, 2020. On December 22, 2023,

the Company received a letter from the NYSE American stating that the staff of NYSE Regulation (the “Staff”) determined

to commence proceedings to delist the Company’s Common Stock, Units and Rights (collectively, the “Securities”)

pursuant to Sections 119(b) and 119(f) of the NYSE American Company Guide (the “Company Guide”) because the Company

failed to consummate a business combination within 36 months of the effectiveness of its initial public offering registration statement,

or such shorter period that the Company specified in its registration statement. As indicated in the letter, the Company had a right

to a review of the delisting determination by a Listing Qualifications Panel (the “Panel”) of the NYSE American’s

Committee for Review (the “Committee”) , provided a written request for such review was requested no later than

December 29, 2023. The Company requested an in-person hearing to deliver an oral presentation to the Panel, which was held on February

13, 2024. The Panel’s hearing considered written and oral presentations made by the Company and the Staff.

On

February 21, 2024, the Company received a letter from the NYSE American that the based upon the material and information presented

to the Panel, discussion that occurred at the hearing and analysis of the NYSE American rules and the Company Guide, the Panel

unanimously determined to affirm the Staff’s decision to initiate delisting proceedings because the Company did not consummate

a merger within the maximum 36 months of the effectiveness of its initial public offering registration statement. The Company may

request, as provided by Section 1205 of the Company Guide, that the full Committee reconsider the decision of the Panel. The request

for the review and the required fee must be made in writing and received within 15 calendar days from the date of the letter. The

Company intends to request that the full Committee reconsiders the Panel’s decision to delist. At this time the Securities

remain listed on the NYSE American, although trading has been suspended. The Securities will trade on the over-the-counter market

until a final determination has been made to delist by the Committee. If the Committee does not overturn the decision by the Panel to delist, the Securities

will be de-listed from the NYSE American and trade in the over-the-counter market. At that time, the Company, together with

Clearday, will make a determination as to whether the Company should cease operations and liquidate, or if they will proceed with

the Business Combination and submit an initial listing application for the combined company to a national securities exchange in

connection with the closing of the Business Combination. There is no guarantee that the initial listing application for the combined

company’s securities will be approved by a national securities exchange.

If

we are unable to successfully consummate the proposed Business Combination with Clearday, or an alternative initial business combination,

we will be forced to (i) cease all operations except for the purpose of winding up, (ii) as promptly as reasonably possible but not

more than ten business days thereafter, redeem 100% of the outstanding public shares, at a per-share price, payable in cash, equal

to the aggregate amount then on deposit in the Trust Account, including any interest but net of taxes payable, divided by the number

of then outstanding public shares, which redemption will completely extinguish public stockholders’ rights as stockholders

(including the right to receive further liquidation distributions, if any), subject to applicable law, and (iii) as promptly as reasonably

possible following such redemption, subject to the approval of our remaining stockholders and our board of directors, dissolve and

liquidate, subject (in the case of (ii) and (iii) above) to our obligations under Delaware law to provide for claims of creditors

and the requirements of other applicable law. |

|

|

|

|

| Q. |

What happens if the Fourth Extension Proposal and the

Trust Amendment Proposal are not approved? |

|

A. If the Fourth Extension

Proposal and the Trust Amendment Proposal are not approved at the Special Meeting, and we are unable to consummate the proposed Business

Combination prior to or on March 31, 2024, we will (i) cease all operations except for the purpose of winding up, (ii) as promptly

as reasonably possible but not more than ten business days thereafter, redeem 100% of the outstanding public shares, at a per-share

price, payable in cash, equal to the aggregate amount then on deposit in the Trust Account, including any interest but net of taxes

payable, divided by the number of then outstanding public shares, which redemption will completely extinguish public stockholders’

rights as stockholders (including the right to receive further liquidation distributions, if any), subject to applicable law, and

