true

0001667313

0001667313

2025-02-05

2025-02-05

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

(Amendment No. 1)

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

February 5, 2025

Zedge, Inc.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

1-37782 |

|

26-3199071 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

|

1178

Broadway, Ste. 1450 (3rd Floor)

New York, NY |

|

10001 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (330) 577-3424

Not Applicable

(Former name or former address, if changed since

last report.)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ☐ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol |

|

Name of each exchange on which registered |

| Class B common stock, par value $0.01 per share |

|

ZDGE |

|

NYSE American |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Explanatory Note

On January 21, 2025, Zedge,

Inc. (the “Company”) filed a Current Report on 8-K (the “Original 8-K”) under Item 2.05 to, among other things,

report a restructuring initiative. Pursuant to Item 2.05(d) of Form 8-K, the Company is now filing this Amendment No. 1 to refine its

disclosure related to the scope of the restructuring efforts and the amount of its estimated savings related to the restructuring. The

disclosure included in Item 2.05 of the Original 8-K otherwise remains unchanged. The Original Report is hereby amended to provide the

information set forth herein, which was unable to be determined at the time of the Original Report.

Item 2.05. Costs Associated with Exit or Disposal

Activities.

On February 5, 2025, the Company

announced additional restructuring initiatives, notably the closure of its Norwegian operations. This closure, along with the consolidation

of certain of the related activities in the Company’s current operations in Lithuania and Israel, is projected to result in approximately

$0.9 million in annualized compensation-related savings.

The previously announced restructuring

actions, which include a significant reorganization of the GuruShots team, are expected to yield approximately $1.7 million in annualized

compensation-related savings. In conjunction with this efforts, the Company is also targeting reductions in non-employee expenses related

to its restructuring efforts. This includes scaling back paid player acquisition initiatives at GuruShots for the remainder of fiscal

2025, with a goal of reducing non-employee expenses by approximately $0.1 to $0.3 million. Additionally, the Company anticipates an additional

reduction in annualized expenses for GuruShots (and Zedge) of approximately $1.2 million, beginning in fiscal Q4, upon the completion

of employee retention bonuses related to the 2022 acquisition of GuruShots, which are scheduled to conclude in April 2025.

Overall, the estimated total

savings from the global restructuring and other cost reduction initiatives are expected to range from $3.9 million to $4.1 million annually.

Cumulatively, these efforts will include a 22% workforce reduction, which is projected to yield about $2.6 million in pre-tax annualized

compensation-related savings, as well as the targeted non-employee cost reductions.

The Company expects that accounting

charges related to its restructuring efforts will primarily be reflected in the results for the second and third fiscal quarters, covering

periods ending January 31 and April 30, 2025, respectively.

A copy of the press release issued

by the Company on February 5, 2025, announcing the estimated savings from the global restructuring plan and other cost reductions, is

furnished as Exhibit 99.1 and is incorporated herein by reference.

Item 7.01. Regulation FD Disclosure.

On February 5, 2025, the Company

issued a press release announcing the estimated savings from the global restructuring plan and other cost reductions. A copy

of the press release is furnished as Exhibit 99.1 and is incorporated herein by reference.

The Company is furnishing

the information contained in this Report, including Exhibit 99.1, pursuant to Item 7.01 of Form 8-K promulgated by the Securities and

Exchange Commission (the “SEC”). This information shall not be deemed to be “filed” with the SEC or incorporated

by reference into any other filing with the SEC. In addition, the press release contains statements intended as “forward-looking

statements” that are subject to the cautionary statements about forward-looking statements set forth in the press release.