(iii) as promptly as reasonably possible following such redemption, subject to the approval of our remaining stockholders and our

board of directors, dissolve and liquidate, subject (in the case of (ii) and (iii) above) to our obligations under Delaware law to

provide for claims of creditors and the requirements of other applicable law. |

| |

|

|

The holders

of the insider shares waived their rights to participate in any liquidation distribution with respect to such shares. There will

be no distribution from the Trust Account with respect to our rights and warrants which will expire worthless in the event we wind

up. The Company will pay the costs of liquidation from its remaining assets outside of the Trust Account, which it believes are sufficient

for such purposes. If such funds are insufficient, the Sponsor has agreed to advance the Company the funds necessary to complete

such liquidation (currently anticipated to be no more than approximately $15,000) and has agreed not to seek repayment of such expenses. |

| |

|

|

|

| Q. |

If the Fourth Extension Proposal and the Trust Amendment

Proposal are approved, what happens next? |

|

A. If the Fourth Extension

Proposal and the Trust Amendment Proposal are approved, the Company will make the initial Deposit into the Trust Account, file the

Fourth Extension Amendment with the Delaware Secretary of State and continue to attempt to consummate the proposed Business Combination,

or a potential alternative initial business combination, until the Fourth Extended Date, or such earlier date on which the Company’s

board of directors otherwise determines in its sole discretion that it will not be able to consummate the proposed Business Combination,

or a potential alternative initial business combination by the Fourth Extended Date. |

| |

|

|

|

| |

|

|

If the Fourth Extension

Proposal and the Trust Amendment Proposal are approved, the removal of the Withdrawal Amount from the Trust Account, if any, will

reduce the amount remaining in the Trust Account and increase the percentage interest of Company shares held by the Company’s

officers, directors and their affiliates. As of the date of this proxy statement, the Company’s, officer, directors and Sponsor

own 73.17% of the Company’s issued and outstanding shares. |

| |

|

|

|

| Q. |

Would I still be able to exercise my redemption rights

in the future if I vote against any subsequently proposed business combination? |

|

A. Unless you elect to

redeem your shares in connection with this stockholder vote to approve the Fourth Extension Proposal and the Trust Amendment Proposal,

you will be able to vote on the Business Combination or any subsequently proposed business combination when it is submitted to stockholders.

If you disagree with any such business combination, you will retain your right to vote against it and/or redeem your public shares

upon consummation of any such business combination in connection with the stockholder vote to approve such business combination,

subject to any limitations set forth in the charter. |

| |

|

|

|

| Q. |

How do I change my vote? |

|

A. If you have submitted

a proxy to vote your shares and wish to change your vote, or revoke your proxy, you may do so by delivering a later-dated, signed

proxy card to Advantage Proxy, Inc., Attention: Karen Smith, Toll Free: 877-870-8565, Collect: 1-206-870-8565, E-mail: ksmith@advantageproxy.com,

the Company’s proxy solicitor, prior to the date of the Special Meeting. |

| |

|

|

|

| Q. |

How are votes counted? |

|

A.

The Company’s proxy solicitor, Advantage Proxy, will be appointed as inspector of election for the meeting. Votes will

be counted by the inspector of election, who will separately count “FOR” and “AGAINST” votes, abstentions,

and broker non-votes.

Fourth

Extension Proposal. The Fourth Extension Proposal must be approved by the affirmative vote of at least a majority of the

issued and outstanding shares of common stock as of the Record Date. |

| |

|

|

With

respect to the Fourth Extension Proposal, abstentions and broker non-votes will have the same effect as “AGAINST”

votes.

Trust

Amendment Proposal. The Trust Amendment Proposal must be approved by the affirmative vote of at least 50% of the public shares

of common stock issued and outstanding as of the Record Date.

With

respect to the Trust Amendment Proposal, abstentions and broker non-votes will have the same effect as “AGAINST” votes. |

| |

|

|

|

| |

|

|

Adjournment Proposal.

The Adjournment Proposal must be approved by at least a majority of the issued and outstanding shares of common stock present

in person by virtual attendance or represented by proxy and entitled to vote at the Special Meeting or any adjournment thereof. Abstentions

with respect to this proposal will have the effect of a vote “AGAINST” such proposal. Broker non-votes with respect to

this proposal will have no effect on the vote. |

| |

|

|

|

| Q. |

If my shares are held in “street name,”

will my broker automatically vote them for me? |

|

A.

The Fourth Extension Proposal and the Trust Amendment Proposal are non-discretionary items. Your broker can only vote your shares

for those proposals if you provide instructions on how to vote. If your shares are held by your broker as your nominee (that

is, in “street name”), you may need to obtain a proxy form from the institution that holds your shares and follow

the instructions included on that form regarding how to instruct your broker to vote your shares. If you do not give instructions

to your broker, your broker can vote your shares with respect to “discretionary” items, but not with respect to “non-discretionary”

items. Discretionary items are proposals considered routine under the rules of the New York Stock Exchange applicable to member

brokerage firms. These rules provide that for routine matters your broker has the discretion to vote shares held in street name

in the absence of your voting instructions. On non-discretionary items for which you do not give your broker instructions, the

shares will be treated as broker non-votes.

Your

brokers can only use their discretionary authority to vote shares with respect to the Adjournment Proposal. |

| |

|

|

|

| Q. |

What is a quorum requirement? |

|

A. A quorum of stockholders

is necessary to hold a valid meeting. A quorum will be present if at least a majority of the issued and outstanding shares of common

stock on the Record Date are represented by stockholders present at the meeting or by proxy. |

| |

|

|

|

| |

|

|

Your shares will be counted

towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or

if you vote in person at the Special Meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If

there is no quorum, a majority of the votes represented in person or by proxy at the Special Meeting may adjourn the Special Meeting

to another date. |

| |

|

|

|

| Q. |

Who can vote at the Special Meeting? |

|

A.

Only holders of record of the Company’s common stock at the close of business on February 29, 2024 are entitled to have their

vote counted at the Special Meeting and any adjournments or postponements thereof. On the Record Date, there were 6,648,665

outstanding shares of Company common stock, including 1,617,415 outstanding public shares. |

| |

|

|

|

| |

|

|

Stockholder of Record:

Shares Registered in Your Name. If on the Record Date your shares were registered directly in your name with the Company’s

transfer agent, Continental Stock Transfer & Trust Company, then you are a stockholder of record. As a stockholder of record,

you may vote in person at the Special Meeting or vote by proxy. Whether or not you plan to attend the Special Meeting virtually,

we urge you to fill out and return the enclosed proxy card to ensure your vote is counted. |

| |

|

|

Beneficial

Owner: Shares Registered in the Name of a Broker or Bank. If on the Record Date your shares were held, not in your name,

but rather in an account at a brokerage firm, bank, dealer, or other similar organization, then you are the beneficial owner of shares

held in “street name” and these proxy materials are being forwarded to you by that organization. As a beneficial owner,

you have the right to direct your broker or other agent on how to vote the shares in your account. You are also invited to attend

the Special Meeting. However, since you are not the stockholder of record, you may not vote your shares in person at the Special

Meeting unless you request and obtain a valid proxy from your broker or other agent. |

| |

|

|

|

| Q. |

Does the board recommend voting for the Fourth Extension

Proposal, the Trust Amendment Proposal and the Adjournment Proposal? |

|

A. Yes. The board of directors

recommends that the Company’s stockholders vote “FOR” each of the Fourth Extension Proposal, the Trust Amendment

Proposal and the Adjournment Proposal. |

| |

|

|

|

| Q. |

What interests do the Company’s directors and

officers have in the approval of the Fourth Extension Proposal and the Trust Amendment Proposal? |

|

A. The Company’s

directors, officers and their affiliates have interests in the Fourth Extension Proposal and the Trust Amendment Proposal that may

be different from, or in addition to, your interests as a stockholder. These interests include, but are not limited to, beneficial

ownership of insider shares and warrants that will become worthless if the Fourth Extension Proposal and the Trust Amendment Proposal

are not approved, loans by them that will not be repaid in the event of our winding up and the possibility of future compensatory

arrangements. See the section entitled “Interests of the Company’s Directors and Officers.” |

| |

|

|

|

| Q. |

What if I object to the Fourth Extension Proposal or

the Trust Amendment Proposal? Do I have appraisal rights? |

|

A. Company stockholders

do not have appraisal rights in connection with the Fourth Extension Proposal and the Trust Amendment Proposal under the Delaware

General Corporations Law (the “DGCL”). |

| |

|

|

|

| Q. |

What happens to the Company’s warrants and rights

if the Fourth Extension Proposal and the Trust Amendment Proposal are not approved? |

|

A. If the Fourth Extension

Proposal and the Trust Amendment Proposal are not approved at the Special Meeting and the proposed Business Combination is not consummated

by March 31, 2024, we will (i) cease all operations except for the purpose of winding up, (ii) as promptly as reasonably possible

but not more than ten business days thereafter, redeem 100% of the outstanding public shares, at a per-share price, payable in cash,

equal to the aggregate amount then on deposit in the Trust Account, including any interest but net of taxes payable, divided by the

number of then outstanding public shares, which redemption will completely extinguish public stockholders’ rights as stockholders