Forward-Looking Statements

This current report on Form

8-K contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These

forward-looking statements reflect the Company’s current views with respect to, among other things, its operations, including the

recently announced plan to implement a global workforce reduction and restructuring of our operations and its expected impact, its financial

performance, its industry and its business. Forward-looking statements include all statements that are not historical facts. In some cases,

you can identify these forward-looking statements by the use of words such as “outlook,” “believe(s),” “expect(s),”

“potential,” “continue(s),” “may,” “will,” “should,” “could,”

“would,” “seek(s),” “predict(s),” “intend(s),” “trends,” “plan(s),”

“estimate(s),” “anticipates,” “projection,” “will likely result” and or the negative version

of these words or other comparable words of a future or forward-looking nature. Such forward-looking statements are subject to various

risks and uncertainties. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially

from those indicated in these statements. These factors include but are not limited to those described under “Item 1A. Risk Factors”

in the Company’s Annual Report on Form 10-K for the year ended July 31, 2024 filed with the Securities and Exchange Commission (the

“SEC”) as such factors may be updated from time to time in the Company’s periodic filings with the SEC. These factors

should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the

Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

ZEDGE, INC. |

| |

|

|

| |

By: |

/s/ Jonathan Reich |

| |

Name: |

Jonathan Reich |

| |

Title: |

Chief Executive Officer |

Dated: February 12, 2025

EXHIBIT INDEX

4

Exhibit 99.1

ZEDGE INCREASES COST REDUCTION EFFORTS TO A

TARGETED $4 MILLION ANNUALLY

Estimated total global restructuring and other cost reductions

to save $3.9 to $4.1 million annually relative to Q1 FY25 run rate – FY24 free cash flow* was $4.7 million

Total global restructuring efforts to date include a 22% workforce

reduction with expected annualized compensation-related cost savings of approximately $2.6 million (pre-tax); additional $0.1 to $0.3

million in annualized non-employee cost reductions being targeted

Other annual cost reductions of $1.2 million stem from the completion

of scheduled payments of GuruShots acquisition-related retention bonuses

New York, NY – February 5, 2025 – Zedge, Inc. (NYSE

AMERICAN: ZDGE), $ZDGE, a leader in digital marketplaces and interactive games that foster creativity, self-expression and community engagement,

today announced additional restructuring initiatives, mainly the closure of its Norway operations. Combined with the previously announced

headcount and compensation expense reductions at GuruShots and other initiatives, these actions mark a key milestone in the Company’s

strategy to streamline operations and enhance profitability while positioning for growth and revamped focus.

Jonathan Reich, CEO of Zedge, commented:

“Today’s announcement, including the closure of our Norwegian subsidiary, marks an end to our aggressive restructuring efforts. Combined

with the actions announced on January 21, 2025, and some additional reductions, we expect to lower our annualized expense run rate by

roughly $4 million, or approximately $0.30 per share, on a pre-tax basis. This is significant progress, given that we generated

$30 million in revenue and $4.7 million in free cash flow in FY24.

“Beyond cost savings, these measures will consolidate our workforce

in Lithuania and Israel, streamlining operations, driving efficiency and reducing expenses beyond compensation. These changes are designed

to position us for sustainable growth and support our strategic objectives.”

Estimated Change in Expense (vs Q1 FY25) |

| |

| in $M | |

Annualized Reductions | |

| Restructuring: | |

| |

| Compensation-Related Expense | |

| ($2.6) | |

| Non-employee | |

| ($0.1) - ($0.3) | |

| Other: | |

| | |

| Expiration of GS Retention Bonus | |

| ($1.2) | |

| Total | |

| ($3.9) - ($4.1) | |

Cost-saving benefits in the above table are expected to begin taking

effect in Zedge’s third and fourth fiscal quarters.

Highlights of Zedge’s Restructuring Initiatives

Announced February 5, 2025:

Closure of Norwegian Subsidiary - $0.9 million in annualized compensation-related

savings

| · | Zedge is ceasing operations in Norway while consolidating

its activities in Lithuania and Israel. The Company expects this move to enhance operational efficiency and reduce expenses. |

Announced January

21, 2025:

Rightsizing the GuruShots Workforce - $1.7 million in annualized

compensation-related savings

| · | As part of the restructuring, the GuruShots team underwent

a significant reorganization. These changes aim to bring GuruShots closer to breakeven while supporting the development of the GuruShots

2.0 product strategy. |

Non-employee expense reduction targets - $0.1 to $0.3 million

| · | Zedge

is also targeting non-employee expense reductions related to its restructuring initiatives,

including scaling back GuruShots paid player acquisition initiatives for the remainder of

fiscal 2025. |

Reimagining GuruShots Gameplay and Monetization

| · | The GuruShots team is conducting a comprehensive review of

the game via the GuruShots 2.0 initiative, reimagining gameplay, progression dynamics, monetization strategies, and technology infrastructure.