(including the right to receive further liquidation distributions, if any), subject to applicable law, and (iii) as promptly as reasonably

possible following such redemption, subject to the approval of our remaining stockholders and our board of directors, dissolve and

liquidate, subject (in the case of (ii) and (iii) above) to our obligations under Delaware law to provide for claims of creditors

and the requirements of other applicable law. In such event, your warrants and rights will become worthless. |

| |

|

|

|

| Q. |

What do I need to do now? |

|

A. The Company urges you

to read carefully and consider the information contained in this proxy statement and to consider how the Fourth Extension Proposal,

the Trust Amendment Proposal and the Adjournment Proposal will affect you as a Company stockholder. You should then vote as soon

as possible in accordance with the instructions provided in this proxy statement and on the enclosed proxy card. |

| Q. |

How do I redeem my shares of Company

common stock? |

|

A. In connection

with the Special Meeting and the vote on the Fourth Extension Proposal and the Trust Amendment Proposal, each public stockholder

may seek to redeem its public shares for a pro rata portion of the funds available in the Trust Account, less any taxes we anticipate

will be owed on such funds but have not yet been paid. Holders of public shares do not need to vote on the Fourth Extension Proposal

and the Trust Amendment Proposal or be a holder of record on the Record Date to exercise redemption rights. |

| |

|

|

|

| |

|

|

To

demand redemption, you must either physically tender your stock certificates to Continental Stock Transfer & Trust Company, the

Company’s transfer agent, at Continental Stock Transfer & Trust Company, 1 State Street, New York, New York 10004, Attn:

Mark Zimkind, mzimkind@continentalstock.com, no later than two business days (March 25, 2024) prior to the Special Meeting

or deliver your shares to the transfer agent electronically using The Depository Trust Company’s DWAC (Deposit/Withdrawal At

Custodian) System, which election would likely be determined based on the manner in which you hold your shares. You will only be

entitled to receive cash in connection with a redemption of these shares if you continue to hold them until the effective date of

the filing of the Fourth Extension Amendment. |

| |

|

|

|

| Q. |

What should I do if I receive more than one set of

voting materials? |

|

A. You may receive more

than one set of voting materials, including multiple copies of this proxy statement and multiple proxy cards or voting instruction

cards, if your shares are registered in more than one name or are registered in different accounts. For example, if you hold your

shares in more than one brokerage account, you will receive a separate voting instruction card for each brokerage account in which

you hold shares. Please complete, sign, date and return each proxy card and voting instruction card that you receive in order to

cast a vote with respect to all of your Company shares. |

| |

|

|

|

| Q. |

Who is paying for this proxy solicitation? |

|

A. The Company will pay

for the entire cost of soliciting proxies. In addition to these mailed proxy materials, our directors and officers may also solicit

proxies in person, by telephone or by other means of communication. Our officers and directors will not be paid any additional compensation

for soliciting proxies. We have also engaged Advantage Proxy to solicit proxies on our behalf. We will pay Advantage Proxy approximately

$8,500 in fees plus disbursements for such services. We may also reimburse brokerage firms, banks and other agents for the cost

of forwarding proxy materials to beneficial owners. |

| |

|

|

|

| Q. |

Who can help answer my questions? |

|

A.

If you have questions about the proposals or if you need additional copies of the proxy statement or the enclosed proxy card

you should contact:

Advantage

Proxy, Inc.

Toll

Free: 1-877-870-8565

Collect:

1-206-870-8565

Email:

ksmith@advantageproxy.com |

| |

|

|

|

| |

|

|

You may also obtain additional

information about the Company from documents filed with the SEC by following the instructions in the section entitled “Where

You Can Find More Information.” |

| |

|

|

|

| Q. |

How do I vote? |

|

A. If you are a stockholder

of record, you may vote online at the virtual Special Meeting or vote by proxy using the enclosed proxy card, the Internet or telephone.

Whether or not you plan to participate in the virtual Special Meeting, we urge you to vote by proxy to ensure your vote is counted.

To vote using the proxy card, please complete, sign and date the proxy card and return it in the prepaid envelope. If you return

your signed proxy card before the Special Meeting, we will vote your shares as you direct. |

| |

|

|

To

vote via the telephone, you can vote by calling the telephone number on your proxy card. Please have your

proxy card handy when you call. Easy-to-follow voice prompts will allow you to vote your shares and confirm

that your instructions have been properly recorded.

To

vote via the Internet, please go to https://www.cstproxy.com/viveon/2024 and follow the instructions. Please have your proxy

card handy when you go to the website. As with telephone voting, you can confirm that your instructions have been properly recorded.

Telephone

and Internet voting facilities for stockholders of record will be available 24 hours a day until 11:59 p.m. Eastern Time on March

26, 2024. After that, telephone and Internet voting will be closed, and if you want to vote your shares, you will either need

to ensure that your proxy card is received before the date of the Special Meeting. |

| |

|

|

|

| |

|

|

If

your shares are registered in the name of your broker, bank or other agent, you are the “beneficial owner” of those

shares and those shares are considered as held in “street name.” If you are a beneficial owner of shares registered

in the name of your broker, bank or other agent, you should have received a proxy card and voting instructions with these proxy

materials from that organization rather than directly from us. Simply complete and mail the proxy card to ensure that your vote

is counted. You may be eligible to vote your shares electronically over the Internet or by telephone. A large number of banks

and brokerage firms offer Internet and telephone voting. If your bank or brokerage firm does not offer Internet or telephone

voting information, please complete and return your proxy card in the self-addressed, postage-paid envelope provided.

If

you are a beneficial owner of the shares and would like to vote your shares yourself, you will need to contact Continental at the

phone number or email below to receive a control number and you must obtain a legal proxy from your broker, bank or other nominee

reflecting the number of shares of Common Stock you held as of the Record Date, your name and email address. You must contact Continental

for specific instructions on how to receive the control number. Please allow up to 48 hours prior to the Special Meeting for processing

your control number.

After

obtaining a valid legal proxy from your broker, bank or other agent, you must submit proof of your legal proxy reflecting the number

of your shares along with your name and email address to Continental. Requests for registration should be directed to 917-262-2373

or email proxy@continentalstock.com. Requests for registration must be received no later than 5:00 p.m., Eastern Time, on March

22, 2024. |

| |

|

|

|

| Q. |

How may I participate in the virtual Special Meeting? |

|

A.

If you are a stockholder of record as of the Record Date for the Special Meeting, you should receive a proxy card from Continental,

containing instructions on how to attend the virtual Special Meeting including the URL address, along with your control number.

You will need your control number for access. If you do not have your control number, contact Continental at 917-262-2373 or

email proxy@continentalstock.com.

You

can pre-register to attend the virtual Special Meeting starting on March 26, 2024. Go to https://www.cstproxy.com/viveon/2024,

enter the control number found on your proxy card you previously received, as well as your name and email address. Once you pre-register

you can vote. At the start of the Special Meeting you will need to re-log into https://www.cstproxy.com/viveon/2024 using

your control number.

If

your shares are held in street name, and you would like to join and not vote, Continental will issue you a guest control number.

Either way, you must contact Continental for specific instructions on how to receive the control number. Please allow up to 48 hours

prior to the meeting for processing your control number. |

FORWARD-LOOKING

STATEMENTS

We

believe that some of the information in this proxy statement constitutes forward-looking statements. You can identify these statements

by forward-looking words such as “may,” “expect,” “anticipate,” “contemplate,” “believe,”

“estimate,” “intends,” and “continue” or similar words. You should read statements that contain these

words carefully because they:

| |

● |

discuss future expectations; |

| |

|

|

| |

● |

contain projections of future results of operations

or financial condition; or |

| |

|

|

| |

● |

state other “forward-looking” information. |

We

believe it is important to communicate our expectations to our stockholders. However, there may be events in the future that we are not

able to predict accurately or over which we have no control. The cautionary language discussed in this proxy statement provide examples

of risks, uncertainties and events that may cause actual results to differ materially from the expectations described by us in such forward-looking

statements, including, among other things, claims by third parties against the Trust Account, unanticipated delays in the distribution

of the funds from the Trust Account and the Company’s ability to finance and consummate a business combination following the distribution

of funds from the Trust Account. You are cautioned not to place undue reliance on these forward-looking statements, which speak only

as of the date of this proxy statement.