Once the GuruShots 2.0 strategy and roadmap are finalized, Zedge plans to re-invest strategically based on achieving key milestones. |

Additional Cost Savings

Zedge

also expects to benefit from the completion (in April 2025) of GuruShots employee retention bonuses (that were committed to as part of

the 2022 acquisition), which will further reduce GuruShots (and Zedge’s) annualized expense run-rate by approximately $1.2

million beginning in fiscal Q4.

Restructuring Charges

Zedge anticipates accounting charges related to its restructuring efforts will primarily be reflected in the Company’s second and

third fiscal quarter results, covering periods ending January 31 and April 30, 2025, respectively.

By completing these restructuring efforts, Zedge is positioning itself

for sustainable growth while improving operational focus and cost efficiency.

| * | Free cash flow is a non-GAAP metric defined as cash flow

from operations ($5.9 million in FY24) minus capital expenditures ($1.2 million in FY24). Zedge believes this is relevant because it

is a key valuation metric used by investors to evaluate a company’s performance. |

About Zedge

Zedge empowers tens

of millions of consumers and creators each month with its suite of interconnected platforms that enable creativity, self-expression and

e-commerce and foster community through fun competitions. Zedge’s ecosystem of product offerings includes the Zedge Marketplace,

a freemium marketplace offering mobile phone wallpapers, video wallpapers, ringtones, notification sounds, and pAInt, a generative AI

image maker; GuruShots, “The World’s Greatest Photography Game,” a skill-based photo challenge game; and Emojipedia,

the #1 trusted source for ‘all things emoji.’ For more information, visit https://www.investor.zedge.net/ .

Follow us on X: @Zedge @Emojipedia

Follow us on Zedge LinkedIn Emojipedia LinkedIn

Download the Zedge App:

Download the GuruShots App:

Contact:

Brian Siegel, IRC, MBA

Senior Managing Director

Hayden IR

(346) 396-8696

ir@zedge.net

3

v3.25.0.1

Cover

|

Feb. 05, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K/A

|

| Amendment Flag |

true

|

| Amendment Description |

On January 21, 2025, Zedge,

Inc. (the “Company”) filed a Current Report on 8-K (the “Original 8-K”) under Item 2.05 to, among other things,

report a restructuring initiative. Pursuant to Item 2.05(d) of Form 8-K, the Company is now filing this Amendment No. 1 to refine its

disclosure related to the scope of the restructuring efforts and the amount of its estimated savings related to the restructuring. The

disclosure included in Item 2.05 of the Original 8-K otherwise remains unchanged. The Original Report is hereby amended to provide the

information set forth herein, which was unable to be determined at the time of the Original Report.

|

| Document Period End Date |

Feb. 05, 2025

|

| Entity File Number |

1-37782

|

| Entity Registrant Name |

Zedge, Inc.

|

| Entity Central Index Key |

0001667313

|

| Entity Tax Identification Number |

26-3199071

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

1178

Broadway

|

| Entity Address, Address Line Two |

Ste. 1450 (3rd Floor)

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10001

|

| City Area Code |

330

|

| Local Phone Number |

577-3424

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class B common stock, par value $0.01 per share

|

| Trading Symbol |

ZDGE

|

| Security Exchange Name |

NYSEAMER

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionDescription of changes contained within amended document.

| Name: |

dei_AmendmentDescription |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

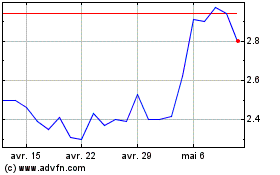

Zedge (AMEX:ZDGE)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

Zedge (AMEX:ZDGE)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025