All

forward-looking statements included herein attributable to the Company or any person acting on the Company’s behalf are expressly

qualified in their entirety by the cautionary statements contained or referred to in this section. Except to the extent required by applicable

laws and regulations, the Company undertakes no obligation to update these forward-looking statements to reflect events or circumstances

after the date of this proxy statement or to reflect the occurrence of unanticipated events.

BACKGROUND

The

Company

We

are a Delaware company incorporated on August 7, 2020 for the purpose of entering into a merger, share exchange, asset acquisition, stock

purchase, recapitalization, reorganization or other similar business combination with one or more businesses or entities.

In

December 2020, we consummated our IPO of 20,125,000 units, including 2,625,000 units that were subject to the underwriters’ over-allotment

option, with each unit consisting of one share of common stock and one redeemable warrant, with each warrant to purchase one half of

a share of common stock, and one right to receive one-twentieth (1/20) of a share of common stock. The units were sold at an offering

price of $10.00 per unit, generating gross proceeds of $201,250,000.

Prior

to our IPO, we issued an aggregate of 5,031,250 insider shares for an aggregate purchase price of $25,000 to our Sponsor. Simultaneous

with the consummation of the IPO, we consummated the private placement of an aggregate of 18,000,000 private warrants at a price of $0.50

per private warrant, generating total proceeds of $9,000,000 to our Sponsor. Our Sponsor is not, is not controlled by, and does not have

substantial ties with a foreign person and therefore will not be subject to U.S. foreign investment regulations and review by a U.S.

government entity such as the Committee on Foreign Investment in the United States (CFIUS).

In

March 2022, our shareholders approved an amendment to our Amended Charter to extend the date by which we could consummate a business

combination through December 2022. Holders representing 15,092,126 public shares redeemed their shares in connection with the amendment

resulting in approximately $51,554,623 in our Trust Account.

In

December 2022, our shareholders approved an amendment to our Amended Charter to extend the date by which we could consummate a business

combination through June 2023. Holders representing 3,188,100 public shares redeemed their shares in connection with the amendment resulting

in approximately $19,816,456 remaining in our Trust Account.

On

April 6, 2023, the Company announced that it entered into a definitive agreement to acquire Clearday. If the Business Combination is

approved at a special meeting of the shareholders of the Company, the Company would consummate the Business Combination shortly thereafter.

On

June 22, 2023, our shareholders approved an amendment to our Amended Charter to extend the date by which we could consummate a business

combination through March 31, 2024. Holders representing 227,359 public shares redeemed

their shares in connection with the amendment resulting in approximately $17,777,323.54 remaining

in our Trust Account.

The

Company’s principal executive office is located at 3480 Peachtree Road NE 2nd Floor, Suite #112 Atlanta, Georgia 30326.

RISKS

RELATED TO BEING DEEMED AN INVESTMENT COMPANY

If

we are deemed to be an investment company for purposes of the Investment Company Act, we would be required to institute burdensome compliance

requirements and our activities would be severely restricted and, as a result, we may abandon our efforts to consummate the Business

Combination and liquidate the Company.

The

Company could potentially be subject to the Investment Company Act and the regulations thereunder. There is currently uncertainty concerning

the applicability of the Investment Company Act to a SPAC that may not complete its initial business combination within 24 months after

the effective date of the IPO Registration Statement. We entered into the business combination agreement with Clearday on April 6, 2023,

which was more than 24 months after the effective date of our IPO Registration Statement. As a result, it is possible that a claim could

be made that we have been operating as an unregistered investment company.

If

we are deemed to be an investment company under the Investment Company Act, our activities would be severely restricted. In addition,

we would be subject to burdensome compliance requirements. We do not believe that our principal activities will subject us to regulation

as an investment company under the Investment Company Act. However, if we are deemed to be an investment company and subject to compliance

with and regulation under the Investment Company Act, we would be subject to additional regulatory burdens and expenses for which we

have not allotted funds. As a result, unless we are able to modify our activities so that we would not be deemed an investment company,

we would expect to abandon our efforts to complete an initial business combination and instead to liquidate the Company. If we are required

to liquidate the Company, our investors would not be able to realize the benefits of owning shares in a successor operating business,

including the potential appreciation in the value of our shares and warrants following such a transaction, and our warrants would expire

worthless.

To

mitigate the risk that we might be deemed to be an investment company for purposes of the Investment Company Act, we instructed the trustee

to liquidate the securities held in the Trust Account prior to December 22, 2022, and instead hold the funds in the Trust Account in

cash until the earlier of the consummation of our initial business combination or our liquidation. As a result, following the liquidation

of securities in the Trust Account, we would likely receive minimal interest, if any, on the funds held in the Trust Account, which would

reduce the dollar amount our public stockholders would receive upon any redemption or liquidation of the Company.

The

funds in the Trust Account have, since the closing of our IPO, been held only in U.S. government treasury obligations with a maturity

of 185 days or less or in money market funds investing solely in U.S. government treasury obligations and meeting certain conditions

under Rule 2a-7 under the Investment Company Act. However, to mitigate the risk of us being deemed to be an unregistered investment company

(including under the subjective test of Section 3(a)(1)(A) of the Investment Company Act) and thus subject to regulation under the Investment

Company Act, we instructed the trustee, with respect to the Trust Account, to liquidate the U.S. government treasury obligations or money

market funds held in the Trust Account prior to December 22, 2022, and thereafter to hold all funds in the Trust Account in cash until

the earlier of consummation of our initial business combination or liquidation of the Company. Following such liquidation and transfer

of the funds in the Trust Account to cash, we would likely receive minimal interest, if any, on the funds held in the Trust Account.

However, interest previously earned on the funds held in the Trust Account still may be released to us to pay our taxes, if any, and

certain other expenses as permitted.

In

addition, even prior to the 24-month anniversary (December 22, 2022) of the effective date of the IPO Registration Statement, we may

have been deemed to be an investment company. The longer that the funds in the Trust Account were held in short-term U.S. government

treasury obligations or in money market funds invested exclusively in such securities, even prior to the 24-month anniversary, the greater

the risk that we may be considered an unregistered investment company, in which case we may be required to liquidate. Accordingly, in

an attempt to mitigate the risk, we instructed the trustee to liquidate the securities held in the Trust Account prior to the 24-month

anniversary, and instead hold all funds in the Trust Account in cash. As a result, we would likely receive minimal interest, if any,

on the funds still held in the Trust Account that would be available to our public stockholder upon any redemption or liquidation of

the Company.

Risk

of not Completing a Business Combination

If

the Fourth Extension Proposal is not approved, or if approved and we are unable to complete our Business Combination within the prescribed

time frame, we would cease all operations except for the purpose of winding up and we would redeem our public shares and liquidate, in

which case our public stockholders may only receive approximately $11.57 per share, or less than such amount in certain circumstances,

and our warrants will expire worthless.

Our

Amended Charter currently provides that we must complete our Business Combination by the March Termination Date. In connection with the

Special Meeting, you are being asked to consider and vote upon the Fourth Extension Proposal to amend the Company’s Amended Charter

in order to, among other things, extend the March Termination Date for additional one month periods, until the Fourth Extended Date.

We may be unable to complete our Business Combination by the Fourth Extended Date. Our ability to complete our Business Combination may

be negatively impacted by general market conditions, volatility in the capital and debt markets and the other risks described herein.

If

the Fourth Extension Proposal and the Trust Amendment Proposal are approved, and we are unable to complete the Business Combination by

the Fourth Extended Date, then the Company’s Board of Discretion, will determine in its sole discretion: (i) cease all operations

except for the purpose of winding up, (ii) as promptly as reasonably possible but not more than ten business days thereafter, redeem

100% of the outstanding public shares for a pro rata portion of the funds held in the Trust Account, which redemption will completely

extinguish public stockholders’ rights as stockholders (including the right to receive further liquidation distributions, if any),

subject to applicable law, and (iii) as promptly as reasonably possible following such redemption, subject to the approval of our remaining

holders of Common Stock and our board of directors, dissolve and liquidate, subject (in the case of (ii) and (iii) above) to our obligations

under Delaware law to provide for claims of creditors and the requirements of other applicable law.

Holders

of rights or warrants will receive no proceeds in connection with the liquidation with respect to such rights or warrants, which will

expire worthless In such case, our public stockholders may only receive approximately $11.57 per share. In certain circumstances,

our public stockholders may receive less than $11.57 per share on the redemption of their shares. This will also cause you to

lose the investment opportunity to realize the benefits of owning shares in a successor operating business, including the potential appreciation